Finance

When Do I Pay A Penalty On My Pension Funds?

Published: January 23, 2024

Learn about penalties on pension funds and how they affect your finances. Find out when and why you may have to pay a penalty on your pension funds.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Understanding the Impact of Pension Fund Penalties

Pension funds serve as a vital financial cushion for individuals during their retirement years. However, navigating the complexities of pension fund penalties is crucial for ensuring the optimal management of these funds. By gaining a comprehensive understanding of the circumstances that may lead to penalties and the associated implications, individuals can make informed decisions to safeguard their retirement savings.

Navigating the intricacies of pension fund penalties is essential for individuals seeking to optimize their retirement savings. By comprehending the circumstances that may trigger penalties and the associated implications, individuals can make informed decisions to safeguard their financial well-being in retirement.

In this article, we will delve into the various scenarios that can lead to penalties on pension funds, shedding light on the consequences of early withdrawals, required minimum distribution penalties, and other potential charges. Furthermore, we will explore exceptions to these penalties, providing valuable insights for individuals seeking to navigate the intricate landscape of pension fund management.

Understanding the nuances of pension fund penalties is of paramount importance for anyone with retirement savings. By equipping yourself with the knowledge presented in this article, you can make informed decisions to maximize the potential of your pension funds while mitigating the risk of incurring unnecessary penalties.

Understanding Pension Fund Penalties

Penalties on pension funds are financial sanctions imposed on individuals for non-compliance with specific regulations governing retirement savings. These penalties are designed to deter early or excessive withdrawals and ensure that individuals adhere to the prescribed guidelines for managing their retirement funds.

It’s essential to recognize that pension fund penalties can significantly impact an individual’s financial well-being in retirement. Therefore, understanding the circumstances that may trigger these penalties is crucial for making informed decisions regarding the management of pension funds.

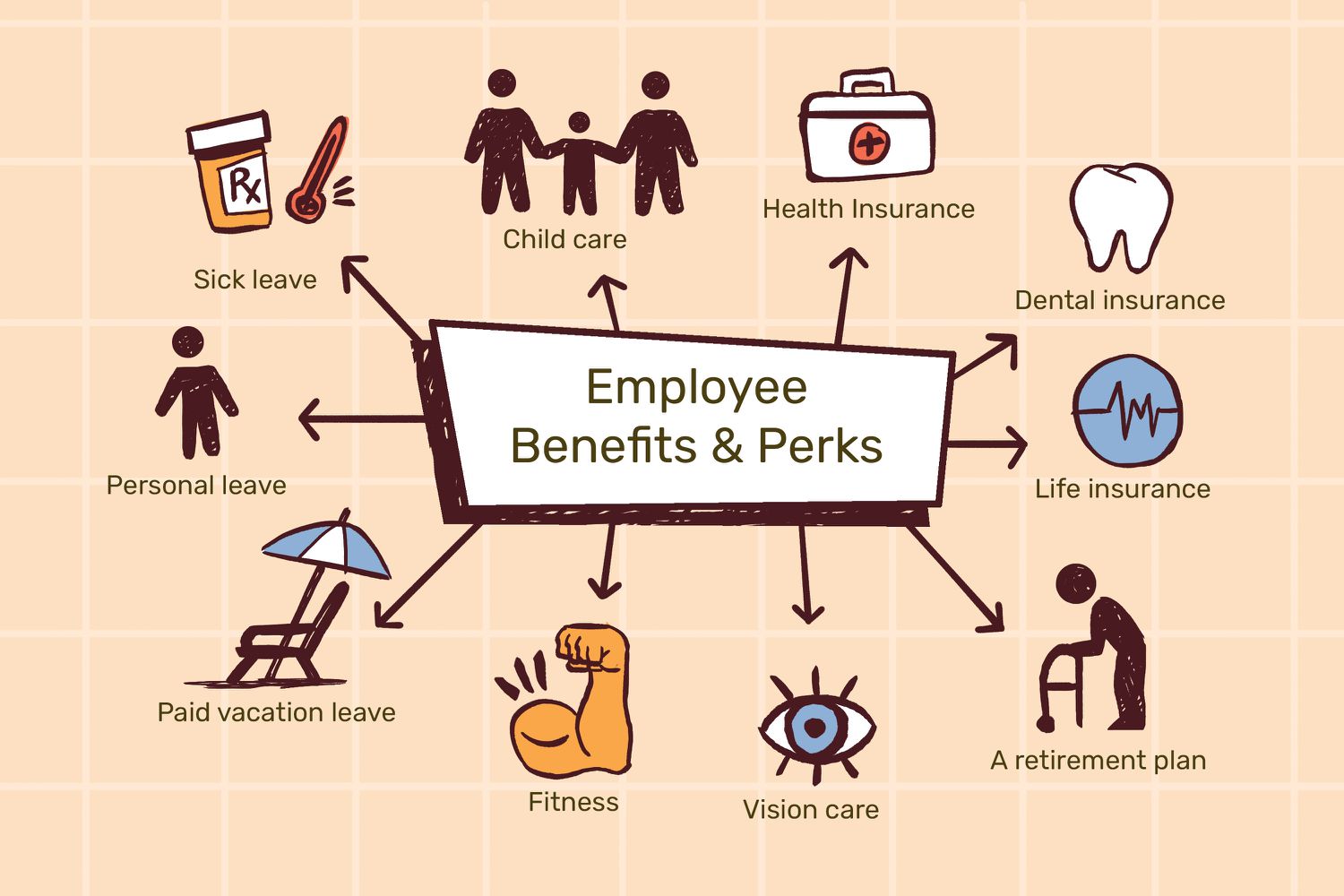

Common factors that may lead to pension fund penalties include early withdrawals, failure to meet required minimum distributions (RMDs), and other taxable events. Each of these scenarios carries its own set of penalties and tax implications, underscoring the importance of prudent financial planning and adherence to retirement savings regulations.

Furthermore, the intricacies of pension fund penalties underscore the need for individuals to stay abreast of the evolving regulatory landscape governing retirement savings. By remaining informed about changes in pension fund regulations and tax laws, individuals can proactively adjust their financial strategies to avoid potential penalties and optimize their retirement savings.

Ultimately, comprehending the implications of pension fund penalties empowers individuals to make well-informed decisions regarding their retirement savings. By delving into the specifics of early withdrawal penalties, RMD penalties, and other potential charges, individuals can navigate the complexities of pension fund management with confidence and prudence.

Early Withdrawal Penalties

Early withdrawal penalties are imposed on individuals who access their pension funds before reaching the eligible age for distributions, typically before the age of 59½. These penalties serve as a deterrent to discourage premature depletion of retirement savings and are in addition to the regular income tax due on the withdrawn amount.

Generally, early withdrawal penalties amount to 10% of the distributed funds, representing a substantial financial consequence for individuals seeking to tap into their pension savings prematurely. It’s important for individuals to be cognizant of these penalties and consider them when evaluating the timing of potential withdrawals.

However, certain exceptions exist that may exempt individuals from early withdrawal penalties. These exceptions include using the funds for qualified higher education expenses, purchasing a first home, covering medical expenses that exceed a certain percentage of the individual’s adjusted gross income, or as part of substantially equal periodic payments.

Understanding the implications of early withdrawal penalties is pivotal for individuals contemplating accessing their pension funds before the stipulated age. By being mindful of these penalties and the potential exceptions, individuals can make informed decisions that align with their financial goals while mitigating the risk of incurring substantial financial sanctions.

Required Minimum Distribution Penalties

Required Minimum Distributions (RMDs) are mandatory withdrawals from retirement accounts, such as traditional IRAs and 401(k) plans, that individuals must initiate after reaching a certain age, typically 72 years old. Failing to take the full amount of the RMD by the specified deadline can result in significant penalties, amounting to 50% of the shortfall.

It’s imperative for individuals to adhere to the RMD requirements to avoid incurring substantial penalties that can erode their retirement savings. By calculating the RMD accurately and ensuring timely distributions, individuals can fulfill their obligations while preserving the integrity of their retirement funds.

Moreover, individuals should stay informed about any changes in the RMD rules and regulations to proactively adjust their distribution strategies and avoid potential penalties. Remaining vigilant and proactive in managing RMDs is essential for safeguarding retirement savings and mitigating the risk of incurring avoidable financial sanctions.

Understanding the implications of Required Minimum Distribution penalties underscores the importance of meticulous planning and adherence to regulatory guidelines. By prioritizing compliance with RMD requirements and staying abreast of pertinent regulations, individuals can navigate the complexities of retirement account distributions with prudence and foresight.

Other Penalties and Taxes

When it comes to managing pension funds, it's crucial to be aware of potential penalties and taxes beyond early withdrawal and Required Minimum Distribution (RMD) penalties. One such consideration is the taxation of pension income, which is typically subject to ordinary income tax when withdrawn. This tax treatment applies to distributions from traditional IRAs, 401(k) plans, and other tax-deferred retirement accounts.

Additionally, individuals should be mindful of the potential tax implications of overcontributions to retirement accounts. Excess contributions beyond the allowable limits can result in tax penalties if not rectified within the specified time frames. It's essential for individuals to monitor their contributions to retirement accounts to ensure compliance with contribution limits and avoid unnecessary tax liabilities.

Moreover, individuals should consider the tax implications of inherited pension funds. Beneficiaries who inherit pension accounts may be subject to specific distribution requirements and tax obligations. Understanding the tax implications of inherited pension funds is vital for beneficiaries to navigate the distribution process and optimize the tax treatment of inherited retirement assets.

Furthermore, individuals should be cognizant of the tax treatment of Roth IRA distributions. While contributions to Roth IRAs are made with after-tax dollars, qualified distributions are tax-free. However, non-qualified distributions may be subject to taxes and penalties. It's essential for individuals to understand the tax implications of Roth IRA distributions to make informed decisions regarding the timing and purpose of withdrawals.

By staying informed about the various tax implications and potential penalties associated with pension funds, individuals can proactively manage their retirement savings to minimize tax liabilities and avoid avoidable financial sanctions. Prioritizing tax efficiency and compliance with regulatory guidelines is essential for optimizing the long-term growth and sustainability of retirement assets.

Exceptions to Penalties

While penalties on pension funds are designed to deter premature or excessive withdrawals, certain exceptions exist that may alleviate or exempt individuals from incurring these financial sanctions. Understanding these exceptions is crucial for individuals seeking to navigate the complexities of retirement fund management while mitigating the risk of incurring avoidable penalties.

One notable exception pertains to early withdrawal penalties on IRA funds used for qualified higher education expenses. Individuals may avoid the 10% early withdrawal penalty when utilizing the distributed funds to cover eligible educational costs for themselves, their spouses, children, or grandchildren.

Another exception relates to the purchase of a first home, where individuals can utilize IRA funds, up to a specified limit, without incurring early withdrawal penalties. This exception provides flexibility for individuals seeking to utilize their retirement savings to facilitate homeownership without facing substantial financial sanctions.

Furthermore, individuals facing unforeseen medical expenses that exceed a certain percentage of their adjusted gross income may qualify for an exception to early withdrawal penalties. This provision offers relief to individuals grappling with substantial medical costs, allowing them to access their retirement funds without incurring punitive financial penalties.

Additionally, the concept of substantially equal periodic payments provides a mechanism for individuals to access their retirement funds in a series of substantially equal payments over a specified period, potentially exempting them from early withdrawal penalties.

Understanding these exceptions empowers individuals to make informed decisions regarding the utilization of their pension funds while considering the potential implications of early withdrawals. By leveraging these exceptions strategically and prudently, individuals can optimize the flexibility of their retirement savings while mitigating the risk of incurring avoidable financial penalties.

Conclusion

Managing pension funds entails a nuanced understanding of the potential penalties and tax implications associated with retirement savings. By comprehending the circumstances that may trigger penalties, such as early withdrawals and Required Minimum Distributions (RMDs), individuals can navigate the complexities of pension fund management with prudence and foresight.

It is imperative for individuals to prioritize meticulous planning and adherence to regulatory guidelines to safeguard their retirement savings from avoidable financial sanctions. Remaining informed about changes in pension fund regulations and tax laws is essential for proactively adjusting financial strategies to mitigate the risk of incurring penalties and optimize the long-term growth of retirement assets.

Furthermore, understanding the exceptions to penalties on pension funds empowers individuals to leverage strategic opportunities, such as utilizing funds for qualified higher education expenses or the purchase of a first home, without incurring punitive financial sanctions. By leveraging these exceptions prudently, individuals can optimize the flexibility of their retirement savings while aligning with their financial goals.

In conclusion, a comprehensive understanding of pension fund penalties and tax implications is pivotal for individuals seeking to maximize the potential of their retirement savings while mitigating risk. By prioritizing compliance with regulatory guidelines, staying informed about pertinent regulations, and leveraging exceptions strategically, individuals can navigate the intricate landscape of pension fund management with confidence and prudence.