Finance

What Is Statement Credit Amex

Published: January 9, 2024

Learn more about statement credit with American Express (Amex) cards in our guide. Understand how it works and how it can benefit your personal finances.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to managing your finances, understanding the various terms and concepts can be overwhelming. One such term you may have encountered is “statement credit.” If you’re an American Express (Amex) cardholder, you’ve probably come across this feature. Statement credit offers a convenient way to offset your credit card charges and can provide substantial benefits. In this article, we’ll delve into the world of statement credit on Amex and explore how it works, the benefits it offers, and how you can make the most of it.

Amex is a well-known credit card issuer renowned for its outstanding perks and rewards programs. Statement credit is just one of the many features they offer to enhance cardholders’ financial experience. With statement credit, you have the opportunity to reduce your outstanding balance or future payments by applying credit earned through participating in rewards programs or taking advantage of special promotional offers.

Understanding how statement credit works and the benefits it offers can help you make informed decisions about your credit card utilization. Whether you’re new to Amex or have been using their cards for years, this article will provide you with a comprehensive understanding of statement credit and how to make the most of this valuable feature.

Understanding Statement Credit on Amex

Statement credit is a feature offered by American Express that allows you to reduce your credit card balance or future payments by using credit earned through various means. It is an effective way to offset charges and save money on your credit card expenses.

To understand statement credit better, let’s consider an example. Suppose you have an Amex credit card with a rewards program that offers 5% cash back on grocery purchases. If you spend $200 on groceries, you will earn $10 in statement credit. This means that $10 will be subtracted from your credit card balance or applied as a credit towards your next payment.

Statement credit can be earned through a variety of methods, including rewards programs, promotional offers, and special deals. Some Amex cards offer flat-rate statement credits, while others may have rotating categories or specific spending requirements to qualify for statement credit. It’s important to read the terms and conditions of your card’s rewards program to understand how statement credit can be earned.

It’s worth noting that statement credit is not the same as cash back. While cash back can be received as a direct deposit or check, statement credit is applied to your credit card balance. This means that statement credit can only be used to offset charges on your Amex card, making it a valuable tool for managing your credit card expenses.

Statement credit on Amex is a flexible and convenient feature that allows you to save money and reduce your credit card debt. By understanding how it works and how to earn it, you can take full advantage of the benefits it offers.

How Does Statement Credit Work?

Statement credit on Amex works by applying earned credits towards your credit card balance or future payments. It effectively reduces the amount you owe, making it an excellent way to save money on your credit card expenses. Here’s how it typically works:

1. Earning Statement Credit: You can earn statement credit through various means, such as participating in rewards programs, taking advantage of promotional offers, or fulfilling specific spending requirements. Depending on your card’s terms and conditions, statement credit may be earned as a flat rate or a percentage of your purchases.

2. Accumulating Statement Credit: As you make eligible purchases or meet the requirements outlined by your card’s rewards program, statement credits will accumulate in your account. These credits will be reflected on your credit card statement.

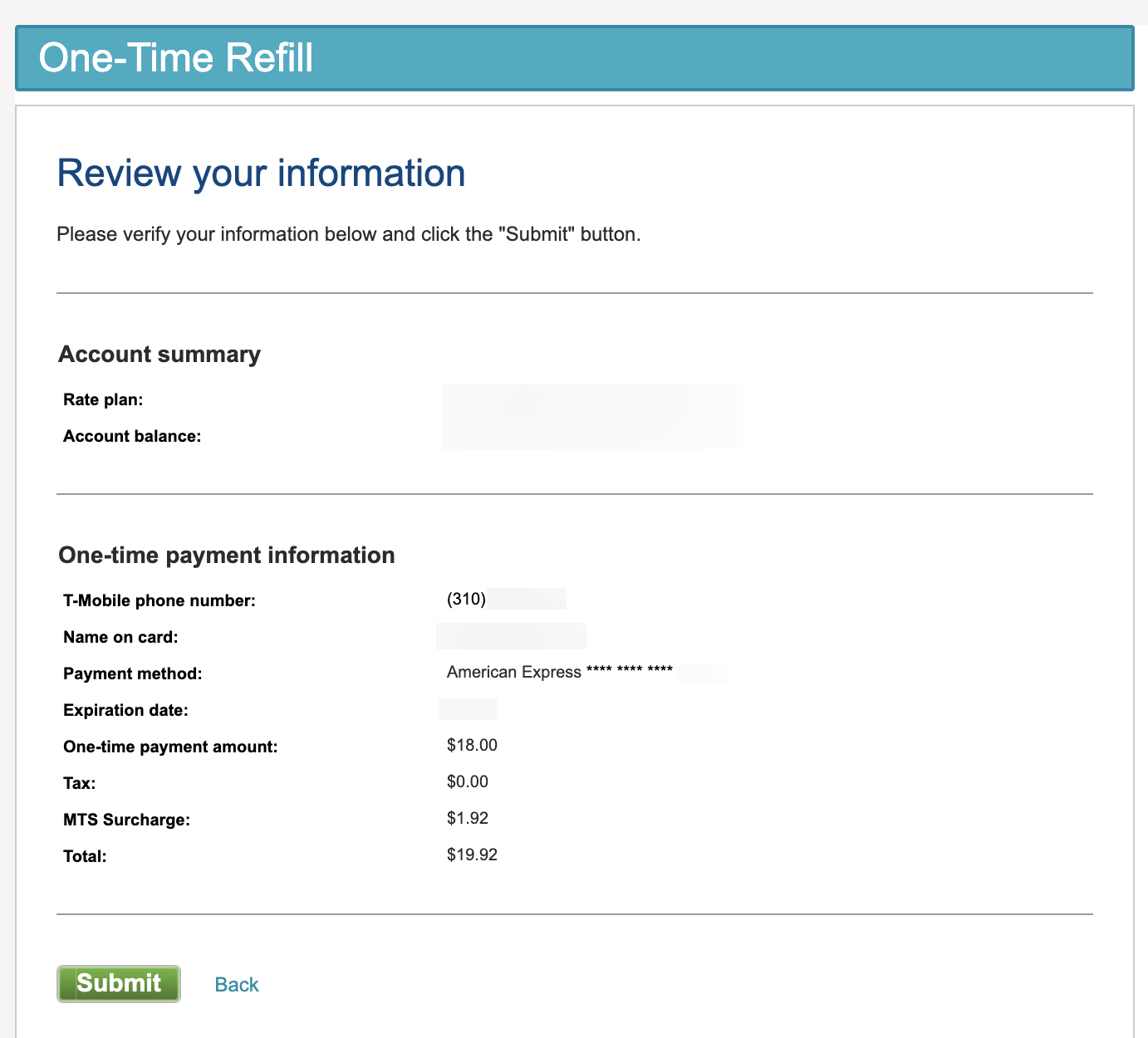

3. Applying Statement Credit: Once you have accumulated statement credits, you have the option to apply them to your credit card balance. This can be done by selecting the statement credit option during the payment process or by contacting Amex customer service. The statement credit will then be deducted from your outstanding balance or used to offset future payments.

4. Reducing Outstanding Balance: When you apply statement credit to your account, it effectively reduces the amount you owe. For example, if you have a $500 credit card balance and apply a $50 statement credit, your new balance will be $450.

5. Utilizing Statement Credit: Statement credit can be used for a variety of purposes. You can use it to offset the total amount due on your credit card statement, reducing the need for additional payments. Additionally, statement credit can be applied towards specific charges, such as travel expenses or eligible purchases, depending on your card’s rewards program.

Remember, statement credit is specific to your Amex credit card and cannot be transferred to another card or turned into cash. It is essential to review your card’s terms and conditions to understand how statement credit applies to your specific account.

Overall, statement credit on Amex provides cardholders with a valuable opportunity to reduce their credit card expenses and save money on their balances. By accumulating and applying statement credits strategically, you can effectively manage your finances and make the most of your Amex card’s benefits.

Benefits of Statement Credit

Statement credit on Amex offers several benefits that can greatly enhance your credit card usage and overall financial experience. Understanding these benefits can help you make the most of your rewards program and maximize your savings. Here are some key advantages of statement credit:

1. Cost Reduction: Statement credit allows you to offset your credit card charges, effectively reducing your financial burden. By applying earned credits to your account, you can lower your outstanding balance or eliminate it entirely, saving you money on interest charges and reducing your overall debt.

2. Flexibility in Reward Redemption: Statement credit provides flexibility in how you utilize your rewards. Unlike other forms of rewards such as gift cards or merchandise, statement credit can be applied to any eligible purchase or used towards your credit card bill. This allows you to enjoy the benefits of your rewards program in a way that suits your individual needs.

3. Ease of Use: Statement credit is incredibly easy to use. Whether you choose to apply it to your current balance or save it for a future payment, the process is straightforward, and you can typically do it online or through the Amex mobile app. It provides a hassle-free method of reducing your credit card expenses.

4. Redemption Options: Depending on your Amex card’s rewards program, statement credit may be just one of the many redemption options available. Some programs offer the flexibility to redeem your earned rewards for other benefits such as travel, gift cards, or merchandise. This gives you the freedom to choose the most valuable option for your individual preferences.

5. Cost-Saving Opportunities: Using statement credit can open up cost-saving opportunities. For example, if you have a travel rewards card, you can use statement credit to offset travel-related expenses such as airfare, hotel stays, or rental car charges. This can help you save significant amounts of money on your travel expenses.

6. Rewards Maximization: By strategically utilizing statement credit, you can maximize the benefits of your rewards program. Understanding the earning potential and redemption options of your particular Amex card allows you to make informed decisions that yield the highest value for your earned statement credits.

Statement credit on Amex offers a range of benefits that can improve your financial well-being and enhance your credit card experience. By taking advantage of these benefits, you can effectively manage your expenses, reduce your debt, and enjoy the perks and rewards that come with being an Amex cardholder.

Eligible Purchases for Statement Credit

When it comes to earning statement credit on Amex, understanding which purchases qualify for credit is essential. While specific eligibility criteria may vary depending on the card and rewards program, there are common categories that typically qualify for statement credit. Here are some examples:

1. Everyday Expenses: Many Amex cards offer statement credit on everyday expenses such as groceries, gas, dining, and household supplies. These are expenses that most individuals incur on a regular basis, making them a great way to earn statement credits simply by making necessary purchases.

2. Travel Expenses: Some Amex cards provide statement credit on travel-related expenses. This can include airfare, hotel stays, rental cars, airport parking fees, and even travel insurance. If you frequently travel or plan a vacation, taking advantage of statement credit on travel expenses can result in significant savings.

3. Entertainment and Events: Certain Amex cards offer statement credit on entertainment expenses, including ticket purchases for concerts, sporting events, theaters, and amusement parks. This provides an opportunity to earn credit while enjoying leisure activities.

4. Online Shopping: Depending on the card, Amex may offer statement credit for online purchases from specific retailers or on specific categories like electronics, clothing, or home goods. This allows you to earn credit while enjoying the convenience of online shopping.

5. Dining and Restaurants: Amex cards often provide statement credit for dining at eligible restaurants. This can be a great perk for individuals who frequently dine out or enjoy exploring new culinary experiences.

It’s important to note that eligibility for statement credit is subject to the terms and conditions of your specific card’s rewards program. Some programs may have restrictions, spending caps, or limited-time offers. It’s essential to review the details of your card’s terms and conditions to understand which purchases qualify for statement credit and any specific requirements for earning credit.

Additionally, Amex may offer limited-time promotions or partnerships with specific retailers or establishments, providing opportunities to earn statement credit on purchases from those vendors. These promotions are usually communicated through email, the Amex website, or the mobile app.

By utilizing your Amex card for eligible purchases, you can earn statement credits while spending money on essential goods and services. This allows you to effectively offset your credit card expenses and enjoy the benefits of statement credit.

Redeeming Statement Credit

Once you have accumulated statement credit on your Amex card, the next step is to redeem it. Redeeming statement credit is a straightforward process that allows you to apply your earned credits towards your credit card balance or future payments. Here’s how you can redeem statement credit on Amex:

1. Online Redemption: The most convenient way to redeem statement credit is through the Amex online portal or mobile app. Simply log in to your Amex account, navigate to the rewards or statement credit section, and select the option to redeem your available credits. Follow the prompts to apply the credit to your outstanding balance.

2. Automatic Redemption: Some Amex cards offer automatic redemption options. With this feature, you can set up your account to automatically apply statement credits to your balance at specific intervals, such as monthly or when a certain credit threshold is met. This ensures that your statement credits are consistently used without needing manual intervention.

3. Contacting Customer Service: If you prefer to redeem statement credit via a phone call, you can contact Amex customer service and inform them of your intention to apply statement credits to your account. They will guide you through the process and ensure that the appropriate credits are applied to your balance.

4. Specific Redemption Offers: Amex may occasionally offer specific redemption offers or promotions. These can include opportunities to redeem statement credits for gift cards, merchandise, or exclusive experiences. Pay attention to any communications from Amex regarding such offers and follow the instructions provided to enjoy these unique redemption opportunities.

It’s important to note that statement credit cannot be redeemed for cash or transferred to a different card. It can only be applied to your Amex credit card balance or future payments. Additionally, statement credits must be redeemed within the specified timeframe outlined in your card’s terms and conditions.

Regularly monitoring your statement credits and their expiration dates will ensure that you don’t miss out on the opportunity to use them. By redeeming statement credit, you can effectively reduce your outstanding balance, save money on interest charges, and make the most of your rewards program benefits.

Limitations and Restrictions

While statement credit offers several benefits and opportunities for savings, it’s important to be aware of the limitations and restrictions that may apply. These limitations help ensure the integrity of the rewards program and maintain a fair and balanced system for all cardholders. Here are some common limitations and restrictions to keep in mind:

1. Eligible Purchases: Not all purchases will qualify for statement credit. Each Amex card and rewards program has specific criteria for eligible purchases. It’s crucial to review your card’s terms and conditions to understand which transactions qualify for statement credit and any restrictions that may apply.

2. Expiration Dates: Statement credits earned through rewards programs or promotional offers often have expiration dates. It’s important to be aware of these dates and ensure that you redeem your statement credits before they expire. Failure to do so may result in the loss of earned credits.

3. Redemption Minimums: Some Amex cards may have minimum redemption thresholds for statement credit. For example, you may need to accumulate a certain amount of credits before you can redeem them. Review your card’s terms and conditions to understand if any redemption minimums apply.

4. Limited-Time Offers: Amex may periodically introduce limited-time offers or promotional deals that allow you to earn statement credits for specific purchases or during specific timeframes. These offers may have restrictions and time limitations, so it’s important to stay informed about any such promotions through Amex communications.

5. Individual Card Terms: Each Amex card has its own set of terms and conditions regarding statement credit. It’s crucial to read and understand these terms to fully comprehend the benefits, limitations, and restrictions that apply to your specific card.

6. Account Status: Maintaining a good standing with your Amex account is important for earning and redeeming statement credit. Defaulting on payments, closing your account, or engaging in fraudulent activity may result in the forfeiture of earned credits and the loss of future statement credit benefits.

7. Non-Transferable: Statement credits earned through Amex rewards programs or promotional offers are non-transferable and cannot be shared or combined with other cardholders.

Remember to regularly review your credit card statements, monitor your accumulated statement credits, and stay updated on any changes to your card’s rewards program and redemption policies. By understanding the limitations and restrictions, you can make the most informed decisions to maximize the benefits of statement credit on your Amex card.

Tips for Maximizing Statement Credit

Statement credit can be a valuable tool for saving money and maximizing the benefits of your Amex credit card. Here are some tips to help you make the most of statement credit:

1. Understand Your Card’s Rewards Program: Familiarize yourself with the details of your card’s rewards program, including the earning structure, eligible purchases, and redemption options. This knowledge allows you to strategically plan your spending to maximize statement credit earnings.

2. Use Your Card for Everyday Expenses: Utilize your Amex card for everyday expenses such as groceries, gas, and dining to earn statement credits on essential purchases. Be mindful of the earning potential for each spending category and focus on maximizing statement credits in those areas.

3. Take Advantage of Promotions: Keep an eye out for promotions and limited-time offers that can earn you additional statement credits. These promotions may include bonuses for specific spending categories or partnerships with select retailers. Take advantage of these opportunities to boost your statement credit earnings.

4. Pay Attention to Expiration Dates: Stay aware of the expiration dates for your earned statement credits. Make it a habit to check your account regularly and redeem your credits before they expire. This ensures that you don’t miss out on valuable savings.

5. Set Up Automatic Redemption: If your card offers the option, set up automatic redemption of statement credits. This ensures that your credits are consistently applied to your balance without requiring you to actively remember to redeem them. Automatic redemption also eliminates the risk of losing credits due to expiration.

6. Monitor and Optimize Your Spending: Track your spending patterns and adjust accordingly to maximize statement credit earnings. If you notice that you are falling short in a particular spending category, consider shifting some of your purchases to that category to earn more credits.

7. Stack Statement Credits: Look for opportunities to stack statement credits with other discounts or promotions. For example, if a retailer offers a discount and your Amex card provides statement credit for purchases at that specific retailer, you can save even more by combining both offers.

8. Redeem Strategically: When redeeming statement credits, consider your financial goals and priorities. You may choose to use the credit to reduce your outstanding balance, offset a large purchase, or apply it to expenses like travel or dining. Evaluate the most effective use of your statement credits based on your personal financial situation.

9. Stay Informed: Regularly review your card’s terms and conditions and stay updated on any changes or new promotions. Being informed allows you to make the most informed decisions to maximize statement credit earnings.

By following these tips, you can optimize your usage of statement credit on your Amex card and enjoy significant savings on your credit card expenses.

Conclusion

Statement credit on Amex is a valuable feature that allows cardholders to save money and offset their credit card expenses. Understanding how statement credit works and the benefits it offers can help you make informed decisions about your credit card utilization.

In this article, we’ve explored the world of statement credit on Amex, delving into its functionality, benefits, and limitations. We’ve discussed how statement credit allows you to reduce your credit card balance or future payments by applying earned credits. We’ve also highlighted the various eligible purchases and redemption options available.

Statement credit provides cardholders with the flexibility to offset charges on everyday expenses, travel, entertainment, and more. By strategically earning and redeeming statement credits, you can effectively manage your finances and save money on your credit card expenses.

To maximize your statement credit, it’s important to understand your specific card’s rewards program, monitor your accumulated credits, and stay updated on any promotions or limited-time offers. By following tips such as using your card for everyday expenses, taking advantage of promotions, and paying attention to expiration dates, you can optimize your statement credit earnings.

Remember to review your card’s terms and conditions regularly and remain informed about any changes or updates to the rewards program. This will enable you to make the most of statement credit and take full advantage of the benefits it offers.

In conclusion, statement credit on Amex provides a valuable opportunity to save money, reduce debt, and enjoy the perks of your credit card. By understanding how statement credit works and implementing useful strategies, you can make the most of this beneficial feature and improve your financial well-being.