Finance

Where Does The IRS Mail Checks From?

Published: November 1, 2023

Discover where the IRS mails checks from for your finance needs. Gain insight into the mailing process and ensure a smooth financial experience.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to a world where paper checks are still a method of payment. Despite the rise of digital transactions, many organizations and government agencies, including the Internal Revenue Service (IRS), continue to rely on traditional checks as a means to deliver funds to recipients. When it comes to the IRS, a frequently asked question is, “Where does the IRS mail checks from?” In this article, we will delve into the process of how the IRS sends checks and explore the various locations from which these checks are mailed.

The IRS is a government agency responsible for collecting taxes and administering the Internal Revenue Code. In the United States, individuals and businesses are required to pay federal taxes, and the IRS plays a vital role in ensuring compliance with tax laws.

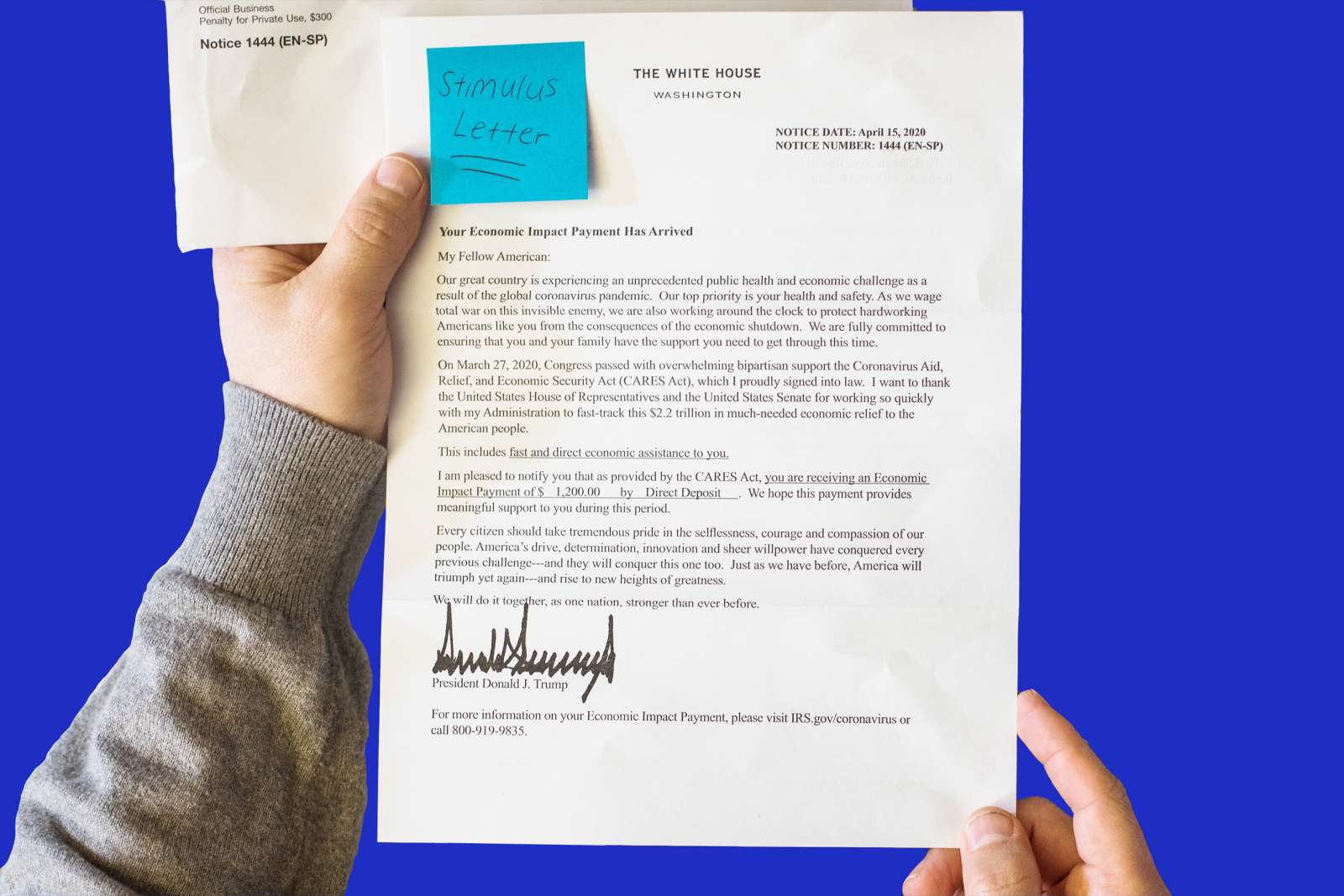

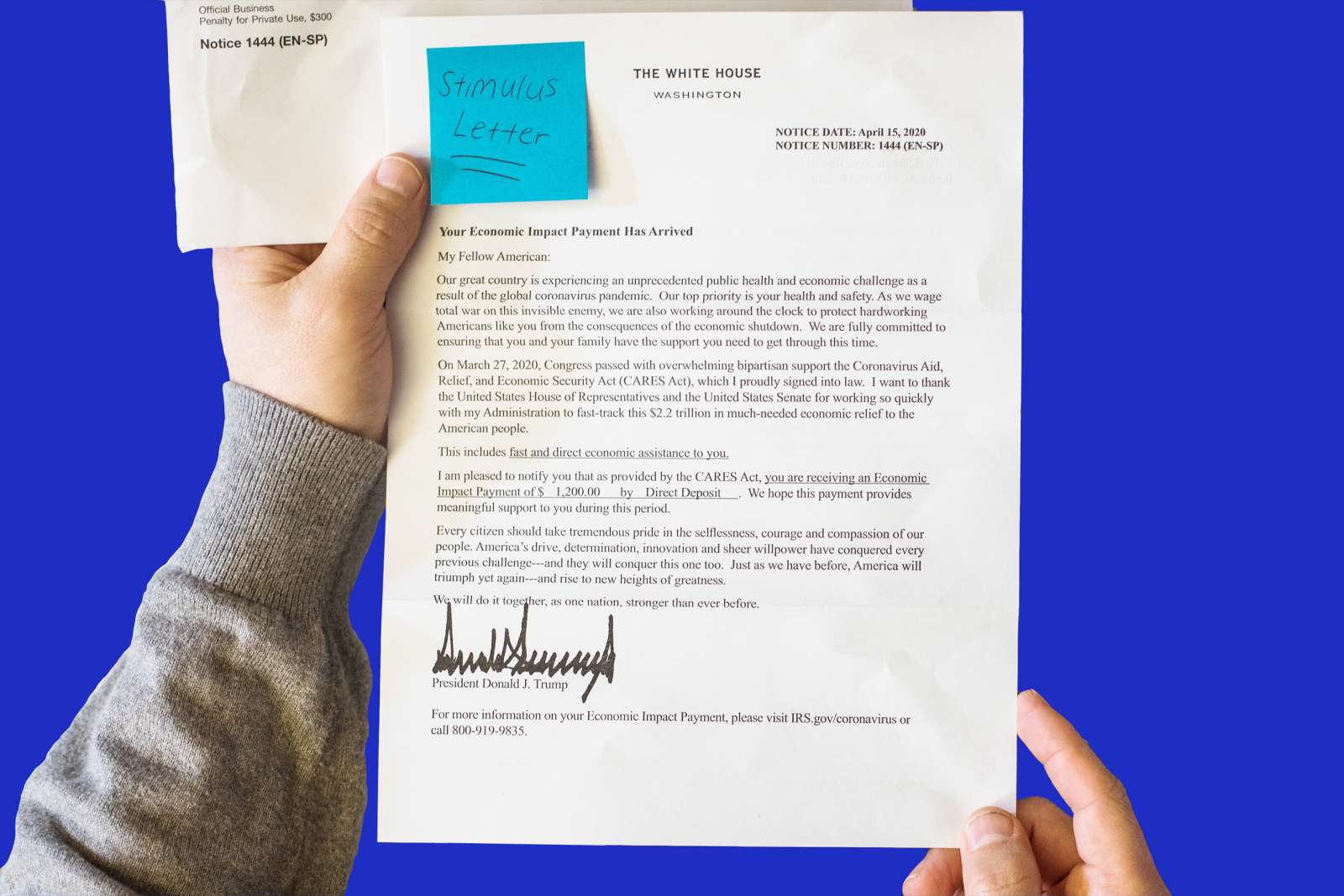

When taxpayers are owed a refund or receive certain types of payments from the IRS, such as economic impact payments or tax credits, the agency utilizes the traditional method of mailing paper checks to the designated recipients. Understanding the logistics behind this process shed lights on where these checks originate and how they are delivered.

In the following sections, we will explore the background of how checks are sent by the IRS, the typical locations from which these checks are mailed, as well as any special circumstances that may arise when mailing checks to specific recipients.

Background

Before we dive into the specifics of where the IRS mails checks from, let’s first understand the general process of how checks are sent by the IRS. When the IRS needs to issue a paper check, they go through a series of steps to ensure it reaches its intended recipient.

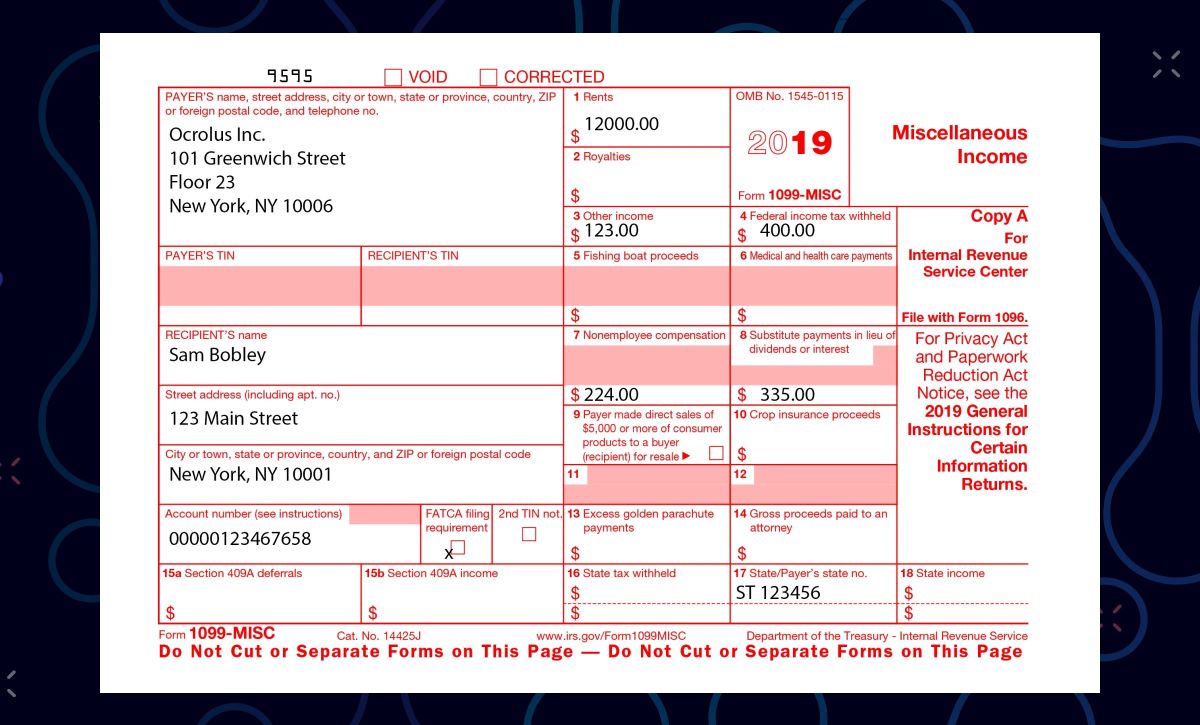

First, the IRS verifies the taxpayer’s identity and determines the amount of the refund or payment owed. Once the amount is determined, the IRS prepares the check for mailing. This involves printing the check with the necessary information, including the recipient’s name, address, and the amount to be paid. The check is then signed by an authorized IRS official.

Once the check is prepared, the IRS assigns it a unique identifier, such as a check number or batch number, to track it throughout the mailing process. This is done to ensure that the check is properly accounted for and can be traced if any issues arise.

After the check is prepared and assigned an identifier, it is then sent to a specific location from where it will be mailed. The location from which the check is mailed can vary depending on factors such as the recipient’s location, the type of payment being made, and other logistical considerations.

Now that we have a general understanding of the check issuance process, let’s explore the specific locations from where the IRS typically mails checks.

How Does the IRS Send Checks?

The IRS employs various methods to send checks to taxpayers. The determination of how a check is sent depends on factors such as the type of payment being made, the recipient’s location, and any special circumstances that may be present.

One common method used by the IRS is regular mail delivery through the United States Postal Service (USPS). This method is typically utilized for sending refund checks, economic impact payments, and other routine payments. The checks are placed in envelopes with the recipient’s address clearly printed on the front, along with any necessary IRS return address information.

For certain types of payments or in specific circumstances, the IRS might choose to send checks through certified mail or with a return receipt requested. This provides extra security and proof of delivery.

In some cases, the IRS may opt to use direct deposit instead of mailing a physical check. Direct deposit is a secure and convenient method that allows the IRS to electronically transfer funds directly into the recipient’s designated bank account. This method eliminates the need for a physical check and provides a faster way for recipients to access their funds.

It’s important to note that the IRS encourages taxpayers to utilize direct deposit whenever possible. In fact, when filing tax returns, individuals are often given the option to provide their bank account information for direct deposit purposes.

If a recipient has previously chosen direct deposit for their tax refunds or other payments, the IRS will continue to use that method for future payments, unless the recipient provides new information to update their preferences.

Now that we understand the various methods of sending checks, let’s explore the specific locations from where the IRS commonly mails these checks.

Origin of IRS Mailing

The origin of IRS mailing, or the location from where the IRS sends checks, can vary depending on a few factors. The IRS has multiple facilities across the United States that handle the processing and distribution of payments. The specific location from where a check is mailed will depend on the recipient’s geographical location and the nature of the payment being made.

One of the key facilities involved in the IRS mailing process is the IRS Service Center. These centers are strategically located throughout the country and are responsible for processing tax returns, issuing refunds, and distributing various types of payments.

There are four main IRS Service Centers spread across the United States:

- Fresno, California

- Austin, Texas

- Kansas City, Missouri

- Ogden, Utah

Each of these service centers has specific responsibilities and handles different aspects of the payment distribution process. Depending on the recipient’s location, the IRS will allocate the responsibility to the appropriate service center for check issuance and mailing.

For example, if a taxpayer resides in California, their checks will likely be sent from the Fresno Service Center, while individuals in Texas may have their checks mailed from the Austin Service Center.

It’s important to note that the location from which the check is mailed doesn’t necessarily reflect the physical location of the recipient’s bank or the IRS processing center where their tax return was processed. The mailing location is determined based on the IRS’s internal distribution process and logistics.

In addition to the specific service centers, the IRS also has various regional offices and other facilities that may be involved in the mailing process. These locations may handle specific types of payments or deal with certain special circumstances, such as manual processing of checks or complex payment arrangements.

Understanding the origin of IRS mailing sheds light on why recipients may receive checks from different locations within the United States.

Next, let’s explore some commonly known IRS mailing locations and the reasons behind their use.

Common IRS Mailing Locations

When it comes to mailing checks, the IRS utilizes various locations throughout the United States. These locations are typically IRS facilities that are responsible for processing and distributing payments. Here are some of the commonly known IRS mailing locations:

- Fresno, California: The IRS Service Center in Fresno, California, is responsible for processing tax returns and distributing payments for individuals residing in the western region of the United States. This facility plays a significant role in issuing refunds and mailing checks to taxpayers in states such as California, Oregon, Washington, and Alaska.

- Austin, Texas: The IRS Service Center in Austin, Texas, is another major location for mailing checks. It serves as a processing center for taxpayers in the central region of the United States. Individuals in states like Texas, Oklahoma, Louisiana, and Arkansas may have their checks mailed from this facility.

- Kansas City, Missouri: The IRS Service Center in Kansas City, Missouri, handles tax return processing and payment distribution for taxpayers in the central part of the country. This facility serves individuals in states such as Missouri, Kansas, Nebraska, and Iowa.

- Ogden, Utah: The IRS Service Center in Ogden, Utah, is responsible for processing returns and distributing payments for individuals in the western region of the United States. Taxpayers in states like Utah, Colorado, Arizona, and Nevada may receive their checks from this facility.

These locations represent just a few examples of the mailing centers utilized by the IRS across the United States. The specific mailing location for a recipient will depend on their geographical location and the IRS’s distribution process.

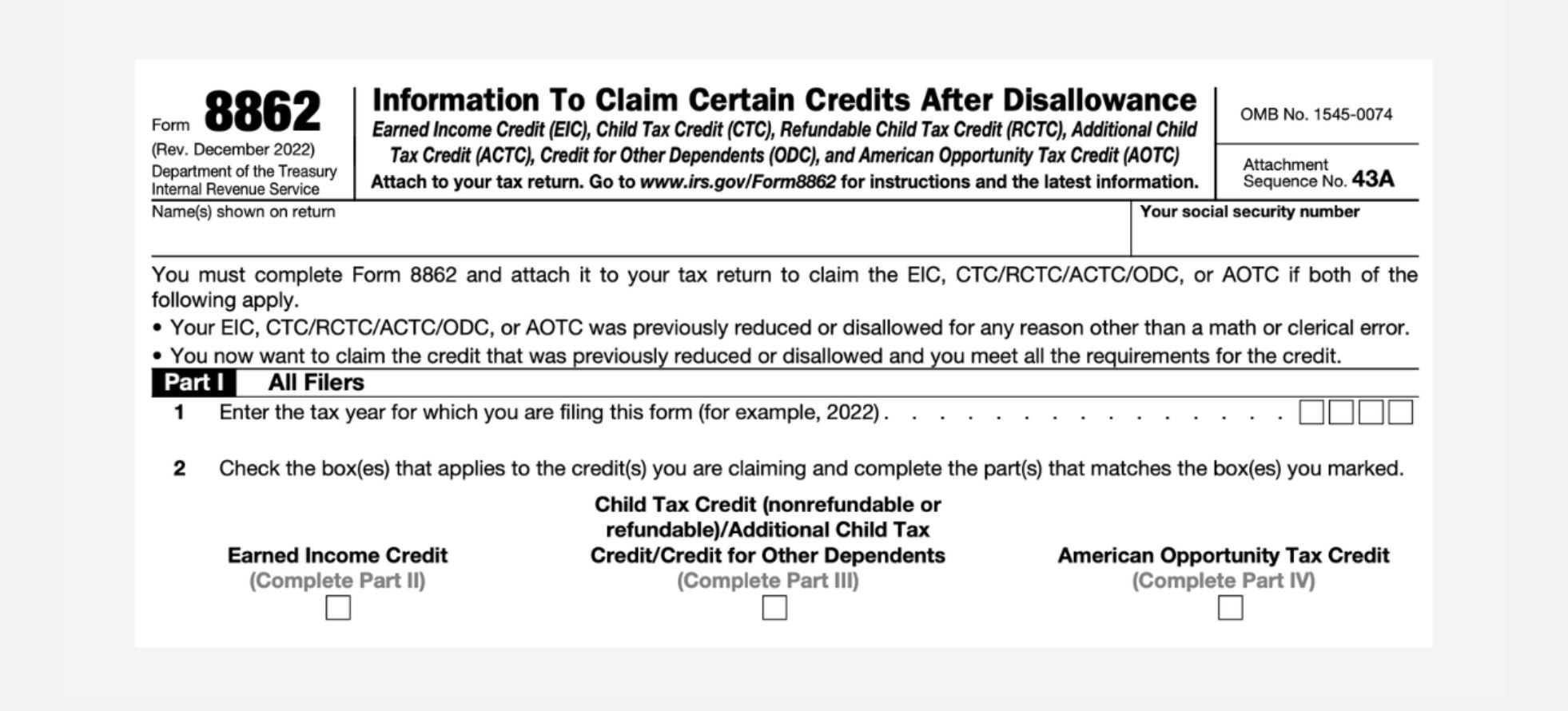

It is worth noting that the IRS may also utilize other regional or satellite offices for specific types of payments or circumstances. These additional locations may handle specialized payments, such as refunds for certain tax credits or payments related to complex tax situations.

Overall, the IRS utilizes a network of facilities and mailing locations to ensure efficient and timely distribution of payments to eligible recipients.

Now that we have explored the common IRS mailing locations, let’s delve into any special circumstances that may arise when mailing checks to specific recipients.

Special Circumstances for Mailing Checks

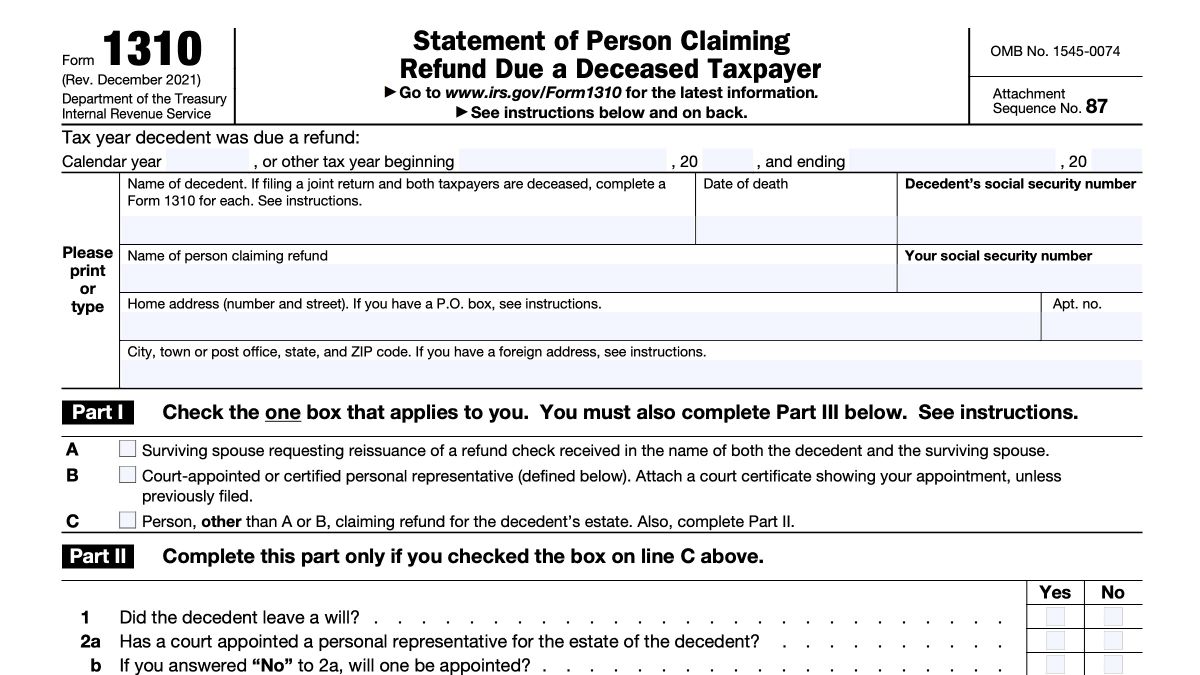

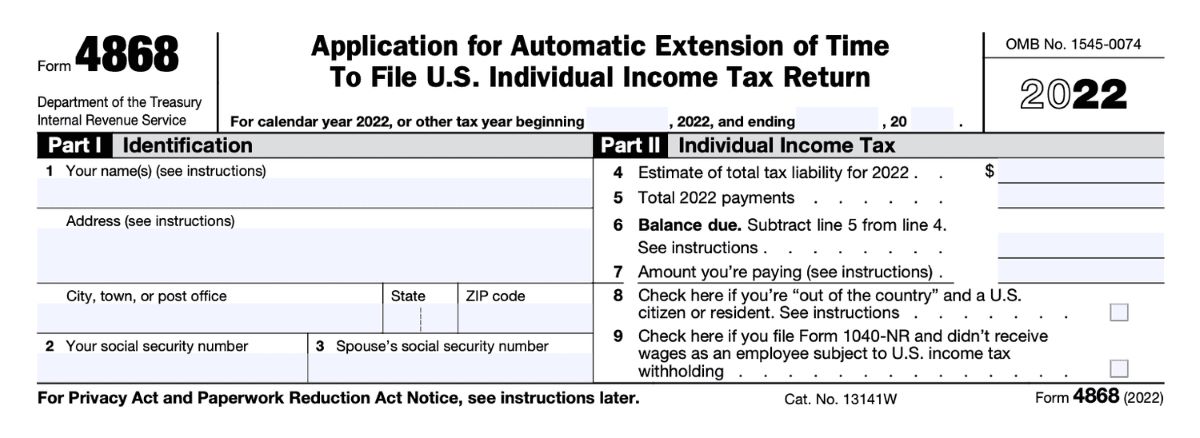

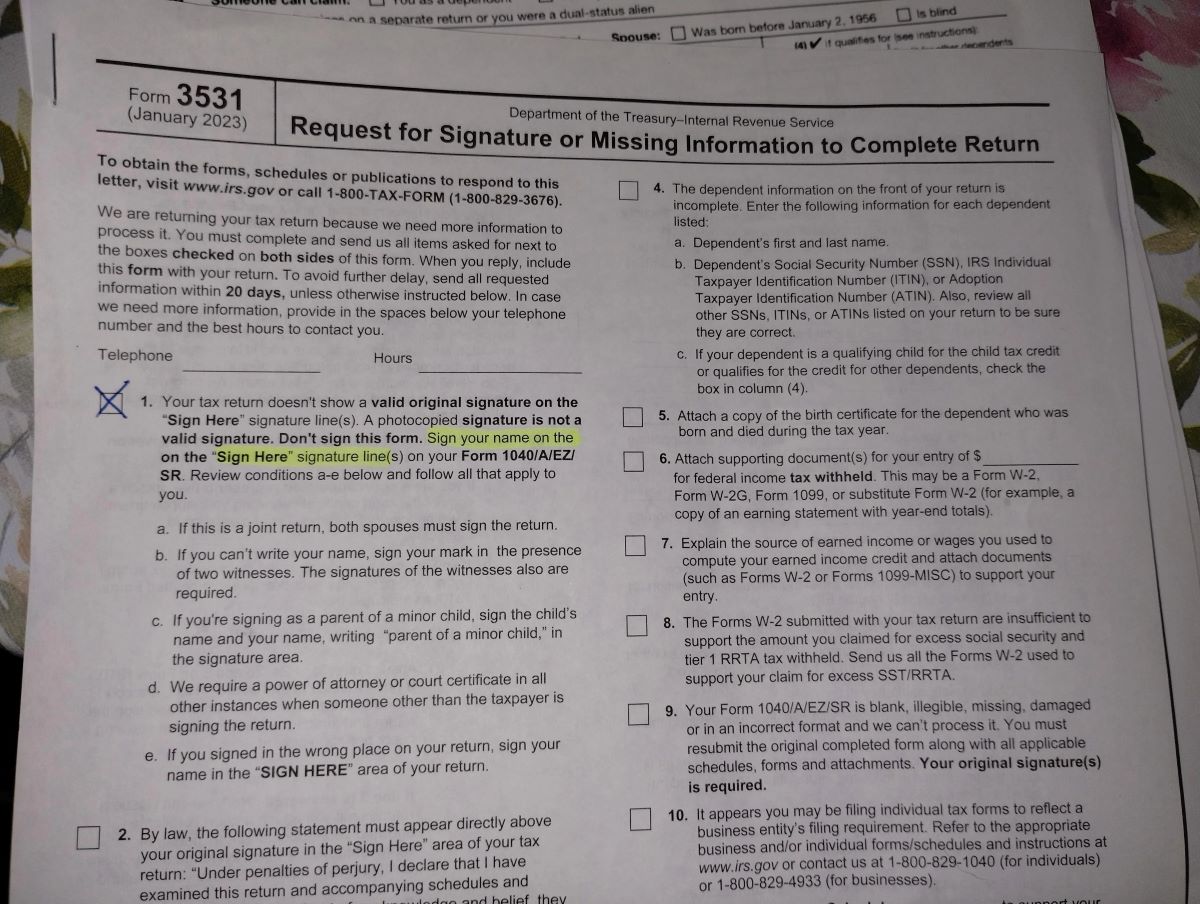

While the IRS has standard procedures for mailing checks, there are certain special circumstances that may arise when it comes to delivering payments to specific recipients. These circumstances may require alternative methods or special considerations to ensure that checks reach their intended recipients. Here are a few examples:

- International Mailing: In some cases, the IRS may need to mail checks to individuals residing outside of the United States. This could include U.S. citizens living abroad or non-resident aliens who are eligible for certain tax refunds or payments. International mailing involves additional logistics, such as adhering to international postage regulations and considering potential delays in delivery.

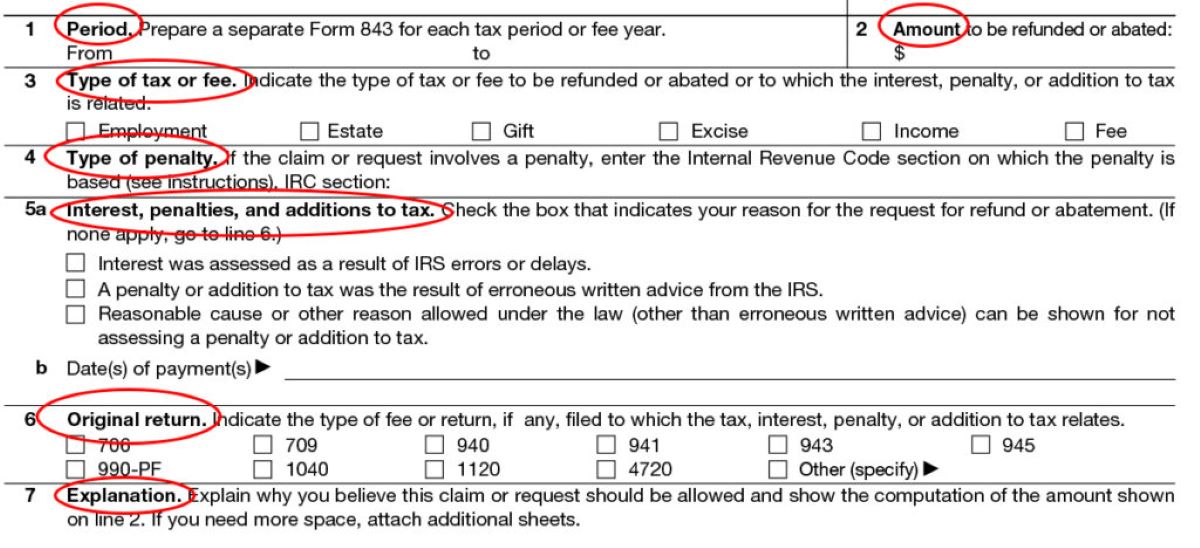

- Manual Processing: While the IRS has sophisticated automated systems for processing payments, there are instances where manual processing is required. This may be due to complex tax situations, adjustments to payment amounts, or other unique circumstances. Manual processing can lead to longer processing times and may involve mailing checks from specific IRS offices equipped to handle such cases.

- Special Programs or Initiatives: The IRS may implement special programs or initiatives that require separate mailing processes. For example, during economic crises or emergencies, the IRS may issue economic impact payments to eligible individuals. In these cases, the IRS may establish dedicated mailing locations or partner with external fulfillment centers to expedite the distribution of the payments.

- Physical Disabilities: Individuals with physical disabilities or visual impairments may require special accommodations when receiving checks from the IRS. The IRS has provisions to provide alternative formats, such as large-print checks, braille checks, or electronic funds transfers, to ensure that these individuals can access and utilize their payments effectively.

It’s worth noting that the IRS is constantly adapting its mailing processes and exploring digital alternatives to enhance efficiency and improve recipient experience. As technology advances, the IRS may transition from physical checks to electronic payment methods, reducing the need for traditional mailing.

It’s important for individuals with specific circumstances to contact the IRS directly for guidance on how their checks will be mailed or to explore alternative payment options.

In summary, while the IRS follows standard procedures for mailing checks, there are special circumstances that may require alternative methods or considerations. The IRS strives to ensure that all eligible recipients receive their payments in a timely and secure manner.

Now let’s wrap up our discussion on IRS mailing and conclude this article.

Conclusion

In conclusion, the IRS utilizes various methods and locations to mail checks to taxpayers. From the traditional practice of mailing paper checks through the USPS to the growing use of direct deposit, the IRS aims to efficiently and securely deliver payments to eligible recipients.

The origin of IRS mailing can often be traced back to one of the IRS Service Centers located in Fresno, California; Austin, Texas; Kansas City, Missouri; or Ogden, Utah. These centers play a crucial role in processing tax returns, generating refunds, and distributing various types of payments.

However, there are special circumstances that may arise when it comes to mailing checks. International mailing, manual processing, special programs or initiatives, and accommodating physical disabilities are among the situations that may require additional considerations or alternative methods for delivering payments.

As technology advances, the IRS continues to explore digital alternatives to traditional mailing, aiming to provide faster and more convenient payment options for taxpayers. Direct deposit is becoming increasingly popular, allowing for expedited and secure fund transfers directly into recipients’ bank accounts.

It is important for individuals to stay informed about the options available to them and provide accurate and updated information to the IRS to ensure smooth payment processing and delivery.

In summary, while the IRS continues to rely on traditional mailing methods, they are also adapting to changing times and exploring more efficient ways to deliver payments. Whether it’s through the USPS, certified mail, or direct deposit, the goal remains the same – to ensure that taxpayers receive the funds they are owed in a timely and secure manner.

Remember, if you have specific questions or concerns regarding the mailing of checks from the IRS, it is always advisable to reach out to the IRS directly for accurate and up-to-date information.