Finance

What Is Red Arrow Loans?

Published: February 17, 2024

Discover how Red Arrow Loans can help you with your finance needs. Learn about our flexible loan options and get the financial support you need. Apply now!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Red Arrow Loans is a leading financial institution that offers a wide range of lending products designed to meet the diverse needs of individuals and businesses. With a commitment to providing accessible and flexible financing solutions, Red Arrow Loans has established itself as a trusted partner for those seeking reliable financial assistance.

As the financial landscape continues to evolve, the demand for convenient and transparent lending options has grown significantly. In response to this need, Red Arrow Loans has positioned itself as a reputable provider of loans, offering competitive rates and personalized service to its clients.

In this comprehensive guide, we will delve into the intricacies of Red Arrow Loans, exploring the various loan products available, the application process, and the advantages and considerations associated with obtaining financing through this esteemed institution. Whether you are a prospective borrower seeking insights into the offerings of Red Arrow Loans or an individual interested in understanding the dynamics of modern lending, this article aims to provide valuable information to guide your financial decisions.

With a focus on clarity and practicality, we will navigate the features, benefits, and potential drawbacks of Red Arrow Loans, empowering you to make informed choices when considering your borrowing options. Additionally, we will outline the steps involved in applying for a loan through Red Arrow Loans, ensuring that you are equipped with the knowledge needed to embark on a seamless and efficient loan application process.

Join us as we embark on a journey to uncover the essence of Red Arrow Loans, unraveling the intricacies of its lending solutions and shedding light on the opportunities it presents for those in need of financial support.

What Are Red Arrow Loans?

Red Arrow Loans, a reputable financial institution, offers a diverse array of lending products tailored to meet the specific needs of its clients. These loans are designed to provide individuals and businesses with access to the funds they require, whether for personal expenses, home improvements, business ventures, or unexpected financial challenges.

At Red Arrow Loans, the emphasis is on providing transparent and flexible lending solutions, ensuring that borrowers have a clear understanding of the terms and conditions associated with their loans. This commitment to transparency fosters trust and confidence among borrowers, setting Red Arrow Loans apart as a reliable and customer-centric lending provider.

One of the defining characteristics of Red Arrow Loans is its dedication to offering competitive interest rates, enabling borrowers to access financing at favorable terms. Whether individuals are seeking short-term loans to cover immediate expenses or long-term financing for significant investments, Red Arrow Loans strives to accommodate a wide spectrum of financial needs.

Moreover, Red Arrow Loans takes pride in its commitment to personalized service, recognizing that each borrower has unique circumstances and requirements. By offering customized loan solutions, Red Arrow Loans endeavors to address the distinct financial goals and challenges of its clients, fostering a supportive and accommodating lending environment.

As a forward-thinking financial institution, Red Arrow Loans remains attuned to the evolving needs of its clientele, regularly updating its loan offerings to align with changing market dynamics and customer preferences. This adaptability ensures that Red Arrow Loans continues to provide relevant and impactful lending solutions in an ever-changing financial landscape.

Whether you are considering a personal loan to address immediate expenses, a business loan to fuel growth and expansion, or a specialized financing option tailored to your unique needs, Red Arrow Loans stands ready to assist you in achieving your financial objectives.

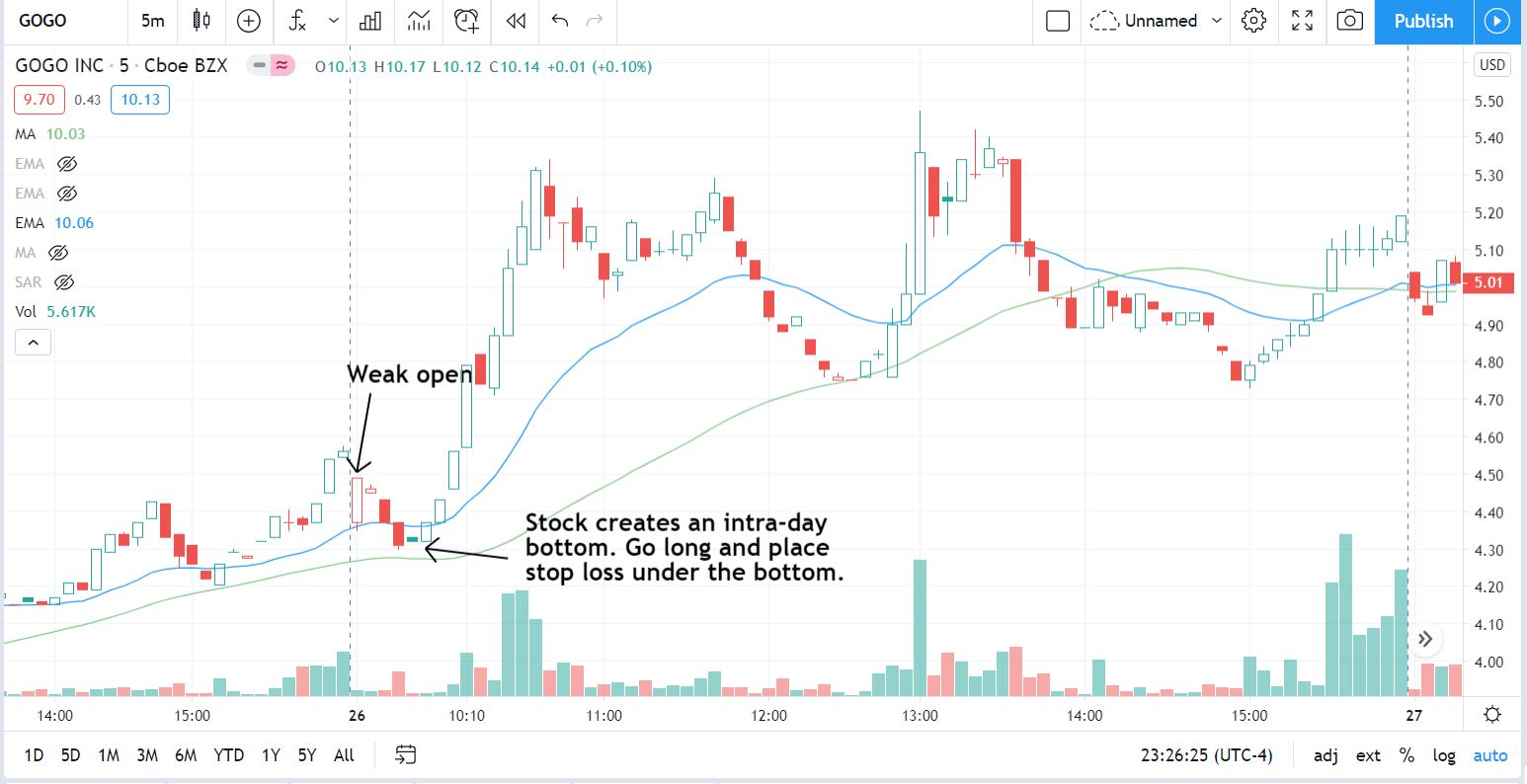

How Do Red Arrow Loans Work?

Red Arrow Loans operates on a straightforward and client-centric approach, aiming to streamline the borrowing process and provide borrowers with a clear understanding of their loan arrangements. The process begins with a prospective borrower expressing their financing needs and engaging with a Red Arrow Loans representative to explore the available loan options.

Upon identifying the most suitable loan product, the borrower is presented with a comprehensive overview of the terms, including the loan amount, interest rate, repayment schedule, and any associated fees. This transparent disclosure ensures that borrowers are fully informed before committing to the loan, fostering a relationship built on trust and clarity.

Red Arrow Loans offers a seamless application process, allowing borrowers to submit their loan requests through user-friendly online platforms or in-person consultations. This accessibility and convenience enable individuals and businesses to initiate their loan applications with ease, minimizing the barriers often associated with traditional lending institutions.

Once the loan application is submitted, Red Arrow Loans conducts a thorough review of the borrower’s financial profile, assessing factors such as credit history, income stability, and overall financial health. This evaluation is aimed at determining the borrower’s creditworthiness and ensuring that the proposed loan aligns with their financial capabilities.

Upon approval, the borrower receives the funds as per the agreed-upon terms, empowering them to address their financial needs or pursue their intended ventures. Throughout the loan tenure, Red Arrow Loans maintains open lines of communication with borrowers, providing ongoing support and guidance to ensure a positive borrowing experience.

Red Arrow Loans places a strong emphasis on timely and consistent repayments, encouraging borrowers to fulfill their financial obligations responsibly. By adhering to the agreed-upon repayment schedule, borrowers can build a positive credit history and strengthen their financial standing, paving the way for future financial opportunities.

Overall, the operational framework of Red Arrow Loans reflects a commitment to transparency, accessibility, and personalized service, creating a conducive environment for borrowers to secure the financing they need while navigating their financial journeys with confidence.

Types of Red Arrow Loans

Red Arrow Loans offers a diverse range of loan products tailored to address the distinct financial needs of its clientele. Whether individuals are seeking personal financing solutions or businesses require capital for expansion and development, Red Arrow Loans provides a comprehensive selection of loan options designed to accommodate various requirements.

Personal Loans: Red Arrow Loans extends personal loans to individuals seeking financial assistance for diverse purposes, such as debt consolidation, home improvements, education expenses, or unforeseen medical costs. These loans offer flexibility and can be tailored to meet specific funding needs, empowering borrowers to address their personal financial goals with confidence.

Business Loans: For entrepreneurs and business owners, Red Arrow Loans offers business loans aimed at supporting the growth and sustainability of enterprises. Whether it involves financing operational expenses, expanding facilities, or investing in new ventures, these loans provide businesses with the capital necessary to pursue their strategic objectives and capitalize on emerging opportunities.

Auto Loans: Red Arrow Loans provides auto loans to individuals looking to purchase a vehicle or refinance existing auto loans. With competitive interest rates and favorable terms, these loans enable borrowers to acquire the transportation they need while managing their financial commitments effectively.

Home Equity Loans: Homeowners can leverage the equity in their properties through home equity loans offered by Red Arrow Loans. These loans allow individuals to access funds based on the value of their homes, providing a versatile financing option for home renovations, major expenses, or other financial endeavors.

Debt Consolidation Loans: Red Arrow Loans offers debt consolidation loans designed to help individuals manage and streamline their outstanding debts. By consolidating multiple debts into a single loan with favorable terms, borrowers can simplify their financial obligations and work towards achieving greater financial stability.

Specialized Loans: In addition to the aforementioned loan categories, Red Arrow Loans may provide specialized loan products catering to unique financial needs, such as medical loans, vacation loans, or other specialized financing options tailored to specific circumstances.

By offering a diverse array of loan products, Red Arrow Loans demonstrates its commitment to addressing the multifaceted financial requirements of its clients, empowering individuals and businesses to pursue their financial aspirations with confidence and support.

Pros and Cons of Red Arrow Loans

When considering the potential benefits and drawbacks of obtaining a loan from Red Arrow Loans, it is essential to weigh the following factors to make an informed financial decision.

Pros

- Competitive Interest Rates: Red Arrow Loans offers competitive interest rates, providing borrowers with access to financing at favorable terms, potentially resulting in cost savings over the loan tenure.

- Transparent Terms: The institution prioritizes transparency, ensuring that borrowers have a clear understanding of the terms and conditions associated with their loans, fostering trust and confidence in the lending process.

- Flexible Loan Options: Red Arrow Loans provides a diverse range of loan products, catering to the specific needs of individuals and businesses, offering flexibility in terms of loan amounts, repayment schedules, and purposes.

- Personalized Service: The institution emphasizes personalized service, recognizing the unique circumstances of each borrower and offering customized loan solutions to address their distinct financial goals and challenges.

- Convenient Application Process: Red Arrow Loans offers a user-friendly and accessible application process, allowing borrowers to initiate their loan requests through online platforms or in-person consultations, minimizing barriers to accessing financing.

Cons

- Credit Requirements: Some loan products may have specific credit requirements, potentially limiting access to certain financing options for individuals with less-than-ideal credit histories.

- Associated Fees: While Red Arrow Loans strives to maintain transparency, borrowers should be mindful of any associated fees, such as origination fees or prepayment penalties, which could impact the overall cost of the loan.

- Eligibility Criteria: Certain loan products may have eligibility criteria related to income, employment status, or other factors, requiring borrowers to meet specific qualifications to secure financing.

- Market Conditions: Like any lending institution, the availability of loan products and the prevailing interest rates may be influenced by broader economic conditions, potentially impacting the overall lending environment.

By carefully considering these pros and cons, prospective borrowers can gain a comprehensive understanding of the advantages and considerations associated with obtaining a loan from Red Arrow Loans, empowering them to make well-informed decisions aligned with their financial needs and objectives.

How to Apply for Red Arrow Loans

Applying for a loan with Red Arrow Loans is a straightforward process designed to provide convenience and accessibility to prospective borrowers. Whether individuals are seeking personal financing solutions or businesses require capital for growth and development, the institution offers a seamless application process to initiate the borrowing journey.

Online Application

Prospective borrowers can begin the application process by visiting the official website of Red Arrow Loans, where they will find a user-friendly interface that facilitates the submission of loan requests. The online platform allows individuals to input their personal and financial details, specify the desired loan amount, and provide any necessary documentation to support their application.

Upon submission, the online application is reviewed by Red Arrow Loans, and borrowers are promptly notified regarding the status of their applications. This digital application process offers convenience and expediency, enabling individuals to initiate their loan requests from the comfort of their homes or offices.

In-Person Consultation

For those who prefer a more personalized approach, Red Arrow Loans also welcomes borrowers to engage in in-person consultations at designated branch locations. During these consultations, borrowers can interact directly with knowledgeable loan officers who can provide guidance, address inquiries, and assist in navigating the loan application process.

By offering the option of in-person consultations, Red Arrow Loans ensures that individuals who prefer face-to-face interactions can receive the support and information they need to make informed decisions about their borrowing needs.

Documentation and Review

Upon submitting the loan application, prospective borrowers are required to provide relevant documentation, such as proof of income, identification, and any additional documentation specific to the desired loan product. Red Arrow Loans conducts a thorough review of the provided information, assessing the borrower’s financial profile to determine creditworthiness and eligibility for the requested loan.

Approval and Disbursement

Upon approval of the loan application, borrowers receive notification of the approved loan amount, interest rate, and repayment terms. The funds are then disbursed according to the agreed-upon schedule, empowering borrowers to address their financial needs or pursue their intended ventures.

By offering both online and in-person application options, Red Arrow Loans ensures that individuals and businesses can access the financing they need through a convenient and accommodating application process, supported by personalized guidance and transparent communication throughout the loan journey.

Conclusion

In conclusion, Red Arrow Loans stands as a reputable and customer-centric financial institution, offering a diverse array of loan products designed to address the unique financial needs of individuals and businesses. With a commitment to transparency, competitive interest rates, and personalized service, Red Arrow Loans has positioned itself as a trusted partner for those seeking reliable and accessible financing solutions.

Through its emphasis on clarity and flexibility, Red Arrow Loans provides borrowers with the opportunity to secure financing tailored to their specific requirements, whether it involves personal expenses, business endeavors, or strategic investments. The institution’s dedication to transparent terms and personalized service fosters trust and confidence among borrowers, creating a conducive environment for navigating the borrowing process with assurance and support.

By offering a seamless and accessible application process, both through online platforms and in-person consultations, Red Arrow Loans ensures that individuals and businesses can initiate their loan requests with ease, minimizing barriers to accessing essential financial support.

While weighing the potential advantages and considerations associated with obtaining a loan from Red Arrow Loans, prospective borrowers are empowered to make informed decisions aligned with their financial objectives. The institution’s commitment to competitive interest rates, transparent terms, and diverse loan options presents a compelling opportunity for those seeking reliable and accommodating financing solutions.

Overall, Red Arrow Loans exemplifies a dedication to empowering individuals and businesses to pursue their financial aspirations with confidence, supported by a foundation of transparency, flexibility, and personalized service. Whether borrowers are seeking personal loans, business financing, or specialized lending options, Red Arrow Loans stands ready to provide impactful and supportive loan solutions that cater to diverse financial needs.

As the financial landscape continues to evolve, Red Arrow Loans remains steadfast in its commitment to delivering relevant and impactful lending solutions, positioning itself as a dependable ally for those navigating the complexities of modern borrowing.