Home>Finance>What Is The Annual Percentage Rate (APR) If A Bank Pays 0.3% Interest Monthly On Savings?

Finance

What Is The Annual Percentage Rate (APR) If A Bank Pays 0.3% Interest Monthly On Savings?

Published: January 16, 2024

Learn how to calculate the Annual Percentage Rate (APR) when a bank pays 0.3% interest on savings monthly. Get the details here and improve your financial knowledge.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where understanding the intricacies of money management is key to making informed decisions. One essential concept in the realm of banking and lending is the Annual Percentage Rate (APR). Whether you’re considering a credit card, a mortgage, or a savings account, the APR plays a crucial role in determining the true cost of borrowing or the earnings potential of an investment.

The APR is a standardized way for financial institutions to disclose the annualized cost of borrowing or the yield on an investment. It accounts for not only the interest rate charged but also any additional fees or expenses associated with the loan or investment product. By providing a more comprehensive picture of the costs, the APR enables consumers to compare different financial offers and make more informed choices.

When it comes to savings accounts, the APR is a measure of the interest rate paid by the bank on the funds deposited by the account holder. In this article, we’ll dive deeper into the concept of APR and explore how it is calculated when the bank pays a 0.3% interest rate on savings accounts on a monthly basis.

Understanding the APR is essential for anyone looking to grow their savings or access credit at the most favorable terms. So, let’s unpack the details of this financial metric and delve into the world of interest rates and annual percentages.

Understanding the Annual Percentage Rate (APR)

The Annual Percentage Rate (APR) is a key metric used in the world of finance to measure the true cost of borrowing or the earnings potential of an investment. It takes into account not only the interest rate charged but also any additional fees, charges, or costs associated with the financial product.

For borrowers, the APR represents the total cost of a loan over a year, expressed as a percentage. It helps consumers compare different loan offers and choose the one that best fits their needs. A lower APR indicates a lower cost of borrowing, while a higher APR means higher borrowing costs.

On the other hand, for savers, the APR represents the annual interest rate paid by the financial institution on the deposited funds. It determines the potential earnings on a savings account, with a higher APR indicating higher returns.

It’s important to note that the APR is standardized across financial products and institutions, enabling consumers to make meaningful comparisons. Whether you’re considering a mortgage, an auto loan, or a credit card, the APR provides a clear and consistent way to assess the real cost of borrowing.

By including additional fees and charges in the APR, lenders are required to be transparent about the true cost of the loan. This ensures that borrowers have a clear understanding of the total amount they will repay over the life of the loan. It also protects consumers from hidden fees and deceptive lending practices.

Understanding the APR is crucial for both borrowers and savers. Whether you’re taking out a loan or seeking to maximize your savings, having a solid understanding of the APR will empower you to make better financial decisions. In the next section, we’ll explore how the APR calculation works in the context of monthly interest paid by a bank on savings.

How Does the APR Calculation Work?

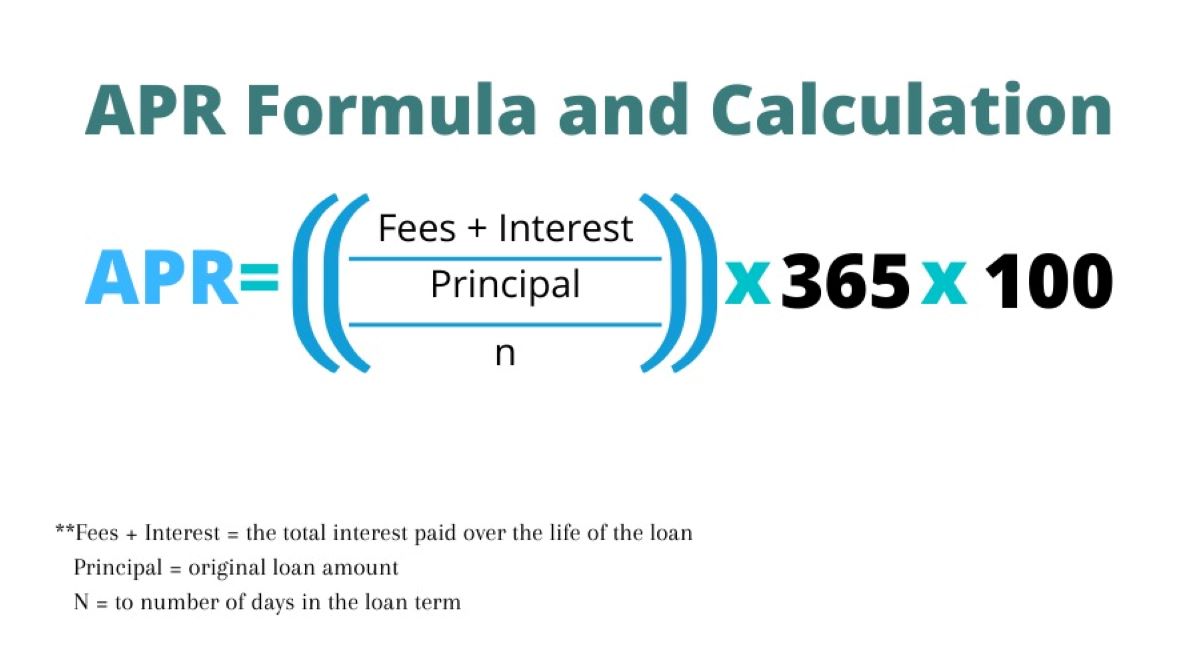

To understand how the Annual Percentage Rate (APR) is calculated, let’s consider the scenario where a bank pays a monthly interest rate of 0.3% on savings accounts. The APR calculation takes into account this monthly interest rate to determine the annualized rate of return on the deposited funds.

The first step in the APR calculation is to convert the monthly interest rate to an annual rate. Since there are 12 months in a year, we can simply multiply the monthly interest rate by 12. In this case, multiplying 0.3% by 12 gives us an annual interest rate of 3.6%.

However, it’s important to note that the APR calculation goes beyond just the interest rate. It includes any additional fees or charges associated with the savings account. These can include account maintenance fees, transaction fees, or any other charges imposed by the bank.

To calculate the APR, all fees and charges must be taken into account. These are added to the calculated interest rate to provide a more accurate representation of the overall cost of holding the savings account for a year.

Once all fees and charges are considered, the APR is determined by factoring in the total cost over a year and expressing it as a percentage of the deposited funds. For example, if the total cost of holding the savings account for a year (including fees) is $100 on a $1,000 deposit, the APR would be calculated as 10%.

It’s important to remember that the APR is an annualized rate, which means that it provides a standardized measure to compare different financial products over a year. It allows savers to evaluate the potential return on investment when comparing various savings accounts.

Understanding the APR calculation is crucial for savers, as it helps them assess the overall value of a savings account beyond just the advertised interest rate. By taking into account any additional fees, charges, or costs, the APR provides a more accurate representation of the true returns on the deposited funds.

In the next section, we’ll explore the specific factors that can affect the APR calculation on savings accounts, furthering our understanding of this important financial metric.

Bank’s Monthly Interest Rate on Savings

When it comes to savings accounts, the interest rate offered by the bank plays a crucial role in determining the potential growth of your funds. The interest rate represents the percentage of your deposited funds that the bank will pay you as earnings over a certain period of time.

In the given scenario, where the bank pays a monthly interest rate of 0.3% on savings accounts, it means that for every dollar you have in your account, the bank will pay you 0.3 cents in interest per month.

To put it into perspective, let’s consider an example. If you have $10,000 in your savings account, the bank will pay you $30 in interest for that month. As your balance changes from month to month due to deposits or withdrawals, the interest will also adjust accordingly based on the monthly rate.

The bank’s monthly interest rate can vary depending on a variety of factors. Market conditions, the bank’s financial health, and competition within the industry can all influence the interest rate that a bank offers on its savings accounts. Banks often adjust their interest rates to attract and retain customers, so it’s important to regularly compare rates and find the best possible option for your savings.

It’s worth noting that the interest earned on savings accounts is generally calculated based on the average daily balance during a given period. This means that the interest is not solely based on the initial deposit, but rather on the average balance maintained throughout the month.

By offering an attractive interest rate, banks aim to incentivize individuals and businesses to save their money rather than spending it. With a higher interest rate, your savings have the potential to grow more rapidly over time, accelerating your journey towards achieving your financial goals.

Now that we understand the bank’s monthly interest rate on savings accounts, let’s move on to the next section, where we will delve into the calculation of the Annual Percentage Rate (APR) – a metric that takes into account the interest rate along with other fees and charges associated with the savings account.

Calculating the Annual Percentage Rate (APR)

Calculating the Annual Percentage Rate (APR) requires considering not only the bank’s monthly interest rate on savings accounts but also any additional fees and charges associated with the account. The APR provides a comprehensive measure of the true cost or return on your funds, taking into account both the interest rate and other costs.

Let’s continue with the example where the bank pays a monthly interest rate of 0.3% on savings accounts. To calculate the APR, we need to account for any fees or charges associated with the account.

First, we convert the monthly interest rate to an annual rate by multiplying it by 12, as there are 12 months in a year. In this case, a monthly interest rate of 0.3% translates to an annual interest rate of 3.6%.

Next, we consider any fees or charges associated with the savings account. These can include maintenance fees, transaction fees, or any other costs imposed by the bank. For illustration purposes, let’s assume there are no additional fees or charges.

Therefore, in this scenario, the APR would simply be the same as the annual interest rate of 3.6%. This means that, taking into account the absence of fees, the bank will pay an annual interest of 3.6% on the funds in the savings account.

It’s important to note that the APR calculation becomes more complex when there are additional fees involved. If there are fees or charges associated with the savings account, these need to be factored into the APR calculation to provide a more accurate representation of the overall cost or return.

By calculating the APR, you can effectively compare different savings account offers from various banks. It allows you to evaluate not only the interest rate but also any additional costs, giving you a clearer picture of the total value offered by each account.

Remember, the APR is a standardized metric that enables you to make informed decisions by considering all the relevant factors involved in holding a savings account. It helps you choose the account that best suits your financial goals and provides the highest potential return on your funds.

Now that we have explored how to calculate the APR in the context of a monthly interest rate on savings accounts, let’s move on to the next section, where we will discuss the factors that can impact the APR calculation.

Factors Affecting the APR Calculation

The calculation of the Annual Percentage Rate (APR) takes into account various factors that can influence the overall cost or return on a financial product. While the bank’s monthly interest rate on savings accounts is a primary factor, there are other variables that can impact the APR calculation.

Here are some key factors that can affect the APR calculation:

1. Fees and Charges: Any additional fees or charges associated with the savings account, such as maintenance fees, transaction fees, or ATM fees, can increase the overall cost and lower the effective rate of return on the account. These fees need to be taken into account to accurately calculate the APR.

2. Compounding Frequency: The compounding frequency refers to how often the interest is calculated and added to the account balance. A higher compounding frequency, such as daily or monthly, can result in higher earnings due to the effect of compounding.

3. Minimum Balance Requirements: Some savings accounts may require a minimum balance to be maintained to avoid certain fees or to qualify for a higher interest rate. These requirements can impact the overall cost or return on the account and should be considered in the APR calculation.

4. Introductory and Promotional Rates: Financial institutions may offer introductory or promotional rates for a certain period of time to attract new customers. These rates are typically higher than the standard rate but expire after a specific timeframe. When calculating the APR, it is important to account for the duration of the promotional rate and adjust the overall interest earned accordingly.

5. Variable Interest Rates: Some savings accounts have variable interest rates that can change over time. These fluctuations in interest rates can impact the overall cost or return on the account. When calculating the APR, it is crucial to consider the potential changes in the interest rate to get a more accurate estimate of the annualized rate.

6. Penalties and Early Withdrawal Fees: Some savings accounts may impose penalties or charges for early withdrawal or not meeting certain account conditions. These penalties can reduce the overall return on the account and should be factored into the APR calculation.

By considering these factors, you can obtain a more comprehensive understanding of the true cost or return associated with a savings account. It is crucial to carefully review the terms and conditions of the account and understand how these factors may impact the APR calculation.

Now that we have explored the factors that can affect the APR calculation, let’s move on to the final section where we will discuss the importance of comparing APRs when making financial decisions.

Importance of Comparing APRs

When it comes to making financial decisions, comparing the Annual Percentage Rates (APRs) of different savings accounts is crucial. The APR provides a standardized metric that allows you to assess the overall cost or return of the account, taking into account factors such as interest rates, fees, and other charges.

Here are several reasons why comparing APRs is important:

1. Transparent Comparison: By comparing the APRs of different savings accounts, you can easily compare the true cost or return of each account in a standardized manner. It allows you to make an apples-to-apples comparison, taking into account all the relevant factors that impact the overall value of the account.

2. Identify the Best Value: APR comparison helps you identify the savings account that offers the highest potential return or the lowest cost, depending on your needs. It allows you to make an informed decision based on the financial institution’s pricing and terms, ensuring that you choose the account that aligns with your goals and preferences.

3. Awareness of Additional Costs: Comparing APRs helps you become aware of any additional fees and charges associated with the savings account. While a bank may offer a higher interest rate, it may also come with hidden fees that diminish the overall returns. By considering the APR, you can evaluate the total cost of the account, including any fees, and make an informed decision.

4. Long-Term Impact: Over time, even a slight difference in APR can have a significant impact on your savings. Comparing APRs allows you to identify the account that offers the highest potential growth for your money. By optimizing your savings with a higher APR, you can maximize your earnings and achieve your financial goals faster.

5. Protection against Deceptive Offers: Comparing APRs helps protect you from deceptive marketing practices and misleading offers. Financial institutions may advertise attractive interest rates but fail to disclose hidden fees or charges. By comparing APRs, you can see the true cost of the account and avoid falling into the trap of misleading promotions.

6. Informed Decision-Making: Ultimately, comparing APRs enables you to make an informed decision when choosing a savings account. It empowers you to evaluate the overall value, weigh the benefits against the costs, and select the account that best suits your financial needs and goals.

In summary, comparing APRs is essential to make informed financial decisions. It allows you to assess the true cost or return of a savings account by considering factors such as interest rates, fees, and other charges. By comparing APRs, you can choose the account that offers the best value for your money, maximize your savings, and achieve your financial objectives.

Now, let’s wrap up this article in the next section, summarizing the key points we’ve covered on APR and its significance in evaluating savings accounts.

Conclusion

Understanding the Annual Percentage Rate (APR) and its impact on savings accounts is crucial for making informed financial decisions. The APR provides a standardized metric that takes into account the interest rate, fees, and charges associated with an account, offering a comprehensive view of the true cost or return.

Throughout this article, we have explored the concept of APR and its calculation when the bank pays a 0.3% interest rate on savings accounts monthly. We learned that the APR calculation involves converting the monthly interest rate to an annual rate and considering any additional fees or charges.

Factors such as fees, compounding frequency, minimum balance requirements, promotional rates, variable interest rates, and penalties can impact the APR calculation. It is essential to compare APRs when evaluating savings accounts to make transparent comparisons, identify the best value, and be aware of any additional costs or potential long-term impact.

By comparing APRs, you can make an informed decision when selecting a savings account, ensuring it aligns with your financial goals and offers the highest potential return. Comparing APRs also protects you from misleading offers and empowers you to make confident choices based on accurate information.

In a world where every financial institution offers different interest rates, terms, and fees, the APR serves as a vital tool for evaluating savings accounts objectively. It allows you to see beyond the surface and assess the true value of different accounts.

As you navigate the financial landscape, remember to consider the APR along with your personal financial goals, risk tolerance, and liquidity needs. By doing so, you can optimize your savings, make the most of your money, and work towards achieving financial security and success.

So, take your time to compare APRs, explore different options, and choose the savings account that best suits your needs. With a solid understanding of the APR, you are now equipped to make informed financial decisions that will benefit your financial future.