Finance

How To Trade Futures Contracts

Modified: February 21, 2024

Learn how to trade futures contracts in the finance industry. Increase your knowledge and make informed decisions for profitable trading.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What are Futures Contracts

- Advantages of Trading Futures Contracts

- Understanding Futures Exchanges

- Types of Futures Contracts

- How to Choose a Futures Broker

- Setting Up a Futures Trading Account

- Fundamental Analysis for Futures Trading

- Technical Analysis for Futures Trading

- Developing a Futures Trading Strategy

- Placing Trades and Managing Positions

- Risk Management in Futures Trading

- Common Mistakes to Avoid in Futures Trading

- Monitoring and Exiting Futures Trades

- Conclusion

Introduction

Welcome to the world of futures trading! Whether you’re a seasoned investor or just starting out, understanding how to trade futures contracts can open up new opportunities in the financial markets. Futures trading provides a way for individuals and businesses to speculate on the future price of various assets, from commodities such as oil and gold to financial instruments like stock indices and interest rates.

In this comprehensive guide, we will delve into the intricacies of futures trading, from the basics of what futures contracts are to the strategies and risk management techniques that can help you succeed in this dynamic market. We will examine the advantages of trading futures contracts, the different types of contracts available, and how to choose a futures broker. We’ll also explore the essential tools and techniques for analyzing the futures markets and developing effective trading strategies.

Understanding the mechanics of futures exchanges is vital for anyone looking to trade futures contracts. We will explain how futures exchanges operate and how contracts are standardized to ensure transparency and liquidity in the market. Additionally, we’ll cover the process of setting up a futures trading account and discuss the key factors to consider when selecting a futures broker that suits your trading needs.

Once you have a solid foundation in the basics, we’ll dive into the world of fundamental and technical analysis for futures trading. Fundamental analysis involves evaluating supply and demand factors, geopolitical events, and economic data to forecast future price movements. On the other hand, technical analysis utilizes various chart patterns, indicators, and trend analysis to identify potential trading opportunities.

Developing a robust and effective futures trading strategy is crucial for achieving consistent profitability. We’ll guide you through the process of formulating a trading plan that aligns with your risk appetite and investment objectives. We’ll explore different trading styles, timeframes, and risk management techniques to help you make informed trading decisions.

Placing trades and managing positions in the futures market requires a solid understanding of order types, margin requirements, and contract specifications. We’ll demystify the terminology and walk you through the process of executing trades effectively. Furthermore, we’ll discuss risk management principles and highlight common mistakes to avoid in order to protect your capital and maximize your returns.

Lastly, we’ll cover the importance of monitoring and exiting futures trades. Markets can move quickly, and it’s crucial to have a plan for managing your positions and knowing when to exit for profits or limit potential losses.

By the end of this guide, you’ll have a comprehensive understanding of how to trade futures contracts and be equipped with the knowledge and tools to navigate the exciting world of futures trading. So, let’s dive in and get started on your journey to becoming a successful futures trader!

What are Futures Contracts

Futures contracts are derivative financial instruments that represent an agreement to buy or sell an asset at a predetermined price on a specified date in the future. These contracts are standardized and traded on regulated futures exchanges. They serve as a means for market participants to hedge against price fluctuations or speculate on the future direction of various underlying assets.

The underlying assets of futures contracts can include commodities such as crude oil, gold, wheat, and natural gas, as well as financial instruments like stock indices, currency exchange rates, and interest rates. The value of the futures contract is derived from the underlying asset, and the contract specifies the quantity, quality, and delivery or settlement terms.

Unlike traditional stock or bond investments, futures contracts are leveraged instruments, meaning traders can control a large position with a relatively small amount of capital. This leverage amplifies both potential profits and losses, making futures trading a high-risk, high-reward endeavor.

One of the key features of futures contracts is their standardized nature. This means that each contract has predetermined specifications regarding the size of the contract, the quality of the underlying asset, the delivery or settlement terms, and the expiration date. Standardization ensures transparency and liquidity in the market, allowing traders to easily buy or sell contracts without having to negotiate terms individually.

There are two primary types of futures contracts: those for physical delivery and those for cash settlement. Physical delivery contracts require the actual delivery of the underlying asset on the specified delivery date. For example, a corn futures contract would require the physical delivery of a specified amount of corn. Cash-settled contracts, on the other hand, do not involve the physical transfer of the underlying asset. Instead, the contracts are settled in cash based on the difference between the futures price and the spot price at the time of expiration.

Futures contracts are typically traded on organized exchanges, such as the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the Intercontinental Exchange (ICE). These exchanges act as intermediaries, providing a platform for buyers and sellers to transact. The exchanges also maintain a central clearinghouse, which acts as the counterparty to every trade, ensuring the integrity of the market.

Trading futures contracts offers several advantages over other forms of investing. Firstly, futures provide the opportunity to profit from both rising and falling markets. Traders can take long positions to profit from an expected price increase or short positions to profit from an expected price decline. Secondly, futures contracts are highly liquid, with a massive volume of trades executed daily. This liquidity ensures that traders can enter and exit positions easily without significant price slippage.

In summary, futures contracts are derivative instruments that allow traders to speculate on the price movement of underlying assets or hedge against potential price fluctuations. They are standardized, leveraged instruments traded on regulated exchanges, providing traders with the potential for significant profits while carrying inherent risks. Understanding the mechanics and features of futures contracts is essential for anyone looking to engage in futures trading.

Advantages of Trading Futures Contracts

Trading futures contracts offers several distinct advantages for investors and traders. Understanding these advantages can help you navigate the futures market and capitalize on its unique opportunities. Below are some of the key benefits of trading futures contracts:

- Leverage: Futures trading allows you to control a larger amount of the underlying asset with a relatively smaller amount of capital. This leverage can amplify your potential profits. However, it’s important to note that leverage also increases the risk of losses, so proper risk management is crucial.

- Hedging: Futures contracts provide a means for hedging against price fluctuations in the underlying asset. For example, if you’re a farmer and want to protect against a decline in corn prices, you can sell corn futures contracts to offset potential losses in the physical market. Hedging with futures allows businesses and individuals to manage their price risk effectively.

- Speculation: Futures trading also provides opportunities for speculators to profit from anticipated price movements. Whether you believe the price of an asset will rise or fall, you can take long or short positions in futures contracts accordingly. This flexibility allows traders to profit in both bullish and bearish market conditions.

- Market Liquidity: The futures market is highly liquid, meaning there are numerous buyers and sellers actively participating in trades. This liquidity ensures that you can enter and exit positions easily without significantly impacting prices. Trades can be executed swiftly and with minimal slippage.

- Diversification: Futures contracts cover a wide range of asset classes, including commodities, currencies, stock indices, and interest rates. This variety allows you to diversify your investment portfolio beyond traditional stocks and bonds, helping to spread risk and potentially enhance returns.

- Transparent and Regulated: Futures markets operate on regulated exchanges, ensuring transparency and fairness in trading. The exchanges set standards for contract specifications and monitor trading activities to maintain market integrity. As a result, participants have confidence in the pricing and execution of trades.

- Lower Transaction Costs: Compared to other financial instruments, such as options or individual stocks, futures contracts generally have lower transaction costs. This is because futures transactions involve standardized contracts, reducing the need for individual negotiations.

While trading futures contracts offers numerous advantages, it’s essential to carefully consider the risks involved. Leverage can amplify both profits and losses, so risk management and proper position sizing are crucial. It’s also important to stay informed about market conditions, conduct thorough analysis, and follow a disciplined trading plan.

In summary, trading futures contracts provides leverage, hedging capabilities, speculative opportunities, and market liquidity. It also offers diversification potential and operates on transparent and regulated exchanges. Understanding and harnessing these advantages can help you navigate the futures market effectively and potentially enhance your investment returns.

Understanding Futures Exchanges

Futures exchanges play a vital role in facilitating the trading of futures contracts. These exchanges provide a centralized marketplace where buyers and sellers can come together to transact. Understanding how futures exchanges work is crucial for anyone looking to engage in futures trading.

One of the primary functions of futures exchanges is to provide transparency and facilitate fair trading. They achieve this through the establishment of standardized contracts. These contracts specify the size, quality, and delivery or settlement terms of the underlying asset. Standardization ensures consistency across contracts and eliminates the need for individual negotiations, enhancing liquidity and efficiency in the market.

Futures exchanges operate under the oversight of regulatory bodies to ensure the integrity of trading activities. Regulatory agencies set rules and regulations that govern the operations of the exchanges and protect market participants from fraud and manipulation. Examples of prominent futures exchanges include the Chicago Mercantile Exchange (CME), the New York Mercantile Exchange (NYMEX), and the Intercontinental Exchange (ICE).

In addition to providing a trading platform, futures exchanges also maintain a central clearinghouse. The clearinghouse acts as a counterparty to every trade, assuming the role of buyer to the seller and seller to the buyer. This arrangement reduces counterparty risk, as the clearinghouse guarantees the performance of each trade.

Upon entering into a futures contract, traders are required to post an initial margin, which is a portion of the contract value, as collateral. This margin serves as a guarantee of their ability to meet contractual obligations. The margin requirements are established by the exchange and vary depending on the volatility and risk associated with the underlying asset.

Throughout the life of a futures contract, the clearinghouse continually monitors the positions and mark-to-market value of each participant. Mark-to-market refers to the process of adjusting the contract’s value based on the prevailing market price. Profits and losses are calculated daily and added or deducted from the participant’s margin account. This process ensures that participants have sufficient funds to support their positions.

At the expiration of a futures contract, there are two possible outcomes: physical delivery or cash settlement. For physical delivery contracts, the seller is obligated to deliver the underlying asset, while the buyer is obliged to accept the delivery. However, the majority of futures contracts are cash-settled, meaning no physical delivery occurs. Instead, the contracts are settled in cash based on the difference between the futures price and the spot price of the underlying asset at the time of expiration.

It’s important to note that futures exchanges are dynamic and operate in real-time. Prices are constantly changing as supply and demand factors evolve. Market participants can access real-time pricing information through trading platforms provided by the exchange or through brokerage firms.

In summary, futures exchanges play a critical role in facilitating futures trading. They provide standardized contracts, ensure fairness and transparency, and reduce counterparty risk through central clearinghouses. Understanding the operations of futures exchanges, including margin requirements, mark-to-market processes, and settlement methods, is essential for successful futures trading.

Types of Futures Contracts

Futures contracts cover a wide range of underlying assets, offering traders and investors various opportunities to engage in different markets. Understanding the different types of futures contracts is essential for selecting the ones that align with your trading objectives. Below are some common types of futures contracts:

- Commodity Futures: Commodity futures contracts are some of the oldest and most widely traded contracts. They involve the buying or selling of physical commodities, such as crude oil, natural gas, gold, silver, wheat, corn, coffee, and cotton. Commodity futures allow market participants to speculate on price movements or hedge against potential price fluctuations.

- Stock Index Futures: Stock index futures provide exposure to the broader market rather than individual stocks. These contracts are based on popular stock indexes, such as the S&P 500, Dow Jones Industrial Average, or NASDAQ-100. Traders can speculate on the direction of the overall market by buying or selling stock index futures.

- Interest Rate Futures: Interest rate futures contracts are tied to the future value of interest rates. They enable market participants to speculate on or hedge against changes in interest rates. Common interest rate futures contracts include those linked to short-term interest rates, long-term government bonds, Treasury bills, Eurodollar deposits, and Euroyen futures.

- Foreign Exchange (Forex) Futures: Forex futures contracts allow traders to speculate on the future value of currency exchange rates. These contracts are based on various pairs of currencies, such as the Euro/US Dollar, British Pound/Japanese Yen, or Australian Dollar/Swiss Franc. Forex futures provide opportunities for traders to engage in the global currency market and manage currency-related risks.

- Energy Futures: Energy futures contracts involve the buying or selling of energy-related commodities, such as crude oil, natural gas, gasoline, heating oil, and electricity. These contracts track the future prices of these commodities and allow market participants to manage exposure to energy markets or speculate on price movements driven by supply and demand dynamics.

- Metal Futures: Metal futures contracts involve the trading of precious and industrial metals. Examples include contracts for gold, silver, platinum, copper, and aluminum. Metal futures are influenced by factors such as macroeconomic trends, industrial demand, geopolitical events, and investor sentiment.

- Agricultural Futures: Agricultural futures contracts cover a wide range of agricultural products, including grains (wheat, corn, soybeans), livestock (cattle, hogs), soft commodities (sugar, cocoa, coffee), and dairy products. These contracts allow market participants to hedge against changes in commodity prices or speculate on market movements driven by weather conditions, supply and demand factors, and trade policies.

It’s worth noting that within each category of futures contracts, there may be numerous specific contracts with different contract sizes, expiration dates, and settlement methods. These factors, along with market liquidity and contract specifications, should be considered when selecting the appropriate futures contracts for trading.

Understanding the characteristics of each type of futures contract is crucial for successful trading. It’s important to conduct thorough research, stay updated on market developments, and assess the risk-reward potential of each contract before initiating trades.

In summary, futures contracts encompass a wide range of assets, including commodities, stock indexes, interest rates, foreign exchange, energy, metals, and agricultural products. Each type of futures contract presents unique opportunities and risks, and traders should carefully consider their trading objectives and risk tolerance when selecting the contracts to trade.

How to Choose a Futures Broker

When venturing into futures trading, selecting the right futures broker is critical to your success. A futures broker acts as an intermediary between you and the futures exchange, facilitating your trading activities. Here are some key considerations to help you choose a futures broker that suits your needs:

- Regulation and Security: Ensure that the futures broker you choose is registered and regulated by a recognized regulatory authority. This helps safeguard your funds and ensures that the broker operates in compliance with relevant rules and regulations. Look for brokers that are members of reputable futures exchanges and have a strong reputation in the industry.

- Platform and Tools: Evaluate the trading platform and tools provided by the broker. A user-friendly and robust trading platform is essential for efficient order execution, market analysis, and monitoring positions. Look for features such as real-time streaming quotes, charting tools, technical indicators, and risk management features.

- Market Access and Product Offering: Consider the breadth of markets and futures contracts offered by the broker. Ensure the broker provides access to the specific markets and contracts you intend to trade. A diverse product offering allows you to diversify your trading and take advantage of different opportunities as they arise.

- Execution and Order Types: Evaluate the quality of trade execution offered by the broker. Look for low latency and reliable order execution to minimize slippage and enhance trading efficiency. Additionally, ensure the broker provides a range of order types to accommodate your trading preferences, such as market orders, limit orders, stop orders, and trailing stops.

- Commission and Fees: Consider the commission structure and any additional fees charged by the broker. Compare the commission rates across different brokers, keeping in mind that lower fees may not always translate to better service. Balance the cost of trading with the quality of services provided by the broker.

- Customer Support: Assess the level of customer support provided by the broker. Look for brokers that offer responsive customer service and support channels, such as phone, email, or live chat. A knowledgeable and accessible customer support team can assist you in resolving issues, answering inquiries, and navigating the trading platform.

- Education and Resources: Check if the broker offers educational resources and materials to help you enhance your trading skills and knowledge. Educational materials such as webinars, tutorials, and market analysis can be valuable for traders, especially those new to futures trading.

- Account Funding and Withdrawal: Evaluate the ease and speed of funding your trading account and withdrawing funds when needed. Look for brokers that support multiple funding options, such as bank transfers, credit cards, and electronic payment methods. Consider any withdrawal fees or processing times associated with account withdrawals.

- Research and Analysis: Some brokers provide research reports, market analysis, and trading recommendations. These resources can be beneficial for traders who rely on fundamental or technical analysis to make trading decisions. Consider the quality and relevance of the research provided by the broker.

- Reputation and Reviews: Research the reputation and reviews of the broker from independent sources. Look for feedback from other traders to gain insights into their experiences with the broker’s services, reliability, and customer support.

It’s important to note that each trader may have different priorities and preferences when selecting a futures broker. Assess your individual requirements and trading style to find a broker that aligns with your specific needs.

In summary, choosing a futures broker involves evaluating factors such as regulation, trading platforms and tools, market access, execution quality, fees, customer support, educational resources, account funding and withdrawal options, research and analysis, and the broker’s overall reputation. By considering these factors and conducting thorough research, you can select a futures broker that provides a reliable and suitable trading environment for your futures trading endeavors.

Setting Up a Futures Trading Account

Setting up a futures trading account is an essential step for anyone looking to engage in futures trading. It provides you with a platform to access the futures markets and execute trades. Here’s a step-by-step guide on how to set up a futures trading account:

- Educate Yourself: Before setting up a futures trading account, educate yourself about futures markets, contract specifications, trading strategies, and risk management principles. Familiarize yourself with the basics of futures trading and understand the potential risks involved.

- Research Brokers: Research and compare different futures brokers to find one that meets your trading needs. Consider factors such as regulation, trading platform features, product offering, execution quality, fees, customer support, and educational resources. Choose a reputable and reliable broker that suits your requirements.

- Complete the Application: Once you’ve chosen a broker, you’ll need to complete their account application. This process typically involves providing personal information, contact details, and financial information. You may also need to provide identification documents, such as a passport or driver’s license, to verify your identity.

- Fund Your Account: After your application is approved, you’ll need to fund your futures trading account. Most brokers offer various funding methods, such as bank transfers, credit card payments, or electronic payment systems. Choose a funding method that is convenient and secure for you. Be aware of any minimum deposit requirements set by the broker.

- Select Account Type: Determine the type of futures trading account you want to open. Different brokers may offer various account types, such as individual accounts, joint accounts, corporate accounts, or IRA accounts. Choose the account type that aligns with your trading objectives and personal circumstances.

- Sign Necessary Agreements: Read through and sign the necessary agreements provided by the broker. These agreements typically include a customer agreement, risk disclosure statement, and terms of service. Ensure that you understand and agree to the terms and conditions set by the broker.

- Download the Trading Platform: Once your account is set up and funded, download and install the trading platform provided by the broker. The trading platform is essential for monitoring the markets, analyzing price movements, and executing trades. Ensure that the platform is compatible with your computer or mobile device.

- Set Up Security Features: Take steps to secure your futures trading account. Create a strong and unique password and enable two-factor authentication if available. Regularly monitor your account for any irregularities and promptly report any suspicious activity to your broker.

- Learn the Trading Platform: Take the time to familiarize yourself with the features and functionalities of the trading platform. Explore the different order types, charting tools, and risk management features offered by the platform. Practicing with a demo account can help you become comfortable with the platform before trading with real money.

- Develop a Trading Plan: Before placing trades, create a trading plan that outlines your trading goals, risk tolerance, and trading strategies. Determine your position sizing, entry and exit criteria, and risk management rules. A well-defined trading plan helps maintain discipline and consistency in your trading activities.

Setting up a futures trading account requires careful consideration and preparation. By selecting a reliable broker, understanding the account setup process, and developing a trading plan, you’ll be ready to enter the exciting world of futures trading.

Fundamental Analysis for Futures Trading

Fundamental analysis is a crucial tool for futures traders as it helps them evaluate the intrinsic value of an asset by analyzing relevant economic, financial, and geopolitical factors. By understanding these underlying factors, traders can make informed decisions regarding the potential price movements of futures contracts. Here are the key components of fundamental analysis in futures trading:

- Economic Indicators: Economic indicators provide insights into the overall health of an economy and can help forecast the demand and supply dynamics that impact the prices of certain futures contracts. Key economic indicators to monitor include Gross Domestic Product (GDP), inflation rates, unemployment data, consumer sentiment, and interest rates. These indicators help assess the overall economic conditions and identify potential trading opportunities.

- Supply and Demand Factors: Understanding the supply and demand dynamics of the underlying asset is essential. For agricultural futures, factors such as weather conditions, crop reports, and global supply and demand projections can impact prices. In the energy market, factors such as production levels, geopolitical tensions, and inventories influence prices. Analyzing supply and demand factors helps identify potential imbalances and anticipate price movements.

- Fundamental Reports: Keep track of fundamental reports relevant to the asset class you are trading. For example, in commodity futures, reports such as the Crop Production Report, Energy Information Administration (EIA) Petroleum Status Report, or the monthly World Agricultural Supply and Demand Estimates (WASDE) can provide valuable information on supply and demand fundamentals. Understanding and interpreting these reports can reveal potential trading opportunities.

- Geopolitical Developments: Geopolitical events can significantly impact futures markets. Political instability, trade disputes, and natural disasters can disrupt supply chains, affect production levels, or trigger changes in government policies. Stay informed about global news and geopolitical developments to understand their potential impact on market prices.

- Seasonality: Seasonal trends can influence futures markets. Some commodities like grains, natural gas, or heating oil have distinct seasonal patterns due to factors like crop cycles or weather demand. Understanding the historical pricing patterns associated with seasonality can help identify potential trading opportunities and manage risk accordingly.

- Intermarket Analysis: Consider the interrelationships between related markets. For example, energy futures may be influenced by changes in currency exchange rates, geopolitical tensions, or stock market movements. Analyzing the correlations between different markets can provide insights into potential price movements and help identify trading opportunities.

- Analyst Recommendations: Analyst recommendations and forecasts can offer insights into the market sentiment and the potential direction of an asset’s price. Taking into account expert opinions and market consensus can inform your trading decisions and provide valuable perspectives on market expectations.

- Trade Policies and Regulations: Changes in trade policies, tariffs, or regulations can significantly impact certain futures markets, particularly those involving agricultural or international commodities. Stay updated on trade agreements, government policies, and regulatory changes that may affect the supply chain and pricing dynamics of the asset you are trading.

Keep in mind that fundamental analysis is subjective and relies on interpreting data and information. It is important to combine fundamental analysis with other forms of analysis, such as technical analysis and market sentiment, to make well-informed trading decisions.

In summary, fundamental analysis is a valuable tool for futures trading. By analyzing economic indicators, supply and demand factors, fundamental reports, geopolitical developments, seasonality, intermarket relationships, analyst recommendations, and trade policies, traders can gain insights into the potential price movements of futures contracts and make informed trading decisions.

Technical Analysis for Futures Trading

Technical analysis is a widely used tool for futures traders to forecast future price movements based on historical price patterns and market statistics. It involves studying charts, patterns, and indicators to identify trends and trading opportunities. Here are the key components of technical analysis in futures trading:

- Chart Analysis: Charts provide a visual representation of historical price movements. Traders use various types of charts, such as line charts, bar charts, and candlestick charts, to identify patterns, trends, and support/resistance levels. Chart analysis helps determine the overall direction of the market and potential entry and exit points for trades.

- Support and Resistance: Support and resistance levels are price levels where buying or selling pressure is historically significant. Support refers to a price level where demand exceeds supply, preventing prices from falling further. Resistance, on the other hand, is a price level where supply exceeds demand, preventing prices from rising further. Identifying these levels can help traders make decisions on when to enter or exit trades.

- Trend Analysis: Identifying and following trends is a fundamental aspect of technical analysis. Traders use trendlines and moving averages to determine the direction and strength of a trend. By trading in the direction of the prevailing trend, traders increase the probability of profitable trades.

- Chart Patterns: Chart patterns, such as head and shoulders, double tops/bottoms, and triangles, are formed by price movements and reflect market psychology. These patterns can provide insights into potential trend reversals or continuation. Traders use chart patterns as an additional tool to make trading decisions.

- Indicators: Technical indicators are mathematical calculations based on historical price and volume data. They help traders evaluate market conditions and generate trading signals. Common indicators include moving averages, oscillators (such as the Relative Strength Index – RSI and Stochastic Oscillator), and volume-based indicators (like On-Balance Volume – OBV). Indicators can assist traders in identifying overbought or oversold conditions and potential trend reversals.

- Candlestick Patterns: Candlestick patterns provide visual representations of price movements within a specified time frame. Patterns, such as doji, engulfing, and hammer, offer insights into potential market reversals or continuation of trends. Candlestick analysis helps traders gauge market sentiment and make trading decisions based on these patterns.

- Volume Analysis: Volume analysis focuses on the trading volume accompanying price movements. High volume during price advances or declines indicates strong participation and potential continuation of the trend. Low volume during price movements may suggest a lack of conviction in the market. By analyzing volume patterns, traders can confirm or question the strength of price movements.

- Timeframes: Technical analysis can be conducted on various timeframes, from short-term intraday charts to longer-term daily or weekly charts. Different timeframes provide different perspectives on price movements and help traders identify trends and patterns. It’s important to align your trading strategies with the chosen timeframe.

- Backtesting: Backtesting involves applying trading strategies to historical data to assess their effectiveness. By testing strategies on past data, traders can evaluate their performance and potential profitability. This helps refine trading strategies before actual implementation.

While technical analysis is a widely used approach, it’s important to note that it is subjective and relies on historical data. It is essential to combine technical analysis with other forms of analysis and risk management techniques to make well-informed trading decisions.

In summary, technical analysis is a valuable tool for futures trading. By analyzing charts, support and resistance levels, trends, chart and candlestick patterns, indicators, volume, timeframes, and backtesting, traders can gain insights into potential price movements and make informed trading decisions.

Developing a Futures Trading Strategy

Developing a well-defined trading strategy is crucial for success in futures trading. A trading strategy provides a systematic approach to decision-making, helping traders identify opportunities, manage risk, and maintain discipline. Here are the key steps to develop a futures trading strategy:

- Define Your Trading Goals: Determine your trading objectives, risk tolerance, and investment horizon. Consider whether you aim to generate consistent income, capitalize on short-term price movements, or hedge existing positions. Defining your goals helps shape your trading strategy and align it with your personal circumstances.

- Select a Trading Style: Choose the trading style that suits your personality and trading objectives. Common trading styles include day trading, swing trading, position trading, and trend following. Each style has different timeframes and approaches to entry and exit points. Select the style that best matches your trading preferences.

- Identify Market Opportunities: Determine the markets and instruments you want to trade. Assess the characteristics, liquidity, and volatility of different futures contracts and identify the ones that align with your trading goals. Consider factors like market hours, contract specifications, and the economic factors that influence each market.

- Analyze Market Conditions: Use a combination of fundamental and technical analysis to evaluate market conditions and identify potential trading opportunities. Assess supply and demand factors, economic indicators, trend patterns, support and resistance levels, and other relevant factors. Analyzing market conditions helps you make informed trading decisions.

- Develop Entry and Exit Strategies: Define clear entry and exit rules based on your analysis and trading goals. Determine the criteria for entering a trade, such as specific chart patterns, technical indicators, or fundamental triggers. Also, establish rules for exiting trades, including profit targets and stop-loss levels. Having predefined entry and exit strategies helps remove emotion from trading decisions.

- Risk Management: Implement proper risk management techniques to protect your capital and minimize potential losses. Determine the maximum risk you are willing to take for each trade and set appropriate position sizes accordingly. Use stop-loss orders to limit losses and consider implementing trailing stops to protect profits. Regularly review and adjust risk management strategies as needed.

- Backtest and Evaluate: Backtest your trading strategy using historical data to assess its effectiveness and profitability. This process involves applying your strategy to past market conditions and analyzing the results. Evaluate the performance of the strategy and refine it based on the findings. Keep in mind that past performance is not indicative of future results, but backtesting provides insights into how your strategy might perform.

- Implement and Monitor: Once you have defined your trading strategy, implement it consistently and monitor its performance. Keep a trading journal to record your trades, including entry and exit points, rationale, and outcomes. Regularly review and analyze your trading results to identify areas for improvement or potential adjustments to your strategy.

- Continuing Education: The markets are dynamic, and it’s essential to stay informed and continuously learn. Stay current with relevant news, economic events, and market developments. Engage in ongoing education through books, courses, webinars, or participation in trading communities to enhance your knowledge and refine your trading strategy.

Remember that developing a successful futures trading strategy takes time, practice, and continuous evaluation. It’s crucial to maintain discipline, stick to your plan, and adapt your strategy as market conditions change. By following a well-defined trading strategy, you can increase your probability of success in futures trading.

Placing Trades and Managing Positions

Once you have developed a solid trading strategy in futures trading, the next step is to understand how to place trades and effectively manage your positions. Here are key considerations for placing trades and managing positions in futures trading:

- Order Types: Understand the various order types available and choose the one that best fits your trading strategy. Common order types include market orders, limit orders, stop orders, and stop-limit orders. Market orders are executed at the best available price, while limit orders allow you to set a specific price at which you are willing to buy or sell. Stop orders are triggered when the market reaches a specified price, while stop-limit orders combine elements of both stop and limit orders.

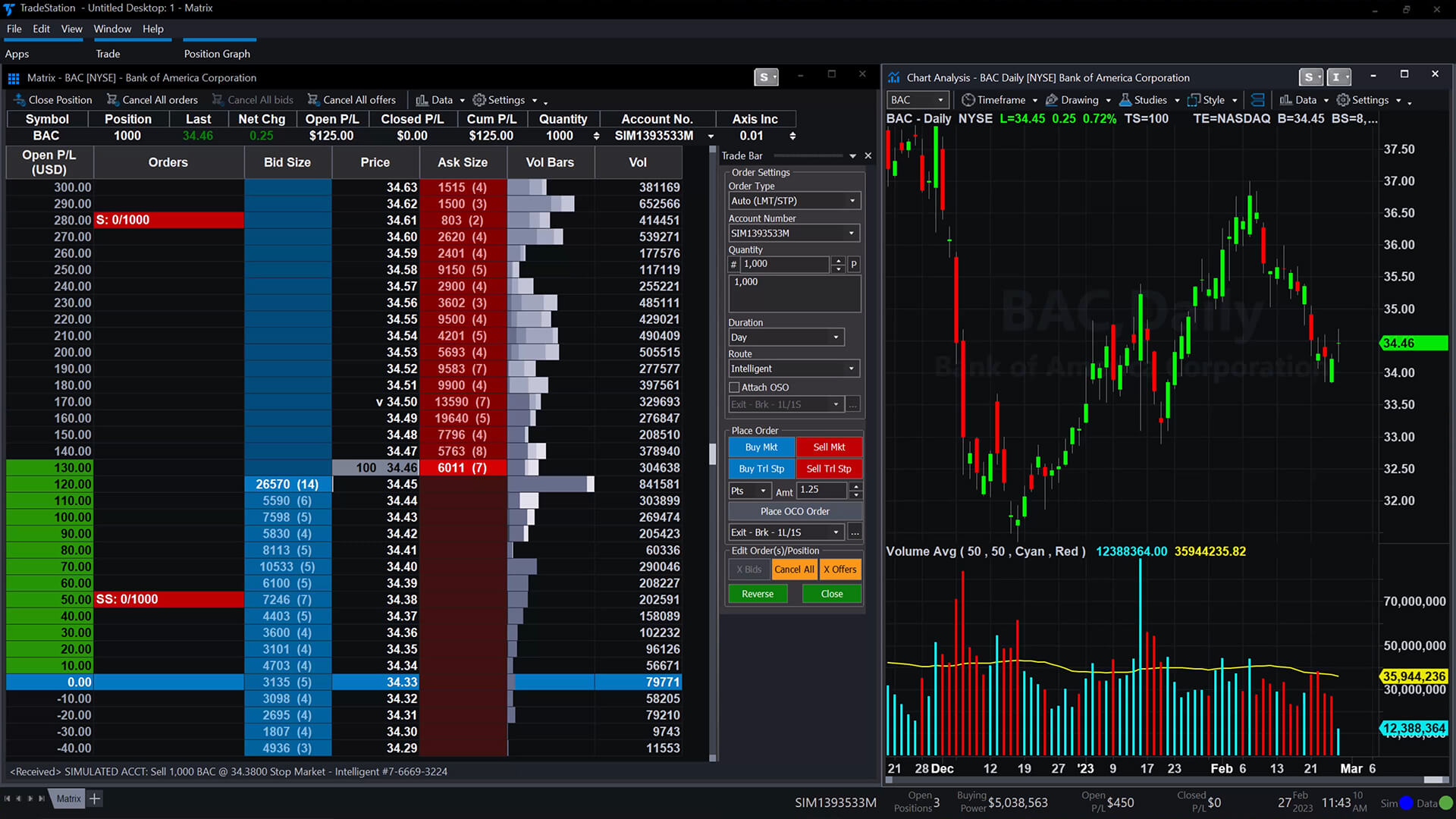

- Order Execution: Ensure you have access to a reliable and efficient trading platform provided by your futures broker. Practice using the platform and understand how to place and execute orders quickly and accurately. Consider factors such as order routing, order confirmation, and order fill speed. Efficient order execution is crucial, particularly for short-term traders.

- Position Sizing: Determine the appropriate position size based on your risk management strategy and your trading goals. Position sizing refers to the number of contracts you will trade for each position. It is determined by factors such as your account size, risk tolerance, and the volatility of the particular futures contract. Proper position sizing helps manage risk and protect your trading capital.

- Monitoring Positions: Continuously monitor your open positions, keeping track of price movements, profit/loss changes, and any relevant news or market events. Consider setting up price alerts or utilizing technical indicators to notify you of significant price movements. Being actively engaged in monitoring your positions allows you to make timely decisions and take appropriate action.

- Profit Targets and Stop-Loss Orders: Set profit targets and stop-loss orders for each trade to manage risk and protect your trading capital. Profit targets are predetermined price levels at which you plan to exit a portion or all of your position to lock in profits. Stop-loss orders are placed at specific price levels to limit losses by triggering a market order to exit the position in the event the price moves against you. Adhering to profit targets and stop-loss orders helps maintain discipline and minimize emotional decision-making.

- Trailing Stops: Consider using trailing stops to protect profits and potentially capture additional gains. Trailing stops are dynamic stop-loss orders that automatically adjust as the market price moves in your favor. They help lock in profits in a trending market while allowing for potential upside if the price continues to move in the desired direction. Trailing stops can be particularly useful in capturing profits during volatile market conditions.

- Scaling In and Scaling Out: Scaling in refers to gradually entering into a position by taking partial positions at different price levels. Scaling out, on the other hand, means exiting a position in increments at different price levels. These techniques can be used to manage risk and take advantage of potential market volatility. Scaling in allows you to average into a position, while scaling out helps protect profits and minimize exposure.

- Trade Management: Regularly review and reassess your open positions to determine if market conditions or your original analysis has changed. Consider adjusting profit targets, stop-loss orders, or trailing stops based on new developments. Reevaluate the risk-reward ratio and adjust position sizes accordingly. Be disciplined in sticking to your trading strategy and avoid making impulsive decisions.

- Journaling and Analysis: Keep a detailed trading journal to record your trades, including entry and exit points, reasons for the trade, and your emotions at the time. Regularly review and analyze your trading journal to identify patterns, strengths, and weaknesses in your trading. Analyze both winning and losing trades to learn from your experiences and make necessary adjustments to your trading strategy.

Placing trades and managing positions in futures trading requires a disciplined and systematic approach. By understanding order types, effectively monitoring positions, implementing profit targets and stop-loss orders, and practicing trade management techniques, you can improve your chances of success in the futures market.

Risk Management in Futures Trading

Risk management is a crucial aspect of futures trading as it helps protect your capital and ensure long-term success. Effective risk management strategies are essential for managing potential losses and preserving trading capital. Here are key considerations for risk management in futures trading:

- Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and account size. Position sizing refers to the number of contracts you trade for each position. It should be based on a calculated risk percentage of your capital. By controlling the size of your positions, you can limit potential losses and avoid overexposure to any one trade.

- Stop-Loss Orders: Implement stop-loss orders for each trade to define your risk tolerance and limit potential losses. A stop-loss order is triggered when the price reaches a predetermined level, automatically exiting the position. Placing stop-loss orders helps you manage risk by defining your maximum acceptable loss before entering a trade.

- Profit Targets: Set profit targets to lock in gains and prevent greed from driving you to hold onto positions for too long. A profit target is a predetermined price level at which you plan to exit a portion or all of your position to secure profits. Setting profit targets helps you take profits and avoid giving back gains if the market reverses.

- Risk-Reward Ratio: Evaluate the risk-reward ratio for each trade to assess the potential profitability and determine if a trade is worth taking. The risk-reward ratio compares the amount you are risking (potential loss) to the potential reward (potential profit) of a trade. Aim for trades with a favorable risk-reward ratio of at least 1:2 or higher, where the potential reward outweighs the potential risk.

- Diversification: Diversify your trading portfolio across different markets and instruments to spread risk. By not overconcentrating on a single trade or market, you mitigate the impact of any individual trade or market downturn. Diversification can help reduce the overall risk exposure and protect your capital against significant losses.

- Risk Assessment: Regularly assess the risk associated with each trade and the overall risk in your trading portfolio. Consider the market conditions, potential volatility, and any relevant news or events that may impact your positions. Continuously evaluate and adjust your risk management plan to reflect changing market conditions.

- Keep Emotions in Check: Emotions can cloud judgment and lead to impulsive trading decisions. Avoid making impulsive trades based on fear or greed. Stick to your trading plan and avoid chasing losses or taking excessive risks to recover losses. Emotional discipline is crucial for successful risk management.

- Contingency Plans: Have contingency plans in place for unexpected market events or extreme price movements. Prepare for potential scenarios by establishing rules for adjusting positions, managing risk during volatile periods, or protecting profits. Having contingency plans helps you respond to changing market conditions swiftly and decisively.

- Regular Evaluation and Learning: Continuously evaluate your trading performance and learn from both wins and losses. Review your trading journal, analyze your trades, and identify patterns or areas for improvement. Regularly update and refine your risk management plan based on your assessment and learning experiences.

Remember, risk management is a continuous process, and it should be integrated into every aspect of your trading strategy. By implementing proper position sizing, using stop-loss orders, setting profit targets, diversifying your portfolio, and maintaining emotional discipline, you can effectively manage risk in futures trading and increase your chances of consistent profitability in the long run.

Common Mistakes to Avoid in Futures Trading

Futures trading can be lucrative, but it also involves risks. To navigate the markets successfully, it’s important to be aware of common mistakes that many traders make and take steps to avoid them. Here are key mistakes to avoid in futures trading:

- Lack of Proper Education: One of the biggest mistakes traders make is jumping into futures trading without sufficient knowledge and understanding. It’s essential to educate yourself about the workings of the futures markets, different contract types, risk management strategies, and trading techniques. Continuously improve your knowledge through books, courses, and staying updated with industry trends.

- Failure to Develop a Trading Plan: Trading without a well-defined plan is a recipe for disaster. A trading plan outlines your trading goals, strategies, risk management techniques, and criteria for entering and exiting trades. Not having a plan leaves you vulnerable to emotions, impulsive decisions, and inconsistency in your trading approach. Develop a clear trading plan and stick to it.

- Overtrading: Overtrading occurs when you execute too many trades, often driven by a desire to be constantly active in the markets. Excessive trading can lead to increased transaction costs, emotional exhaustion, and poor decision-making. Focus on quality rather than quantity and only take trades that align with your trading plan and strategy.

- Chasing Losses: Chasing losses is a dangerous mistake. Traders who become emotional and desperate to recover losses often end up taking impulsive trades or increasing their position sizes beyond their risk tolerance. This can lead to even larger losses. Accept losses as part of trading and stick to your risk management plan. Avoid the temptation to take revenge trades or make emotional decisions driven by the need to recoup losses quickly.

- Ignoring Risk Management: Risk management is crucial in futures trading, yet many traders overlook it or don’t give it the attention it deserves. Failing to set stop-loss orders, not properly sizing positions, or disregarding risk-reward ratios can result in significant losses. Make risk management an integral part of your trading strategy and always prioritize capital preservation.

- Impulsive Trading: Acting on emotions or making impulsive trading decisions is a common mistake that can lead to poor outcomes. Reacting to short-term market fluctuations, following tips or rumors, or deviating from your trading plan based on fear or greed can undermine your trading strategy. Stay disciplined, stick to your trading plan, and make rational decisions based on careful analysis rather than impulsive reactions.

- Not Conducting Proper Research: Failing to conduct thorough research before entering a trade is a recipe for disaster. Some traders rely solely on tips or rumors without conducting their own analysis. It’s essential to study the market, assess fundamental and technical factors, and develop an informed opinion before executing trades. Make decisions based on your own research and analysis to increase your chances of success.

- Ignoring Market Conditions: Ignoring market conditions and failing to adapt to changing circumstances can lead to poor trading decisions. Market conditions can vary from quiet and trending to volatile and choppy. Adjust your strategies and risk management techniques accordingly. Stay up to date with news, economic events, and shifts in market sentiment to make better-informed trading decisions.

- Not Using Stop-Loss Orders: Failing to use stop-loss orders leaves you vulnerable to significant losses in case of adverse market moves. Stop-loss orders help limit losses and protect your capital. Always place stop-loss orders as part of your risk management strategy and adhere to them.

- Ignoring the Importance of Record-Keeping: Keeping a trading journal to track and analyze your trades is often overlooked but immensely valuable. Maintaining detailed records of your trades, including entry and exit points, reasons for trades, and emotions at the time, provides insights into your trading performance. Learn from both successful and unsuccessful trades by reviewing your journal regularly.

Avoiding these common mistakes requires discipline, education, and a commitment to following sound trading principles. By developing a well-defined trading plan, prioritizing risk management, conducting thorough research, and maintaining emotional discipline, you can minimize mistakes and increase your chances of success in futures trading.

Monitoring and Exiting Futures Trades

Monitoring and exiting trades effectively is a crucial aspect of successful futures trading. By actively monitoring your positions and making timely and informed decisions about when to exit trades, you can optimize your profitability and manage risk. Here are important considerations when it comes to monitoring and exiting futures trades:

- Regularly Review Positions: Continuously monitor the market and keep a close eye on your open positions. Regularly assess market conditions and the performance of your trades. Stay updated on relevant news, economic data, and market events that may impact your trades.

- Set Clear Exit Criteria: Before entering a trade, establish clear criteria for when you plan to exit. Define your profit target levels, stop-loss levels, or other technical or fundamental triggers that indicate your desired exit points. Having pre-determined exit criteria helps you make objective decisions and avoid emotional reactions to market fluctuations.

- Adjust Stop-Loss Levels: As the market moves in your favor, consider adjusting your stop-loss levels to protect your profits and minimize potential losses. This technique is known as trailing stops. Trailing stops automatically adjust your stop-loss order as the price moves in your favor, enabling you to secure profits while giving the trade room to potentially further mature.

- Take Partial Profits: Consider taking partial profits when a trade moves in your favor. By scaling out of a position gradually, you lock in profits while keeping a portion of your position open to participate in further potential gains. This approach allows you to manage risk and secure returns along the way.

- Follow Your Trading Plan: Stick to your trading plan and avoid making impulsive decisions based on emotions or short-term market fluctuations. Trust the analysis and criteria outlined in your plan and make trade exits accordingly. Emotional discipline and adherence to your trading plan are crucial for consistent performance.

- Utilize Technical Indicators: Technical indicators can help you identify potential reversal or exit signals. Consider using indicators such as moving averages, trendlines, or oscillators to guide your exit decisions. These indicators can supplement your analysis and provide objective signals based on price action and market trends.

- Consider Volatility: Take volatility into account when deciding when to exit a trade. Higher volatility can lead to more significant price swings and increased risk. In highly volatile markets, it may be prudent to exit trades earlier or adjust your profit targets and stop-loss levels accordingly.

- Assess Changes in Market Conditions: Continuously reassess market conditions to determine if your trade aligns with the current environment. If there are significant changes in supply-demand dynamics, economic indicators, or geopolitical events that impact your trade thesis, consider adjusting your exit strategy accordingly. Be flexible and adapt to changing market conditions as necessary.

- Exit Losing Trades: Don’t hold onto losing trades in the hope that the market will reverse. If a trade continuously moves against your analysis and reaches your predetermined stop-loss level, exit the trade promptly. Accepting small losses is part of trading, and cutting losing trades early is essential for risk management.

- Record and Review Exit Decisions: Keep a trading journal and record your exit decisions along with the rationale behind them. Regularly review and analyze your exit decisions to learn from your trades. Evaluate the effectiveness of your exit strategies and make adjustments to improve your future trading decisions.

Monitoring and exiting trades effectively requires active engagement and disciplined decision-making. By regularly reviewing your positions, setting clear exit criteria, adjusting stop-loss levels, and following your trading plan, you can optimize your trading outcomes and manage risk more effectively in the futures market.

Conclusion

Engaging in futures trading can be a rewarding endeavor, but it requires knowledge, skill, and discipline. By understanding the fundamentals of futures contracts, selecting the right broker, and setting up a trading account, you can embark on your trading journey with confidence. It is crucial to develop a comprehensive trading strategy that incorporates both fundamental and technical analysis, while implementing sound risk management techniques to protect your capital.

Throughout this guide, we have explored the advantages of trading futures contracts and the different types of contracts available. We have discussed how to choose a futures broker that meets your needs, as well as the process of setting up a futures trading account. Understanding and applying fundamental and technical analysis have been emphasized, along with the development of a robust trading strategy.

Placing trades and managing positions effectively requires continuous monitoring and the ability to make informed decisions. Risk management should be at the forefront of your trading approach, utilizing techniques such as position sizing, stop-loss orders, and profit targets to safeguard your funds. Additionally, we have highlighted common mistakes to avoid and the importance of journaling and analyzing your trading activities.

In conclusion, futures trading can offer significant opportunities for profits, diversification, and risk management. However, it is not without risks. By continuously educating yourself, staying disciplined, and following a well-defined trading plan, you increase your chances of success in the dynamic and ever-evolving futures markets.

Remember that trading is a journey of continuous learning and adaptation. Markets change, and strategies need to be adjusted. Stay committed to improving your skills, managing risk effectively, and maintaining emotional discipline. With dedication and perseverance, you can navigate the futures markets with confidence and aim for consistent profitability.