Finance

How Are Futures Contracts Settled?

Published: December 24, 2023

Discover how futures contracts are settled in the world of finance, understanding the methods and processes involved. Enhance your knowledge on futures trading and financial derivatives.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to understanding the world of finance, futures contracts play a crucial role in providing investors with opportunities to hedge against price fluctuations, speculate on market movements, and diversify their investment portfolios. But how exactly are futures contracts settled? In this article, we will explore the concept of futures contract settlement, the different methods employed, and the factors that influence the choice of settlement method.

A futures contract is a legally binding agreement between two parties to buy or sell an asset, such as commodities, currencies, or financial instruments, at a predetermined price and date in the future. These contracts are traded on organized exchanges, such as the Chicago Mercantile Exchange (CME), where standardized contract specifications are established to ensure transparency and efficiency in the trading process.

Settlement refers to the process of fulfilling the contractual obligations of a futures contract. It is the mechanism by which the buyer and seller reconcile their positions and exchange the underlying asset or its cash equivalent. There are two primary methods of settlement: physical settlement and cash settlement. The choice of settlement method depends on various factors, including the nature of the underlying asset, market liquidity, and the preferences of the parties involved.

Definition of Futures Contracts

Futures contracts are financial derivatives that oblige the parties involved to buy or sell an underlying asset at a predetermined price and date in the future. These contracts are standardized, meaning they have uniform terms and conditions, which allows for efficient trading on organized exchanges. Futures contracts are commonly used in commodities trading, where participants seek to mitigate price volatility and protect against adverse market movements.

The key components of a futures contract include the underlying asset, contract size, contract expiration date, and settlement method. The underlying asset can be anything that has a measurable value, such as agricultural products, energy commodities, metals, currencies, stock indices, or interest rates. The contract size represents the quantity of the underlying asset that the contract represents, usually specified in standardized units.

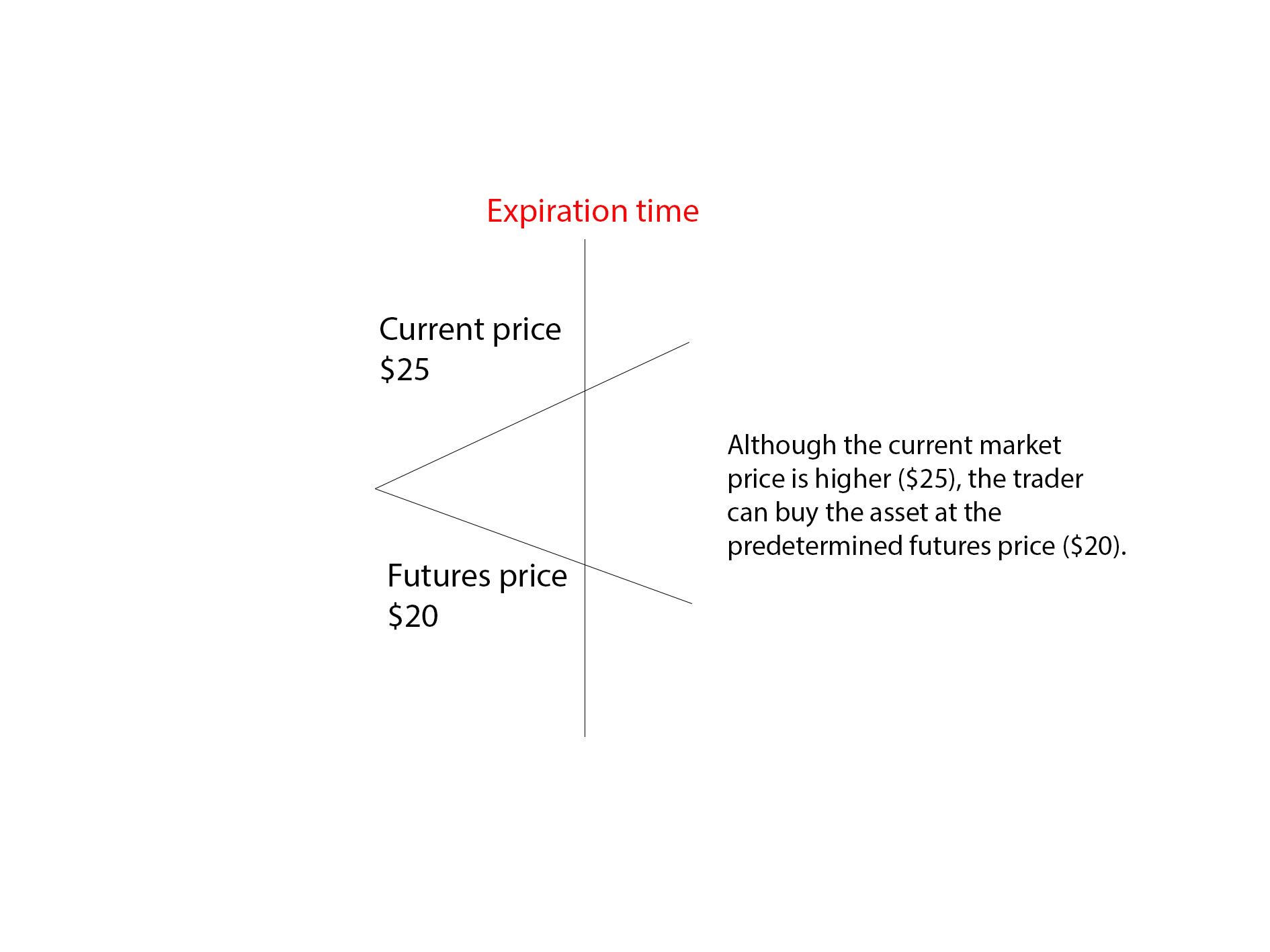

The expiration date, also known as the contract maturity, signifies the date on which the contract ceases to exist. At this point, the parties must either settle the contract or roll it over to a future date by closing the existing contract and entering into a new one. The settlement method determines how the obligations of the contract will be fulfilled, either through physical delivery of the underlying asset or through a cash transaction.

It’s important to note that futures contracts are distinct from forward contracts. While both involve an agreement to buy or sell an asset at a future date and price, futures contracts are traded on exchanges and are standardized, while forward contracts are privately negotiated between two parties and can be tailored to their specific needs.

The primary purpose of futures contracts is to provide market participants with a means to manage risk, speculate on price movements, and facilitate the efficient functioning of financial markets. By allowing investors to take long (buy) or short (sell) positions on various assets, futures contracts enable better price discovery and liquidity in the market.

Types of Futures Contracts

There are various types of futures contracts available in the financial markets, each catering to different asset classes and investment objectives. Let’s explore some of the common types:

- Commodity Futures: Commodity futures contracts involve the trading of raw materials or agricultural products such as crude oil, gold, wheat, or corn. These contracts allow participants to gain exposure to the price movements of these commodities without physically owning them.

- Stock Index Futures: Stock index futures track the performance of a specific stock index like the S&P 500 or the NASDAQ. Investors use these contracts to speculate on the overall direction of the stock market, hedge existing stock positions, or create a diversified portfolio.

- Currency Futures: Currency futures contracts facilitate the trading of foreign exchange rates. They allow investors to speculate on the exchange rate between two currencies, providing a means of hedging against currency risk or profiting from potential currency fluctuations.

- Interest Rate Futures: Interest rate futures contracts are based on the movement of interest rates or the yield of underlying financial instruments such as treasury bonds or Eurodollar deposits. These contracts enable participants to manage interest rate risk, speculate on changes in interest rates, or hedge existing positions.

- Energy Futures: Energy futures contracts involve the trading of energy commodities like natural gas, crude oil, or gasoline. These contracts are influenced by various factors, including supply and demand dynamics, geopolitical events, and weather conditions. Energy futures provide opportunities for investors to gain exposure to the energy sector and manage price risks.

These are just a few examples of the diverse array of futures contracts available. It’s important for investors to carefully consider their investment objectives and risk tolerance when choosing which type of futures contract to trade. It’s also essential to stay updated with market trends and news that might impact the specific asset class covered by the futures contract.

Physical Settlement

In futures contracts, physical settlement refers to the process of delivering the underlying asset to fulfill the contractual obligations. This method is typically used for commodities, such as agricultural products, metals, or energy resources, where the physical delivery of the asset is feasible and practical.

When a futures contract reaches its expiration date and physical settlement is chosen, the buyer and seller are obligated to complete the delivery and receipt of the specified quantity and quality of the underlying asset. The terms and conditions for the physical delivery, including the location and timeline for the delivery, are predetermined and standardized by the exchange.

For example, in a corn futures contract, if the buyer wants to receive the physical corn, they must inform the exchange of their intent before the designated delivery period. The seller, on the other hand, must provide the corn in the specified quantity and ensure its conformity to the exchange’s quality standards.

Physical settlement provides tangible ownership and possession of the underlying asset, which can be advantageous for market participants who use futures contracts to manage their supply chain or have a physical need for the asset. It ensures the fulfillment of the contract’s terms and eliminates any uncertainties or counterparty risks associated with cash settlement.

However, physical settlement may also pose logistical challenges, especially when it comes to storage, transportation, and handling of the underlying asset. These factors can increase the costs and complexities of the settlement process, making it less attractive for some market participants.

It’s important to note that not all futures contracts offer physical settlement. The availability of physical settlement depends on the specific contract and the rules of the exchange on which it is traded. Many futures contracts, especially those involving financial instruments or non-deliverable commodities, are primarily settled through cash settlement.

Cash Settlement

In contrast to physical settlement, cash settlement is a method used in futures contracts where the obligations of the contract are settled in cash rather than through the delivery of the underlying asset. Instead of exchanging the physical goods, the parties involved settle the contract by transferring the cash equivalent of the contract’s value.

Cash settlement is commonly utilized in futures contracts for financial instruments, stock indices, and certain commodities that are not easily deliverable or where physical delivery is not practical. It allows for convenient and efficient settlement, as it eliminates the need for storage, transportation, and other logistical challenges associated with physical settlement.

When a futures contract is settled in cash, the settlement price is determined based on a specified reference rate or an index. This reference rate could be the average price of the underlying asset over a specific period, the market price at a particular time, or a formula derived from various factors.

For example, in a stock index futures contract, the cash settlement may be based on the closing value of the underlying index on the expiration date. If the index value is higher than the agreed-upon contract price, the buyer of the contract will receive cash from the seller. Conversely, if the index value is lower, the seller will receive cash from the buyer.

Cash settlement provides several advantages, including simplicity, liquidity, and flexibility. It allows investors to participate in the price movements of various assets without the burdens associated with physical delivery. It also facilitates trading and gives market players the ability to close out their positions easily and efficiently.

However, it’s important to note that cash settlement has some limitations. It may result in a disconnection between futures prices and the actual market prices of the underlying assets. Additionally, the cash settled amount may not fully reflect the potential gains or losses that could be achieved through physical delivery.

Overall, the choice between physical settlement and cash settlement depends on the nature of the underlying asset, the preferences of the parties involved, and the specific rules and regulations of the exchange. Both methods serve as vital tools for risk management, speculation, and hedging in the futures market.

Factors Affecting Settlement Method

The choice of settlement method in futures contracts, whether physical settlement or cash settlement, depends on various factors that influence the decision-making process of market participants. Let’s explore some of these key factors:

- Nature of the Underlying Asset: The type of underlying asset plays a significant role in determining the settlement method. Commodities that are easily deliverable, such as agricultural products or metals, are more likely to be settled through physical delivery. On the other hand, financial instruments or non-deliverable commodities are better suited for cash settlement due to their intangible or non-physical nature.

- Market Liquidity: The liquidity of the market for the underlying asset is another crucial factor. If there is a high level of trading activity and sufficient market liquidity, cash settlement may be preferred as it allows for easier buying and selling without the need for physical delivery or storage concerns. Conversely, illiquid markets may necessitate physical settlement to ensure the availability of the underlying asset.

- Logistical Considerations: Practical considerations such as storage, transportation, and handling costs can influence the choice of settlement method. If the underlying asset is bulky, perishable, or requires specialized storage facilities, physical settlement may present logistical challenges and make cash settlement a more viable option.

- Risk Mitigation: Settlement methods can also be influenced by risk mitigation strategies. Market participants may choose physical settlement to ensure the fulfillment of the contract’s terms and eliminate any uncertainties or counterparty risks associated with cash settlement. Conversely, cash settlement can provide risk management benefits by reducing exposure to price fluctuations and minimizing the need for physical storage.

- Regulatory and Exchange Requirements: The rules and regulations of the exchange where the futures contract is traded may dictate the available settlement method. Some contracts may have specific requirements or limitations on settlement methods to ensure fair and orderly trading.

It’s important to note that while market participants may have a preference for a particular settlement method, the terms and conditions of the contract, including the specified settlement method, are agreed upon by both parties at the time of initiating the futures contract.

Example of Futures Contract Settlement

Let’s consider an example to illustrate the process of futures contract settlement. Suppose there is a futures contract for crude oil with a contract size of 1,000 barrels and an expiration date of the last day of the month. The settlement method for this contract is physical delivery. As the expiration date approaches, the buyer and seller need to fulfill their contractual obligations.

On the expiration date, the buyer, who intends to receive the physical crude oil, contacts the exchange and notifies them of their intent to take delivery. The exchange then assigns a specific location for the delivery, such as a designated storage facility or a pipeline terminal.

Simultaneously, the seller, who has the obligation to deliver the crude oil, prepares to transport the specified quantity of crude oil to the designated delivery location. The seller ensures that the crude oil meets the quality standards specified by the exchange.

Once the crude oil arrives at the delivery location, an inspection is conducted to verify its quantity and quality. If the delivery complies with the exchange’s specifications, the buyer takes ownership of the physical crude oil, and the seller receives the agreed-upon payment.

It’s important to note that during the process of futures contract settlement, both parties must adhere to the terms and conditions outlined in the contract. Any discrepancies or failures to meet the delivery requirements could result in penalties or legal consequences.

In cases where physical delivery is not feasible or preferred, the settlement process would follow a different path. For example, if the futures contract for crude oil had a cash settlement option, the settlement amount would be determined based on the difference between the contract price and the prevailing market price of crude oil on the expiration date. The buyer would receive cash if the market price is higher than the contract price, or the seller would receive cash if the market price is lower.

This example highlights the importance of understanding the specific terms and settlement methods of different futures contracts. The choice between physical settlement and cash settlement depends on factors such as the nature of the underlying asset, market liquidity, and logistical considerations.

Conclusion

Futures contract settlement is a critical aspect of derivatives trading, providing market participants with the means to manage risk, speculate on market movements, and diversify their investment portfolios. The two primary methods of settlement, physical settlement and cash settlement, offer different advantages and considerations based on the nature of the underlying asset and market dynamics.

Physical settlement involves the delivery of the underlying asset, which is typically used for commodities where physical possession is feasible. It ensures the fulfillment of contract terms but can present logistical challenges and increased costs. Cash settlement, on the other hand, involves the transfer of cash equivalent to the contract’s value and offers simplicity, liquidity, and flexibility. It is often used for financial instruments or non-deliverable commodities.

The choice of settlement method depends on several factors, including the nature of the underlying asset, market liquidity, logistical considerations, risk mitigation strategies, and regulatory requirements. Market participants evaluate these factors to determine the most suitable settlement method for their specific needs and objectives.

Understanding the settlement process is crucial for participants in futures markets as it affects their trading strategies, risk exposures, and contractual obligations. It is essential to carefully review the terms and conditions of a futures contract, including the specified settlement method, to ensure compliance and avoid any unintended consequences.

In conclusion, futures contract settlement plays a vital role in the functioning of financial markets, providing investors with opportunities to manage risk, speculate on price movements, and facilitate efficient trading. By choosing the most appropriate settlement method, market participants can navigate the complexities of futures contracts and make informed decisions to achieve their financial goals.