Finance

How To Calculate Your Net Income

Modified: September 6, 2023

Your net income is an essential financial information that you can easily track. Learn all about net income, its formula, and how to calculate it.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Whether you are an employer, employee, or self-employed, you are most probably familiar with net income. It is one of the most important pieces of financial information an individual needs to track. You do not have to be a professional accountant to know what this is and the formula for easy computation.

It is simple to keep records of your earnings and be in charge of your finances once you have an understanding of the process. With this guide, you will learn all about net income, the details of its formula and how to calculate it.

Personal Net Income

Personal net income is also called net earnings. It is the total amount of income an employee takes home (either hourly or by a fixed salary) after withholding taxes and other paycheque deductions. These deductions include social security taxes, health insurance benefits, or retirement plan investments.

Photo by Alexander Mils on Unsplash

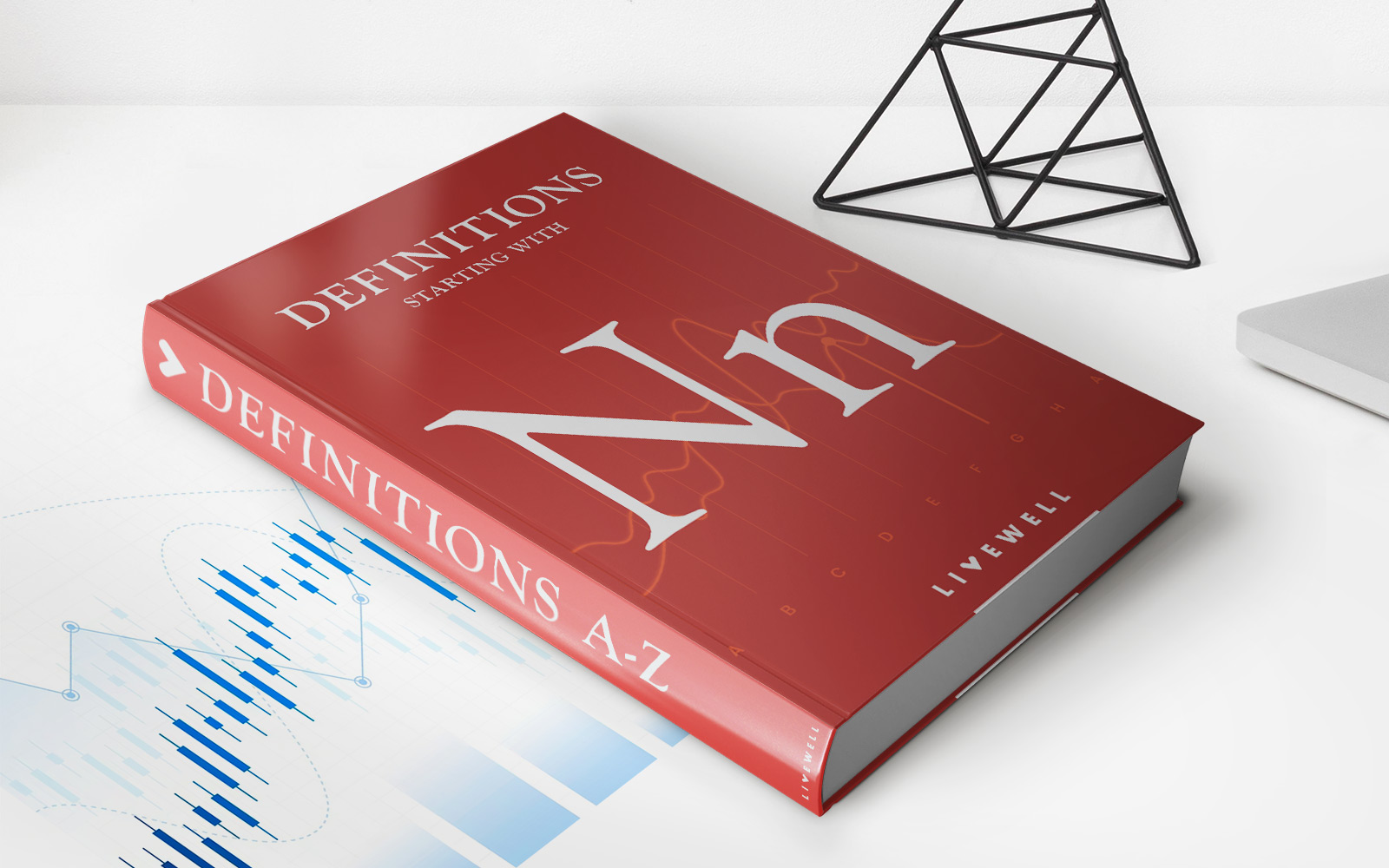

Business Net Income

Business net income is the total earnings or profits of a business. It is determined by taking the total revenue and deducting business operating expenses. The costs of business include taxes, depreciation, interest, building lease, and payroll.

This number appears on the company’s income statement. It will track the company’s profitability and indicate how it is growing, which is useful for both investors and stakeholders.

Difference Between Net Income And Gross Income

Net income and gross income are also known as net profit and gross profit. Both involve different calculations. For an individual, gross income refers to their total earnings or salary before taxes and deductions. Whereas, net income is the difference after factoring the said payroll deductions and taxes.

For businesses, gross income is the revenue generated from sales and its net earnings are the total profit made when the cost of expenses is taken out. These two are a helpful way to track how businesses generate revenue each year and evaluate expenses that may need adjustments.

Photo by stevepb from Pixabay

Net Income Formula

To calculate and determine the net income, accountants use the net income formula. It measures the amount of revenue or profit that exceed total expenses or deductions. To put it simply, the formula is:

Net Income = Total Revenue – Total Expenses

Let us look into the definition of total revenue and total expenses to have a better understanding of this calculation.

Revenue(s) – the amount of money a company earns over time. This can take in the form of cash, checks, credit cards, and other ways that someone can use to pay for their goods or services.

Expenses – this is anything that the company pays out to the government, creditors, vendors, employees, etc. It includes lease, rent, salary, taxes, and other expenses such as product returns or any other negative transaction.

Once you understand what goes into revenues and expenses, the net income formula is not complicated. It is especially easy to calculate if you have an account or a good accounting software that does the bookkeeping work for you. You can just take the total revenue and subtract it against your total expenses to get your net earnings.

Also, if you do not know your total revenue, you can subtract the cost of goods sold with the gross profit amount. It will give you the total revenue.

Photo by Michal Jarmoluk from Pixabay

How To Calculate Personal Net Income

1. Find Out Your Gross Annual Income

First, you need to know your gross income before calculating your net income. This should be easy to calculate if you are on a fixed salary or work stable hours. Look at your payslip and total amount before your employer takes out deductions and taxes.

Know how often you are paid and multiply the gross income accordingly. If you are paid every month, multiply the number from your payslip by 12 to get your gross annual income. Multiply it by 52 if you are paid weekly. And if you are paid bi-weekly, multiply it by 26.

If you work irregular hours, you will have to add up all your payslips for the year to get an accurate measure of your gross annual income.

2. Subtract Any Deductions You Have

To get your net earnings, you have to subtract any deductions you have from your gross annual income. After doing this, you will end with your total taxable income.

For instance, if you have a gross income of $55,000 and $5,000 in deductions, your taxable income is $50,000.

3. If Applicable, Deduct Your Retirement Contributions

Your IRA or individual retirement arrangement can be deducted from your taxable income under certain circumstances. Depending on your particular situation, you can consult the IRS if you can make any deductions on your retirement savings.

Let’s say, for instance, that you are allowed to deduct $2,000 from your taxable income. This means that your taxable income falls between $43,000 to $45,000.

Photo by Chris Potter from Flickr

4. Deduct Your Medical Expenses If Also Applicable

Aside from your retirement savings, you can also deduct medical and dental expenses from your taxable income. This also varies depending on your personal arrangement so you can also consult the IRS if you can also make any deductions.

5. Subtract Taxes From Your Annual Pay

After finding out your total taxable income, you have to subtract what you owe in taxes. Add up all taxes and total deductions and subtract them from your earnings to get your net annual income.

Using the earlier example, if your gross income is $55,000 with $5,000 in deductions and another $3,000 for retirement, your taxable income is $47,000. Also, if you owe $10,000 in taxes, that makes your net income $37,000.

Photo from Pexels

How To Calculate Business Net Income

1. Add Up Last Year’s Gross Income

To calculate your net income, gather your records for the past year and add up your total earnings before taxes or expenses. Subtract returns from your gross income.

For this example, let’s say that your gross income before expenses was $200,000.

2. Add Up The Cost Of Goods Sold

If your business involves selling products, take into account the original cost of those products. Multiply the price of each product by the number of products sold and subtract it from the total income. This will be your operating income.

If you sold 2,000 products and each cost $10, then the cost of goods sold is $20,000.

3. Add Up Administrative Costs

Begin adding up all of your expenses in operating your business. These may vary from different businesses, but there are a few common costs such as rent and utilities, employees’ salaries, gas, taxes, insurance, maintenance for vehicles, or equipment.

Photo by Steve Buissinne from Pixabay

4. Compute The Taxable Income

After adding up product cost and administrative expenses, you can compute the taxable income.

Add up the administrative expenses, cost of goods, and other deductions. Then subtract it from your net gross income. That number will be your taxable income.

Since your original net gross income was $100,000 with a $20,000 deduction, your taxable income is $80,000.

5. Calculate What You Owe In Taxes

You can figure out what you owe in taxes based on your taxable income. This number will depend on your income, the size of your business, the amount of equipment you have, and so on.

Photo from Max Pixel

6. Subtract Taxes From Your Taxable Income

After figuring out how much you owe in taxes, subtract that from your taxable income. You will then find out your business net income.

For instance, you found out you owe $10,000 in taxes. Subtract the number from your taxable income of $80,000 and your final net income is $70,000.