Home>Finance>Associate In Fidelity And Surety Bonding (AFSB) Definition

Finance

Associate In Fidelity And Surety Bonding (AFSB) Definition

Published: October 9, 2023

Learn the definition of Associate In Fidelity And Surety Bonding (AFSB) in the field of finance, and explore the opportunities it offers for professionals in this industry.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Associate In Fidelity And Surety Bonding (AFSB) Definition

If you are looking to expand your knowledge and establish yourself as an expert in the field of finance, the Associate in Fidelity and Surety Bonding (AFSB) certification is a highly valuable designation to pursue. Designed specifically for professionals in the insurance industry, this certification equips individuals with the necessary skills and expertise to excel in the complex world of fidelity and surety bonding.

Are you interested in obtaining the AFSB certification but unsure of what it entails? Look no further! In this blog post, we will delve into the definition of AFSB, discuss its importance in the finance industry, and explore the benefits it can bring to your career growth.

Key Takeaways:

- AFSB is an industry-recognized certification for professionals in the insurance sector.

- This certification equips individuals with the necessary skills to navigate the complexities of fidelity and surety bonding.

1. What is Associate in Fidelity and Surety Bonding (AFSB)?

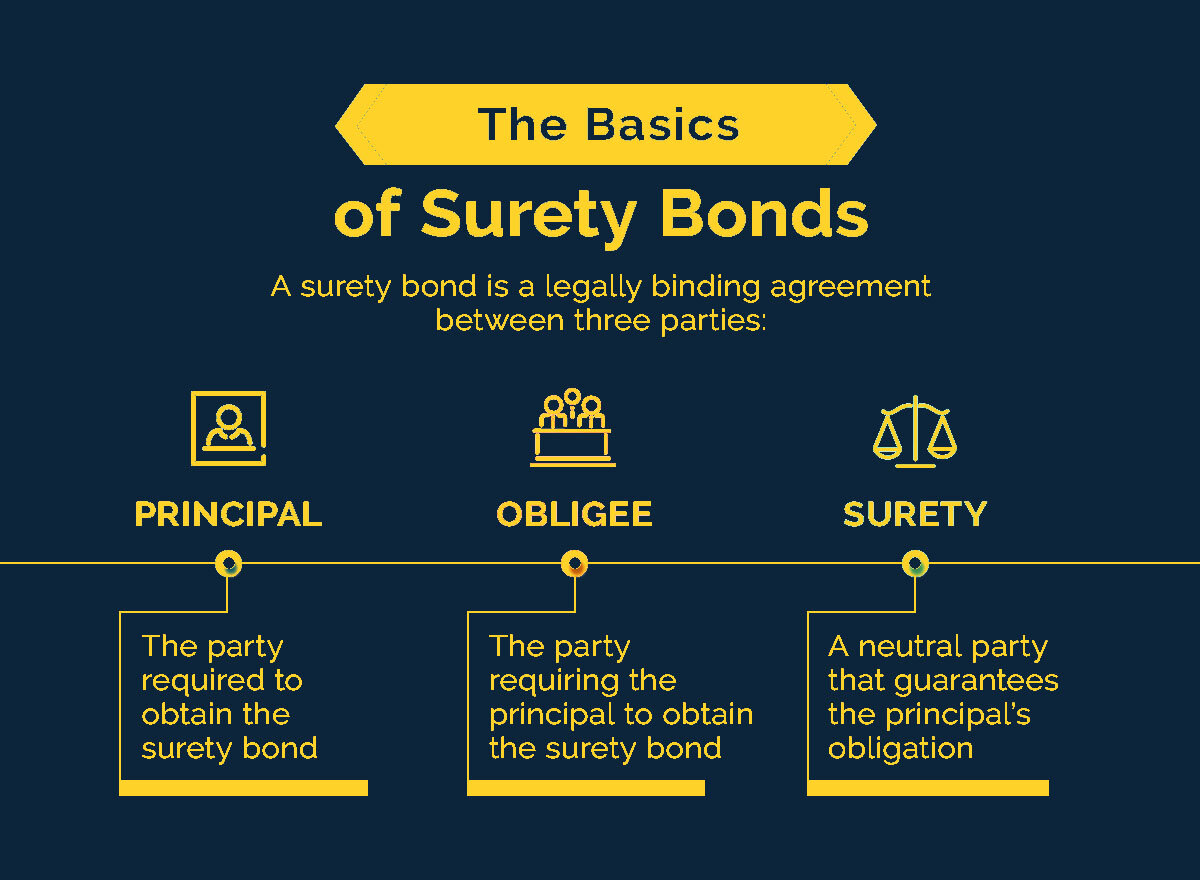

The Associate in Fidelity and Surety Bonding (AFSB) designation is an industry-recognized certification offered by The Institutes. It is specifically tailored to professionals in the insurance industry who deal with various aspects of fidelity and surety bonding. This certification series includes three courses, each focusing on specific areas of expertise:

- Course 1: Foundations of Fidelity and Surety Bonding: This course introduces key concepts, principles, and essential practices related to fidelity and surety bonding. It covers topics such as underwriting, policy drafting, claim handling, and risk management.

- Course 2: Advanced Fidelity and Surety Bonding: Building upon the foundational knowledge gained in Course 1, this course delves deeper into the complexities of fidelity and surety bonding. It explores advanced topics such as financial analysis, fraud detection and prevention, legal considerations, and contract surety underwriting.

- Course 3: Management of Fidelity and Surety Bonding: The final course in the AFSB certification series focuses on the managerial aspects of fidelity and surety bonding. It covers topics such as team leadership, agency management, client relationship management, and strategic planning.

2. Why is AFSB important in the finance industry?

In an industry as complex and evolving as finance, having specialized knowledge is essential to thrive and stay ahead of the competition. AFSB certification provides professionals with a comprehensive understanding of the intricacies of fidelity and surety bonding, enabling them to effectively analyze risks, create appropriate bonding solutions, and efficiently manage claims.

With AFSB certification, professionals can gain a competitive edge in the job market, showcasing their expertise and dedication to the fidelity and surety bonding field. Employers often prioritize candidates with specialized certifications like AFSB, as it demonstrates their commitment to professional growth and development.

Benefits of AFSB Certification:

- Enhanced knowledge and expertise in fidelity and surety bonding.

- Improved career prospects and increased earning potential.

- Recognition and credibility within the insurance industry.

- Access to a network of industry professionals and resources.

- Continual professional development and lifelong learning opportunities.

In conclusion, the Associate in Fidelity and Surety Bonding (AFSB) certification offers finance professionals a unique opportunity to specialize in the intricate field of fidelity and surety bonding. By gaining this certification, individuals can enhance their knowledge, career prospects, and earning potential while solidifying their position as trusted experts in the industry. So, if you are looking to take your finance career to the next level, consider pursuing the AFSB certification and unlock a world of possibilities.