Home>Finance>Which Futures Contracts Are Most Actively Traded?

Finance

Which Futures Contracts Are Most Actively Traded?

Modified: February 21, 2024

Discover the most actively traded futures contracts in the world of finance, providing insights into the dynamic nature of the financial markets.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Futures contracts are an integral part of the global financial markets, allowing traders to speculate on the future price movements of various assets. These contracts are standardized agreements to buy or sell a particular asset at a predetermined price and date in the future. While there are a wide range of futures contracts available, not all of them are traded at the same level of activity. Some contracts are highly liquid and actively traded, while others may have lower trading volumes.

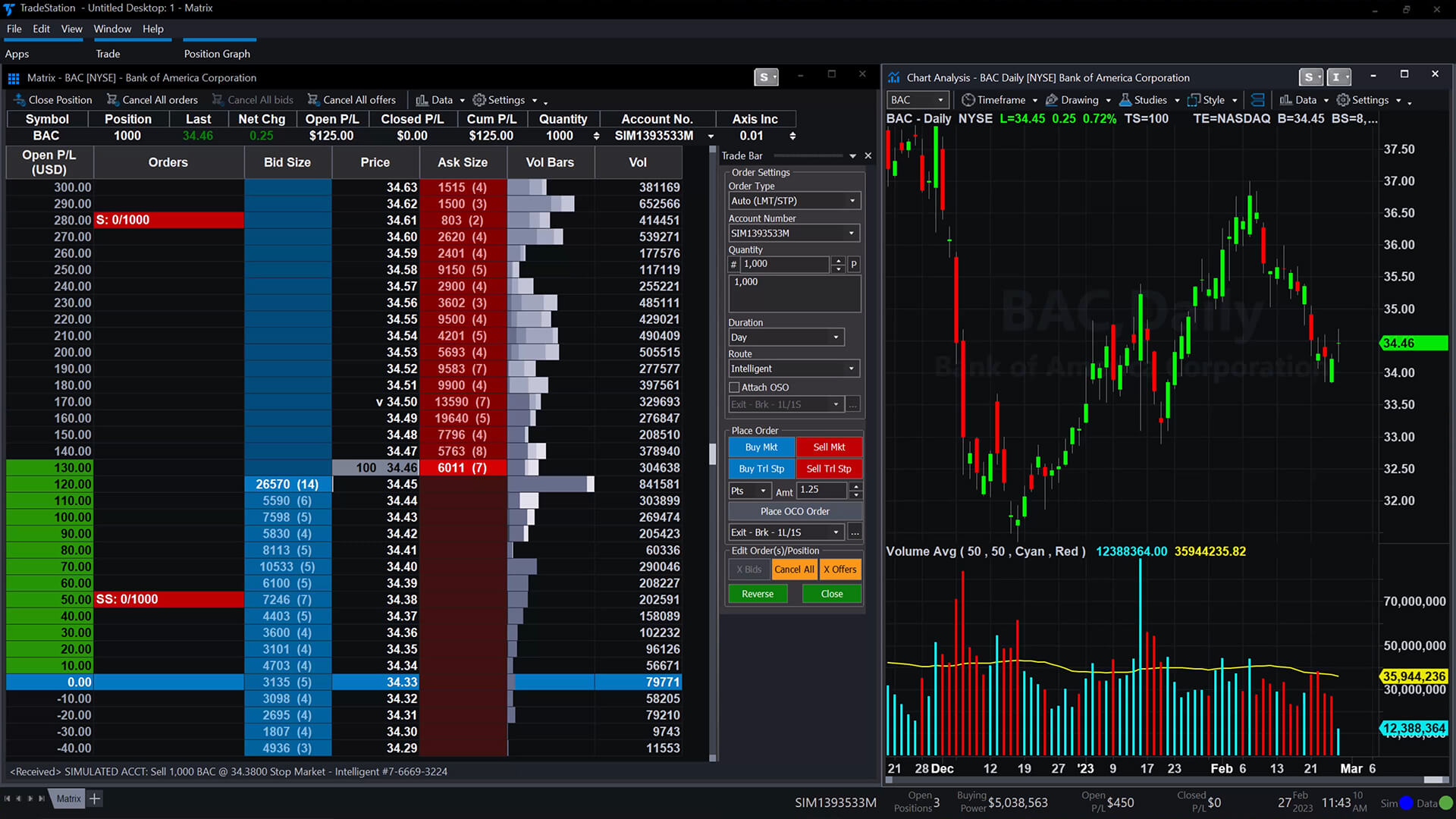

Understanding which futures contracts are most actively traded is crucial for investors and traders. Actively traded contracts provide several advantages, including tighter bid-ask spreads, increased liquidity, and more opportunities for entering and exiting positions. Additionally, higher trading activity usually indicates a greater level of participation and interest from market participants, which can lead to more accurate price discovery.

The level of trading activity in futures contracts is influenced by various factors. These include the popularity of the underlying asset, overall market conditions, global economic factors, and the trading strategies of market participants. Additionally, the trading activity may vary across different exchanges and regions. Therefore, it’s important to analyze the most actively traded futures contracts in order to make informed investment decisions.

In this article, we will explore the factors that determine the trading activity of futures contracts and identify some of the most actively traded contracts in the financial markets. By gaining insights into these contracts, you can better navigate the world of futures trading and potentially capitalize on the opportunities they present.

Definition of Futures Contracts

Futures contracts are financial instruments that represent an agreement between two parties to buy or sell an underlying asset at a specified price on a predetermined date in the future. These contracts are standardized and trade on specialized exchanges known as futures exchanges. The underlying assets can include commodities such as oil, gold, or wheat, financial instruments like stock indices or currencies, or even specific events like the outcome of elections.

The key characteristic of futures contracts is that they are binding agreements that must be fulfilled at the agreed-upon time and price. They are legally enforceable, which means both parties are obligated to meet their contractual obligations. This makes futures contracts different from options contracts, where the buyer has the right, but not the obligation, to buy or sell the underlying asset.

Futures contracts have specific features that distinguish them from other financial instruments. Firstly, they have standardized terms, including the size of the contract (known as the contract size or contract multiplier), the price increment (known as the tick size), and the delivery date (known as the expiration date or delivery month). These standards help facilitate liquidity and make trading more efficient.

Secondly, futures contracts are marked-to-market. This means that the value of the contract is reassessed daily based on the prevailing market prices. Profits and losses are settled on a daily basis, ensuring transparency and reducing counterparty risk.

Lastly, futures contracts offer leverage. Traders are required to put up a margin, which is a fraction of the total value of the contract, to initiate and maintain a position. This allows investors to control a larger position than their initial investment, amplifying both potential gains and losses.

Futures contracts serve various purposes for market participants. Hedgers, such as farmers or manufacturers, use futures contracts to mitigate the risk of price fluctuations by locking in prices for their commodities or inputs in advance. Speculators, on the other hand, aim to profit from price movements by buying or selling futures contracts without the intention of taking physical delivery of the underlying asset. The combination of hedgers and speculators creates market liquidity and allows for efficient price discovery.

Importance of Actively Traded Futures Contracts

Actively traded futures contracts play a pivotal role in the global financial markets. They provide a range of benefits and opportunities for investors, traders, and the overall market ecosystem. Here are the key reasons why actively traded futures contracts are important:

Liquidity:

One of the primary advantages of actively traded futures contracts is the high level of liquidity they offer. Liquidity refers to the ease with which an asset can be bought or sold without significantly impacting its price. Actively traded contracts typically have a large number of buyers and sellers, resulting in tighter bid-ask spreads and efficient price discovery. This allows market participants to enter and exit positions at desired prices with minimal slippage, decreasing transaction costs and increasing overall market efficiency.

Price Discovery:

Actively traded futures contracts contribute to the process of price discovery in the underlying assets. The continuous buying and selling activity provides a wealth of information about market sentiment and supply and demand dynamics. Traders and investors closely monitor the price movements and trading volumes of actively traded contracts to gauge market trends and make informed decisions. Accurate price discovery is essential for fair and transparent markets.

Risk Management:

Actively traded futures contracts are vital tools for managing and hedging risks. Hedgers, such as producers or manufacturers of the underlying asset, can use futures contracts to lock in prices and protect themselves from adverse price movements. By entering into futures contracts, they can ensure a predictable cost for their inputs or secure a selling price for their outputs. This risk management function helps stabilize prices and promotes stability in the overall economy.

Portfolio Diversification:

Actively traded futures contracts provide investors with the opportunity to diversify their portfolios. By adding futures contracts to their investment mix, investors can gain exposure to different asset classes, including commodities, currencies, and stock indices. This diversification can help reduce the overall risk of the portfolio and potentially enhance returns. Moreover, futures contracts can be used to hedge against specific risks, adding an additional layer of protection to an investor’s overall holdings.

Trading Opportunities:

Actively traded futures contracts offer a plethora of trading opportunities for speculators. Traders can take advantage of price volatility in the underlying asset and profit from both upward and downward price movements. The high liquidity and constant market activity in actively traded contracts enable traders to execute their trades quickly and efficiently, optimizing their potential returns.

Overall, actively traded futures contracts are essential for market participants, as they provide liquidity, contribute to price discovery, offer risk management tools, facilitate portfolio diversification, and present a wide range of trading opportunities. By understanding and utilizing these contracts effectively, investors and traders can navigate the financial markets with confidence and enhance their investment strategies.

Factors that Determine Trading Activity

The level of trading activity in futures contracts is influenced by various factors that shape market conditions and participant behavior. Understanding these factors can provide insights into why certain futures contracts are more actively traded than others. Here are the key factors that determine trading activity:

Popularity of the Underlying Asset:

The popularity and demand for the underlying asset significantly impact the trading activity of futures contracts. Assets such as crude oil, gold, or major stock indices tend to attract a large number of investors and traders, resulting in high trading volumes. The more widely an asset is traded and followed by market participants, the more likely it is to have actively traded futures contracts related to it.

Market Volatility:

Volatility in the asset’s price encourages trading activity in futures contracts. Higher volatility presents trading opportunities for speculators who aim to profit from price swings. Traders are more likely to be active in contracts with significant price movements as there is greater potential for profits. As a result, futures contracts tied to volatile assets experience higher trading activity.

Global Economic Factors:

Macroeconomic factors such as interest rates, inflation, and geopolitical events can influence trading activity in futures contracts. Economic news and events can impact market sentiment and drive participants to adjust their positions. For example, announcements about central bank policies or major economic indicators can trigger increased trading activity in futures contracts tied to currencies or interest rates.

Market Perception and Sentiment:

Market participants’ perception of future price movements and overall sentiment towards a particular asset can significantly affect trading activity. Positive market sentiment can lead to increased buying interest, while negative sentiment can drive more selling activity. Traders closely monitor market sentiment and adjust their positions accordingly, contributing to higher trading volumes in contracts related to the asset under scrutiny.

Expiration and Roll-over Dates:

Trading activity in futures contracts tends to increase as the expiration date approaches. Traders who do not wish to take physical delivery of the underlying asset often close their positions before expiration to avoid associated costs and logistical challenges. Additionally, roll-over dates, where traders shift their positions to the next contract period, can also lead to increased trading activity as positions are transferred from one contract to another.

Exchange and Regulatory Factors:

Different exchanges may have unique trading rules or listing requirements, which can affect the trading activity of futures contracts. Regulatory factors, such as margin requirements or position limits, also influence participants’ willingness to trade specific contracts. Furthermore, the reputation and accessibility of an exchange can impact trading activity, as market participants prefer to trade on reputable and easily accessible platforms.

These factors collectively contribute to the trading activity in futures contracts. It’s important to note that trading activity can vary across different contracts and markets, so understanding the underlying factors that drive trading activity is essential for investors and traders seeking to identify the most actively traded contracts.

Most Actively Traded Futures Contracts

Several futures contracts stand out as the most actively traded in the global financial markets. These contracts attract substantial trading volumes and provide ample trading opportunities for market participants. Here are some of the most actively traded futures contracts:

S&P 500 E-Mini:

The S&P 500 E-Mini futures contract is based on the S&P 500 stock index, which represents the performance of 500 large-cap U.S. companies. It is one of the most actively traded futures contracts globally. Traders and investors actively trade this contract to speculate on the direction of the U.S. stock market as a whole.

Eurodollar:

The Eurodollar futures contract represents the interest rate on U.S. dollar-denominated deposits held in banks outside the United States. It is a popular contract among traders looking to manage interest rate risk or speculate on changes in short-term interest rates. Its liquidity makes it one of the most actively traded interest rate futures contracts.

WTI Crude Oil:

The WTI (West Texas Intermediate) crude oil futures contract tracks the price of light, sweet crude oil delivered to the U.S. It is widely considered to be the global benchmark for oil prices. With oil being a vital commodity in global trade, the WTI crude oil futures contract attracts significant trading activity from speculators, hedgers, and institutional investors.

Gold:

The gold futures contract allows market participants to speculate on the price of gold, a traditional safe-haven asset and a store of value. Gold futures contracts are actively traded due to the metal’s popularity as a hedge against inflation and geopolitical uncertainty. The contract volume often rises during times of economic instability or when there are significant swings in global financial markets.

US Treasury Bonds:

The futures contracts tied to U.S. Treasury Bonds, such as the 10-year or 30-year bond, are heavily traded. These contracts enable market participants to manage interest rate risk or bet on changes in bond yield prices. Given the importance of U.S. Treasury Bonds in global financial markets as a safe-haven investment, the trading activity in these futures contracts remains consistently high.

Currency Futures:

Currency futures contracts, such as the Euro, Japanese Yen, or British Pound, are actively traded in the foreign exchange market. These contracts allow traders and investors to speculate on the future exchange rates between various currencies. The currency futures market experiences high trading activity due to its liquidity and the constant flow of global currency transactions.

While these contracts are among the most actively traded, it’s important to note that trading activity can vary over time depending on market conditions and investor sentiment. It’s crucial for market participants to stay updated on changes in trading volumes and adapt their strategies accordingly.

Conclusion

Actively traded futures contracts play a crucial role in the global financial markets, offering numerous benefits and opportunities for investors, traders, and hedgers alike. These contracts provide liquidity, contribute to price discovery, and facilitate risk management and portfolio diversification. By understanding the factors that determine trading activity and identifying the most actively traded futures contracts, market participants can make more informed investment decisions.

Popularity of the underlying asset, market volatility, global economic factors, market perception, expiration dates, and exchange/regulatory factors all influence the trading activity in futures contracts. By analyzing these factors, investors can gain insights into the level of participation and liquidity within a contract.

Some of the most actively traded futures contracts include the S&P 500 E-Mini, Eurodollar, WTI Crude Oil, Gold, US Treasury Bonds, and Currency Futures. These contracts attract significant trading volumes due to their popularity, volatility, and importance in global financial markets.

It is important for market participants to stay informed about current market conditions and adapt their strategies accordingly. By keeping track of trading activity, analyzing market trends, and monitoring key factors that drive liquidity and price discovery, investors can take advantage of the opportunities presented by actively traded futures contracts.

In conclusion, actively traded futures contracts provide a valuable avenue for market participants to engage in trading, price discovery, and risk management. Understanding the dynamics that influence trading activity and staying updated on the most actively traded contracts can help investors and traders navigate the financial markets with confidence and achieve their investment objectives.