Finance

How To Retrieve P&L From QuickBooks

Published: February 29, 2024

Learn how to easily retrieve your profit and loss statement from QuickBooks to gain valuable insights into your finance performance. Streamline your financial reporting with our step-by-step guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Importance of Profit and Loss Statements in Business

Profit and Loss (P&L) statements are vital financial documents that provide a comprehensive overview of a company’s financial performance over a specific period. These statements offer valuable insights into the revenue, costs, and expenses incurred by the business, ultimately revealing its profitability. Understanding and analyzing P&L statements is crucial for making informed business decisions, evaluating the effectiveness of financial strategies, and identifying areas for improvement.

In the context of QuickBooks, a popular accounting software used by businesses of all sizes, the ability to retrieve P&L statements efficiently is essential for financial management and reporting. This article will guide you through the process of accessing, generating, customizing, and exporting P&L statements using QuickBooks, empowering you to harness the full potential of this powerful tool for financial analysis and decision-making.

Whether you’re a small business owner, an accounting professional, or a financial enthusiast, mastering the art of retrieving P&L statements from QuickBooks can significantly enhance your understanding of your company’s financial health and performance. By delving into the intricacies of P&L statements and leveraging the features of QuickBooks, you can gain actionable insights that drive sustainable growth and success.

Understanding Profit and Loss Statements

Profit and Loss (P&L) statements, also known as income statements, are fundamental financial documents that provide a snapshot of a company’s financial performance over a specific period, typically monthly, quarterly, or annually. These statements offer a detailed breakdown of the revenues, costs, and expenses incurred by the business, ultimately revealing its profitability. By analyzing P&L statements, businesses can assess their operational efficiency, track revenue trends, and identify areas for improvement.

At its core, a P&L statement consists of several key components, including:

- Revenue: This section outlines the total income generated from the sale of goods or services. It encompasses sales revenue, interest income, and any other sources of income.

- Cost of Goods Sold (COGS): COGS represents the direct costs associated with producing goods or delivering services. It includes raw materials, labor, and manufacturing overhead.

- Gross Profit: Calculated by subtracting COGS from the total revenue, gross profit reflects the profitability of the core business activities.

- Operating Expenses: This category encompasses all expenses not directly related to production, such as marketing, salaries, rent, utilities, and administrative costs.

- Operating Income: Also known as operating profit, this figure is derived by subtracting operating expenses from the gross profit, indicating the profitability from regular business operations.

- Net Income: The final section of the P&L statement, net income represents the total profit after accounting for all expenses, including taxes and interest.

By comprehensively analyzing these components, businesses can gain valuable insights into their financial performance, assess the effectiveness of their operations, and make informed decisions to drive sustainable growth.

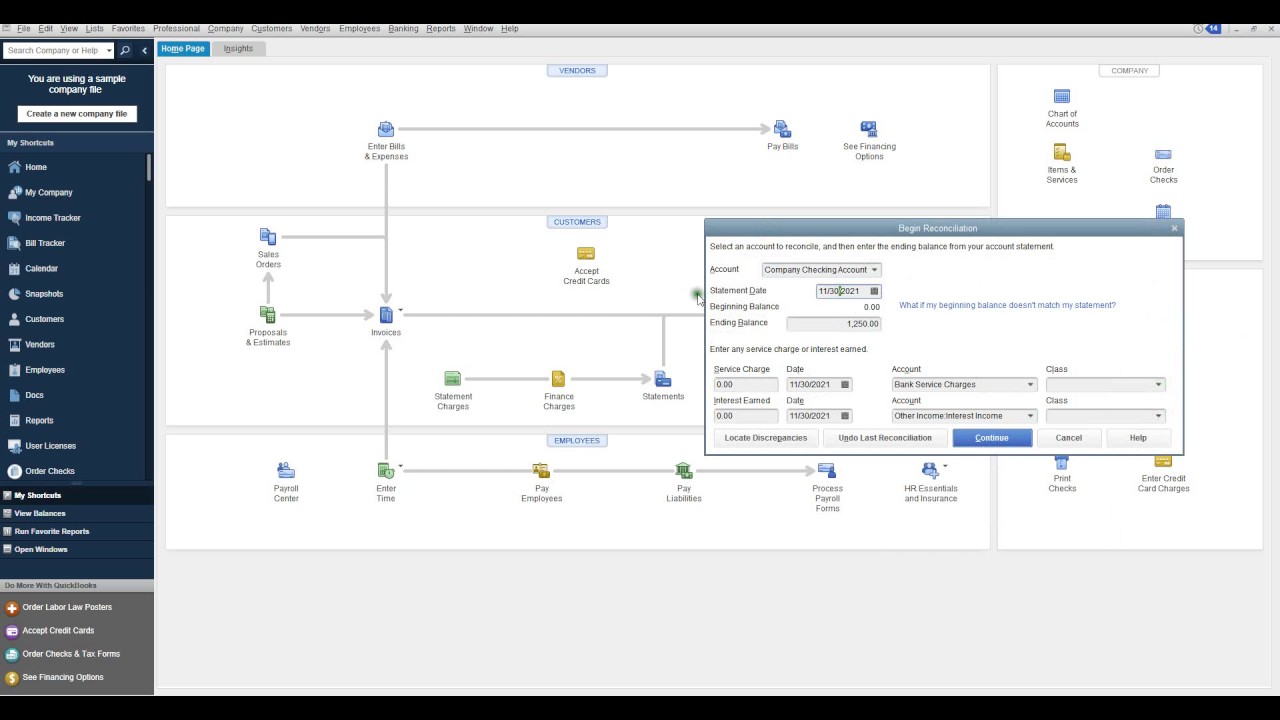

Accessing QuickBooks

QuickBooks is a powerful accounting software designed to streamline financial management for businesses. Whether you’re a small business owner, a freelance professional, or an established enterprise, accessing QuickBooks is the first step towards harnessing its robust features for efficient bookkeeping, invoicing, and financial reporting.

As a cloud-based solution, QuickBooks offers the flexibility of accessing your financial data from anywhere, at any time, using a web browser or the dedicated mobile app. This accessibility empowers users to stay connected to their business’s financial health, manage transactions on the go, and collaborate with team members seamlessly.

Upon logging into QuickBooks, users are greeted by an intuitive dashboard that provides an overview of their company’s financial status, including account balances, income and expense trends, and upcoming tasks. Navigating through the software’s interface is user-friendly, allowing users to effortlessly locate the tools and features they need to perform various accounting tasks.

For businesses that prefer desktop-based accounting solutions, QuickBooks also offers a desktop version that provides robust functionality and offline access to financial data. Users can install the software on their computers and enjoy the convenience of managing their finances without being dependent on an internet connection.

Whether you opt for the online or desktop version of QuickBooks, accessing the software is the gateway to streamlining your financial processes, gaining valuable insights through comprehensive reporting, and leveraging advanced features to drive business growth.

Generating Profit and Loss Statements

Within QuickBooks, generating profit and loss (P&L) statements is a straightforward process that empowers users to gain valuable insights into their company’s financial performance. Whether you’re aiming to assess monthly profitability, track quarterly trends, or analyze annual revenue, QuickBooks offers intuitive tools to generate comprehensive P&L statements.

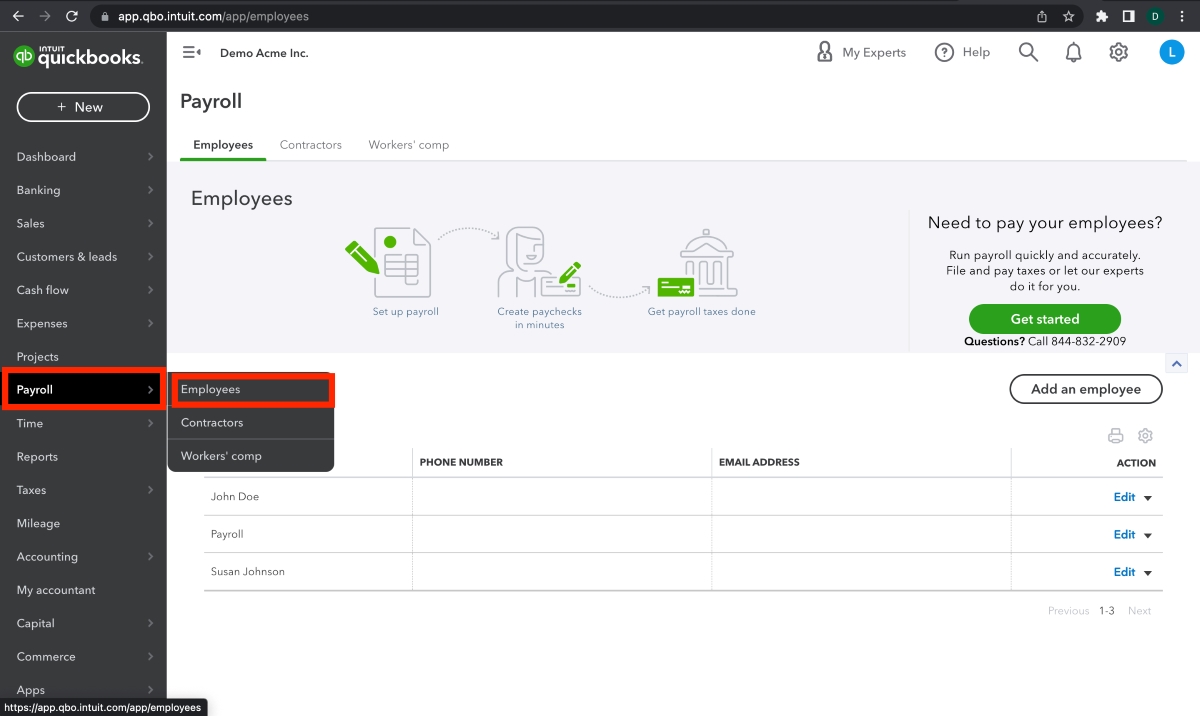

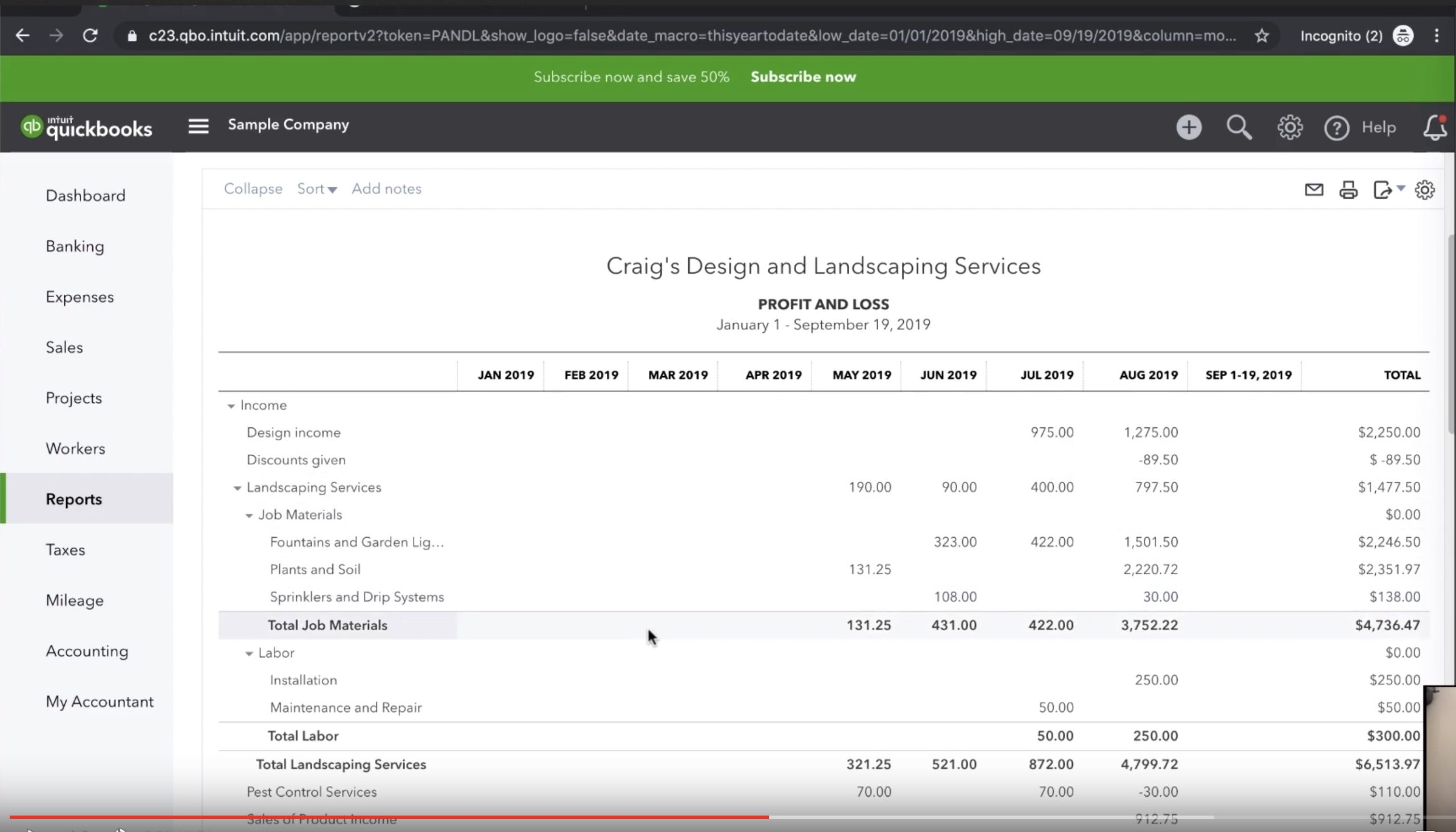

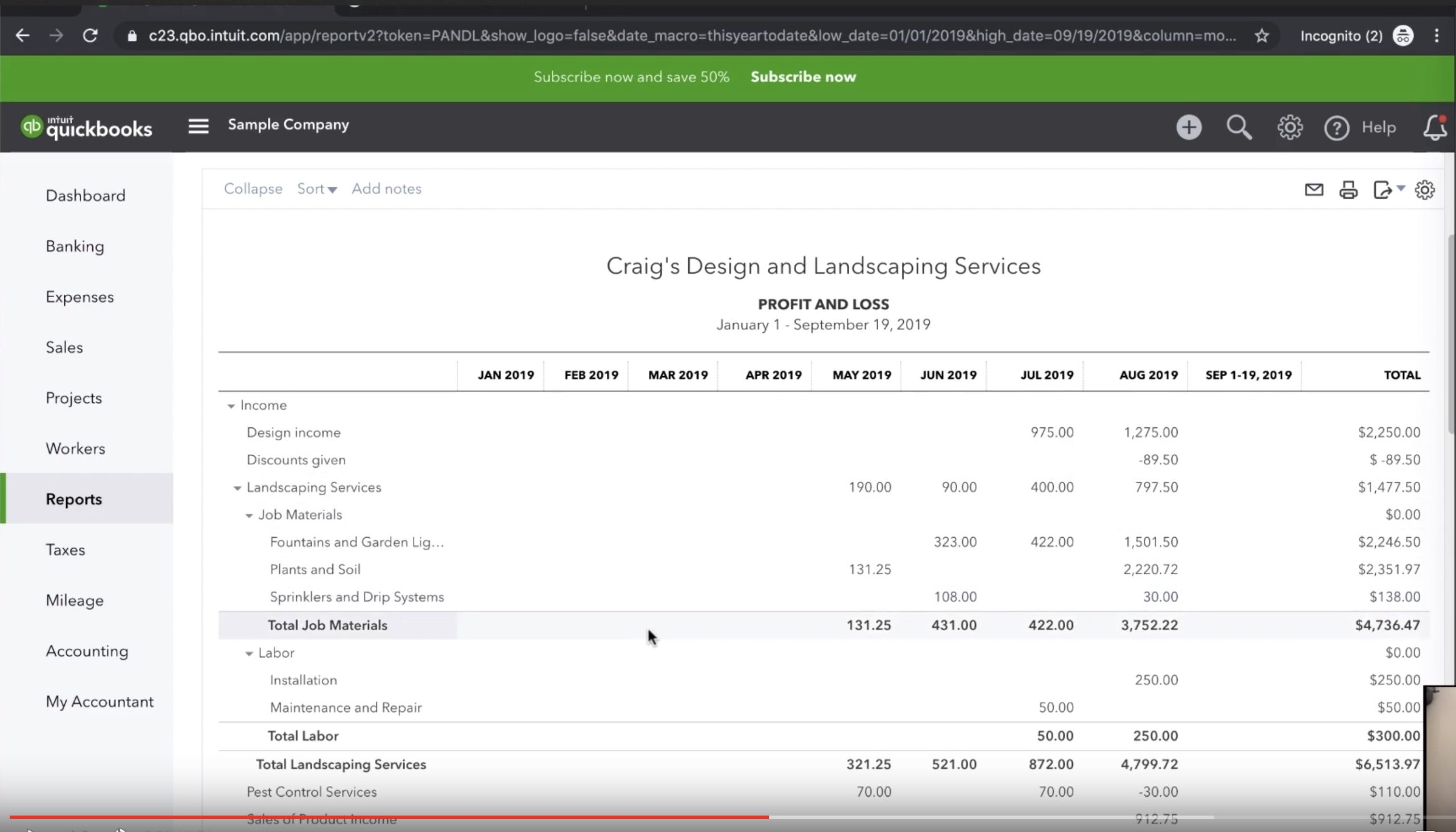

To initiate the process, users can navigate to the “Reports” tab within QuickBooks and select the “Profit and Loss” report from the list of available financial reports. This action triggers the generation of a standard P&L statement, providing a summary of the company’s revenues, expenses, and net income for the specified period.

Upon generating the P&L statement, users can customize the reporting period to align with their specific analysis needs. Whether you’re focusing on a specific month, a fiscal quarter, or the entire year, QuickBooks allows you to tailor the timeframe, ensuring that the insights derived from the P&L statement are relevant and actionable.

Furthermore, QuickBooks offers the flexibility to generate comparative P&L statements, enabling users to juxtapose the financial performance of different periods. This comparative analysis can be instrumental in identifying trends, evaluating the impact of strategic initiatives, and making data-driven decisions to enhance profitability.

By empowering users to effortlessly generate P&L statements, QuickBooks plays a pivotal role in facilitating informed financial analysis, enabling businesses to monitor their performance, identify areas for improvement, and make strategic adjustments to drive sustainable growth.

Customizing Profit and Loss Statements

QuickBooks offers robust customization options for profit and loss (P&L) statements, allowing users to tailor the presentation of financial data to suit their specific analytical needs and reporting preferences. By leveraging these customization features, businesses can gain deeper insights into their financial performance and present information in a format that aligns with their unique requirements.

One of the key customization options available in QuickBooks is the ability to modify the layout and structure of P&L statements. Users can choose to include or exclude specific data fields, rearrange the sequence of financial categories, and emphasize critical metrics based on the intended audience or analytical focus.

Beyond structural adjustments, QuickBooks enables users to apply filters to P&L statements, refining the data displayed based on predefined criteria. Whether it’s isolating revenues from a particular product line, segmenting expenses by department, or excluding specific cost categories, these filters empower users to extract targeted insights from their financial data.

Moreover, QuickBooks facilitates the addition of custom fields and calculations to P&L statements, allowing businesses to incorporate supplementary metrics, performance indicators, or derived values that provide a comprehensive view of their financial health. This capability enhances the relevance and depth of the P&L statement, catering to the specific analytical requirements of users.

By embracing the customization features offered by QuickBooks, businesses can transform standard P&L statements into powerful tools for financial analysis, decision-making, and stakeholder communication. The ability to tailor the presentation of financial data empowers users to extract actionable insights, identify performance trends, and communicate financial information in a manner that resonates with their audience.

Exporting Profit and Loss Statements

QuickBooks equips users with the capability to export profit and loss (P&L) statements in various formats, facilitating seamless data sharing, collaboration, and further analysis. By offering flexible export options, QuickBooks empowers businesses to leverage their financial data beyond the confines of the software, enabling comprehensive reporting and decision-making.

Upon generating a P&L statement within QuickBooks, users can effortlessly export the report in commonly used formats such as PDF or Excel. This functionality ensures that the financial data can be readily shared with stakeholders, archived for future reference, or integrated into presentations and financial documents.

Furthermore, QuickBooks enables users to customize the export settings, tailoring the appearance and structure of the exported P&L statement to align with specific reporting requirements. Whether it’s adjusting the page layout, including additional annotations, or formatting the data for compatibility with external systems, these customization options enhance the usability and relevance of the exported report.

Beyond traditional file-based exports, QuickBooks facilitates seamless integration with cloud storage platforms and third-party applications, allowing users to directly transfer P&L statements to their preferred digital repositories or accounting tools. This integration streamlines data workflows, minimizes manual intervention, and enhances the accessibility of financial reports across different platforms.

By offering versatile export capabilities, QuickBooks empowers businesses to extend the value of their financial data, fostering collaborative decision-making, regulatory compliance, and strategic planning. The ability to export P&L statements in user-friendly formats and integrate them with external systems amplifies the utility of financial reports, enabling users to harness actionable insights for sustained growth and financial management.

Conclusion

Mastering the retrieval and utilization of profit and loss (P&L) statements within QuickBooks is a pivotal skill for businesses seeking to gain comprehensive insights into their financial performance and drive informed decision-making. By understanding the significance of P&L statements and leveraging QuickBooks’ robust features, users can unlock a wealth of actionable insights, streamline financial reporting, and empower their organizations for sustained growth.

Through this article, we’ve explored the foundational importance of P&L statements, delving into their role as essential tools for assessing revenue, expenses, and profitability. Understanding the components of a P&L statement and their implications for financial analysis is fundamental to leveraging QuickBooks effectively.

Accessing QuickBooks presents users with a gateway to seamless financial management, whether through the cloud-based online version or the feature-rich desktop application. The accessibility and user-friendly interface of QuickBooks enable businesses to stay connected to their financial data and streamline their accounting processes.

Generating P&L statements within QuickBooks empowers users to extract valuable insights into their company’s financial performance, while the customization options offer the flexibility to tailor the presentation of financial data to suit specific analytical needs and reporting preferences. This capability enhances the relevance and depth of the P&L statement, catering to the specific requirements of users and stakeholders.

Furthermore, the ability to export P&L statements in various formats and integrate them with external systems amplifies the utility of financial reports, fostering collaborative decision-making, regulatory compliance, and strategic planning.

In conclusion, the seamless integration of financial data and reporting capabilities within QuickBooks empowers businesses to harness the full potential of profit and loss statements, driving informed decision-making, strategic planning, and sustainable growth. By mastering the retrieval and utilization of P&L statements, businesses can navigate the complexities of financial management with confidence, leveraging actionable insights to propel their success.