Finance

Why Hasnt The IRS Withdraw My Payment

Published: October 31, 2023

Learn why the IRS hasn't withdrawn your payment and get expert insights on finance. Find the answers you need today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to tax season, waiting for your refund or expecting a payment withdrawal from the IRS can be an anxious time. It’s not uncommon for taxpayers to wonder why their IRS payment hasn’t been withdrawn yet. There could be several reasons why the process may be taking longer than expected.

Understanding how the IRS payment process works can help shed some light on the potential delays. The IRS typically follows a systematic procedure when processing payments, but there are instances where issues can arise, causing delays in the withdrawal of payments. In this article, we will delve into the possible reasons behind payment withdrawal delays and how you can address them.

It’s important to keep in mind that payment withdrawal delays from the IRS can occur for various reasons, and not all cases are the same. However, by understanding the common issues that can lead to delays, you can take steps to resolve them and ensure your payment is processed as smoothly as possible. Let’s explore some of the most common issues that taxpayers face when waiting for their IRS payment to be withdrawn.

Understanding the IRS payment process

Before diving into the possible reasons for payment withdrawal delays, it’s essential to have a basic understanding of how the IRS payment process works. When you owe taxes to the IRS, whether it’s for income taxes or other obligations, you are required to make a payment to settle your debt. The IRS provides various methods for making payments, including electronic funds transfer, credit or debit card payments, and even check or money order.

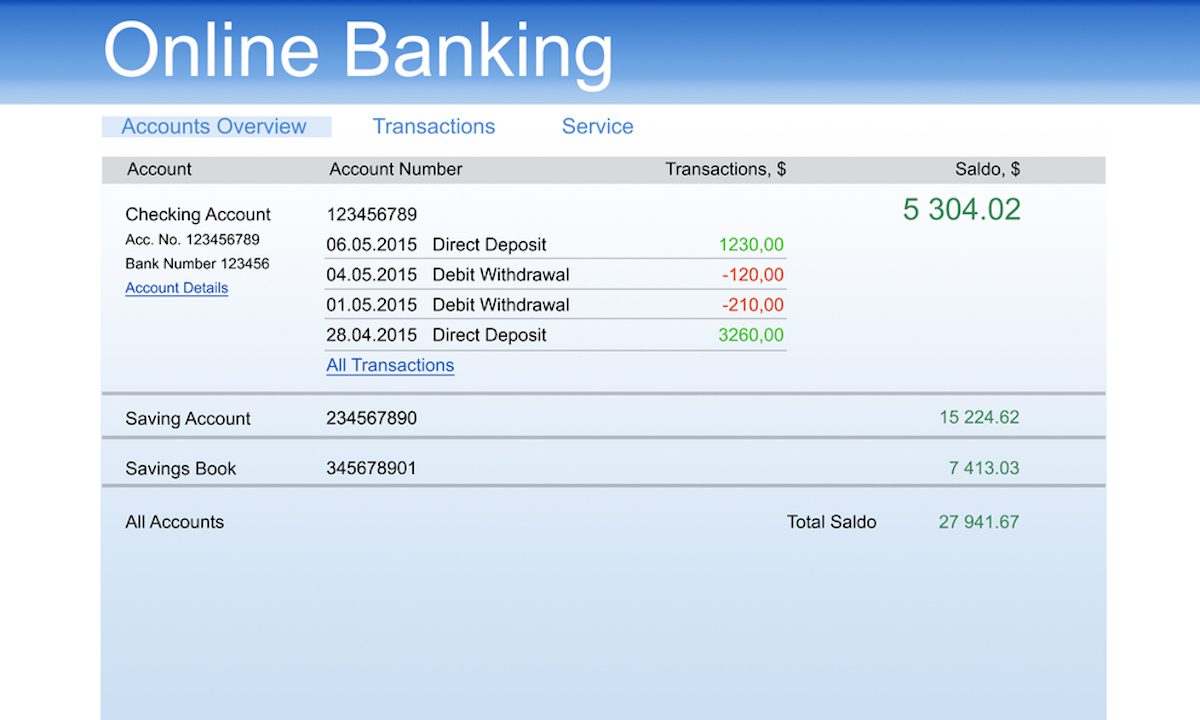

Once you initiate a payment, the IRS goes through a series of steps to process and withdraw the funds. The specific timeline can vary, but generally, it takes a few days for the IRS to capture the payment information and match it with your tax account. Once the payment is successfully matched, the IRS will process the withdrawal and apply the payment to your outstanding balance.

It’s important to note that the IRS has a system to prioritize payments based on due dates and other factors. When you make a payment, the IRS will typically allocate it to your oldest tax debt first, unless you specify otherwise. This ensures that any penalties and interest continue to accrue on the remaining outstanding balance.

After the payment withdrawal is initiated, it can take a further few days for the funds to be transferred from your account to the IRS. During this time, it’s crucial to ensure that you have sufficient funds available to cover the payment. Failure to do so can result in penalties or even bounced payment fees from your financial institution.

Now that you have a basic understanding of the IRS payment process, let’s explore some of the common reasons why your payment withdrawal may be delayed.

Possible reasons for delay in payment withdrawal

If you’re wondering why your IRS payment hasn’t been withdrawn yet, there could be several reasons for the delay. Here are some common factors that can contribute to a delay in payment withdrawal:

- Processing backlog: The IRS processes millions of payments each year, and during peak tax season, there can be a significant backlog of payments to manage. This backlog can cause delays in the withdrawal of payments as the IRS works through the volume of transactions.

- Incorrect payment information: One of the most common reasons for payment withdrawal delays is incorrect payment information. If you provided incorrect or incomplete banking details, the IRS will be unable to process the payment. It’s crucial to double-check all the information you provide to ensure accuracy.

- Payment method issues: Different payment methods have their own processes and timelines. If you chose to pay by check or money order, it may take longer for the payment to be received and processed by the IRS. Electronic payments, like direct debit or credit card payments, are generally processed faster, but they can still encounter issues that cause delays.

- Tax return issues: In some cases, a delay in the withdrawal of your payment could be related to issues with your tax return itself. If there are errors or inconsistencies on your return, the IRS may need additional time to review and resolve these issues before processing your payment.

- Update in payment preferences: If you recently updated your payment preferences or banking information, it may take some time for the IRS to update their records and process your payment accordingly. This update can result in a delay in payment withdrawal.

These are just a few of the possible reasons why your IRS payment may be delayed in the withdrawal process. It’s important to remember that each taxpayer’s situation is unique, and it’s always a good idea to stay in touch with the IRS or consult with a tax professional if you have concerns about your payment.

Common issues leading to payment withdrawal delays

While there can be various reasons for payment withdrawal delays, certain common issues tend to arise frequently for taxpayers. Understanding these issues can help shed light on why your IRS payment hasn’t been withdrawn yet. Here are some common factors that can lead to payment withdrawal delays:

- Payment processing errors: Sometimes, errors occur during the payment processing stage. It could be a technical glitch, an error in data entry, or a miscommunication between the IRS and your financial institution. These errors can cause delays in the withdrawal of your payment.

- Insufficient funds: If you made a payment by check or direct debit, ensure that your bank account has sufficient funds to cover the payment. If the bank rejects the payment due to insufficient funds, it can cause delays as the IRS will need to process it again once funds are available.

- Identity verification: In order to prevent fraud and ensure the accuracy of payments, the IRS may require additional verification if they suspect identity theft or fraud. This verification process can cause delays in the withdrawal of your payment.

- Tax return discrepancies: If there are significant discrepancies between the information on your tax return and the payment you made, the IRS may need to investigate further before processing the payment. This can delay the withdrawal process while they review and validate the information.

- System updates or maintenance: At times, the IRS may conduct system updates or maintenance that temporarily affects payment processing. During these periods, payment withdrawal delays can occur as the IRS works to ensure the accuracy and security of transactions.

- Communication gaps: Sometimes, there can be communication gaps between the IRS and taxpayers. If you have made changes to your contact information or have not received any communication regarding your payment, it’s possible that there may be a delay due to a missed or overlooked notification.

These common issues highlight the complexities involved in the payment withdrawal process. It’s important to remain patient and proactive when experiencing delays, ensuring that you stay in touch with the IRS to address any concerns or issues that may arise.

Resolving payment withdrawal issues

If you’re facing delays in the withdrawal of your IRS payment, there are steps you can take to resolve the issue. Here are some suggestions to help you address and resolve payment withdrawal issues:

- Contact the IRS: If you suspect there is a problem with your payment, the first step is to contact the IRS. You can reach out to the IRS directly through their toll-free helpline or visit a local IRS office. Explain the situation and provide any relevant information or documentation to support your case.

- Verify payment information: Double-check your payment information to ensure accuracy. If you provided incorrect banking details or entered the wrong account number, contact the IRS to update the information as soon as possible. This will help ensure the timely withdrawal of your payment.

- Monitor your payment status: Keep a record of your payment confirmation and monitor your payment status regularly. The IRS provides online tools, such as the “Where’s My Refund?” portal, where you can track the progress of your payment. This will help you stay informed and identify any potential issues or delays.

- Seek professional assistance: If you’re experiencing persistent issues or are uncertain about how to resolve payment withdrawal delays, consider seeking assistance from a tax professional. They can guide you through the process, communicate with the IRS on your behalf, and ensure that your payment withdrawal issue is addressed effectively.

- Follow up with the IRS: In case you have contacted the IRS regarding your payment withdrawal issue and aren’t seeing any progress, it’s important to follow up. Regularly communicate with the IRS to inquire about the status of your case and any necessary steps you need to take.

- Keep records and documentation: Throughout the process of resolving payment withdrawal issues, it’s crucial to maintain detailed records and documentation. This includes payment confirmation receipts, any communication with the IRS, and any relevant supporting documents. These records will be valuable in case you need to provide evidence or reference later on.

By taking proactive steps, staying in touch with the IRS, and seeking professional assistance when needed, you can effectively address and resolve payment withdrawal issues. Remember to exercise patience during the process, as it may take time to resolve the underlying cause of the delay and ensure the successful withdrawal of your payment.

Steps to follow for checking payment status

When you’re waiting for your IRS payment to be withdrawn, it’s essential to stay informed about the status of your payment. The IRS provides tools and resources that allow you to check the progress of your payment. Here are the steps to follow for checking your payment status:

- Visit the IRS website: Start by visiting the official website of the IRS at irs.gov. This is the authoritative source for all information related to tax payments and refunds.

- Access the “Where’s My Refund?” portal: Look for the “Where’s My Refund?” or similar tool on the IRS website. This portal allows you to track the progress of your payment and provides real-time updates on its status.

- Input the required information: Enter the necessary information requested by the portal, such as your social security number, filing status, and the exact amount of your expected payment. Double-check the accuracy of the information you provide to ensure accurate results.

- Click “Submit” or similar option: After entering the required information, click on the “Submit” or similar option to initiate the search for your payment status. The portal will then provide you with the most up-to-date information available regarding the progress of your payment.

- Review the payment status: Once the search is complete, the portal will display the status of your payment. This can include information such as whether your payment has been successfully withdrawn, any delays or issues encountered, or an estimated time frame for the completion of the payment process.

- Follow any instructions: If the portal provides any instructions or further actions to take, make sure to carefully read and follow them. This can include providing additional information or contacting the IRS directly to resolve any payment-related concerns.

- Keep a record of the payment status: After checking your payment status, it’s important to keep a record of the information provided by the portal. Take a screenshot or note down the details for future reference. This will help you to track any changes or progress in your payment status over time.

Following these steps will allow you to conveniently check the status of your IRS payment. By staying informed, you can address any potential issues promptly and ensure the timely withdrawal of your payment.

Conclusion

Waiting for the IRS to withdraw your payment can be a nerve-wracking experience, especially when there are delays in the process. However, understanding the IRS payment process, the possible reasons for withdrawal delays, and the steps for resolving payment withdrawal issues can help alleviate some of the anxiety associated with the waiting period.

From processing backlogs to payment method issues or tax return discrepancies, there are several factors that can contribute to delays in payment withdrawals. By staying in touch with the IRS, verifying payment information, and monitoring your payment status, you can take proactive steps to ensure timely resolution of any issues.

If you encounter persistent problems or are uncertain about how to address payment withdrawal delays, seeking assistance from a tax professional can provide valuable guidance and support.

Remember to remain patient throughout the process. While delays can be frustrating, it’s important to give the IRS the necessary time to resolve any issues and complete the withdrawal of your payment. Keeping detailed records and maintaining open communication with the IRS will also aid in the resolution process.

By staying informed, proactive, and persistent, you can navigate the payment withdrawal process with confidence and ensure that your payment is processed in a timely manner.