Finance

What Is Banking Regulation?

Modified: December 30, 2023

Learn about banking regulation and its importance in the finance industry. Explore how it helps to ensure the stability and integrity of the banking system.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

In today’s global financial landscape, banking regulation plays a vital role in ensuring the stability and integrity of the banking system. It provides a framework that governs the operations, conduct, and risk management of banks to protect depositors and investors and safeguard the overall financial system.

Banking regulation encompasses a wide range of rules, guidelines, and requirements that are set by regulatory authorities to govern the activities of banks. These regulations aim to maintain financial stability, prevent fraudulent activities, and promote fair and transparent practices within the banking industry.

The significance of banking regulation became apparent during the global financial crisis of 2008, which highlighted the need for stricter oversight and regulatory measures. In response, governments and regulatory authorities around the world have since implemented comprehensive regulatory frameworks to mitigate risks and protect against future financial crises.

This article will provide a comprehensive overview of banking regulation, including its definition, purpose, types, examples, and the role of regulatory authorities. It will also discuss the benefits and challenges associated with banking regulation and examine its impact on the financial system as a whole.

By understanding the importance and implications of banking regulation, individuals and businesses can make informed decisions, while regulators can effectively monitor and enforce compliance to ensure a stable and secure banking environment.

Definition of Banking Regulation

Banking regulation refers to the set of rules, guidelines, and requirements imposed by regulatory authorities to oversee and govern the activities of banks and financial institutions. It encompasses a wide range of regulations that dictate how banks should operate, manage risks, and interact with customers and stakeholders.

The primary objective of banking regulation is to maintain the stability and integrity of the banking system. It aims to protect the interests of depositors, investors, and the overall economy by ensuring that banks adhere to certain standards and practices.

Banking regulations cover various aspects of banking operations, including capital requirements, liquidity management, risk management, lending practices, consumer protection, and corporate governance. These regulations are designed to promote transparency, maintain financial stability, and prevent misconduct and fraudulent activities within the banking sector.

The regulatory framework for banking regulation typically consists of laws, statutes, and regulations established by government bodies or independent regulatory authorities, such as central banks or financial regulatory agencies. These regulatory bodies are responsible for creating, implementing, and enforcing the regulations to ensure compliance.

Over time, banking regulation has evolved and become more complex, reflecting the changing dynamics of the financial industry and the need for increased oversight. The regulatory framework differs from country to country, as each jurisdiction has its own set of rules and regulatory authorities overseeing the banking sector.

Furthermore, banking regulation is not limited to traditional banks alone. It also applies to other financial institutions, such as credit unions, investment banks, and non-banking financial institutions, which play a significant role in the global financial system.

Overall, banking regulation serves as a safeguard against risks and malpractices within the banking industry, contributing to the stability and trustworthiness of financial systems and promoting the well-being of the economy as a whole.

Purpose of Banking Regulation

The purpose of banking regulation is to ensure the stability and integrity of the banking system, protect the interests of depositors and investors, and promote fair and transparent practices within the industry. It serves multiple important purposes, which are outlined below:

- Financial Stability: One of the primary objectives of banking regulation is to maintain the stability of the financial system. By imposing capital requirements and risk management guidelines, regulators aim to prevent excessive risk-taking and mitigate the impact of potential financial crises.

- Consumer Protection: Banking regulations are designed to protect consumers from unfair practices and ensure that banks treat their customers fairly and ethically. These regulations include guidelines on disclosure requirements, transparency in fees and charges, fair lending practices, and protection against fraudulent activities.

- Risk Management: Banking regulations provide guidelines and frameworks for banks to assess and manage risks effectively. These rules cover areas such as credit risk, market risk, liquidity risk, and operational risk, helping to ensure that banks have appropriate risk management practices in place to protect their own stability and that of the financial system.

- Prevention of Financial Crimes and Money Laundering: Banking regulations aim to prevent and detect financial crimes such as money laundering, terrorist financing, and fraud. They require banks to have robust anti-money laundering (AML) and know-your-customer (KYC) procedures in place, helping to ensure the integrity of the financial system and protect it from illicit activities.

- Promotion of Fair Competition: Banking regulations play a crucial role in promoting fair competition within the banking sector. They help to prevent anti-competitive practices and ensure that banks do not abuse their market power, ultimately benefiting consumers and maintaining a level playing field for all financial institutions.

In summary, the purpose of banking regulation is to maintain financial stability, protect consumers, manage risks, prevent financial crimes, and promote fair competition. By establishing rules and guidelines, regulatory authorities aim to create an environment where banks can operate safely and soundly, while also fostering trust and confidence in the banking system.

Types of Banking Regulations

Banking regulations encompass a wide range of rules and guidelines that govern the operations and conduct of banks. These regulations can be broadly categorized into the following types:

- Prudential Regulations: Prudential regulations focus on the safety and soundness of banks by imposing minimum capital requirements and liquidity standards. These regulations ensure that banks have sufficient financial resources to absorb potential losses and maintain the stability of the banking system.

- Consumer Protection Regulations: Consumer protection regulations aim to safeguard the interests of bank customers and ensure fair treatment. They cover areas such as disclosure requirements, fair lending practices, protection of personal information, and resolution of consumer complaints. These regulations promote transparency, honesty, and ethical behavior in the relationship between banks and their customers.

- Risk Management Regulations: Risk management regulations require banks to identify, assess, and manage various types of risks, including credit risk, market risk, liquidity risk, and operational risk. These regulations provide guidelines for risk measurement, risk mitigation strategies, and stress testing, ensuring that banks have robust risk management practices in place.

- Capital Adequacy Regulations: Capital adequacy regulations specify the minimum amount of capital that banks must maintain in proportion to their risk-weighted assets. These regulations ensure that banks have sufficient capital buffers to absorb losses and reduce the likelihood of financial distress or insolvency. The most widely recognized capital adequacy framework is the Basel Framework, developed by the Basel Committee on Banking Supervision.

- Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) Regulations: AML and CFT regulations aim to prevent banks from being used for illegal activities such as money laundering and terrorist financing. These regulations require banks to establish robust systems and procedures to identify and report suspicious transactions, conduct due diligence on customers, and comply with international standards to combat financial crimes.

Additionally, there may be specific regulations governing areas such as corporate governance, data privacy, cybersecurity, liquidity management, and market conduct, depending on the jurisdiction and the specific requirements of the banking industry.

It is important for banks to stay abreast of these regulations and ensure compliance to avoid penalties, reputational damage, and legal consequences. Moreover, regulatory authorities continuously monitor and update these regulations to adapt to changing market conditions, emerging risks, and technological advancements.

Examples of Banking Regulations

Banking regulations vary across jurisdictions, but there are several common examples of regulations that are commonly implemented worldwide. These examples include:

- Basel III: Basel III is an international regulatory framework developed by the Basel Committee on Banking Supervision. It sets out minimum capital requirements, liquidity standards, and leverage ratios that banks must adhere to. The aim is to strengthen the resilience of the banking system and prevent a recurrence of the financial crisis experienced in 2008.

- Know Your Customer (KYC) and Anti-Money Laundering (AML) Regulations: KYC and AML regulations require banks to verify the identity of their customers and establish the source of funds to prevent money laundering and terrorist financing. These regulations include due diligence procedures, customer screening, and reporting of suspicious transactions.

- Dodd-Frank Wall Street Reform and Consumer Protection Act: This legislation was enacted in the United States in response to the 2008 financial crisis. It aims to improve accountability and transparency in the financial industry, enhance consumer protection, and regulate complex financial instruments such as derivatives.

- Consumer Credit Regulations: These regulations govern the lending practices of banks, ensuring that consumers are treated fairly and protected from predatory lending. They cover areas such as disclosure requirements, interest rate limits, and fair debt collection practices.

- Prudential Regulations: Prudential regulations set out the minimum capital adequacy ratios that banks must maintain to ensure their stability and ability to withstand financial shocks. These regulations are designed to prevent excessive risk-taking and promote the overall safety of the banking system.

These are just a few examples of banking regulations that exist globally. It is important to note that banking regulations are dynamic and subject to change as regulators adapt to new emerging risks and market developments. Therefore, banks must stay updated with the latest regulatory requirements and ensure compliance to maintain a secure and trustworthy banking environment.

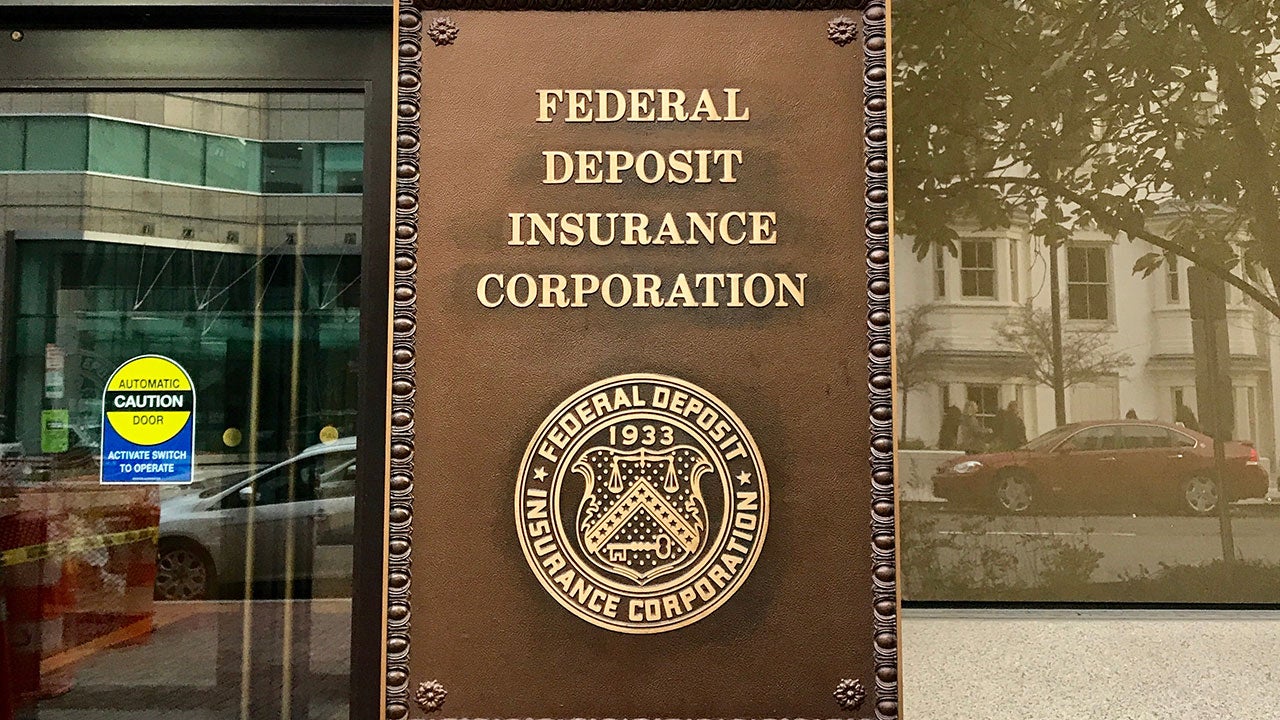

Role and Responsibilities of Regulatory Authorities

Regulatory authorities play a crucial role in overseeing and enforcing banking regulations to ensure the stability and integrity of the financial system. Their responsibilities are diverse and multifaceted, with the overall aim of protecting the interests of depositors, investors, and the broader economy. The key roles and responsibilities of regulatory authorities include:

- Licensing and Supervision: Regulatory authorities are responsible for granting licenses to banks and financial institutions, ensuring that they meet the necessary criteria and standards to operate. They conduct ongoing supervision to monitor the banks’ activities, assess risk management practices, and ensure compliance with regulatory requirements.

- Enforcement of Regulations: Regulatory authorities have the power to enforce banking regulations and take appropriate actions against banks that fail to comply. This may involve imposing fines, penalties, or sanctions, and in some cases, revoking licenses or initiating legal proceedings against non-compliant institutions.

- Policy Formulation: Regulatory authorities are responsible for formulating and implementing banking policies and regulations. They assess market conditions, evaluate risks, and develop regulatory frameworks that address emerging challenges and promote financial stability.

- Monitoring and Reporting: Regulatory authorities closely monitor the activities of banks to detect any potential misconduct, fraud, or systemic risks. They require banks to submit regular reports and disclosures, enabling authorities to analyze and assess the health of banks and the overall financial system.

- Resolution and Crisis Management: In the event of a financial crisis or the failure of a bank, regulatory authorities are responsible for implementing resolution mechanisms to minimize the impact on depositors and maintain the stability of the financial system. This may involve initiating bank restructuring, liquidation, or facilitating mergers and acquisitions.

- Consumer Protection: Regulatory authorities have a responsibility to protect the interests of consumers. They establish regulations and guidelines to ensure fair treatment, transparency, and responsible lending practices. They also handle consumer complaints and provide avenues for dispute resolution.

- International Cooperation: Regulatory authorities collaborate with international counterparts to address cross-border regulatory challenges, promote harmonization of regulatory standards, and exchange information and best practices. This helps in creating a global regulatory framework that enhances the stability of the international financial system.

Overall, regulatory authorities serve as guardians of the banking system, working to maintain stability, enforce regulations, protect consumers, and promote confidence in the financial sector. Their role is vital in ensuring the integrity and safety of the banking system, as well as fostering economic growth and development.

Benefits and Challenges of Banking Regulation

Banking regulation plays a crucial role in promoting financial stability, protecting consumers, and ensuring transparent and fair practices within the banking industry. However, it also presents both benefits and challenges. Let’s explore them below:

Benefits of Banking Regulation:

- Financial Stability: Banking regulation helps maintain the stability of the financial system by imposing capital requirements and risk management guidelines. This reduces the likelihood of bank failures, systemic risks, and financial crises, thereby safeguarding the overall economy.

- Consumer Protection: Regulations protect consumers by promoting fair lending practices, ensuring transparency in fees and charges, and providing avenues for complaint resolution. This helps build trust between banks and their customers, fostering a healthy banking environment.

- Risk Management: Banking regulations require banks to implement robust risk management practices, reducing the chances of excessive risk-taking and improving the resilience of banks. This enhances the overall risk management capability of the banking industry.

- Market Confidence: Effective banking regulation enhances market confidence in the financial system. It provides assurance to investors, depositors, and other stakeholders that banks operate under a well-defined regulatory framework, reducing uncertainty and promoting stability.

- Prevention of Financial Crimes: Regulations such as anti-money laundering (AML) and combating the financing of terrorism (CFT) measures help combat financial crimes, reducing the risk of banks being used for illicit activities. This promotes the integrity of the financial system and protects its reputation.

Challenges of Banking Regulation:

- Compliance Costs: Compliance with banking regulations can be costly for banks, especially smaller institutions. The implementation of complex regulatory requirements may require significant investments in technology, human resources, and training, which can strain the financial resources of banks.

- Burden for Small Banks: Smaller banks may face disproportionate burdens due to regulatory compliance. The regulatory requirements may be designed for larger institutions and may not be easily scalable for smaller banks, potentially leading to compliance challenges and a competitive disadvantage.

- Regulatory Arbitrage: The complexity of banking regulations may inadvertently create opportunities for regulatory arbitrage. Banks may exploit loopholes or engage in activities that fall outside the regulatory perimeter, leading to potential risks to the stability of the financial system.

- Overregulation: Excessive or poorly designed regulations can stifle innovation, hinder competition, and hamper the growth of the banking sector. It is essential to strike a balance between effective regulation and allowing space for innovation and market-driven developments.

- Changing Regulatory Landscape: The dynamic nature of the regulatory landscape poses challenges for banks to adapt and comply with evolving requirements. Frequent revisions and updates to regulations may require significant resources and adjustments, impacting operational efficiency and strategic planning.

Overall, while banking regulation brings several benefits such as financial stability, consumer protection, and risk management, there are challenges that need to be addressed to ensure the effectiveness and efficiency of the regulatory framework.

Impact of Banking Regulation on the Financial System

Banking regulation has a significant impact on the financial system, shaping the behaviors and operations of banks and influencing the overall stability and functioning of the industry. The impact of banking regulation can be observed in various aspects:

- Financial Stability: The primary goal of banking regulation is to maintain financial stability. By imposing capital adequacy requirements, liquidity standards, and risk management guidelines, banking regulation helps prevent excessive risk-taking, improves the resilience of banks, and reduces the likelihood of financial crises. This contributes to overall stability in the financial system.

- Consumer Protection: Banking regulation plays a critical role in safeguarding the interests of consumers. Regulations such as consumer credit regulations and disclosure requirements ensure that banks treat their customers fairly, provide transparent information, and prevent abusive lending practices. This helps maintain trust and confidence in the financial system.

- Risk Management: Banking regulation requires banks to implement robust risk management practices. This includes assessing and managing various types of risks, such as credit risk, market risk, liquidity risk, and operational risk. By implementing effective risk management strategies, banks are better able to identify and minimize risks, reducing the probability of financial distress and ensuring the stability of the financial system.

- Enhanced Market Confidence: A well-regulated banking sector enhances market confidence. When banks operate under a clear and transparent regulatory framework, investors, depositors, and other market participants have greater trust in the financial system. This confidence promotes investment, facilitates economic growth, and contributes to overall market stability.

- Reduction of Systemic Risks: Banking regulation addresses systemic risks that could have far-reaching consequences for the financial system. By implementing measures such as stress testing, capital adequacy requirements, and resolution frameworks, regulatory authorities aim to identify and mitigate risks that could potentially impact the stability of the entire financial system. This reduces the likelihood of contagion and limits the systemic impact of potential bank failures.

However, it is important to acknowledge that banking regulation can also have unintended consequences. Excessive or poorly designed regulations can hinder innovation, create compliance burdens, and potentially stifle competition. Therefore, striking a balance between effective regulation and allowing room for market-driven developments is crucial.

Overall, banking regulation plays a vital role in shaping the financial system, ensuring stability, protecting consumers, and promoting trust and confidence. The impact of banking regulation extends beyond individual banks and has far-reaching implications for the wider economy and the well-being of society as a whole.

Conclusion

Banking regulation is a fundamental component of the financial system, providing a framework that governs the operations, conduct, and risk management of banks. It plays a crucial role in maintaining the stability and integrity of the banking system, protecting the interests of depositors and investors, and promoting fair and transparent practices within the industry.

Regulatory authorities are tasked with overseeing and enforcing banking regulations, ensuring compliance and enforcing penalties when necessary. They play a vital role in licensing and supervising banks, enforcing regulations, formulating policies, monitoring activity, resolving crises, and protecting consumers.

Banking regulation brings numerous benefits to the financial system. It promotes financial stability, protects consumers, enhances risk management practices, instills market confidence, and combats financial crimes. However, it also presents challenges, including compliance costs, burden for smaller banks, regulatory arbitrage, overregulation, and the need to adapt to a changing regulatory landscape.

The impact of banking regulation on the financial system is significant. It contributes to financial stability, protects consumers, improves risk management practices, enhances market confidence, and reduces systemic risks. However, striking a balance between effective regulation and allowing market-driven developments is crucial to prevent unintended consequences.

In conclusion, banking regulation is essential for the healthy functioning of the banking industry and the overall stability of the financial system. By providing a regulatory framework, it ensures that banks operate in a responsible and transparent manner, ultimately benefiting individuals, businesses, and the broader economy.