Finance

What Is M&A In Investment Banking

Modified: December 30, 2023

Learn the basics of M&A in investment banking and its significance in the world of finance. Understand how it can impact businesses and drive strategic growth.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of Investment Banking and the exciting world of Merger and Acquisition (M&A) activity. In today’s business landscape, M&A plays a crucial role in shaping the corporate landscape and driving growth. Whether it’s a high-profile merger between two industry giants or the acquisition of a smaller company by a larger conglomerate, M&A transactions have the power to transform industries, create synergies, and unlock value for shareholders.

So, what exactly is M&A in the context of investment banking? M&A refers to the consolidation or combination of companies or assets through various methods such as mergers, acquisitions, divestitures, and joint ventures. It involves the buying, selling, merging, or restructuring of businesses to achieve strategic objectives, increase market share, enhance competitive positioning, and capture cost synergies.

The world of M&A is dynamic and ever-evolving, driven by a multitude of factors, including economic conditions, industry trends, technological advancements, and changing consumer preferences. Investment banks play a pivotal role in facilitating M&A transactions by providing advisory services, conducting due diligence, structuring deals, arranging financing, and navigating legal and regulatory frameworks.

In this article, we will delve deeper into the fascinating world of M&A in investment banking. We will explore the reasons behind M&A activity, the different types of M&A transactions, the role of investment banks in the M&A process, valuation techniques used, legal and regulatory considerations, financing options, and the challenges and risks involved. By the end, you will have a clearer understanding of the significance of M&A in the finance industry and its impact on businesses and the economy.

So, let’s dive in and explore the captivating world of M&A in investment banking!

Definition of M&A

Mergers and Acquisitions (M&A) in investment banking refer to the activities involved in the combination, consolidation, or restructuring of companies and their assets. It involves the buying, selling, merging, or divesting of businesses to achieve strategic objectives, drive growth, and create value for shareholders.

A merger occurs when two separate companies combine to form a new entity, pooling their resources, expertise, and market presence. It is a voluntary decision made by both companies to join forces and operate as a unified entity, sharing risks, profits, and control.

On the other hand, an acquisition involves one company purchasing another company, generally by acquiring a majority stake or all of its outstanding shares. The acquiring company gains control over the acquired company’s operations, assets, and intellectual property, thereby expanding its market presence and potentially entering new industries or geographic markets.

Both mergers and acquisitions can take various forms, such as horizontal, vertical, conglomerate, or friendly and hostile takeovers.

A horizontal merger occurs when two companies operating in the same industry and offering similar products or services merge to consolidate their market share and eliminate competition. This type of merger can lead to cost synergies, increased efficiencies, and enhanced market power.

In a vertical merger, companies operating at different stages of the supply chain or within the same industry merge to achieve better integration, streamline operations, and capture value at different stages of the production or distribution process. A vertical merger can reduce costs, improve coordination, and enhance control over the supply chain.

A conglomerate merger involves companies from unrelated industries coming together to diversify their business portfolios and leverage their complementary strengths and resources. This type of merger allows companies to enter new markets, capitalize on new opportunities, and minimize risks associated with a single industry or sector.

Lastly, the terms “friendly” and “hostile” refer to the nature of the acquisition. In a friendly takeover, the target company’s management and board of directors are supportive and actively involved in the acquisition process. Conversely, a hostile takeover occurs when the acquiring company bypasses or faces resistance from the target company’s management and board of directors. Hostile takeovers are often pursued when the acquiring company believes that the target company’s management is not acting in the best interests of the shareholders.

M&A transactions have the potential to reshape industries, drive growth, unlock synergies, and create value. They provide opportunities for companies to expand their market presence, enter new markets, diversify their revenue streams, access new technologies, and achieve economies of scale. However, M&A transactions also pose risks, including integration challenges, cultural differences, regulatory hurdles, and the potential for value destruction if not properly executed.

In the next sections, we will explore in more detail the reasons behind M&A activity, the types of M&A transactions, and the role of investment banks in facilitating these transactions.

Reasons for M&A Activity

The decision to pursue M&A activity in the world of investment banking is driven by a multitude of strategic, financial, and operational reasons. These reasons vary depending on the specific goals and circumstances of the companies involved. Let’s explore some of the common reasons behind M&A activity:

1. Strategic Expansion

One of the primary reasons for M&A activity is to achieve strategic expansion. Companies may seek to enter new markets, expand their customer base, or diversify their product or service offerings. Through mergers or acquisitions, companies can quickly gain access to new markets, distribution channels, and technology, allowing them to grow and compete more effectively.

2. Synergies and Cost Efficiencies

Merging with or acquiring another company can create synergies and cost efficiencies. Synergies can arise from combined expertise, complementary product lines, shared resources, or increased bargaining power with suppliers. By eliminating duplicate functions, streamlining operations, and optimizing the supply chain, companies can achieve cost savings, improve profitability, and enhance overall operational efficiency.

3. Market Share and Competitive Advantage

M&A activity is often driven by the desire to gain a larger market share and establish a competitive advantage. By combining forces with a competitor or acquiring a competitor, companies can increase their market presence, strengthen their market position, and achieve a larger customer base. This can result in increased pricing power, improved customer loyalty, and a stronger foothold in the industry.

4. Access to New Technologies and Intellectual Property

Technology plays a critical role in today’s business landscape. M&A transactions can provide companies with access to new technologies, patents, and intellectual property rights. By acquiring a tech-savvy company, businesses can enhance their innovation capabilities, stay ahead of industry trends, and gain a competitive edge in the market.

5. Economies of Scale

Merging with or acquiring another company can lead to economies of scale. By combining operations, companies can benefit from increased purchasing power, shared resources, and improved utilization of assets. This can result in lower production costs, improved profit margins, and enhanced financial performance.

6. Elimination of Competition

In some cases, M&A activity is driven by the desire to eliminate competition. By acquiring or merging with a rival company, a business can reduce the number of competitors in the market, increase market share, and gain a stronger position in the industry. This can lead to increased pricing power, improved profitability, and enhanced market influence.

These are just a few examples of the many reasons why companies engage in M&A activity. It is important to note that each M&A transaction is unique, and the motivations behind them can vary significantly. Companies must carefully evaluate the strategic fit, financial implications, and potential risks before embarking on an M&A journey.

In the next section, we will explore the different types of M&A transactions that can occur in the world of investment banking.

Types of M&A Transactions

In the world of investment banking, M&A transactions come in various forms, each with its own unique characteristics and strategic implications. Let’s explore some of the common types of M&A transactions:

1. Mergers

A merger refers to the combination of two separate companies into a new entity. In a merger, the companies involved join forces to create a unified organization, sharing resources, expertise, and decision-making powers. Mergers are typically conducted between companies of similar size and stature, and they can lead to increased market presence, enhanced synergies, and improved competitive positioning.

2. Acquisitions

An acquisition occurs when one company purchases another company, either by acquiring a majority stake or all of its outstanding shares. In an acquisition, the acquiring company gains control over the target company’s operations, assets, and intellectual property. Acquisitions can be friendly or hostile, depending on the willingness of the target company’s management to support the transaction. Acquisitions are often pursued to expand market share, enter new markets, acquire valuable assets or technology, and increase profitability.

3. Divestitures

Divestitures involve the sale or spin-off of a company’s assets, subsidiaries, or business units. Companies may choose to divest certain assets or divisions that are not aligned with their core business strategy or no longer provide a competitive advantage. Divestitures can generate cash, streamline operations, and allow companies to focus on their core competencies.

4. Joint Ventures

A joint venture is a strategic partnership between two or more companies to collaborate on a specific project or venture. In a joint venture, the companies involved contribute their resources, expertise, and capital to achieve a common objective. Joint ventures allow companies to share risks, access new markets, leverage complementary strengths, and pursue opportunities that would be challenging to undertake individually.

5. Leveraged Buyouts (LBO)

A leveraged buyout occurs when a company or group of investors acquires another company primarily using borrowed funds. In an LBO, the acquiring company uses the assets and cash flows of the target company being acquired as collateral for the debt. This type of transaction is often used when a company is undervalued or requires significant restructuring. LBOs can provide the acquiring company with increased control and potential upside if the acquired company performs well.

6. Reverse Mergers

In a reverse merger, a private company acquires a publicly traded company, allowing the private company to go public without undergoing the traditional initial public offering (IPO) process. This type of transaction provides a faster and more cost-effective way for private companies to access the public markets and raise capital.

These are just a few examples of the types of M&A transactions that take place in the world of investment banking. Each type of transaction serves different purposes and carries its own set of advantages and considerations. Companies must carefully assess their strategic goals, financial capabilities, and risk tolerance when deciding which type of M&A transaction to pursue.

In the next section, we will explore the role of investment banks in facilitating M&A transactions.

Role of Investment Banks in M&A

When it comes to M&A transactions, investment banks play a vital role in facilitating the process and providing valuable advisory services to their clients. Let’s explore the key roles investment banks play in M&A:

1. Strategic Advisory

Investment banks provide strategic advice and guidance to companies considering M&A transactions. They assess the market landscape, industry trends, and potential synergies to help clients develop a strategic approach to M&A. Investment banks conduct thorough due diligence, evaluate target companies or potential merger partners, and provide insights into the risks and opportunities associated with the proposed transactions.

2. Valuation Services

Determining the value of a company or its assets is a critical step in M&A transactions. Investment banks use various valuation techniques to assess the worth of a target company, including discounted cash flow analysis, comparable company analysis, and precedent transactions analysis. By providing accurate and unbiased valuation services, investment banks help clients negotiate fair deal terms and evaluate the financial impact of the proposed transaction.

3. Deal Structuring and Negotiations

Investment banks assist clients in structuring M&A deals in a way that maximizes value and aligns with their strategic goals. They help negotiate deal terms, including the purchase price, payment terms, and any contingencies or conditions. Investment banks leverage their industry expertise, knowledge of market trends, and negotiation skills to advocate for their clients’ best interests and secure favorable deal terms.

4. Financing Arrangements

One of the crucial roles of investment banks in M&A transactions is arranging the necessary financing. They help clients secure debt or equity financing to fund the transaction. Investment banks have access to a wide network of lenders, investors, and capital markets, allowing them to structure financing packages that meet their clients’ specific needs. They assist in the preparation of financial projections, offering memorandums, and conducting roadshows to attract potential investors or lenders.

5. Due Diligence

Investment banks conduct extensive due diligence to assess the legal, financial, and operational aspects of the target company. They review the target company’s financial statements, contracts, legal obligations, intellectual property rights, and any potential risks or liabilities. Investment banks help clients identify any red flags or issues that may impact the viability or valuation of the proposed transaction.

6. Regulatory and Legal Compliance

Navigating the complex regulatory landscape is crucial in M&A transactions. Investment banks assist clients in complying with applicable laws and regulations, including antitrust laws, securities regulations, and disclosure requirements. They help clients secure the necessary regulatory approvals, file the required documentation, and ensure compliance throughout the M&A process.

The role of investment banks doesn’t end once the deal is finalized. They continue to provide post-merger integration support, helping companies successfully combine their operations, cultures, and systems to achieve the expected synergies and maximize value.

Overall, investment banks bring extensive industry knowledge, financial expertise, and a broad network of resources to the table. Their involvement in M&A transactions significantly enhances the chances of success for their clients and helps navigate the complexities of the M&A process.

In the next section, we will explore the M&A process in investment banking, detailing the steps involved from initial planning to deal closure.

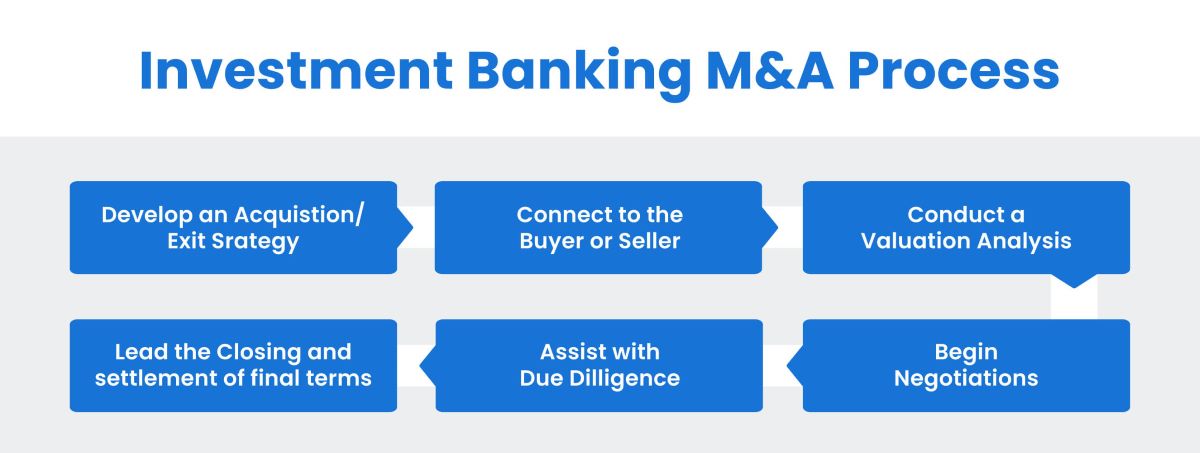

M&A Process in Investment Banking

The M&A process in investment banking involves several distinct stages, each requiring careful planning, analysis, and execution. While the specifics may vary depending on the transaction and parties involved, the following provides a general overview of the M&A process:

1. Pre-Deal Planning

During this stage, the acquiring company and its investment banking advisor define their strategic objectives and identify potential target companies. They conduct market research, assess industry trends, and analyze potential synergies to determine the viability and attractiveness of an M&A deal. The investment bank assists in the development of an M&A strategy and helps source suitable targets.

2. Initial Contact and Due Diligence

Once a target company is identified, the acquiring company, with the support of the investment bank, initiates contact to express interest in the potential transaction. Confidentiality agreements may be signed, allowing the acquiring company to conduct due diligence. The investment bank plays a crucial role in conducting financial, legal, and operational due diligence to assess the target company’s financial health, legal compliance, market position, and growth prospects.

3. Valuation and Deal Structuring

Based on the outcomes of the due diligence, the investment bank assists in valuing the target company and structuring the deal. They employ various valuation techniques to determine a fair purchase price and negotiate the terms and conditions of the agreement. The investment bank’s expertise in deal structuring helps balance the interests of the acquiring company, the target company, and the potential investors or lenders.

4. Financing and Deal Negotiation

Once the deal terms are agreed upon, the investment bank helps secure the necessary financing for the acquisition. They work closely with the acquiring company to identify and approach potential investors or lenders, helping structure financing arrangements that align with the company’s financial goals. The investment bank also assists in deal negotiation, advocating for their client’s interests and ensuring a fair and equitable agreement is reached.

5. Regulatory and Legal Compliance

Complying with legal and regulatory requirements is crucial in the M&A process. The investment bank guides the acquiring company through the necessary regulatory filings, disclosures, and compliance obligations. They ensure that all legal processes are followed, including obtaining regulatory approvals, antitrust clearances, and shareholder consent, if applicable.

6. Post-Merger Integration

After the deal is closed, the investment bank may provide support in the post-merger integration process. They assist in combining the operations, systems, and cultures of the acquiring and target companies. This includes integrating teams, optimizing processes, and leveraging synergies to maximize the value created by the transaction.

Throughout the M&A process, the investment bank acts as a trusted advisor, providing guidance, expertise, and strategic insights. They ensure that the M&A transaction aligns with the acquiring company’s objectives, mitigates risks, and maximizes value for all parties involved.

It is important to note that the M&A process can be complex and time-consuming, requiring close collaboration between the acquiring company, the investment bank, legal advisors, and other stakeholders. Each stage of the process involves careful analysis, due diligence, and decision-making to ensure a successful M&A transaction.

In the next section, we will explore the valuation techniques used in M&A transactions.

Valuation Techniques in M&A

Valuation is a critical aspect of M&A transactions, as it determines the fair value of a target company or its assets. Investment banks use various valuation techniques to assess the financial worth of the target company and help their clients make informed decisions. Let’s explore some of the common valuation techniques used in M&A:

1. Discounted Cash Flow (DCF) Analysis

DCF analysis is a widely used valuation technique that calculates the present value of expected future cash flows of a company. It considers the time value of money by discounting projected cash flows to their present value using an appropriate discount rate, such as the company’s cost of capital. DCF analysis provides insights into the intrinsic value of a company and assesses its potential for generating future cash flows.

2. Comparable Company Analysis

Comparable company analysis involves comparing the financial metrics and multiples of a target company to those of similar publicly traded companies. Investment banks identify a group of comparable companies in the same industry, with similar business models, growth prospects, and financial characteristics. By analyzing the valuation multiples, such as price-to-earnings (P/E) ratio or enterprise value-to-revenue (EV/Revenue) ratio, of these comparable companies, they can estimate the valuation of the target company.

3. Precedent Transactions Analysis

Precedent transactions analysis involves examining the valuation multiples and deal terms of previous M&A transactions in the same industry. Investment banks identify comparable M&A deals with similar transaction structures, company size, and market dynamics. By analyzing these precedents, they can derive valuation multiples or ratios, such as enterprise value-to-EBITDA (EV/EBITDA) or price-to-sales (P/S), to assess the potential value of the target company.

4. Asset-Based Valuation

Asset-based valuation focuses on the net value of a company’s assets and liabilities. Investment banks assess the fair market value of a company’s tangible and intangible assets, including property, equipment, inventory, intellectual property, and goodwill. They subtract the company’s liabilities to determine its net asset value. Asset-based valuation is commonly used when a company’s underlying assets have significant value and the projection of future cash flows may be uncertain.

5. Replacement Cost Method

The replacement cost method estimates the cost of replacing the assets of a company if they were to be built from scratch. Investment banks assess the cost of acquiring or constructing similar assets, taking into account the current market prices and the company’s specific requirements. This method is particularly useful for companies with unique or specialized assets, such as infrastructure or intellectual property.

It is important to note that no single valuation technique provides a definitive answer to a target company’s value. Investment banks typically use a combination of these techniques to gain a comprehensive understanding of a company’s financial position and determine its fair value. The choice of valuation technique depends on factors such as the industry dynamics, the availability of data, the company’s performance, and the specific circumstances surrounding the M&A transaction.

The valuation process requires extensive analysis, consideration of various factors, and the application of sound judgment. Investment banks work closely with their clients to conduct thorough valuations, ensuring that the price paid for an acquisition is fair and reflects the potential value of the target company.

In the next section, we will explore the legal and regulatory considerations involved in M&A transactions.

Legal and Regulatory Considerations in M&A

Legal and regulatory considerations are a crucial aspect of M&A transactions in the world of investment banking. Companies must navigate complex laws, regulations, and compliance requirements to ensure a smooth and legally sound M&A process. Let’s explore some of the key legal and regulatory considerations in M&A:

1. Antitrust and Competition Laws

In M&A transactions, one significant concern is ensuring compliance with antitrust and competition laws. Regulatory authorities are keen on preventing monopolies or anti-competitive behavior that could harm consumers. Investment banks conduct thorough antitrust analyses to assess potential regulatory issues and determine any necessary filings or clearances. They help companies understand and comply with the relevant laws by addressing issues related to market concentration, price fixing, or unfair competition.

2. Securities Regulations

M&A transactions often involve the issuance or transfer of securities, such as stocks or bonds. Companies must comply with securities regulations, which aim to protect investors and ensure transparent and fair markets. Investment banks assist their clients in filing the necessary documents and disclosures, such as the prospectus or offering memorandum, to comply with securities laws. They help navigate issues related to insider trading, market manipulation, shareholder communication, and compliance with reporting requirements.

3. Corporate Governance and Shareholder Rights

M&A transactions can potentially impact corporate governance structures and the rights of shareholders. Investment banks work closely with companies to ensure that the transaction is conducted in accordance with corporate governance best practices and legal requirements. They help address issues related to board approvals, shareholder voting, fiduciary duties, and potential conflicts of interest. Investment banks play a vital role in ensuring that the interests of all stakeholders, including shareholders, are protected throughout the M&A process.

4. Employment and Labor Laws

M&A transactions can have significant implications for employees, including potential job losses or changes in employment terms. Investment banks assist companies in complying with employment and labor laws, ensuring that employee rights are properly protected. They help address issues related to employee compensation, benefits, retention, and potential redundancies. Investment banks work with their clients to develop appropriate communication and employee engagement strategies to minimize disruptions and ensure a smooth transition for the workforce.

5. Intellectual Property Rights

M&A transactions involve the transfer or acquisition of intellectual property (IP) rights, such as patents, trademarks, copyrights, or trade secrets. Investment banks help companies conduct IP due diligence to assess the ownership, validity, and value of the target company’s IP assets. They address issues related to licensing, assignment, infringement risks, and potential litigation. Investment banks ensure that the necessary IP agreements and protections are in place to safeguard the value and integrity of the IP assets being transferred or acquired.

These are just a few examples of the legal and regulatory considerations involved in M&A transactions. Depending on the jurisdiction, industry, and specific circumstances, there may be additional legal and regulatory hurdles that companies must navigate. Investment banks play a crucial role in guiding their clients through these considerations, ensuring compliance with the relevant laws and regulations, and mitigating potential risks.

In the next section, we will explore the financing options available for M&A transactions.

Financing M&A Transactions

Financing is a critical aspect of M&A transactions, as it enables companies to fund the acquisition of a target company or assets. When it comes to financing M&A transactions, companies have several options to consider. Let’s explore some of the common financing methods in M&A:

1. Cash Financing

Cash financing involves using the acquiring company’s available cash reserves or raising additional funds to finance the acquisition. Cash financing provides the advantage of a quick and straightforward transaction, as it eliminates the need for complex financing arrangements. However, it can put a strain on the acquiring company’s balance sheet and may require careful cash flow management to mitigate the impact on day-to-day operations and future investment opportunities.

2. Debt Financing

Debt financing involves raising funds by borrowing from external sources, such as banks, financial institutions, or bond markets. The acquiring company secures the necessary debt to finance the acquisition, which is typically repaid over time with interest. Debt financing can offer several advantages, including preserving cash reserves, leveraging the target company’s assets and cash flows, and potentially benefiting from tax advantages. However, it comes with the obligation to meet debt repayments and interest payments, requiring a careful assessment of the acquiring company’s debt capacity and financial health.

3. Equity Financing

Equity financing involves issuing new shares or selling existing shares to raise funds for the acquisition. Companies can turn to private equity investors, institutional investors, or the public markets. By offering equity, the acquiring company provides ownership stakes to investors in exchange for capital. Equity financing allows companies to share the financial risks and potential returns of the acquisition. It can also strengthen the acquiring company’s balance sheet and enhance its credibility and market value. However, it dilutes existing shareholders’ ownership and control, and the valuation of the equity offering must be carefully considered to ensure it aligns with the acquisition’s value.

4. Mezzanine Financing

Mezzanine financing combines elements of debt and equity financing. It involves raising funds through a combination of subordinated debt and equity-linked instruments, such as convertible bonds or preferred shares. Mezzanine financing provides companies with additional capital while offering investors the potential for a higher return. This type of financing is often used when companies require a flexible and non-dilutive funding option to bridge the financing gap between senior debt and equity financing.

5. Seller Financing

Seller financing occurs when the seller of the target company provides financing to the buyer as part of the acquisition agreement. The seller may agree to receive a portion of the purchase price over time in the form of a loan or earn-out based on the future performance of the acquired company. Seller financing can be advantageous when the acquiring company faces challenges in obtaining external financing or when the seller wants to ensure a smooth transition and maintain an interest in the success of the acquired business.

These are just a few examples of the financing options available for M&A transactions. The choice of financing method depends on various factors, including the financial health of the acquiring company, the size and nature of the transaction, the availability of capital, and the desired ownership and control structure. Investment banks play a crucial role in assisting companies in evaluating and securing the most appropriate financing options for their M&A transactions.

In the next section, we will explore the challenges and risks that companies may encounter in M&A transactions.

Challenges and Risks in M&A

M&A transactions in the world of investment banking can be complex and fraught with challenges and risks. Companies must carefully navigate these potential pitfalls to ensure a successful outcome. Let’s explore some of the common challenges and risks in M&A:

1. Integration Challenges

One of the most significant challenges in M&A transactions is successfully integrating the operations, systems, cultures, and employees of the acquiring and target companies. Misalignments in processes, technologies, or organizational structures can lead to inefficiencies, decreased productivity, and cultural clashes. It is essential to have a well-defined integration plan, effective communication, and a dedicated team to manage the integration process and ensure a smooth transition.

2. Cultural Differences

Merging companies often encounter cultural differences that can pose challenges to a successful integration. Different corporate cultures, values, and ways of doing business may result in employee resistance, communication breakdowns, and a loss of morale. It is crucial to proactively address these cultural differences and foster a collaborative and inclusive culture that helps align the workforce and drives post-merger success.

3. Financial Performance and Synergy Realization

Realizing the expected financial performance and synergies from an M&A transaction can be challenging. Companies must effectively identify, capture, and integrate the anticipated synergies, whether they are cost savings, revenue growth opportunities, or operational efficiencies. Failure to realize these synergies can lead to financial underperformance and a loss of shareholder value.

4. Legal and Regulatory Risks

M&A transactions are subject to a range of legal and regulatory risks. Companies must ensure compliance with antitrust and competition laws, securities regulations, and other applicable laws and regulations. Failure to obtain the necessary regulatory approvals or adhere to legal requirements can result in delays, fines, legal disputes, or even the cancellation of the transaction. Proper due diligence and engaging legal advisors are essential to mitigate these risks.

5. Uncertain Market and Economic Conditions

The dynamic nature of market and economic conditions can pose risks to M&A transactions. Unforeseen changes in the economic environment, industry dynamics, or customer demand can impact the financial performance and value of the acquired company. Fluctuations in currency exchange rates, interest rates, or commodity prices can also affect the financial viability of the transaction. Companies must carefully analyze and anticipate market and economic risks to make informed decisions and adjust their strategies accordingly.

6. Stakeholder Resistance

M&A transactions can face resistance from various stakeholders, including employees, customers, suppliers, or local communities. Concerns about job security, changes in business relationships, or the impact on local economies can lead to resistance or opposition to the transaction. Companies must proactively communicate and engage with stakeholders, addressing their concerns, and demonstrating the benefits and positive impact of the transaction to build support and minimize resistance.

It is important for companies engaging in M&A transactions to conduct robust due diligence, develop a comprehensive integration plan, and seek expert advice from investment banks, legal advisors, and other professionals. Careful planning, effective communication, and diligent execution are key to mitigating these challenges and risks and achieving a successful outcome in M&A transactions.

In the final section, we will summarize the key points discussed in this article and emphasize the significance of M&A in the finance industry.

Conclusion

Mergers and Acquisitions (M&A) transactions play a significant role in the world of investment banking, shaping industries, driving growth, and creating value for businesses and shareholders. In this article, we have explored the various aspects of M&A in investment banking, from its definition to the reasons behind M&A activity, the types of transactions, the role of investment banks, valuation techniques, legal and regulatory considerations, financing options, and the challenges and risks involved.

M&A transactions are fueled by strategic expansion, synergies, market share gains, access to new technologies, and cost efficiencies. Investment banks provide invaluable advisory services throughout the M&A process, offering strategic guidance, conducting due diligence, structuring deals, arranging financing, and ensuring legal and regulatory compliance. They play a crucial role in driving successful M&A transactions, helping companies navigate complex challenges and risks while maximizing value.

Valuation techniques such as discounted cash flow analysis, comparable company analysis, precedent transactions analysis, asset-based valuation, and replacement cost method assist in determining the fair value of target companies or assets. Legal and regulatory considerations, including antitrust and competition laws, securities regulations, corporate governance, employment and labor laws, and intellectual property rights, must be carefully addressed to ensure compliance and mitigate legal risks.

Financing M&A transactions can be done through cash financing, debt financing, equity financing, mezzanine financing, or seller financing. Each method has its own advantages and considerations, and companies must evaluate their financial capabilities and goals to determine the most suitable financing option.

Of course, M&A transactions are not without challenges and risks. Integration challenges, cultural differences, financial performance realization, legal and regulatory risks, uncertain market conditions, and stakeholder resistance can impact the success of M&A transactions. However, with proper planning, due diligence, and effective execution, companies can overcome these challenges and minimize risks.

In conclusion, M&A transactions are a crucial driver of growth and value creation in the finance industry. Investment banks serve as trusted advisors, helping companies navigate the complexities of M&A and positioning them for success. By understanding the dynamics of M&A activity and incorporating strategic planning, financial expertise, and legal compliance, companies can harness the power of M&A to achieve their strategic objectives and drive long-term success.