Home>Finance>What Is The Average Credit Limit On American Express Platinum

Finance

What Is The Average Credit Limit On American Express Platinum

Published: January 5, 2024

Discover the typical credit limit on the American Express Platinum card and gain insights into managing your finances with this prestigious credit card.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

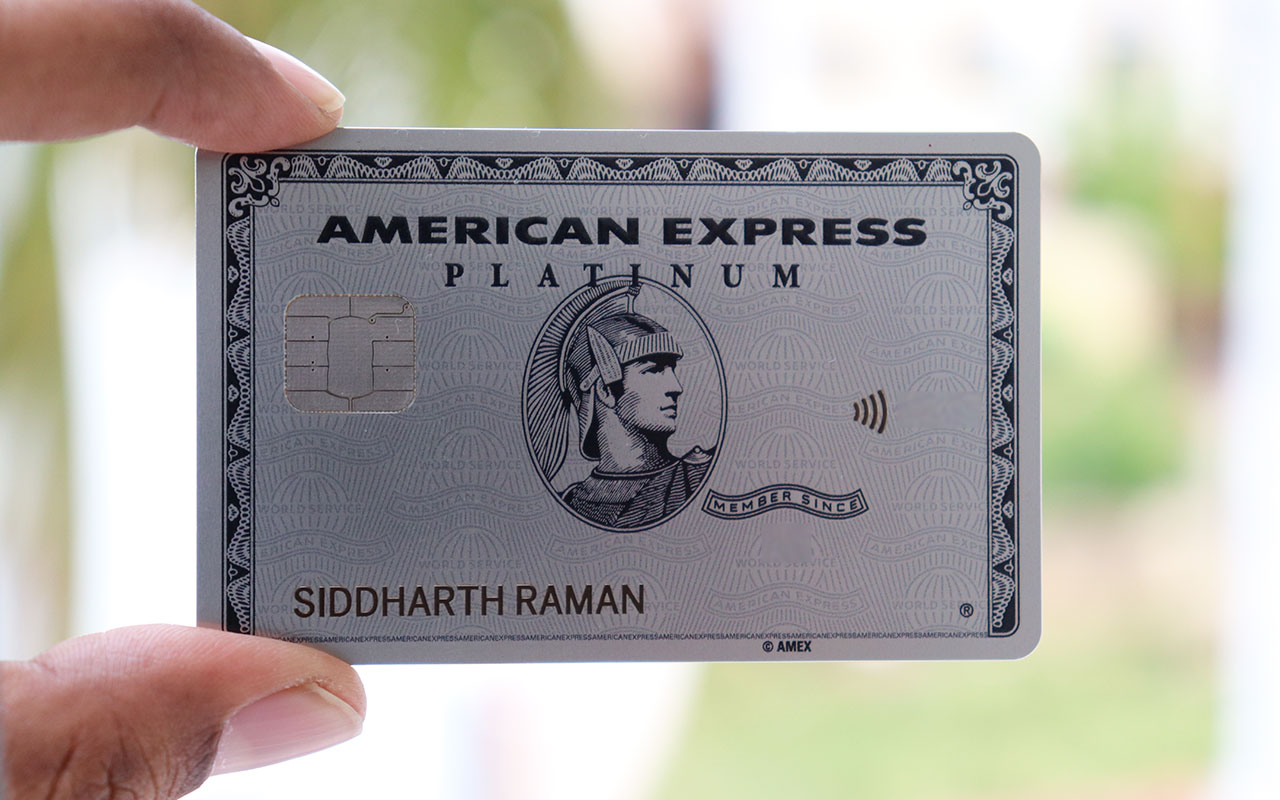

When it comes to credit cards, American Express Platinum is known for its prestige and exclusive benefits. But have you ever wondered what the average credit limit is on an American Express Platinum card? The credit limit is the maximum amount of money you can borrow on your credit card.

American Express Platinum cards are designed for individuals with excellent credit histories and higher income levels, offering a wide range of luxury perks and benefits. However, the specific credit limit varies from person to person and is influenced by several factors. Understanding these factors can help you manage your credit limit effectively and potentially increase it over time.

In this article, we will delve into the world of American Express Platinum credit limits. We will explore the factors that influence credit limits, unveil the average credit limit on an American Express Platinum card, and provide tips on how to manage and increase your credit limit.

So, if you’re curious about the credit limits on American Express Platinum cards and want to gain insights on managing and maximizing your credit limit, read on!

Understanding American Express Platinum Credit Cards

American Express Platinum credit cards are considered a symbol of financial status and luxury. They are renowned for their exceptional perks, comprehensive travel benefits, and access to exclusive events. However, it’s important to understand the unique features of these cards before delving into credit limits.

First and foremost, American Express Platinum credit cards come in different variants, such as the Platinum Card® and the Platinum Delta SkyMiles® Card. Each card offers its own set of rewards and benefits tailored to different lifestyles and travel preferences.

These cards often have substantial annual fees, but cardholders are rewarded with an array of benefits such as airport lounge access, travel credits, elite status with hotel and car rental programs, concierge services, and more. Some cards even offer complimentary elite benefits with partner airlines.

With their premium features and benefits, American Express Platinum credit cards are highly sought after by individuals who want to experience luxury travel and enjoy exclusive privileges. However, it’s crucial to note that these cards require excellent credit scores and a higher income level to qualify.

Now that we understand the essence of American Express Platinum credit cards, let’s explore the various factors that influence the credit limit offered on these prestigious cards.

Factors That Influence the Average Credit Limit

When it comes to determining the average credit limit on American Express Platinum cards, several factors come into play. American Express evaluates various aspects of an applicant’s financial profile before assigning a credit limit. Here are some crucial factors that influence the average credit limit:

1. Credit History: Your credit history plays a significant role in determining your credit limit. If you have a strong credit history with a consistent record of on-time payments and low credit utilization, you are more likely to be offered a higher credit limit.

2. Income Level: American Express considers your income level and financial stability before determining your credit limit. A higher income level indicates a greater ability to repay debts, which can result in a higher credit limit.

3. Debt-to-Income Ratio: Your debt-to-income ratio reflects the percentage of your monthly income that goes toward paying debts. Lower debt-to-income ratios demonstrate financial responsibility and may lead to a higher credit limit.

4. Existing American Express Relationship: If you are an existing American Express cardholder in good standing or have a long-term relationship with the company, it can positively impact your credit limit. American Express may take your history with the company into consideration when assigning your credit limit.

5. Credit Utilization: Credit utilization refers to the amount of available credit you use. Keeping your credit utilization low, preferably below 30%, showcases responsible credit management and may increase your chances of obtaining a higher credit limit.

6. Employment History: Your employment history can provide insights into your stability and income potential. A steady employment history reflects financial stability, which may equate to a higher credit limit.

It’s important to remember that while these factors are influential, American Express considers them as part of a holistic evaluation process. Ultimately, the credit limit assigned to an individual can vary based on their unique financial circumstances and creditworthiness.

Average Credit Limit on American Express Platinum

As mentioned earlier, the average credit limit on American Express Platinum cards can vary significantly from person to person. American Express determines credit limits on a case-by-case basis, taking into account several factors, including the applicant’s credit history, income level, and financial stability.

While it is challenging to provide an exact average credit limit, it is not uncommon for American Express Platinum cardholders to have relatively high credit limits. In general, the credit limits on these cards can range from a few thousand dollars to tens of thousands of dollars or even more.

However, it’s crucial to note that having a higher income level and an excellent credit score significantly increases the chances of being offered a higher credit limit. Additionally, individuals who maintain a long-term relationship with American Express and demonstrate responsible credit management may also have the opportunity to enjoy higher credit limits.

It’s important to remember that the credit limit on your American Express Platinum card is not set in stone. As your financial circumstances improve and your creditworthiness strengthens, you may be eligible for credit limit increases. American Express periodically reviews cardholders’ accounts and may offer credit limit adjustments based on their evaluation.

To gain a better understanding of your specific credit limit, it is recommended to contact American Express directly and discuss your credit limit with a representative. They can provide you with information tailored to your account and guide you through any potential credit limit increase requests.

How to Increase Your American Express Platinum Credit Limit

If you currently hold an American Express Platinum credit card and wish to increase your credit limit, there are several steps you can take to improve your chances:

1. Pay your bills on time: Consistently making on-time payments demonstrates your responsible financial behavior and can positively impact your creditworthiness, thus increasing your chances of a credit limit increase.

2. Reduce your credit utilization: Lowering your credit utilization ratio by paying down existing balances or maintaining low balances can show that you can effectively manage credit, prompting American Express to consider a credit limit increase.

3. Update your income information: If your income has significantly increased since you initially applied for your American Express Platinum card, consider updating your income information with American Express. A higher income level can increase your chances of a credit limit increase.

4. Request a credit limit increase: Contact American Express customer service and inquire about the possibility of a credit limit increase. Be prepared to provide reasons why you believe you deserve an increase, such as an improved credit score, higher income, or responsible credit management.

5. Manage your accounts well: Monitor your credit card accounts, ensuring that you are using credit responsibly and staying within your credit limit. Avoid maxing out your card or carrying high balances, as this may negatively impact your chances of a credit limit increase.

6. Build a positive credit history: If you are new to credit or have a limited credit history, focus on building a positive credit history by making timely payments and maintaining low credit utilization. Over time, this can improve your creditworthiness and increase your chances of a credit limit increase.

Remember, while these strategies can potentially improve your chances of a credit limit increase, approval is not guaranteed. American Express evaluates each request on a case-by-case basis, considering various factors to determine eligibility for a credit limit increase.

Tips for Managing Your American Express Platinum Credit Limit

Effectively managing your American Express Platinum credit limit is essential to maintain a healthy credit profile and maximize the benefits of your card. Here are some helpful tips to manage your credit limit responsibly:

1. Track your spending: Keep a close eye on your credit card transactions and regularly review your statements. By monitoring your spending, you can ensure that you stay within your credit limit and avoid any potential overages or penalties.

2. Create a budget: Establishing a budget helps you plan your expenses and allocate your available credit wisely. By setting spending limits for different categories, you can prevent overspending and avoid reaching your credit limit prematurely.

3. Avoid unnecessary debt: While it can be tempting to use your American Express Platinum card for luxury purchases, it’s important to be mindful of your financial situation. Avoid accumulating unnecessary debt that may strain your ability to manage your credit limit effectively.

4. Pay your bill in full and on time: Aim to pay your American Express Platinum credit card bill in full by the due date each month. This not only helps you avoid interest charges but also showcases responsible credit management, which can positively impact your creditworthiness.

5. Communicate with American Express: If you anticipate a large purchase or need a temporary increase in your credit limit, consider reaching out to American Express in advance. They may be able to provide a temporary credit limit increase to accommodate your needs.

6. Manage your credit utilization ratio: Keeping your credit utilization ratio below 30% is generally recommended. This means using no more than 30% of your available credit limit. By keeping your credit utilization low, you demonstrate responsible credit usage and maintain a positive credit profile.

7. Regularly review your credit report: Monitor your credit report to ensure its accuracy and identify any discrepancies or errors that could negatively impact your creditworthiness. Addressing these issues promptly can help maintain a healthy credit profile and potentially increase your credit limit over time.

By implementing these tips and adopting responsible credit management habits, you can effectively manage your American Express Platinum credit limit and optimize the benefits of your prestigious card.

Conclusion

American Express Platinum credit cards are highly esteemed for their exclusive perks and benefits, making them an ideal choice for individuals seeking luxury and travel privileges. While the average credit limit on an American Express Platinum card can vary based on multiple factors, such as credit history, income level, and financial stability, they often offer relatively high credit limits.

Understanding the factors that influence credit limits, such as credit history, income, and debt-to-income ratio, provides insight into the credit evaluation process. By managing these factors effectively and demonstrating responsible credit management habits, cardholders can potentially increase their credit limit over time.

It is essential to manage your American Express Platinum credit limit wisely by tracking your spending, creating a budget, and avoiding unnecessary debt. Paying your bill on time and in full helps maintain a positive credit profile and can impact your chances of a credit limit increase. Regularly reviewing your credit report and communicating with American Express when necessary are also important steps in managing your credit limit effectively.

Remember, the credit limit on your American Express Platinum card is not fixed and can be subject to change based on your financial circumstances and creditworthiness. By implementing the tips and strategies outlined in this article, you can navigate and maximize the benefits of your American Express Platinum credit card while maintaining control over your credit limit.

In summary, American Express Platinum credit cards offer a prestigious and luxurious experience. Understanding the factors that influence credit limits, utilizing tips to manage your credit limit effectively, and maintaining responsible credit management habits can help you make the most out of your American Express Platinum credit card.