Finance

How To Order Tax Return Transcripts

Published: October 28, 2023

Order your tax return transcripts easily with our step-by-step guide in the finance section. Get accurate financial information for tax purposes.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to our guide on how to order tax return transcripts. Tax return transcripts are official documents issued by the Internal Revenue Service (IRS) that provide a summary of the information included in your tax returns. These transcripts are commonly used for a variety of reasons, including applying for financial aid, obtaining mortgage loans, and resolving tax-related issues.

Ordering tax return transcripts can be a straightforward process, and there are several methods available to do so. Whether you prefer to order online, by mail, over the phone, or in person, we will guide you through each process step-by-step.

But why would you need to order tax return transcripts in the first place? Tax return transcripts are often required when applying for financial aid, such as student loans or grants. They provide a comprehensive overview of your income, tax payments, and any adjustments made to your tax returns. Mortgage lenders may also request tax return transcripts to verify your income and ensure that you can meet the financial obligations of the loan. Additionally, tax return transcripts can be helpful if you need to amend your tax returns or resolve any discrepancies with the IRS.

In this guide, we will explore the different methods available to order tax return transcripts, including online, by mail, over the phone, and in person. We will provide detailed instructions for each method so that you can choose the option that best suits your needs.

Now that you have a basic understanding of tax return transcripts and their importance, let’s dive into the various methods of ordering them. Whether you’re a student seeking financial aid, a homebuyer in the mortgage application process, or an individual seeking to resolve tax-related issues, this guide will help you navigate the process and obtain your tax return transcripts efficiently.

What are Tax Return Transcripts?

Tax return transcripts, also known as tax transcripts, are official documents issued by the IRS that provide a summary of the information included in your tax returns. They serve as a record of your tax filing history and include important details such as your reported income, deductions, credits, and tax payments. Tax return transcripts are often used by individuals and organizations for various purposes, including financial aid applications, mortgage loan approvals, and resolving tax-related issues.

There are different types of tax return transcripts that you can request from the IRS:

- Return Transcript: This transcript includes most of the line items from your original tax return form, such as adjusted gross income (AGI), taxable income, and the amount of tax owed or refunded.

- Account Transcript: The account transcript provides a more detailed overview of your tax account history, including any adjustments made to your tax returns, additional reported income, penalty assessments, and other relevant information.

- Wage and Income Transcript: This transcript shows any income reported to the IRS from various sources, including employers, financial institutions, and other payers.

It’s important to note that tax return transcripts are not the same as a copy of your filed tax return. While tax return transcripts provide a summarized version of the information, a copy of your filed tax return will show the actual forms and schedules you submitted to the IRS.

So, why are tax return transcripts important? These documents are often required by external parties, such as educational institutions, lenders, and government agencies, to verify your financial information. For example, when applying for financial aid, colleges and universities may request tax return transcripts to assess your eligibility based on your reported income. Mortgage lenders may require tax return transcripts to verify your income during the loan approval process.

Additionally, tax return transcripts can be useful for individuals who need to amend their tax returns or resolve any discrepancies with the IRS. By reviewing the information on the transcripts, you can ensure the accuracy of your reported income and deductions, and take necessary steps to address any issues that may arise.

In the next sections, we will explore the various methods available for ordering tax return transcripts, including online, by mail, over the phone, and in person. Whether you need tax return transcripts for financial aid applications or to resolve tax-related matters, following the appropriate process will help you obtain these essential documents efficiently.

Why Order Tax Return Transcripts?

Ordering tax return transcripts can be a necessary step for a variety of reasons. Let’s explore the key reasons why you might need to order tax return transcripts:

1. Financial aid applications: When applying for financial aid, such as grants or student loans, educational institutions often require tax return transcripts. These transcripts provide a verified summary of your income and financial information, allowing the institution to assess your eligibility for financial assistance accurately.

2. Mortgage loan approvals: Lenders typically request tax return transcripts when evaluating mortgage loan applications. These transcripts serve as evidence to verify your income and ensure that you have the financial capacity to repay the loan. Having tax return transcripts readily available can expedite the loan approval process and provide lenders with the necessary information to make an informed decision.

3. Tax-related matters: If you need to resolve any tax-related issues with the IRS, tax return transcripts can be invaluable. They provide a comprehensive overview of your reported income, deductions, credits, and tax payments, making it easier to identify any discrepancies or errors. Whether you need to amend your tax return or verify information for an IRS audit, tax return transcripts can provide the necessary documentation to support your case.

4. Identity verification: Tax return transcripts can serve as an official proof of filing and income verification in various situations. For example, when applying for certain jobs or government benefits, you may be required to provide tax return transcripts as part of the identity verification process.

5. Tax planning: Tax return transcripts can also be useful for tax planning purposes. By reviewing your past tax returns and transcripts, you can gain insights into your income, deductions, and tax liabilities. This information can help you make strategic decisions when it comes to tax-saving strategies and financial planning.

Ordering tax return transcripts is a relatively straightforward process. The next sections will guide you through the different methods available to order tax return transcripts, including online, by mail, over the phone, and in person. Regardless of the reason you need tax return transcripts, following the appropriate process will ensure that you obtain the documents you require efficiently and accurately.

How to Order Tax Return Transcripts Online

Ordering tax return transcripts online is a convenient and efficient method. It allows you to access your transcripts quickly without the need to wait for mail delivery. Follow these steps to order tax return transcripts online:

- Visit the official IRS website: Start by visiting the IRS website at www.irs.gov. Make sure you are on the official IRS website to ensure the security of your personal information.

- Find the “Get Transcript” tool: On the IRS website, search for the “Get Transcript” tool. You can usually find it under the “Tools” or “Forms & Instructions” section.

- Choose the appropriate transcript type: Select the type of tax return transcript you need, such as “Return Transcript,” “Account Transcript,” or “Wage and Income Transcript.”

- Verify your identity: The IRS website will prompt you to verify your identity to ensure the security of your tax information. You may need to provide personal identification information, such as your Social Security number, date of birth, and filing status.

- Request your tax return transcript: Once your identity is verified, you can request your tax return transcript online. The transcript will usually be available for immediate download or mail delivery, depending on the option you choose.

It’s important to note that in order to order tax return transcripts online, you will need to have certain information on hand, such as your Social Security number, date of birth, and the exact mailing address used on your most recent tax return.

Online ordering of tax return transcripts offers several benefits. It is available 24/7, allowing you to conveniently access your transcripts at any time. Additionally, the online method usually provides instant access to downloadable transcripts, eliminating the need to wait for physical copies to arrive by mail.

However, it’s important to ensure the security of your personal information when ordering tax return transcripts online. Only use the official IRS website and avoid entering any personal information on unofficial or suspicious websites.

In the next sections, we will explore other methods available to order tax return transcripts, including ordering by mail, over the phone, and in person. These alternate methods may be suitable if you prefer traditional mail delivery, have limited internet access, or require additional assistance with your request.

How to Order Tax Return Transcripts by Mail

If you prefer a more traditional approach, you can order tax return transcripts by mail. Simply follow these steps to request your transcripts through the mail:

- Download Form 4506-T: Visit the official IRS website at www.irs.gov/forms-pubs/about-form-4506-t and download Form 4506-T, also known as the “Request for Transcript of Tax Return.” This form is used to request various types of tax transcripts, including tax return transcripts.

- Fill out the form: Complete the required fields on Form 4506-T. Make sure to indicate the specific tax year or years for which you need the transcripts.

- Choose the appropriate transcript type: On Form 4506-T, indicate the type of transcript you need, such as “Return Transcript” or “Account Transcript,” depending on your requirements.

- Provide your mailing address: Enter the address where you want the transcripts to be mailed. Make sure the address provided matches the one used on your most recent tax return.

- Sign and date the form: Sign and date the completed form. The IRS requires your signature to authorize the release of the requested tax return transcripts.

- Mail the form to the appropriate IRS address: Refer to the instructions on Form 4506-T to find the correct IRS address for your location. It’s important to send the form to the appropriate address to ensure timely processing.

- Wait for processing and delivery: Once the IRS receives your request, they will process it and mail the requested tax return transcripts to the address you provided on Form 4506-T. It may take several weeks to receive the transcripts, so be patient.

Ordering tax return transcripts by mail is a viable option if you prefer physical copies or if you have limited internet access. It is important to ensure that you correctly fill out Form 4506-T and provide the necessary information to avoid delays in processing your request.

If you have specific time constraints or need the tax return transcripts urgently, it may be more efficient to consider other methods, such as ordering online or by phone, as these options generally offer quicker access to the requested documents.

In the next sections, we will explore how to order tax return transcripts over the phone and in person, providing alternative methods to obtain your transcripts if they better align with your preferences or circumstances.

How to Order Tax Return Transcripts by Phone

If you prefer a more direct and convenient method, you can order tax return transcripts by phone. Simply follow these steps to request your transcripts over the phone:

- Gather required information: Before calling the IRS, make sure you have all the necessary information on hand. This includes your Social Security number, date of birth, and the exact mailing address used on your most recent tax return.

- Call the IRS transcript line: Dial the IRS transcript line at the appropriate phone number based on your location. You can find the correct transcript line phone number on the official IRS website or in the instructions provided on IRS publications.

- Follow the prompts: Once you are connected to the transcript line, follow the automated prompts to request your tax return transcripts. The system will guide you through the process and ask for the required information.

- Choose the appropriate transcript type: During the call, you will be asked to specify the type of tax return transcript you need, such as “Return Transcript,” “Account Transcript,” or “Wage and Income Transcript.”

- Authorize the release of the transcripts: The IRS will require your verbal authorization to release the requested tax return transcripts. This ensures that your information remains confidential and protected.

- Provide your mailing address: When prompted, provide the mailing address where you want the transcripts to be sent. Ensure that the address you provide matches the one used on your most recent tax return.

- Confirm and complete the call: Once you have provided all the necessary information, verify the details with the automated system. If everything is correct, complete the call, and the IRS will process your request.

Ordering tax return transcripts by phone offers a convenient option, especially if you prefer speaking directly to an IRS representative. It allows you to quickly request your transcripts and address any questions or concerns you may have during the call.

Keep in mind that wait times when calling the IRS transcript line may vary, especially during peak tax seasons. It’s best to allocate sufficient time for the call and have all the required information readily available to expedite the process.

In the next section, we will explore how to order tax return transcripts in person, providing an alternative method for obtaining your transcripts if it aligns with your preferences or circumstances.

How to Order Tax Return Transcripts in Person

If you prefer a more hands-on approach, you have the option to order tax return transcripts in person. Follow these steps to request your transcripts through an in-person visit:

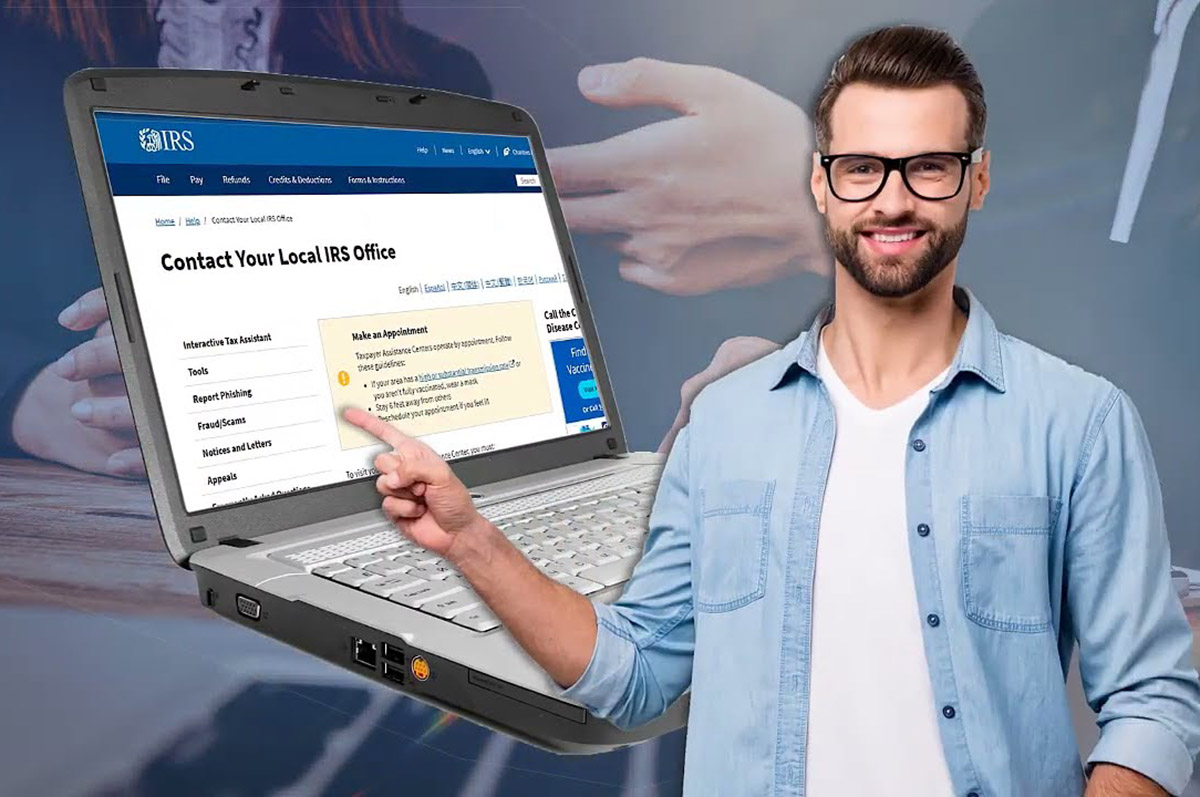

- Locate your local IRS office: Find the nearest IRS office by visiting the official IRS website or contacting the IRS toll-free number. The website and phone line will provide you with the necessary information to locate the office closest to your area.

- Prepare the required documentation: Before visiting the IRS office, make sure you have all the necessary documentation with you. This includes your identification documents (such as a valid government-issued ID), Social Security number, and any relevant tax documents.

- Visit the IRS office: Head to the IRS office during their operating hours. It is recommended to call ahead and schedule an appointment, especially during busy seasons, to avoid long wait times.

- Explain your request: Once at the IRS office, explain to the IRS representative that you would like to order tax return transcripts. Provide them with the necessary information, such as the tax years you need the transcripts for and the type of transcript you are requesting.

- Verify your identity: The IRS representative may ask you to provide identification documents and additional information to verify your identity. This is a standard procedure to ensure the security of your tax information.

- Authorize the release of the transcripts: Once your identity is confirmed, you will be asked to sign a consent form authorizing the IRS to release the requested tax return transcripts to you.

- Receive the transcripts: After completing the required paperwork, the IRS representative will process your request, and you will receive the tax return transcripts directly at the office. You may be able to obtain physical copies of the transcripts or receive them electronically, depending on the office’s procedures.

Ordering tax return transcripts in person allows you to interact directly with an IRS representative and address any questions or concerns you may have during the process. It can be especially beneficial if you require additional guidance or have complex inquiries related to your tax return transcripts.

Remember to bring all the necessary documentation and schedule an appointment whenever possible to ensure a smooth and efficient visit to the IRS office.

Now that you are familiar with how to order tax return transcripts online, by mail, over the phone, and in person, you can choose the method that best suits your preferences and circumstances. In the next section, we will provide additional tips and considerations to help you successfully navigate the process of ordering tax return transcripts.

Additional Tips and Considerations

When ordering tax return transcripts, there are a few important tips and considerations to keep in mind:

- Accuracy of information: Ensure that you provide accurate and up-to-date information when ordering tax return transcripts. Double-check your Social Security number, date of birth, and the mailing address used on your most recent tax return to avoid delays or errors in processing your request.

- Processing time: The processing time for tax return transcripts can vary depending on the method you choose and the current workload of the IRS. Online requests may provide instant access to downloadable transcripts, while requests made by mail, phone, or in-person may take several weeks. Plan accordingly and allow sufficient time for processing and delivery.

- Transcript types: Before ordering, consider which type of tax return transcript best meets your needs. Whether you need a summarized overview of your tax return (Return Transcript), a detailed account history (Account Transcript), or a record of reported income (Wage and Income Transcript), choose the appropriate type for your specific situation.

- Need for physical copies: If you require physical copies of your tax return transcripts, consider ordering them by mail or in person. Online and phone methods generally provide electronic access or mail delivery of the transcripts. Physical copies may be necessary for certain applications or instances where digital copies may not be accepted.

- Security: Protect the security of your personal information when ordering tax return transcripts. Only use the official IRS website or authorized communication channels to provide your information. Avoid sharing sensitive details on unofficial or suspicious websites or over non-secure communication methods.

- Keep copies and records: It is advisable to keep copies of your tax return transcripts for your records. These documents can be useful for future reference, especially if you need to provide proof of income or resolve any discrepancies with the IRS.

By following these additional tips and considerations, you can ensure a smooth and successful process when ordering tax return transcripts. Whether you choose to order online, by mail, over the phone, or in person, understanding these key factors will aid in obtaining your transcripts accurately and efficiently.

As a final note, always consult the official IRS website or contact the IRS directly for the most up-to-date and accurate information regarding the specific process and requirements for ordering tax return transcripts.

We hope this guide has provided you with valuable insights and guidance on how to order tax return transcripts. Whether you’re applying for financial aid, seeking a mortgage loan, or resolving tax-related matters, obtaining your tax return transcripts is a crucial step in the process. Best of luck with your endeavors!

Conclusion

Ordering tax return transcripts is an essential process for a variety of purposes, from applying for financial aid to resolving tax-related issues. Throughout this guide, we have explored the different methods available to order tax return transcripts, including online, by mail, over the phone, and in person. Each method offers its own advantages and considerations, allowing you to choose the option that best suits your preferences and circumstances.

Ordering tax return transcripts online provides convenience and immediate access to downloadable transcripts, making it a popular choice for many. However, if you prefer traditional methods or have limited internet access, ordering by mail or in person may be more suitable for you. Additionally, ordering over the phone offers a direct and convenient option, allowing you to speak with an IRS representative for guidance and support.

When ordering tax return transcripts, ensure that you provide accurate information and carefully select the transcript type that aligns with your needs. Be mindful of the processing time for each method and plan accordingly to allow for sufficient time to receive your transcripts.

Remember to prioritize the security of your personal information by using official IRS channels and avoiding unofficial or suspicious websites. Keep copies of your tax return transcripts for your records, as they may be useful for future reference or resolving any discrepancies that may arise.

We hope that this guide has equipped you with the knowledge and guidance you need to successfully order tax return transcripts. By following the appropriate method and considering the tips provided, you can obtain the necessary documents efficiently and accurately.

Whether you’re a student applying for financial aid, a homebuyer in the mortgage application process, or an individual seeking to resolve tax-related matters, ordering tax return transcripts is an important step in your journey. Now, armed with this information, you can navigate the process with confidence and achieve your goals. Best of luck!