Finance

How To Sell Stocks On Marketwatch

Published: January 19, 2024

Learn how to sell stocks on Marketwatch and manage your finances effectively. Maximize your returns with our step-by-step guide on selling stocks in the stock market.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of stock trading! Whether you’re a seasoned investor or a beginner looking to dip your toes into the world of finance, understanding how to sell stocks is a crucial skill to have. And what better platform to guide you through this process than Marketwatch?

Marketwatch is a popular financial news and information platform that not only helps you stay updated on the latest market trends, but also provides you with the tools to execute your trades. Selling stocks on Marketwatch can be a seamless and efficient process that allows you to make informed decisions and maximize your profits.

In this article, we will walk you through the steps of selling stocks on Marketwatch. From researching and choosing which stocks to sell, to executing your sell order and monitoring your sales performance, we will cover every aspect to ensure you have a comprehensive understanding of the process.

Before we dive into the nitty-gritty details, let’s take a moment to understand the stock market and its role in the overall financial landscape.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Suspendisse viverra augue lacus, a eleifend justo fringilla id. Vestibulum ultricies quam in turpis efficitur, nec ullamcorper ante ultricies. Vestibulum non felis quis augue rutrum faucibus eget ut ex. Phasellus lacus sem, fringilla finibus dictum et, porta ac mi. Curabitur mollis euismod eros sed viverra. Nullam ac congue orci, nec dignissim purus. Aliquam dictum, arcu vitae cursus pharetra, sapien sem lacinia orci, sit amet tristique elit enim ut velit. Ut convallis lorem nisi, et faucibus lectus rutrum ut. Phasellus ac turpis interdum, aliquam nulla at, consectetur leo. Morbi ac justo at enim faucibus elementum ac a lorem. Sed quis auctor ex, ut facilisis enim. Etiam laoreet, nisl eu laoreet finibus, ipsum risus condimentum tortor, at aliquam felis enim a nibh.

Proin auctor maximus quam, ac imperdiet ligula commodo vitae. Pellentesque habitant morbi tristique senectus et netus et malesuada fames ac turpis egestas. Phasellus sit amet arcu nec lacus mollis commodo vel et arcu. Phasellus vitae turpis sed elit sagittis consectetur ac nec urna. Sed volutpat metus massa, ut eleifend neque dapibus in. Phasellus quis placerat ipsum, non semper sapien. Quisque gravida tellus non lectus accumsan, quis cursus velit iaculis. Donec sed enim quis tortor finibus feugiat non tempus massa. Donec rhoncus aliquam hendrerit. Vivamus ullamcorper dapibus leo, at dapibus odio ullamcorper eget. Interdum et malesuada fames ac ante ipsum primis in faucibus. Quisque accumsan tellus vitae purus dictum, id consectetur tortor ultrices. Vivamus viverra ac ipsum nec finibus. Donec iaculis nisi a laoreet tristique.

Understanding the Stock Market

Before you start selling stocks on Marketwatch, it’s important to have a basic understanding of how the stock market works. Essentially, the stock market is a platform where investors can buy and sell shares of publicly-traded companies. It serves as a marketplace for individuals and institutions to trade stocks, bonds, and other securities.

The stock market can be divided into two main parts: the primary market and the secondary market. The primary market is where newly-issued securities are bought and sold through initial public offerings (IPOs). On the other hand, the secondary market is where previously-issued securities are traded between investors. Marketwatch primarily focuses on the secondary market, allowing you to buy and sell stocks of already established companies.

Stocks, also known as equities, represent ownership in a company. When you buy stocks, you become a shareholder and have a claim on the company’s assets and profits. The value of stocks can fluctuate based on a variety of factors such as company performance, economic conditions, and investor sentiment.

It’s important to note that the stock market can be volatile and subject to short-term fluctuations. Prices can be influenced by factors such as news events, earnings reports, geopolitical events, and market trends. Therefore, it is crucial to conduct thorough research and make informed decisions when it comes to buying or selling stocks.

Marketwatch provides valuable resources to help you stay informed about the market and make well-informed decisions. From real-time stock quotes and charts to news articles and expert analysis, you can access a wealth of information to guide your selling strategy.

Now that you have a basic understanding of the stock market, let’s delve into the process of researching the stocks you want to sell on Marketwatch.

Researching the Stocks to Sell

Before you sell stocks on Marketwatch, it’s crucial to conduct thorough research on the stocks you’re considering selling. This research will help you make informed decisions and maximize your selling potential.

Here are some key steps to follow when researching the stocks to sell:

- Review Company Performance: Start by examining the company’s financial performance. Look at its revenue growth, earnings per share, and profitability over time. Pay attention to any significant changes in the company’s financials, such as fluctuations in revenue or declining profitability. This information will provide you with insights into the company’s overall health and stability.

- Analyze Industry Trends: Consider the broader industry trends and how they may impact the company. Understanding the industry dynamics can give you a better sense of the competitive landscape and help you assess the company’s long-term prospects. Look for any emerging trends or disruptive technologies that could potentially impact the company’s future growth.

- Study Market Conditions: Evaluate the overall market conditions and sentiment. Marketwatch provides real-time market data, news, and analysis that can help you understand the current market trends and sentiment. Consider factors such as economic indicators, geopolitical events, and investor sentiment when assessing the selling potential of your chosen stocks.

- Read Analyst Reports: Take advantage of the analyst reports available on Marketwatch. These reports provide insights and recommendations from professional analysts who have expertise in evaluating stocks. Analyst reports can offer valuable perspectives on a company’s prospects and target price recommendations, helping you make more informed decisions about selling your stocks.

- Consider Risk Factors: Assess the potential risks associated with the stocks you’re considering selling. Look for factors such as regulatory challenges, competition, and any legal or operational risks that may impact the company’s performance. Understanding and quantifying these risks will help you determine your selling strategy and potential selling price.

By thoroughly researching the stocks you intend to sell, you’ll be equipped with the necessary knowledge to make informed decisions and optimize your selling strategy. Once you have completed your research, it’s time to move on to the next step: setting your selling strategy.

Setting Your Selling Strategy

Setting a well-defined selling strategy is crucial when it comes to selling stocks on Marketwatch. By establishing a clear plan, you can navigate the market with confidence and increase your chances of achieving your desired selling outcomes. Here are some key factors to consider when setting your selling strategy:

- Define Your Objectives: Start by clarifying your selling objectives. Are you looking to take profits on a short-term trade, or are you aiming for long-term capital appreciation? Understanding your goals will help you determine the appropriate selling approach for your stocks.

- Identify Your Selling Price: Decide on the price at which you are willing to sell your stocks. This price can be based on a variety of factors, including your investment thesis, target price based on analyst recommendations, or a specific desired return on investment. Keep in mind that market conditions can fluctuate, so be prepared to be flexible with your selling price if necessary.

- Determine Your Selling Timeframe: Consider your time horizon and when you want to sell your stocks. Are you planning to sell your stocks in the short-term, or are you willing to hold them for an extended period? This decision may be influenced by factors such as your investment goals, market conditions, or changes in the company’s performance.

- Establish Stop-Loss and Take-Profit Levels: Implementing stop-loss and take-profit orders can help mitigate risks and protect your investment. A stop-loss order instructs your broker to sell your stocks if they reach a specific predetermined price, limiting potential losses. On the other hand, a take-profit order sets a price at which your stocks will be sold automatically when they reach a certain level of profit.

- Consider Tax Implications: Understand the tax implications of selling your stocks. Depending on your jurisdiction and the holding period of your stocks, you may be subject to capital gains taxes. Consult with a tax professional to ensure you comply with the relevant tax regulations.

By carefully considering these factors and establishing a comprehensive selling strategy, you’ll be well-equipped to navigate the stock market and make informed decisions when it comes to selling your stocks on Marketwatch. Now that your selling strategy is in place, it’s time to move forward and learn how to execute your sell order on Marketwatch.

Placing a Sell Order on Marketwatch

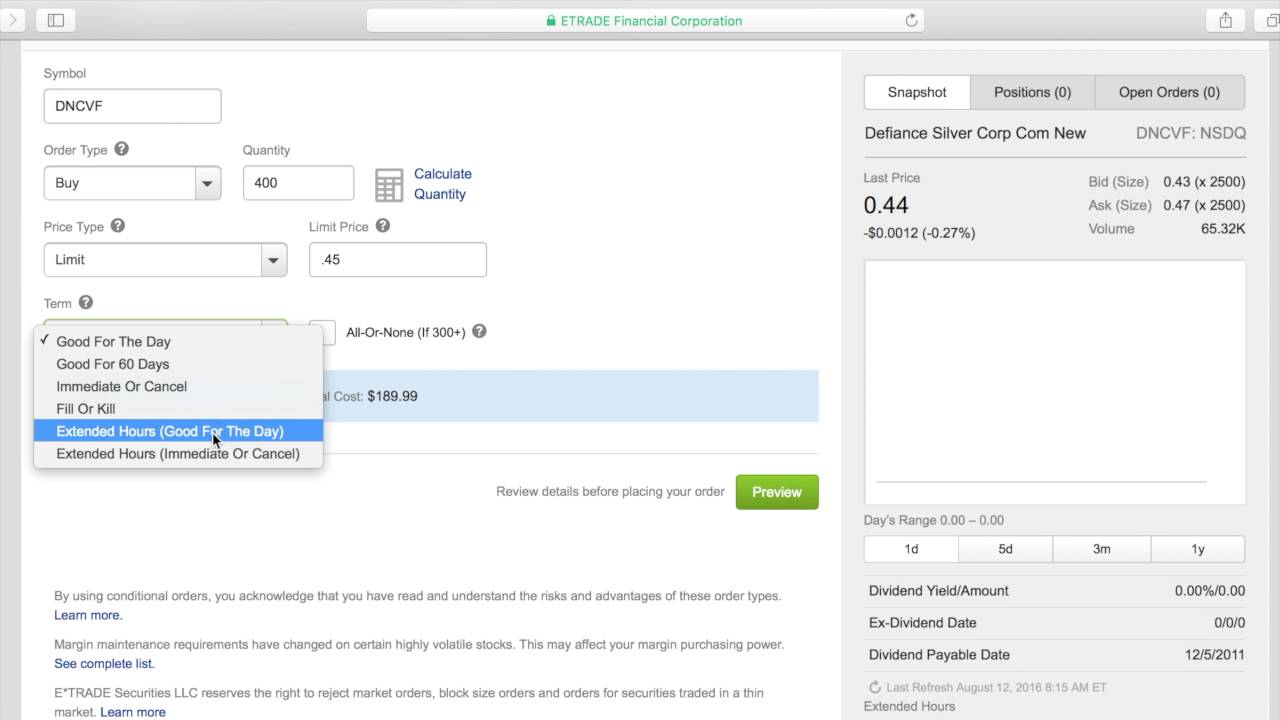

Once you have conducted your research, set your selling strategy, and determined that it’s time to sell your stocks on Marketwatch, the next step is to place a sell order. Marketwatch provides a user-friendly platform where you can easily execute your trades. Here’s how to place a sell order on Marketwatch:

- Log into Your Marketwatch Account: If you haven’t already done so, log into your Marketwatch account. If you don’t have an account yet, you’ll need to create one.

- Access the Trading Platform: Once you’re logged in, navigate to the trading platform on Marketwatch. This is where you can place your sell order.

- Select the Stock You Want to Sell: Locate the stock you wish to sell from your portfolio or the search bar on Marketwatch. Click on the stock symbol to access the stock’s trading details.

- Choose the Sell Option: On the stock’s trading details page, you will see various options such as “Buy,” “Sell,” or “Trade.” Select the “Sell” option to initiate the selling process.

- Enter the Quantity: Specify the quantity or number of shares you wish to sell. Ensure that you enter the correct amount based on your selling strategy and the number of shares you want to liquidate.

- Set the Selling Price: Enter the desired selling price for your shares. You can opt to set a limit order, which means your shares will only be sold at the specified price or higher. Alternatively, you can choose a market order, which means your shares will be sold at the best available price in the market.

- Review and Confirm: Before finalizing your sell order, review all the details carefully to ensure accuracy. Double-check the quantity, selling price, and any additional order instructions.

- Place the Sell Order: Once you are satisfied with the details, click on the “Place Order” or “Sell” button to execute the sell order. Marketwatch will process your order, and you will receive a confirmation once it’s executed.

It’s important to note that the execution of your sell order may be subject to market conditions and the availability of buyers. The time it takes for your order to be executed may vary, so be prepared for potential fluctuations in the selling price.

Now that you have successfully placed your sell order on Marketwatch, it’s time to move on to the next step: monitoring your sales performance.

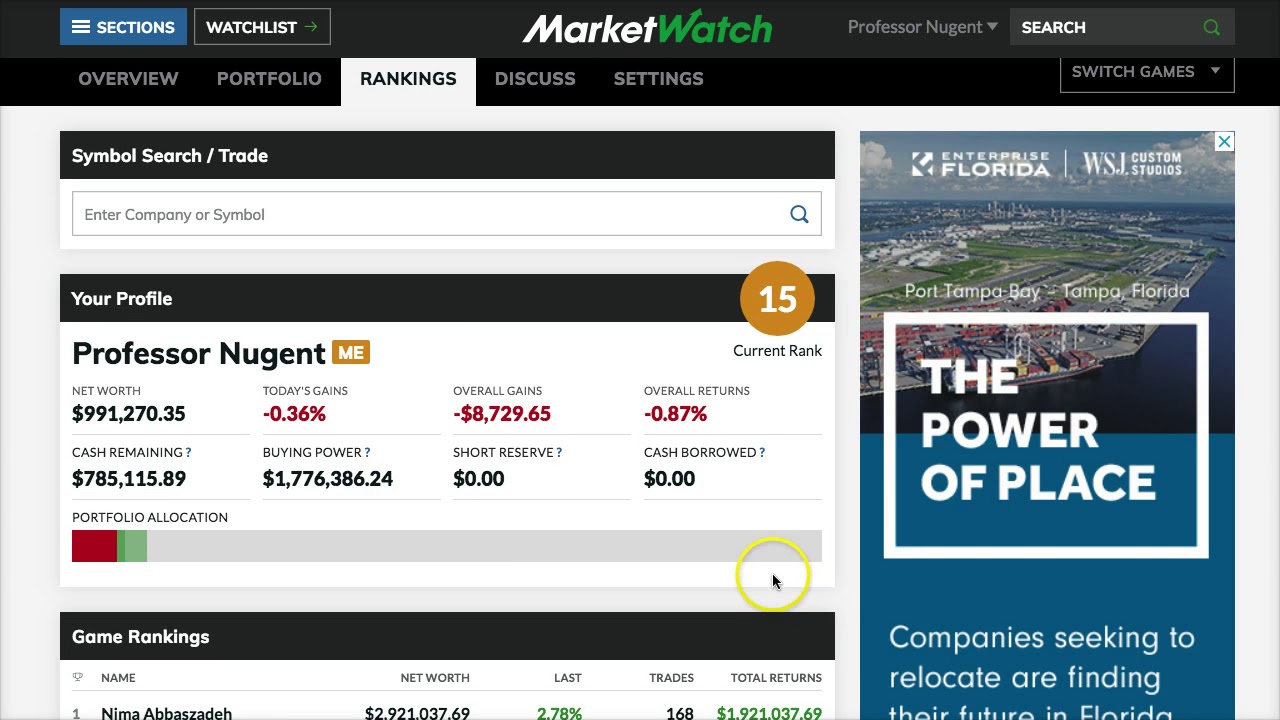

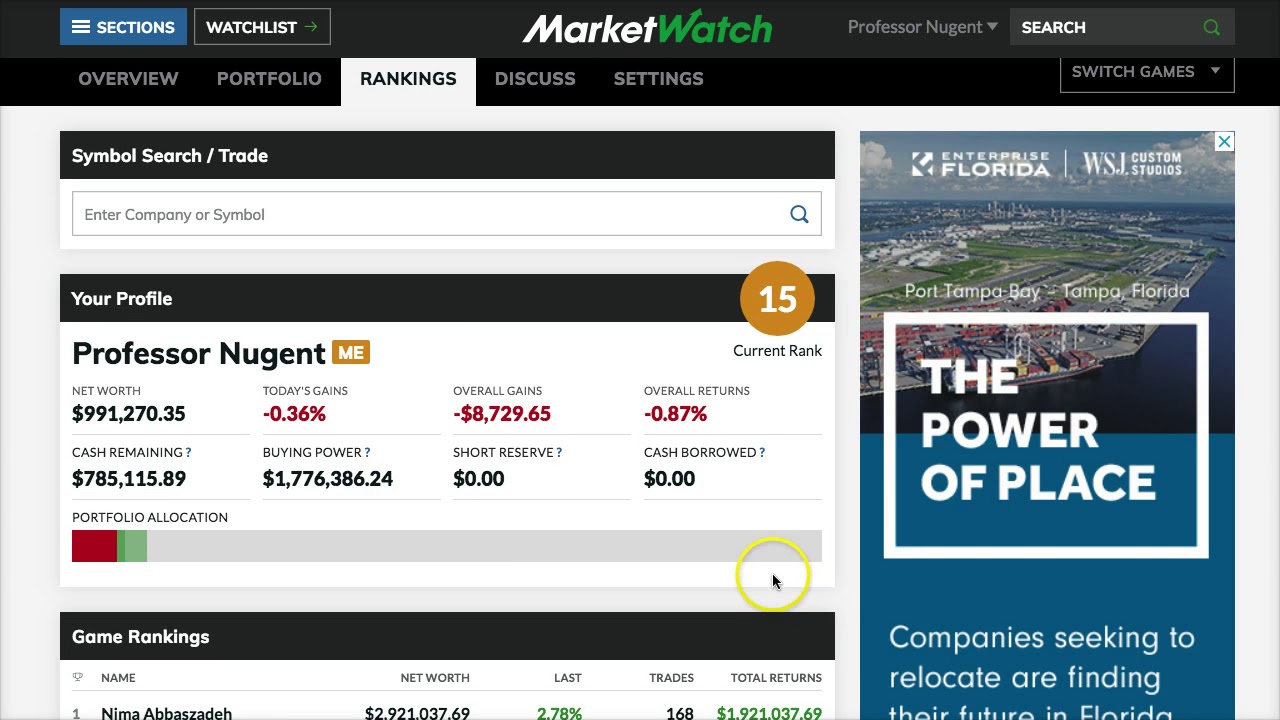

Monitoring Your Sales Performance

After placing a sell order on Marketwatch, it’s essential to actively monitor your sales performance to assess the effectiveness of your selling strategy and make any necessary adjustments. Here are some key steps to effectively monitor your sales performance:

- Track the Stock Price: Keep an eye on the stock’s price movement after placing your sell order. Monitor whether the price is moving in your desired direction or if there are significant fluctuations that could impact your selling strategy.

- Stay Informed with Marketwatch: Utilize the resources available on Marketwatch to stay up-to-date with the latest news and market analysis. Monitor any news or events that may affect the company you have sold stocks in, as well as broader market trends that could impact your sales performance.

- Review Order Execution: Confirm that your sell order has been executed correctly. Check your Marketwatch account to ensure that the shares you intended to sell have been removed from your portfolio and that the corresponding funds have been added to your account.

- Analyze Sales Performance: Evaluate the performance of your sold stocks over time. Calculate and compare your selling price with the price at which the stock is currently trading. Assess whether your selling strategy was successful in achieving your objectives, such as taking profits or limiting losses.

- Assess Tax Implications: Keep track of any tax implications resulting from your stock sales. Consult with a tax professional to ensure you comply with the relevant tax regulations and understand the impact on your overall financial situation.

- Reflect and Adjust: Reflect on the results of your sales performance and identify any adjustments that may be necessary. Consider factors such as market conditions, industry trends, and changes in company fundamentals when determining if further selling or adjustments to your selling strategy are warranted.

Monitoring your sales performance is an ongoing process. Stay actively engaged in the market, review your selling strategy regularly, and make adjustments as needed to optimize your future sales.

Now that you have learned how to monitor your sales performance, let’s move on to the final section: evaluating the results and adjusting your approach.

Evaluating the Results and Adjusting Your Approach

Once you have monitored your sales performance, it’s important to evaluate the results and make any necessary adjustments to your approach. Evaluating your results will help you identify successes, areas for improvement, and guide your future selling decisions on Marketwatch. Here are key steps to effectively evaluate the results and adjust your approach:

- Analyze Profitability: Calculate your overall profitability from the stocks you sold. Compare the selling price with your initial purchase price to determine if you achieved your desired profit or met your selling objectives. Analyzing your profitability will help you gauge the effectiveness of your selling strategy.

- Assess Market Trends: Consider how market trends have influenced your sales performance. Evaluate whether the market was in your favor or if unforeseen events affected the stock price. This assessment will help you determine if any adjustments need to be made to your approach based on future market expectations.

- Review Industry Analysis: Analyze the performance of the industry in which the sold stocks belong. Assess whether industry factors, such as regulatory changes or technological advancements, impacted the stock’s performance. This analysis will allow you to understand any external influences that influenced your results.

- Seek Feedback from Experts: Consult experts or financial advisors to gain insights into your selling strategy and results. They can provide valuable feedback and offer suggestions for improving your approach. Take advantage of Marketwatch’s resources, including expert articles and forums, to gather additional perspectives.

- Adjust Your Selling Strategy: Based on your evaluation, make adjustments to your selling strategy as necessary. This may involve fine-tuning your price targets, modifying your timeframes, or implementing different order types to more effectively achieve your objectives. The key is to learn from your experiences and adapt your approach accordingly.

- Continuously Educate Yourself: Stay informed and continue to expand your knowledge of the stock market. Keep up with the latest financial news, market trends, and investment strategies. Industry knowledge will enhance your ability to evaluate results and make informed decisions moving forward.

Remember, evaluating the results and adjusting your approach is an iterative process. As you gain more experience and insights, you can refine your selling strategy to better align with your goals and market conditions.

Congratulations! You have now learned the key steps to sell stocks on Marketwatch and effectively evaluate your results. Armed with these skills, you are ready to navigate the stock market and make informed decisions to maximize your selling potential.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Conclusion

Selling stocks on Marketwatch can be a rewarding and exciting experience, especially when armed with the right knowledge and tools. In this article, we have explored the key steps involved in selling stocks on Marketwatch to help you navigate the process with confidence.

We started by understanding the basics of the stock market and the role it plays in the financial landscape. We then discussed the importance of thorough research when selecting stocks to sell and how to set an effective selling strategy that aligns with your objectives.

Next, we explored the process of placing a sell order on Marketwatch, highlighting the necessary steps to execute your sell order successfully. We discussed the importance of monitoring your sales performance, staying informed with market trends, and assessing your results to make informed decisions.

Lastly, we emphasized the importance of evaluating your results and adjusting your approach accordingly. By analyzing profitability, assessing market trends, seeking expert feedback, and continuously educating yourself, you can refine your strategy and enhance your future selling outcomes.

Remember, navigating the stock market requires a combination of knowledge, ongoing learning, and adaptability. Marketwatch provides valuable resources to help you stay informed and make informed decisions while selling stocks.

Now that you have a comprehensive understanding of how to sell stocks on Marketwatch, it’s time to put your knowledge into action. Remember to conduct thorough research, set a clear selling strategy, monitor your sales performance, and be open to adjusting your approach when necessary.

With dedication, discipline, and a commitment to ongoing learning, you can navigate the stock market with confidence and increase your chances of achieving your selling objectives on Marketwatch.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. Always conduct thorough research and consult with a qualified financial advisor before making any investment decisions.