Home>Finance>What Is The Minimum Payment On A 0 Interest Credit Card

Finance

What Is The Minimum Payment On A 0 Interest Credit Card

Modified: March 3, 2024

Learn how to calculate the minimum payment on a 0 interest credit card and manage your finances effectively. Understand the implications and make informed decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Minimum Payment on a 0 Interest Credit Card

Credit cards have become an integral part of modern-day financial transactions, offering convenience and flexibility for consumers. Among the various types of credit cards available, 0 interest credit cards stand out as an attractive option for individuals seeking to manage their finances effectively. These cards offer an introductory period during which no interest is charged on purchases or balance transfers, making them a popular choice for those looking to save on interest expenses.

One crucial aspect of managing a 0 interest credit card is understanding the minimum payment requirement. While the absence of interest during the introductory period can be advantageous, it's essential for cardholders to grasp the implications of the minimum payment and how it influences their overall financial well-being. This article delves into the concept of minimum payments on 0 interest credit cards, shedding light on the factors that affect them and providing valuable tips for managing these payments effectively.

Understanding the dynamics of minimum payments on 0 interest credit cards is vital for individuals looking to make informed financial decisions and maintain a healthy credit profile. Whether you're considering applying for a 0 interest credit card or already have one in your wallet, gaining insights into minimum payment requirements will empower you to navigate the world of credit with confidence and prudence. Let's explore the intricacies of minimum payments on 0 interest credit cards and equip ourselves with the knowledge needed to make sound financial choices.

Understanding 0 Interest Credit Cards

0 interest credit cards, also known as 0% APR credit cards, offer an introductory period during which no interest is charged on purchases or balance transfers. This promotional period typically ranges from 6 to 18 months, providing cardholders with a window of opportunity to make purchases or transfer existing balances without incurring interest expenses. These cards are designed to attract new customers and provide existing cardholders with a valuable incentive to continue using their credit cards.

During the 0 interest promotional period, cardholders can take advantage of the financial breathing room to pay down existing balances or make significant purchases without the burden of accruing interest. This feature can be particularly beneficial for individuals seeking to consolidate high-interest debt or finance large expenses without the immediate pressure of interest charges.

It’s important to note that while the promotional period offers relief from interest charges, cardholders are still required to make minimum monthly payments as stipulated by the credit card issuer. These minimum payments ensure that cardholders are meeting their financial obligations and are a fundamental aspect of managing a 0 interest credit card responsibly.

Furthermore, 0 interest credit cards may also offer rewards programs, cashback incentives, or other perks, adding another layer of value for cardholders. By leveraging these benefits in conjunction with the 0% APR promotional period, individuals can maximize the advantages of their credit cards and enhance their overall financial position.

Understanding the nuances of 0 interest credit cards empowers consumers to make informed decisions regarding their financial strategies. Whether it’s taking advantage of the interest-free period for large purchases or devising a plan to pay down existing debt, the features of 0 interest credit cards can be leveraged to achieve various financial goals. However, it’s essential to comprehend the minimum payment requirements and other terms and conditions associated with these cards to make the most of their benefits while avoiding potential pitfalls.

Minimum Payment Requirements

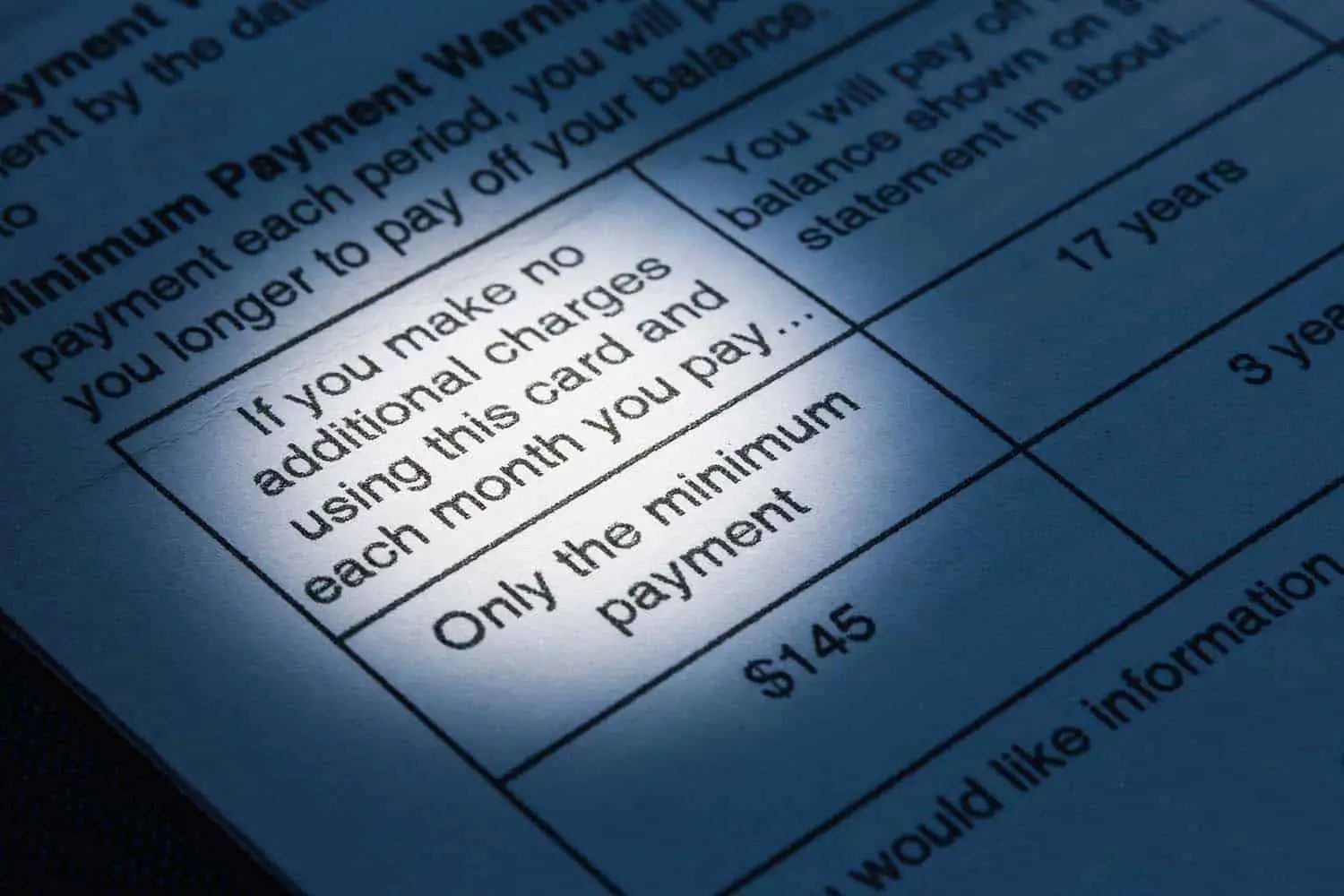

Minimum payment requirements on credit cards, including 0 interest credit cards, represent the lowest amount that cardholders must pay each month to keep their accounts in good standing. This mandatory payment is determined by the credit card issuer and is typically calculated as a percentage of the outstanding balance, subject to a minimum dollar amount.

For 0 interest credit cards, the minimum payment serves as a critical obligation that cardholders must fulfill, even during the promotional period when no interest is being charged. Failing to meet the minimum payment can result in late fees, penalty interest rates, and negative effects on the cardholder’s credit score. Therefore, it is imperative for cardholders to understand and adhere to the minimum payment requirements to avoid potential financial repercussions.

The minimum payment is generally calculated as a percentage of the total balance, typically ranging from 1% to 3% of the outstanding amount. Additionally, credit card issuers may impose a minimum dollar threshold, such as $25, to ensure that even small balances require a reasonable minimum payment. It’s important for cardholders to review their credit card agreements to ascertain the specific formula used by their issuer to calculate the minimum payment.

While the 0% APR promotional period provides relief from interest charges, cardholders should not overlook the significance of making at least the minimum payment each month. Doing so ensures that the account remains in good standing and prevents the accumulation of fees and negative credit reporting. Moreover, consistently meeting minimum payment obligations reflects positively on the cardholder’s credit history and demonstrates responsible financial behavior to creditors and credit bureaus.

Understanding the minimum payment requirements on 0 interest credit cards is paramount for maintaining financial stability and managing credit effectively. By staying informed about the minimum payment calculation, adhering to payment deadlines, and proactively managing their credit card accounts, individuals can navigate the nuances of minimum payments with confidence and prudence.

Factors Affecting Minimum Payments

Several factors influence the calculation of minimum payments on 0 interest credit cards, impacting the amount that cardholders are required to pay each month to maintain their accounts in good standing. Understanding these factors is essential for individuals seeking to manage their credit card obligations effectively and avoid potential financial pitfalls.

- Outstanding Balance: The most significant factor affecting the minimum payment is the outstanding balance on the credit card. Typically calculated as a percentage of the total balance, the minimum payment increases as the outstanding amount grows. Cardholders with higher balances will consequently face larger minimum payment requirements.

- Minimum Payment Percentage: Credit card issuers determine the minimum payment percentage, which can range from 1% to 3% of the total balance. This percentage serves as the basis for calculating the minimum payment due each month. Cardholders should be aware of this percentage to anticipate their minimum payment obligations accurately.

- Interest Rates After the Promotional Period: While 0 interest credit cards offer a temporary reprieve from interest charges, it’s crucial for cardholders to consider the interest rates that will apply once the promotional period ends. Understanding the potential impact of higher interest rates on minimum payments can help individuals plan their finances effectively.

- Additional Fees and Charges: Apart from the minimum payment, credit card statements may include fees such as annual fees, late payment fees, and other charges. These additional expenses can affect the overall amount due and should be factored into the cardholder’s financial planning.

- Payment History: A cardholder’s payment history, including any missed or late payments, can influence the minimum payment amount and the imposition of penalty fees. Maintaining a positive payment history is crucial for managing minimum payments effectively and avoiding adverse consequences.

By considering these factors, cardholders can gain insights into the dynamics of minimum payments on 0 interest credit cards and proactively manage their financial responsibilities. Being mindful of the variables that impact minimum payment calculations enables individuals to make informed decisions regarding their credit card usage and overall financial planning.

Tips for Managing Minimum Payments

Effectively managing minimum payments on 0 interest credit cards is crucial for maintaining financial stability and a positive credit standing. By implementing sound strategies and staying proactive, cardholders can navigate their minimum payment obligations with confidence. Here are valuable tips for managing minimum payments on 0 interest credit cards:

- Understand the Terms and Conditions: Familiarize yourself with the terms and conditions of your 0 interest credit card, including the minimum payment calculation method, payment due dates, and potential fees. Being well-informed empowers you to meet your obligations and avoid unnecessary charges.

- Create a Payment Schedule: Establish a payment schedule to ensure that you consistently meet your minimum payment requirements on time. Setting reminders or automating payments can help you stay on track and prevent late fees or negative credit reporting.

- Pay More Than the Minimum When Possible: While the minimum payment is mandatory, strive to pay more than the minimum whenever your financial situation allows. By paying more, you can reduce your outstanding balance faster and minimize the impact of interest charges once the promotional period ends.

- Monitor Your Spending: Keep a close eye on your credit card spending to avoid accumulating excessive balances that can lead to higher minimum payments. Practicing responsible spending habits can contribute to more manageable minimum payment obligations.

- Plan for the Post-Promotional Period: Anticipate the interest rates that will apply after the 0% APR period ends and factor this into your financial planning. Being prepared for potential interest charges can help you make informed decisions about your minimum payment strategy.

- Communicate with Your Issuer: In case of financial challenges or unexpected circumstances, don’t hesitate to communicate with your credit card issuer. They may offer assistance or alternative payment arrangements to help you manage your minimum payments effectively.

By incorporating these tips into your financial approach, you can navigate the complexities of managing minimum payments on 0 interest credit cards with confidence and prudence. Proactive financial management not only ensures that you fulfill your obligations but also contributes to a positive credit history and overall financial well-being.

Conclusion

Managing minimum payments on 0 interest credit cards is a critical aspect of maintaining financial stability and responsible credit card usage. While the allure of 0% APR promotional periods offers relief from interest charges, understanding and effectively managing minimum payments is essential for individuals seeking to make the most of their credit cards while safeguarding their financial well-being.

By comprehending the factors that influence minimum payments, such as outstanding balances, minimum payment percentages, and potential post-promotional period interest rates, cardholders can make informed decisions about their financial strategies. Implementing sound practices, including creating payment schedules, monitoring spending, and proactively communicating with credit card issuers, empowers individuals to navigate their minimum payment obligations with confidence.

Furthermore, paying more than the minimum whenever feasible and planning for the post-promotional period can contribute to a proactive and prudent approach to managing minimum payments on 0 interest credit cards. By adhering to these strategies and maintaining a clear understanding of the terms and conditions of their credit cards, individuals can cultivate responsible financial habits and ensure that their credit card accounts remain in good standing.

Ultimately, the effective management of minimum payments on 0 interest credit cards not only facilitates financial stability but also contributes to a positive credit history, positioning cardholders for long-term financial success. By leveraging the benefits of 0 interest credit cards while prudently managing their minimum payment obligations, individuals can navigate the realm of credit with confidence and foresight, enhancing their overall financial well-being.