Finance

Where To Find AGI On Tax Return 2021

Published: October 28, 2023

Looking for AGI on your 2021 tax return? Find out where to locate it easily with our helpful finance guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding AGI (Adjusted Gross Income)

- Why is AGI important on a tax return?

- Where to find AGI on Tax Return Form 1040

- Where to find AGI on Tax Return Form 1040A

- Where to find AGI on Tax Return Form 1040EZ

- Where to find AGI on Tax Return Form 1040NR

- Where to find AGI if filing a Joint Tax Return

- Additional considerations regarding AGI

- Conclusion

Introduction

Welcome to the world of taxes and finance! Whether you’re a seasoned taxpayer or new to the concept of filing tax returns, it’s important to understand the various terms and sections of your tax forms. One crucial term you’ll come across is AGI, which stands for Adjusted Gross Income.

AGI plays a significant role in determining your tax liability and eligibility for certain deductions and credits. It serves as the foundation upon which many tax calculations are based. Knowing where to find your AGI on your tax return is essential to properly fill out your forms and ensure accurate reporting.

In this article, we will explore the importance of AGI on your tax return and guide you on where to find it on the different tax return forms. Whether you’re completing Form 1040, 1040A, 1040EZ, or 1040NR, we’ve got you covered.

Understanding and locating your AGI correctly will not only save you time and effort but also help you avoid costly mistakes. So, let’s dive in and demystify the world of AGI and tax returns!

Understanding AGI (Adjusted Gross Income)

Before we discuss where to find your AGI on your tax return form, let’s take a moment to understand what AGI actually means. AGI, or Adjusted Gross Income, is a figure calculated from your total income for the year, minus any specific deductions that you are eligible for.

Income sources that contribute to your AGI include wages, salaries, tips, dividends, capital gains, rental income, and many others. However, AGI does not include certain items such as tax-exempt interest, Social Security benefits, and some other types of income.

To arrive at your AGI, you must first calculate your total income, which is the sum of all the taxable income you earned throughout the year. This includes income from your job, interest earned from investments, rental income, and any other taxable income sources.

Once you have determined your total income, you can begin subtracting specific deductions to arrive at your AGI. These deductions are known as above-the-line deductions and include items such as educator expenses, student loan interest, contributions to Health Savings Accounts (HSAs), and self-employment tax deductions.

The final figure you obtain after subtracting the above-the-line deductions is your Adjusted Gross Income (AGI). Your AGI serves as a baseline for many tax calculations, including determining your eligibility for certain tax credits, deductions, and other financial benefits.

Understanding your AGI is crucial as it plays a significant role in determining your tax liability. It affects various aspects of your tax return, such as determining your eligibility for deductions like IRA contributions, medical expenses, and education-related expenses.

Now that you have a better grasp of what AGI is and why it is important, let’s move on to discovering how to find your AGI on different tax return forms.

Why is AGI important on a tax return?

AGI, or Adjusted Gross Income, holds significant importance on a tax return for several reasons. Understanding why AGI matters can help you navigate the complexities of your tax obligations and maximize your financial benefits. Let’s explore why AGI is crucial:

1. Tax Calculation:

AGI serves as the starting point for calculating your federal income tax liability. It determines which tax bracket you fall into and helps establish the percentage of your income that is subject to taxation. The lower your AGI, the lower your tax liability is likely to be.

2. Eligibility for Deductions and Credits:

Many tax deductions and credits have AGI limitations. Your AGI determines whether you qualify for certain deductions such as the student loan interest deduction, tuition and fees deduction, or the medical expense deduction. It also impacts eligibility for tax credits like the Child Tax Credit, Earned Income Tax Credit, and the Lifetime Learning Credit.

3. Filing Status and Standard Deduction:

Your AGI determines your filing status, whether you’re single, married filing jointly, married filing separately, or head of household. Certain filing statuses have different tax rates and eligibility for specific deductions and credits. Additionally, your AGI determines the standard deduction amount you can claim, which reduces your taxable income.

4. Qualification for Retirement Contributions:

AGI affects your eligibility to contribute to various retirement accounts such as an Individual Retirement Account (IRA) or a Roth IRA. Depending on your AGI, you may be able to deduct your contributions to a traditional IRA or contribute to a Roth IRA directly.

5. Financial Aid Eligibility:

For students and parents applying for financial aid, AGI is a key factor. It is used to determine eligibility for need-based scholarships, grants, loans, or work-study programs. A lower AGI can increase your chances of receiving financial aid.

Understanding the importance of AGI on your tax return will help you make informed financial decisions, optimize your tax planning strategies, and ensure accurate reporting. Now that we know why AGI is significant, let’s proceed to find out where to locate your AGI on different tax return forms.

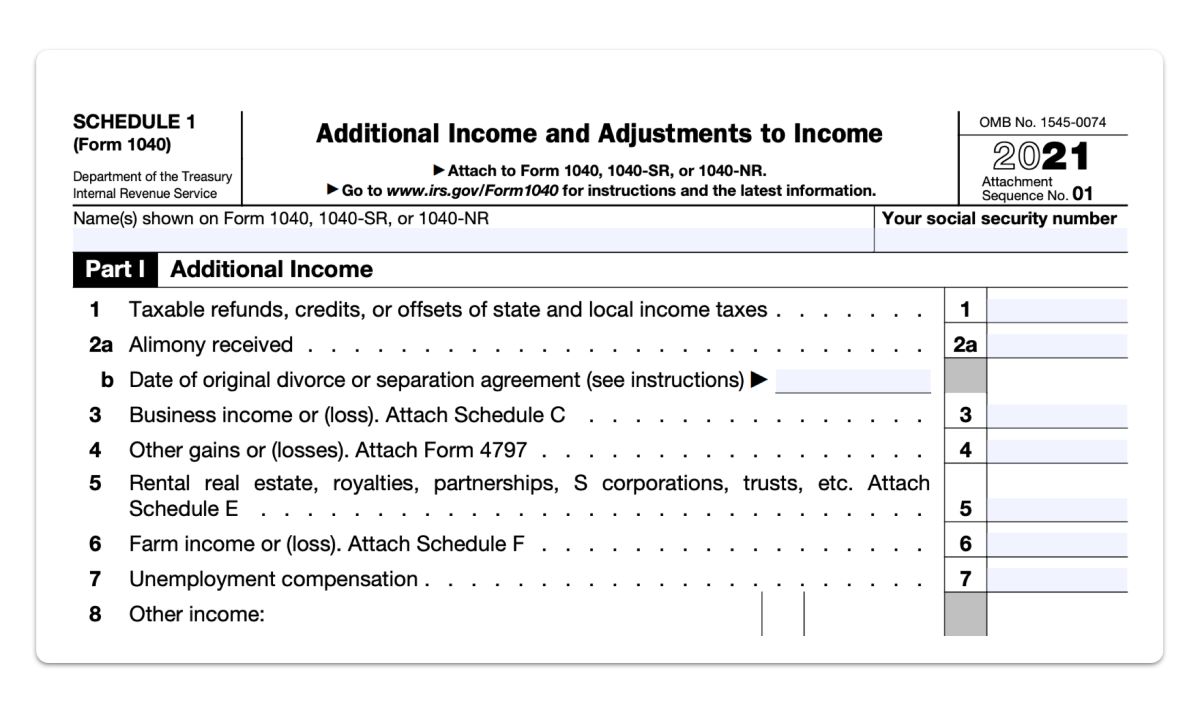

Where to find AGI on Tax Return Form 1040

If you file your tax return using Form 1040, locating your AGI is relatively straightforward. Here are the steps to find your AGI on Form 1040:

- First, locate Line 11 on your Form 1040. This line is labeled “Adjusted Gross Income”.

- Your AGI will be listed on Line 11, corresponding to the applicable tax year.

Form 1040 is the standard tax form for individual taxpayers and allows for more detailed reporting of income, deductions, credits, and adjustments. Make sure to use the correct year’s form, as the location of Line 11 may vary slightly from one year to another.

Now that you know where to find AGI on Form 1040, let’s move on to finding AGI on other tax return forms.

Where to find AGI on Tax Return Form 1040A

If you file your tax return using Form 1040A, you can easily locate your Adjusted Gross Income (AGI) by following these steps:

- Start by finding Line 21 on your Form 1040A. This line is labeled “Adjusted Gross Income.”

- Your AGI will be listed on Line 21, corresponding to the applicable tax year.

Form 1040A is a simplified version of Form 1040, and it is designed for taxpayers who have less complex tax situations. It allows for a limited number of adjustments and deductions, making it easier to complete. As with Form 1040, ensure that you are using the correct year’s form to locate your AGI accurately.

Now that you know where to find AGI on Form 1040A, let’s move on to finding AGI on other tax return forms.

Where to find AGI on Tax Return Form 1040EZ

If you file your tax return using Form 1040EZ, finding your Adjusted Gross Income (AGI) is a simple process. Follow these steps to locate your AGI on Form 1040EZ:

- Begin by looking for Line 4 on your Form 1040EZ. This line is labeled “Adjusted Gross Income.”

- Your AGI will be listed on Line 4, corresponding to the applicable tax year.

Form 1040EZ is the shortest and simplest tax form available, intended for taxpayers with straightforward tax situations. It has limited options for deductions and credits; therefore, it is easier and quicker to complete. As always, ensure that you are using the correct year’s form to find your AGI accurately.

Now that you know where to find AGI on Form 1040EZ, let’s move on to finding AGI on other tax return forms.

Where to find AGI on Tax Return Form 1040NR

If you are a nonresident alien or filing a tax return as a nonresident alien based on the subtitle of the Internal Revenue Code, you will file your tax return using Form 1040NR. To find your Adjusted Gross Income (AGI) on Form 1040NR, follow these steps:

- Locate Line 37 on your Form 1040NR. This line is labeled “Adjusted Gross Income”.

- Your AGI will be listed on Line 37, corresponding to the applicable tax year.

Form 1040NR is specifically designed for nonresident aliens who have U.S. income, deductions, or credits. It is important to note that the line numbers and label descriptions may vary slightly between different versions or years of the form. Therefore, it is crucial to ensure you are using the correct form and year to accurately locate your AGI.

Now that you know where to find AGI on Form 1040NR, let’s move on to finding AGI if you are filing a joint tax return.

Where to find AGI if filing a Joint Tax Return

If you are filing a joint tax return with your spouse, the process of finding your Adjusted Gross Income (AGI) may vary slightly. To locate your AGI when filing a joint tax return, follow these steps:

- Begin by gathering the tax return from the previous year.

- Look for the Adjusted Gross Income (AGI) amount on the jointly filed tax return from the prior year.

- On the current year’s tax return, enter the AGI from the previous year on the designated line. This ensures the accuracy and security of your return.

Filing a joint tax return with your spouse allows you to combine your income, deductions, and credits. By doing so, you may be eligible for various deductions and credits that wouldn’t be available to you if filing separately. It’s important to accurately report the AGI from the previous year to maintain consistency in your tax filings and avoid any discrepancies.

Now that you know how to find AGI if filing a joint tax return, let’s move on to discuss additional considerations regarding AGI.

Additional considerations regarding AGI

While knowing where to find your Adjusted Gross Income (AGI) on your tax return is essential, there are a few additional considerations to keep in mind:

1. Accuracy is Key:

It is crucial to ensure the accuracy of your AGI. Failing to report the correct AGI can result in delayed processing of your return, potential tax penalties, or even a rejected return. Always double-check your figures and refer to the appropriate tax return form for the desired tax year.

2. Identity Protection:

Your AGI serves as an additional layer of protection against identity theft and tax fraud. When e-filing your tax return, including your AGI helps verify your identity to the Internal Revenue Service (IRS) and safeguards your sensitive information.

3. Amending Your Return:

If you need to amend a previously filed tax return, you will require your original AGI. This ensures that your amended return aligns with the previously reported AGI and maintains consistency. Be sure to keep a record of your AGI for each tax year.

4. Using the IRS Retrieval Tool:

If you have difficulty finding your AGI or need to confirm it, you can use the IRS Retrieval Tool. This online tool allows you to electronically access and retrieve your previous year’s AGI to accurately file your current tax return. It simplifies the process and reduces the chances of input errors.

5. State Tax Returns:

While this article primarily focuses on federal tax returns, some states may also require you to report your AGI when filing state tax returns. Check the specific state tax instructions or consult a tax professional to determine the requirements for your state return.

By considering these additional factors, you can ensure the accuracy, security, and smooth processing of your tax return. Always consult the IRS guidelines or seek professional guidance for any specific circumstances or questions regarding your AGI and tax obligations.

With that, we have covered the importance of AGI, where to find it on different tax return forms, and additional considerations to keep in mind. Armed with this knowledge, you can confidently navigate your tax obligations and make informed financial decisions.

Conclusion

Understanding and locating your Adjusted Gross Income (AGI) on your tax return is crucial for accurate reporting and maximizing your financial benefits. AGI serves as the foundation for various tax calculations, eligibility for deductions and credits, and determining your tax liability.

In this article, we explored the importance of AGI on your tax return and provided guidance on where to find it on different tax return forms. From Form 1040 to Form 1040EZ and Form 1040NR, we covered the specific lines where your AGI can be located.

We also highlighted additional considerations to keep in mind, such as the accuracy of your AGI, identity protection, amending your return, utilizing the IRS Retrieval Tool, and potential state tax requirements.

By accurately reporting your AGI, you can optimize your tax planning strategies, qualify for deductions and credits, determine your filing status, and potentially lower your overall tax liability.

Remember, tax laws and forms may change from year to year, so it is essential to refer to the specific tax return form for the correct tax year you are filing. Additionally, consulting with a tax professional or using online resources provided by the IRS can further assist in navigating your tax obligations.

Armed with the knowledge of how to find your AGI, you can approach your tax filing with confidence and ensure compliance with tax laws while maximizing your financial benefits.

Now that you have a solid understanding of AGI and its significance, go forth and conquer your tax returns with ease!