Home>Finance>What Types Of Life Insurance Are Normally Used For Key Employee Indemnification?

Finance

What Types Of Life Insurance Are Normally Used For Key Employee Indemnification?

Published: October 15, 2023

Discover the different types of life insurance commonly used for key employee indemnification in finance. Find out which policy suits your business needs.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Definition of Key Employee Indemnification

- Importance of Key Employees for Businesses

- Overview of Life Insurance for Key Employee Indemnification

- Types of Life Insurance Policies Used for Key Employee Indemnification

- Term Life Insurance

- Whole Life Insurance

- Universal Life Insurance

- Factors to Consider When Choosing a Life Insurance Policy for Key Employee Indemnification

- Coverage Amount

- Premiums

- Cash Value Accumulation

- Flexibility and Customization Options

- Underwriting and Approval Process

- Conclusion

Introduction

Welcome to the world of key employee indemnification and the role that life insurance plays in protecting businesses against the loss of their most valuable assets – their key employees. In today’s competitive marketplace, businesses rely heavily on the skills, knowledge, and experience of key employees to drive success. Losing a key employee can have severe financial consequences, including disruption to operations, loss of clients or customers, and decreased profitability.

Key employee indemnification refers to the process of insuring a business against the financial impact of losing a key employee. Life insurance is commonly used as a tool for key employee indemnification because it provides a financial safety net in the event of the unexpected death of a key employee.

In this article, we will explore the different types of life insurance policies that are typically used for key employee indemnification. We will discuss the benefits and considerations of each type, helping businesses understand which policy may be the most suitable for their specific needs.

It is important to note that the information provided in this article is intended to serve as a general guide. Each business is unique, and it is advisable to consult with a financial advisor or insurance specialist to determine the most appropriate insurance solutions for key employee indemnification.

Definition of Key Employee Indemnification

Key employee indemnification, also known as key person insurance or key man insurance, is a form of business insurance that provides financial protection to a company in the event of the death or disability of a key employee. A key employee is an individual who possesses unique skills, knowledge, experience, or relationships that are crucial for the success and profitability of the business.

Key employee indemnification is designed to mitigate the financial impact of losing a key employee by compensating the company for the potential loss of revenue, customer relationships, expertise, or intellectual property that the key employee contributes. This type of insurance helps businesses continue operations and recover from the financial setback caused by the absence of a key employee.

The policy is typically purchased by the business and the beneficiary is the company itself. Premiums are paid by the company, and in the event of the death or disability of the key employee, the insurance proceeds are received by the company to cover various costs and expenses, such as finding a suitable replacement, providing training, meeting financial obligations, or compensating for a decline in sales.

Key employee indemnification can be a valuable risk management strategy for businesses of all sizes, from small startups to large corporations. It provides financial stability and peace of mind, knowing that the company will have the necessary resources to navigate the challenges brought about by the loss of a key employee.

It is important to accurately assess and determine the value of a key employee to the business when considering key employee indemnification. This value is often based on factors such as the employee’s role and responsibilities, their contribution to revenue generation, their relationship with key clients or customers, and the difficulty of finding a suitable replacement.

Importance of Key Employees for Businesses

Key employees are the backbone of any successful business. These individuals possess specialized skills, knowledge, and expertise that are crucial for the smooth functioning and growth of the organization. They often hold key leadership or strategic roles and play a significant role in driving innovation, managing client relationships, and executing business strategies.

Here are some reasons why key employees are essential for businesses:

- Expertise and Knowledge: Key employees bring years of industry-specific knowledge and expertise to the table. They have a deep understanding of the business operations, market trends, and best practices, allowing them to make informed decisions and provide valuable insights.

- Leadership and Vision: Key employees often hold leadership positions and contribute to the development and execution of the company’s long-term vision and strategic goals. Their leadership abilities inspire and motivate other employees, driving innovation and growth within the organization.

- Client Relationships: Key employees often have established relationships with key clients or customers. These relationships are built on trust, and the loss of a key employee can significantly impact the company’s ability to retain those clients or maintain customer satisfaction.

- Innovation and Problem-Solving: Key employees are usually the driving force behind innovation and problem-solving within the organization. They possess the creativity and critical thinking skills necessary to identify areas for improvement, develop new products or services, and solve complex business challenges.

- Business Continuity: Losing a key employee can disrupt operations and create a temporary void in the organization. The absence of a key employee can lead to delays, decreased productivity, and increased costs. Key employee indemnification helps businesses mitigate these risks and maintain continuity during challenging times.

Given the vital role that key employees play in the success of a business, it is imperative for companies to protect themselves against the potential financial impact of losing them. Key employee indemnification, supported by appropriate life insurance policies, provides businesses with the necessary financial safeguards to recover from the loss and continue thriving.

Overview of Life Insurance for Key Employee Indemnification

In the realm of key employee indemnification, life insurance serves as a fundamental tool for providing financial protection to businesses. Life insurance policies offer a way to safeguard against the loss of a key employee due to death or disability, ensuring the continuity and stability of the business.

Life insurance for key employee indemnification operates on the basis of the business being the policyholder and beneficiary. The premiums are typically paid by the company, and in the event of the key employee’s passing or disability, the insurance proceeds are received by the company. These proceeds can be used to cover various expenses associated with the loss of the key employee, including finding a replacement, training new personnel, managing financial obligations, or compensating for a decline in revenue.

Life insurance policies for key employee indemnification come in different forms, such as term life insurance, whole life insurance, and universal life insurance. Each type has its own characteristics and benefits, providing businesses with flexibility in tailoring their coverage to meet their specific needs.

Regardless of the type of life insurance chosen, the primary objective of key employee indemnification is to provide financial stability and security to the business in the face of unexpected events. It offers a safety net that can help the company navigate the challenges brought about by the loss of a key employee and minimize the potential negative impacts on operations, finances, and reputation.

It’s worth noting that life insurance policies for key employee indemnification are not limited to large corporations or high-profile executives only. Small businesses and startups can also benefit from this type of insurance, as they often have key employees who play crucial roles in their success.

Before selecting a life insurance policy for key employee indemnification, it is advisable for businesses to consult with an insurance specialist or financial advisor. These professionals can assist in assessing the company’s specific needs, evaluating the potential risks associated with the loss of a key employee, and recommending the most suitable policy type and coverage amount.

Overall, life insurance for key employee indemnification provides businesses with a proactive approach to risk management by ensuring financial stability, continuity, and peace of mind. It allows companies to focus on their core operations while having a safety net in place to handle unforeseen circumstances.

Types of Life Insurance Policies Used for Key Employee Indemnification

When it comes to key employee indemnification, businesses have several options for life insurance policies to protect against the loss of a key employee. Each type of policy offers different features, benefits, and considerations. Let’s take a closer look at three common types of life insurance policies used for key employee indemnification:

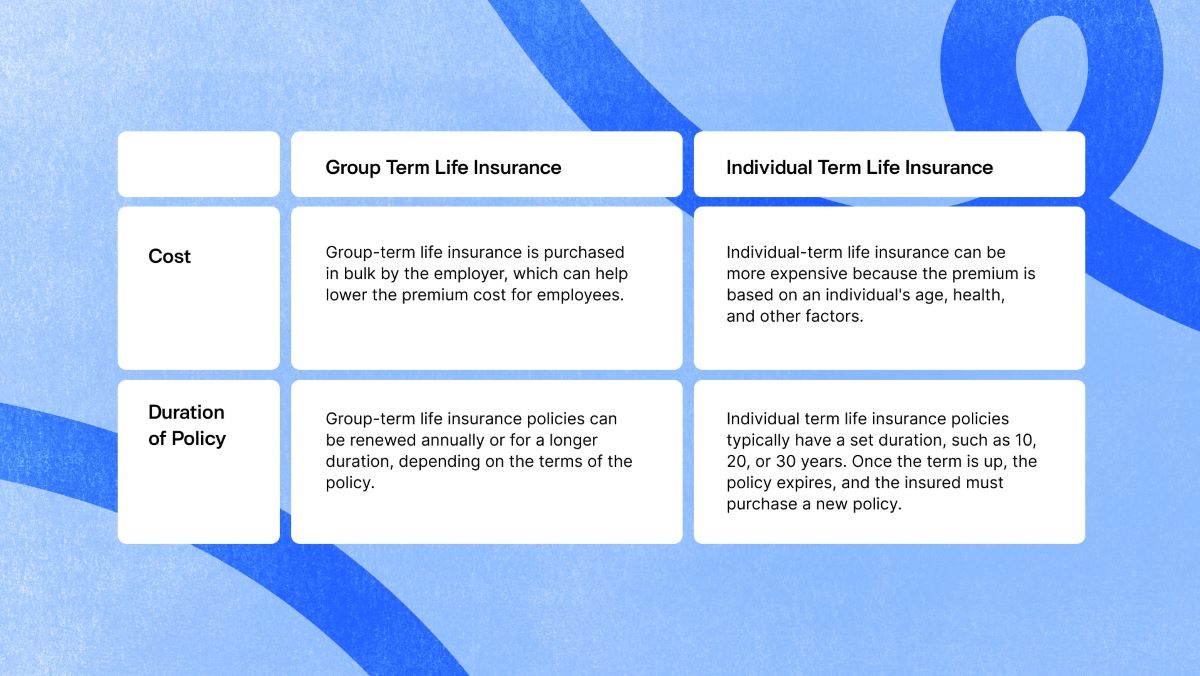

- Term Life Insurance: Term life insurance provides coverage for a specific period, typically ranging from 10 to 30 years. This type of policy offers a death benefit if the insured person passes away during the term. Term life insurance is often more affordable compared to other types of life insurance policies. It is suitable for businesses that want coverage for a predetermined period, such as the duration of a key employee’s employment contract or until a specific milestone is reached.

- Whole Life Insurance: Whole life insurance provides coverage for the entire lifetime of the insured person, as long as the premiums are paid. In addition to the death benefit, whole life insurance builds cash value over time, which can be utilized by the business. This cash value can be accessed through policy loans or withdrawals, providing flexibility for the company to address any financial needs or opportunities that may arise. Whole life insurance is generally more expensive than term life insurance but offers lifelong protection and potential cash value accumulation.

- Universal Life Insurance: Universal life insurance is a flexible type of policy that combines a death benefit with a cash value component. With universal life insurance, businesses have the flexibility to adjust the premium payments and death benefit amount throughout the policy, within certain limits. This flexibility allows for customization and the ability to adapt to changing business circumstances. Universal life insurance provides the opportunity for cash value growth based on the performance of the policy’s underlying investments, offering potential accumulation of funds that can be utilized by the company.

Each type of life insurance policy has its own benefits and considerations. When selecting a policy, businesses should consider factors such as the coverage amount needed, premium affordability, cash value accumulation potential, flexibility for customization, and the underwriting and approval process.

It is crucial for businesses to carefully assess their specific needs and consult with an insurance specialist or financial advisor to determine the most appropriate type of life insurance policy for their key employee indemnification requirements. The choice of policy should align with the company’s financial goals, risk tolerance, and long-term plans.

Remember, the goal of selecting a life insurance policy for key employee indemnification is to ensure financial stability and protection in the event of the loss of a key employee. By choosing the right type of policy, businesses can effectively mitigate risks and have the necessary resources to navigate through challenging times.

Term Life Insurance

Term life insurance is a popular choice for businesses seeking key employee indemnification. With term life insurance, businesses can provide coverage for a specific period, known as the policy term. This type of policy offers a death benefit if the insured individual passes away during the term.

One of the main advantages of term life insurance is its affordability. Premiums for term life insurance policies are typically lower compared to other types of life insurance, making it an attractive option for businesses seeking cost-effective coverage for key employees.

Term life insurance is particularly useful in situations where businesses require coverage for a predetermined period. For example, if a key employee has a fixed-term employment contract or if the company is involved in a specific project with an expected completion date, a term life insurance policy can provide coverage during that duration.

When selecting a term life insurance policy for key employee indemnification, businesses should carefully consider the length of the policy term. The duration should align with the specific needs and circumstances of the business, such as the expected tenure of the key employee or the duration of a critical project.

It’s important to note that term life insurance does not build cash value over time. Once the policy term expires, there is no value remaining, unless the insured person passes away during the coverage period. This lack of cash value accumulation distinguishes term life insurance from other types of policies, such as whole life or universal life insurance.

Businesses opting for term life insurance should regularly review the coverage amount to ensure it is sufficient to meet the needs of key employee indemnification. As business circumstances or the value of the key employee may change over time, it’s important to reassess the coverage periodically and make adjustments as necessary.

Overall, term life insurance is a practical and cost-effective option for businesses looking to protect against the loss of a key employee. It offers coverage for a specific period, providing financial security and indemnification during critical phases of the business or employment contract. By choosing the appropriate term length and coverage amount, businesses can effectively safeguard their operations and mitigate risks associated with the loss of a key employee.

Whole Life Insurance

Whole life insurance is another option for businesses seeking key employee indemnification. Unlike term life insurance, whole life insurance provides coverage for the entire lifetime of the insured individual, as long as the premiums are paid. This type of policy offers both a death benefit and a cash value component.

One of the primary advantages of whole life insurance is the accumulation of cash value over time. As premiums are paid, a portion of the payment goes towards the policy’s cash value, which grows on a tax-deferred basis. The cash value can be accessed by the business through policy loans or withdrawals, providing a valuable source of funds for various purposes.

Whole life insurance is generally more expensive than term life insurance due to the lifelong coverage and cash value accumulation. However, the extra cost provides additional benefits and financial flexibility. The death benefit of a whole life insurance policy remains the same throughout the insured person’s lifetime, offering a fixed payout in the event of their passing.

For key employee indemnification, whole life insurance can provide businesses with stability and a long-term financial strategy. The cash value accumulated in the policy can be utilized to cover expenses related to the loss of a key employee, such as finding a replacement, training new personnel, or meeting financial obligations.

Whole life insurance is particularly suitable for businesses that prioritize lifelong protection and potential cash value growth. It allows companies to not only protect against the financial impact of losing a key employee but also build a cash reserve that can act as a financial asset for the business. The cash value can be used strategically, such as reinvesting in the company, funding business expansion, or providing a cushion during challenging times.

Businesses considering whole life insurance for key employee indemnification should carefully evaluate the premium costs and ensure they align with the budget and financial goals of the company. Additionally, it is crucial to review the coverage amount periodically to ensure it adequately reflects the value of the key employee and the potential financial impact their loss may have on the business.

Overall, whole life insurance offers lifelong protection, cash value accumulation, and financial flexibility for businesses seeking key employee indemnification. It provides a comprehensive and long-term solution to mitigate risks associated with the loss of a key employee, ensuring the company’s stability and continued success.

Universal Life Insurance

Universal life insurance is a flexible and versatile option for businesses seeking key employee indemnification. It is a type of permanent life insurance that combines a death benefit with a cash value component, offering businesses a range of benefits and customization options.

One of the key features of universal life insurance is its flexibility in premium payments and death benefit amounts. Businesses have the ability to adjust the premium payments and coverage amounts within certain limits, allowing for customization based on their specific needs and financial circumstances.

Universal life insurance policies accumulate cash value over time, similar to whole life insurance policies. The cash value grows on a tax-deferred basis and can be accessed by the business through policy loans or withdrawals. This feature provides businesses with financial flexibility, as they can tap into the cash value to address various needs, such as covering expenses related to the loss of a key employee or managing unexpected financial challenges.

Universal life insurance also offers greater transparency regarding the cost structure compared to other types of life insurance policies. Businesses can see the breakdown of the premium payment, including the cost of insurance and the allocation towards the cash value component. This transparency allows businesses to make informed decisions and understand how their premium payments impact the policy’s cash value and death benefit.

With universal life insurance, the cash value growth potential is tied to the performance of the policy’s underlying investments, typically through a selection of investment options provided by the insurance company. This feature enables the cash value to potentially grow at a faster rate than traditional whole life insurance policies, depending on the performance of the selected investments.

Businesses considering universal life insurance for key employee indemnification should carefully assess their risk tolerance and financial goals. They should also review the policy’s investment options and understand the potential risks and rewards associated with the underlying investments.

When selecting a universal life insurance policy, businesses should work closely with an insurance specialist or financial advisor to determine the appropriate premium payments, death benefit amounts, and investment strategies that align with the company’s needs and objectives.

In summary, universal life insurance offers businesses flexibility, transparency, and growth potential for key employee indemnification. It allows for customization in premium payments and death benefit amounts, while also providing the opportunity for cash value accumulation based on the performance of selected investments. Universal life insurance can be a valuable tool for businesses looking to protect against the loss of a key employee and maintain financial stability in the long run.

Factors to Consider When Choosing a Life Insurance Policy for Key Employee Indemnification

When selecting a life insurance policy for key employee indemnification, businesses should take several factors into consideration. These factors will help determine the most suitable policy that aligns with the company’s specific needs and requirements. Here are key considerations:

- Coverage Amount: The coverage amount should reflect the potential financial impact of losing a key employee. This includes costs associated with finding a replacement, training new personnel, and compensating for a decline in revenue. A thorough evaluation of the key employee’s role and contribution to the business can aid in determining an appropriate coverage amount.

- Premiums: Premiums are an ongoing expense, and businesses should ensure they are affordable and sustainable over the long term. It is advisable to obtain multiple quotes from insurance providers and compare the premiums, taking into account any potential premium increases in the future.

- Cash Value Accumulation: Depending on the policy type, some life insurance policies, such as whole life insurance and universal life insurance, accumulate cash value over time. Businesses should assess the potential for cash value growth and consider the flexibility and accessibility of the cash value for future financial needs.

- Flexibility and Customization: Different life insurance policies offer varying degrees of flexibility and customization. Consider the ability to adjust coverage amounts, premium payments, and policy features to accommodate changing business circumstances and requirements.

- Underwriting and Approval Process: Evaluate the underwriting process of the insurance provider, including the medical exams, documentation, and review process. Understanding the timeline and requirements for policy approval is essential to ensure coverage is in place when needed.

It is crucial for businesses to consult with an insurance specialist or financial advisor who can provide expert guidance in selecting the most suitable life insurance policy for key employee indemnification. These professionals can assess the unique needs of the business, evaluate potential risks, and navigate through the complexities of insurance offerings.

Remember, choosing the right life insurance policy for key employee indemnification is a critical decision for the financial security and stability of the business. By considering these factors and seeking professional advice, businesses can ensure they have the appropriate coverage in place to protect against the potential loss of a key employee.

Coverage Amount

Determining the appropriate coverage amount is a crucial factor when selecting a life insurance policy for key employee indemnification. The coverage amount should reflect the potential financial impact that the loss of a key employee could have on the business.

When considering the coverage amount, businesses need to assess the costs associated with replacing the key employee, training new personnel, and managing the potential decline in revenue or client relationships. It’s important to conduct a thorough evaluation of the key employee’s role and contribution to the company to accurately gauge the potential monetary repercussions of their absence.

Factors to consider when determining the coverage amount include:

- Role and Responsibilities: Evaluate the key employee’s responsibilities and the specific expertise they bring to the company. Consider the impact of their absence on daily operations, decision-making processes, and overall productivity.

- Revenue Generation: Assess the key employee’s role in generating revenue for the business. This can include their impact on sales, client retention, or the development of new business opportunities. Quantify the potential financial loss that could occur in their absence.

- Client Relationships: Consider the key employee’s relationships with clients, customers, or partners. Evaluate the potential impact on existing relationships and the likelihood of retaining those relationships without the key employee’s involvement.

- Specialized Skills and Knowledge: Take into account the key employee’s unique skills, knowledge, or intellectual property that contribute to the company’s success. Determine the cost of replacing and replicating those skills, including any specialized training or expertise required.

It’s important for businesses to avoid underinsuring or overinsuring for key employee indemnification. Underinsurance can leave the business exposed to significant financial risks in the event of the key employee’s loss. Conversely, overinsurance can result in unnecessarily high premiums and expenses.

Regularly reviewing and reassessing the coverage amount is crucial, particularly as the business evolves and the value of the key employee may change over time. Periodic evaluations ensure that the coverage remains appropriate and aligned with the company’s needs and goals.

By accurately determining the coverage amount needed, businesses can ensure that the selected life insurance policy provides sufficient financial protection to mitigate the potential risks and challenges associated with the loss of a key employee.

Premiums

Premiums are a significant factor to consider when choosing a life insurance policy for key employee indemnification. Premiums are the recurring payments made by the business to the insurance company in exchange for coverage. It is essential for businesses to evaluate and assess the affordability and sustainability of the premiums over the long term.

When considering premiums, there are several key points to keep in mind:

- Affordability: It is crucial for businesses to ensure that the premium payments fit within their budget. The cost of the premiums should be sustainable over the life of the policy to avoid any financial strain on the company’s operations.

- Policy Type and Coverage: Different policy types, such as term life insurance or whole life insurance, have different premium structures. Term life insurance policies generally have lower premiums compared to whole life insurance policies. Understanding the cost implications of each policy type is important in determining the affordability of the premiums.

- Duration of Coverage: The duration of coverage is also a factor in premium calculations. For instance, term life insurance policies usually have lower premiums because they provide coverage for a specific term, whereas whole life insurance policies come with higher premiums because they offer lifelong coverage.

- Age and Health of the Key Employee: The age and health of the key employee can impact the premium amount. Generally, younger and healthier individuals may qualify for lower premiums due to their lower risk profile.

- Underwriting Factors: Insurance providers take into account various underwriting factors, such as medical history, lifestyle choices, and occupation, when determining premiums. Any pre-existing health conditions or high-risk activities of the key employee can affect the premium calculations.

It’s important to obtain multiple quotes from insurance providers and compare premiums to ensure competitive pricing. It may also be beneficial to consult with an insurance specialist or financial advisor who can assist in assessing the affordability of premiums and provide guidance on selecting the most cost-effective policy for the desired coverage.

While the affordability of premiums is a crucial consideration, businesses should not solely focus on finding the lowest premium. It’s equally important to consider the overall value and benefits provided by the policy, including coverage amount, additional features, and potential cash value accumulation.

By carefully evaluating the affordability of premiums and considering the long-term financial implications, businesses can select a life insurance policy that strikes the right balance between cost and coverage, providing adequate financial protection for key employee indemnification.

Cash Value Accumulation

Cash value accumulation is an important factor to consider when choosing a life insurance policy for key employee indemnification. Certain types of life insurance policies, such as whole life insurance and universal life insurance, offer a cash value component that grows over time.

Here are key points to consider regarding cash value accumulation:

- Growth Potential: Whole life insurance and universal life insurance policies accumulate cash value over time, usually on a tax-deferred basis. This cash value has the potential to grow based on factors such as the premiums paid, the policy’s interest crediting rate, and any dividends earned by the policy.

- Accessibility: The accumulated cash value in a life insurance policy can usually be accessed by the business through policy loans or withdrawals, providing a valuable source of funds. This accessibility can help in covering unexpected expenses, addressing financial needs related to the loss of a key employee, or seizing opportunities that arise.

- Flexibility: Depending on the policy type, there may be different options for utilizing the cash value. Businesses should understand and consider the flexibility offered by the policy, such as the ability to borrow against the cash value, make partial withdrawals, or use the cash value to pay premiums.

- Tax Benefits: The cash value accumulation within a life insurance policy typically grows on a tax-deferred basis. This means that the growth is not subject to immediate taxation, providing potential tax advantages for the business.

- Interest Rates and Investment Options: Different insurance companies may offer varying interest rates and investment options for the cash value component. Businesses should evaluate the performance history of the policy’s investments and understand the potential risks and rewards associated with the underlying investments.

When considering cash value accumulation, businesses should assess their financial goals and determine how the cash value can align with those objectives. For some businesses, the cash value may serve as a valuable financial asset that can be strategically utilized for business expansion, investment opportunities, or managing unexpected financial challenges.

It is important to review the policy’s cash value accumulation projections and understand the conditions and limitations associated with accessing the cash value. Additionally, businesses should consider the long-term sustainability of the premium payments and their impact on the cash value growth over time.

Consulting with an insurance specialist or financial advisor can provide valuable insights into the cash value accumulation potential of different policies. These professionals can help evaluate the benefits, risks, and growth opportunities associated with the cash value component, assisting businesses in selecting a policy that aligns with their financial objectives.

By considering the cash value accumulation, businesses can not only provide key employee indemnification but also benefit from the additional flexibility and financial opportunities offered by the accumulated cash value within the selected life insurance policy.

Flexibility and Customization Options

Flexibility and customization options are important considerations when choosing a life insurance policy for key employee indemnification. Different policies offer varying degrees of flexibility, allowing businesses to tailor the coverage to their specific needs and circumstances.

Here are key points to keep in mind regarding flexibility and customization options:

- Adjustable Premiums: Some life insurance policies, such as universal life insurance, provide flexibility in premium payments. Businesses have the ability to adjust the premium amounts within certain limits. This flexibility allows companies to adapt their premium payments based on their financial situation and changing needs.

- Death Benefit Customization: Certain policies allow businesses to customize the death benefit amount. This allows companies to align the coverage amount with the value of the key employee and the potential financial impact of their loss. Customizable death benefit options provide businesses with greater control and the ability to adjust the coverage as needed.

- Additional Riders and Benefits: Life insurance policies may offer additional riders or benefits that can be added to the base policy for enhanced coverage. These riders can include options such as accelerated death benefit riders, which allow for early access to the death benefit in the event of a terminal illness, or waiver of premium riders, which waive premium payments in case of disability. The ability to add these riders provides businesses with added flexibility and customization based on their specific needs.

- Policy Duration: Depending on the type of policy, businesses have the flexibility to choose the duration of coverage that best fits their needs. Some policies, like term life insurance, provide coverage for a specific term, while others, like whole life insurance or universal life insurance, offer lifelong coverage. The ability to select the policy duration allows businesses to align the coverage period with their anticipated requirements.

- Changing Coverage Amounts: As the needs of the business change over time, the ability to adjust the coverage amount can be crucial. Policies that allow for changes in the coverage amount provide businesses with the flexibility to increase or decrease the coverage to match the evolving needs of the company.

It is important for businesses to closely examine the flexibility and customization options offered by different life insurance policies. Consider the specific needs and objectives of the business, both in the short term and the long term. Assessing the potential for policy adjustments and customization ensures that the selected policy can adapt to changes in the business environment.

Consulting with an insurance specialist or financial advisor can provide valuable insights into the flexibility and customization options available with various policies. These professionals can assist businesses in evaluating the features and benefits offered by different policies, helping them select the most suitable coverage that aligns with their unique requirements.

By considering flexibility and customization options, businesses can choose a life insurance policy that provides the necessary adaptability to address changing circumstances and effectively safeguard against the potential loss of a key employee.

Underwriting and Approval Process

The underwriting and approval process is an important consideration when selecting a life insurance policy for key employee indemnification. The underwriting process assesses the risk profile of the individual being insured, and understanding this process is crucial to ensure a smooth and efficient policy approval.

Here are key points to consider regarding the underwriting and approval process:

- Medical Exams and Documentation: Life insurance companies typically require applicants to undergo a medical examination to assess their health. This may involve physical measurements, blood tests, and other medical evaluations. It is important to understand the requirements and prepare the necessary documentation to facilitate the underwriting process.

- Health and Lifestyle Factors: Insurers consider various health and lifestyle factors when assessing the risk of an individual. This can include medical history, age, weight, tobacco use, and participation in high-risk activities. These factors can influence the premium calculations and the overall insurability of the key employee.

- Occupation and Risk Assessment: The occupation of the key employee may also impact the underwriting process. Certain occupations that involve greater risk or exposure to hazardous conditions may require additional scrutiny by the insurance company.

- Timeline for Approval: It’s important to have a clear understanding of the typical timeline for the underwriting and approval process. This ensures that the coverage is in place when needed and allows for proper planning within the business.

- Applicant’s Cooperation: The applicant’s cooperation and timely provision of requested information during the underwriting process are crucial. Providing accurate and complete information helps facilitate a smooth approval process and reduces the risk of any delays or complications.

It is advisable to consult with an insurance specialist or financial advisor who can guide businesses through the underwriting and approval process. These professionals can assist in preparing the necessary documentation, answering any questions, and ensuring that the application is submitted accurately to expedite the approval process.

Understanding the underwriting and approval process helps businesses manage expectations and ensures a seamless experience when obtaining life insurance for key employee indemnification. By being well-informed and prepared, businesses can navigate the process with ease and secure the necessary coverage to protect against the potential loss of a key employee.

Conclusion

Choosing the right life insurance policy for key employee indemnification is a critical decision for businesses looking to protect against the potential loss of their key employees. Understanding the factors that impact this decision is essential in selecting a policy that aligns with the unique needs and goals of the company.

Key employee indemnification through life insurance provides businesses with financial stability and peace of mind, ensuring that the company can navigate the challenges and potential financial impact caused by the loss of a key employee. By selecting the appropriate coverage amount, businesses can protect against the costs of finding a replacement, training new personnel, and managing any decline in revenue or client relationships that may arise.

Considerations such as premiums, cash value accumulation, flexibility, and the underwriting process play crucial roles in determining the most suitable policy for key employee indemnification. Evaluating these factors, along with the specific needs and objectives of the business, allows for informed decision-making.

Consulting with insurance specialists or financial advisors can provide valuable guidance in navigating the various options and complexities of life insurance policies. These professionals can help businesses assess their unique requirements and recommend the most appropriate policy type, coverage amount, and customization options.

Ultimately, selecting the right life insurance policy for key employee indemnification empowers businesses to protect their financial stability, ensure business continuity, and safeguard against the potential challenges that may arise from the loss of a key employee. By investing in comprehensive and tailored coverage, businesses can focus on their core operations with the confidence that they have taken proactive measures to mitigate risks and secure their future success.