Finance

What Is Treasury Management In Banking

Published: October 13, 2023

Learn all about treasury management in banking and its importance in modern finance. Discover how it helps optimize cash flow, liquidity, and risk management for financial institutions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Treasury Management

- Importance of Treasury Management in Banking

- Functions of Treasury Management

- Components of Treasury Management

- Treasury Management Services

- Benefits of Treasury Management in Banking

- Challenges in Treasury Management

- Best Practices in Treasury Management

- Conclusion

Introduction

Treasury management is a critical function in the banking industry that involves managing financial assets and liabilities to efficiently balance risk and maximize profitability. It encompasses a range of activities, including cash management, liquidity management, risk management, and investment management. Effective treasury management plays a vital role in ensuring the stability and success of banking institutions.

In today’s dynamic and rapidly changing financial landscape, banking institutions face numerous challenges in managing their liquidity and financial resources. The global financial crisis of 2008 highlighted the importance of robust treasury management practices and the potential consequences of inadequate risk management. As a result, regulators and banking institutions alike have recognized the need for stringent treasury management policies and procedures.

Efficient treasury management enables banks to optimize their liquidity, minimize risks, and generate revenue from their financial assets. By effectively managing and deploying their funds, banks can enhance their profitability, increase financial stability, and meet regulatory requirements.

This article aims to provide an in-depth understanding of treasury management in the banking industry. We will explore its definition, the importance of treasury management in banking, its functions and components, treasury management services available to banks, and the benefits it offers. Additionally, we will discuss the challenges faced by banks in treasury management and highlight some best practices that can help banks optimize their treasury management operations.

By the end of this article, you will have a comprehensive understanding of treasury management in the banking industry and the key considerations for implementing effective treasury management practices.

Definition of Treasury Management

Treasury management, also known as cash management or treasury operations, refers to the strategic management of an organization’s financial resources, including cash, investments, and liabilities. In the context of the banking industry, treasury management involves the oversight and control of a bank’s cash flows, liquidity, and financial assets for the purpose of optimizing risk management, profitability, and regulatory compliance.

At its core, treasury management encompasses the activities and processes involved in managing a bank’s cash position, liquidity, and financial risks. It involves formulating and implementing policies, procedures, and systems to effectively monitor, control, and allocate financial resources. This includes managing cash inflows and outflows, maintaining appropriate liquidity levels, mitigating financial risks, and making informed investment and funding decisions.

Some of the key objectives of treasury management include:

- Ensuring adequate and efficient liquidity management to meet short-term financial obligations

- Optimizing cash flow forecasting and working capital management

- Minimizing financial risks, such as interest rate risk, foreign exchange risk, and credit risk

- Maximizing investment returns while adhering to risk appetite and regulatory guidelines

- Complying with regulatory requirements and maintaining robust internal controls

To achieve these objectives, treasury management functions typically involve various activities, including cash flow analysis and forecasting, cash pooling, payment processing, debt and funding management, investment management, foreign exchange management, and risk management.

Overall, treasury management plays a crucial role in the effective financial management of banks. It helps ensure that banks have sufficient liquidity to meet their operational and regulatory requirements, while also optimizing their financial resources to generate income and manage risks.

Importance of Treasury Management in Banking

Treasury management is of paramount importance in the banking industry due to its significant impact on the financial stability, profitability, and overall success of banking institutions. Here are some key reasons why treasury management holds such importance in the banking sector:

1. Liquidity Management:

Treasury management allows banks to effectively manage their liquidity, ensuring that they have sufficient funds to meet their day-to-day operational needs and financial obligations. By accurately forecasting cash flows, monitoring liquidity positions, and implementing appropriate liquidity management strategies, banks can avoid liquidity crunches, minimize funding costs, and optimize their overall liquidity position.

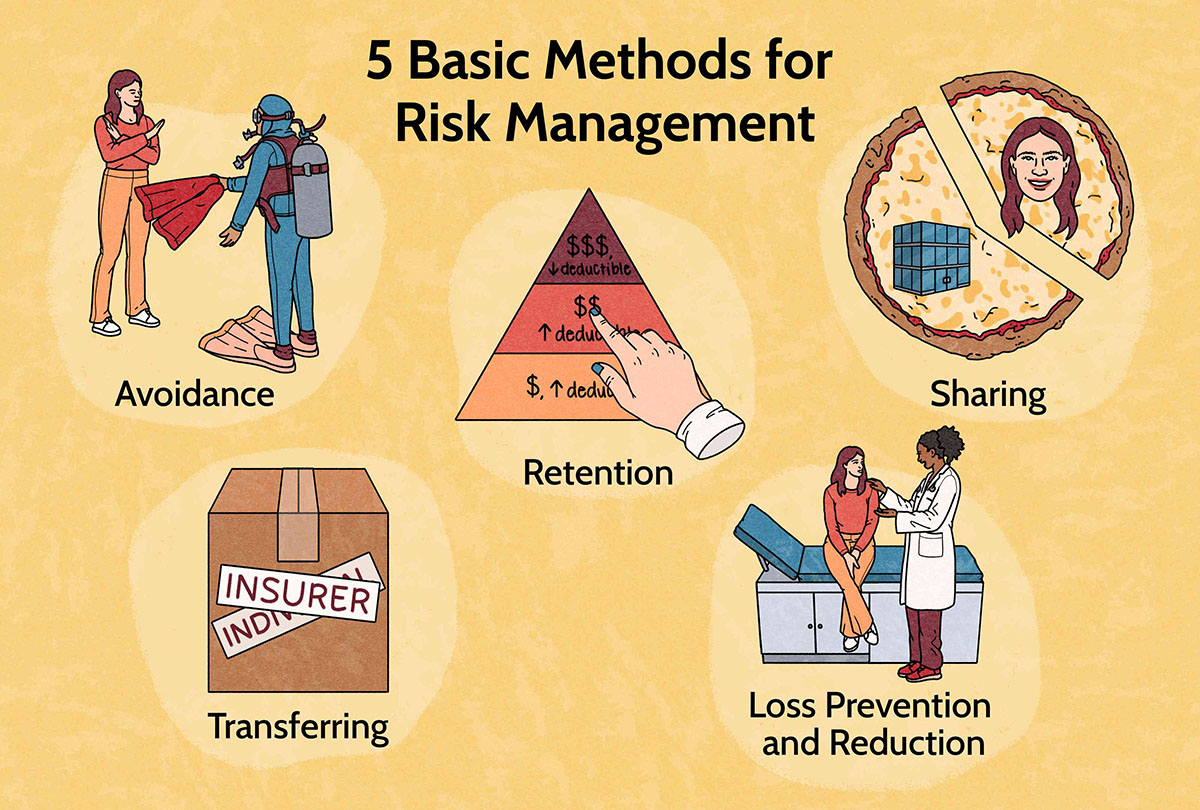

2. Risk Management:

Treasury management is instrumental in identifying, assessing, and mitigating various financial risks faced by banks. This includes interest rate risk, foreign exchange risk, credit risk, and market risk. Through comprehensive risk management practices, banks can minimize potential losses, protect their capital, and maintain financial soundness.

3. Profitability Optimization:

Efficient treasury management allows banks to optimize their profitability by actively managing their financial assets and liabilities. Treasury managers analyze interest rate movements, make informed investment decisions, and employ effective asset-liability management techniques to maximize returns. Additionally, they identify cost-saving opportunities, such as optimizing funding mix and reducing interest expenses, contributing to enhanced profitability.

4. Regulatory Compliance:

Treasury management helps banks comply with regulatory requirements imposed by governing bodies. Banks must adhere to liquidity and capital adequacy regulations, risk management guidelines, and anti-money laundering laws. By implementing robust treasury management practices, banks can ensure compliance and avoid penalties or reputational damage.

5. Customer Satisfaction:

Efficient treasury management indirectly impacts customer satisfaction. By effectively managing liquidity and financial risks, banks are better positioned to provide seamless customer service, fulfill client requests, and honor financial commitments. This builds trust and strengthens relationships with customers, enhancing satisfaction and loyalty.

In summary, treasury management is crucial for banking institutions as it enables them to maintain liquidity, manage risks, optimize profitability, comply with regulations, and enhance customer satisfaction. By implementing robust treasury management practices, banks can navigate the complexities of the financial landscape and achieve long-term financial stability and success.

Functions of Treasury Management

Treasury management encompasses several key functions that are crucial for the effective management of a bank’s financial resources. These functions contribute to maintaining liquidity, managing risks, optimizing profitability, and ensuring regulatory compliance. Let’s explore some of the primary functions of treasury management:

1. Cash Management:

One of the core functions of treasury management is cash management. This involves monitoring and controlling cash flows to ensure that a bank has enough liquidity to meet its operational and financial obligations. Cash management includes activities such as cash flow forecasting, cash positioning, optimizing cash balances, managing bank accounts, and facilitating efficient payment and collection processes.

2. Liquidity Management:

Liquidity management is vital in treasury management as it focuses on maintaining an optimal level of liquidity to meet short-term funding requirements and unexpected cash outflows. Treasury managers monitor liquidity positions, assess funding needs, and employ liquidity management strategies such as cash pooling, cash concentration, and short-term funding arrangements to ensure that the bank has sufficient liquidity on hand.

3. Risk Management:

Risk management is a critical component of treasury management. Treasury managers identify, assess, and manage various financial risks faced by the bank, including interest rate risk, credit risk, market risk, and foreign exchange risk. They develop risk management policies, set risk limits, implement hedging strategies, and monitor risk exposures to protect the bank from potential losses.

4. Funding and Capital Management:

Treasury management involves managing a bank’s funding and capital structure. Treasury managers analyze funding needs, evaluate funding sources, and make decisions regarding debt issuance, equity capital, and other forms of financing. They optimize the bank’s capital structure to support growth, ensure regulatory compliance, and manage the cost of funds.

5. Investment Management:

Investment management is another essential function of treasury management. Treasury managers oversee the investment of surplus funds in various financial instruments such as government securities, corporate bonds, money market instruments, and other short-term or long-term investments. Their goal is to maximize investment returns while balancing risk and liquidity requirements.

6. Treasury Reporting and Analysis:

Treasury management includes generating reports and analyzing financial data to provide insights into the bank’s liquidity position, risk exposure, and performance. Treasury managers prepare reports on cash flow forecasts, liquidity ratios, investment portfolios, interest rate sensitivity, and other key metrics. These reports aid in informed decision-making and ensure effective communication with stakeholders, including senior management, regulators, and investors.

These functions collectively enable banks to efficiently manage their financial resources, optimize profitability, mitigate risks, and ensure adequate liquidity. Effective treasury management is vital for the long-term success of a bank by supporting its operational activities, regulatory compliance, and strategic decision-making processes.

Components of Treasury Management

Treasury management encompasses various components that work together to achieve efficient financial resource management and risk mitigation. These components provide a comprehensive framework for banks to effectively manage their treasury operations. Let’s explore some of the key components of treasury management:

1. Cash Management:

Cash management is a fundamental component of treasury management that focuses on maintaining optimal levels of cash and cash equivalents. It involves activities such as cash flow forecasting, cash positioning, payment processing, and cash pooling. Cash management aims to ensure that the bank has sufficient liquidity to meet its immediate financial obligations while minimizing idle cash balances.

2. Liquidity Management:

Liquidity management is essential to ensure that a bank has adequate funds to meet its short-term cash needs. It involves developing strategies to maintain the right level of liquidity, optimizing the deployment of funds, and managing funding sources. Liquidity management also includes monitoring liquidity positions, stress testing, and contingency planning to handle any unexpected liquidity disruptions.

3. Risk Management:

Risk management is a crucial component of treasury management that focuses on identifying, assessing, and mitigating various financial risks. This includes interest rate risk, credit risk, foreign exchange risk, and market risk. Treasury managers employ risk management techniques such as hedging, diversification, and risk limits to protect the bank’s financial position and ensure regulatory compliance.

4. Funding and Capital Management:

Funding and capital management involve managing the bank’s funding sources and capital structure. Treasury managers evaluate funding needs, analyze the cost of funds, and make decisions regarding debt issuance, equity capital, and other financing options. Effective funding and capital management help optimize the bank’s balance sheet and support its growth objectives.

5. Cash Flow Forecasting:

Cash flow forecasting is an essential component of treasury management that involves analyzing historical cash flows and predicting future cash inflows and outflows. Accurate cash flow forecasting is crucial for decision-making, managing liquidity, and identifying potential funding gaps or excess cash positions. It enables treasury managers to allocate financial resources effectively and adapt to changing market conditions.

6. Treasury Technology and Systems:

The effective implementation of treasury management requires the use of appropriate technology and systems. These tools help automate processes, improve efficiency, enhance control, and provide real-time visibility into cash positions, transactions, and risk exposures. Treasury management systems (TMS) enable treasury managers to streamline operations, perform accurate analysis, and generate reports for better decision-making.

By integrating these components, banks can establish a robust treasury management framework that supports their financial stability, liquidity management, risk mitigation, and regulatory compliance. This comprehensive approach enables banks to optimize their financial resources and achieve strategic objectives while effectively managing risks.

Treasury Management Services

Treasury management services are specialized solutions and tools offered by financial institutions, treasury service providers, and technology vendors to assist banks in efficiently managing their treasury functions. These services are designed to streamline processes, optimize liquidity, mitigate risks, and enhance overall treasury operations. Let’s explore some common treasury management services:

1. Cash Management Services:

Cash management services focus on optimizing cash flow processes and maintaining efficient cash balances. These services may include cash pooling, cash concentration, electronic payments and collections, automated cash forecasting, account reconciliation, and fraud prevention measures. Cash management services enable banks to effectively control their cash flows, improve operational efficiency, and minimize idle cash balances.

2. Liquidity Management Services:

Liquidity management services help banks manage their liquidity positions and ensure sufficient funds are available to meet obligations. These services may include liquidity planning and forecasting, liquidity risk assessment, access to liquidity markets, short-term funding facilities, and liquidity reporting and analysis. By leveraging liquidity management services, banks can optimize their liquidity management, withstand unforeseen cash flow fluctuations, and maintain compliance with regulatory requirements.

3. Risk Management Services:

Risk management services assist banks in identifying, assessing, and mitigating financial risks. These services may include interest rate risk management, foreign exchange risk management, credit risk assessment, and market risk analysis. Providers of risk management services offer hedging tools, risk measurement models, and advisory services to help banks safeguard against potential losses and ensure compliance with risk management guidelines.

4. Treasury Technology Solutions:

Treasury technology solutions provide banks with advanced software and systems for efficient treasury operations. These solutions may include Treasury Management Systems (TMS), which automate treasury processes such as cash management, risk management, and reporting. They may also offer solutions for cash flow forecasting, bank connectivity, payment processing, and regulatory compliance. Treasury technology solutions enhance accuracy, improve operational efficiency, and provide real-time visibility into treasury data.

5. Trade Finance Services:

Trade finance services assist banks in managing and financing international trade transactions. These services may include letters of credit, bank guarantees, supply chain finance, export financing, and import financing. Trade finance services facilitate efficient trade settlement, mitigate trade-related risks, and help banks support the needs of their corporate clients engaged in global trade activities.

6. Investment Management Services:

Investment management services provide expertise and tools to assist banks in optimizing their investment portfolios. These services may include investment advisory, portfolio analysis, securities lending and borrowing, and asset allocation strategies. Investment management services help banks generate income from their surplus funds while ensuring risk-appropriate investments and compliance with regulatory guidelines.

By leveraging these treasury management services, banks can enhance their treasury functions, improve operational efficiency, mitigate risks, optimize liquidity, and maintain regulatory compliance. Each service can be tailored to the specific needs of the bank, enabling them to achieve their treasury management objectives effectively.

Benefits of Treasury Management in Banking

Treasury management plays a crucial role in the banking industry, offering a wide range of benefits that contribute to the financial stability, profitability, and overall success of banks. Here are some key benefits of effective treasury management in banking:

1. Liquidity Optimization:

Effective treasury management enables banks to optimize their liquidity by maintaining an appropriate level of funds to meet their short-term obligations. By accurately forecasting cash flows, implementing efficient cash management techniques, and utilizing liquidity management strategies, banks can minimize the risk of cash shortages and maintain a healthy liquidity position.

2. Risk Management:

Treasury management helps banks proactively identify, assess, and manage various financial risks. By implementing robust risk management practices, such as interest rate risk hedging, credit risk assessments, and foreign exchange risk management, banks can mitigate potential losses, protect their capital, and enhance overall financial stability.

3. Profitability Enhancement:

Optimizing profitability is a significant benefit of treasury management. By actively managing their financial assets and liabilities, banks can maximize investment returns, reduce funding costs, and generate additional revenue streams. Treasury management allows banks to make informed decisions on investment opportunities, interest rate movements, and balance sheet optimization, contributing to enhanced profitability.

4. Regulatory Compliance:

Treasury management ensures compliance with regulatory requirements imposed on banks. By implementing robust internal controls, maintaining accurate and timely reporting, and adhering to liquidity and capital adequacy regulations, banks can meet regulatory obligations and avoid penalties or reputational damage.

5. Strategic Decision-making:

With treasury management, banks have access to accurate and timely financial data, along with sophisticated tools for analysis and forecasting. This enables senior management to make informed strategic decisions regarding funding, capital allocation, and risk management. Effective treasury management supports the alignment of financial objectives with overall business strategy.

6. Operational Efficiency:

Treasury management streamlines various treasury operations through automation, standardized processes, and integration of systems. This enhances operational efficiency, reduces manual errors, and improves productivity. With efficient treasury processes, banks can minimize operational risks, optimize resource utilization, and focus on value-added activities.

Overall, effective treasury management offers numerous benefits to banks, including improved liquidity management, robust risk mitigation, increased profitability, regulatory compliance, strategic decision-making, and operational efficiency. By leveraging these benefits, banks can enhance their financial stability, competitive advantage, and long-term success in the dynamic and evolving banking industry.

Challenges in Treasury Management

Treasury management in the banking industry comes with its fair share of challenges due to the complex and ever-changing nature of financial markets. These challenges can pose obstacles to effectively managing liquidity, mitigating risks, and optimizing financial resources. Let’s explore some of the common challenges faced in treasury management:

1. Market Volatility:

Financial markets can experience significant volatility, which can make it challenging to manage risks and predict future cash flows. Fluctuating interest rates, exchange rates, and market conditions can impact a bank’s profitability and liquidity. Treasury managers must closely monitor market developments and adapt their strategies to mitigate the impact of market volatility.

2. Regulatory Changes:

The banking industry is subject to a wide range of regulatory requirements, including liquidity and capital adequacy regulations, risk management guidelines, and reporting standards. Keeping up with evolving regulations and ensuring compliance can be a challenge for banks. Treasury managers must stay abreast of regulatory changes, implement necessary procedures, and adapt their treasury operations to remain compliant.

3. Technology Integration:

Integrating technology and systems plays a crucial role in efficient treasury management. However, implementing new technology, upgrading legacy systems, and integrating various platforms can be complex and time-consuming. Banks face challenges in ensuring seamless integration, data accuracy, and system reliability to support their treasury operations effectively.

4. Data Management:

Treasury management relies heavily on accurate and timely financial data. Banks often face challenges in aggregating data from multiple sources, ensuring data integrity, and maintaining data security. Managing vast amounts of data can be complex, and it requires robust data management practices and systems to support informed decision-making.

5. Cybersecurity Threats:

With the increasing reliance on technology, banks face the constant threat of cyberattacks and data breaches. Maintaining strong cybersecurity measures and protecting sensitive treasury data is a significant challenge for banks. Treasury managers must implement robust security protocols, conduct regular risk assessments, and stay updated on evolving cybersecurity threats.

6. Shortage of Skilled Talent:

Treasury management demands a high level of financial expertise, risk management skills, and a deep understanding of financial markets. Finding and retaining talent with the required skillset can be challenging for banks. The shortage of skilled treasury professionals presents a challenge in effectively managing treasury operations and making informed decisions.

While these challenges can pose hurdles to effective treasury management in the banking industry, banks can overcome them through a combination of strategic planning, investment in technology, continuous monitoring of market dynamics, and a strong focus on risk management and compliance. By addressing these challenges, banks can achieve successful treasury management and maintain a competitive edge in the financial landscape.

Best Practices in Treasury Management

Implementing best practices in treasury management is vital for banks to optimize their financial resources, mitigate risks, and ensure efficient operations. These practices help enhance liquidity management, strengthen risk management frameworks, and promote strategic decision-making. Here are some key best practices in treasury management:

1. Cash Flow Forecasting:

Develop robust cash flow forecasting models that accurately predict future cash inflows and outflows. Regularly review and update cash flow forecasts to adapt to changing market conditions and make informed decisions regarding liquidity management and funding needs.

2. Liquidity Risk Management:

Establish comprehensive liquidity risk management frameworks that include stress testing, scenario analysis, and contingency planning. Maintain sufficient liquidity buffers, diversify funding sources, and regularly assess liquidity positions to ensure readiness for unexpected liquidity disruptions.

3. Risk Measurement and Mitigation:

Implement robust risk measurement tools and frameworks to identify, measure, and mitigate various financial risks. This includes interest rate risk, credit risk, foreign exchange risk, and market risk. Utilize hedging strategies, diversify portfolios, and establish risk limits to protect against potential losses.

4. Technology Integration:

Invest in advanced treasury management systems (TMS) that streamline treasury operations, automate processes, and provide real-time data analysis. Integrate various systems and platforms to ensure seamless connectivity, enhance data accuracy, and improve operational efficiency.

5. Regulatory Compliance:

Stay updated on regulatory requirements and ensure compliance with liquidity and capital adequacy regulations, risk management guidelines, and reporting standards. Implement robust internal controls, conduct regular audits, and maintain accurate and timely reporting to meet regulatory obligations.

6. Strategic Treasury Planning:

Develop a strategic treasury plan aligned with the bank’s overall objectives. This includes setting clear financial goals, optimizing capital allocation, and developing effective funding strategies. Regularly review and assess treasury performance against the strategic plan to identify areas of improvement and make necessary adjustments.

7. Talent Development:

Invest in talent development initiatives to ensure banks have skilled treasury professionals. Foster a culture of continuous learning and provide training opportunities to enhance knowledge and expertise in treasury management and financial markets.

8. Collaboration and Communication:

Promote collaboration between treasury, finance, and other relevant departments within the bank. Foster effective communication channels to ensure alignment of objectives, sharing of information, and coordination of activities. This facilitates better decision-making and strengthens overall treasury management practices.

By implementing these best practices, banks can optimize their treasury management functions, improve risk management capabilities, enhance liquidity management, and make informed strategic decisions. Continuous evaluation and refinement of treasury management practices are key to adapting to changing market dynamics and achieving sustainable success in the banking industry.

Conclusion

Treasury management is a critical function in the banking industry that encompasses the strategic management of financial resources, liquidity, and risks. Effective treasury management is vital for maintaining liquidity, optimizing profitability, managing risks, and ensuring regulatory compliance.

In this article, we have explored the definition of treasury management, its importance in banking, and its key functions and components. We have also discussed treasury management services available to banks and the benefits it offers, including liquidity optimization, risk management, profitability enhancement, regulatory compliance, strategic decision-making, and operational efficiency.

However, treasury management does not come without its share of challenges. Market volatility, regulatory changes, technology integration, data management, cybersecurity threats, and talent shortages are some of the challenges faced in treasury management. Overcoming these challenges requires strategic planning, technological investments, risk mitigation measures, and a focus on compliance and talent development.

To achieve effective treasury management, it is essential for banks to implement best practices. These include cash flow forecasting, liquidity risk management, risk measurement and mitigation, technology integration, regulatory compliance, strategic treasury planning, talent development, collaboration, and communication.

In conclusion, treasury management plays a vital role in the financial stability, profitability, and success of banks. By implementing robust treasury management practices, banks can optimize their financial resources, mitigate risks, enhance liquidity management, and make informed strategic decisions. Continuous evaluation and refinement of treasury management practices are essential to adapt to evolving market dynamics and achieve sustained success in the banking industry.