Home>Finance>What Is The Relationship Between Credit And Debt?

Finance

What Is The Relationship Between Credit And Debt?

Modified: February 21, 2024

Learn about the intricate connection between credit and debt in the world of finance. Discover how these two factors influence each other and impact your financial well-being.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where credit and debt play a significant role in our lives. These two terms are often used interchangeably, but they have distinct meanings and implications. Understanding the relationship between credit and debt is crucial for making informed financial decisions and managing your financial well-being.

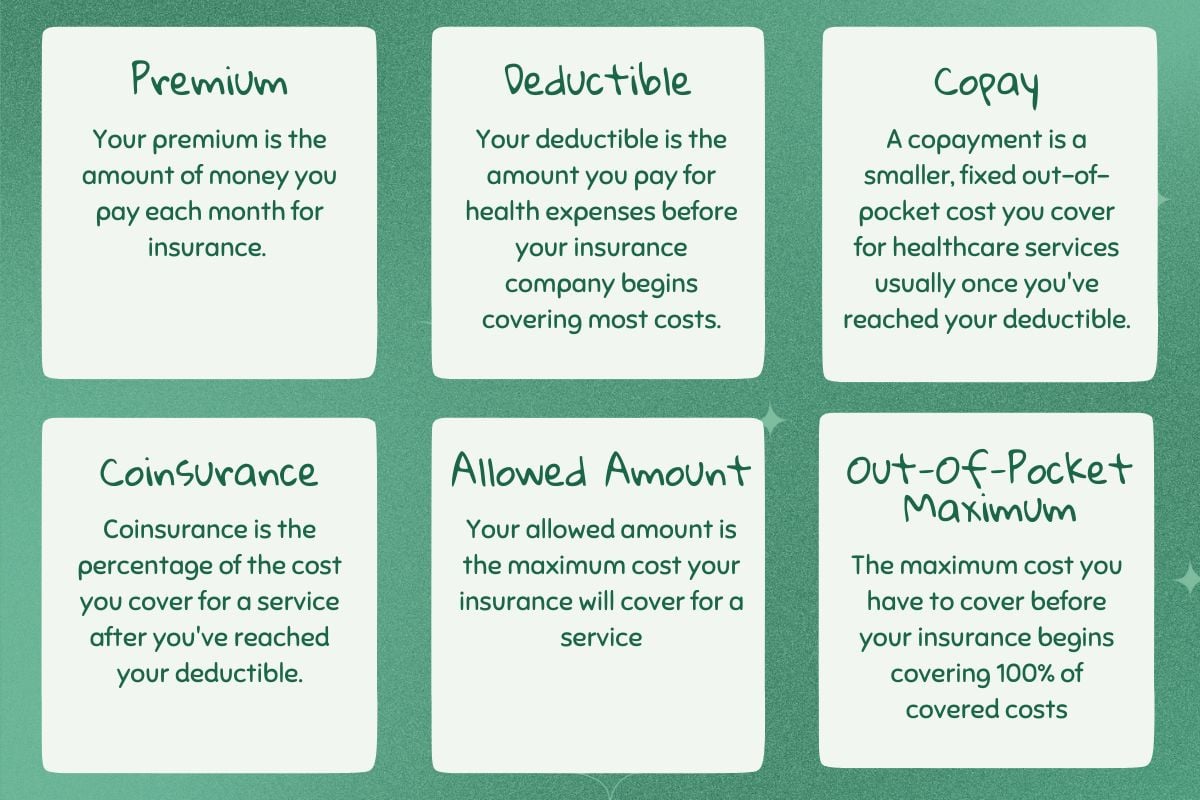

Credit refers to the ability to borrow money or obtain goods and services with the promise of repayment in the future. It is a financial resource that allows individuals and businesses to access funds beyond their immediate means. Credit can be extended by various entities, such as banks, credit card companies, and lending institutions.

On the other hand, debt is the result of utilizing credit. It represents the amount of money owed to creditors or lenders for goods, services, or borrowed funds. Debt can accumulate through various means, such as credit card purchases, loans, mortgages, and other financial obligations.

The relationship between credit and debt is intrinsically linked. Credit provides the means to accumulate debt, while debt is the result of using credit. They form a cyclical relationship, impacting each other in various ways.

In this article, we will delve deeper into the connection between credit and debt, exploring the types of credit and debt, understanding their management, and analyzing the impact they have on each other. By gaining a comprehensive understanding of this relationship, you will be better equipped to navigate the complex world of finance and make informed decisions regarding your credit and debt obligations. Let’s begin the journey to unravel the intricacies of credit and debt.

Understanding Credit

Credit is a financial tool that allows individuals and businesses to borrow money or access goods and services on the promise of repayment in the future. It serves as a temporary source of funds, providing financial flexibility and resources beyond what is immediately available.

When you apply for credit, such as a credit card or a loan, the lender evaluates your creditworthiness based on factors such as your income, credit history, and ability to repay the borrowed amount. If approved, you are given a designated credit limit or loan amount that you can utilize.

There are various types of credit available, including:

- Credit Cards: These are revolving lines of credit that allow you to make purchases up to a certain limit, with the flexibility of repaying the borrowed amount in full or making minimum monthly payments.

- Loans: Loans come in different forms, such as personal loans, auto loans, and mortgages. They involve borrowing a specific amount of money, which is repaid over a defined period, often with interest.

- Lines of Credit: Similar to credit cards, lines of credit provide access to a predetermined amount of funds that you can use as needed. Interest is charged only on the amount borrowed.

- Store Credit: Some retailers offer credit accounts that allow customers to make purchases and pay off the balance over time, often with special financing offers.

Using credit wisely is essential to maintain a positive credit history and ensure financial stability. When you use credit responsibly—making timely payments, keeping debt levels manageable, and utilizing credit for necessary purchases—you can build a good credit score, which is a measure of your creditworthiness. A good credit score can help you secure better interest rates on loans and access higher credit limits.

However, it’s important to note that misusing credit can lead to financial difficulties. Accumulating excessive debt, missing payments, or maxing out credit limits can negatively impact your credit score and make it challenging to obtain loans or credit in the future.

Understanding the different types of credit and how they work is the first step in managing your credit effectively. With this knowledge, you can make informed decisions about borrowing and use credit as a valuable financial tool to achieve your goals.

Definition of Debt

Debt is the financial obligation that arises when you borrow money, obtain goods or services on credit, or have unpaid financial obligations. It represents the amount of money owed to creditors or lenders for the utilization of credit.

Debt can take various forms, including:

- Credit Card Debt: This type of debt is incurred when you make purchases using a credit card and do not pay off the full balance by the due date. The remaining balance accrues interest, and if left unpaid, can accumulate into a significant debt.

- Student Loans: Student loans are debts that are taken to finance education expenses. These loans often have specific repayment terms and interest rates and are typically repaid after the completion of education or a grace period.

- Mortgages: Mortgages are long-term loans used to finance the purchase of real estate properties. They involve borrowing a substantial amount of money, which is repaid over an extended period, often with interest.

- Personal Loans: Personal loans are unsecured loans that provide funds for various purposes, such as debt consolidation, home improvements, or emergency expenses. These loans have fixed repayment terms and interest rates.

- Auto Loans: Auto loans are loans used to purchase vehicles. The borrower agrees to repay the borrowed amount along with interest over a specific period, typically through monthly installments.

- Business Loans: Business loans are funds borrowed by businesses to finance operations, expansions, or other financial needs. These loans have specific terms, repayment schedules, and interest rates based on the nature of the business and its financial standing.

It’s essential to manage debt responsibly to avoid financial stress and maintain a healthy financial profile. This involves making regular payments on time, managing debt levels within your means, and prioritizing high-interest debts. Failing to meet debt obligations can result in late fees, penalties, and a negative impact on your credit score, making it more challenging to access credit in the future.

Understanding the types and implications of debt is crucial for effective financial planning. By being mindful of your borrowing habits and developing a strategic debt repayment plan, you can take control of your financial situation and work towards achieving long-term financial stability.

The Connection between Credit and Debt

Credit and debt are intrinsically linked in the world of finance. While credit provides the means to access funds and goods beyond our immediate resources, debt is the result of utilizing credit. They form a cyclical relationship, impacting each other in various ways.

When you utilize credit, whether through credit cards, loans, or other forms of credit, you incur debt. The debt represents the amount borrowed or the outstanding balance that needs to be repaid to the creditor or lender. In this way, credit enables the accumulation of debt.

On the other hand, the utilization of credit is often necessary to manage personal or business expenses and goals. By borrowing money or using credit, individuals and businesses can make purchases, invest in education, start businesses, or secure assets like homes and vehicles. Without credit, many financial opportunities and significant purchases would be out of reach for most people.

However, it is crucial to carefully manage debt to avoid adverse financial consequences. Accumulating too much debt or being unable to repay debt obligations can lead to financial stress, high-interest payments, and damage to your credit score. This, in turn, can make it more challenging to access credit in the future.

It’s important to strike a balance between utilizing credit and managing debt responsibly. This involves budgeting, planning, and making informed decisions about borrowing. By borrowing only what you need and can afford to repay, not maxing out credit limits, and making timely payments, you can maintain a healthy credit-to-debt ratio and minimize the risk of financial hardship.

Moreover, actively managing your credit can have a positive impact on your ability to obtain favorable terms for future credit. A good credit history and a low debt-to-income ratio can increase your creditworthiness, making it easier to secure lower interest rates, higher credit limits, and better loan terms.

Remember, credit and debt are both essential aspects of the financial landscape, and understanding their connection is crucial for maintaining a healthy and sustainable financial life. By utilizing credit wisely and managing debt responsibly, you can leverage the benefits of credit while avoiding the pitfalls of excessive debt.

Types of Credit and Debt

There are various types of credit and debt available to individuals and businesses, catering to different financial needs and goals. Understanding these types can help you make informed decisions about borrowing and managing your debt effectively.

1. Credit Cards: Credit cards are one of the most common types of credit. They allow you to make purchases up to a certain credit limit. You can choose to pay off the balance in full each month or make minimum payments. However, be cautious with credit card debt as high interest rates can quickly accumulate if you carry a balance.

2. Personal Loans: Personal loans are unsecured loans that can be used for various purposes, such as debt consolidation, home improvements, or emergency expenses. These loans have fixed terms and interest rates, and the repayment period is typically shorter compared to other types of loans.

3. Auto Loans: Auto loans are loans used to finance the purchase of vehicles. They involve borrowing a specific amount of money, which is repaid over a predetermined period, generally through monthly installments. The vehicle itself serves as collateral for the loan.

4. Student Loans: Student loans are specifically designed to help cover the cost of education. They can come from federal or private lenders and often have specific repayment terms and flexible options for deferment or income-based repayment.

5. Mortgages: Mortgages are long-term loans used to finance the purchase of real estate. These loans typically have lower interest rates compared to other types of debt due to the collateral (the property) involved. Repayment periods for mortgages can span over several decades.

6. Business Loans: Business loans provide funding for business-related expenses, such as starting or expanding a business, purchasing inventory, or equipment. These loans can be secured or unsecured, depending on the lender’s requirements and the borrower’s creditworthiness.

7. Lines of Credit: Lines of credit are flexible, revolving credit accounts that allow you to borrow funds up to a maximum limit. You can draw funds as needed, and interest is charged only on the amount borrowed. Lines of credit can be secured or unsecured, and they offer financial flexibility for both personal and business purposes.

8. Store Credit: Many retailers offer their own store credit accounts, allowing customers to make purchases and pay off the balance over time. These accounts often come with special financing offers or rewards programs tied to the store.

It’s important to consider your specific financial needs and goals when deciding which type of credit or debt is suitable for you. Carefully review the terms and conditions, interest rates, repayment terms, and any associated fees before taking on any debt.

Remember, different types of credit and debt carry different risks and benefits. Responsible borrowing and managing your debt obligations are key to maintaining a healthy financial profile and achieving your financial goals.

Credit and Debt Management

Effective management of credit and debt is crucial for maintaining financial stability and avoiding unnecessary financial stress. By adopting sound financial practices, you can take control of your credit and debt obligations. Here are some essential strategies for credit and debt management:

- Create a Budget: Start by creating a budget that outlines your income, expenses, and debt obligations. This will help you understand your financial situation and identify areas where you can cut back on expenses to allocate more funds towards debt repayment.

- Establish an Emergency Fund: Building an emergency fund is essential to avoid relying on credit for unexpected expenses. Aim to save at least three to six months’ worth of living expenses in a separate savings account.

- Pay on Time: Make your credit card payments, loan payments, and other debt obligations on time. Late payments not only result in late fees and penalties but also negatively impact your credit score.

- Pay More than Minimum: When possible, pay more than the minimum required payment on credit cards and loans. By paying more than the minimum, you can reduce the overall interest costs and pay off the debt faster.

- Focus on High-Interest Debt: Prioritize paying off high-interest debt first. Identify which debts have the highest interest rates and allocate extra funds towards those debts while making minimum payments on others.

- Consolidate Debt: If you have multiple high-interest debts, consider consolidating them into a single low-interest loan. Debt consolidation can simplify payments and potentially reduce the overall interest you pay.

- Avoid Maxing Out Credit Cards: Keep your credit card balances well below their credit limits. Utilizing a high percentage of your available credit can negatively impact your credit utilization ratio, which is a key factor in determining your credit score.

- Monitor Your Credit: Regularly check your credit report to ensure its accuracy and identify any potential errors or fraudulent activity. A clean credit report is crucial for maintaining good credit and accessing favorable loan terms.

- Seek Professional Help: If you’re struggling with debt or credit management, consider reaching out to a credit counseling agency or a financial advisor. They can provide guidance, assistance, and debt management strategies tailored to your specific situation.

By implementing these credit and debt management strategies, you can take control of your financial well-being. It’s important to remember that managing credit and debt is an ongoing process. Regularly reassess your financial situation, adjust your strategies as needed, and stay committed to your financial goals.

Impact of Credit on Debt

Credit plays a significant role in the accumulation of debt. The availability and responsible use of credit can greatly impact the level of debt an individual or business carries. Here are some key ways in which credit influences debt:

- Access to Funds: Credit provides individuals and businesses with access to funds beyond their immediate resources. It allows them to make purchases, invest in education, start businesses, and acquire assets like homes and vehicles. Without credit, these opportunities would be limited or unattainable, and debt accumulation would be significantly reduced.

- Borrowing Costs: The cost of borrowing, including interest rates and fees, directly affects the amount of debt incurred. Higher interest rates on credit cards, loans, or other forms of credit can result in greater debt accumulation. It is important to carefully consider the terms and costs associated with credit to minimize the impact on debt levels.

- Credit Limits and Utilization: Credit limits determine the amount individuals or businesses can borrow. Higher credit limits can lead to higher levels of borrowing, potentially increasing the amount of debt. However, it is important to utilize credit responsibly and avoid maxing out credit limits, as high credit utilization can negatively impact credit scores and financial stability.

- Repayment Flexibility: The repayment terms and flexibility associated with credit can influence the level of debt. For example, credit cards offer the option to make minimum payments, which can result in a slower repayment process and potentially lead to higher debt due to growing interest charges. Choosing longer-term loans may lower monthly payments but can result in more interest paid over time.

- Creditworthiness and Access to Favorable Loan Terms: Maintaining good credit is essential for accessing favorable loan terms in the future. A positive credit history enables individuals and businesses to secure lower interest rates, higher credit limits, and better loan terms when they need additional funds. This can help reduce debt accumulation and improve overall financial stability.

While credit can facilitate the accumulation of debt, it is important to use credit responsibly and within your means. Careful consideration of borrowing needs, understanding the costs associated with credit, and systematic repayment efforts can help minimize the impact of credit on debt accumulation. By managing credit effectively, individuals and businesses can maintain a healthy balance between credit utilization and debt levels.

Impact of Debt on Credit

Debt has a significant impact on an individual’s or business’s credit profile. How debt is managed and repaid directly affects credit scores and overall creditworthiness. Here are some key ways in which debt impacts credit:

- Credit Utilization Ratio: The amount of debt you carry compared to your available credit, known as the credit utilization ratio, plays a crucial role in credit scoring. High credit utilization, where you use a large percentage of your available credit, can negatively impact your credit score. It’s advisable to keep your credit utilization ratio below 30% to maintain a healthy credit profile.

- Payment History: How you manage your debt repayments has a significant impact on your credit. Late or missed payments on debts can lower your credit score and signal to lenders that you may be a higher credit risk. Consistently making on-time payments helps build a positive credit history and improves your creditworthiness.

- Debt-to-Income Ratio: Lenders also consider your debt-to-income ratio when assessing creditworthiness. This ratio compares your total debt payments to your income. Higher levels of debt in relation to income may raise red flags and potentially affect your ability to qualify for new credit or better loan terms.

- Credit History Length: The duration of your credit history is an important factor in credit scoring. Carrying debt over time and maintaining a good repayment record can positively impact your credit history length, which demonstrates your ability to manage debt responsibly.

- Diverse Debt Mix: Having a mix of different types of debt, such as credit cards, loans, and a mortgage, can positively impact your credit. Demonstrating responsible management across various debt accounts shows lenders that you can handle different types of credit obligations.

- Bankruptcies and Collections: Significant negative impacts on credit result from bankruptcies, foreclosures, and collections. These events can stay on your credit report for several years, severely impacting your ability to obtain new credit or secure favorable loan terms. It’s critical to address financial difficulties promptly and explore options to minimize the long-term effects on credit.

It’s important to note that the impact of debt on credit is not solely determined by the amount of debt owed. Responsible management and consistent repayment efforts can help mitigate negative effects and improve credit over time. By prioritizing debt repayment, making timely payments, and maintaining a healthy debt-to-income ratio, individuals and businesses can positively impact their credit and enhance their overall financial position.

Conclusion

Credit and debt are intertwined aspects of the financial world, and understanding their relationship is essential for personal and business financial management. Credit provides access to funds and resources beyond our immediate means, while debt represents the accumulated financial obligations resulting from the utilization of credit.

By utilizing credit wisely and managing debt responsibly, individuals and businesses can maintain a healthy financial profile, achieve their goals, and secure better loan terms. It is important to create a budget, establish an emergency fund, and make timely payments to control debt levels and avoid unnecessary financial stress.

Types of credit, such as credit cards, personal loans, auto loans, and mortgages, provide various options for borrowing, each with its own implications and costs. Understanding the features and costs associated with different types of credit can guide informed decision-making and debt management strategies.

Debt has a direct impact on credit, influencing credit scores, creditworthiness, and access to favorable loan terms. Maintaining a low credit utilization ratio, making on-time payments, and managing debt-to-income ratios contribute to a positive credit profile.

Ultimately, effective credit and debt management involve responsible borrowing, systematic debt repayment efforts, and regular monitoring of one’s credit profile. By implementing these strategies and seeking professional assistance when needed, individuals and businesses can maintain financial stability, achieve their financial goals, and enjoy the benefits of a healthy credit profile.

In conclusion, by understanding the relationship between credit and debt and implementing sound financial practices, individuals and businesses can navigate the complex world of finance with confidence and work towards long-term financial success.