Finance

Where To Report Dividends Paid On Form 1120?

Published: January 3, 2024

If you need to report dividends paid on your Form 1120, find out where to report them and fulfill your finance requirements.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on where to report dividends paid on Form 1120. If you’re a business owner or a tax professional, understanding the reporting requirements for dividends paid is crucial to accurately filing your Form 1120. Dividends paid refer to the distribution of a corporation’s earnings to its shareholders. Whether you’re a C Corporation or an S Corporation, it’s important to correctly report these dividends to ensure compliance with tax regulations.

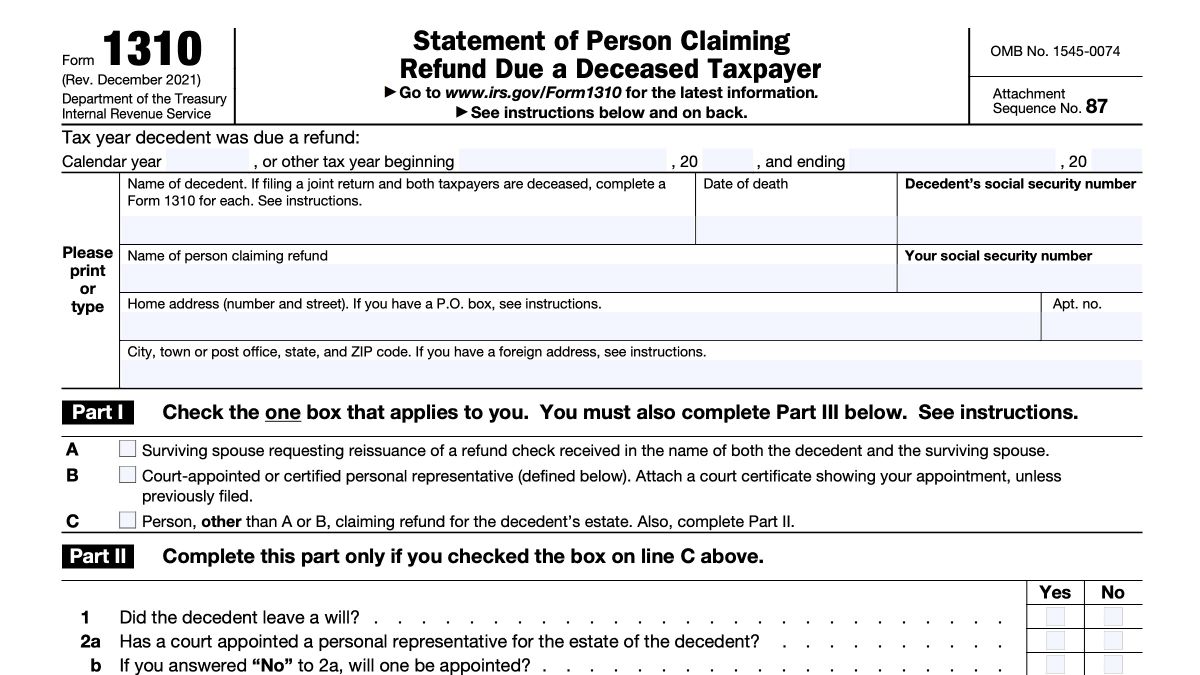

Form 1120, also known as the U.S. Corporation Income Tax Return, is used by corporations to report their income, deductions, and tax liabilities to the Internal Revenue Service (IRS). It is a comprehensive form that requires detailed information about a corporation’s financial activities throughout the year. Reporting dividends paid is a key component of this form, and it is necessary to know the appropriate sections to report this information accurately.

In this article, we will provide an overview of Form 1120 and discuss the specific sections where dividends paid should be reported. We will also touch on additional reporting requirements related to dividends paid. By the end of this guide, you’ll have a clear understanding of how to report dividends paid on Form 1120.

Overview of Form 1120

Form 1120 is the U.S. Corporation Income Tax Return, used by corporations to report their income, deductions, and tax liabilities to the IRS. It is an essential form for every corporation to accurately report their financial activities. The form consists of several schedules that provide detailed information on different aspects of the corporation’s finances.

When filling out Form 1120, it’s important to ensure that all relevant information is included and accurately reported. Failure to do so may result in penalties or inaccuracies in the corporation’s tax liability calculations. Therefore, it is crucial to have a solid understanding of the form’s structure and the specific sections where various financial activities must be reported.

Some of the key sections and schedules of Form 1120 include:

- Schedule A: Provides information on the corporation’s cost of goods sold (COGS) and other deductions related to the production of goods or services.

- Schedule D: Reports the corporation’s capital gains and losses from the sale or exchange of assets.

- Schedule G: Provides information on the corporation’s related entities and transactions with those entities.

- Schedule M-1: Reconciles the corporation’s accounting income with its taxable income as reported on the form.

- Schedule M-2: Reports the corporation’s accumulated earnings and profits (AE&P), which plays a role in determining dividend tax treatment.

- Schedule K: Summarizes the corporation’s income, deductions, and tax liability.

- Schedule K-1: Reports the corporation’s shareholders’ pro-rata shares of income, deductions, and other tax items.

Understanding these schedules and their purpose is vital to accurately report dividends paid on Form 1120. In the next section, we will focus specifically on the schedule and sections relevant to reporting dividends paid.

Reporting Dividends Paid on Form 1120

When it comes to reporting dividends paid on Form 1120, there are specific sections and schedules that you need to be aware of. Properly reporting dividends is crucial to ensure compliance with tax regulations and accurately calculate your corporation’s tax liability. Let’s take a closer look at the key components involved in reporting dividends paid on Form 1120.

Schedule M-2: Schedule M-2, also known as the Analysis of Accumulated Earnings and Profits, is a critical schedule for reporting dividends paid. This schedule provides information on the corporation’s accumulated earnings and profits (AE&P), which is essential in determining the tax treatment of dividends.

Dividends can be classified as either qualified or non-qualified. Qualified dividends are subject to preferential tax rates, while non-qualified dividends are taxed at the ordinary income tax rates. The amount of qualified dividends a corporation can distribute depends on whether it has sufficient AE&P to cover the distribution.

To accurately report dividends paid, you must accurately calculate the corporation’s AE&P and allocate the distribution between qualified and non-qualified dividends. This information is reported on Schedule M-2.

Schedule K: Schedule K, also known as the Summary of Corporation’s Income, Deductions, and Partners’ Share of Income, is another relevant schedule for reporting dividends paid. This schedule summarizes the corporation’s income, deductions, and tax liability for the tax year.

On Schedule K, you will report the total dividends paid during the tax year. This figure should match the allocation of dividends reported on Schedule M-2. It’s important to ensure consistency between these two schedules to avoid errors or discrepancies on your Form 1120.

Schedule K-1: Schedule K-1 is used to report each shareholder’s pro-rata share of the corporation’s income, deductions, credits, and other tax items. Shareholders who receive dividends from the corporation will receive a Schedule K-1 indicating their share of the dividends received.

On Schedule K-1, the shareholder’s share of dividends is reported, including the portion that is considered qualified and non-qualified. This information is derived from the allocations made on Schedules M-2 and K.

Properly reporting dividends paid on both Schedule K and Schedule K-1 ensures that the shareholders receive accurate information about their taxable income and the tax treatment of their dividends.

In addition to these schedules, it’s important to maintain accurate records of dividends paid throughout the year. This includes documenting the dates and amounts of the dividend distributions, as well as the recipients of the dividends.

By understanding and correctly utilizing Schedules M-2, K, and K-1, you can accurately report dividends paid on Form 1120, ensure compliance with tax regulations, and provide shareholders with the necessary information for their individual tax filings.

Schedule M-2

Schedule M-2, the Analysis of Accumulated Earnings and Profits, is a vital schedule on Form 1120 for reporting dividends paid by a corporation. This schedule provides detailed information about the corporation’s accumulated earnings and profits (AE&P), which plays a significant role in determining the tax treatment of dividends.

The purpose of Schedule M-2 is to reconcile the corporation’s AE&P as reported on the balance sheet with the adjustments required for tax purposes. This schedule assists in calculating the portion of the distributed dividends that qualifies for the lower tax rates applicable to qualified dividends.

Here are some key components of Schedule M-2:

- Beginning Balance of AE&P: The schedule begins with the opening balance of AE&P at the start of the tax year. This figure represents the cumulative profits and losses of the corporation from previous years that have not been distributed as dividends.

- Net Income (Loss) Per Books: Next, the net income or loss for the current tax year as per the corporation’s books is reported. This figure reflects the profitability or loss incurred during the reporting period.

- Non-Dividend Distributions: Any non-dividend distributions made during the year are subtracted from the accumulated earnings and profits. Non-dividend distributions include amounts distributed to shareholders that are not classified as dividends, such as return of capital or stock redemptions.

- Other Adjustments: Schedule M-2 also provides space for reporting other adjustments that may be required for tax purposes. These adjustments may include items such as capital contributions, deemed dividends, or adjustments to the AE&P due to changes in accounting methods.

- Ending Balance of AE&P: Finally, the schedule concludes with the ending balance of AE&P after accounting for all the adjustments. This figure represents the updated accumulated earnings and profits of the corporation at the end of the tax year.

To properly report dividends paid, it is essential to accurately calculate the AE&P and allocate the distribution between qualified and non-qualified dividends. Schedule M-2 provides the necessary information for this calculation.

By accurately completing Schedule M-2, you ensure that the correct portion of the distributed dividends qualifies for preferential tax rates if eligible. This is important for both the corporation’s tax liability and the shareholders’ individual tax obligations.

Remember to maintain clear and accurate records of dividend distributions and other adjustments made throughout the year. This will assist in the preparation of Schedule M-2 and provide supporting documentation in case of any inquiries or audits by the IRS.

Understanding and correctly utilizing Schedule M-2 is crucial in accurately reporting dividends paid on Form 1120, complying with tax regulations, and ensuring proper tax treatment of dividends for both the corporation and its shareholders.

Schedule K

Schedule K is an important component of Form 1120 for reporting various aspects of a corporation’s income, deductions, and tax liability. It provides a summary of the corporation’s financial activities for the tax year and serves as a key section for reporting dividends paid.

Here are some essential elements of Schedule K:

- Income and Deductions: Schedule K begins by summarizing the corporation’s income and deductions. This includes revenue from sales, services, and other sources, as well as deductions such as business expenses, depreciation, and interest paid.

- Taxable Income: The schedule calculates the corporation’s taxable income by subtracting the deductions from the total income. This figure serves as the starting point for determining the tax liability.

- Tax Liability: The schedule then calculates the corporation’s federal income tax liability based on the taxable income. This includes incorporating tax credits, alternative minimum tax (AMT), and other relevant factors.

- Dividends Paid: Schedule K provides a specific line item for reporting the total dividends paid by the corporation during the tax year. This figure should match the allocation of dividends reported on Schedule M-2.

- Balance Sheet Analysis: The schedule analyzes changes in the corporation’s balance sheet over the tax year. It considers items such as cash, accounts receivable, inventory, and liabilities. This analysis helps provide a broader financial perspective of the corporation’s operations.

- Tax Payments and Credits: Lastly, Schedule K includes information on the corporation’s tax payments made during the year, as well as any tax credits or overpayments that can be applied to the current or future tax liabilities.

When reporting dividends paid, it is crucial to accurately record and report the total amount on the designated line of Schedule K. This ensures consistency with the allocation of dividends reported on Schedule M-2, which determines the appropriate tax treatment.

Properly completing Schedule K requires attention to detail, accurate calculations, and precise reporting of all income, deductions, and tax liability information. By accurately reporting dividends paid on Schedule K, you provide a comprehensive summary of the corporation’s financial activities while complying with tax regulations.

Remember to maintain supporting documentation and records of dividend distributions, as well as any adjustments made throughout the year. These records will ensure accurate reporting on Schedule K and serve as essential documentation in the event of an IRS review or audit.

By understanding and correctly utilizing Schedule K, you can accurately report dividends paid on Form 1120, maintain compliance with tax regulations, and provide essential information for shareholders and stakeholders.

Schedule K-1

Schedule K-1 is a critical schedule on Form 1120 for reporting each shareholder’s pro-rata share of a corporation’s income, deductions, and other tax items. This schedule provides detailed information to shareholders, allowing them to accurately report their share of the corporation’s financial activities on their individual tax returns.

Here is a breakdown of the key components of Schedule K-1:

- Shareholder Information: Schedule K-1 begins by providing basic information about the shareholder, such as their name, address, and taxpayer identification number.

- Income and Deductions: The schedule reports the shareholder’s pro-rata share of the corporation’s income and deductions. This includes their share of the corporation’s revenue, business expenses, depreciation, interest income, and other taxable items.

- Taxable Income: The schedule calculates the shareholder’s share of the corporation’s taxable income by subtracting their share of the deductions from their share of the income.

- Distributions and Other Tax Items: Schedule K-1 also reports the shareholder’s distributions received from the corporation during the tax year. This includes any dividends paid to the shareholder.

- Tax Credits and Other Adjustments: The schedule provides space for reporting any tax credits and other tax adjustments that are directly attributable to the shareholder.

By accurately filling out Schedule K-1, each shareholder receives the necessary information to accurately report their share of the corporation’s financial activities on their individual tax returns. This includes the reporting of dividends received from the corporation.

For reporting dividends paid, Schedule K-1 includes a specific line item where the shareholder’s share of dividends is reported. This information is derived from the allocations made on Schedule M-2 and Schedule K.

It’s important to ensure consistency between the allocations made on Schedule M-2, the total dividends reported on Schedule K, and the individual shareholder’s share of dividends reported on Schedule K-1. This helps avoid discrepancies and provides accurate information to the shareholders and the IRS.

As a corporation, it is important to provide a correctly prepared Schedule K-1 to each shareholder. The shareholders will use this schedule to accurately report their share of the corporation’s income, deductions, and tax items on their individual tax returns.

Remember to maintain accurate records and documentation for all items reported on Schedule K-1. This will assist in supporting the accuracy of the reported information and provide necessary documentation during IRS reviews or audits.

By understanding and correctly utilizing Schedule K-1, you ensure accurate reporting of each shareholder’s share of the corporation’s financial activities, including dividends paid, on Form 1120.

Other Reporting Requirements for Dividends Paid

While Schedule M-2, Schedule K, and Schedule K-1 are the primary schedules used to report dividends paid on Form 1120, there are additional reporting requirements that businesses need to be aware of. These requirements ensure accurate reporting and compliance with tax regulations. Let’s explore some of the other reporting considerations for dividends paid:

- Form 1099-DIV: In addition to reporting dividends paid on Form 1120, corporations are also required to issue Form 1099-DIV to individual recipients who have received dividends of $10 or more during the tax year. This form provides the recipient with the necessary information to accurately report the dividends received on their personal tax return.

- Dividend Withholding: If the corporation pays dividends to nonresident alien shareholders, there may be dividend withholding requirements. The corporation is responsible for withholding the appropriate amount of tax on these dividends and filing the necessary documentation with the IRS.

- State and Local Reporting: It’s important to consider any additional reporting requirements imposed by state and local tax jurisdictions. Some states have specific forms or schedules to report dividends paid, and corporations must comply with these regulations in addition to the federal requirements.

- Shareholder Documentation: Corporations should provide accurate and timely documentation to shareholders regarding their dividends paid. This includes providing details about the type of dividends received (qualified or non-qualified) and the tax implications. Shareholders rely on this information for their individual tax filings and to determine the appropriate treatment of the dividends.

- Record Keeping: Proper record keeping is essential for dividends paid and all related documentation. Corporations should maintain records of dividend distributions, dates, amounts, and recipient information. These records serve as essential documentation in case of IRS inquiries or audits.

Adhering to these additional reporting requirements ensures accurate reporting of dividends paid and compliance with both federal and state tax regulations. By providing the necessary documentation to shareholders and maintaining proper records, corporations can facilitate smooth tax filings and mitigate any potential issues in the future.

It’s important to consult with a tax professional or advisor to ensure full compliance with all reporting requirements for dividends paid. They can provide guidance tailored to your specific business situation and help navigate any complexities associated with reporting dividends on Form 1120.

Conclusion

Accurately reporting dividends paid on Form 1120 is crucial for business owners and tax professionals. Understanding the specific sections and schedules where dividends should be reported ensures compliance with tax regulations and helps calculate the appropriate tax liabilities. Throughout this guide, we have covered the key aspects of reporting dividends paid on Form 1120, including Schedule M-2, Schedule K, Schedule K-1, and other reporting requirements.

Schedule M-2 provides crucial information about the corporation’s accumulated earnings and profits (AE&P), allowing for the proper calculation and allocation of qualified and non-qualified dividends. This information is essential for determining the tax treatment of the dividends paid. Schedule K summarizes the corporation’s income, deductions, and tax liability, providing a space to report the total dividends paid by the corporation during the tax year. Schedule K-1 ensures that each shareholder receives accurate information about their share of the corporation’s financial activities, including dividends paid. These schedules work together to provide a comprehensive overview of the corporation’s financial transactions and ensure accurate reporting to both the corporation and its shareholders.

Additionally, we discussed other reporting requirements, such as issuing Form 1099-DIV to individual recipients who received dividends, dividend withholding for nonresident alien shareholders, state and local reporting obligations, and the importance of maintaining accurate records and providing necessary documentation to shareholders.

By following these reporting requirements, corporations can avoid penalties, ensure compliance with tax regulations, and provide the necessary information to shareholders for their individual tax filings. It is advised to consult with a tax professional or advisor to ensure accurate reporting and compliance with all applicable regulations.

In conclusion, understanding how to report dividends paid on Form 1120 is essential for any corporation. By accurately completing the relevant schedules, maintaining proper record-keeping, and providing the necessary documentation to shareholders, corporations can fulfill their reporting obligations and navigate the tax landscape with confidence.