Finance

What Is A Credit Sale

Published: January 14, 2024

Discover the concept of credit sales and its importance in finance. Explore how credit sales affect businesses and consumers, and learn about the benefits and risks involved.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance and business, credit sales play a crucial role in facilitating economic transactions. A credit sale occurs when a seller allows a buyer to purchase goods or services on credit, with the agreement that the buyer will make payment at a later date or in installments. This arrangement can be beneficial for both parties involved, as it provides the buyer with flexibility to pay over time and the seller with the opportunity to attract more customers and increase sales.

Understanding the concept of credit sales is essential for anyone involved in the finance industry or running a business, as it directly impacts cash flow, profitability, and customer relationships. In this article, we will dive deep into the world of credit sales, exploring its definition, features, advantages, disadvantages, types, and importance in business. We will also discuss strategies for effectively managing credit sales and mitigating associated risks.

Whether you are a business owner, a financial professional, or simply interested in learning more about the dynamics of credit sales, this article will provide valuable insights and practical tips to enhance your understanding and make informed decisions.

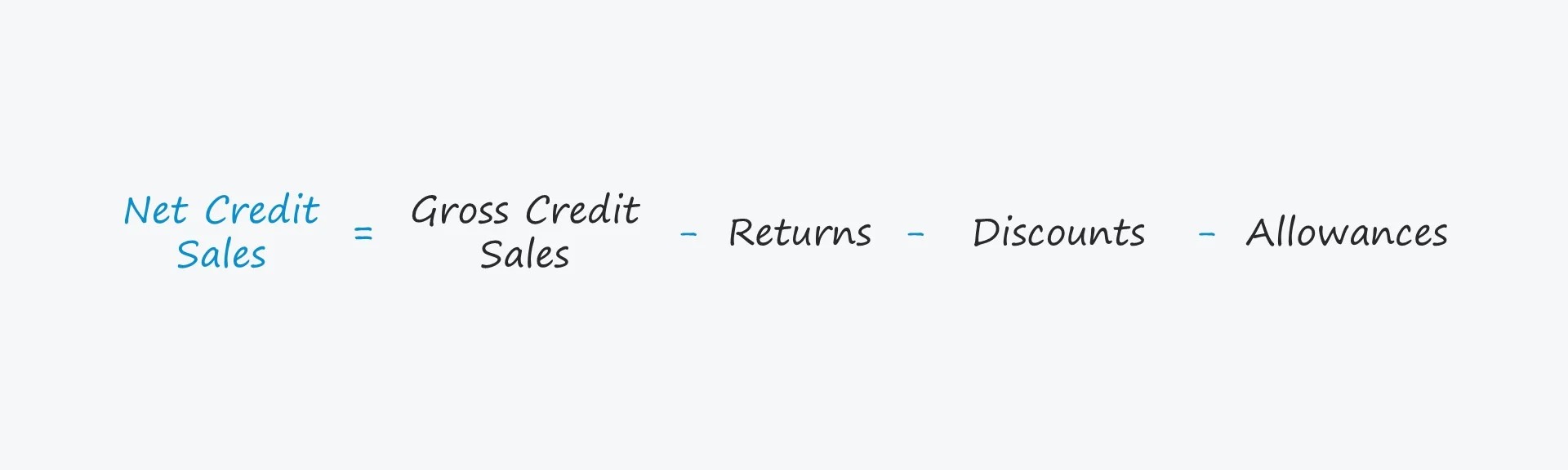

Definition of Credit Sale

A credit sale refers to a transaction in which a seller allows a buyer to purchase goods or services without the immediate payment of cash or upfront payment. Instead, the seller extends credit to the buyer, allowing them to make the payment at a later agreed-upon date or in installments.

Under a credit sale arrangement, the buyer receives the desired goods or services upfront and commits to paying the seller within a specified timeframe. This timeframe can vary depending on the terms agreed upon between the buyer and seller, and it may involve a single payment due on a future date or multiple payments distributed over a series of installments.

Credit sales often involve the use of credit terms or credit limits, which outline the specific conditions and terms under which the buyer is allowed to purchase on credit. The credit terms may include details such as the payment due date, interest rates, late payment penalties, and any other relevant terms and conditions.

It’s important to note that credit sales are different from cash sales, where the buyer pays for the goods or services at the time of purchase. Credit sales provide customers with greater flexibility in managing their finances, as they can defer payment until a later date, aligning their expenses with their cash flow situation. This flexibility can be particularly beneficial for businesses and individuals facing temporary financial constraints or planning to leverage the assets they purchase before making the payment.

In essence, credit sales serve as a mechanism for buyers to access goods and services immediately without immediate payment, while offering sellers the opportunity to expand their customer base and boost sales by providing alternative payment options.

Features of Credit Sale

Credit sales possess several distinctive features that differentiate them from other forms of transactions. Understanding these features is crucial for both buyers and sellers engaging in credit sales, as they influence the terms, conditions, and dynamics of the transaction. Here are some key features of credit sales:

- Delayed payment: One of the primary features of credit sales is the delayed payment aspect. Unlike cash sales where payment is made immediately, credit sales allow buyers to defer payment until a later agreed-upon date or over a set period of time.

- Extension of credit: Credit sales involve the extension of credit by the seller to the buyer. This means that the seller takes on the risk of allowing the buyer to make a purchase without immediate payment, with the expectation that the buyer will fulfill their payment obligation in the future.

- Agreed-upon terms: Credit sales operate on predetermined terms and conditions, which are agreed upon by both the buyer and seller. These terms include details such as the payment due date, interest rates (if applicable), repayment schedule, and any penalties for late payment.

- Credit evaluation: Before granting credit to a buyer, sellers often conduct a credit evaluation to assess the buyer’s creditworthiness and ability to make timely payments. This evaluation may involve analyzing the buyer’s credit history, financial statements, and other relevant information.

- Interest charges: In some cases, sellers may apply interest charges on credit sales to compensate for the delayed payment and the associated risk. The interest rate charged can vary depending on the terms of the sale and prevailing market conditions.

- Record keeping: Credit sales require proper record keeping by both the buyer and seller. Sellers need to maintain accurate records of credit transactions, including invoices, receipts, and payment schedules. Buyers must also keep track of their outstanding credit obligations and ensure timely payments.

These features of credit sales provide a framework for buyers and sellers to engage in transactions where deferred payment is allowed. By clearly defining the terms and conditions of the credit sale, both parties can establish trust and maintain a healthy business relationship.

Advantages of Credit Sale

Credit sales offer several advantages to both buyers and sellers, making them a popular method of conducting business transactions. These advantages contribute to increased sales, customer loyalty, and improved cash flow management. Here are some key benefits of credit sales:

- Increased sales: By offering credit sales, sellers can attract a larger customer base. Many buyers prefer the option to purchase goods or services on credit, as it allows them to spread the cost over time. This increased accessibility often results in higher sales volumes and revenue for the seller.

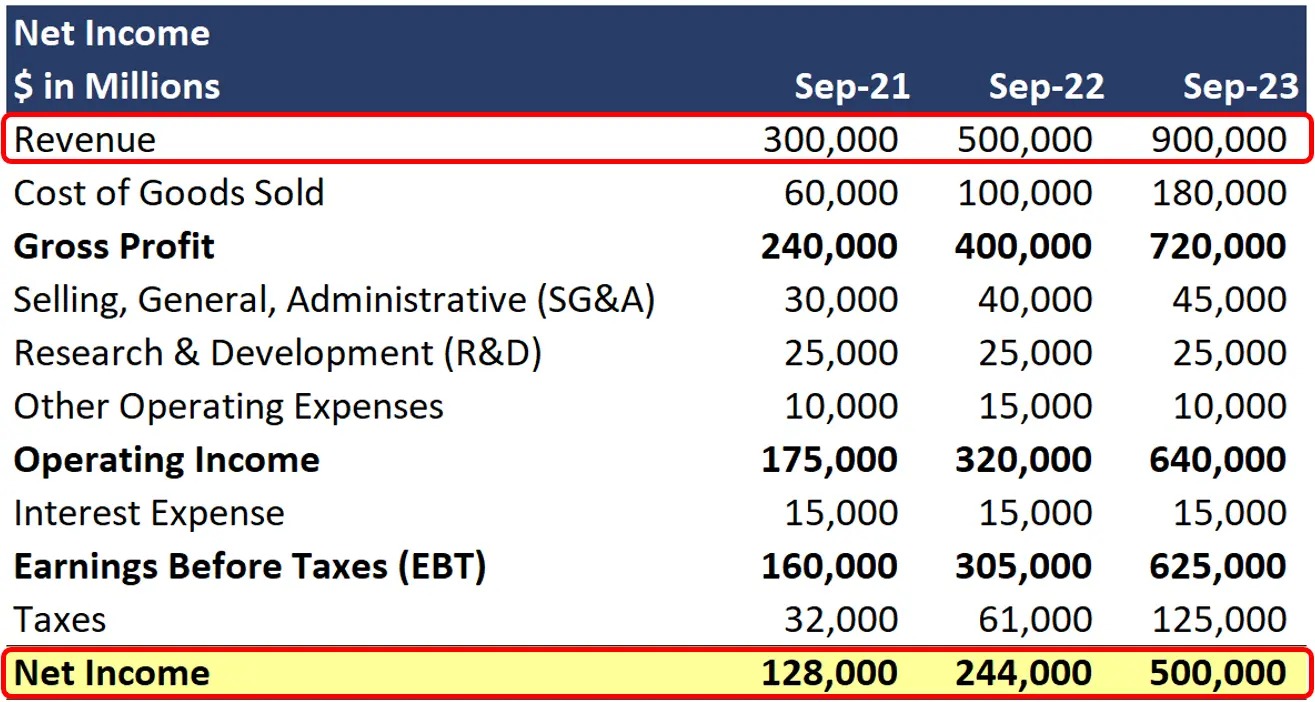

- Improved cash flow: Credit sales provide sellers with the opportunity to generate revenue even when buyers are unable to make an immediate payment. This helps maintain a steady cash flow and provides the seller with the necessary capital to cover expenses and invest in business growth.

- Customer convenience: Offering credit sales enhances customer convenience by giving them the flexibility to make purchases even if they don’t have immediate cash at hand. This convenience can create a positive customer experience and boost customer loyalty.

- Competitive advantage: In a competitive market, the option of credit sales can give a seller a competitive edge over other businesses. By providing an alternative payment method, sellers can differentiate themselves and attract customers who prefer the option of purchasing on credit.

- Building customer relationships: Credit sales can help build strong, long-term relationships between buyers and sellers. By extending credit and demonstrating trust in their customers’ ability to pay, sellers can establish a sense of loyalty and encourage repeat business.

- Opportunity for upselling: Credit sales provide the opportunity for sellers to upsell or cross-sell additional products or services. When buyers have the flexibility to purchase on credit, they may be more inclined to consider additional offerings from the seller, leading to increased sales and higher average purchase value.

- Encouraging purchases of high-value items: For higher-priced items that may be out of reach for buyers without credit options, credit sales can make these purchases more attainable. This can lead to increased sales of high-value items, contributing to improved profitability for sellers.

Overall, credit sales offer numerous advantages that can benefit both buyers and sellers. From increased sales and customer convenience to improved cash flow and customer relationships, credit sales are a valuable tool in the world of commerce.

Disadvantages of Credit Sale

While credit sales can offer numerous benefits, they also come with their own set of disadvantages. It is essential for both buyers and sellers to be aware of these potential drawbacks to make informed decisions regarding credit transactions. Here are some of the main disadvantages of credit sales:

- Delayed payments and cash flow challenges: One of the primary drawbacks of credit sales is the delayed receipt of payment. Sellers may face cash flow challenges when they have to wait for payment, particularly if they rely on timely payment to cover their own expenses or meet financial obligations.

- Risk of non-payment: Sellers face the risk of buyers not honoring their credit obligations. Some buyers may default on their payments, leading to financial losses for the seller and additional effort and costs associated with collecting outstanding debts.

- Administrative burden: Credit sales often involve additional administrative tasks such as credit evaluations, maintaining records, sending payment reminders, and managing collections. This administrative burden can be time-consuming and resource-draining for sellers.

- Increased costs and risk of bad debts: Sellers may incur higher costs, such as employing credit analysts or collection agencies, to mitigate the risk of bad debts. These costs can eat into profits and affect the overall financial health of the business.

- Opportunity cost of capital: When sellers extend credit to buyers, they effectively provide an interest-free loan. This means sellers forgo the opportunity to invest their capital elsewhere or earn interest on the funds tied up in credit sales.

- Potential strain on customer relationships: If buyers experience difficulties in making payments, it can strain their relationships with the seller. This strain can lead to dissatisfaction and potential loss of future business.

- Potential overextension of credit: Sellers must carefully manage their credit policies and avoid extending credit to buyers who may pose a high risk of default. Overextending credit can lead to an accumulation of bad debts and financial instability.

It is important for both buyers and sellers to consider these disadvantages and find ways to mitigate associated risks. Establishing clear credit terms, conducting thorough credit assessments, and implementing effective credit management practices can help minimize the impact of these disadvantages and create a more secure and successful credit sales process.

Types of Credit Sales

Credit sales encompass various types, each with its own unique characteristics and implications for buyers and sellers. Understanding these different types of credit sales is crucial for effectively managing and structuring credit transactions. Here are some common types of credit sales:

- Open account: This is one of the most common types of credit sales, where the seller extends credit to the buyer based on a mutual agreement. The buyer is allowed to make purchases on credit without a specific repayment schedule, with payment typically due within a specified time period, such as 30 or 60 days. This type of credit sale is often used in B2B (business-to-business) transactions.

- Installment sale: In an installment sale, the buyer agrees to make a series of payments over a set period of time. This type of credit sale is commonly used for high-value purchases, such as automobiles or appliances. The payment schedule and terms are agreed upon upfront, including the amount of each installment and any applicable interest charges.

- Revolving credit: Revolving credit is a type of credit sale that provides buyers with a line of credit that can be used repeatedly within a specified credit limit. The buyer can make purchases on credit up to the limit, and as they make payments, the available credit replenishes. This type of credit sale is often associated with credit cards or store credit accounts.

- Factoring: Factoring is a type of credit sale where a business sells its accounts receivable (invoices) to a third party, known as a factor. The factor then assumes the responsibility of collecting payments from the buyers. This allows the business to receive immediate cash flow instead of waiting for the buyers to make payments.

- Consignment sale: In a consignment sale, the seller retains ownership of the goods until they are sold by the buyer. The seller allows the buyer to display and sell the goods without paying upfront. The buyer only pays the seller once the goods are sold. This type of credit sale is often used in retail or art industries.

These are just a few examples of the types of credit sales that exist. Each type offers a different structure and arrangement for the extension of credit, catering to specific industries, products, or buyer preferences. By understanding these types, buyers and sellers can choose the most suitable credit sale arrangement to meet their needs and effectively manage their financial transactions.

Importance of Credit Sale in Business

Credit sales play a vital role in the success and growth of businesses across various industries. Whether it’s a small retail store or a multinational corporation, understanding the importance of credit sales is crucial for effectively managing cash flow, attracting customers, and expanding market reach. Here are some key reasons why credit sales are important in business:

- Increased sales: Offering credit sales allows businesses to attract a larger customer base. It provides potential buyers who may not have immediate funds with the opportunity to make purchases, thereby increasing sales volumes and revenue.

- Fostering customer loyalty: By extending credit to customers, businesses can build strong, long-term relationships. Buyers who have a positive credit experience are more likely to become loyal customers, leading to repeat business and increased customer retention.

- Competitive advantage: In a competitive marketplace, the availability of credit sales can give businesses a distinct advantage. It provides an alternative payment option and sets them apart from competitors who may only accept cash or immediate payment.

- Flexibility for buyers: Credit sales offer buyers flexibility in managing their finances. They can make purchases now and pay later, aligning their expenses with their cash flow. This convenience can attract a wider range of customers who may not have the means to pay upfront.

- Cash flow management: Credit sales provide businesses with a consistent cash inflow, even when buyers choose to defer payment. This helps maintain a steady cash flow, enabling the company to meet its financial obligations, invest in growth opportunities, and manage day-to-day operations effectively.

- Upselling and cross-selling opportunities: Credit sales present opportunities for businesses to upsell or cross-sell additional products or services. Once a buyer has been approved for credit, they may be more inclined to consider complementary or higher-value items, leading to increased sales and revenue.

- Market expansion: With credit sales, businesses can expand their reach by making their products or services accessible to a wider audience. Buyers who would otherwise be unable to afford the purchase upfront can now access the offerings, allowing businesses to tap into new markets and customer segments.

- Building creditworthiness: Consistently managing credit sales and ensuring timely repayments can help businesses build a positive credit history. This can enhance their credibility and creditworthiness with financial institutions, suppliers, and other stakeholders, enabling easier access to financing and better business opportunities.

Overall, credit sales provide numerous benefits to businesses, ranging from increased sales and customer loyalty to improved cash flow management and market expansion. By understanding the importance of credit sales and implementing effective credit management strategies, businesses can thrive in today’s competitive marketplace.

How to Manage Credit Sales

Effectively managing credit sales is crucial for businesses to maintain a healthy cash flow, mitigate risks, and build strong customer relationships. Here are some key strategies to help businesses manage credit sales:

- Establish clear credit policies: Clearly define your credit policies and procedures, setting out the terms and conditions for extending credit to customers. This includes determining credit limits, payment terms, and any applicable interest or penalties for late payments.

- Perform thorough credit assessments: Before granting credit to customers, conduct comprehensive credit evaluations to assess their creditworthiness. Review their credit history, financial statements, and other relevant information to ensure they have the ability to make timely payments.

- Implement credit agreements or contracts: Use written agreements or contracts to formalize credit sales. Clearly document the agreed-upon terms, payment schedules, interest rates, and any additional provisions to protect your interests and minimize disputes.

- Monitor credit utilization: Regularly monitor the credit utilization of your customers to identify any red flags or potential risks. Keep track of their outstanding balances and payment patterns to proactively address any issues and ensure timely collections.

- Send regular statements and reminders: Send periodic statements to customers highlighting their outstanding balances and payment due dates. Follow up with friendly reminders as the payment due date approaches to encourage timely payment and reduce the risk of late or missed payments.

- Offer incentives for early payment: Consider offering incentives such as discounts or rewards for customers who make early or prompt payments. This can encourage timely payment and improve cash flow while fostering goodwill with your customers.

- Implement a collections process: Develop a structured collections process for managing overdue payments. Clearly communicate the consequences of non-payment and establish steps to escalate collections efforts if necessary, such as sending collection letters or engaging collection agencies.

- Regularly review and update credit policies: Continuously evaluate and review your credit policies to ensure they are aligned with the changing needs of your business and industry. Make adjustments as necessary to address any potential risks or opportunities for improvement.

- Utilize technology and automation: Leverage technology and automation tools to streamline credit management processes. This can include using accounting software to track credit sales, sending automated payment reminders, and generating aging reports to monitor outstanding balances.

- Provide customer support and communication: Maintain open lines of communication with your customers and provide exceptional customer support. Address any concerns or inquiries promptly to build trust and reinforce the importance of meeting their payment obligations.

By implementing these strategies, businesses can effectively manage credit sales, minimize risks, and maintain a healthy financial position. Effective credit management not only ensures timely payments but also plays a vital role in maintaining strong customer relationships and sustaining long-term business success.

Tips for Effective Credit Sale Management

Managing credit sales effectively is crucial for businesses to maintain financial stability and maximize profitability. To ensure smooth operations and mitigate risks, here are some key tips to help businesses effectively manage credit sales:

- Establish clear credit policies and procedures: Clearly define your credit terms, including credit limits, payment terms, and interest rates, and communicate them to your customers. This clarity helps set expectations and minimizes confusion.

- Conduct thorough credit assessments: Before extending credit to customers, conduct a comprehensive credit evaluation to assess their creditworthiness. Look into their credit history, financial statements, and references to determine their ability to make timely payments.

- Set realistic credit limits: Determine appropriate credit limits for each customer based on their financial capacity and their history with your business. Avoid overextending credit to minimize the risk of bad debts.

- Establish a proper credit monitoring system: Regularly monitor customer credit accounts to identify any signs of potential payment issues or concerns. Keep track of outstanding balances and payment patterns to take proactive measures when necessary.

- Implement a invoicing system: Develop an efficient invoicing system to ensure accurate and timely billing. Clearly state payment terms on invoices, including due dates and any late payment penalties.

- Send timely payment reminders: Regularly send payment reminders to customers as their payment due dates approach. This can help prompt them to make timely payments and reduce the risk of late or missed payments.

- Offer discounts for early payment: Provide incentives for customers to make early payments by offering discounts or other perks. This can encourage prompt payment and improve cash flow.

- Establish a collections process: Develop a structured collections process to manage delinquent accounts effectively. Clearly communicate consequences for non-payment and establish steps for escalation, such as sending collection letters or engaging collection agencies.

- Regularly review and update credit terms: Continuously evaluate and update your credit terms to reflect changes in your business and industry. Stay current with market trends and adjust your credit policies to minimize risk and maximize profitability.

- Utilize technology and automation: Leverage technology and automation tools to streamline credit sale management. Use accounting software to track credit sales, automate payment reminders, and generate reports for accurate monitoring and analysis.

- Provide exceptional customer service: Maintain open lines of communication with your customers and provide excellent customer support. Address any inquiries or concerns promptly, as this fosters trust and reinforces the importance of meeting payment obligations.

By implementing these tips, businesses can effectively manage credit sales, minimize the risk of bad debts, and maintain healthy cash flow. Consistency, communication, and proactive credit management are key elements in successfully navigating credit sales and ensuring long-term business success.

Conclusion

Credit sales are an integral part of the business world, offering benefits to both buyers and sellers. The ability to purchase goods or services on credit provides flexibility for buyers and helps sellers attract a wider customer base, increase sales, and improve cash flow management. However, credit sales also come with potential disadvantages such as delayed payments, increased administrative burden, and the risk of non-payment.

To effectively manage credit sales, businesses must establish clear credit policies, perform thorough credit assessments, and monitor credit utilization. Communication with customers, timely payment reminders, and incentives for early payment can also play a crucial role in maintaining healthy customer relationships and reducing the risk of bad debts. Additionally, leveraging technology and automation tools can streamline credit sale management and enhance efficiency.

By understanding the importance of credit sales and implementing effective credit management strategies, businesses can navigate the challenges and reap the rewards. From increased sales and customer loyalty to improved cash flow and market expansion, credit sales provide a valuable tool for growth and success in the competitive business landscape.

It is essential for businesses to strike a balance between offering credit sales and managing associated risks. By consistently reviewing and adjusting credit policies, businesses can adapt to changing market dynamics and ensure a sustainable and profitable credit sale process.

Overall, credit sales play a significant role in driving business growth, fostering customer loyalty, and enhancing financial stability. By effectively managing credit sales, businesses can optimize their operations, build strong customer relationships, and thrive in today’s dynamic business environment.