Home>Finance>Which States Offer Defined Contribution Plans For State Employees

Finance

Which States Offer Defined Contribution Plans For State Employees

Published: January 2, 2024

Explore which states provide defined contribution plans for state employees and stay updated on the latest developments in finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Overview of Defined Contribution Plans

- Benefits of Defined Contribution Plans for State Employees

- States Offering Defined Contribution Plans for State Employees

- Comparison of Defined Contribution Plans across States

- Challenges and Criticisms of Defined Contribution Plans for State Employees

- Conclusion

Introduction

Welcome to our comprehensive guide on defined contribution plans for state employees! In this article, we’ll delve into the world of retirement savings options available to state employees across different states in the United States. Defined contribution plans, also known as DC plans, have gained popularity in recent years as an alternative to traditional pension systems.

DC plans provide state employees with the opportunity to take control of their retirement savings by contributing a portion of their salary into individual investment accounts. Unlike traditional pensions, which guarantee a set amount of income during retirement, DC plans offer more flexibility and portability.

Throughout this article, we’ll discuss the benefits of defined contribution plans for state employees, highlight the states that offer these plans, compare the various options available across states, and address some of the challenges and criticisms associated with DC plans. So, whether you’re a state employee looking to understand your retirement savings options, or simply seeking information on state retirement plans, you’ve come to the right place.

It’s important to note that while we provide general information on defined contribution plans for state employees, the specific details and policies may vary from state to state. It’s always advisable to consult with your state’s retirement system or a financial advisor to get accurate and personalized information.

Now, let’s dive into the world of defined contribution plans for state employees and explore the benefits, options, and considerations involved in these retirement savings plans.

Overview of Defined Contribution Plans

A defined contribution plan is a type of retirement savings plan where contributions are made by both the employee and the employer. These contributions are then invested, typically in mutual funds, stocks, bonds, or other investment vehicles, with the aim of growing the account over time.

One of the key distinguishing factors of defined contribution plans is that the retirement income is not predetermined or guaranteed. Instead, it is dependent on the amount of contributions made, the performance of the investments, and the length of time the funds are invested. This puts the onus on the employee to actively manage their investments and ensure they are making sufficient contributions to meet their financial goals.

DC plans offer several advantages for state employees. First and foremost, they provide individuals with greater control and flexibility over their retirement savings. Unlike traditional pension plans where the employer bears the investment risk and provides a fixed benefit at retirement, defined contribution plans allow employees to make investment choices and potentially reap the benefits of market upswings.

Another advantage of DC plans is their portability. If a state employee decides to leave their current job, they can generally take their defined contribution account with them. This flexibility allows employees to maintain their retirement savings, even if they switch jobs within or outside the state government.

Moreover, defined contribution plans offer transparency and visibility in terms of how the retirement funds are invested. Employees can typically access their account statements, review investment performance, and make adjustments to their portfolio based on their risk tolerance and financial goals.

It’s important to note that certain limits and regulations apply to defined contribution plans, such as annual contribution limits, withdrawal restrictions, and tax implications. Understanding these rules is crucial for state employees to make informed decisions and maximize the benefits of their retirement savings.

In the next section, we will explore the specific states that offer defined contribution plans for their employees and delve into the details of each plan. So, let’s continue on this journey to discover the options available to state employees seeking to secure their financial futures.

Benefits of Defined Contribution Plans for State Employees

Defined contribution plans offer state employees a range of benefits that can help them build a secure and comfortable retirement. Let’s explore some of the key advantages of these retirement savings plans.

- Flexibility and Control: Unlike traditional pension plans, defined contribution plans provide state employees with more flexibility and control over their retirement savings. Employees have the ability to choose how much they contribute, where their contributions are invested, and how they manage their account.

- Portability: Defined contribution plans are typically portable, meaning that if a state employee changes jobs within the state government or moves to a different state, they can usually take their retirement savings account with them. This ensures that their savings continue to grow and that they can easily manage and track their funds.

- Investment Options: DC plans often offer a variety of investment options to choose from, ranging from conservative to aggressive investment strategies. State employees can adapt their investment choices based on their risk tolerance, investment knowledge, and retirement goals.

- Transparency: One of the key benefits of defined contribution plans is the transparency they provide. Employees can typically access regular account statements, check their investment performance, and review the fees associated with their investments. This transparency helps employees stay informed about their retirement savings and make any necessary adjustments.

- Matching Contributions: Many states offer matching contributions as part of their defined contribution plans. This means that for every dollar an employee contributes, the state will also contribute a certain percentage. Matching contributions can significantly boost retirement savings, effectively multiplying the employee’s contributions and accelerating the growth of their account.

- Tax Advantages: Another advantage of defined contribution plans is the potential for tax benefits. Contributions to DC plans are typically made on a pre-tax basis, meaning that the employee’s taxable income is reduced by the amount contributed. This can result in immediate tax savings. Additionally, the growth of the investments within the plan is tax-deferred until the funds are withdrawn during retirement.

These benefits provide state employees with greater autonomy and potential for building a robust retirement nest egg. However, it’s important for employees to regularly assess their retirement goals, investment performance, and contribution levels to ensure they are on track for a secure future.

Now that we understand the advantages of defined contribution plans, let’s dive into the specific states that offer these plans to their employees and explore the nuances of each plan.

States Offering Defined Contribution Plans for State Employees

Several states in the United States have implemented defined contribution plans as part of their retirement savings options for state employees. Let’s take a closer look at some of the states that offer these plans and the specific details of each.

- New York: New York offers a defined contribution plan known as the New York State Deferred Compensation Plan. This plan allows state employees to contribute a portion of their salary on a pre-tax basis into individual investment accounts. The plan offers a variety of investment options, including mutual funds and life cycle funds, to suit different risk appetites and retirement goals.

- California: California offers the Savings Plus Program, a defined contribution plan available to state employees. This plan provides a range of investment options, including index funds, mutual funds, and target date funds. Employees can choose their contribution amount and the investments that align with their retirement objectives.

- Texas: The Texas Employees Retirement System offers a defined contribution plan called the Texa$aver 401(k) / 457 Program. State employees have the option to contribute a portion of their salary to a traditional 401(k) or a Roth 401(k), as well as a 457 plan. The plan provides various investment options and features automatic enrollment for new employees to encourage retirement savings.

- Florida: Florida offers the Florida Retirement System Investment Plan (FRS Investment Plan) as a defined contribution option for state employees. This plan allows employees to contribute a portion of their salary to individual investment accounts and offers a range of investment options, including mutual funds and lifecycle funds. The FRS Investment Plan provides flexibility and portability, allowing employees to continue their retirement savings if they switch jobs within or outside the state government.

- Illinois: In Illinois, state employees have access to the State Employees’ Retirement System (SERS) Defined Contribution Plan. Contributions to this plan are made on a pre-tax basis, allowing employees to reduce their taxable income while saving for retirement. The plan offers a variety of investment options, and employees have the freedom to manage and monitor their accounts.

These are just a few examples of states that offer defined contribution plans for state employees. Each state may have different plan names, features, and investment options to suit the diverse needs of employees. It is important for state employees to review the details of their specific state retirement system to understand the options available to them.

Now, let’s move on to the next section where we will compare the defined contribution plans across states to help state employees make informed decisions about their retirement savings.

Comparison of Defined Contribution Plans across States

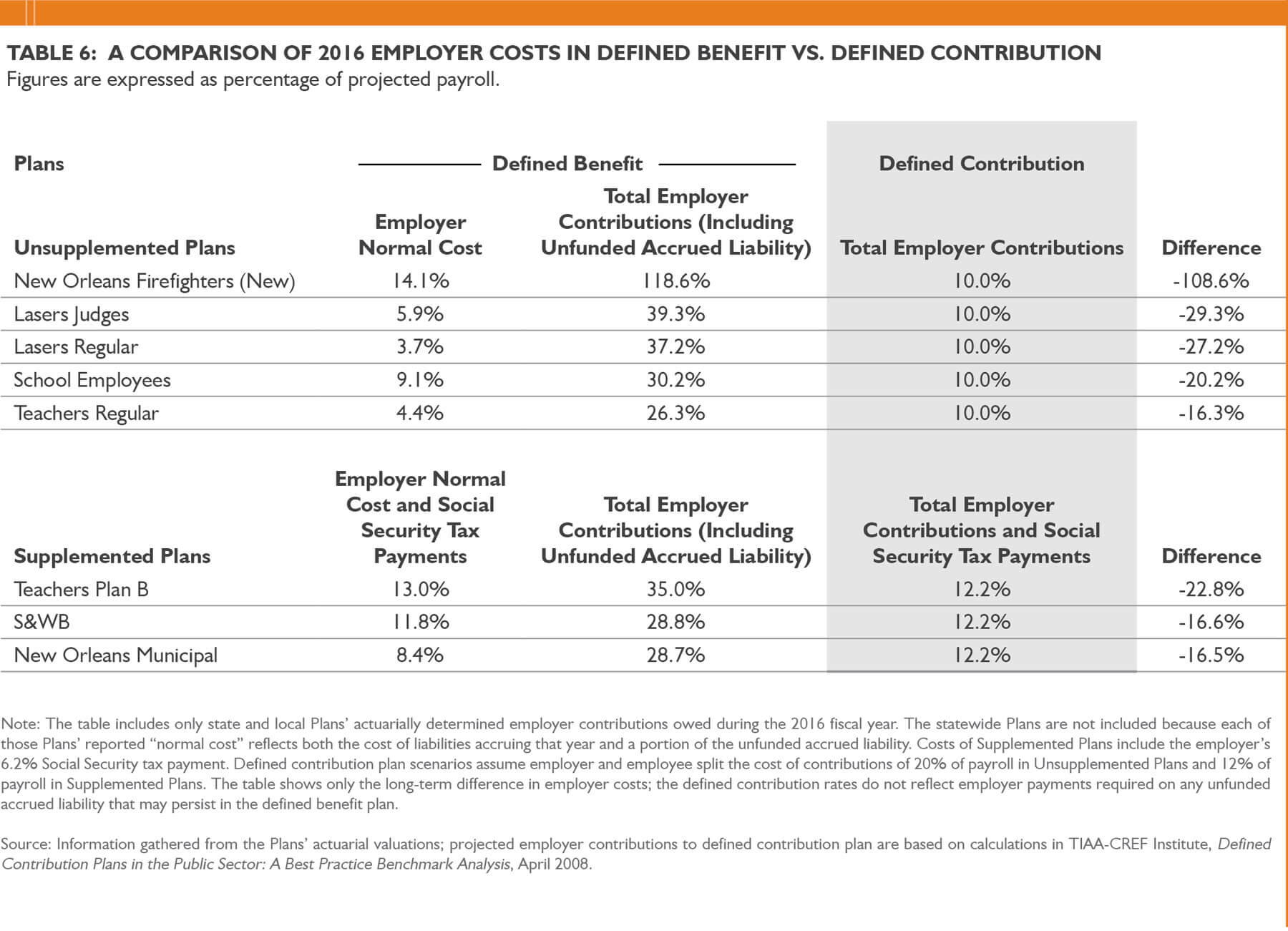

While defined contribution plans for state employees share common characteristics, the specific details and features can vary from state to state. Let’s compare some key aspects of these plans across different states to help state employees understand their options.

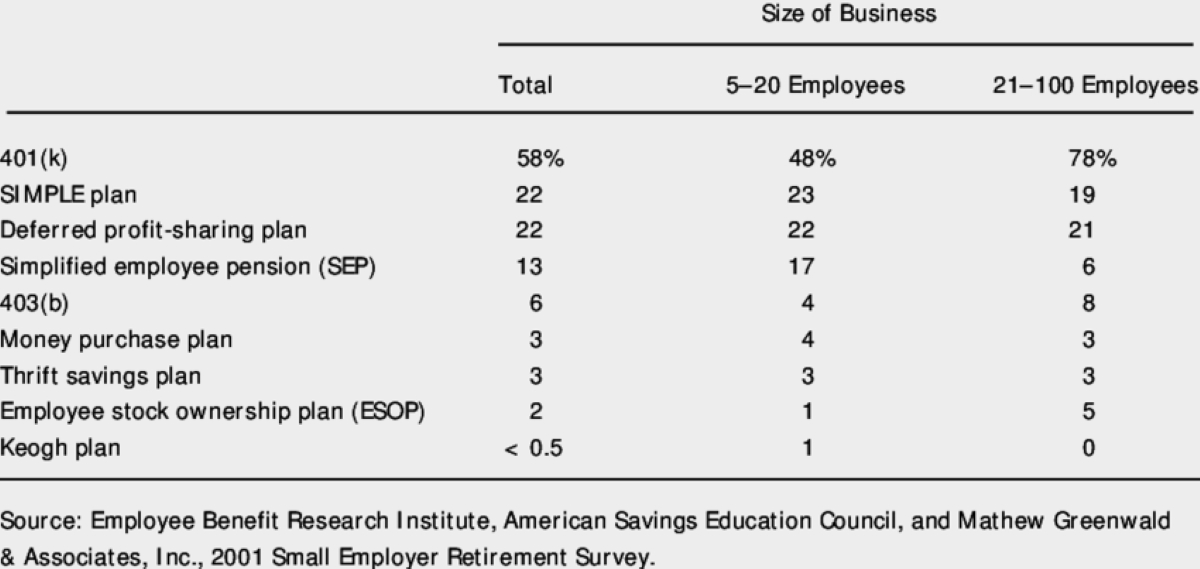

- Investment Options: The range of investment options available within defined contribution plans can vary. Some states may offer a diverse selection of mutual funds, index funds, and target date funds, while others may have a more limited choice.

- Contributions: Each state may have its own rules and limits regarding employee and employer contributions. This includes the ability for employees to make additional voluntary contributions beyond the required amount.

- Matching Contributions: Some states offer matching contributions as an incentive for employees to save for retirement. The matching percentage and contribution limits can vary, providing employees with varying degrees of additional retirement savings.

- Portability: The portability of a defined contribution plan refers to the ability of employees to carry their retirement savings from one job to another within or outside the state government. Some states have more flexible portability options, allowing employees to seamlessly transfer their funds, while others may have limitations.

- Loan and Withdrawal Options: Defined contribution plans may offer loans or hardship withdrawal options. These provisions allow employees to access their retirement savings under certain circumstances, such as a financial emergency or the need for a loan. The specific terms and conditions for loans and withdrawals can differ from state to state.

- Administrative Fees: Each state’s defined contribution plan may have its own fee structure, which can impact the overall growth of the retirement savings. It’s important for employees to understand any administrative fees associated with their accounts.

By comparing these factors across states, state employees can evaluate the suitability of each defined contribution plan based on their individual needs and preferences. It’s important to thoroughly review and understand the details of the chosen plan, including investment options, fees, and any associated rules or limitations.

Consulting with a financial advisor or contacting the retirement system in their respective state can provide additional clarity and guidance in making an informed decision about their defined contribution plan.

Now that we have explored the comparison of defined contribution plans across different states, let’s move on to the final section of our guide, where we will address some of the challenges and criticisms of these plans for state employees.

Challenges and Criticisms of Defined Contribution Plans for State Employees

While defined contribution plans offer several advantages for state employees, there are also some challenges and criticisms associated with these retirement savings options. Let’s explore some of the key concerns raised by critics and the potential challenges employees may face.

- Investment Risk: One of the main criticisms of defined contribution plans is that they shift the investment risk from the employer to the employee. Employees are responsible for managing their own investments and bearing the potential losses that may occur due to market volatility or poor investment decisions.

- Retirement Income Uncertainty: Unlike traditional pension plans that provide a fixed income during retirement, defined contribution plans do not guarantee a specific income amount. The retirement income is dependent on various factors, such as the rate of return on investments and the contributions made over the years. This uncertainty can make it challenging for employees to adequately plan and budget for their retirement years.

- Lack of Financial Knowledge: Successfully managing a defined contribution plan requires financial literacy and investment knowledge. Some state employees may lack the necessary expertise to make informed decisions about their investments, potentially leading to suboptimal retirement outcomes.

- Administrative Fees: Defined contribution plans often come with administrative fees, which can eat into employees’ retirement savings. These fees can vary depending on the provider and investment options, and over time, they can significantly impact the overall growth of the retirement account.

- Inadequate Contributions: While employees have control over their contributions in defined contribution plans, some individuals may not contribute enough to meet their retirement goals. Low contribution rates or inconsistent contributions can result in a shortfall of funds during retirement.

- Market Volatility: Defined contribution plans are exposed to market fluctuations, and during periods of economic downturns or recessions, the value of the investments can decline significantly. Such volatility can have a negative impact on retirement savings, especially if employees are close to their retirement age and do not have enough time to recover losses.

It’s important for state employees to be aware of these challenges and criticisms when considering a defined contribution plan. Understanding the risks involved and taking steps to address them, such as seeking financial advice or increasing contributions, can help mitigate some of the potential downsides.

Despite these challenges, defined contribution plans still offer valuable retirement savings opportunities for state employees, providing them with flexibility, portability, and the potential for long-term growth. Building a diversified investment portfolio, regularly reviewing and adjusting contributions, and staying informed about retirement planning can help employees make the most of their defined contribution plans.

Now, let’s conclude our comprehensive guide on defined contribution plans for state employees.

Conclusion

In conclusion, defined contribution plans offer state employees a flexible and individualized approach to saving for retirement. These plans provide employees with greater control over their investments, portability if they change jobs, and transparency in monitoring their retirement savings.

While there are challenges and criticisms associated with defined contribution plans, such as investment risk and retirement income uncertainty, these can be addressed through careful planning, financial education, and regular review of contributions and investment strategies.

It’s important for state employees to take advantage of the benefits of defined contribution plans by maximizing contributions, diversifying investments, and staying informed about their retirement options. Consulting with financial advisors and utilizing resources provided by their state retirement system can help employees make informed decisions and set realistic retirement goals.

Remember, the specific details and options of defined contribution plans can vary from state to state, so it’s crucial for state employees to understand the specific policies and features of their state’s plan.

We hope this comprehensive guide has provided valuable insights into defined contribution plans for state employees. By taking an active role in managing their retirement savings and making informed decisions, state employees can work towards a secure and comfortable future.

Now it’s time to embark on your journey to financial freedom and start planning for the retirement you deserve!