Finance

How To Trade Futures Contracts On E*TRADE?

Modified: December 29, 2023

Learn how to trade futures contracts on E*TRADE and take control of your financial future. Discover the ins and outs of futures trading with our comprehensive guide.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Futures Contracts

- Opening an E*TRADE Account

- Getting Familiar with E*TRADE Platform

- Researching Futures Contracts on E*TRADE

- Placing a Futures Trade on E*TRADE

- Managing and Monitoring Your Futures Positions

- Closing Futures Contracts on E*TRADE

- Tips and Strategies for Trading Futures on E*TRADE

- Conclusion

Introduction

Trading futures contracts can be an excellent way to diversify your investment portfolio and potentially earn significant profits. Futures contracts allow investors to speculate on the price movement of various assets, including commodities, currencies, and stock market indices.

If you are interested in trading futures contracts, one popular platform to consider is E*TRADE. E*TRADE is a well-established online brokerage that provides traders with a user-friendly platform, robust research tools, and competitive pricing.

In this article, we will guide you through the process of trading futures contracts on the E*TRADE platform. Whether you are a beginner or an experienced trader, we will cover everything you need to know to get started with futures trading on E*TRADE.

Before we dive into the specifics, let’s briefly discuss what futures contracts are and how they work. Futures contracts are standardized agreements to buy or sell an asset at a predetermined price and date in the future. Unlike traditional stock trading, futures trading involves a commitment to buy or sell the underlying asset, regardless of its current market price when the contract expires.

This means that futures trading carries both opportunities and risks. On one hand, it allows traders to potentially profit from price movements without owning the actual asset. On the other hand, the leverage involved in futures trading can amplify both gains and losses.

E*TRADE offers a wide range of futures contracts, including commodities such as gold, oil, and corn, as well as financial instruments like stock market indices and currencies. The platform provides traders with the tools and resources they need to conduct thorough research, execute trades, and manage their positions.

Whether you are looking to hedge your existing investments, speculate on market trends, or simply diversify your portfolio, trading futures contracts on E*TRADE can be a valuable addition to your trading strategy.

In the following sections, we will walk you through the process of opening an E*TRADE account, getting familiar with the platform, researching futures contracts, placing trades, managing positions, and closing out contracts. We will also share some tips and strategies to help you make informed trading decisions and maximize your potential for success.

Understanding Futures Contracts

Before you begin trading futures contracts on E*TRADE, it is important to have a solid understanding of how these contracts work. A futures contract is a legally binding agreement to buy or sell a specific asset at a predetermined price on a specified future date. These contracts are traded on exchanges, and their prices are influenced by factors such as supply and demand, interest rates, and economic conditions.

Futures contracts are used for various purposes, including speculation, hedging, and risk management. Traders can speculate on the price movements of assets without actually owning them, allowing for potential profits in both rising and falling markets.

One key characteristic of futures contracts is leverage. Traders are only required to deposit a fraction of the total contract value, known as the initial margin, which allows for greater exposure to the underlying asset. While leverage magnifies potential gains, it also amplifies potential losses, making it crucial to manage risk effectively.

There are different types of futures contracts available on E*TRADE, including commodities, stock market indices, currencies, and interest rates. Commodities futures contracts track the prices of physical commodities such as gold, oil, and wheat. Stock market index futures contracts enable traders to speculate on the performance of popular indices like the S&P 500 or the Dow Jones Industrial Average. Currency futures contracts allow traders to take positions on the exchange rates between different currencies.

When trading futures contracts on E*TRADE, it’s important to understand the specifications of the contract you are trading. These specifications include the contract size, tick size, expiration date, and delivery months. It’s vital to keep track of these details to ensure you are trading the correct contract and to avoid any unexpected delivery or expiration issues.

It’s also essential to stay informed about the factors that can affect the price of the futures contracts you are trading. This requires conducting thorough research and staying up-to-date with market news, economic indicators, and relevant geopolitical developments that may impact the underlying asset’s supply and demand dynamics.

By gaining a solid understanding of futures contracts and staying informed about market trends and developments, you can make more informed trading decisions. E*TRADE provides robust research tools and resources to help you stay informed and navigate the complexities of futures trading.

Now that you have a good understanding of futures contracts, let’s move on to the next step: opening an E*TRADE account.

Opening an E*TRADE Account

Opening an E*TRADE account is the first step towards trading futures contracts on the platform. E*TRADE offers various types of accounts, including individual brokerage accounts, IRA accounts, and corporate accounts. Follow these steps to open an E*TRADE account:

- Visit the E*TRADE website: Go to the official E*TRADE website and click on the “Open an Account” or “Get Started” button to begin the account opening process.

- Choose the account type: Select the type of account that best suits your needs. E*TRADE offers individual brokerage accounts, retirement accounts, education savings accounts, and more.

- Provide personal information: Fill out the required personal information, including your name, address, date of birth, social security number, and employment details.

- Choose account settings: Set your preferences for account features, such as margin trading, options trading, and market data subscriptions. You can also select your trading experience level and risk tolerance.

- Review and agree to terms and conditions: Carefully read through the terms and conditions of opening an E*TRADE account and agree to them.

- Fund your account: Once your account is open, you will need to fund it. E*TRADE accepts various funding methods, including bank transfers, wire transfers, and checks.

During the account opening process, the platform will prompt you to select the types of securities you are interested in trading. Make sure to select futures contracts as one of your preferred securities to enable futures trading on your account.

It’s important to note that E*TRADE may require additional documentation or verification steps, depending on your specific circumstances. This could include providing proof of identity or residency.

Once your E*TRADE account is open and funded, you can proceed to the next step: getting familiar with the E*TRADE platform.

It’s worth mentioning that E*TRADE offers a demo account for practice purposes. The demo account allows you to familiarize yourself with the platform’s features and practice trading futures contracts without risking real money. This can be a valuable tool for new traders or those looking to try out different trading strategies.

Now that you have successfully opened an E*TRADE account, let’s move on to the next section, where we will explore the E*TRADE platform and its features.

Getting Familiar with E*TRADE Platform

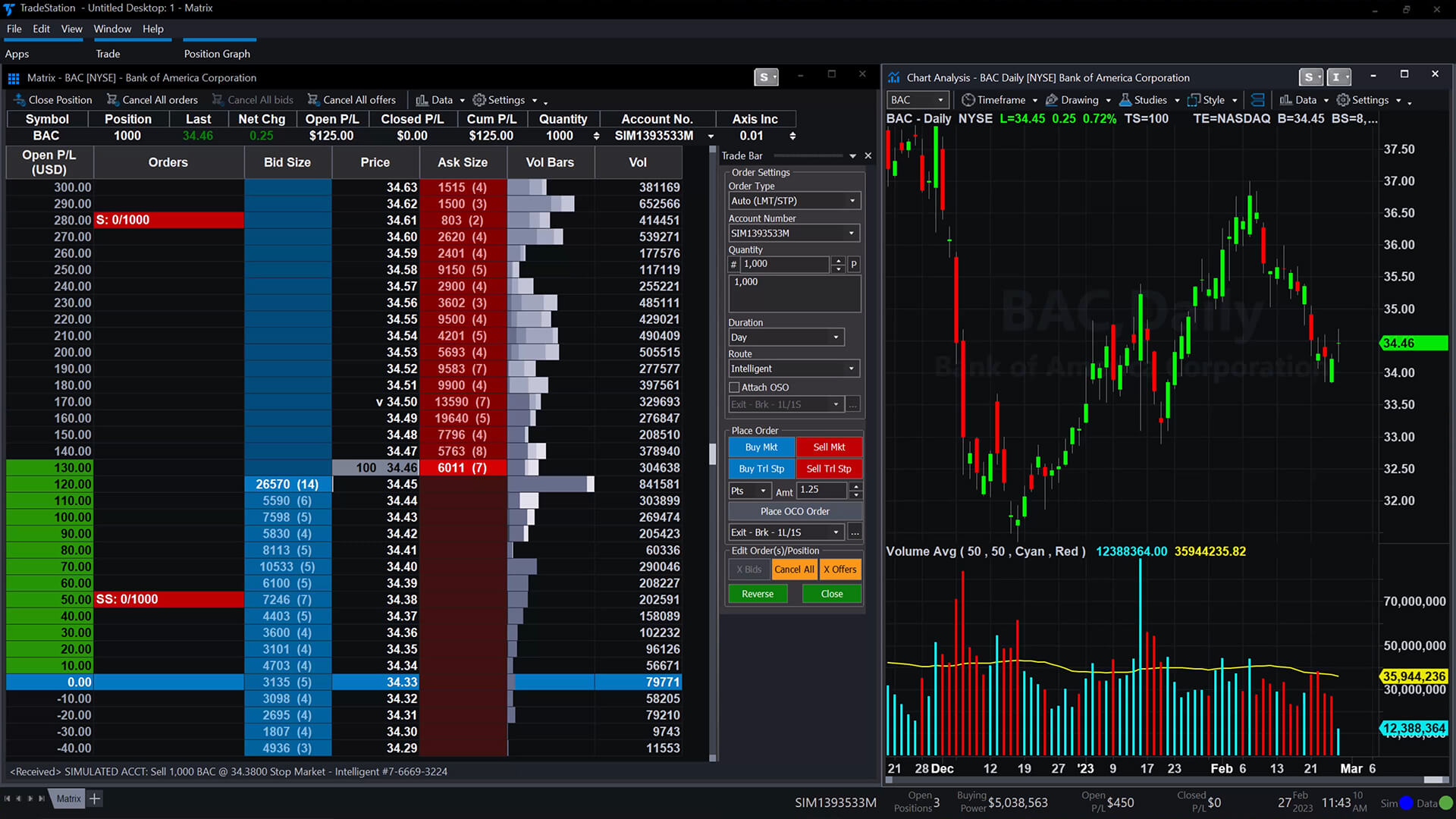

Once you have opened an E*TRADE account, it’s important to familiarize yourself with the E*TRADE platform to effectively trade futures contracts. The E*TRADE platform offers a user-friendly interface, powerful trading tools, and real-time market data to help you make informed trading decisions. Here are the key features and functionalities of the E*TRADE platform:

- Dashboard: Upon logging into your E*TRADE account, you will be greeted with a customizable dashboard. The dashboard provides an overview of your account balance, positions, watchlists, and important market news.

- Market Data and Research: The E*TRADE platform offers extensive market data and research tools to assist you in analyzing futures contracts. You can access real-time quotes, interactive charts, and comprehensive information about the underlying assets.

- Order Entry: E*TRADE provides a straightforward order entry system. You can enter different types of orders, including market orders, limit orders, stop orders, and more. When placing your orders, make sure to select the correct futures contract, quantity, and order type.

- Trade Execution: When a trade is executed, E*TRADE provides confirmation details, including the trade price, order type, and time stamp. You can track your open orders and monitor the status of your executed trades through the platform.

- Account Management: The E*TRADE platform allows you to manage your account settings, personal information, and preferences. You can view your account statements, transaction history, and tax documents.

- Mobile Trading: E*TRADE offers a mobile app that allows you to trade futures contracts on the go. The mobile app provides similar features and functionality as the desktop platform, ensuring you have access to your account and market data wherever you are.

To enhance your trading experience, E*TRADE also offers additional tools and resources, including educational materials, webinars, and expert analysis. These resources can help you improve your understanding of futures contracts, develop trading strategies, and stay updated on market trends.

As a new user, it may take some time to navigate and fully utilize all the features and tools offered by the E*TRADE platform. Take advantage of the platform’s help center, support resources, and demo account to familiarize yourself with the different functionalities and optimize your trading experience.

Now that you are familiar with the E*TRADE platform, the next section will delve into researching futures contracts on E*TRADE. Research is a crucial step in making informed trading decisions and increasing your chances of success in futures trading.

Researching Futures Contracts on E*TRADE

Researching futures contracts is a vital step in trading on E*TRADE. Having a thorough understanding of the underlying assets and market conditions can help you make informed trading decisions. E*TRADE provides a range of research tools and resources to assist you in conducting comprehensive analysis. Here are some key features and methods of researching futures contracts on E*TRADE:

- Market Data: E*TRADE offers real-time market data for futures contracts. You can access information such as the contract’s current price, daily price movements, volume, open interest, and more. This data allows you to track the performance and liquidity of different futures contracts.

- Charts and Technical Analysis: E*TRADE provides interactive charts and technical analysis tools to help assess the historical performance and trends of futures contracts. You can use various technical indicators, trendlines, and drawing tools to analyze price patterns and identify potential entry and exit points.

- News and Insights: The E*TRADE platform offers access to timely news articles, market commentary, and expert insights. Staying informed about market news, economic events, and geopolitical developments can help you understand the factors that impact the price of futures contracts.

- Fundamental Analysis: For certain futures contracts, fundamental analysis plays a crucial role. E*TRADE provides financial statements, company profiles, and industry analysis for relevant futures contracts. This information can help you evaluate the underlying asset’s supply and demand dynamics and make more informed trading decisions.

- Research Reports and Recommendations: E*TRADE offers research reports and recommendations from various third-party research providers. These reports can provide valuable insights, analysis, and trading strategies from industry experts. It’s important to consider multiple research sources and conduct your own due diligence before making trading decisions.

- Customizable Watchlists: E*TRADE allows you to create customized watchlists to monitor your favorite futures contracts. You can add relevant contracts, track their prices, and easily compare their performance to make informed trading decisions.

When researching futures contracts, it’s essential to consider both technical and fundamental factors. Technical analysis focuses on price patterns, trends, and indicators, while fundamental analysis examines the underlying asset’s fundamentals and broader market conditions.

Additionally, it’s vital to manage your risk effectively when trading futures contracts. E*TRADE provides risk assessment tools and educational resources to help you understand the potential risks and rewards associated with futures trading.

By leveraging the research tools and resources provided by E*TRADE, you can gain insights into the market and make informed trading decisions. Remember to stay updated with the latest market news and regularly assess the performance and outlook of the futures contracts you are interested in trading.

Now that you have conducted thorough research, it’s time to place your first futures trade on E*TRADE. The next section will guide you through the process of placing a futures trade on the platform.

Placing a Futures Trade on E*TRADE

Once you have conducted your research and are ready to execute a trade, E*TRADE provides a seamless process for placing futures trades. Here is a step-by-step guide on how to place a futures trade on E*TRADE:

- Log in to your E*TRADE account: Visit the E*TRADE website and log in using your account credentials.

- Navigate to the trading page: From the E*TRADE platform’s main menu, select the “Trade” or “Trading” tab to access the trading page.

- Select the futures contract: On the trading page, you will find a search bar or a drop-down menu. Enter the symbol or keywords for the futures contract you want to trade and select it from the available options.

- Enter the trade details: Once you have selected the futures contract, enter the trade details. This includes the quantity or number of contracts, order type (market order, limit order, etc.), time-in-force (day order, good ’til canceled, etc.), and any other required information.

- Review and confirm the trade: Before placing the trade, carefully review the trade details, including the contract specifications, order type, and associated costs. Ensure that everything is accurate, and if necessary, make any adjustments.

- Place the trade: Once you are satisfied with the trade details, click on the “Place Order” or similar button to execute the trade.

- Monitor the trade: After placing the trade, it is essential to monitor its status. E*TRADE provides real-time updates on your open orders and executed trades. You can track your trade’s progress on the trading platform.

It’s important to note that futures trading involves risk, and it is advisable to set appropriate stop-loss and take-profit levels to manage your risk exposure. These levels can help limit potential losses and protect your profits.

E*TRADE offers various order types, including market orders, limit orders, stop orders, and more. Each order type has different execution rules and restrictions, so it’s crucial to understand how each one works before placing your trade. E*TRADE provides educational resources and support to help you understand the different order types and select the most appropriate one for your trading strategy.

Additionally, E*TRADE provides a feature called “One-Cancel-Other” (OCO). OCO orders allow you to place two orders simultaneously, with one order contingent upon the execution of the other. This can be helpful for setting both stop-loss and take-profit levels in one trade.

Once you have successfully executed your futures trade on E*TRADE, it’s important to manage and monitor your positions. The next section will delve into how to effectively manage and monitor your futures positions on the platform.

Managing and Monitoring Your Futures Positions

After placing a futures trade on E*TRADE, it is crucial to effectively manage and monitor your positions to optimize your trading experience. Here are some key strategies and tools to help you manage and monitor your futures positions on E*TRADE:

- Position Dashboard: E*TRADE provides a position dashboard that gives you an overview of all your open futures positions. This dashboard displays essential information such as the contract symbol, quantity, average cost, current price, and unrealized profit or loss.

- Real-time Market Data: E*TRADE offers real-time market data for futures contracts. You can track the current prices, bid-ask spreads, and volume to stay updated on the market conditions.

- Order Status: Keep track of your pending orders and their status. E*TRADE will provide real-time updates on the execution of your orders, whether they are filled, partially filled, or cancelled.

- Stop-loss and Take-profit Orders: Set appropriate stop-loss and take-profit levels to manage potential losses and secure profits. E*TRADE allows you to place these conditional orders to automatically trigger the execution of your desired actions once specific price levels are reached.

- Monitor Margin Levels: Futures trading involves leverage, so it is crucial to monitor your margin levels. E*TRADE provides tools to help you keep track of your margin requirements and available buying power.

- Research and News Updates: Stay informed about the factors that can potentially impact your futures positions. Continuously monitor market news, economic indicators, and relevant events to make informed decisions about managing and adjusting your positions.

- Profit and Loss Analysis: Regularly evaluate the performance of your futures positions. E*TRADE offers profit and loss analysis tools that allow you to review the realized and unrealized profits or losses of your trades over a specified period.

- Risk Management: Continuously assess and manage your risk exposure. Adjust your position sizes, set appropriate stop-loss levels, and diversify your portfolio to mitigate potential risks associated with futures trading.

- Regular Portfolio Reviews: Conduct periodic reviews of your futures positions and overall trading strategy. Evaluate the performance of your trades, identify any patterns or trends, and make adjustments as needed to optimize your trading approach.

In addition to these strategies, E*TRADE provides educational resources, webinars, and support to help you enhance your knowledge of futures trading and improve your position management skills. Utilize these resources to stay informed and continually develop your trading expertise.

Remember that trading is inherently risky, and there are no guarantees of profit. It’s important to remain disciplined and make rational decisions based on your risk tolerance, financial goals, and market analysis.

Now that you have learned how to manage and monitor your futures positions, the next section will cover closing out futures contracts on E*TRADE.

Closing Futures Contracts on E*TRADE

Closing out futures contracts on E*TRADE is a straightforward process that allows you to exit your positions and realize your profits or losses. Here are the steps to close futures contracts on E*TRADE:

- Log in to your E*TRADE account: Access the E*TRADE platform using your account credentials.

- Navigate to the trading page: From the main menu, select the “Trade” or “Trading” tab to reach the trading page.

- Locate your futures position: On the trading page, locate the futures contract you want to close. You can use the search bar or browse through your open positions.

- Select the position: Click on the futures contract to select the position you want to close.

- Choose “Close Position” or “Sell”: Depending on the E*TRADE interface, you might find a specific “Close Position” button or an option to sell the contract. Select this option to initiate the closing process.

- Review and confirm the trade: Carefully review the details of the trade, including the contract, quantity, and order type (market order, limit order, etc.). Ensure that everything is accurate, and if necessary, make any adjustments.

- Place the trade: Once you are satisfied with the trade details, click “Place Order” or a similar button to execute the trade and close your futures position.

- Monitor the trade and confirmation: After placing the trade, monitor the order status to ensure that the position is closed. E*TRADE will provide real-time updates on your closed positions and the associated trade confirmation.

It’s important to note that closing out a futures contract involves selling the contract if you initially went long or buying the contract if you initially went short. The process is similar to initiating a trade, but in the opposite direction.

When closing out futures contracts, it is crucial to consider any transaction costs, such as commissions or fees, that may be applicable. Review the costs associated with closing out contracts to ensure they align with your trading strategy and financial goals.

By diligently monitoring your positions and strategically closing out contracts, you can effectively manage your futures trading portfolio and potentially realize profits or limit losses.

Now that you understand how to close futures contracts on E*TRADE, let’s explore some tips and strategies to help you make the most of your futures trading experience.

Tips and Strategies for Trading Futures on E*TRADE

Trading futures contracts on E*TRADE requires knowledge, skill, and a well-thought-out trading strategy. Here are some valuable tips and strategies to help you navigate the futures market on E*TRADE:

- Educate Yourself: Before diving into futures trading, take the time to educate yourself about how futures contracts work, understand the underlying assets, and learn about different trading strategies. E*TRADE provides resources, webinars, and educational materials to help you enhance your knowledge.

- Develop a Trading Plan: Establish a clear trading plan that outlines your objectives, risk tolerance, and entry and exit criteria. Stick to your plan and avoid impulsive trading decisions based on emotions or market noise.

- Practice with a Demo Account: E*TRADE offers a demo account that allows you to practice trading futures contracts without risking real money. Utilize this feature to test strategies, practice executing trades, and gain confidence before trading with real funds.

- Start with Small Positions: When starting out, it’s wise to begin with small position sizes. This allows you to manage risk effectively and gain experience without exposing yourself to significant losses.

- Apply Risk Management: Implement risk management techniques, such as setting stop-loss levels, employing proper position sizing, and diversifying your portfolio. Ensure that you have a plan for managing risk in every trade you enter.

- Stay Informed: Continuously monitor market news, economic indicators, and relevant events that may impact the markets. This will help you make informed trading decisions and respond to changing market conditions effectively.

- Use Technical and Fundamental Analysis: Combine technical analysis (using charts, indicators, and patterns) and fundamental analysis (assessing economic data, company reports) to gain a comprehensive understanding of the markets and make well-informed trading decisions.

- Manage Emotions: Emotions can often cloud judgment and lead to impulsive trading decisions. Develop discipline and keep emotions in check to make rational choices based on your trading plan and analysis.

- Monitor Liquidity: Ensure that there is sufficient liquidity in the futures contracts you are trading. Higher liquidity provides tighter spreads and a greater likelihood of having your orders filled at desired prices.

- Regularly Review and Adjust: Perform periodic evaluations of your trading performance, review your trades, and analyze your successes and shortcomings. Adjust your strategies accordingly to refine your approach and improve your results.

Remember that there is no guaranteed formula for success in futures trading. It takes time, practice, and continuous learning to become a successful trader. Manage your risk, be patient, and stick to your trading plan.

E*TRADE is dedicated to supporting your journey as a futures trader by providing educational resources, research tools, and a user-friendly platform. Take advantage of these resources to enhance your understanding and improve your trading skills.

Now that you have learned valuable tips and strategies for trading futures on E*TRADE, let’s conclude this article.

Conclusion

Trading futures contracts on E*TRADE can be an exciting and potentially profitable endeavor. By understanding the fundamentals of futures contracts, opening an E*TRADE account, familiarizing yourself with the platform, conducting thorough research, and implementing effective trading strategies, you can make informed trading decisions and maximize your chances of success.

In this article, we explored the process of opening an E*TRADE account, getting familiar with the platform, researching futures contracts, placing trades, managing positions, and closing out contracts. We also provided valuable tips and strategies to enhance your futures trading experience.

It is important to note that futures trading involves risk, including the potential for substantial losses. Therefore, it is crucial to educate yourself, manage risk effectively, and continuously evaluate and adjust your trading strategies.

E*TRADE offers a comprehensive platform, powerful research tools, and support resources to assist you in your futures trading journey. As you gain experience and refine your skills, make use of the educational materials, practice with a demo account, and stay informed about market news and developments.

Remember, successful futures trading requires discipline, patience, and sound decision-making. Stick to your trading plan, manage your risk, and cultivate a mindset focused on continuous learning and improvement.

Begin your futures trading journey on E*TRADE with a solid foundation of knowledge, an effective trading strategy, and a commitment to ongoing education. With dedication and perseverance, you have the potential to achieve your financial goals through trading futures contracts on E*TRADE.