Home>Finance>When Is Open Enrollment For Health Insurance In 2022?

Finance

When Is Open Enrollment For Health Insurance In 2022?

Modified: February 21, 2024

Discover when open enrollment for health insurance in 2022 begins and ensure you're covered. Stay informed about important finance-related dates for your financial well-being.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Open enrollment is a critical period for individuals and families to secure health insurance coverage for the upcoming year. It is a window of opportunity to enroll, renew, or make changes to your health insurance plan. Understanding when open enrollment takes place is essential for everyone seeking healthcare coverage.

During open enrollment, individuals have the chance to explore different health insurance options and select the plan that best suits their needs and budget. It provides an opportunity to reassess your healthcare needs, evaluate any changes in your life circumstances, and make informed decisions about your coverage.

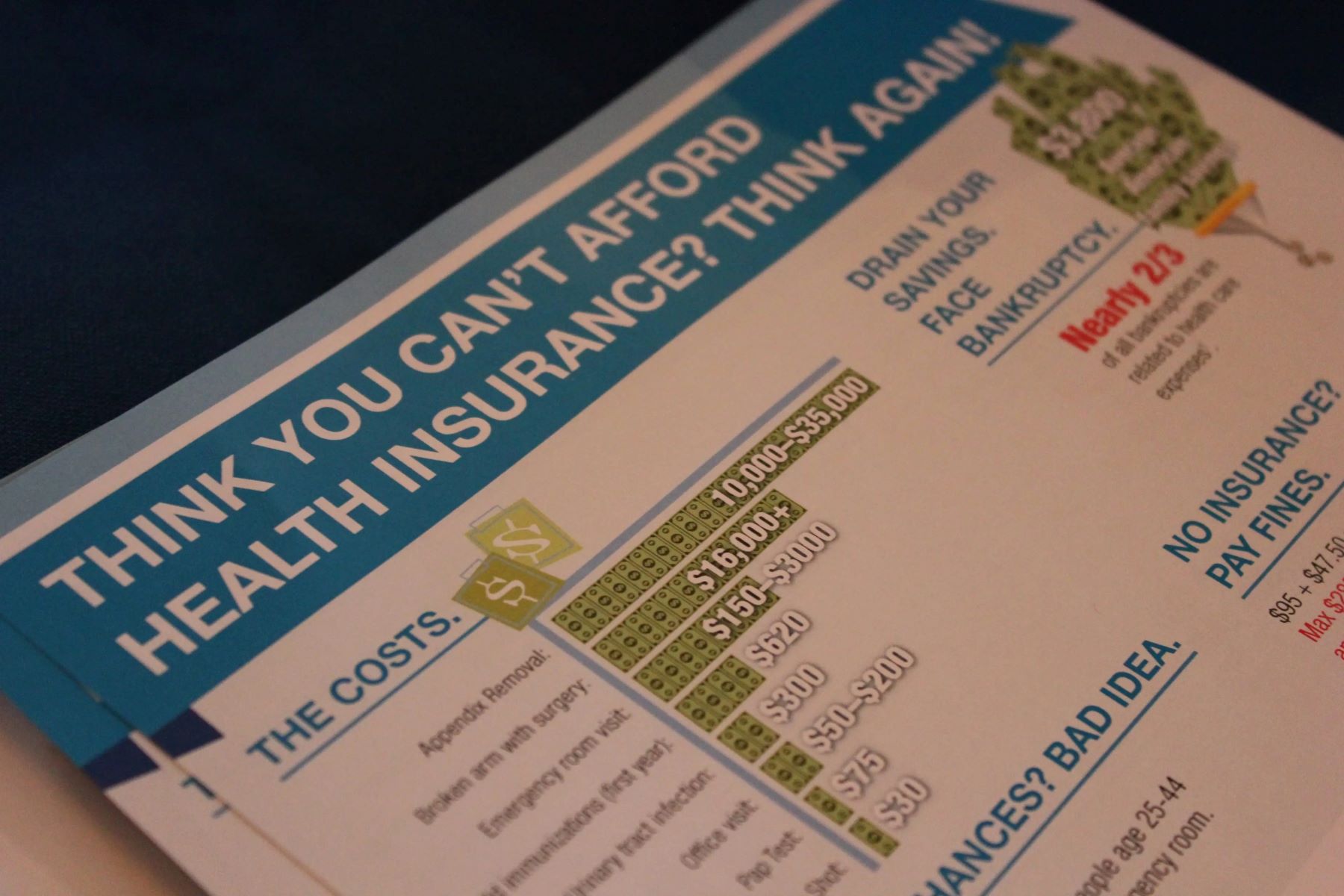

Open enrollment also allows individuals to take advantage of certain protections provided by the Affordable Care Act (ACA), such as coverage for pre-existing conditions and essential health benefits. It ensures that everyone has access to affordable and comprehensive health insurance, regardless of their medical history.

Furthermore, open enrollment is not limited to individual coverage. It is also the time when employers offer their employees the opportunity to enroll in or make changes to their employer-sponsored health insurance plans. This is a crucial period for employees to review their coverage and consider any changes needed to meet their healthcare needs.

Understanding the open enrollment process and knowing when it takes place is essential to ensure uninterrupted coverage and avoid any penalties or gaps in healthcare coverage. In this article, we will explore the open enrollment period for health insurance in 2022, the changes that have been implemented, and how you can enroll in health insurance during this period.

Overview of Open Enrollment

Open enrollment is a designated period during which individuals can enroll in or make changes to their health insurance coverage. It is an opportunity for individuals and families to assess their healthcare needs, compare different plans, and select the one that best meets their requirements.

Open enrollment typically occurs once a year and is offered by both government-run health insurance marketplaces, such as the Health Insurance Marketplace established under the Affordable Care Act (ACA), and employer-sponsored health insurance plans.

During the open enrollment period, individuals can:

- Enroll in a new health insurance plan if they currently do not have coverage.

- Renew their existing health insurance plan and make any necessary changes.

- Switch to a different health insurance plan if they find one that better meets their healthcare needs and budget.

It’s important to be aware of the open enrollment dates as missing this period can limit your options for obtaining health insurance coverage. Outside of the open enrollment period, individuals can only enroll in or make changes to their health insurance plans if they experience certain qualifying life events, such as getting married, having a baby, or losing employer-sponsored coverage.

During open enrollment, insurance companies cannot deny coverage or charge higher premiums based on an individual’s health status or pre-existing conditions. This protection is provided under the ACA, which ensures that everyone has access to affordable and comprehensive health insurance coverage.

It’s important to note that the open enrollment period may vary depending on your location and the type of health insurance plan you are considering. The dates and duration of open enrollment can differ for each state and may also vary for employer-sponsored plans.

In the next sections, we will delve into the specific dates and changes for the open enrollment period in 2022 and discuss how you can enroll in health insurance during this time.

Changes to Open Enrollment Period for 2022

It’s important to stay informed about any changes to the open enrollment period for health insurance coverage in 2022. These changes can impact the duration of the enrollment period and the deadlines for making changes to your health insurance plan.

One significant change for the 2022 open enrollment period is the decision by the Centers for Medicare and Medicaid Services (CMS) to revert to the traditional enrollment period for Healthcare.gov, the federal health insurance marketplace serving most states. In previous years, the enrollment period was extended to provide individuals with more time to enroll or make changes to their coverage. However, for the 2022 coverage year, the open enrollment period will return to its standard length.

For healthcare coverage through the federal marketplace, the open enrollment period for 2022 is expected to start on November 1st and run until December 15th, 2021. This means individuals will have a six-week window to enroll or make changes to their health insurance plans for coverage starting on January 1st, 2022.

It’s worth noting that some states operate their own health insurance marketplaces and may have different open enrollment periods. These states have the flexibility to set their own deadlines and may provide longer open enrollment periods or have different start and end dates. It’s crucial to check with your state’s health insurance marketplace or website to determine the specific open enrollment dates for your location.

Another change to be aware of is that the penalties for not having health insurance, known as the individual mandate penalties, have been reduced or eliminated in some states. Formerly, individuals who did not have health insurance coverage were subject to financial penalties when filing their tax returns. However, some states have implemented their own regulations, removing or reducing these penalties. It’s important to understand the rules regarding penalties in your state and the impact they might have on your decision to enroll in health insurance.

By staying informed about these changes, you can ensure that you are aware of the open enrollment period for 2022, understand any modifications to the duration of the enrollment period, and are informed about any penalties that may apply for being uninsured.

Dates for Open Enrollment in 2022

The open enrollment period for health insurance coverage in 2022 may vary depending on the type of health insurance plan and the state you reside in. It is important to be aware of the specific dates to ensure you don’t miss the opportunity to enroll or make changes to your coverage. Here are some important dates to keep in mind:

- For health insurance coverage through the federal marketplace (Healthcare.gov), the open enrollment period is expected to start on November 1st, 2021. It will run for six weeks, with the enrollment period ending on December 15th, 2021. This time frame applies to most states using the federal marketplace, but it’s essential to check if your state operates its own marketplace with different enrollment dates.

- Some states have their own health insurance marketplaces and may have different open enrollment periods. For example, California, New York, and Washington each operate their own marketplaces and typically offer extended open enrollment periods. These states may have start dates as early as October 15th, 2021, and end dates extending beyond December 15th, 2021. It’s crucial to check with your state’s marketplace for specific dates and any applicable extensions.

- For employer-sponsored health insurance plans, open enrollment dates can vary. Employers typically provide their employees with a specific window to review their current coverage, make changes, or enroll in a new plan. The exact dates for employer-sponsored plans can vary, but they usually occur during the fall months, often between September and December. It’s important to check with your employer to determine the open enrollment dates for your specific plan.

Remember, it’s essential to mark these dates on your calendar and take action during the open enrollment period. Failing to enroll or make changes within the designated window can result in a lapse in coverage and limited options for obtaining health insurance until the next open enrollment period.

By being aware of the open enrollment dates and staying proactive, you can ensure uninterrupted health insurance coverage and have the opportunity to evaluate and select a plan that meets your healthcare needs for the upcoming year.

How to Enroll in Health Insurance

Enrolling in health insurance can be a straightforward process when you understand the steps involved. Here is a general guide on how to enroll in health insurance during the open enrollment period:

- Research Your Options: Start by researching the available health insurance plans. Consider factors such as coverage, cost, network of doctors and hospitals, prescription drug coverage, and any additional benefits that are important to you.

- Review your Healthcare Needs: Assess your healthcare needs and determine what type of coverage will best suit you and your family. Consider any specific medical conditions, prescription medications, and the frequency of doctor visits or planned treatments.

- Compare Plans: Use the information gathered to compare the different health insurance plans available. You can use online resources, insurance marketplaces, or seek guidance from insurance brokers or healthcare navigators to help you navigate the options.

- Apply for Coverage: Once you have selected a health insurance plan, you will need to complete an application. This can typically be done online through the insurance marketplace or directly with the insurance carrier. Provide accurate and up-to-date information to ensure the application process goes smoothly.

- Submit Required Documents: In some cases, you may be required to submit supporting documents to verify your eligibility for certain health insurance programs. These documents may include proof of income, residency, or immigration status. Make sure to provide the necessary documents within the specified timeframe.

- Pay Your Premium: After your application is approved, you will receive information on how to pay your monthly premium. It is important to make your premium payments on time to activate your health insurance coverage.

- Receive Your Insurance Card: Once your coverage is active, you will receive an insurance card that includes important information, such as your policy number and contact details. Keep your card in a safe place and carry it with you at all times.

- Understand Your Coverage: Take the time to review and understand your health insurance coverage. Familiarize yourself with the network of doctors and hospitals, coverage limitations, copayments, deductibles, and any other details that may impact your healthcare costs.

- Utilize Preventive Care: Take advantage of preventive care services covered by your health insurance plan. These services, such as annual check-ups, vaccinations, and preventive screenings, can help catch potential health issues early and save you money in the long run.

Remember, the open enrollment period is the best time to enroll in or make changes to your health insurance coverage. Outside of this period, you may only be able to make changes if you experience a qualifying life event. Stay informed and take action during open enrollment to secure the health insurance coverage that meets your needs.

Factors to Consider During Open Enrollment

As you navigate the open enrollment period for health insurance coverage, several crucial factors need to be taken into consideration to make an informed decision. These factors can help you select a plan that adequately meets your healthcare needs while being mindful of your budget. Here are some key factors to consider:

- Coverage and Benefits: Assess the coverage provided by each health insurance plan. Consider whether it includes services and treatments you may need, such as prescription drugs, specialist visits, or mental health services. Evaluate the benefits and limitations of each plan to ensure they align with your healthcare requirements.

- Network of Providers: Take a close look at the network of doctors, hospitals, and healthcare providers associated with each plan. Ensure that your preferred healthcare professionals are in-network to benefit from lower costs and seamless coordination of care. Check if you need a referral from a primary care physician to see specialists and understand the process for seeking out-of-network care if necessary.

- Costs: Compare the costs associated with each health insurance plan. Consider the monthly premium, deductible, copayments, and coinsurance. Evaluate how these costs may impact your budget and how much you can afford to pay out of pocket for medical expenses.

- Prescription Drug Coverage: If you take prescription medications regularly, review the formulary of each health insurance plan. Ensure that your medications are covered and check if there are any restrictions or prior authorization requirements. Evaluate the cost-sharing structure for prescription drugs, including copayments or coinsurance.

- Flexibility: Consider the flexibility offered by each health insurance plan. Determine whether you have the freedom to choose your healthcare providers, including specialists and hospitals. Understand any restrictions or limitations imposed on out-of-network care or receiving care in different geographic areas.

- Additional Benefits: Some health insurance plans offer additional benefits that may be important to you, such as dental and vision coverage, maternity services, alternative therapies, or wellness programs. Take note of any additional benefits and assess their value in relation to your healthcare needs.

- Health Savings Account (HSA) Eligibility: If you are considering a high-deductible health plan, check if it qualifies you to open a Health Savings Account (HSA). An HSA offers tax advantages and allows you to set aside pre-tax dollars to cover eligible medical expenses.

- Past Healthcare Usage: Reflect on your healthcare usage in the past year. Consider any major medical expenses or recurring treatments. This can help you anticipate your healthcare needs for the upcoming year and choose a plan that provides adequate coverage.

- Life Changes: If you anticipate any significant life changes during the coverage year, such as getting married, having a baby, or starting a new job, consider how these events may impact your healthcare needs. Ensure that the health insurance plan you select can accommodate any anticipated changes.

By carefully considering these factors, you can evaluate the health insurance plans available to you during the open enrollment period and select the one that strikes the right balance between coverage, cost, and personal needs. Remember to review the plan documents, compare options, and seek guidance from insurance professionals if necessary to make an informed decision.

Options for Health Insurance Outside of Open Enrollment

If you missed the open enrollment period for health insurance, there are still options available to obtain coverage outside of this designated timeframe. It’s important to explore these alternatives to ensure you and your family have access to healthcare services. Here are some options for obtaining health insurance outside of open enrollment:

- Qualifying Life Events: Certain major life events may qualify you for a special enrollment period outside of open enrollment. These events can include getting married or divorced, having a baby or adopting a child, losing employer-sponsored coverage, moving to a different state, or experiencing other qualifying life events. If you experience a qualifying life event, you have a limited period to enroll in or make changes to your health insurance coverage.

- Medicaid or Children’s Health Insurance Program (CHIP): Depending on your income and family size, you may qualify for Medicaid or the Children’s Health Insurance Program (CHIP) at any time during the year. These government programs provide low-cost or free health insurance coverage to eligible individuals and families. Visit your state’s Medicaid or CHIP website to learn more about eligibility and how to apply.

- Employer-Sponsored Coverage: If you are currently employed, check if your employer offers health insurance coverage. In many cases, employers have designated periods outside of the open enrollment period when employees can enroll in or make changes to their health insurance plans. Speak with your employer’s Human Resources department to determine if you are eligible for employer-sponsored coverage.

- COBRA Coverage: If you recently lost your job or had a reduction in work hours, you may be eligible for COBRA coverage. COBRA allows you to continue your employer-sponsored health insurance coverage for a limited period, typically up to 18 months. However, it’s important to keep in mind that the premiums for COBRA coverage can be higher since you are responsible for the full cost of the insurance.

- Short-Term Health Insurance: Short-term health insurance plans are designed to provide temporary coverage during specific periods. These plans typically offer limited coverage and are not subject to the same regulations as comprehensive health insurance plans. They may be an option if you need coverage for a brief period, such as between jobs or during a transitional period.

- Healthcare Sharing Plans: Healthcare sharing plans operate on the principle of sharing medical costs among a group of individuals with similar beliefs or values. Members make monthly contributions, and the funds are used to cover healthcare expenses. These plans may have specific eligibility criteria and limitations on coverage, so it’s important to review the details before enrolling.

- Individual Health Insurance Market: In some cases, depending on your state, you may be able to purchase individual health insurance plans outside of the open enrollment period through the individual health insurance marketplace. These plans can provide coverage for non-employer sponsored individuals and families. Check your state’s insurance marketplace website for more information on available options.

It’s important to note that each option may have specific eligibility criteria, enrollment periods, and limitations on coverage. It is advisable to explore these alternatives as soon as possible to minimize any gaps in healthcare coverage.

Remember, obtaining health insurance coverage is essential to protect yourself and your loved ones from unexpected medical expenses. Take the time to research and explore these options to find the coverage that best fits your needs outside of the open enrollment period.

Conclusion

The open enrollment period for health insurance coverage is a crucial time for individuals and families to secure the healthcare protection they need. It provides an opportunity to assess healthcare needs, compare plans, and enroll in or make changes to health insurance coverage.

Throughout this article, we have explored various aspects of the open enrollment process, including the overview of open enrollment, changes to the open enrollment period for 2022, important dates to remember, how to enroll in health insurance, factors to consider during open enrollment, and options for obtaining coverage outside of the open enrollment period. By understanding these key elements, you can make informed decisions about your health insurance coverage.

During open enrollment, take the time to research and compare different health insurance plans based on your healthcare needs, budget, and preferences. Consider factors such as coverage, network providers, costs, prescription drug coverage, flexibility, and any additional benefits offered. This will help you choose a plan that aligns with your needs and provides the necessary coverage for you and your family.

If you missed the open enrollment period, be aware of the options available to you, such as qualifying life events, Medicaid or CHIP, employer-sponsored coverage, COBRA, short-term health insurance, healthcare sharing plans, and individual health insurance marketplaces. Taking advantage of these alternatives can help ensure you have access to healthcare services outside of the designated open enrollment period.

Remember, health insurance coverage is vital for protecting you and your loved ones from medical expenses and ensuring access to necessary healthcare services. Stay informed, review your options, and take action during the open enrollment period or explore alternative options to maintain continuous coverage.

By understanding the open enrollment process and being proactive about your healthcare coverage, you can have peace of mind knowing that you are adequately protected and prepared for any medical needs that may arise.