Finance

Who Buys Stocks When You Sell Them

Published: January 18, 2024

Discover who buys stocks when you sell them in the finance industry. Gain insights into the stock market and the buyers behind your transactions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Stock Market Transactions

- The Concept of Buying and Selling Stocks

- The Role of Investors in the Stock Market

- Determining Who Buys Stocks When You Sell Them

- Stock Market Orders and Execution

- Market Makers and Their Role in Stock Transactions

- Factors Influencing the Buyers of Stocks You Sell

- Conclusion

Introduction

Welcome to the exciting world of stock market transactions! If you’ve ever wondered about the mechanics of buying and selling stocks, you’re in the right place. Understanding how the stock market works can help you make informed decisions and navigate the intricacies of this dynamic financial landscape.

When it comes to buying and selling stocks, it’s natural to wonder who exactly is on the other side of the transaction. Who are the individuals or entities buying the stocks when you sell them? In this article, we’ll dive into the intricacies of stock market transactions and shed light on the various players involved.

The stock market operates on the basic principle of supply and demand. Stock prices fluctuate based on the forces of buying and selling, leading to the rise and fall of individual stocks and overall market indices. Transactions in the stock market are facilitated through exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ, where buyers and sellers come together to complete their trades.

Investing in the stock market allows individuals to become partial owners, or shareholders, in a publicly traded company. By purchasing shares of a company’s stock, investors have the potential to earn returns through capital appreciation and dividends. Conversely, selling stocks allows investors to liquidate their holdings and potentially realize a profit or cut losses.

Understanding Stock Market Transactions

Stock market transactions refer to the buying and selling of stocks or securities on the open market. These transactions are a crucial component of the financial system, providing liquidity and allowing investors to participate in the growth potential of publicly traded companies.

When you buy or sell stocks, you are participating in a transaction that involves two parties: the buyer and the seller. The buyer seeks to acquire shares in a particular company, while the seller is looking to offload their existing shares. These transactions are facilitated through various mechanisms, including stock exchanges and brokerage firms.

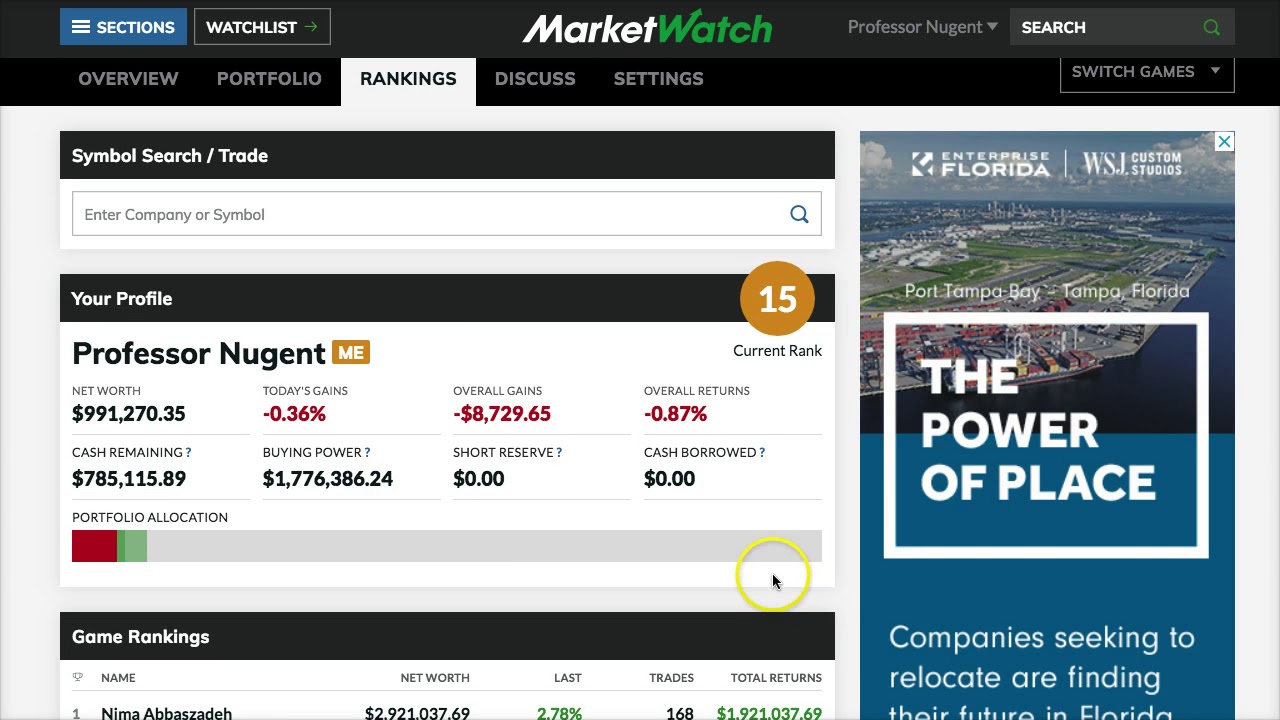

It’s important to note that stock market transactions are not limited to individual investors. Institutions such as pension funds, mutual funds, and hedge funds also engage in buying and selling stocks on a large scale. This blend of individual and institutional investors creates a robust and dynamic market environment.

The process of stock market transactions involves submitting buy or sell orders to a broker or a trading platform. Investors specify the number of shares they are willing to buy or sell and the price at which they are willing to transact. This information is then relayed to the appropriate exchange or market maker for execution.

Stock market transactions can be divided into two primary types: market orders and limit orders. Market orders are executed at the prevailing market price, while limit orders are executed only if the stock reaches a specified price. Both types of orders have their pros and cons, and investors need to consider their objectives and risk tolerance when deciding which type to use.

Furthermore, stock market transactions involve various fees and commissions. Brokers charge fees for executing trades on behalf of investors, and these fees can vary based on factors such as the broker’s platform, the size of the trade, and the frequency of transactions.

In the next sections, we will explore in more detail the concept of buying and selling stocks, as well as the role of investors in the stock market. Understanding these dynamics will shed light on who exactly is buying the stocks when you sell them.

The Concept of Buying and Selling Stocks

Buying and selling stocks lies at the core of investing in the stock market. When you buy a stock, you are essentially purchasing a small portion of ownership in a publicly traded company. This ownership is represented by shares, and the more shares you own, the larger your stake in the company becomes.

The process of buying stocks involves finding a stock that aligns with your investment goals and analyzing its potential for growth or income. Once you have identified a suitable stock, you can place a buy order through a broker or an online trading platform. The order specifies the number of shares you wish to purchase and the price you are willing to pay.

When it comes to selling stocks, the process is similar. Once you decide to sell your shares, you place a sell order, again specifying the number of shares you want to sell and the price at which you are willing to part with them. The goal, of course, is to sell the shares at a higher price than the purchase price, allowing you to make a profit.

It’s essential to understand that the price of a stock is determined by supply and demand dynamics in the market. If more people are buying a particular stock, the demand increases, and the price tends to rise. Conversely, if there are more sellers than buyers, the price may decline.

Investors buy and sell stocks for various reasons. Some aim to make short-term profits by capitalizing on price fluctuations, while others take a long-term approach, investing in companies they believe will generate substantial growth over time. Additionally, some investors focus on dividend-paying stocks, aiming to generate a steady stream of income from their investments.

When you sell your stocks, the buyers can be individuals like yourself, institutional investors, or even market makers. Market makers are entities that facilitate stock market liquidity by continuously providing quotes to buy or sell shares at prevailing market prices. They buy stocks from sellers and sell them to buyers, profiting from the spread between the bid and ask prices.

Overall, the concept of buying and selling stocks is a fundamental aspect of stock market investing. Understanding these mechanisms is crucial for investors who want to navigate the market effectively and make informed decisions about their holdings.

The Role of Investors in the Stock Market

Investors play a vital role in the functioning and growth of the stock market. Their participation represents the demand side of the equation, driving the buying and selling activity in the market. Understanding the role of investors in the stock market can provide valuable insights into who buys stocks when you sell them.

Individual investors, also known as retail investors, are everyday people who buy and sell stocks for personal investment purposes. They may invest in the stock market directly through brokerage accounts or indirectly through retirement accounts such as 401(k) plans or individual retirement accounts (IRAs). Retail investors are diverse in terms of their investment goals, risk tolerance, and investing strategies.

Institutional investors, on the other hand, are large entities that manage investments on behalf of others. These investors include pension funds, mutual funds, hedge funds, insurance companies, and other financial institutions. Institutional investors typically have significant financial resources at their disposal, allowing them to make substantial investments in the stock market.

The role of investors in the stock market extends beyond the buying and selling of stocks themselves. Investors provide the necessary capital for companies to grow and expand by purchasing newly issued shares through initial public offerings (IPOs). This influx of capital allows companies to fund research and development, invest in new projects, hire employees, and drive innovation.

Moreover, investors influence stock prices based on their perceptions of a company’s value and future prospects. Positive news or favorable developments can attract more buyers, leading to an increase in stock prices. Conversely, negative news can prompt investors to sell their shares, causing prices to decline. The actions of investors collectively contribute to the overall market sentiment and impact stock prices.

Investors also play a crucial role in corporate governance. As shareholders, they have the right to vote on important company decisions, such as the election of the board of directors and approval of corporate policies. This mechanism allows investors to voice their opinions and exert influence over the companies they invest in.

Furthermore, the behavior of investors, particularly institutional investors, can move the stock market as a whole. Large institutional investors have the ability to buy or sell significant amounts of shares, resulting in price fluctuations and market volatility.

Overall, investors are fundamental to the functioning of the stock market. Their buying and selling activities, along with their investment decisions and capital allocation, shape the market and influence the prices of stocks. Understanding the roles and behaviors of investors can help explain who is buying stocks when you decide to sell them on the market.

Determining Who Buys Stocks When You Sell Them

When you sell stocks on the market, it’s important to understand that the buyers can be a diverse mix of individuals, institutions, and market makers. The exact identity of the buyers can vary depending on several factors, including the stock’s popularity, current market conditions, and the size of the transaction.

One possible scenario when you sell stocks is that individual retail investors could be the ones buying them. These investors include individuals like yourself, who are looking to invest in specific companies or diversify their portfolios. Retail investors may be seeking long-term growth, dividend income, or even making short-term trading decisions.

In addition to individual investors, institutional investors can also play a significant role in buying stocks when you sell. Institutions such as pension funds, mutual funds, and insurance companies actively invest in the stock market on behalf of their clients or policyholders. These large-scale investors have the resources and expertise to make substantial stock purchases, even in times of market volatility.

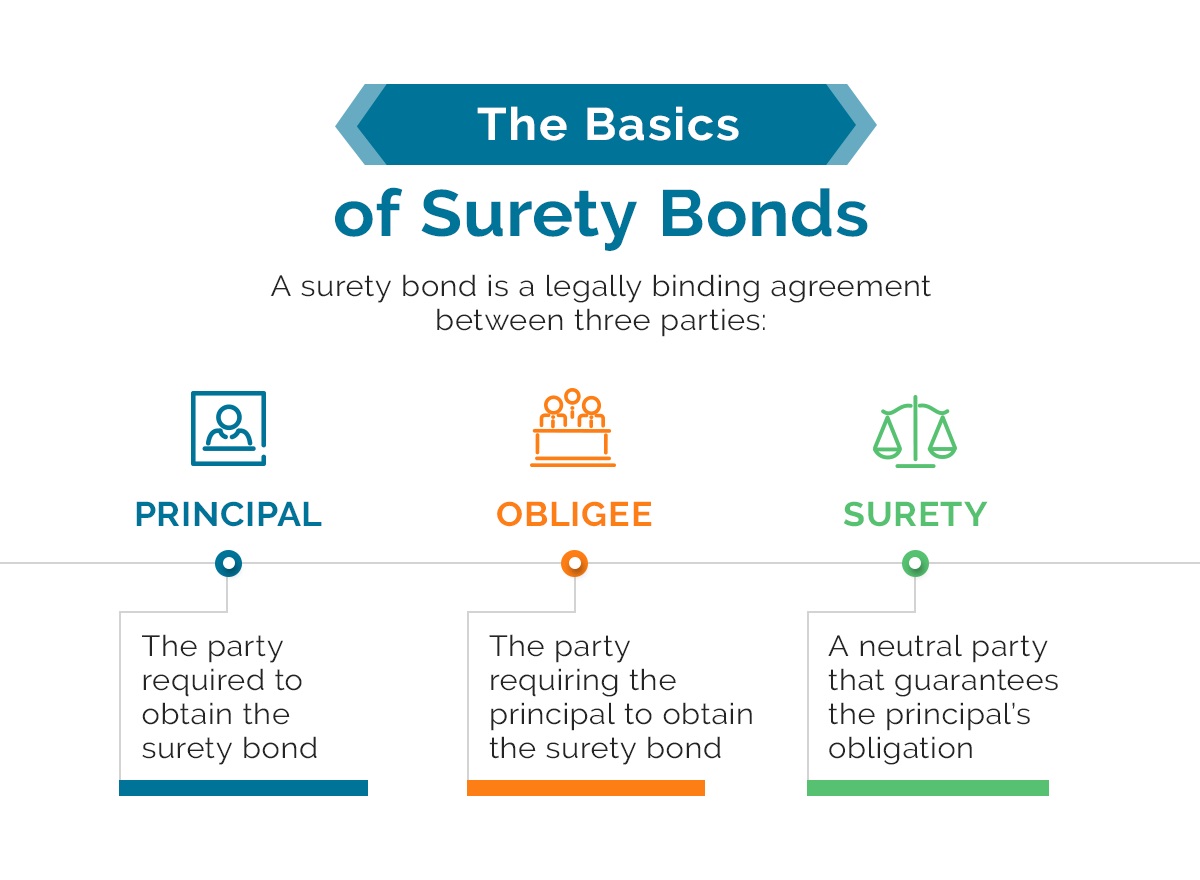

Market makers, or authorized participants, are another crucial player in stock transactions. Market makers are financial firms or broker-dealers that provide liquidity to the stock market by continuously buying and selling shares. They quote both bid (buy) and ask (sell) prices for stocks, allowing investors to transact at any given time. Market makers ensure that there is always a buyer for every seller, helping to maintain market efficiency.

In some instances, especially for highly traded stocks, the buyer may be another investor who is looking to increase their position in a particular company. These buyers could be individual investors or institutional investors who see value in the stock and believe it has the potential for future growth.

It’s also worth noting that some buyers may have a different investment strategy than you as a seller. While you may be selling to realize a profit or cut losses, others may be buying based on their analysis of the stock’s growth prospects, dividend potential, or even market trends. Different investors have different objectives, risk tolerances, and time horizons, which can result in varying buying behaviors.

Ultimately, the specific buyers of your stocks when you sell them cannot be determined with certainty. The stock market is a dynamic environment where millions of transactions occur every day. While individual and institutional investors drive much of the buying activity, market makers also play a critical role in ensuring liquidity and facilitating transactions.

Understanding the various players in the stock market and their behaviors can provide a broader perspective on who is likely to buy stocks when you decide to sell them. However, it’s important to remember that the exact buyers can vary depending on market conditions and the specific circumstances surrounding your sale.

Stock Market Orders and Execution

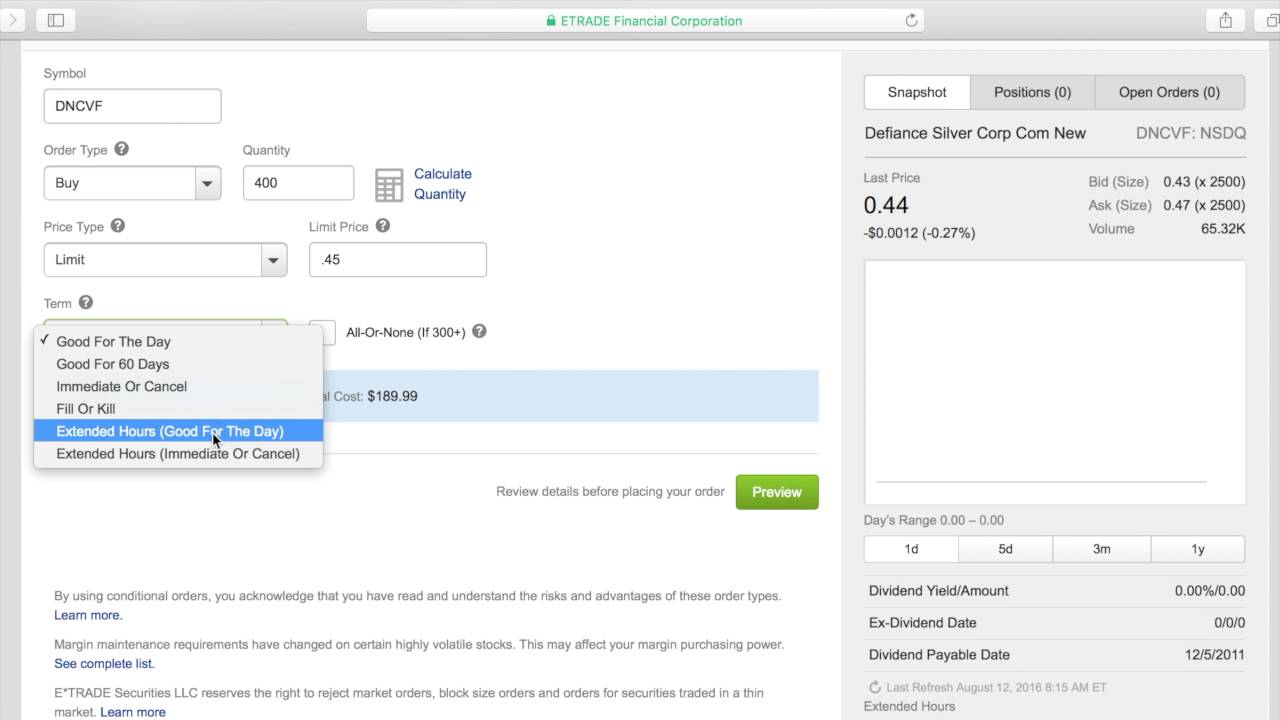

Stock market orders are instructions given by investors to buy or sell stocks at a certain price. These orders are essential for executing stock market transactions and ensuring that the buying and selling process is carried out efficiently. Understanding the different types of orders and their execution is crucial for investors.

When placing a stock market order, investors have several options to consider:

- Market Order: A market order is an instruction to buy or sell a stock at the prevailing market price. Market orders are executed quickly, as they prioritize filling the order over obtaining a specific price. This means that the actual price at which the order is executed may differ slightly from the quoted price at the time of placing the order.

- Limit Order: A limit order is an instruction to buy or sell a stock at a specific price or better. With limit orders, investors set a price threshold at which they are willing to transact. If the market price reaches or surpasses the specified limit price, the order is executed. If the limit price is not reached, the order remains open until it is either canceled or executed at a later time.

- Stop Order: A stop order becomes a market order once the stock reaches a specified stop price. Investors typically use stop orders to limit potential losses or protect profits. For example, a stop-loss order is placed below the current market price to automatically sell a stock if it declines to a certain level.

- Stop-Limit Order: A stop-limit order is a combination of a stop order and a limit order. It triggers the creation of a limit order once the stock reaches a specified stop price. The difference from a regular stop order is that the limit order specifies a minimum acceptable price for the transaction, providing investors with additional control over the execution price.

Once an order is placed, it goes through the execution process, which involves matching buy and sell orders. Stock exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ, operate electronic trading systems that facilitate the matching of orders and the execution of trades.

The execution of stock market orders occurs through a process known as the “order book.” When an order is placed, it is added to the order book, where it is matched against other orders based on price and time priority. Orders are typically filled in a first-in, first-out (FIFO) manner, with existing orders in the book taking precedence over new orders.

The time it takes for an order to be executed can vary based on the stock’s liquidity, market conditions, and the type of order placed. Highly liquid stocks with a high trading volume tend to have faster order execution, while less liquid stocks may take longer to fill an order.

It’s worth noting that in fast-moving markets or during periods of high volatility, the execution price of a market order may differ significantly from the expected price due to rapid price fluctuations. This is known as slippage and can occur when the market price changes between the time the order is placed and the time it is executed.

Overall, understanding the various types of stock market orders and their execution criteria is essential for investors. It allows them to choose the most appropriate order type for their investment objectives and manage their expectations regarding order execution time and potential price slippage.

Market Makers and Their Role in Stock Transactions

Market makers are key participants in stock transactions, playing a crucial role in ensuring market liquidity and facilitating the buying and selling of stocks. They are specialized entities, often broker-dealers or financial firms, that constantly provide two-way quotes for specific stocks, acting as intermediaries between buyers and sellers.

The primary function of market makers is to maintain an orderly and efficient market by continuously quoting bid and ask prices for stocks. The bid price represents the price at which the market maker is willing to buy shares, while the ask price indicates the price at which they are willing to sell. These quotes enable investors to conduct transactions at any given time, providing liquidity to the market.

When a buyer places a buy order or a seller places a sell order, market makers step in to match the orders and complete the transaction. They serve as counterparties to both sides of the transaction, buying stocks from sellers and selling them to buyers. By doing so, they ensure that there is always a buyer for every seller and vice versa, even if there is an imbalance in supply and demand.

Market makers make a profit from the bid-ask spread, which is the difference between the price at which they buy and the price at which they sell stocks. The spread serves as compensation for the risk they assume in maintaining inventory and providing liquidity, as well as the cost of capital required to support their operations.

In addition to facilitating trades, market makers help establish and maintain market prices. Their continuous quoting activity helps determine the fair market value of a stock based on real-time supply and demand dynamics. Market makers monitor market conditions, news, and other factors that can influence stock prices, adjusting their bid and ask prices accordingly.

Market makers also play a vital role in enhancing market efficiency. By providing liquidity, they reduce the bid-ask spread and minimize price volatility, ensuring that buyers and sellers can transact at fair and transparent prices. Their presence helps improve market depth, allowing large orders to be executed without excessive price impact.

Furthermore, market makers contribute to market stability during periods of market stress or high volatility. They act as stabilizers by absorbing selling pressure and providing a cushion against sharp price declines. This can prevent extreme market movements and promote orderly trading conditions.

It’s important to note that market makers are subject to regulatory oversight to ensure fair and transparent trading practices. They must comply with regulations governing their quoting obligations, price reporting, and transaction transparency.

In summary, market makers play a critical role in stock transactions by providing liquidity, maintaining market prices, and contributing to market efficiency. Their continuous quoting activity allows for smooth and efficient buying and selling of stocks, ensuring that investors can transact at fair and transparent prices.

Factors Influencing the Buyers of Stocks You Sell

When you sell stocks, several factors can influence the buyers who are willing to purchase them. Understanding these factors can provide valuable insights into the demand side of the market and help explain who may be interested in buying the stocks you are selling.

1. Company Fundamentals: The financial health and performance of the company whose stocks you are selling play a significant role. Buyers consider factors such as revenue growth, profitability, debt levels, and earnings potential. Positive company fundamentals can attract buyers who believe in the company’s growth prospects.

2. Industry Trends: Buyers often consider the broader industry trends and market outlook. If an industry is experiencing growth or disruption, it can attract buyers looking to capitalize on the sector’s potential. Conversely, if an industry is facing challenges or uncertainty, it may deter buyers.

3. Market Sentiment: Overall market sentiment, influenced by economic factors, geopolitical events, and investor sentiment, can impact the buying interest in stocks. During periods of strong market optimism, buyers may be more willing to make investments. Conversely, during times of market volatility or pessimism, buyers may be more cautious.

4. Institutional Investor Activity: The activity of institutional investors, such as mutual funds, pension funds, and hedge funds, can significantly influence the buying interest in stocks. If reputable institutional investors are accumulating shares, it can attract other buyers who seek to follow their investment decisions.

5. Investor Risk Appetite: Investor risk tolerance and investment preferences also impact the buyers of stocks. Some investors may be more risk-averse, preferring stable dividend-paying stocks, while others may be more aggressive, seeking high-growth opportunities. Buyers with a specific risk appetite may be more inclined to purchase certain stocks.

6. Market News and Analyst Recommendations: News and recommendations from analysts can influence buyer perceptions and decisions. Positive news, such as strong earnings reports or new product announcements, can generate interest from buyers. Similarly, positive recommendations from well-regarded analysts or brokerage firms can attract buyers’ attention.

7. Valuation Metrics: Buyers often evaluate stocks based on valuation metrics, such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, or other valuation multiples. Buying decisions may be influenced by whether a stock appears undervalued or overvalued compared to industry peers or its historical valuation.

8. Dividend Policies: For buyers seeking income, a company’s dividend history and dividend policy can be influential factors. Companies with a consistent or growing dividend track record may attract buyers looking for reliable cash flow from their investments.

9. Technical Analysis: Some buyers rely on technical analysis, studying historical price patterns, trends, and indicators, to make buying decisions. Technical analysis can help identify potential entry or exit points for trades based on chart patterns and momentum indicators.

10. Market Liquidity: The level of liquidity in the market can impact the number and type of buyers. Higher liquidity generally attracts more buyers, as they can easily enter and exit positions without significant price impact.

It’s important to note that different buyers have varying investment objectives, time horizons, and risk preferences. As a result, the factors influencing their buying decisions may differ from buyer to buyer. By understanding these factors, you can gain insights into the potential buyers of the stocks you are selling and their motivations for purchasing them.

Conclusion

Understanding the dynamics of buying and selling stocks in the stock market can provide valuable insights into who is on the other side of the transaction when you sell your stocks. While the exact buyers can vary depending on various factors, several key players participate in stock market transactions.

Individual retail investors, institutional investors, and market makers all contribute to the liquidity and efficiency of the stock market. Retail investors can be individuals like yourself, seeking to invest in specific companies or diversify their portfolios. Institutional investors, such as pension funds and mutual funds, invest on a larger scale on behalf of their clients. Market makers, on the other hand, facilitate stock transactions and provide liquidity by continuously quoting bid and ask prices.

Factors influencing the buyers of stocks that you sell include company fundamentals, industry trends, market sentiment, institutional investor activity, investor risk appetite, market news and recommendations, valuation metrics, dividend policies, technical analysis, and market liquidity. These factors can impact the demand for your stocks and attract buyers with different investment goals and strategies.

Ultimately, the stock market operates based on the principles of supply and demand. As a seller, your stocks can be purchased by a wide range of buyers, each with their own investment objectives and motivations. Understanding these dynamics can provide valuable insights into the market environment and help inform your decision-making process.

As you navigate the world of stock market transactions, it’s essential to stay informed, conduct thorough research, and consult with financial professionals if needed. By staying up-to-date with market trends and understanding the factors influencing buyers, you can make more informed decisions and maximize the potential of your investments in the stock market.