Finance

Where To Find IP Pin On A Tax Return

Published: October 29, 2023

Looking for your IP pin on your tax return? Find out where to locate it and ensure the security of your financial information.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of personal finance, where understanding the intricacies of tax returns is essential. When it comes to filing taxes, there are many important details to consider, including the IP PIN. In this article, we will explore what an IP PIN is, its purpose, and how to locate it on a tax return.

An IP PIN, short for Identity Protection Personal Identification Number, is a unique six-digit code assigned to eligible taxpayers by the Internal Revenue Service (IRS). It serves as an additional layer of security to prevent fraudulent activity and protect taxpayers’ identities. Since its introduction in 2011, the IP PIN has become an integral part of the tax filing process.

The primary purpose of an IP PIN is to combat tax-related identity theft. With the increasing number of cases involving stolen Social Security numbers and fraudulent tax returns, the IRS developed this security measure to safeguard taxpayers’ sensitive financial information. By requiring the IP PIN, it adds an extra level of authentication, ensuring that only legitimate taxpayers can successfully file their returns.

Obtaining an IP PIN can be done through various methods, depending on your preference and eligibility. The IRS offers three options: online, by mail, and in person. Each method has its unique benefits and requirements, allowing taxpayers to choose the most convenient option for their circumstances. We will delve deeper into these options shortly to help you understand which one is the best fit for you.

Once you have successfully obtained an IP PIN, it is important to know where to locate it on your tax return. This six-digit code is typically found in a specific section of your tax documents, ensuring that it is easy to spot and access when needed. We will provide a step-by-step guide on how to locate your IP PIN on your tax return, ensuring that you have all the necessary information at your fingertips.

Understanding the importance of an IP PIN and knowing where to find it on your tax return is crucial for a smooth and secure tax filing process. So let’s dive into the details and explore how you can obtain and locate your IP PIN effectively.

What is an IP PIN?

An IP PIN, or Identity Protection Personal Identification Number, is a unique six-digit code assigned to eligible taxpayers by the Internal Revenue Service (IRS). It serves as an additional layer of security to protect taxpayers’ identities and prevent fraudulent activity during the tax filing process.

The IP PIN program was introduced by the IRS in 2011 as a response to the growing problem of tax-related identity theft. This type of fraud occurs when someone uses another individual’s stolen Social Security number to file a fraudulent tax return and claim a refund. By assigning an IP PIN to eligible taxpayers, the IRS aims to prevent unauthorized individuals from filing under someone else’s name.

Each IP PIN is automatically generated by the IRS and is valid for one calendar year. Taxpayers who are issued an IP PIN must use it when filing their federal tax returns. Failure to provide the correct IP PIN can result in rejection of the tax return or a delay in processing.

It’s important to note that not all taxpayers are eligible for an IP PIN. The IRS determines eligibility based on certain criteria, including previous instances of identity theft or suspicious activity on a taxpayer’s account. Additionally, victims of identity theft who have resolved their cases with the IRS may be issued an IP PIN to protect against future incidents.

Obtaining an IP PIN provides an added layer of security and peace of mind during tax season. With this unique code, taxpayers can reduce the risk of falling victim to tax-related identity theft and ensure that their returns are processed smoothly and efficiently.

While an IP PIN is specifically designed for federal tax returns, it does not replace any other personal identification numbers or passwords used when interacting with the IRS. Taxpayers should still keep their Social Security numbers secure and use their IP PINs whenever required.

Now that we understand the purpose and significance of an IP PIN, let’s explore the various methods available to obtain one.

Purpose of an IP PIN

The primary purpose of an IP PIN, or Identity Protection Personal Identification Number, is to provide an additional layer of security and protect taxpayers from falling victim to tax-related identity theft. By assigning a unique six-digit code to eligible individuals, the IRS aims to verify the authenticity of tax returns and prevent unauthorized individuals from filing under someone else’s name.

Tax-related identity theft occurs when criminals use stolen Social Security numbers to file fraudulent tax returns and claim refunds. This type of fraud not only causes financial loss to the affected individual but also creates a hassle and potential long-term consequences in resolving the issue.

Here are some key purposes of an IP PIN:

- Preventing Fraudulent Tax Returns: The IP PIN acts as a security measure to ensure that only legitimate taxpayers can file their federal tax returns. By requiring the IP PIN, the IRS can verify the identity of the taxpayer and prevent fraudulent filings that may result in unauthorized refunds.

- Safeguarding Sensitive Financial Information: With an IP PIN in place, taxpayers can have peace of mind knowing that their personal and financial information is protected. This code adds an extra layer of authentication to ensure that only the rightful owner of the Social Security number can file a tax return.

- Reducing the Risk of Identity Theft: By using an IP PIN when filing tax returns, eligible taxpayers can significantly reduce the risk of becoming victims of tax-related identity theft. This proactive measure helps to safeguard their personal and financial information from falling into the wrong hands.

- Streamlining the Return Filing Process: The use of an IP PIN can help expedite the processing of tax returns. Once the IRS verifies the authenticity of the IP PIN, they can proceed with processing the return without additional delays or requests for further information, ensuring a smoother and more efficient filing process.

It is important to note that an IP PIN is valid for one calendar year and must be used when filing federal tax returns. Taxpayers who are issued an IP PIN should keep it secure and not share it with anyone else.

Now that we understand the purpose of an IP PIN, let’s explore the different methods available to obtain one.

How to Obtain an IP PIN

Obtaining an IP PIN, or Identity Protection Personal Identification Number, is a simple process that can be done through various methods provided by the IRS. Eligible taxpayers have three options to obtain an IP PIN: online, by mail, or in person. Let’s explore each option in more detail.

Option 1: Online

The online method is the most convenient and commonly used way to obtain an IP PIN. To use this option, taxpayers must have an existing account with the IRS. They can then visit the IRS website and follow the steps provided to request an IP PIN online. This method is available to eligible taxpayers who can pass the identity verification process set by the IRS.

Option 2: By Mail

Taxpayers who prefer to request an IP PIN by mail can do so by completing and submitting Form 14446, Identity Protection Personal Identification Number Request. The form can be downloaded from the IRS website or requested by calling the IRS toll-free number. Once completed, taxpayers should mail the form to the designated address provided by the IRS. It’s important to note that the processing time for requests submitted by mail may take longer compared to online or in-person requests.

Option 3: In Person

If taxpayers prefer a face-to-face interaction, they have the option to visit their local IRS office and request an IP PIN in person. Prior to the visit, it is advisable to schedule an appointment to ensure a smooth process. Taxpayers should bring valid identification documents, such as a driver’s license or passport, along with other supporting documents as required by the IRS. A representative at the IRS office will guide them through the process and issue an IP PIN if eligible.

It is important to note that not all taxpayers are eligible for an IP PIN. The IRS determines eligibility based on certain criteria, such as previous instances of identity theft or suspicious activity on a taxpayer’s account. Additionally, victims of identity theft who have resolved their cases with the IRS may be issued an IP PIN for future protection.

Once taxpayers have successfully obtained an IP PIN, they should keep this information secure and use it when filing their federal tax returns. Using the correct IP PIN is crucial for the successful processing of the tax return and to ensure the added security measures are in place.

Now that you know how to obtain an IP PIN, let’s move on to the next section to learn where to locate the IP PIN on a tax return.

Option 1: Online

Obtaining an IP PIN online is a convenient and efficient method for eligible taxpayers. This option allows individuals to request and receive their IP PIN through the IRS website. To utilize this method, taxpayers must have an existing account with the IRS. If you don’t have an account, you can create one easily by providing the necessary information.

Here’s a step-by-step guide on how to obtain an IP PIN online:

- Create or Access your IRS Account: Visit the IRS website and navigate to the account creation page. Follow the prompts to create an account or log in to your existing account.

- Identity Verification: The IRS uses a multi-step identity verification process to ensure the security of your personal and financial information. You may be asked to provide information from your prior year’s tax return, financial account numbers, or a unique code received through the mail to complete this step.

- Request an IP PIN: Once your identity is verified, you can request an IP PIN. Navigate to the appropriate section on your account dashboard and follow the instructions provided.

- Receive and Use your IP PIN: After successfully requesting an IP PIN online, you will receive your six-digit code. It is important to keep this information secure and use it when filing your federal tax return. Note that the IP PIN is valid for the current calendar year, and a new one will be issued for each subsequent year if you remain eligible.

By choosing the online option, taxpayers can conveniently obtain their IP PIN without the need to visit an IRS office or deal with paper forms and mail submissions. This method offers a streamlined process, allowing eligible individuals to quickly and securely access their IP PIN and protect themselves against tax-related identity theft.

It’s important to keep in mind that the IRS takes the security of taxpayer information seriously. They employ various measures to safeguard personal and financial data during the online IP PIN request process. However, it is still advisable to exercise caution and use secure internet connections when accessing and submitting sensitive information on the IRS website.

Now that you’re familiar with the online option, let’s move on to explore the second method: obtaining an IP PIN by mail.

Option 2: By Mail

If you prefer a more traditional method, you can obtain an IP PIN by mail. This option allows eligible taxpayers to request their IP PIN by completing and submitting Form 14446, also known as the Identity Protection Personal Identification Number Request. Here’s how you can obtain an IP PIN by mail:

- Download and Print the Form: Visit the IRS website and search for Form 14446. Download and print the form, ensuring that you have the most recent version.

- Fill Out the Form: Carefully complete all the required sections of the form. Provide accurate and up-to-date information to avoid any delays or complications during the processing of your request. Double-check your entries for accuracy and legibility.

- Gather Supporting Documents: Depending on your specific situation, you may need to include supporting documents with your Form 14446. These documents may include a copy of your Social Security card, a valid government-issued identification document, or other documentation requested by the IRS. Review the instructions on the form to determine which documents are required.

- Submit the Form by Mail: Once you have filled out the form and gathered the necessary supporting documents, mail them to the appropriate address provided on the Form 14446 instructions. It’s important to use the correct mailing address to ensure that your request reaches the IRS without any delays.

- Wait for Confirmation: After submitting your request, the IRS will process your information and verify your eligibility for an IP PIN. If approved, you will receive a confirmation letter in the mail, including your six-digit IP PIN. This confirmation letter may take several weeks to arrive, so exercise patience during this waiting period.

It’s important to note that obtaining an IP PIN by mail may take longer compared to the online or in-person methods. The processing time depends on various factors, including the volume of requests received by the IRS. Therefore, it’s advisable to submit your request well in advance to ensure that you have your IP PIN in hand when you need it for filing your federal tax return.

With the IP PIN obtained by mail, you can securely file your tax return and protect yourself against tax-related identity theft. Remember to keep your IP PIN confidential and use it as required when prompted by the IRS during the filing process.

Now that you’re familiar with obtaining an IP PIN by mail, let’s move on to the third option: obtaining an IP PIN in person.

Option 3: In Person

If you prefer a more personal approach, you have the option to obtain an IP PIN in person by visiting a local IRS office. This method allows you to interact directly with an IRS representative who can guide you through the process and address any questions or concerns you may have. Here’s how you can obtain an IP PIN in person:

- Schedule an Appointment: Before visiting an IRS office, it is advisable to schedule an appointment to ensure a smooth process. You can do this by calling the IRS toll-free number or using the appointment scheduling tool available on the IRS website. Arriving with an appointment helps minimize wait times and ensures that a representative will be available to assist you.

- Gather Required Documents: Before your appointment, gather the necessary documents to prove your identity and eligibility for an IP PIN. This may include a valid government-issued identification document (such as a driver’s license or passport), Social Security card, prior year’s tax return, or any other supporting documentation requested by the IRS.

- Visit the IRS Office: On the day of your appointment, visit the designated IRS office at the scheduled time. Be prepared to undergo a security check upon entering the office. Remember to bring all the required documents with you to ensure a smooth and efficient process.

- Provide Information and Request an IP PIN: Once you meet with an IRS representative, they will guide you through the process of requesting an IP PIN. You may be required to provide information and answer questions to verify your identity and eligibility for an IP PIN. The representative will assist you in completing the necessary forms and submit your request.

- Receive Your IP PIN: If approved, you will receive your IP PIN at the IRS office. The representative will provide you with a confirmation letter containing your six-digit IP PIN, ensuring that you have the necessary information to protect yourself against tax-related identity theft.

Visiting an IRS office in person provides an opportunity for face-to-face interaction and personalized assistance. It allows you to address any specific concerns or questions you may have, ensuring that you have a clear understanding of the IP PIN process.

Keep in mind that not all IRS offices offer the same services, so it’s important to check the IRS website or call the IRS toll-free number to find an office near you that provides IP PIN services. Additionally, be aware that wait times at IRS offices can vary depending on the time of year, so it’s advisable to schedule your appointment well in advance.

Now that you’re familiar with the in-person option, let’s move on to the next section to learn where to locate your IP PIN on a tax return.

Locating the IP PIN on a Tax Return

Once you have successfully obtained an IP PIN, it’s important to know where to locate it on your tax return. The IP PIN is a six-digit code that serves as an additional layer of security when filing your federal tax return. Locating it on your tax documents ensures that you include the IP PIN when necessary and facilitate the secure processing of your return.

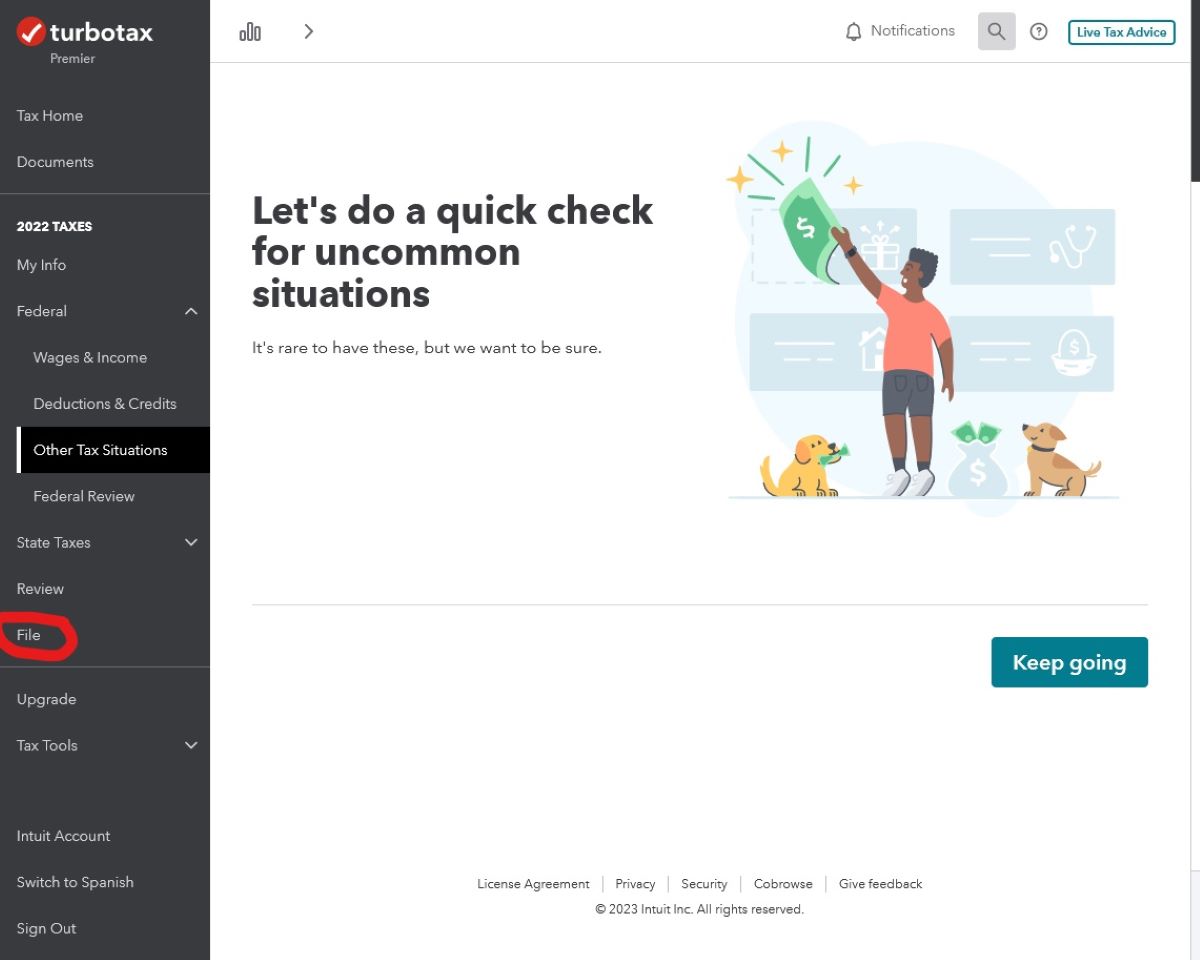

The IP PIN can typically be found in a specific section of your tax return documents, such as Form 1040 or Form 1040A. Here is a step-by-step guide to help you find your IP PIN on your tax return:

- Locate your Tax Return Documents: Gather all the necessary tax return documents, including Form 1040, Form 1040A, or any other relevant forms or schedules.

- Identify the Correct Section: Look for the section of the tax return where the IP PIN is typically provided. This section is usually labeled as “Identity Protection PIN” or similar phrasing.

- Search for the Six-Digit IP PIN: Within the identified section, look for a six-digit code. This code is your unique IP PIN and is generated specifically for your tax return. It is essential to accurately note this code and use it when prompted during the filing process.

- Keep the IP PIN Secure: Once you have located your IP PIN, it’s important to keep it secure and confidential. Treat your IP PIN as sensitive information to prevent unauthorized access or misuse.

If you are using tax preparation software or working with a tax professional, ensure that they are aware of your IP PIN and include it in your tax return filings. Providing the IP PIN correctly ensures that the IRS processes your return smoothly and securely.

It’s important to note that the location of the IP PIN may vary slightly depending on the specific tax return form or software being used. If you have difficulty locating your IP PIN, consult the instructions provided with your tax return documents or seek assistance from a tax professional.

Now that you know how to locate your IP PIN on a tax return, you are well-prepared to file your taxes securely and protect yourself against tax-related identity theft. In the next section, we’ll conclude our discussion and summarize the key points covered in this article.

Step-by-Step Guide to Finding the IP PIN

Locating your IP PIN on your tax return is essential for a smooth and secure filing process. Follow this step-by-step guide to easily find your IP PIN:

- Gather Your Tax Return Documents: Collect all the necessary tax return forms and schedules, such as Form 1040 or Form 1040A, that you used to file your federal taxes.

- Identify the Relevant Section: Look for the section on your tax return where the IP PIN is typically provided. This section is often labeled as “Identity Protection PIN” or may use similar terminology.

- Scan for the Six-Digit Code: Within the identified section, search for a six-digit code. This code is your IP PIN and is unique to your tax return. Take note of this code as you will need it when prompted during the filing process.

- Double-Check for Accuracy: Once you have located your IP PIN, double-check that the six-digit code is accurate. Ensure that you transcribe the code correctly to avoid any errors when entering it on your tax return.

- Securely Store Your IP PIN: After locating your IP PIN and confirming its accuracy, keep it secure and confidential. Treat your IP PIN as sensitive information and store it in a safe place, away from prying eyes or unauthorized individuals.

Remember, the location of the IP PIN may vary slightly depending on the specific tax return form or software you used. If you are unable to find your IP PIN, consult the instructions provided with your tax return documents or seek assistance from a tax professional.

Using the correct IP PIN when filing your taxes is essential to ensure the secure processing of your return and protect yourself against tax-related identity theft. Failure to include or correctly enter your IP PIN may result in delays or rejection of your tax return.

By following this step-by-step guide, you can easily locate your IP PIN on your tax return and confidently complete your tax filing process.

In the next section, we’ll conclude our discussion and summarize the key points covered in this article.

Conclusion

Obtaining an IP PIN, or Identity Protection Personal Identification Number, is an important step in protecting your identity and securing your tax return. This unique six-digit code serves as an additional layer of security to prevent tax-related identity theft and ensure the authenticity of your tax filings.

In this article, we explored the purpose of an IP PIN and discussed its significance in combating fraudulent tax activities. We also delved into the various methods available to obtain an IP PIN, including online, by mail, and in person.

To obtain an IP PIN online, taxpayers can visit the IRS website and create or access their existing account. The online method provides a convenient and efficient way to request and receive an IP PIN, reducing the need for physical paperwork and visits to IRS offices.

For those who prefer a traditional approach, obtaining an IP PIN by mail involves completing the required form and mailing it to the specified IRS address. While this method may take longer, it offers a familiar process for individuals who prefer physical documents.

The in-person option allows taxpayers to schedule an appointment and visit their local IRS office. This method provides personalized assistance and ensures face-to-face interaction with IRS representatives who can guide them through the IP PIN request process.

Once taxpayers have successfully obtained an IP PIN, it’s vital to know where to locate it on their tax return documents. By following a step-by-step guide, individuals can easily find their IP PIN and include it correctly when filing their federal tax returns.

Remember, the IP PIN is a critical security measure that must be kept confidential and used as necessary when prompted by the IRS. It is valid for one calendar year, and a new IP PIN will be issued each subsequent year if eligible.

By understanding the importance of an IP PIN, knowing where to obtain it, and locating it on your tax return, you can confidently secure your tax filings and protect yourself from tax-related identity theft.

As you navigate the world of personal finance, it is crucial to stay informed about the latest developments in tax security and understand the measures you can take to safeguard your financial well-being. Stay proactive, and remember that timely filing and accurate reporting go hand in hand with protecting your sensitive financial information.