Home>Finance>What Is The Tax Year? Definition, When It Ends, And Types

Finance

What Is The Tax Year? Definition, When It Ends, And Types

Published: February 6, 2024

Discover the definition of the tax year, when it ends, and the different types of tax years in the world of finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

What Is the Tax Year? Definition, When It Ends, and Types

Welcome to our Finance blog category, where we dive deep into various aspects of personal finance that can help you make informed decisions and understand key concepts. In today’s post, we will explore the tax year – an essential element of the taxation system that affects individuals and businesses alike. By the end of this article, you’ll have a clear understanding of what the tax year is, when it ends, and the different types of tax years that exist.

Key Takeaways

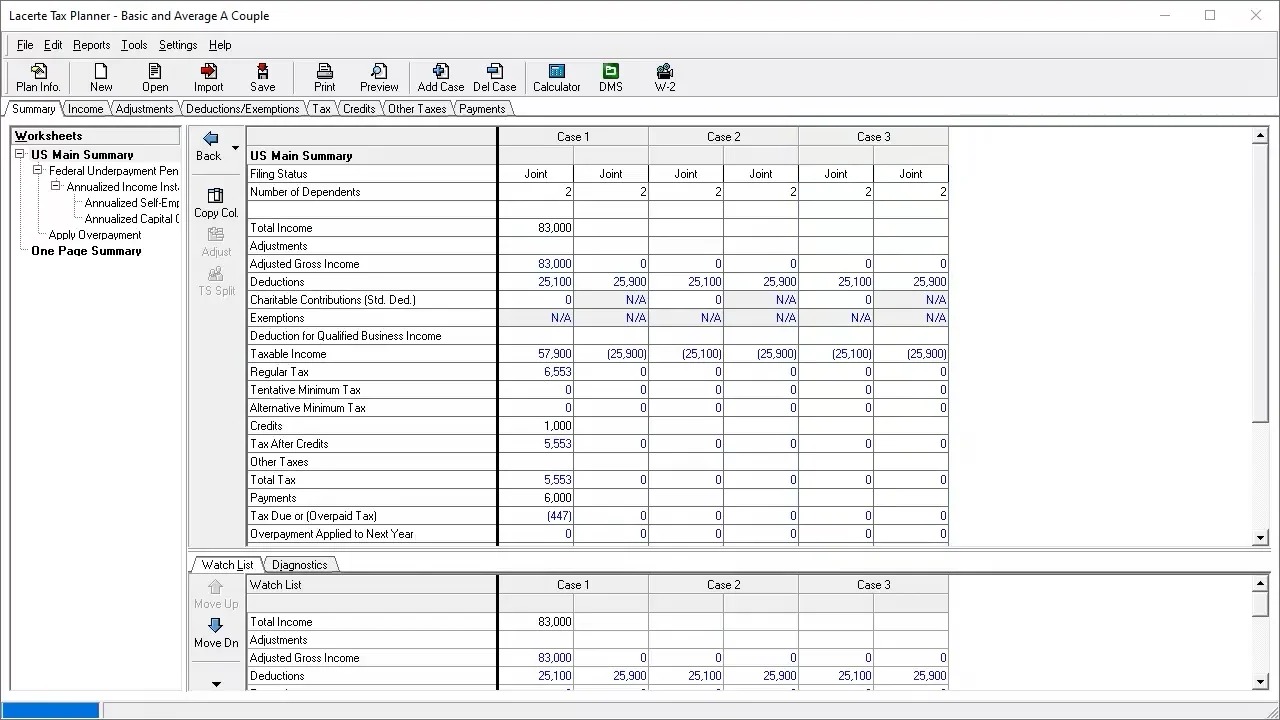

- The tax year is a 12-month period during which individuals and businesses report their financial information and calculate their tax liabilities.

- It is crucial to know the tax year’s ending date as it determines the deadline for filing tax returns and paying any taxes owed.

So, what exactly is the tax year? In simple terms, the tax year refers to the period in which individuals and businesses report their income, expenses, deductions, and other financial information to determine their tax liabilities. While the tax year remains consistent for most people, it can vary depending on certain factors and the country’s tax laws.

When does the tax year end? The ending date of the tax year is a vital piece of information for taxpayers. In many countries, including the United States, the tax year coincides with the calendar year, meaning it begins on January 1st and ends on December 31st. This period allows taxpayers to plan and organize their finances accordingly.

However, some businesses and individuals may not follow the calendar year as their tax year. For instance, a fiscal tax year is utilized by businesses whose annual accounting period doesn’t align with the calendar year. It is typically a 12-month period consistent with their natural business cycle and financial reporting practices.

Now let’s look at the different types of tax years:

- Calendar Tax Year: As mentioned earlier, the calendar year tax period runs from January 1st to December 31st and is the most common type used by individual taxpayers.

- Fiscal Tax Year: A fiscal tax year doesn’t follow the calendar year and can vary from business to business. It is often used by companies that have seasonal business cycles or specific financial reporting requirements that differ from the standard calendar year.

- Short Tax Year: A short tax year occurs when an individual or a business undergoes a significant change in their accounting period, such as starting a new business. It covers a period less than 12 months and requires special accounting considerations.

Understanding the tax year is essential to ensure compliance and avoid any unnecessary penalties or errors in filing tax returns. By familiarizing yourself with the tax year’s definition, when it ends, and the different types of tax years, you can better manage your finances and make informed decisions regarding your tax obligations.

Stay tuned for more informative posts on finance-related topics that can empower you to achieve your financial goals!