Finance

When Does PepsiCo Pay Dividends?

Published: January 3, 2024

Find out when PepsiCo pays dividends and how it can contribute to your finance goals. Stay informed and maximize your investment potential.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Dividends play a significant role in the world of finance, providing investors with a steady stream of income from their investments. For many investors, receiving regular dividend payments is an essential component of their overall investment strategy. If you’re considering investing in a company like PepsiCo, you may be wondering when they pay dividends and how it can benefit your investment portfolio.

In this article, we’ll explore the world of dividends and take a closer look at PepsiCo, one of the leading companies in the food and beverage industry. We’ll delve into the history of PepsiCo’s dividend payments, their payment schedule, and the factors that can influence the company’s dividend payouts. Whether you’re a current investor in PepsiCo or simply curious about dividend investing, this article will provide you with valuable insights.

PepsiCo has a long-standing reputation for delivering quality products and consistent financial performance. As a global powerhouse in the food and beverage sector, the company has built a strong presence with its diverse range of brands, including Pepsi, Lay’s, Gatorade, Quaker, and many more. With a track record of stable growth and a commitment to rewarding shareholders, PepsiCo has become an attractive investment option for dividend-seeking investors.

If you’re new to the concept of dividends, it’s essential to understand how they work. When a company like PepsiCo generates profits, it has the option to distribute a portion of those earnings back to its shareholders in the form of dividends. Dividends are typically paid in cash, though some companies may issue them in the form of additional shares. These regular cash payments not only provide investors with an income stream but also serve as an indicator of a company’s financial strength and stability.

While dividends can be an attractive incentive for investors, it’s crucial to note that not all companies pay them. Some companies, particularly newer ones or those in high-growth industries, may prioritize reinvesting their profits back into the business rather than distributing them to shareholders. However, established companies like PepsiCo, with a proven track record of profitability and cash flow generation, often choose to reward their shareholders through regular dividend payments.

Understanding Dividends

Dividends are a distribution of a company’s profits to its shareholders. When a company generates earnings, it can choose to reinvest those profits back into the business or distribute them to shareholders in the form of dividends. Dividends are typically paid out on a regular basis, such as quarterly, semi-annually, or annually, although the specific frequency may vary from company to company.

There are several key terms to understand when it comes to dividends:

- Dividend Yield: This is a measure of how much a company pays in dividends relative to its stock price. It is calculated by dividing the annual dividend payment by the stock price.

- Dividend Growth: Some companies increase their dividend payments over time, reflecting their growth and profitability. Dividend growth investors seek out companies that consistently raise their dividend payments.

- Dividend Payout Ratio: This ratio indicates what percentage of a company’s earnings is being paid out as dividends. A lower ratio suggests that the company retains more of its earnings for reinvestment in the business, while a higher ratio indicates a larger portion of earnings being distributed to shareholders.

Investors often view dividends as an important indicator of a company’s financial health and stability. Companies that consistently pay dividends are seen as more reliable and established, as they have a history of generating stable profits and positive cash flow. Dividends can provide investors with a reliable income stream, especially for those nearing or in retirement.

Dividends can also play a role in a dividend reinvestment plan (DRIP). With a DRIP, investors can choose to reinvest their dividend payments back into the company by purchasing additional shares. This can help compound returns over time, as the reinvested dividends can lead to the acquisition of more shares, which can then generate additional dividends.

It’s important to note that not all companies pay dividends. Some companies, particularly in high-growth industries, may choose to retain their earnings to fund expansion or research and development. These companies may offer the potential for capital appreciation but do not provide regular dividend income.

In summary, dividends are a distribution of a company’s profits to its shareholders and can be a valuable source of income for investors. They provide an indication of a company’s financial health and stability, and some investors seek out companies with a history of consistent dividend payments and growth. Dividends can also be reinvested through a DRIP to compound returns over time.

Overview of PepsiCo

PepsiCo is a multinational food and beverage corporation headquartered in the United States. It was formed in 1965 through the merger of Pepsi-Cola and Frito-Lay. Today, PepsiCo is one of the world’s leading companies in the food and beverage industry, with a diverse portfolio of iconic brands.

The company operates through several segments, including PepsiCo Beverages North America, Frito-Lay North America, Quaker Foods North America, and PepsiCo International. Its portfolio of well-known brands includes Pepsi, Mountain Dew, Lay’s, Gatorade, Tropicana, Quaker, and Doritos, among many others.

PepsiCo has a strong global presence, with products available in over 200 countries and territories. The company has established a reputation for innovation, consistently introducing new products and responding to changing consumer preferences. It has also made significant efforts to expand its product offerings to cater to a range of consumer needs, including healthier options and snacks.

As of [latest available financial information], PepsiCo generated [revenue amount] in annual revenue, highlighting its position as a major player in the food and beverage industry. The company’s growth has been driven by a combination of organic growth, acquisitions, and strategic partnerships.

PepsiCo is committed to sustainable and responsible business practices. The company has set ambitious environmental and social goals, including reducing its carbon footprint, conserving water, and promoting responsible sourcing and packaging. It has also prioritized diversity and inclusion initiatives and community development through various philanthropic efforts.

In terms of financial performance, PepsiCo has delivered consistent results over the years. The company’s ability to generate strong cash flows has allowed it to reward shareholders through consistent dividend payments. With its diverse and resilient business model, PepsiCo has remained resilient in the face of market challenges and has demonstrated a commitment to long-term value creation.

Overall, PepsiCo’s strong brand portfolio, global presence, and commitment to innovation and sustainability have positioned it as a leading player in the food and beverage industry. Its history of stable financial performance and dedication to shareholder value make it an attractive choice for investors seeking reliable dividend payments and potential long-term growth.

Dividend Payment History

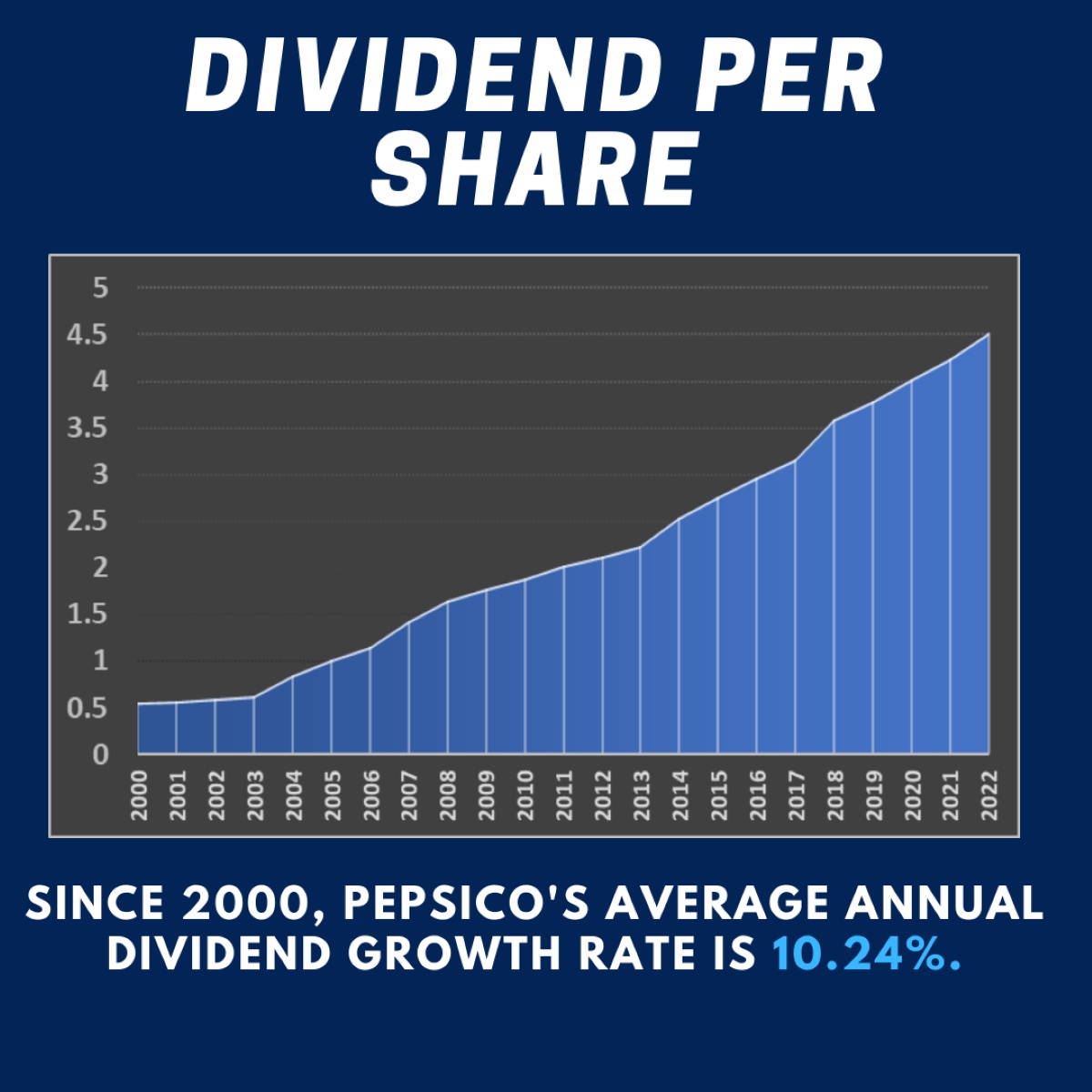

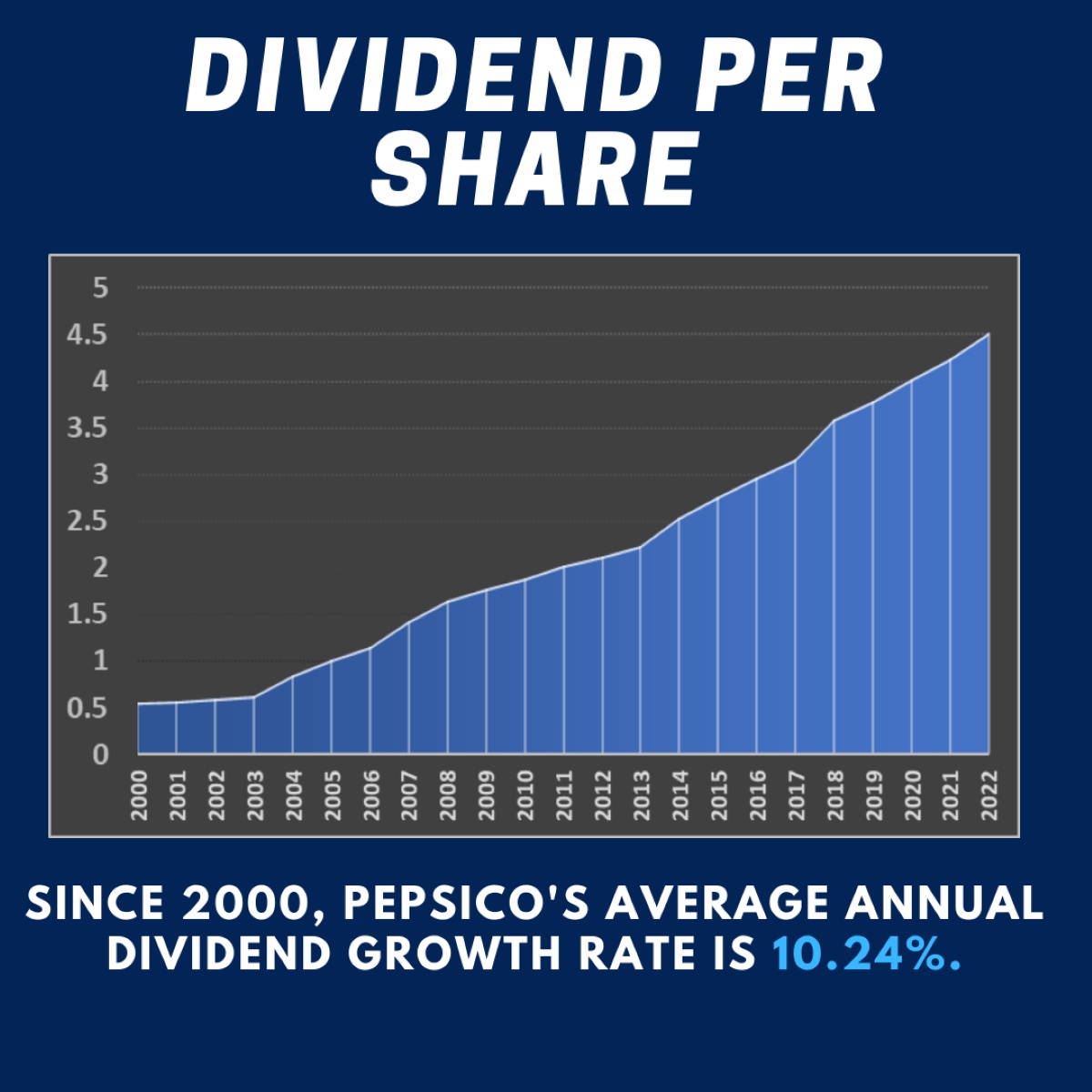

PepsiCo has a strong track record of dividend payments, making it an appealing choice for income-seeking investors. The company has a history of regularly distributing a portion of its earnings back to shareholders in the form of dividends.

Looking back at PepsiCo’s dividend payment history, we can see a consistent pattern of dividend increases over the years, reflecting the company’s strong financial performance and commitment to rewarding its shareholders. While past performance is not indicative of future results, it provides valuable insights into the company’s dividend-paying behavior.

Since [insert year of first dividend payment], PepsiCo has steadily increased its dividend payout, demonstrating its consistent profitability and cash flow generation. The company has a track record of annual dividend increases, which is a testament to its commitment to creating long-term value for shareholders.

While the specific dividend amounts can vary from year to year, PepsiCo has consistently demonstrated its dedication to rewarding shareholders by maintaining or increasing its dividend payments. This stability and growth in dividends can provide investors with a reliable income stream and potential capital appreciation.

It’s important to note that the amount and frequency of dividend payments are ultimately determined by the company’s management and board of directors. They consider various factors, including the company’s financial performance, cash flow, capital allocation priorities, and future growth opportunities when making dividend decisions.

Investors should also be aware that dividend payments are not guaranteed and can be subject to change based on the company’s financial health and market conditions. However, PepsiCo’s consistent dividend history and its position as a leading player in the industry provide a level of confidence in the company’s ability to continue paying dividends in the future.

Overall, PepsiCo’s dividend payment history showcases its commitment to rewarding shareholders and its financial strength. Investors seeking a company with a history of consistent and growing dividends may find PepsiCo to be an attractive option for their investment portfolio.

Dividend Payment Schedule

PepsiCo follows a regular dividend payment schedule, providing investors with a predictable timeline for receiving their dividend income. While specific dates may vary from year to year, PepsiCo typically pays its dividends on a quarterly basis.

Historically, the company has announced its dividend declarations in [month], followed by a subsequent payment in [month] for each quarter. This consistent quarterly payment schedule allows investors to plan and budget their cash flows accordingly.

It’s important for investors to note that the dividend payment schedule is subject to change, and it’s always a good idea to check the official announcements and releases from PepsiCo to stay updated on any adjustments to the schedule. Changes in the dividend payment schedule could be influenced by a variety of factors, such as changes in the company’s financial performance, market conditions, or strategic decisions.

Dividend payments are typically made to shareholders of record on a specific date, known as the record date. This means that investors must be listed as shareholders on the record date to be eligible to receive the dividend. After the record date, the ex-dividend date is established, which is the date when a stock starts trading without the dividend. Investors who purchase the stock after the ex-dividend date will not be eligible for the upcoming dividend payment.

Once the ex-dividend date has passed, the dividend payment date is set. This is the date on which the dividend amount is actually paid out to eligible shareholders. The payment is usually made in cash and deposited directly into the shareholder’s brokerage account or mailed in the form of a check.

By following the dividend payment schedule provided by PepsiCo, investors can anticipate when they will receive their dividend income and plan their investment strategies accordingly. It’s important to note that dividends are taxed at the individual shareholder’s tax rate, so investors should consult with their tax advisor regarding the tax implications of dividend income.

In summary, PepsiCo follows a regular dividend payment schedule, paying dividends on a quarterly basis. While the specific dates may vary from year to year and are subject to change, investors can rely on the company’s historical pattern of quarterly payments. Staying informed about the official announcements and releases from PepsiCo will ensure that investors have the most up-to-date information on the dividend payment schedule.

Factors Affecting PepsiCo’s Dividends

Several factors can influence PepsiCo’s dividend payments, and it’s important for investors to consider these factors when evaluating the sustainability and potential growth of the company’s dividends.

1. Earnings Performance: PepsiCo’s dividend payments are ultimately tied to the company’s earnings performance. If the company’s profitability and cash flow generation decline, it may impact its ability to maintain or increase dividend payouts. Investors should monitor PepsiCo’s financial results to assess the company’s earnings trajectory and its impact on dividends.

2. Cash Flow Generation: In addition to earnings, PepsiCo’s ability to generate strong cash flows is crucial for sustaining and growing its dividend payments. Cash flow provides the liquidity needed to fund dividend distributions and support ongoing business operations and investments. Investors should analyze PepsiCo’s cash flow statements to evaluate the company’s ability to fund its dividends.

3. Market Conditions: External factors, such as changes in consumer behavior, economic conditions, and industry dynamics, can impact PepsiCo’s performance and, consequently, its ability to maintain dividend payments. For example, a downturn in consumer spending or increased competition may affect PepsiCo’s revenue and profitability. Monitoring market conditions and assessing their potential impact on the company is essential for dividend investors.

4. Capital Allocation Priorities: PepsiCo’s management and board of directors have the authority to make decisions regarding the allocation of capital, which can affect dividend payments. The company may choose to allocate funds towards strategic investments, acquisitions, debt reduction, or share repurchases instead of increasing dividend payouts. Understanding PepsiCo’s stated capital allocation priorities and monitoring their execution can provide insight into future dividend prospects.

5. Competitive Landscape: As a prominent player in the food and beverage industry, PepsiCo operates in a competitive environment. The company must continuously innovate and adapt to changing consumer tastes and preferences to maintain its market share and profitability. Monitoring PepsiCo’s competitive position, new product launches, and market share can help gauge the company’s ability to sustain dividend growth.

6. Regulatory and Legal Considerations: PepsiCo’s dividend policy may also be influenced by regulatory and legal requirements. Changes in tax laws, accounting regulations, or other regulatory factors can impact the company’s ability to pay dividends. Investors should stay informed about any legal or regulatory developments that may affect PepsiCo’s dividend payments.

While these factors can influence PepsiCo’s dividend payments, it’s important to remember that the company is committed to creating long-term value for its shareholders. PepsiCo has a history of rewarding shareholders through consistent and growing dividends, and its strong brand portfolio and global presence provide a solid foundation for its financial performance. Nevertheless, investors should diligently assess these factors to make informed decisions regarding their dividend expectations from PepsiCo.

Conclusion

PepsiCo, a global leader in the food and beverage industry, offers investors the opportunity to benefit from regular dividend payments. The company’s strong brand portfolio, global presence, and commitment to innovation and sustainability make it an attractive choice for income-seeking investors.

Understanding dividends and their role in investing is crucial for evaluating PepsiCo’s potential as a dividend stock. Dividends provide investors with a steady income stream and can serve as a reliable indicator of a company’s financial strength and stability.

PepsiCo has a strong dividend payment history, with a record of consistent dividend increases over the years. The company follows a regular quarterly dividend payment schedule, providing investors with predictability and allowing them to plan their income accordingly.

Factors that can affect PepsiCo’s dividends include earnings performance, cash flow generation, market conditions, capital allocation priorities, competitive landscape, and regulatory and legal considerations. Monitoring these factors can provide valuable insights into the potential growth and sustainability of PepsiCo’s dividends.

While past performance is not indicative of future results, PepsiCo’s commitment to creating long-term value for shareholders, coupled with its resilience and innovation, positions the company as a strong contender in the dividend investing space.

Investors seeking a stable and growing income stream, along with the potential for capital appreciation, may find PepsiCo to be an appealing option. However, it’s important for investors to conduct their own research, assess their risk tolerance, and consult with a financial advisor before making any investment decisions.

In conclusion, PepsiCo’s consistent dividend payments, strong brand presence, and commitment to sustainable growth make it an enticing choice for dividend-seeking investors looking to enhance their investment portfolios with a reputable and reliable company.