Home>Finance>Futures Contract Definition: Types, Mechanics, And Uses In Trading

Finance

Futures Contract Definition: Types, Mechanics, And Uses In Trading

Published: November 29, 2023

Discover the different types, mechanics, and uses of futures contracts in the world of finance. Enhance your trading knowledge with this comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Welcome to the World of Futures Contract

Have you ever wondered how investors and traders speculate on the future price of commodities, currencies, or even stock market indexes? One way they do this is through futures contracts. These financial instruments allow participants to buy or sell an asset at a predetermined price at a future date. In this blog post, we will delve into the world of futures contracts, explore their types, mechanics, and uncover their practical uses in trading.

Key Takeaways:

- Futures contracts are financial agreements between two parties to buy or sell an asset at a predetermined price and date.

- These contracts exist for various underlying assets, including commodities, currencies, stock market indexes, and even interest rates.

Understanding Futures Contracts

So, what exactly is a futures contract? Simply put, it is a standardized, legally binding agreement that obligates both parties to buy or sell an asset in the future. The asset involved can be anything from agricultural products like grains and livestock to financial instruments like currencies or interest rates. Futures contracts are traded on regulated exchanges, which provide a centralized marketplace for buyers and sellers.

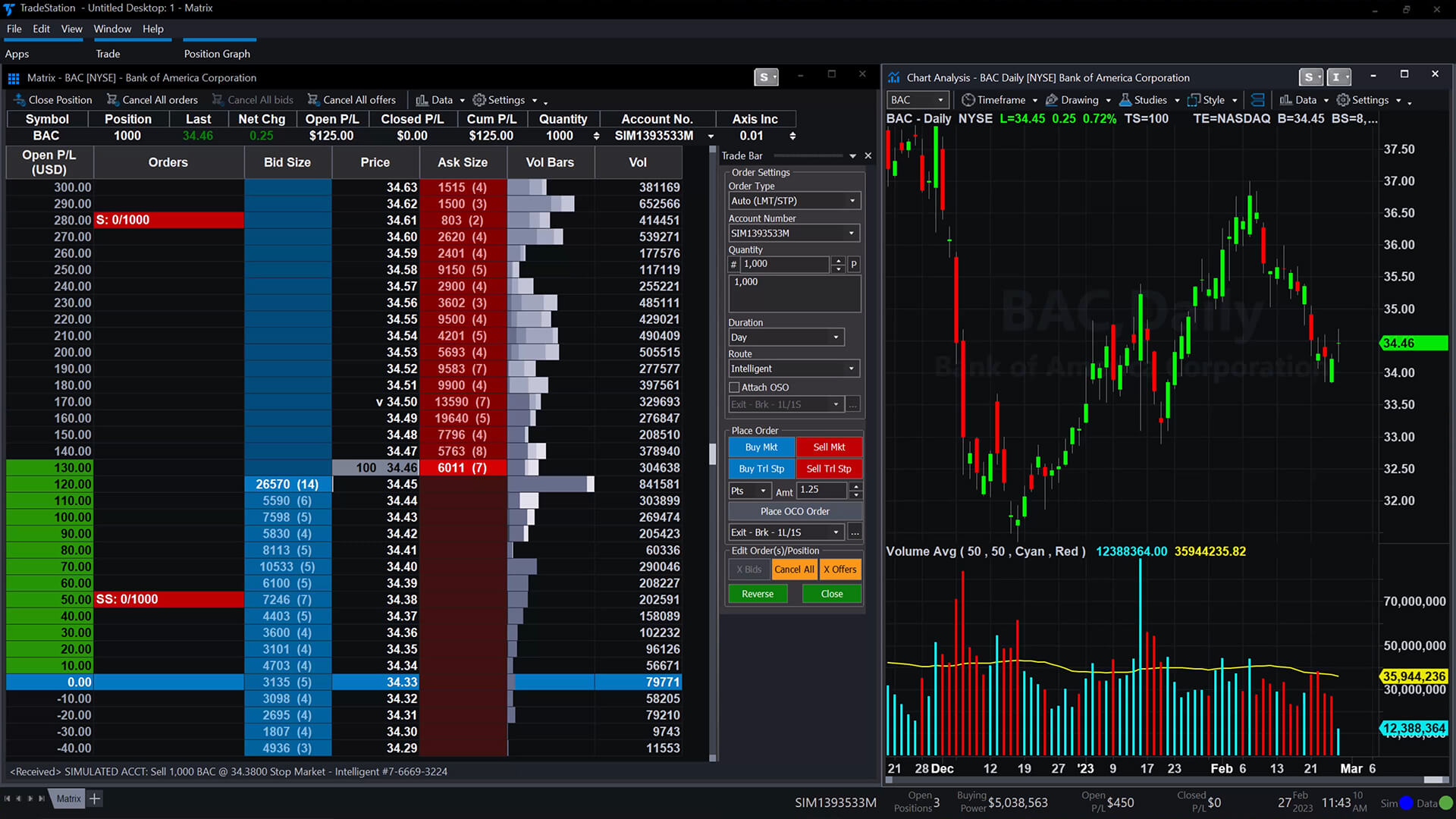

The mechanics of futures contracts are relatively straightforward. Let’s break them down:

- Contract Specifications: Each contract has specific details, including the quantity of the underlying asset, the quality of the asset, the price at which the contract is traded, and the delivery date. These specifications create uniformity and ensure transparency in the futures market.

- Long and Short Positions: In every futures contract, there are two parties involved – the buyer (long position) and the seller (short position). The buyer agrees to purchase the asset at the predetermined price in the future, while the seller agrees to deliver the asset.

- Margin and Leverage: Futures trading typically involves the use of margin, which is a fraction of the total contract value. Traders are only required to deposit this margin, allowing them to control a larger contract size. This leverage magnifies both profits and losses, making futures trading a high-risk, high-reward endeavor.

- Marking to Market: At the end of each trading day, the futures contract is revalued based on the current market price. This process is known as marking to market. Profits and losses are settled daily, with gains credited or losses debited from the trader’s account.

- Delivery or Settlement: While some futures contracts result in physical delivery of the underlying asset, the majority are settled in cash. This means that traders offset their positions or square off before the delivery date, avoiding the hassle of actually taking delivery of the asset.

Practical Uses in Trading

Now that we’ve covered the mechanics, let’s explore the practical uses of futures contracts in trading:

- Hedging: Futures contracts are commonly used to hedge against price movements in the underlying asset. For example, farmers can hedge against a potential decline in crop prices by entering into futures contracts. If prices do fall, their losses in the physical market may be offset by gains in the futures market.

- Speculation: Traders and investors often use futures contracts to speculate on the direction of future price movements. By taking a long or short position, they can profit from correctly predicting price changes in the underlying asset.

- Arbitrage: Futures contracts allow traders to take advantage of price discrepancies between different markets. By simultaneously buying and selling related contracts, they can profit from these temporary imbalances.

While futures trading provides opportunities for profit, it’s essential to remember the inherent risks involved. Proper risk management and a thorough understanding of the underlying assets are crucial to succeed in this highly volatile market.

In conclusion, futures contracts offer market participants a way to speculate, hedge, or engage in arbitrage on various underlying assets. With their standardized nature and widespread use, they provide liquidity and price transparency. By understanding the mechanics and practical uses of futures contracts, traders and investors can make informed decisions and navigate the exciting world of futures trading.