Finance

Where To Send Tax Return 2015

Published: November 2, 2023

Discover where to send your tax return for the year 2015 in this comprehensive finance guide. Maximize your tax savings with expert advice and step-by-step instructions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

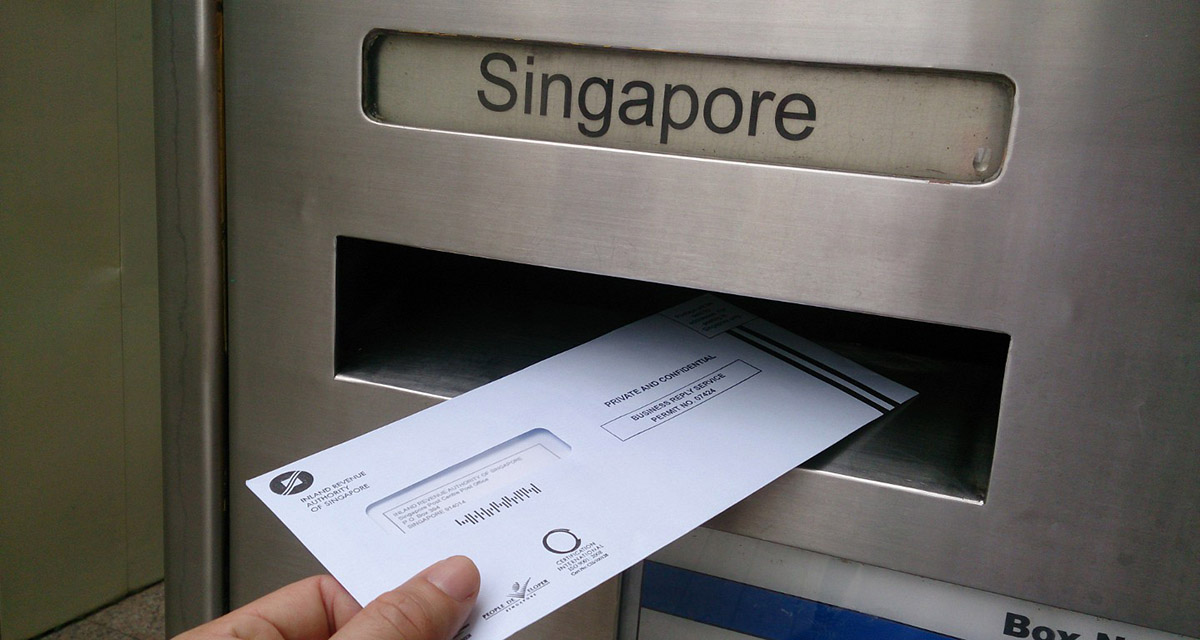

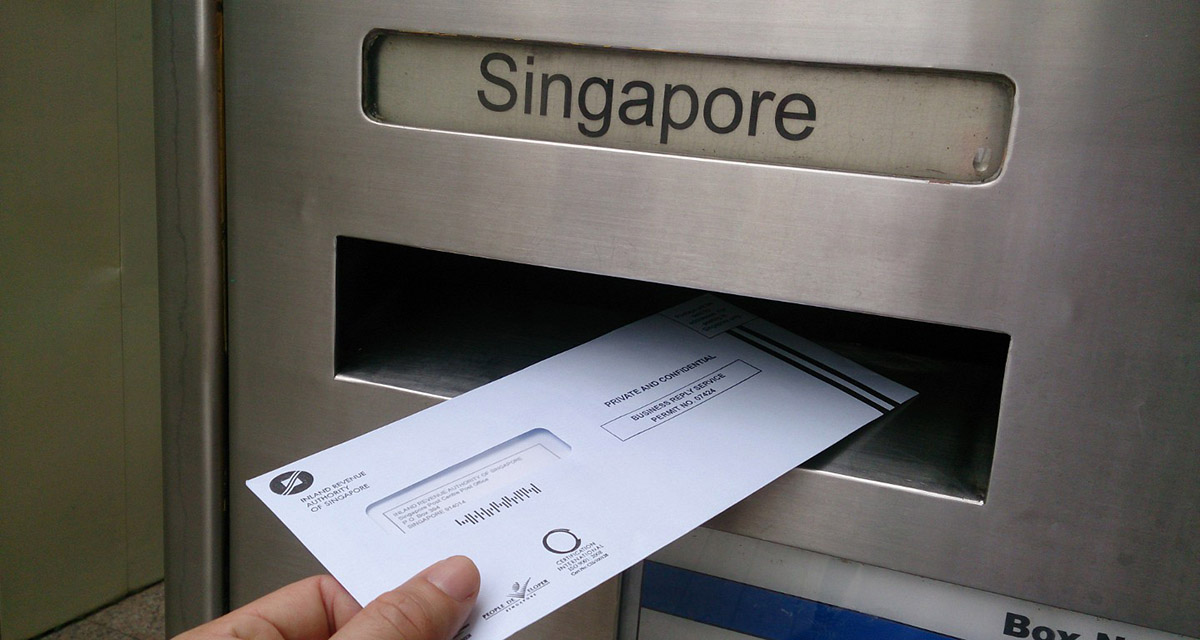

Welcome to our comprehensive guide on where to send your tax return for the year 2015. Filing your taxes can sometimes be a daunting task, but knowing exactly where to send your tax return can make the process a little bit easier. Whether you’re filing your federal tax return or your state tax return, it’s important to ensure that you send it to the correct address. This article will provide you with all the information you need to successfully file your tax returns for the year 2015.

Filing your tax return is an important part of your financial responsibilities. It allows you to report your income, claim deductions, and potentially receive a refund if you overpaid throughout the year. However, if you send your tax return to the wrong address, it may cause delays in processing and could even result in penalties or fees. That’s why it’s crucial to know exactly where to send your tax return.

In this guide, we will cover not only where to send your federal tax return, but also where to send your state tax return, as requirements may vary depending on your location. We will also discuss specific situations that may require you to send your tax return to a different address. By the end of this article, you will have a clear understanding of where to send your tax return for the year 2015, ensuring a smooth and efficient filing process.

Before we dive into the specifics, it’s important to note that the information provided in this article is based on the tax regulations for the year 2015. It’s always a good idea to double-check with the IRS or your state’s tax authority for the most up-to-date information. With that said, let’s get started by understanding the tax return process for 2015.

Understanding the Tax Return Process for 2015

Before we delve into where to send your tax return for 2015, let’s take a moment to understand the tax return process for that year. By familiarizing yourself with the key aspects of filing your tax return, you’ll be better equipped to navigate the process effectively.

In 2015, the tax return deadline for most individuals was April 15th. This means that you had until April 15th of the following year, 2016, to file your tax return for the 2015 tax year. However, if April 15th fell on a weekend or a holiday, the deadline was extended to the next business day.

When preparing your tax return for 2015, it’s important to gather all the necessary documents and information. This includes your W-2 forms, which reflect your income, as well as any 1099 forms for self-employed individuals or those with additional sources of income.

If you had expenses that qualify for deductions, such as mortgage interest or charitable contributions, ensure that you have the appropriate documentation to support these deductions. Keeping organized records will make the tax filing process smoother and help you maximize your deductions.

When filling out your tax return, you may choose to do so manually using paper forms or by using tax software. The IRS provides free electronic filing options for those with a certain income threshold, making e-filing a popular and convenient choice.

Remember that accurately reporting your income and deductions is essential to avoid potential audits or penalties. Take the time to double-check your return for accuracy and consider consulting with a tax professional if you have complex tax situations or uncertainties.

Now that we have a better understanding of the tax return process for 2015, let’s move on to the next section, which covers where to file your federal tax return.

Where to File Your Federal Tax Return

When it comes to filing your federal tax return for the year 2015, the address you need to send it to will depend on several factors, including your state of residence and whether you are enclosing a payment with your return. The address to which you should send your federal tax return can typically be found in the instructions provided by the Internal Revenue Service (IRS).

For most individuals, the mailing address for federal tax returns for the year 2015 is specific to their state of residence. However, there are a few exceptions. If you are a resident of either Florida, Louisiana, Mississippi, or Texas, your tax return should be sent to a different address due to a processing change. The instructions provided by the IRS will provide you with the correct address based on your state of residence.

It’s important to note that if you are enclosing a payment with your federal tax return, you should send it to a separate address specifically designated for tax payments. This address can also be found in the IRS instructions.

If you are using a commercial delivery service instead of the postal service to send your federal tax return, there may be different addresses and rules that apply. Again, it’s crucial to refer to the instructions provided by the IRS for the most accurate and up-to-date information.

Remember, it’s always a good practice to make a copy of your tax return before sending it, regardless of whether you file electronically or by mail. This helps ensure that you have a record of what you submitted and can be valuable in case of any discrepancies or inquiries.

Now that you have a better understanding of where to send your federal tax return for the year 2015, let’s move on to the next section, which will cover where to file your state tax return.

Where to File Your State Tax Return

Filing your state tax return for the year 2015 requires sending it to the appropriate state tax authority. The specific address to which you should send your state tax return can vary depending on the state in which you reside.

To determine the correct address, you can typically visit your state’s official tax website or consult the instructions provided by your state’s tax authority. These resources will provide you with the necessary information, including the mailing address and any specific instructions for sending your state tax return.

It’s essential to note that each state has its own tax laws and regulations, including the requirements for filing your tax return. Some states may require you to file your state tax return electronically, while others may accept both electronic and paper filings. Reviewing the instructions provided by your state’s tax authority will ensure that you understand the proper filing method and where to send your state tax return.

In addition to the address for regular state tax returns, some states may have separate addresses for specific types of tax returns or related documents. For example, if you are making a payment with your state tax return or if you need to amend a previously filed return, there may be different addresses for these specific situations. Checking the instructions or contacting your state’s tax authority directly can help clarify any uncertainties.

As with your federal tax return, it’s recommended to keep copies of your state tax return and any accompanying documents for your records. This includes any payment confirmations or receipts that may be required for future reference or inquiries.

Now that you have a better understanding of where to send your state tax return for the year 2015, let’s move on to the next section, where we will discuss where to file tax returns for specific situations.

Where to File Tax Returns for Specific Situations

While most individuals will follow the general instructions for filing their tax returns, there are specific situations that may require you to send your tax return to a different address. Here are some common scenarios and the corresponding instructions for where to file your tax return:

Amended Tax Returns:

If you need to file an amended tax return for the year 2015, you should send it to a different address than your original tax return. The correct address for filing an amended tax return can typically be found in the instructions provided by the IRS or your state’s tax authority. Make sure to clearly mark the envelope as “Amended Return” to ensure it’s processed accordingly.

Business Tax Returns:

Business tax returns, such as those filed by partnerships, corporations, or self-employed individuals, often have separate filing addresses. These addresses are typically designated based on the type of business entity and location. Check the specific instructions provided by the IRS or your state’s tax authority to find the correct address for filing business tax returns for the year 2015.

Overseas Filers:

If you are a U.S. citizen or resident living abroad and need to file your tax return for the year 2015, you may have different filing requirements. The address for overseas filers can vary depending on your location and whether you are using the regular mail or a private delivery service. The IRS provides specific instructions for overseas filers, including the correct address to which you should send your tax return.

Military Personnel:

Military personnel serving in combat zones or on duty outside of the United States may have different filing rules and filing addresses. The IRS provides specific instructions for military personnel, including the designated address for filing tax returns for the year 2015. Ensure you follow the instructions provided by the IRS to correctly file your tax return as a military service member.

It’s important to note that these specific situations are just a few examples, and there may be other unique circumstances that require a different filing address. Always refer to the instructions provided by the IRS or your state’s tax authority for accurate and up-to-date information based on your particular situation.

With the information provided in this section, you now have a better understanding of where to file your tax return for specific situations. In the next section, we will conclude our guide and summarize the key points discussed throughout the article.

Conclusion

Filing your tax return for the year 2015 involves understanding the correct address to which you should send your federal and state tax returns. By following the instructions provided by the Internal Revenue Service (IRS) and your state’s tax authority, you can ensure that your tax returns are filed correctly and processed in a timely manner.

Throughout this guide, we have covered the important aspects of filing your tax return for the year 2015. We discussed the tax return process, highlighted the specific addresses for sending your federal tax return, and provided guidance on where to send your state tax return.

It’s crucial to gather all the necessary documentation and accurately report your income and deductions when filling out your tax return. Double-checking your return for accuracy and consulting with a tax professional when needed can help avoid any potential issues or penalties.

Additionally, there may be specific situations, such as filing amended tax returns, business tax returns, or addressing special circumstances like overseas filers and military personnel. Understanding the unique filing requirements and addresses for these situations is essential to ensure compliance with tax regulations.

Remember, the specific addresses and filing instructions may change over time, so it’s important to always refer to the most up-to-date instructions provided by the IRS or your state’s tax authority.

By following the guidelines and instructions outlined in this article, you can navigate the tax return filing process for the year 2015 with confidence. Having a clear understanding of where to send your tax returns will help you meet your financial responsibilities and avoid unnecessary delays or penalties.

Now that you have the knowledge and resources at your disposal, it’s time to gather your documents, complete your tax return, and send it to the correct address. Good luck with your tax filing, and may your financial journey be smooth and successful!