Finance

Where To Mail Form 1310 IRS

Modified: March 1, 2024

Looking for where to mail Form 1310 IRS? Discover the correct address and instructions to ensure your finance-related form is filed accurately and on time.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

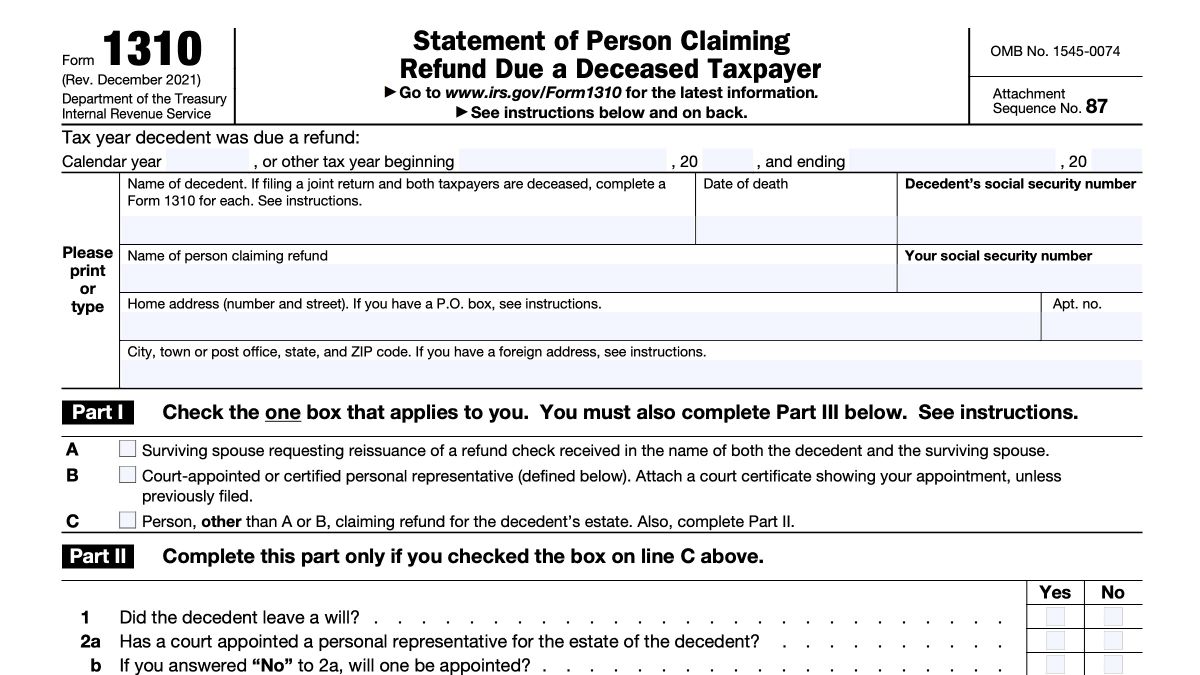

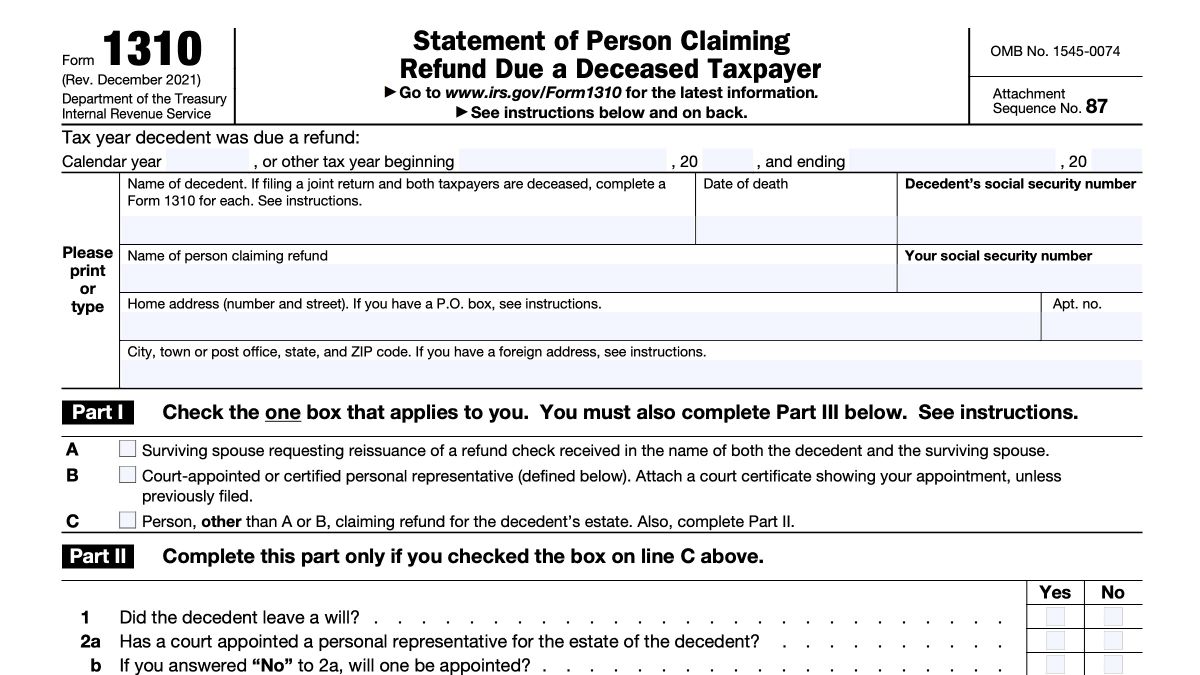

Form 1310 IRS, also known as the Statement of Person Claiming Refund Due a Deceased Taxpayer, is an essential document used by individuals who are seeking to claim a tax refund on behalf of a deceased taxpayer. Dealing with taxes after the passing of a loved one can be a daunting task, but understanding the purpose and proper use of Form 1310 IRS can help streamline the process.

Handling tax matters may not be the first thing on your mind when grieving the loss of a loved one, but it is an important step to ensure that any eligible refunds are appropriately claimed. By using Form 1310 IRS, you can provide the necessary information and documentation to the Internal Revenue Service (IRS) to process the refund properly.

This article will guide you through the process of using Form 1310 IRS, including when and where to use it, how to obtain the form, and where to mail it. Understanding the necessary steps can help you navigate through the complexities of tax matters during a challenging time.

Purpose of Form 1310 IRS

The purpose of Form 1310 IRS is to allow individuals to claim a tax refund on behalf of a deceased taxpayer. When a taxpayer passes away, there may be tax returns that were filed but not yet refunded, or there may be certain tax credits or deductions that the deceased taxpayer was eligible for, but were not claimed.

Form 1310 IRS serves as a statement from the person claiming the refund, certifying their relationship to the deceased taxpayer and their eligibility to claim the refund. This form also provides important information to the IRS, ensuring that the refund is accurately processed.

By submitting Form 1310 IRS, you can inform the IRS of the taxpayer’s passing and claim any refunds that may be due to them. This form acts as a legal document that authorizes the person claiming the refund to receive it on behalf of the deceased taxpayer. It helps to safeguard against fraudulent claims and ensures that the refund is distributed to the appropriate party.

It is important to note that Form 1310 IRS is not required in all cases. If you are the surviving spouse and are filing a joint return with the deceased taxpayer, you do not need to file Form 1310. Additionally, if you are the court-appointed executor or administrator of the deceased taxpayer’s estate, you may not need to file this form. However, in all other cases, it is important to utilize Form 1310 IRS to claim any refunds owed to the deceased taxpayer.

When to Use Form 1310 IRS

Form 1310 IRS should be used in specific situations where you are eligible to claim a tax refund on behalf of a deceased taxpayer. Here are some scenarios when you would need to use Form 1310:

- If you are a surviving spouse and filing a joint return with a deceased taxpayer: In this case, you do not need to file Form 1310. You can simply indicate on the tax return that the taxpayer is deceased and provide the necessary information.

- If you are a court-appointed executor or administrator of the deceased taxpayer’s estate: In some instances, the court-appointed executor or administrator may be authorized to receive the tax refund on behalf of the deceased taxpayer. In this case, Form 1310 may not be necessary. However, it is advisable to consult with a tax professional or the IRS to ensure proper handling.

- If you are an individual who is eligible to claim a refund for a deceased taxpayer: If you are not the surviving spouse or court-appointed executor/administrator, but you are eligible to claim a refund on behalf of a deceased taxpayer, you will need to use Form 1310 IRS. This could be the case if you were a dependent of the deceased taxpayer or if you have legal authority to handle the deceased taxpayer’s finances.

It is important to note that Form 1310 IRS should only be used for claiming tax refunds. If you need to file a tax return for a deceased taxpayer who had income in the year of their passing, you would file a regular tax return on their behalf, using the appropriate filing status. In this case, Form 1310 will not be required.

Before filing Form 1310 IRS, it is recommended to consult with a tax professional or the IRS to ensure that you are eligible to claim the refund and to obtain guidance on the specific requirements and documentation needed to support your claim.

Where to Obtain Form 1310 IRS

To obtain Form 1310 IRS, there are several options available to ensure you have access to the form:

- Download from the IRS website: The easiest and most convenient way to obtain Form 1310 is by downloading it directly from the official IRS website. Simply visit the website (www.irs.gov) and search for “Form 1310”. The form is available in PDF format, which can be saved and printed for your use.

- Request by mail: If you prefer to receive a physical copy of Form 1310 IRS, you can request it to be mailed to you by calling the IRS toll-free number at 1-800-829-3676. Provide your name, address, and specifically ask for Form 1310. The IRS will send the form to you within a few weeks.

- Visit a local IRS office: If you prefer to obtain the form in person, you can visit a local IRS office and ask for a copy of Form 1310 IRS. The IRS website has a tool called “IRS Office Locator” where you can find the nearest office to your location.

It’s important to note that Form 1310 IRS is a free document provided by the IRS. Be cautious of any third-party websites or services that charge a fee for accessing or providing the form.

Once you have obtained Form 1310 IRS, make sure to read through the instructions carefully to understand how to fill out the form correctly and provide all the necessary information.

Remember, if you are uncertain about any aspect of the form or the claiming process, it is always a good idea to seek guidance from a tax professional or reach out to the IRS for assistance.

Where to Mail Form 1310 IRS

After you have completed Form 1310 IRS, it is important to know where to mail it to ensure that it reaches the appropriate IRS processing center. The address you will use depends on your location and whether you are enclosing a payment with the form. Below is a general guideline, but it is recommended to verify the correct mailing address on the IRS website or with the specific instructions provided on the form.

If you are NOT enclosing a payment with Form 1310 IRS:

- For taxpayers living in Alaska, Arizona, California, Colorado, Hawaii, Idaho, Iowa, Kansas, Minnesota, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Washington, Wisconsin, Wyoming, or the Commonwealth of the Northern Mariana Islands, mail the form to:

- For taxpayers living in Alabama, Arkansas, Connecticut, Delaware, Florida, Georgia, Illinois, Indiana, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Mississippi, Missouri, New Hampshire, New Jersey, New York, North Carolina, Ohio, Pennsylvania, Rhode Island, South Carolina, Tennessee, Vermont, Virginia, West Virginia, or the District of Columbia, mail the form to:

- For taxpayers living in all other states or U.S. territories, mail the form to:

Department of the Treasury

Internal Revenue Service Center

Fresno, CA 93888-0045

Department of the Treasury

Internal Revenue Service Center

Kansas City, MO 64999-0052

Department of the Treasury

Internal Revenue Service Center

Austin, TX 73301-0045

If you ARE enclosing a payment with Form 1310 IRS:

- Regardless of your location, if you are enclosing a payment with Form 1310, mail the form and payment to the address based on your state of residence:

Department of the Treasury

Internal Revenue Service Center

Fresno, CA 93888-0045

Remember to double-check the mailing address before sending Form 1310 IRS, as it may be subject to change. You can verify the correct address by checking the IRS website or reviewing the instructions provided on the form itself.

It is recommended to send the form via certified mail or with a tracking number to ensure its safe delivery. Retain a copy of the form and any supporting documents for your records.

Important Things to Consider

When dealing with Form 1310 IRS and the process of claiming a tax refund on behalf of a deceased taxpayer, there are several important factors to keep in mind:

- Taxpayer eligibility: Before using Form 1310, determine if you are eligible to claim a tax refund on behalf of the deceased taxpayer. Not all individuals are eligible, and it is crucial to understand the specific requirements based on your relationship to the taxpayer and your legal authority to handle their finances.

- Documentation: Along with Form 1310, you may need to provide supporting documentation, such as a death certificate, proof of relationship, or legal authorization. Be sure to carefully review the instructions provided with the form to ensure you include all required documentation.

- Timeliness: It is important to file Form 1310 in a timely manner. Generally, you should file the form within three years from the due date of the original tax return or within two years from the date the tax was paid, whichever is later. Filing within this timeframe will help ensure that your claim is processed.

- Seek professional assistance if needed: Dealing with tax matters, especially after the death of a loved one, can be complex and overwhelming. If you are unsure about any aspect of Form 1310 or the claiming process, consider consulting a tax professional. They can provide guidance, help you navigate through the requirements, and ensure that you are maximizing your tax refund.

- Keep thorough records: Throughout the process, it is crucial to keep thorough records of all forms, documents, and communication related to the tax refund claim. This will help you track the progress, communicate effectively with the IRS, and maintain a clear record for your records.

Remember that each situation may have unique circumstances, so it is important to consult with a tax professional or the IRS to ensure that you are following the appropriate steps and meeting all the necessary requirements when using Form 1310 IRS.

By understanding these important considerations, you can navigate the process more effectively and increase the likelihood of a successful tax refund claim on behalf of the deceased taxpayer.

Conclusion

Dealing with taxes after the passing of a loved one can be a challenging and emotional process. However, understanding the purpose and proper use of Form 1310 IRS can help simplify the task of claiming a tax refund on behalf of a deceased taxpayer.

In this article, we discussed the importance of Form 1310 IRS and its role in authorizing individuals to claim a tax refund. We explored when to use the form, how to obtain it, where to mail it, and important considerations to keep in mind throughout the process.

Remember, if you are eligible to claim a tax refund on behalf of a deceased taxpayer, it is essential to accurately complete Form 1310 IRS and provide any necessary supporting documentation. By doing so, you can help ensure that the IRS processes the refund promptly and distributes it to the appropriate party.

If you have any uncertainties or questions during this process, it is highly recommended to seek assistance from a tax professional or reach out to the IRS directly. They can provide guidance tailored to your specific situation and help you navigate through any complexities or challenges.

While handling tax matters after the passing of a loved one can be overwhelming, understanding the use of Form 1310 IRS and following the necessary steps can provide some clarity and help facilitate the tax refund process. By staying organized, seeking guidance when needed, and ensuring compliance with IRS requirements, you can successfully navigate this aspect of managing your loved one’s finances.

Remember to approach this process with patience and compassion, allowing yourself time to grieve while also focusing on fulfilling the necessary tax obligations. With proper attention and care, you can navigate the process of claiming a tax refund and provide closure to the financial matters of your loved one.