Finance

Where Is Dividends On Financial Statements

Published: December 23, 2023

Learn where dividends are reported on financial statements and how they impact the overall financial health of a company. Gain insights into the finance aspect of dividends in this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of finance, where numbers tell a story and financial statements paint a picture of a company’s financial health. As investors and analysts dig deep into these statements, one question that often arises is: where are dividends reflected? Dividends are an important aspect of a company’s financial activities and can have a significant impact on its financial statements.

Dividends, for those unfamiliar with the term, are payments made by a company to its shareholders as a distribution of its profits. These payments are typically made in the form of cash or additional shares of stock. Dividends serve as a reward for investors who have entrusted their capital in the company and can provide a steady stream of income for shareholders.

In this article, we will explore the crucial role that dividends play in a company’s financial statements. We will take a closer look at how dividends are reflected on the income statement, balance sheet, and cash flow statement. Understanding where dividends are shown on these statements is essential for investors and analysts as it provides valuable insights into a company’s financial performance and its ability to generate returns for shareholders.

So, let’s dive into the world of financial statements and uncover the whereabouts of dividends on each statement, revealing their impact on a company’s financial position and cash flow.

Definition of Dividends

Before we delve into the impact of dividends on financial statements, let’s first understand what dividends are. Dividends are essentially a portion of a company’s profits that are distributed to its shareholders. When a company earns a profit, it has a few options for using those earnings. It can reinvest them back into the business for growth, pay off debt, or distribute them to shareholders in the form of dividends.

Dividends can be paid in various ways, depending on the company’s discretion. The most common form of dividends is cash dividends, where shareholders receive a cash payment directly to their accounts. Another form is stock dividends, where additional shares of stock are distributed to shareholders in proportion to their existing holdings.

Dividends are usually paid on a regular basis, such as quarterly, semi-annually, or annually. However, the decision to pay dividends lies with the company’s management and board of directors, who consider various factors, including the company’s financial performance, cash flow, growth opportunities, and the need to retain earnings for future reinvestment.

Dividends are particularly attractive to income-oriented investors who seek a steady stream of income from their investments. They can serve as a reliable source of passive income, especially for retirees or individuals looking for consistent returns on their investments.

It’s important to note that not all companies pay dividends. Start-ups and high-growth companies often reinvest their profits back into the business to fuel further expansion and innovation. While this may result in potentially higher stock prices in the future, it means that shareholders may not receive regular dividend payments in the meantime.

Now that we have a clear understanding of what dividends are, let’s explore how they are reflected on a company’s financial statements and the significance they hold for both the company and its shareholders.

Importance of Dividends on Financial Statements

Dividends play a significant role in a company’s financial statements as they provide insights into the company’s profitability, financial position, and cash flow. Let’s explore the importance of dividends on each of the financial statements:

- Income Statement: Dividends impact the income statement by reducing the company’s net income. When dividends are declared and paid to shareholders, they are categorized as an expense on the income statement, which ultimately reduces the company’s profits. This reduction in net income affects financial ratios and key performance indicators, such as earnings per share (EPS) and return on equity (ROE). Investors and analysts closely monitor these ratios to assess a company’s profitability and determine its ability to generate returns for shareholders.

- Balance Sheet: Dividends also impact the balance sheet, specifically the shareholder’s equity section. When dividends are paid, they reduce the retained earnings, which is a component of shareholder’s equity. Retained earnings represent the accumulated profits of the company that have not been distributed as dividends. A decrease in retained earnings due to dividend payments indicates a reduction in the company’s internal sources of financing. Shareholders also benefit from increased wealth as the dividend payments increase their equity stake in the company.

- Cash Flow Statement: Dividends are an important element in the cash flow statement as they reflect the cash outflow from financing activities. Dividend payments are categorized as cash outflows and are deducted from the company’s cash from operating activities. This highlights the impact of dividends on the company’s cash flow position, which is crucial for assessing its liquidity and ability to meet financial obligations. Investors and analysts may analyze the cash flow statement to gauge the sustainability of dividend payments and evaluate the company’s ability to generate sufficient cash flow to support its dividend policy.

In addition to their impact on financial statements, dividends also carry psychological and investor relations importance. Regular dividend payments can instill confidence in shareholders and attract potential investors who seek a reliable income stream. Dividends are often seen as a sign of a company’s stability, profitability, and commitment to sharing its success with shareholders.

Overall, dividends have a multifaceted impact on a company’s financial statements, reflecting its profitability, equity position, and cash flow. Understanding how dividends are recorded and the implications they have on these statements is crucial for assessing a company’s financial health and evaluating its investment potential.

Dividends on the Income Statement

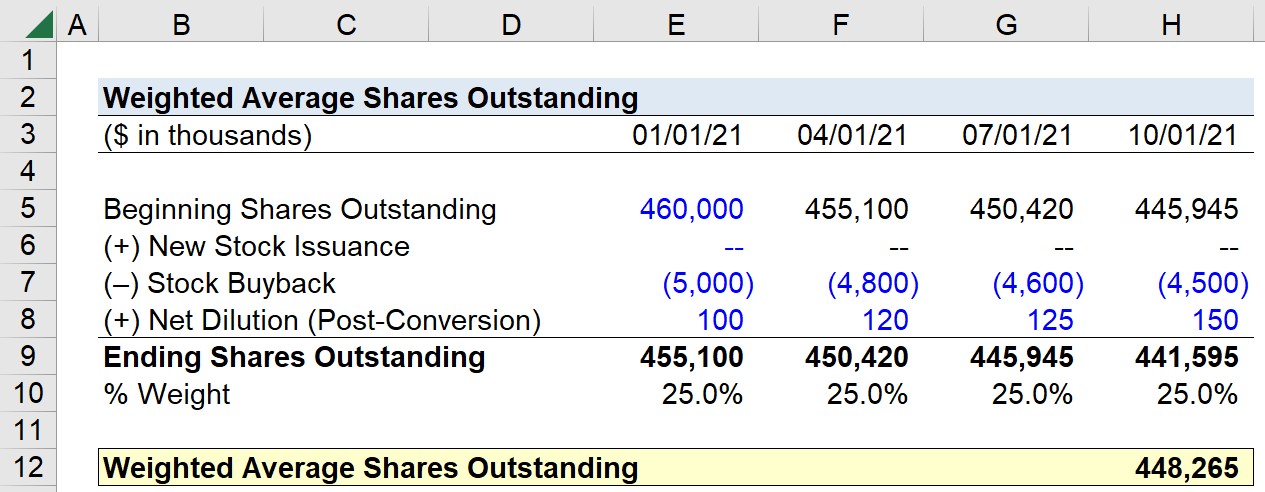

The income statement, also known as the statement of earnings or profit and loss statement, provides a snapshot of a company’s financial performance over a specific period. Dividends have an impact on the income statement, particularly on the company’s net income and earnings per share (EPS) figures. Let’s explore how dividends are reflected on the income statement:

Dividends are treated as an expense on the income statement, specifically under the section of “Dividends” or “Dividends Declared.” When a company declares dividends, the amount of the dividends is deducted from the company’s net income. This deduction reduces the company’s profitability and ultimately lowers its earnings per share.

For example, let’s say a company reported a net income of $1 million for the year. If the company decides to pay $100,000 in dividends to its shareholders, this amount will be subtracted from the net income on the income statement, resulting in a new net income figure of $900,000. Consequently, the earnings per share calculation will also be affected, as the total dividend amount is divided by the number of outstanding shares to determine EPS.

The impact of dividend payments on the income statement is essential for investors and analysts as it provides insights into the company’s profitability after taking into account the distribution of profits to shareholders. It reflects the direct reduction in earnings resulting from the payment of dividends, which can be a crucial consideration for investors who rely on consistent dividend income.

It’s important to note that dividends are not considered an expense in the traditional sense, such as costs incurred to generate revenue. Rather, they are a distribution of profits to shareholders. While they do impact the net income and EPS figures, it’s essential to analyze the company’s overall financial health and profitability by considering other factors, such as revenue, operating expenses, and non-operating income.

By understanding how dividends are reflected on the income statement, investors and analysts can assess a company’s ability to generate profits and sustain dividend payments over time. It provides valuable insights into the company’s financial performance and its commitment to sharing its success with shareholders.

Dividends on the Balance Sheet

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. Dividends play a crucial role in reflecting the distribution of profits to shareholders and the impact on the company’s equity section of the balance sheet. Let’s explore how dividends are reflected on the balance sheet:

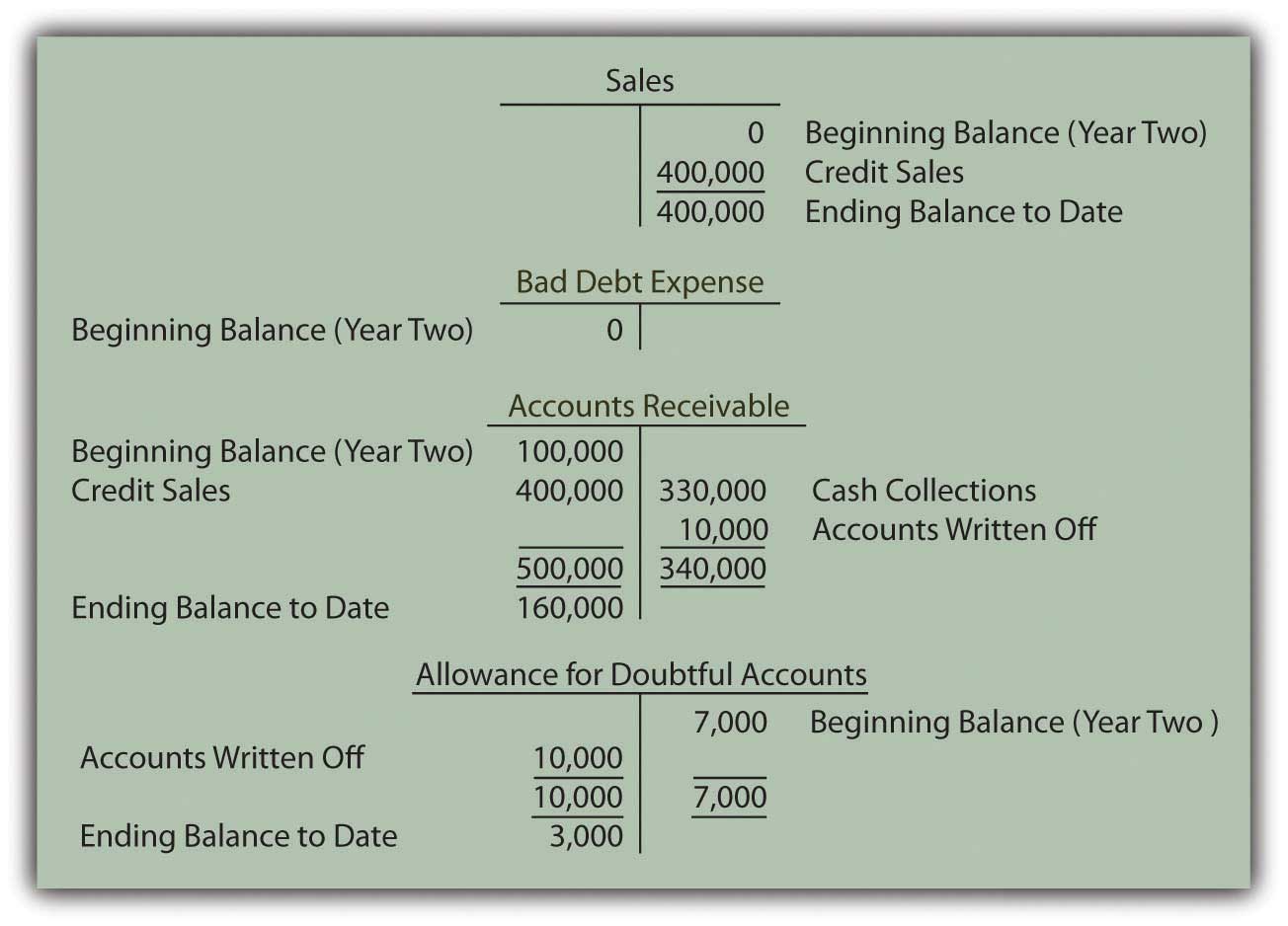

When a company pays dividends to its shareholders, it affects the shareholder’s equity section of the balance sheet, specifically the retained earnings component. Retained earnings represent the accumulated profits that have not been distributed as dividends or reinvested back into the company.

When dividends are declared and paid, the amount of the dividends is deducted from the retained earnings. This reduction in retained earnings reflects the distribution of profits to shareholders and decreases the company’s equity. It is important to note that the decrease in retained earnings due to dividend payments does not impact other components of the balance sheet, such as assets or liabilities.

For example, let’s assume a company has $10 million in retained earnings on its balance sheet. If the company decides to pay $1 million in dividends to shareholders, the amount of $1 million will be subtracted from the retained earnings, resulting in a new balance of $9 million. This reduction reflects the distribution of profits and a decrease in the company’s equity.

The impact of dividends on the balance sheet provides insights into the company’s financial position and changes in its equity over time. It shows how the distribution of profits impacts the company’s internal sources of financing and the shareholders’ stake in the company.

It’s important to note that dividend payments are not shown separately on the liability side of the balance sheet. They are reflected indirectly through the reduction in retained earnings, which is a component of the shareholder’s equity section. This method provides a clear representation of the distribution of profits and its impact on the overall balance sheet equation.

By analyzing the balance sheet and understanding how dividends are reflected, investors and analysts can assess the company’s distribution policy, the impact on its financial position, and the ability to generate returns for shareholders. It provides valuable insights into the relationship between profitability, retained earnings, and shareholder equity.

Impact of Dividends on Cash Flow Statement

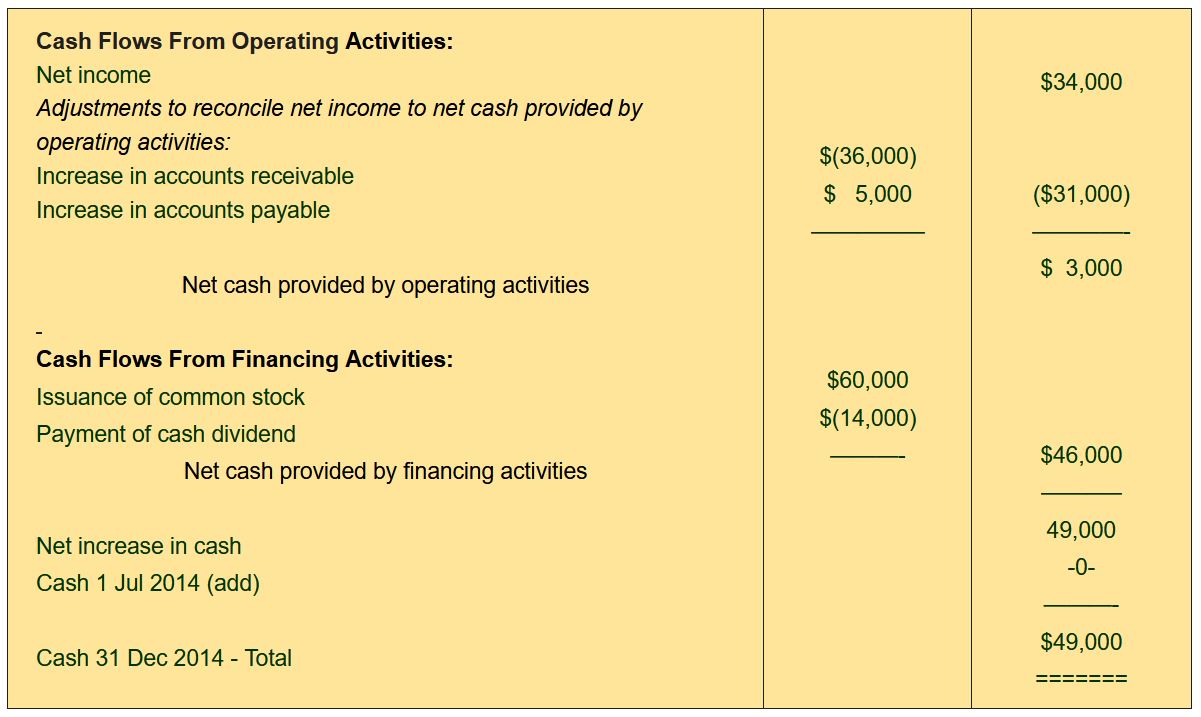

The cash flow statement provides a detailed overview of a company’s cash inflows and outflows over a specific period and is divided into three sections: operating activities, investing activities, and financing activities. Dividends have a specific impact on the financing activities section of the cash flow statement. Let’s explore how dividends are reflected in this section:

Dividend payments are considered cash outflows and are categorized under the financing activities section of the cash flow statement. This section highlights the company’s cash flow activities related to financing sources, including raising capital, repaying debts, and paying dividends to shareholders.

When a company pays dividends, the amount of the dividends is deducted from the total cash provided by operating activities. This deduction reflects the cash outflow resulting from the distribution of profits to shareholders. The payment of dividends reduces the company’s cash reserves, which is important to consider when assessing its liquidity and ability to meet financial obligations.

For example, if a company generates $5 million in cash from operating activities during a specific period and pays $1 million in dividends to shareholders, the cash flow statement will reflect a cash outflow of $1 million under the financing activities section. This reduction in cash reserves due to dividend payments is important for investors and analysts to evaluate the company’s cash flow position and its ability to sustain dividend payments over time.

It’s worth noting that dividend payouts can vary from period to period. Companies may decide to increase, decrease, or even suspend dividend payments based on various factors, including financial performance, cash flow position, and growth opportunities. Analyzing the cash flow statement helps investors and analysts track the sustainability of dividend payments and assess the company’s ability to generate sufficient cash flow for future dividend distributions.

By understanding the impact of dividends on the cash flow statement, investors can gain insights into the company’s capital allocation decisions and evaluate its ability to generate sufficient cash flow to support dividend payments while also meeting its other financial obligations. It provides a comprehensive view of the company’s financial health and its commitment to providing returns to shareholders.

Conclusion

Dividends are a key aspect of a company’s financial activities and play a vital role in its financial statements. Understanding where dividends are reflected on the income statement, balance sheet, and cash flow statement is crucial for investors and analysts to assess a company’s performance, profitability, and ability to generate returns for shareholders.

On the income statement, dividends are treated as an expense, reducing the company’s net income and earnings per share. This impacts profitability and provides insights into the distribution of profits to shareholders.

On the balance sheet, dividends decrease retained earnings, reflecting the distribution of profits and impacting the company’s equity. This reveals the relationship between profitability, retained earnings, and shareholder equity.

On the cash flow statement, dividends are categorized as cash outflows under the financing activities section. This reflects the impact of dividend payments on the company’s cash reserves and liquidity.

Dividends not only have a tangible impact on financial statements but also have psychological and investor relations significance. Regular dividend payments can instill confidence in shareholders and attract potential investors seeking a reliable income stream.

Investors and analysts should carefully analyze a company’s financial statements to understand the implications of dividend payments. This includes evaluating the company’s profitability, financial position, cash flow, and its ability to sustain dividend distributions over time.

In conclusion, dividends are an integral part of a company’s financial statements and provide valuable insights into the company’s financial health, profitability, and commitment to sharing its success with shareholders. By understanding the impact of dividends on financial statements, investors can make informed decisions and assess the company’s ability to generate returns and provide a steady stream of income to its shareholders.