Home>Finance>When To Use Options Hedging Versus Money Market Hedging

Finance

When To Use Options Hedging Versus Money Market Hedging

Modified: February 21, 2024

Discover the different strategies in finance for hedging, including options hedging and money market hedging, and learn when to use each method.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In the world of finance, risk management is a crucial aspect that every investor and business must consider. Hedging is a strategy used to mitigate potential losses in investments and protect against market volatility. Two commonly used hedging techniques in the financial industry are options hedging and money market hedging.

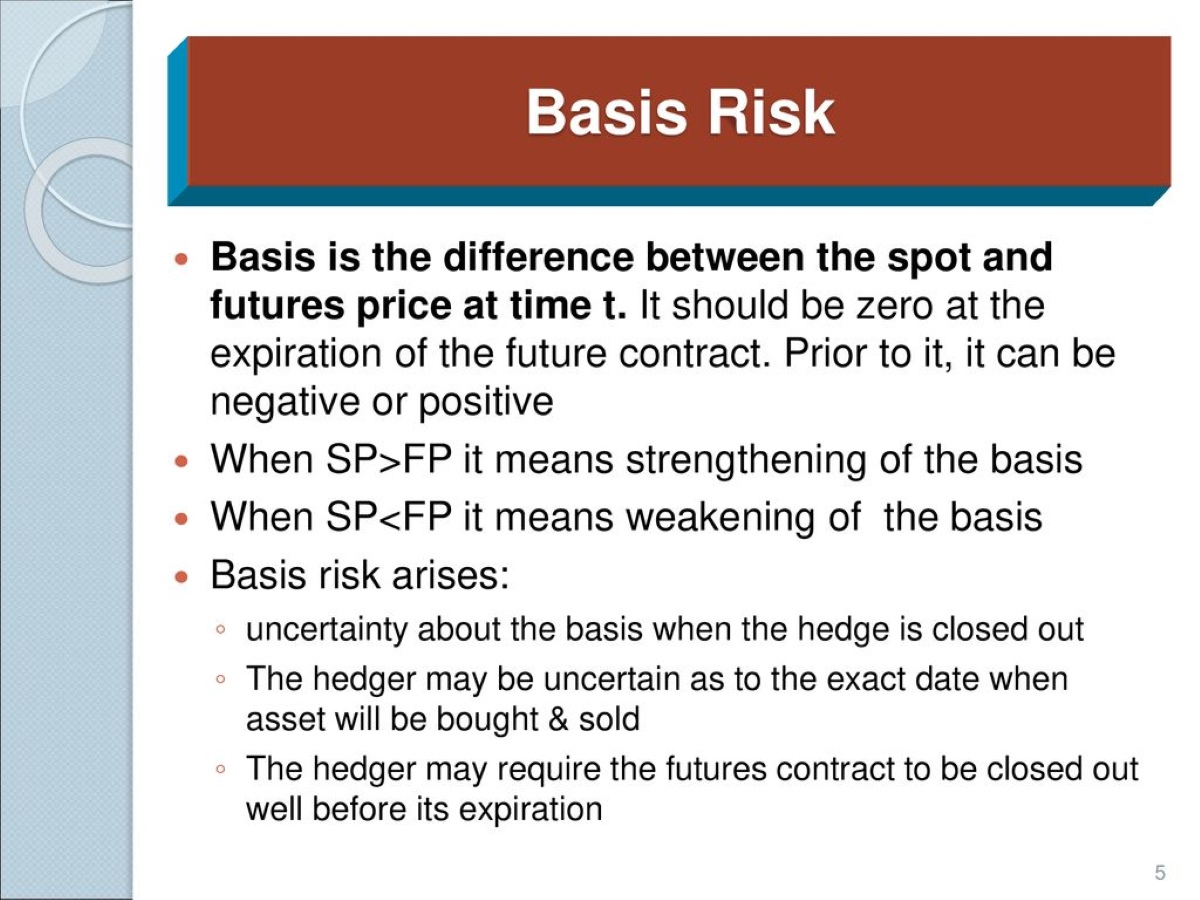

Options hedging involves the use of financial derivatives called options contracts, which give the holder the right, but not the obligation, to buy or sell a specific asset at a predetermined price within a specified period. On the other hand, money market hedging involves using short-term fixed income securities, such as Treasury bills or money market funds, to offset potential losses in investments.

Both options hedging and money market hedging serve the purpose of reducing risks, but they differ in terms of mechanisms, costs, and availability. Understanding the characteristics of these two hedging strategies is essential for investors and businesses to determine when and how to utilize them effectively.

In this article, we will explore when to use options hedging versus money market hedging. We will discuss the factors to consider and the advantages and disadvantages of each strategy. By the end, you will have a better understanding of which hedging technique is best suited for different scenarios.

Options Hedging

Options hedging is a risk management strategy that involves using options contracts to offset potential losses in investments. Options are financial instruments that provide the buyer with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period.

One of the key advantages of options hedging is its flexibility. Investors can choose between buying call options, which give them the right to buy the asset at a predetermined price, or buying put options, which give them the right to sell the asset at a predetermined price. This flexibility allows investors to tailor their hedging strategy according to their specific needs and market expectations.

Options hedging can provide both downside protection and upside potential. For example, if an investor owns a stock and wants to protect against a potential decline in its value, they can purchase put options. If the stock’s price does indeed drop, the gains from the put options can help offset the losses on the stock. On the other hand, if the stock’s price increases, the investor can still benefit from the upside potential.

However, it’s important to note that options hedging comes with certain costs. Options contracts have an expiration date, and if the market doesn’t move in the anticipated direction within the specified timeframe, the options can expire worthless, resulting in a loss. Additionally, purchasing options can require upfront costs in the form of premiums, which can eat into potential profits.

Options hedging also requires a good understanding of options pricing and market dynamics. It is not a strategy that is suitable for beginners or investors who are not familiar with options trading. It involves assessing factors such as implied volatility, time decay, and the relationship between the options’ strike price and the current market price of the underlying asset.

Despite these complexities, options hedging can be a powerful tool for managing risk and providing flexibility in the face of market uncertainty. It is often used by experienced investors, portfolio managers, and businesses to protect against potential losses and navigate challenging market conditions.

Money Market Hedging

Money market hedging is a risk management strategy that involves using short-term fixed income securities, such as Treasury bills or money market funds, to offset potential losses in investments. Unlike options hedging, which relies on derivatives contracts, money market hedging uses cash instruments that provide stability and liquidity.

One of the key benefits of money market hedging is its simplicity. Investors can allocate a portion of their portfolio to low-risk, short-term investments that are highly liquid and offer a predictable return. By doing so, they can protect their investments from market volatility and ensure capital preservation.

Money market securities, such as Treasury bills, are considered a safe haven because they are backed by the full faith and credit of the government. They have a fixed maturity date and pay a fixed interest rate, which makes them less susceptible to market fluctuations compared to other types of investments. Money market funds, on the other hand, pool investors’ funds and invest in a diversified portfolio of short-term securities, providing instant diversification and liquidity.

Money market hedging also offers flexibility. Investors can easily adjust their allocations to money market securities based on market conditions or changing risk profiles. For instance, if there is uncertainty in the market or an economic downturn is anticipated, investors can increase their allocation to money market securities to preserve capital and reduce exposure to riskier assets.

However, it’s important to note that money market hedging may not generate substantial returns compared to higher-risk investments. The focus of this strategy is on capital protection rather than capital appreciation. Returns on money market investments are generally lower than those of equities or higher-yielding fixed income securities.

Additionally, money market hedging is subject to interest rate risk. When interest rates rise, the value of existing money market instruments may decrease, resulting in capital losses. However, the short-term nature of money market investments mitigates this risk to some extent, as investors can reinvest their funds at higher rates when rates increase.

Money market hedging is a popular choice for conservative investors, corporations, and institutional investors who prioritize capital preservation and liquidity. It is a straightforward and accessible strategy that offers stability and protection against market volatility.

Factors to Consider

When deciding between options hedging and money market hedging, there are several factors to consider. These factors can help investors and businesses determine which strategy is best suited for their specific needs and risk tolerance. Here are some key considerations:

- Market Volatility: The level of market volatility is an important factor to consider. Options hedging may be more suitable in highly volatile market conditions, as it allows investors to protect against potential losses and take advantage of potential price movements. Money market hedging, on the other hand, is generally better suited for stable market conditions, where the focus is on preserving capital.

- Risk Tolerance: Assessing risk tolerance is crucial. Options hedging involves more complexity and potential for losses, making it more suitable for sophisticated investors and experienced market participants. Money market hedging, with its lower risk profile, is a better fit for conservative investors who prioritize capital preservation.

- Time Horizon: Consider the investment time horizon. Options contracts have expiration dates, so options hedging may be better suited for short-term hedging needs. Money market hedging, with its focus on short-term fixed income securities, is suitable for both short-term and longer-term hedging strategies.

- Costs: Evaluate the costs associated with each hedging strategy. Options hedging involves premiums, transaction costs, and potential losses if the options expire worthless. Money market hedging generally has lower costs, but potential returns may be limited compared to higher-risk investments.

- Market Access: Consider the accessibility of options contracts and money market instruments. Options contracts are typically traded on exchanges and may require a certain level of expertise. Money market instruments, such as Treasury bills or money market funds, are generally more accessible and can be easily accessed through brokerage accounts or financial institutions.

- Expected Returns: Determine the desired level of returns. Options hedging has the potential for higher returns if the market moves in the anticipated direction. Money market hedging offers more conservative and predictable returns, but these returns may be lower compared to other investment options.

By carefully considering these factors, investors and businesses can make informed decisions about whether to use options hedging or money market hedging as part of their risk management strategy. It’s important to assess individual financial goals, risk tolerance, and market conditions to determine the most suitable approach for hedging against potential losses.

Advantages and Disadvantages of Options Hedging

Options hedging offers several advantages and disadvantages that investors and businesses should consider before implementing this strategy.

Advantages:

- Flexibility: Options hedging provides investors with flexibility. They can choose between call options and put options to tailor their hedging strategy based on their specific needs and market expectations.

- Potential for Upside Gains: Options hedging allows investors to potentially benefit from upside price movements in the underlying asset. If the market moves in the anticipated direction, the gains from the options can offset losses in other investments.

- Defined Risk: With options hedging, the potential loss is limited to the premium paid for the options contract. This provides a defined and known level of risk, allowing investors to manage and control their exposure.

Disadvantages:

- Complexity: Options hedging involves complexities such as options pricing, implied volatility, and understanding the relationship between the strike price and the underlying asset’s market price. It is not a strategy suitable for beginners or investors without a good grasp of options trading.

- Time Sensitivity: Options contracts have expiration dates, after which they become worthless. If the market doesn’t move in the anticipated direction within the specified time, the options can expire, resulting in a loss.

- Upfront Costs: Purchasing options contracts requires paying a premium, which can be an upfront cost that reduces potential profits. These costs should be carefully considered when assessing the feasibility of options hedging.

Overall, options hedging can be a powerful tool for managing risk and providing flexibility in uncertain market conditions. However, it requires a deep understanding of options trading, careful analysis, and ongoing monitoring of market dynamics.

Advantages and Disadvantages of Money Market Hedging

Money market hedging offers several advantages and disadvantages that investors and businesses should consider before implementing this strategy.

Advantages:

- Capital Preservation: Money market hedging focuses on preserving capital by investing in low-risk, short-term fixed income securities such as Treasury bills or money market funds. This strategy is suitable for conservative investors who prioritize protecting their investments.

- Liquidity and Accessibility: Money market instruments are highly liquid and easily accessible. Investors can quickly convert their holdings into cash, providing flexibility in managing their portfolio and addressing short-term cash flow needs.

- Lower Risk Profile: Money market hedging offers a lower risk profile compared to higher-risk investments. Treasury bills and money market funds are considered safe havens due to their low risk of default, backed by government guarantee or diversified portfolios.

- Stable Returns: Money market investments provide predictable and stable returns. The fixed maturity dates and fixed interest rates associated with these instruments make it easier to anticipate and plan for returns.

Disadvantages:

- Potential for Lower Returns: Money market hedging may generate lower returns compared to higher-risk investments such as equities or higher-yielding fixed income securities. The focus of this strategy is on preserving capital rather than generating substantial gains.

- Interest Rate Risk: Money market securities are not immune to interest rate movements. When interest rates rise, the value of existing money market instruments may decrease, resulting in potential capital losses. However, the short-term nature of these investments mitigates this risk to some extent.

- Opportunity Cost: By allocating a significant portion of the portfolio to money market securities, investors may miss out on potential higher returns from other investment opportunities that carry higher risk.

Despite the lower potential for significant returns, money market hedging is a popular choice for conservative investors who prioritize capital preservation and liquidity. It offers stability, accessibility, and a predictable income stream, making it a valuable tool in risk management and cash management strategies.

When to Use Options Hedging

Options hedging can be an effective strategy in certain situations where investors or businesses want to manage risk and protect their investments. Here are some scenarios where options hedging may be appropriate:

- Market Volatility: Options hedging is well-suited for volatile market conditions. If there is increased uncertainty or anticipated price fluctuations in the market, options can provide a means to protect against sudden declines or potential losses.

- Portfolio Protection: Investors who own a concentrated position in a particular stock or asset may use options hedging to protect against a significant decline in its value. By purchasing put options, they can mitigate potential losses if the market moves against their position.

- Earnings Period or Events: Companies may use options hedging strategies during their earnings periods or ahead of significant events that could impact their stock price. This allows them to protect against potential downside risks and ensure a more predictable financial outcome.

- Speculative Trades: Options hedging can also be used in speculative trades, where investors anticipate a potential price movement in an underlying asset. By purchasing call or put options, they can capture potential gains while limiting their exposure to potential losses.

- Volatility Trading: Options hedging can be used in volatility trading strategies, where investors aim to profit from changes in implied volatility levels. Through options contracts, they can take advantage of price swings caused by volatility fluctuations.

It’s important to note that options hedging requires a solid understanding of options trading and market dynamics. Investors should carefully assess their risk tolerance and consider the costs associated with options contracts. Consulting with a financial advisor or options trading specialist can also provide valuable insights and guidance.

When to Use Money Market Hedging

Money market hedging can be an effective strategy in various scenarios where investors or businesses aim to minimize risk and prioritize capital preservation. Here are some situations when money market hedging may be suitable:

- Market Stability: Money market hedging is well-suited for stable market conditions where the focus is on preserving capital. If there are no significant anticipated market fluctuations or uncertainties, allocating a portion of the portfolio to money market securities can provide stability and reduce exposure to market volatility.

- Short-Term Cash Needs: When investors or businesses need short-term liquidity or have upcoming cash requirements, money market hedging can be useful. By investing in highly liquid money market instruments, they can easily access their funds when needed without incurring significant penalties or fees.

- Conservative Investing: Money market hedging is appropriate for investors with a conservative risk tolerance. Those who want to avoid significant capital losses and prefer lower-risk investments may opt for a larger allocation to money market securities while accepting potentially lower returns compared to riskier assets.

- Capital Preservation: Investors or businesses who have achieved their desired financial goals and want to focus on preserving their capital may find money market hedging advantageous. This strategy helps protect the principal investment while generating stable, predictable income in the form of interest payments.

- Risk Mitigation: Money market hedging can also be utilized as a risk mitigation tool in the face of uncertainty. During periods of economic downturns or market downturns, investors may choose to increase their allocation to money market securities to reduce exposure to riskier assets.

It’s important to note that money market hedging is generally suited for those who prioritize capital preservation over high returns. While money market investments provide stability and liquidity, they may not generate significant gains compared to more aggressive investment strategies. It is crucial to assess individual financial goals, investment time horizon, and risk tolerance to determine the appropriate allocation to money market securities.

Conclusion

Options hedging and money market hedging are two distinct strategies employed by investors and businesses to manage risk and protect their investments. Options hedging offers flexibility and the potential for upside gains, but it comes with complexity, time sensitivity, and upfront costs. On the other hand, money market hedging provides capital preservation, liquidity, and lower risk, but it may yield lower returns compared to higher-risk investments.

When deciding between options hedging and money market hedging, it’s essential to consider factors such as market volatility, risk tolerance, time horizon, costs, market access, and expected returns. Options hedging may be more suitable in highly volatile market conditions, for experienced investors, and for short-term hedging needs. Money market hedging, on the other hand, is well-suited for stable market conditions, conservative investors who prioritize capital preservation, and those with short-term cash needs.

Ultimately, the choice between options hedging and money market hedging depends on individual circumstances and objectives. It’s crucial to carefully assess the risk profile, investment goals, and market dynamics before implementing any hedging strategy. Seeking professional advice from a financial advisor or options specialist can provide valuable guidance in determining the most appropriate hedging approach.

By understanding the advantages, disadvantages, and considerations associated with options hedging and money market hedging, investors and businesses can make informed decisions to mitigate risk, protect their investments, and navigate market uncertainties.