Home>Finance>Why May Investors Demand Paying A Lower Price For A Property When Interest Rates Are High?

Finance

Why May Investors Demand Paying A Lower Price For A Property When Interest Rates Are High?

Published: November 1, 2023

Discover why investors may request a lower property price during high interest rates and explore the implications in the finance sector.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to investing in real estate, many factors can influence the decision-making process. One significant factor that has a direct impact on the property market is the prevailing interest rates. Interest rates play a crucial role in determining the overall cost of borrowing and can significantly affect investor demand for properties.

In simple terms, interest rates are the cost of borrowing money from financial institutions. These rates are set by central banks and can fluctuate depending on various economic factors. When interest rates are high, it means that borrowing money becomes more expensive, and this has implications for both buyers and sellers in the real estate market.

For investors, high interest rates may result in demanding a lower price for a property. This is because the cost of financing the purchase increases as interest rates rise. Investors typically consider the total cost of ownership, including the mortgage payments, when evaluating potential investments. Higher interest rates can make these mortgage payments more expensive, thereby reducing the profitability of the investment.

To understand why investors may demand a lower price for a property during high-interest rate periods, it is important to explore the relationship between interest rates and property prices.

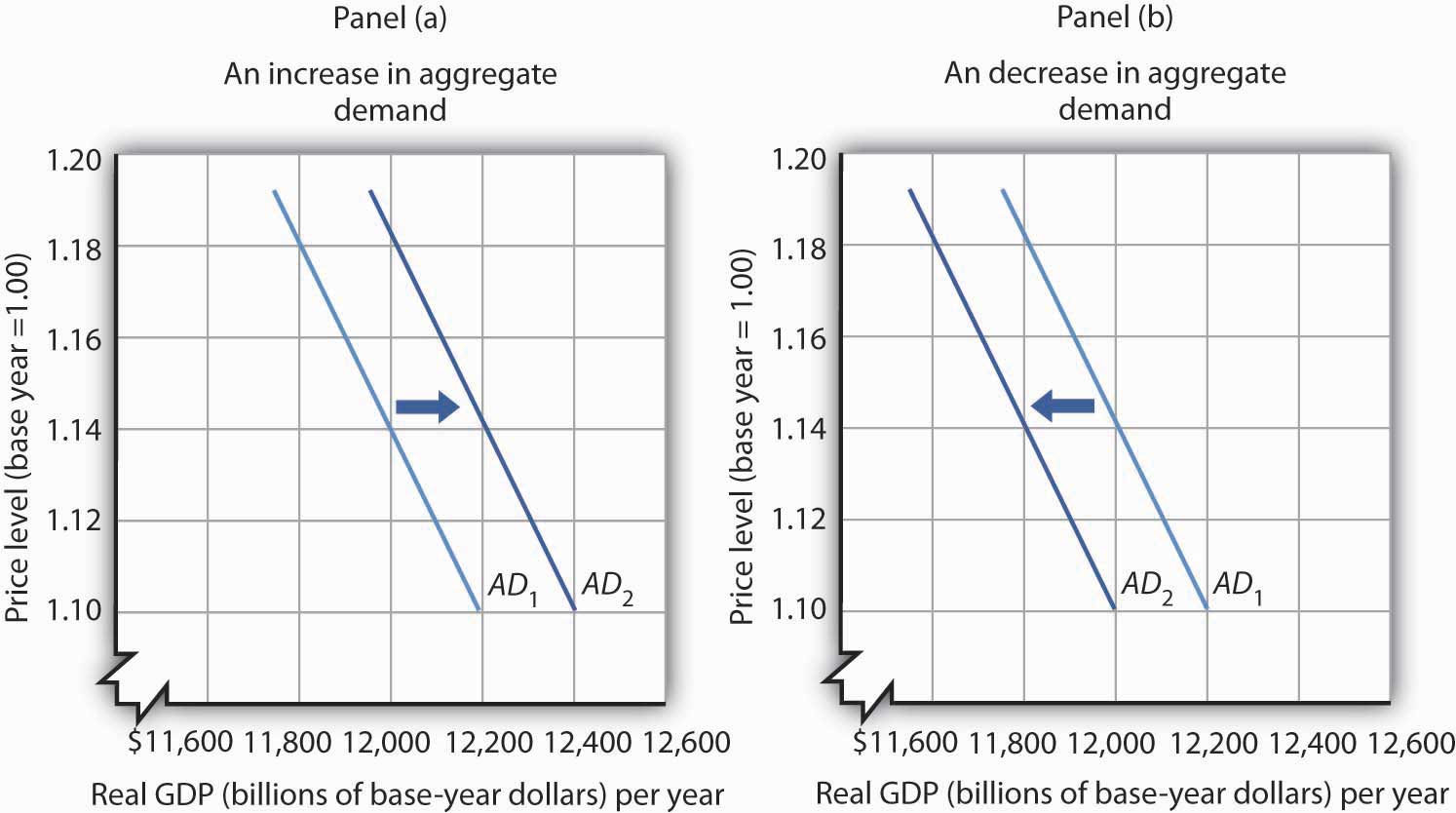

An increase in interest rates can have a direct impact on property prices. When interest rates rise, the cost of borrowing increases, reducing the affordability for potential buyers. As a result, the demand for properties can decrease, which can lead to a decline in property prices.

However, it’s essential to note that the impact of interest rates on property prices can vary depending on factors such as location, market conditions, and the overall state of the economy. While high-interest rates generally have a dampening effect on property prices, other factors such as supply and demand dynamics can also influence the market.

Investors are particularly sensitive to changes in interest rates as they analyze potential investment returns meticulously. When interest rates are high, investors may demand a lower price for a property to account for the increased financing costs. This negotiation tactic aims to mitigate the impact of higher mortgage payments on the overall profitability of the investment.

In the following sections, we will dive deeper into the effects of interest rates on property prices and examine the factors that influence investor demand during periods of high interest rates. We will also explore the associated risks and strategies that investors can employ to navigate the challenges of investing in real estate when interest rates are high.

Effect of Interest Rates on Property Prices

Interest rates have a direct impact on property prices due to their influence on the cost of borrowing. When interest rates are low, borrowing money becomes more affordable, leading to increased demand for properties and potentially driving up prices. Conversely, when interest rates are high, borrowing becomes more expensive, reducing affordability and potentially dampening property prices.

High-interest rates affect property prices in several ways:

- Reduced Affordability: When interest rates are high, the cost of borrowing increases, making mortgages more expensive. This results in reduced affordability for potential homebuyers and investors. As a result, there is a decrease in demand for properties, which can lead to a decline in prices.

- Lower Mortgage Approvals: High-interest rates can lead to stricter lending criteria by financial institutions. This means that individuals may struggle to qualify for mortgages, further reducing the pool of potential buyers. With a lower number of qualified buyers, property prices may be negatively impacted.

- Increased Cost of Financing: For real estate investors, high-interest rates mean higher mortgage payments, which can eat into potential rental income or returns on investment. As a result, investors may be more cautious and demand a lower purchase price to offset the increased financing costs.

- Market Cooling: High-interest rates can have a cooling effect on the overall property market. Buyers may delay their purchasing decisions or opt for smaller properties or alternative investment opportunities. This decrease in demand can put downward pressure on property prices.

It’s important to note that the relationship between interest rates and property prices is not solely determined by interest rates alone. Other factors such as supply and demand dynamics, economic conditions, and market sentiment can also influence property prices.

In addition to the direct impact on property prices, interest rates also affect market sentiment and investor confidence. When interest rates are high, it sends a signal that the economy may be tightening, which can lead to a more cautious approach from investors. This can further contribute to a slowdown in the property market and put downward pressure on prices.

Overall, high-interest rates can have a dampening effect on property prices due to reduced affordability, stricter lending criteria, increased financing costs, and a cooling of demand. Investors need to closely monitor interest rate movements and factor them into their investment strategies to navigate these challenging market conditions.

Investor Demand during High Interest Rates

During periods of high interest rates, investor demand for properties may be affected due to several factors. Understanding these factors is crucial for investors to make informed decisions and adapt their investment strategies accordingly.

1. Increased Financing Costs: High-interest rates directly impact the cost of borrowing for real estate investors. The higher the interest rate, the higher the mortgage payments will be. This increase in financing costs can reduce the potential profitability of investment properties and make them less attractive for investors. As a result, investor demand may decrease during high-interest rate periods.

2. Risk Management: Investors are generally risk-averse and seek to mitigate potential risks. High interest rates increase the uncertainty and risk associated with real estate investments. Investors may perceive an increase in borrowing costs as a potential threat to their cash flow and investment returns. This may lead to a decrease in investor demand as they become more cautious and seek lower-risk investment opportunities.

3. Opportunity Cost: High-interest rates can make alternative investment options, such as bonds or stocks, more appealing for investors. When interest rates are high, investors may choose to allocate their capital to other investment vehicles that offer higher returns or lower risks. This diversion of funds from the real estate market can lead to a decrease in investor demand for properties.

4. Market Sentiment: Investor sentiment is strongly influenced by economic conditions and market trends. High-interest rates can send a signal of a tightening economy, which may dampen investor confidence. This can lead to a decrease in investor demand for properties as they adopt a wait-and-see approach or seek out more favorable market conditions.

Despite these challenges, it’s important to note that high-interest rate periods can also present unique investment opportunities for savvy investors. While overall investor demand may decrease, there may be motivated sellers who are willing to negotiate lower prices to attract buyers. Additionally, rental demand may remain strong, allowing investors to generate stable cash flow even in a high-interest rate environment.

To navigate the challenges of investing during high-interest rate periods, it is crucial for investors to be proactive and adapt their strategies. Some strategies that investors can employ include:

- Seeking favorable financing options: Despite high-interest rates, there may be lenders or financing options that offer more competitive rates. Investors should shop around and compare different financing options to secure the most favorable terms.

- Focus on cash flow: Investors can prioritize properties with strong rental potential to generate consistent cash flow and offset the higher financing costs. This can help mitigate the impact of high-interest rates on investment returns.

- Long-term investment approach: Investors with a long-term horizon can ride out the fluctuations in interest rates. Over time, interest rates may decrease, and property values may appreciate, leading to increased returns.

- Research market conditions: Investors should stay informed about market conditions and monitor interest rate trends. Understanding the local real estate market dynamics can help identify potential opportunities and make well-informed investment decisions.

By taking a prudent and proactive approach, investors can navigate the challenges posed by high-interest rates and position themselves for success in the real estate market.

Risk Factors Associated with High Interest Rates

High interest rates can introduce several risk factors that real estate investors should carefully consider. These risk factors can have significant implications for investment returns and overall portfolio performance during periods of high interest rates.

1. Increased Financing Costs: One of the primary risks associated with high-interest rates is the increased cost of borrowing. Higher interest rates can lead to higher mortgage payments, reducing the cash flow and potential profitability of investment properties. This can put a strain on investors’ ability to meet their financial obligations and negatively impact their returns.

2. Reduced Affordability: High-interest rates can reduce the affordability for potential homebuyers and investors. With higher mortgage rates, individuals may find it more challenging to qualify for loans or afford larger loan amounts. Reduced affordability can lead to decreased demand for properties, which could result in longer holding periods or difficulty finding buyers when selling the investment.

3. Market Volatility: High-interest rate environments often coincide with increased market volatility. Economic conditions can be less predictable, leading to fluctuations in property prices and investor sentiment. Market volatility introduces uncertainty and can impact the overall performance of real estate investments, particularly for those with shorter investment horizons.

4. Impact on Property Valuations: High interest rates can have a direct impact on property valuations. As borrowing costs increase, potential buyers may be less willing or able to pay higher prices for properties. This can result in downward pressure on property values, affecting the overall value of real estate investment portfolios.

5. Refinancing Challenges: Investors who have existing mortgages or loans may face challenges when it comes to refinancing during periods of high interest rates. Higher rates can limit the options available or result in less favorable refinancing terms. This can restrict cash flow and hinder the ability to optimize investment returns.

6. Market Correction Potential: High-interest rate environments can increase the potential for a market correction or economic downturn. As borrowing becomes more expensive, overall demand for properties may decrease, leading to a potential oversupply situation. This imbalance in supply and demand can lead to a decline in property prices, negatively impacting investor returns.

Given these risk factors, it is crucial for investors to assess their risk tolerance and make informed investment decisions. Conducting thorough due diligence, assessing the local market conditions, and stress-testing investment scenarios can help mitigate risk and navigate high-interest rate environments.

Investors should also consider diversifying their real estate portfolio to minimize risk. Diversification across different property types, geographical areas, and investment strategies can help spread risk and reduce the impact of any localized market fluctuations.

Furthermore, maintaining a strong financial cushion, such as a cash reserve for emergencies or contingencies, can provide added security in high-interest rate scenarios. This can help investors weather potential decreases in cash flow or unexpected expenses that may arise as a result of the higher financing costs.

By recognizing and actively managing the risk factors associated with high interest rates, investors can position themselves for success even in challenging market conditions.

Impact on Financing Options

High interest rates have a significant impact on financing options for real estate investors. When interest rates are high, borrowing money becomes more expensive, leading to changes in the availability and terms of financing options.

1. Mortgage Rates: The most direct impact of high interest rates on financing options is the increase in mortgage rates. As interest rates rise, banks and other financial institutions adjust their lending rates accordingly. This can result in higher mortgage rates, making it more costly for investors to borrow money for real estate purchases.

2. Qualification Criteria: High interest rates can lead to stricter qualification criteria for obtaining a mortgage. Lenders may require higher credit scores, lower debt-to-income ratios, and larger down payments to reduce their risks in a high-interest rate environment. This can make it more challenging for some investors to qualify for financing or to secure favorable terms.

3. Loan-to-Value Ratios: Lenders often adjust loan-to-value ratios in response to changes in interest rates. A higher interest rate may lead to a decrease in the maximum loan amount relative to the property’s appraised value. This means that investors may need to bring a larger down payment or secure additional sources of financing to meet the revised loan-to-value requirements.

4. Reduced Affordability: Higher interest rates reduce affordability for potential borrowers. Increased mortgage payments can strain the cash flow of investors and limit their borrowing capacity. This can result in a decrease in the pool of eligible borrowers and a potential decrease in demand for properties.

5. Refinancing Challenges: Existing real estate investors may face challenges when it comes to refinancing their current mortgages. High interest rates can make it less beneficial or cost-effective to refinance, as the interest rates on new loans may be significantly higher than the rates on existing loans. This can impact investors’ ability to optimize their financing terms or access additional capital for future investments.

6. Alternative Financing Options: In a high-interest rate environment, real estate investors may explore alternative financing options. This can include seeking private or hard money lenders, exploring seller financing arrangements, or utilizing creative financing strategies. However, these alternative options may come with higher interest rates, shorter loan terms, or stricter repayment terms compared to traditional mortgage loans.

It is crucial for investors to closely monitor interest rate movements and explore different financing options to adapt to the changing market conditions. This may involve comparing mortgage rates from multiple lenders, working with mortgage brokers who have access to a wide range of loan products, or exploring alternative funding sources.

Additionally, investors should consider the long-term impact of financing options on their investment returns. While high-interest rates may imply higher borrowing costs, it is essential to assess the potential appreciation in property values and the rental market to determine the overall profitability of the investment.

By staying informed, being flexible with financing options, and conducting thorough financial analysis, investors can navigate the impact of high interest rates on financing and position themselves for success in the real estate market.

Strategies for Investors during High Interest Rates

Investing in real estate during high-interest rate periods requires careful consideration and strategic planning. By implementing the following strategies, investors can navigate the challenges posed by high interest rates and maximize their returns:

1. Favor Properties with Strong Cash Flow: In a high-interest rate environment, prioritizing properties with strong rental potential is crucial. Properties that generate consistent cash flow can help offset the higher financing costs and ensure a steady income stream. Conduct thorough market research to identify areas with high rental demand and seek properties that offer favorable rental yields.

2. Secure Favorable Financing Terms: Despite the higher interest rates, investors should explore different lending options to secure the most favorable financing terms. Compare mortgage rates from multiple lenders, consider working with mortgage brokers who have access to a wide range of loan products, and negotiate for lower interest rates or more flexible repayment terms.

3. Adjust Return Expectations: It’s crucial for investors to adjust their return expectations during high-interest rate periods. The increased financing costs may impact the overall returns on investment properties. By being realistic about expected yields and factoring in the higher financing expenses, investors can set appropriate financial targets and evaluate investment opportunities accordingly.

4. Diversify Investment Portfolio: High-interest rate periods may introduce greater potential risks. One strategy to mitigate these risks is to diversify the investment portfolio. Spread investments across different property types, geographical locations, and investment strategies. Diversification can help reduce exposure to any one market and provide a buffer against fluctuations in property values or rental demand.

5. Consider Long-Term Investments: High-interest rate periods may not be as conducive for short-term flipping or rapid property appreciation strategies. Consider adopting a long-term investment approach. Patience and a focus on market fundamentals can allow investors to benefit from potential property value appreciation over an extended period while weathering short-term market fluctuations and interest rate changes.

6. Monitor Market Conditions: Stay informed about the local real estate market dynamics, interest rate trends, and economic indicators. Keeping a close eye on market conditions will help investors identify emerging opportunities or potential risks. Work with real estate agents, attend networking events, and leverage online resources to stay updated on market trends and developments.

7. Negotiate Lower Purchase Prices: During high-interest rate periods, some sellers may be more motivated to negotiate lower purchase prices. Higher financing costs can dampen buyer demand, providing an opportunity for investors to leverage negotiation tactics and secure more favorable purchase terms. Conduct thorough property inspections, research comparable sales, and highlight the impact of higher interest rates on your purchase offer.

8. Secure Proactive Property Management: Optimize the performance of investment properties by implementing proactive property management strategies. This includes ensuring proper maintenance, minimizing vacancy periods, and optimizing rental rates. Diligent property management can help maximize cash flow and mitigate any potential adverse effects of high interest rates.

By adopting these strategies, real estate investors can navigate the challenges associated with high interest rates and position themselves for success. Flexibility, thorough research, and a long-term perspective are key to achieving optimal investment results in a high-interest rate environment.

Conclusion

Investing in real estate during periods of high interest rates requires careful consideration, adaptability, and strategic decision-making. Understanding the impact of interest rates on property prices, investor demand, financing options, and associated risks is crucial for investors to navigate these challenging market conditions.

High interest rates can lead to reduced affordability, increased financing costs, and decreased investor demand for properties. This can create opportunities for investors to negotiate lower purchase prices and focus on properties with strong cash flow potential. Diversifying investment portfolios, adjusting return expectations, and taking a long-term approach can help mitigate the impact of high interest rates and position investors for success.

It is important for investors to closely monitor market conditions, interest rate trends, and local dynamics to stay informed and identify potential opportunities. Seeking favorable financing terms, securing proactive property management, and conducting thorough due diligence are all essential strategies for maximizing returns in a high-interest rate environment.

While high interest rates introduce challenges, they also present unique opportunities for savvy investors. By adapting strategies, understanding potential risks, and making informed investment decisions, real estate investors can thrive even in a high-interest rate market.

In conclusion, a thoughtful and calculated approach, combined with continuous market analysis, can help investors navigate the complexities of investing in real estate during periods of high interest rates. By considering the impact of interest rates on property prices, investor demand, financing options, and implementing appropriate strategies, investors can achieve their financial goals and build a profitable real estate portfolio.