Finance

Where To Mail IRS Form 3531

Published: November 1, 2023

Looking for the correct mailing address for IRS Form 3531? Find out where to send your finance-related documents to ensure accurate processing.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of taxes! Taxes are an unavoidable part of life, and dealing with the Internal Revenue Service (IRS) is a necessary task for taxpayers. One common form that individuals may need to submit is IRS Form 3531. Whether you are a freelancer, a self-employed individual, or a business owner, understanding how to properly handle and mail this form is essential.

In this article, we will guide you through the process of mailing IRS Form 3531. We will explain what this form is used for, provide you with options for mailing it, and inform you of the correct mailing address to use. Additionally, we will offer some helpful tips to ensure that your form reaches the IRS safely and on time.

While the topic of taxes can be overwhelming, our goal is to make this process as straightforward as possible. So, let’s dive in and unravel the mysteries of mailing IRS Form 3531!

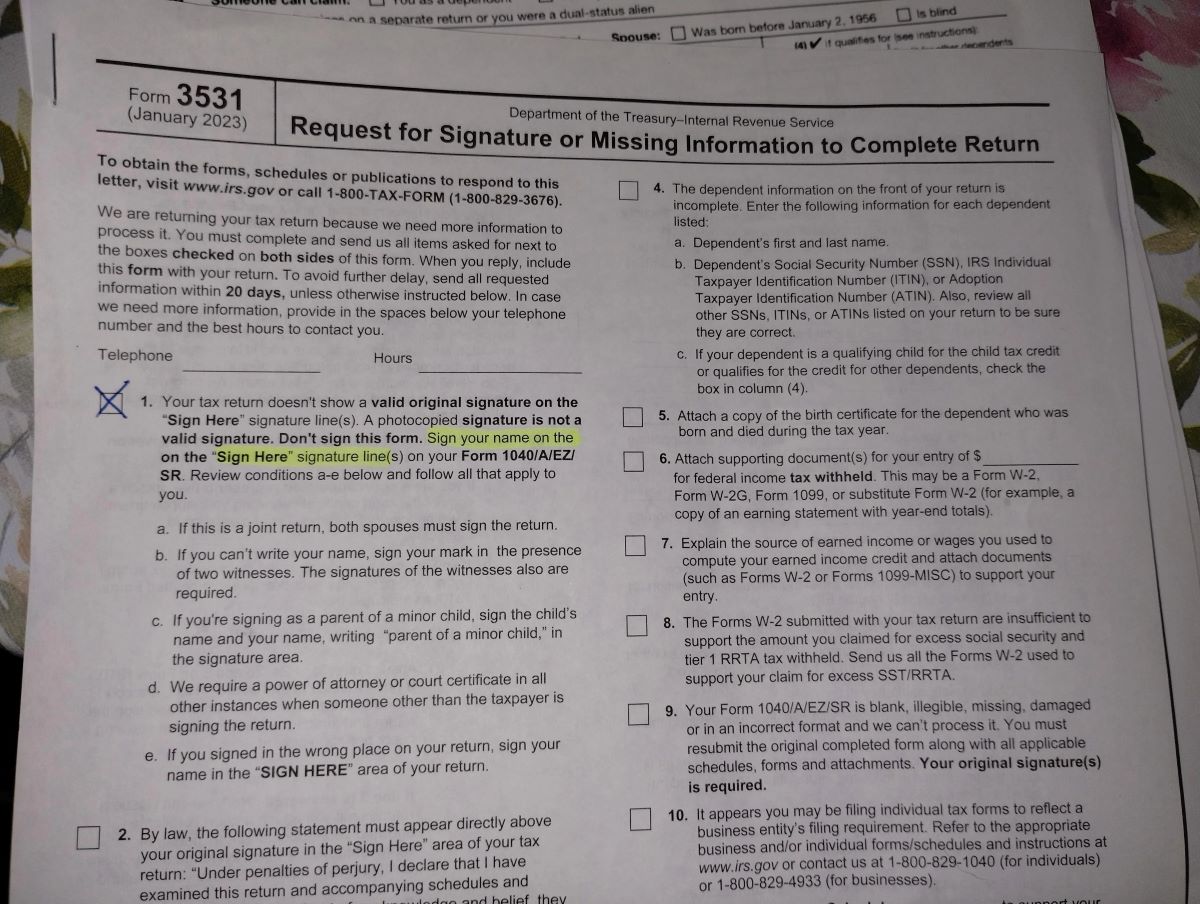

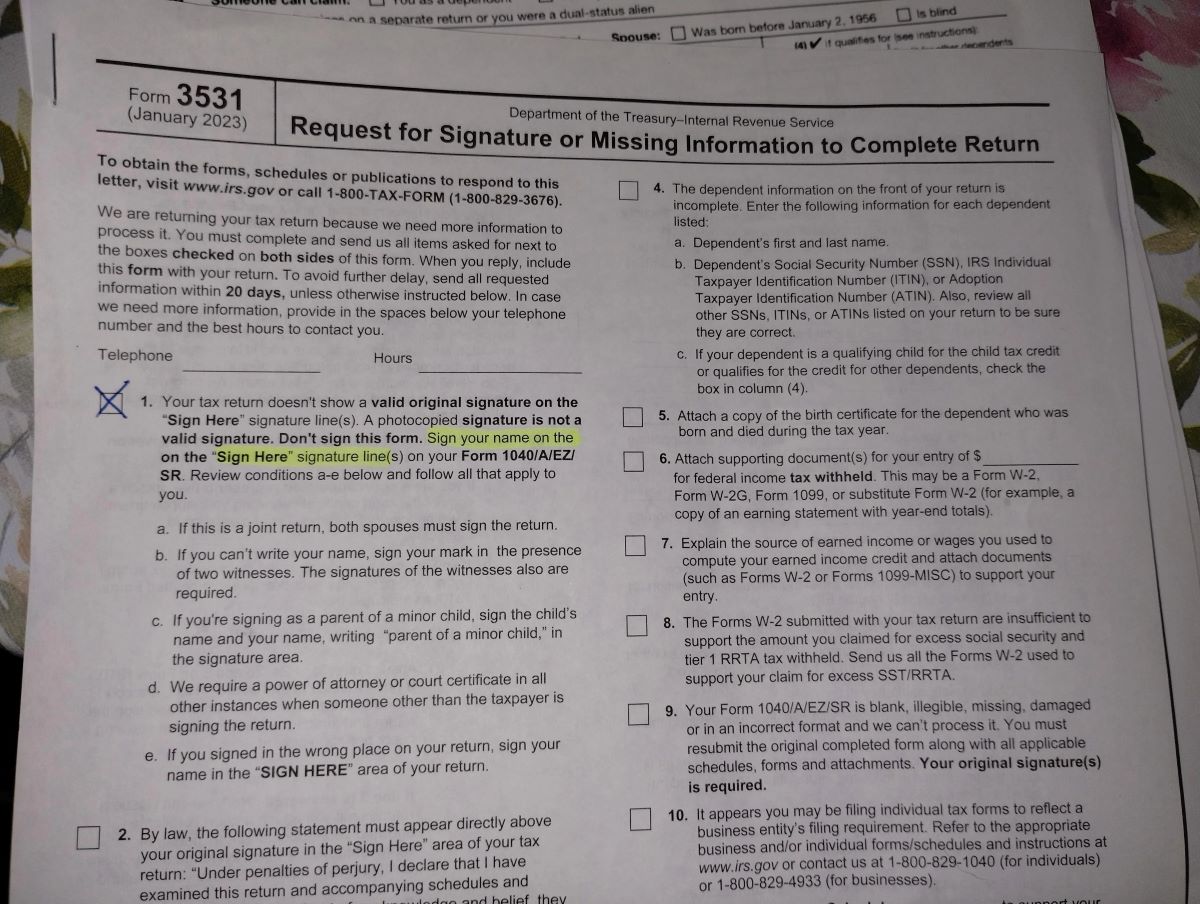

Understanding IRS Form 3531

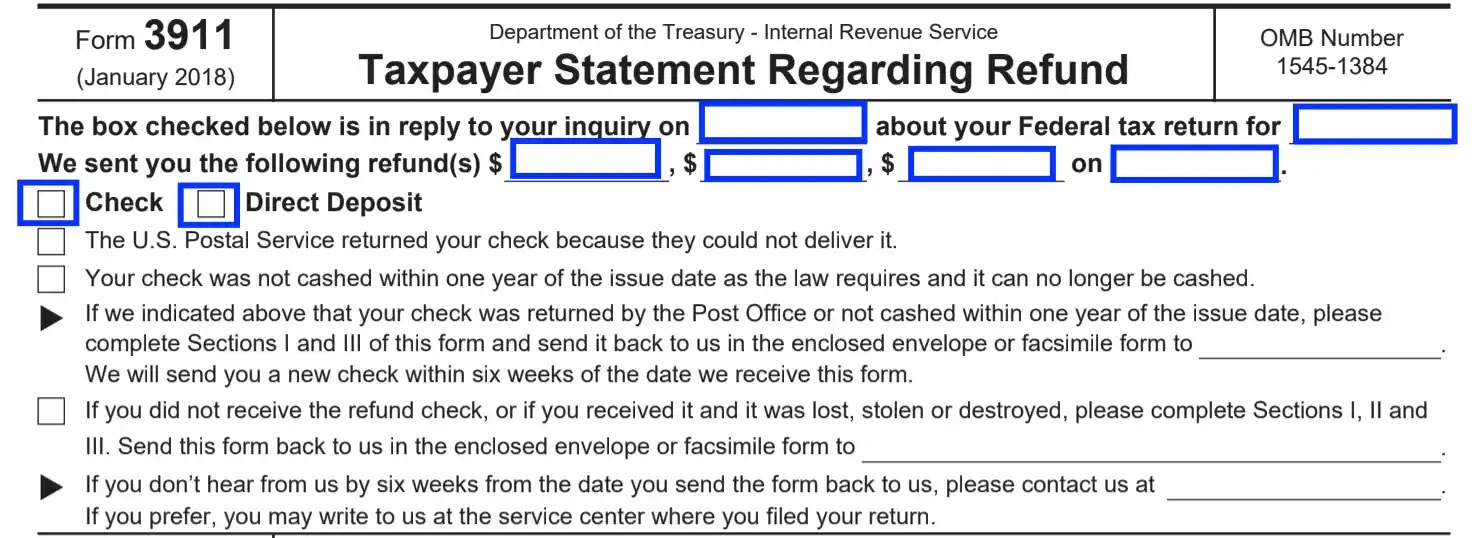

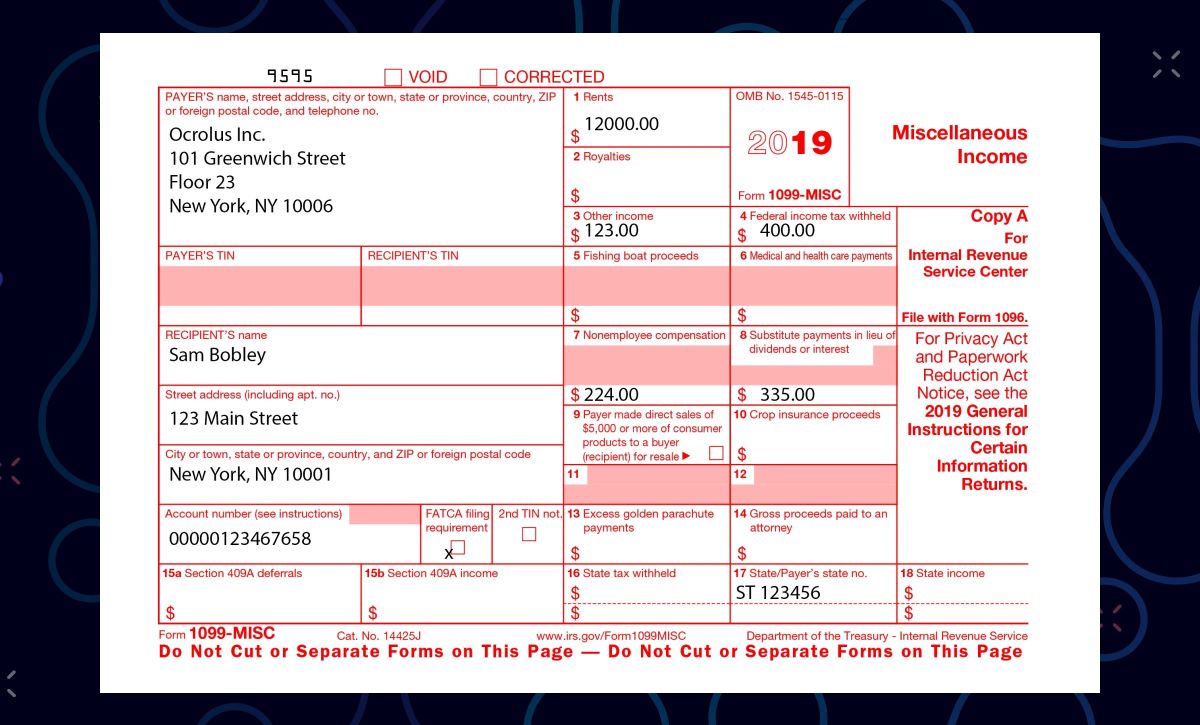

IRS Form 3531, also known as the “Avenue for Stolen Identity Refund Fraud (SIRF) Unit to Obtain Proper Documentation” form, is a document that taxpayers use to report cases of stolen identity refund fraud. Stolen identity refund fraud occurs when someone uses another person’s personal information, such as their Social Security number, to file a fraudulent tax return and claim a refund.

This form is specifically designed for individuals who have been notified by the IRS that their tax return has been flagged for potential identity theft. It provides a way for affected taxpayers to submit additional documentation and help the IRS resolve the issue.

It is crucial to fill out IRS Form 3531 accurately and provide all the required information to assist the IRS in investigating and resolving the case of stolen identity refund fraud. Failure to do so may result in delays in processing your tax return, potential legal consequences, or difficulties in claiming your legitimate refund.

Now that we have a basic understanding of IRS Form 3531, let’s explore the different options available for mailing this form to the IRS.

Options for Mailing IRS Form 3531

When it comes to mailing IRS Form 3531, you have a few options available to ensure that your form reaches the IRS in a timely manner. Here are the most common methods:

- Regular Mail: The traditional way to mail your IRS Form 3531 is through regular mail. Simply print out the form, fill it out accurately, and mail it to the designated IRS mailing address. While this method is reliable, keep in mind that it may take a few days or even weeks for the form to reach its destination.

- Certified Mail: If you prefer a more secure and trackable method, you can opt to send your IRS Form 3531 via certified mail. This allows you to obtain a receipt and track the delivery status of your form. Make sure to keep the receipt and tracking information for your records.

- Electronic Filing: In some cases, you may have the option to electronically file IRS Form 3531. Check the instructions provided by the IRS or consult a tax professional to determine if electronic filing is available for your specific situation. Electronic filing can offer the benefit of faster processing and confirmation of receipt.

When choosing the method that works best for you, consider factors such as time sensitivity, convenience, and the importance of tracking your form. Now that you know the options, let’s move on to the next important aspect – the correct mailing address for IRS Form 3531.

Mailing Address for IRS Form 3531

Ensuring that you have the correct mailing address is crucial when submitting IRS Form 3531. Using the wrong address can lead to delays and potential complications in processing your form. The specific address you should use depends on your location and the type of documentation you are submitting.

If you are mailing IRS Form 3531 from within the United States and you are submitting documentation related to stolen identity refund fraud, use the following address:

Internal Revenue Service

Austin, TX 73301-0036

Be sure to include your complete and accurate contact information on the form, including your name, address, and phone number. These details are crucial for the IRS to reach out to you if they need additional information or clarification regarding your case.

If you are mailing IRS Form 3531 from outside the United States, refer to the IRS website or consult a tax professional for the appropriate mailing address. The IRS provides specific addresses for international submissions based on the country of residence.

Now that you have the correct mailing address, let’s explore some helpful tips to ensure a smooth mailing process for IRS Form 3531.

Tips for Mailing IRS Form 3531

When it comes to mailing IRS Form 3531, it’s important to follow some tips to ensure that your form is successfully delivered and processed by the IRS. Here are a few helpful recommendations:

- Double-check your form: Before mailing IRS Form 3531, review it thoroughly to ensure that all fields are accurately filled out. Make sure to provide complete and up-to-date information, as any missing or incorrect details could delay the processing of your form.

- Keep copies: Make copies of IRS Form 3531 and any supporting documentation for your records. In the event of any issues or inquiries, having copies readily available will help you provide the necessary information to the IRS promptly.

- Choose a secure mailing method: Consider using certified mail or a similar trackable mailing service to send your IRS Form 3531. This way, you can have peace of mind knowing that your form is securely delivered and received by the IRS.

- Include a cover letter: Although not required, including a brief cover letter with your IRS Form 3531 can help provide additional context or explanation for your situation. This can assist the IRS in promptly understanding your case and taking appropriate action.

- Keep proof of mailing: Whether you send your form through regular mail or a trackable service, it is important to keep a record of when and how you mailed the form. This includes the mailing receipt, tracking information, or other proof of delivery. These documents can be valuable in case any discrepancies or issues arise in the future.

By following these tips, you can increase the chances of a smooth process when mailing IRS Form 3531. Now, let’s wrap up our discussion.

Conclusion

Mailing IRS Form 3531 may seem like a daunting task, but with the right information and a few simple steps, you can successfully submit your form and assist the IRS in resolving cases of stolen identity refund fraud. Throughout this article, we have covered the key aspects of mailing IRS Form 3531, including understanding the form, different options for mailing, the correct mailing address, and some helpful tips to make the process smoother.

Remember, accuracy and completeness are crucial when filling out IRS Form 3531. Take the time to review your form before mailing it to avoid any potential delays or complications. Choose a mailing method that suits your needs, whether it’s regular mail, certified mail, or electronic filing if available.

Always use the correct mailing address provided by the IRS for submitting IRS Form 3531. Ensure that you include your accurate contact information on the form in case the IRS needs to reach out to you for additional information or clarification.

Finally, keep in mind the tips we’ve provided to enhance the mailing process. Double-check your form, keep copies for your records, choose a secure mailing method, consider including a cover letter, and retain proof of mailing.

By following these guidelines, you can navigate the mailing process for IRS Form 3531 with confidence and contribute to resolving cases of stolen identity refund fraud. Remember, taxes are a shared responsibility, and your cooperation with the IRS helps ensure the integrity of the tax system.

So, next time you find yourself needing to mail IRS Form 3531, refer back to this article for reference and follow the steps outlined. You’ll be on your way to fulfilling your tax obligations and playing your part in safeguarding the financial system.