Home>Finance>How Does Dave Ramsey Feel About Debt Consolidation

Finance

How Does Dave Ramsey Feel About Debt Consolidation

Published: March 6, 2024

Discover Dave Ramsey's perspective on debt consolidation and gain valuable insights into managing your finances effectively. Learn from the expert in personal finance.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Introduction

Debt consolidation is a topic that often sparks debate and discussion, especially among individuals seeking financial freedom and stability. It involves combining multiple debts into a single loan or payment plan, potentially offering lower interest rates and more manageable monthly payments. However, when it comes to the opinions surrounding debt consolidation, few voices are as influential as that of Dave Ramsey.

With a reputation as a renowned financial expert, best-selling author, and radio host, Dave Ramsey has garnered a massive following by offering practical and no-nonsense advice on managing personal finances. His straightforward approach and unwavering stance on debt have made him a prominent figure in the realm of financial education.

In this article, we will delve into Dave Ramsey’s perspective on debt consolidation, exploring his views, insights, and alternative strategies that he advocates for achieving financial freedom. By understanding his stance on this contentious topic, individuals can gain valuable insights into managing their debts and making informed decisions about their financial well-being.

Who is Dave Ramsey?

Dave Ramsey is a personal finance expert, best-selling author, and nationally syndicated radio host, widely recognized for his straightforward and practical approach to managing money. With a background in real estate, Ramsey experienced firsthand the perils of financial mismanagement, filing for bankruptcy in his twenties. This pivotal event fueled his determination to learn about finances and eventually led him to develop his own financial philosophy, which emphasizes debt-free living, saving, and investing for the future.

Through his radio show, “The Dave Ramsey Show,” Ramsey offers advice on a wide range of financial matters, including budgeting, getting out of debt, investing, and retirement planning. He has authored several best-selling books, such as “The Total Money Makeover” and “Financial Peace,” which have empowered countless individuals to take control of their finances and build wealth responsibly.

Ramsey’s no-nonsense approach to financial management has resonated with millions of people, earning him a loyal following and cementing his status as a leading voice in personal finance. He is known for his “7 Baby Steps” plan, which provides a clear roadmap for achieving financial stability and freedom. Ramsey’s commitment to helping individuals achieve financial independence has made him a trusted source of guidance and inspiration for those striving to improve their financial well-being.

What is Debt Consolidation?

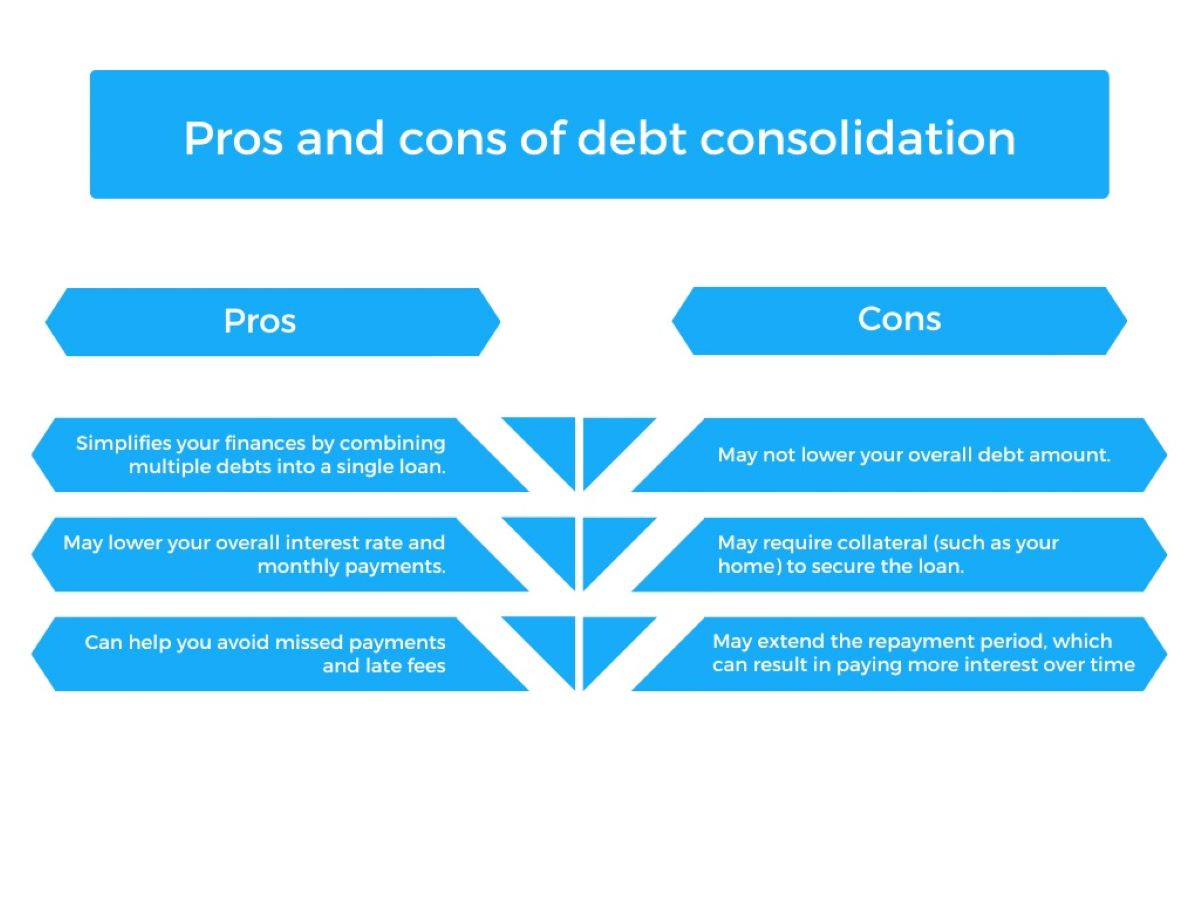

Debt consolidation is a financial strategy that involves combining multiple debts, such as credit card balances, personal loans, or medical bills, into a single loan or payment plan. The primary goal of debt consolidation is to streamline debt repayment by consolidating multiple obligations into a more manageable and structured form. This often involves taking out a new loan to pay off existing debts, resulting in a single monthly payment.

One of the key advantages of debt consolidation is the potential for a lower overall interest rate, which can lead to reduced long-term interest costs and more affordable monthly payments. Additionally, consolidating debts can simplify financial management by eliminating the need to juggle multiple due dates and varying interest rates.

Debt consolidation can be pursued through various methods, including taking out a personal consolidation loan, utilizing a home equity loan or line of credit, or enrolling in a debt management program offered by credit counseling agencies. Each approach carries its own set of considerations, benefits, and potential drawbacks, and it is essential for individuals to thoroughly assess their options and understand the implications before pursuing debt consolidation.

While debt consolidation can offer certain advantages, it is important to approach this strategy with careful consideration and a clear understanding of its potential impact on one’s overall financial situation. As we explore Dave Ramsey’s perspective on debt consolidation, it is crucial to examine the nuances and implications of this financial approach in the context of achieving lasting financial stability.

Dave Ramsey’s Views on Debt Consolidation

When it comes to debt consolidation, Dave Ramsey is known for his unequivocal stance against this financial strategy. Ramsey advocates for a holistic approach to achieving financial freedom, emphasizing the importance of eliminating debt through disciplined budgeting, controlled spending, and strategic debt repayment. His philosophy centers on addressing the root causes of debt and reshaping financial behaviors to establish lasting financial stability.

Ramsey often highlights the potential pitfalls and drawbacks of debt consolidation, cautioning individuals against viewing it as a quick fix for their financial challenges. He contends that while debt consolidation may offer temporary relief by consolidating multiple payments into one, it does not address the underlying issues that led to the accumulation of debt in the first place. According to Ramsey, the fundamental problem lies in overspending, lack of budgeting, and a reliance on debt as a solution to financial shortfalls.

Furthermore, Ramsey emphasizes the psychological impact of debt consolidation, noting that it can create a false sense of progress while potentially extending the duration of debt repayment. He asserts that the act of consolidating debts without addressing the root behaviors that led to their accumulation can perpetuate a cycle of indebtedness, ultimately hindering individuals from achieving true financial freedom.

Instead of endorsing debt consolidation, Ramsey advocates for a systematic approach to debt reduction, popularly known as the “Debt Snowball” method. This strategy involves prioritizing debts based on their balance, regardless of interest rates, and systematically paying them off, starting with the smallest balance. Ramsey contends that this approach provides psychological momentum and a sense of accomplishment, empowering individuals to gain traction in their debt repayment journey.

By understanding Dave Ramsey’s perspective on debt consolidation, individuals can gain valuable insights into the principles that underpin his approach to financial management and debt reduction. While his views may challenge conventional notions of debt management, they reflect a commitment to addressing the root causes of financial distress and empowering individuals to achieve lasting financial wellness.

Alternatives to Debt Consolidation

While Dave Ramsey discourages the use of debt consolidation as a solution to financial challenges, he advocates for alternative strategies that focus on addressing the underlying causes of debt and fostering sustainable financial habits. These alternatives are rooted in proactive financial management and responsible decision-making, offering individuals a path to achieve debt reduction and long-term financial stability.

One of the primary alternatives endorsed by Ramsey is the “Debt Snowball” method, which involves systematically paying off debts starting with the smallest balance, regardless of interest rates. This approach emphasizes the psychological impact of quick wins, providing individuals with a sense of accomplishment as they eliminate smaller debts, thereby gaining momentum and motivation to tackle larger obligations.

Another alternative approach promoted by Ramsey is the concept of budgeting and living within one’s means. By creating and adhering to a comprehensive budget, individuals can gain control over their finances, allocate resources strategically, and prioritize debt repayment. Ramsey’s emphasis on disciplined budgeting aims to curb discretionary spending and channel funds toward debt reduction, laying the foundation for long-term financial health.

Moreover, Ramsey advocates for a mindset shift away from debt reliance and towards building an emergency fund. Establishing a financial safety net can mitigate the need for accumulating additional debt in the face of unexpected expenses, providing a buffer against financial setbacks and reducing reliance on credit instruments.

Additionally, Ramsey encourages individuals to explore opportunities for increasing income through side hustles, additional employment, or entrepreneurial ventures. By augmenting their earning potential, individuals can accelerate debt repayment and bolster their financial resilience, ultimately reducing their reliance on debt as a financial crutch.

By embracing these alternative strategies, individuals can align with Dave Ramsey’s philosophy of proactive financial management, empowering themselves to address the root causes of debt and cultivate sustainable financial practices. While debt consolidation may offer a temporary reprieve, these alternatives prioritize long-term financial well-being and equip individuals with the tools to achieve lasting debt reduction and financial freedom.

Conclusion

Dave Ramsey’s unwavering stance against debt consolidation reflects a commitment to addressing the root causes of financial distress and empowering individuals to achieve lasting financial wellness. His emphasis on proactive financial management, disciplined budgeting, and responsible decision-making resonates with millions of individuals striving to overcome debt and build sustainable financial habits.

While debt consolidation may offer a semblance of relief by consolidating multiple payments into one, Ramsey’s insights underscore the potential pitfalls of this approach, emphasizing the importance of addressing the underlying behaviors that lead to indebtedness. His “Debt Snowball” method and advocacy for disciplined budgeting and living within one’s means provide a roadmap for individuals to systematically tackle debt and gain control over their financial future.

By embracing Ramsey’s alternative strategies and shifting away from debt reliance, individuals can chart a course toward lasting financial stability. The principles espoused by Ramsey not only offer a path to debt reduction but also instill a mindset of financial empowerment, equipping individuals with the tools to navigate financial challenges and build a solid foundation for their future.

In conclusion, Dave Ramsey’s views on debt consolidation serve as a catalyst for individuals to reassess their approach to debt management and embrace proactive and sustainable strategies for achieving financial freedom. By internalizing his principles and adopting a mindset of financial discipline, individuals can embark on a transformative journey toward lasting debt reduction and a future defined by financial independence and security.