Home>Finance>How To Calculate Cash Flow From Rental Property

Finance

How To Calculate Cash Flow From Rental Property

Published: December 20, 2023

Learn how to calculate cash flow from rental property and manage your finances effectively.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Investing in rental properties can be a lucrative venture, providing a steady stream of income and wealth accumulation over time. However, as with any investment, it is important to understand the financial dynamics involved to make informed decisions and assess the profitability of potential properties.

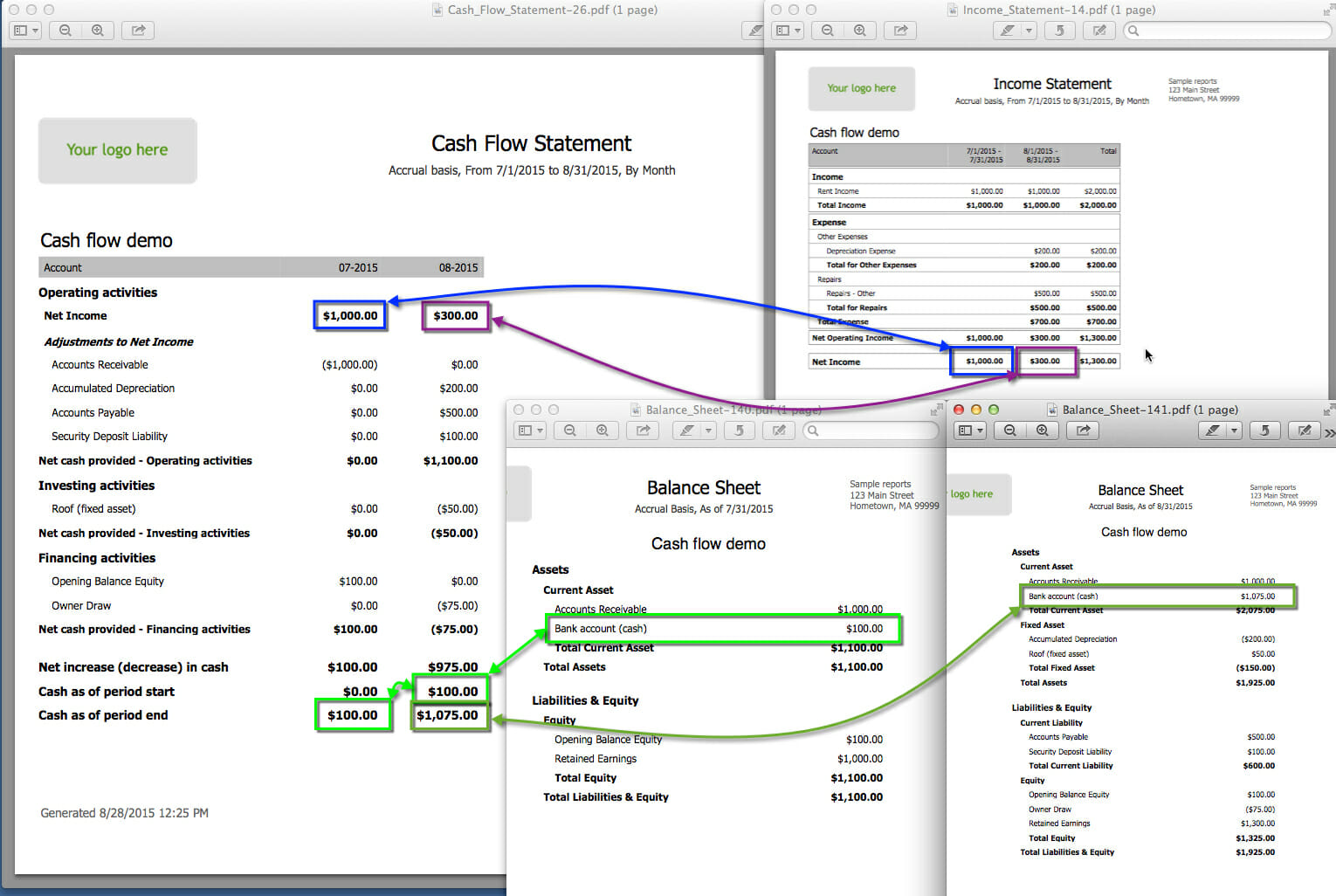

One crucial aspect of evaluating rental properties is calculating their cash flow. Cash flow is the net amount of money generated by an investment property after all expenses have been paid. It serves as a key indicator of the property’s financial performance and its ability to produce positive returns.

In this article, we will dive into the world of cash flow from rental properties and how you can calculate it. By understanding the components of cash flow and following a step-by-step process, you can gain valuable insights into the financial viability of your investment and make sound decisions.

Before we delve into the calculations, it’s important to note that a positive cash flow is generally desirable as it indicates that the property is generating more income than its expenses. This not only provides a steady income stream but also builds equity over time. On the other hand, a negative cash flow means that the property is not generating enough income to cover its operating costs, resulting in a drain on your finances.

Now that we have a basic understanding of cash flow and its significance, let’s explore the components that go into calculating cash flow from rental properties.

Understanding Cash Flow

Before we jump into calculating cash flow from rental properties, it’s important to have a clear understanding of what cash flow represents and why it is a crucial metric for investors.

Cash flow is the amount of money generated by an investment property after accounting for all income and expenses. It provides an accurate measure of the property’s profitability and its ability to generate a positive return on investment.

Positive cash flow indicates that the property is generating more income than its operating costs, including mortgage payments, property taxes, insurance, repairs, and maintenance. This surplus cash flow can be used to reinvest in the property, cover unforeseen expenses, or provide additional income for the investor.

On the other hand, negative cash flow occurs when the property’s expenses exceed its income. This may happen if the rental income does not cover all operating expenses or if there are significant repair or maintenance costs. Negative cash flow can put a strain on an investor’s finances, requiring them to cover the shortfall out of pocket.

Calculating cash flow is essential for several reasons. Firstly, it allows investors to evaluate the financial performance of a rental property and determine if it will be a profitable investment. Positive cash flow indicates that the property has the potential to generate a consistent income stream and build equity over time.

Secondly, cash flow analysis helps investors make informed decisions regarding property management. By understanding the income and expenses associated with the property, investors can identify areas where costs can be reduced or where rent can be increased to maximize cash flow.

Lastly, cash flow calculations also play a crucial role in obtaining financing for investment properties. Lenders often require proof of positive cash flow to ensure that the property can generate enough income to cover the loan payments.

Now that we have a solid understanding of what cash flow is and its importance, let’s explore the different components that go into calculating cash flow from rental properties.

Components of Cash Flow from Rental Property

Calculating cash flow from rental properties involves considering various income and expense components. Understanding these components will enable you to accurately assess the potential cash flow of a property. Here are the key components to consider:

- Rental Income: This is the total amount of money you receive from tenants as rent payments. It is the primary source of income for a rental property. Make sure to include all rental income, whether from residential or commercial tenants.

- Vacancy Rate: Vacancy rate refers to the percentage of time in which your property remains unoccupied. It is important to factor in potential vacancy when calculating cash flow, as periods of low or no rental income can affect your overall profitability.

- Operating Expenses: These are the costs associated with managing and maintaining the property. Operating expenses may include property taxes, insurance, property management fees, maintenance and repairs, utilities, and advertising expenses. It’s crucial to accurately estimate these expenses and account for them in your cash flow calculations.

- Capital Expenditures: Capital expenditures, often referred to as CapEx, are expenses incurred for major repairs, renovations, or replacements that extend the useful life of the property. These expenses are not considered part of the regular operating expenses. Instead, they are typically set aside in a reserve fund and included in cash flow calculations as a separate line item.

- Mortgage Payments: If you have a mortgage on the rental property, the monthly principal and interest payments should be factored into your cash flow calculations. These payments represent a significant portion of your expenses and need to be accounted for accurately.

- Other Income Sources: In addition to rental income, a property may generate income from other sources such as parking fees, laundry facilities, or storage rentals. Including these additional income sources in your cash flow calculations will give you a more comprehensive view of the property’s overall financial performance.

- Tax Considerations: It’s important to take into account the tax implications of owning a rental property. Depending on your jurisdiction, you may be eligible for tax deductions related to mortgage interest, depreciation, property taxes, and certain expenses. Consult with a tax professional to ensure you are accurately factoring in the tax implications of your rental property when calculating cash flow.

By considering these components, you can obtain a more accurate picture of the cash flow potential of a rental property. In the next steps, we will walk you through the process of calculating cash flow using these components.

Step 1: Calculate Rental Income

The first step in calculating cash flow from a rental property is to determine the total rental income. This involves taking into account the rental rates and the occupancy rate of the property.

To calculate the rental income, start by determining the monthly rental rate for each unit or space within the property. Multiply the rental rate by the total number of units or spaces to get the total potential rental income per month.

Next, consider the vacancy rate. The vacancy rate represents the percentage of time that the property is unoccupied and not generating rental income. Multiply the potential rental income by (1 – vacancy rate) to estimate the actual rental income.

For example, if the monthly rental rate is $1,000 and there are 10 units in the property, the potential rental income would be $10,000 per month. If the vacancy rate is 10%, the actual rental income would be $9,000 per month ($10,000 x (1 – 0.10)).

Additionally, if there are any other income sources such as parking fees or laundry revenues, include those in the total rental income calculation as well.

It’s important to note that rental income may vary over time due to factors such as market conditions, tenant turnover, or rental rate adjustments. It’s recommended to use conservative estimates when calculating rental income to avoid overestimating cash flow.

By accurately calculating the rental income, you will have a solid foundation for the next steps in determining cash flow from your rental property.

Step 2: Determine Operating Expenses

After calculating the rental income, the next step in calculating cash flow from a rental property is to determine the operating expenses. Operating expenses are the costs associated with managing and maintaining the property on an ongoing basis.

Operating expenses can vary depending on factors such as the type of property, its location, and the amenities it offers. Here are some common operating expenses to consider:

- Property Taxes: Property taxes are assessed by the local government and vary depending on the value and location of the property.

- Insurance: Property insurance protects against unexpected events such as fire, theft, or natural disasters. Premiums vary based on factors like the property value and coverage amount.

- Maintenance and Repairs: Regular maintenance and repairs are essential to keeping the property in good condition. This includes tasks like painting, plumbing repairs, HVAC maintenance, and landscaping.

- Utilities: Utilities such as water, electricity, gas, and trash removal are ongoing expenses that need to be factored into the cash flow calculation.

- Property Management Fees: If you hire a property management company to handle tenant screening, rent collection, and property maintenance, their fees should be considered as an operating expense.

- Advertising and Marketing: If you incur costs for advertising the property to attract tenants, such as listing fees or advertising campaigns, these expenses should be included.

- HOA Fees: If the property is located in a community with a homeowner’s association (HOA), there may be monthly or annual fees for upkeep, amenities, or shared services.

- Legal and Professional Fees: Expenses related to legal services, accounting, and other professional consultations should be factored into the operating expenses.

- Other Expenses: Depending on the property, there may be additional expenses such as pest control, security systems, or common area maintenance fees.

It’s important to accurately estimate the operating expenses for your rental property. This can be done by keeping track of past expenses, obtaining quotes from service providers, or consulting with other property owners in the area.

Remember to consider both fixed expenses (such as property taxes and insurance) and variable expenses (such as maintenance and utilities) when determining the operating expenses. Regularly reviewing and adjusting your operating expense estimates will help you maintain an accurate cash flow projection.

By including all relevant operating expenses, you will have a comprehensive understanding of the costs associated with managing and maintaining the rental property, which is crucial for determining the overall cash flow.

Step 3: Calculate Net Operating Income (NOI)

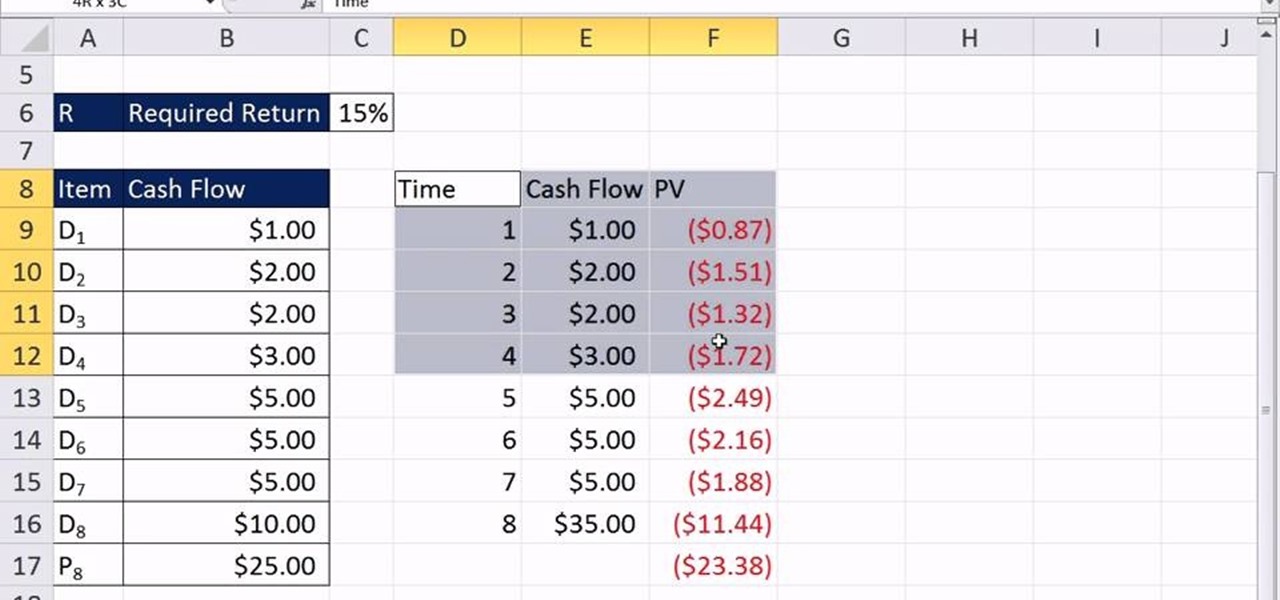

Once you have determined the rental income and operating expenses, the next step is to calculate the Net Operating Income (NOI) of your rental property. NOI is a key metric that represents the income generated by the property after subtracting all operating expenses.

To calculate NOI, subtract the total operating expenses from the rental income. The formula for calculating NOI is:

NOI = Rental Income – Operating Expenses

For example, if your rental income is $9,000 per month and your operating expenses are $3,000 per month, the NOI would be $6,000 per month ($9,000 – $3,000).

Net Operating Income is a critical figure as it provides insight into the property’s profitability and financial performance. A higher NOI signifies stronger cash flow and a more attractive investment opportunity.

NOI is particularly useful when comparing different rental properties or evaluating the potential return on investment. By calculating the NOI for each property, you can make informed decisions about which properties are more financially viable and have better cash flow potential.

It’s worth noting that NOI does not include certain expenses such as mortgage payments or income taxes. NOI represents the property’s ability to generate income before these financial obligations are taken into account.

Calculating Net Operating Income provides a clear snapshot of the property’s financial performance and sets the groundwork for the next steps in determining its cash flow.

Step 4: Account for Debt Service

When calculating cash flow from a rental property, it is crucial to account for debt service, which refers to the mortgage payments associated with the property. Including debt service in your cash flow analysis provides a more accurate representation of the property’s financial performance and profitability.

To account for debt service, start by determining the monthly mortgage payment. This includes both the principal amount and the interest. If you’re not sure about the exact amount, consult your mortgage lender or review your loan documents.

Once you have the monthly mortgage payment, subtract it from the Net Operating Income (NOI) calculated in the previous step. The formula for calculating cash flow after debt service is:

Cash Flow = NOI – Debt Service

For example, if your Net Operating Income (NOI) is $6,000 per month and your monthly mortgage payment is $1,500, your cash flow after debt service would be $4,500 per month ($6,000 – $1,500).

Accounting for debt service is essential as it reflects the impact of financing on your cash flow. It helps you determine the actual income you will receive from the property after accounting for your mortgage obligations. This information is crucial for assessing the profitability of your investment and ensuring that the property generates enough income to cover the loan payments.

If the cash flow after debt service is positive, it indicates that the rental property is producing enough income to cover the mortgage payments and potentially generate additional income. However, if the cash flow after debt service is negative, it suggests that the property’s income falls short of covering its mortgage expenses, which may require additional financial support from the investor.

By factoring in debt service, you can make more informed decisions about your rental property investments and assess their long-term financial viability.

Step 5: Calculate Cash Flow

The final step in determining the cash flow from a rental property is to calculate the actual cash flow, taking into account the Net Operating Income (NOI) and any debt service obligations.

To calculate the cash flow, subtract the debt service (mortgage payment) from the Net Operating Income. The formula for calculating cash flow is:

Cash Flow = NOI – Debt Service

For example, if your Net Operating Income is $6,000 per month and your monthly mortgage payment is $1,500, your cash flow would be $4,500 per month ($6,000 – $1,500).

The cash flow represents the net amount of money generated by the rental property after accounting for all income and expenses, including operating expenses and mortgage payments. A positive cash flow indicates that the property is generating more income than its expenses and is considered financially viable and profitable.

Positive cash flow means that the property can generate surplus income that can be used for reinvestment, savings, or other financial goals. It provides a steady income stream and creates the potential for wealth accumulation over time.

On the other hand, a negative cash flow suggests that the property’s expenses exceed its income. This indicates that the property may not be generating enough income to cover all its financial obligations and could lead to a drain on your finances if not closely monitored.

Calculating the cash flow allows you to assess the financial performance of your rental property and make informed decisions about its viability. It helps you determine if the property is generating enough income to meet your financial goals and if adjustments or improvements are needed to achieve positive cash flow.

In addition to the initial cash flow analysis, it’s important to regularly reassess and monitor the property’s cash flow over time. Market conditions, rental rates, expenses, and other factors may change, impacting the property’s financial performance. By staying on top of the cash flow, you can make timely adjustments and ensure the property remains a profitable investment.

Remember that cash flow is just one aspect to consider when evaluating a rental property. Other factors such as location, market trends, potential for appreciation, and property management should also be taken into account for a comprehensive investment analysis.

Conclusion

Calculating cash flow from rental properties is an essential step for any real estate investor. It allows you to assess the financial viability of a property, make informed investment decisions, and evaluate its potential return on investment. By understanding the components of cash flow and following a systematic process, you can gain valuable insights into the property’s financial performance.

Throughout this article, we have discussed the key steps involved in calculating cash flow from rental properties:

- Calculating Rental Income: Determining the total rental income, accounting for vacancy rates and other income sources.

- Determining Operating Expenses: Identifying and estimating the various costs associated with managing and maintaining the property.

- Calculating Net Operating Income (NOI): Subtracting the operating expenses from the rental income to determine the property’s profitability.

- Accounting for Debt Service: Factoring in the mortgage payments to assess the property’s cash flow after loan obligations.

- Calculating Cash Flow: Determining the net amount of money generated by the property after accounting for all income and expenses.

It’s important to regularly review and revisit the cash flow analysis as market conditions and financial obligations may change over time. By staying proactive and adjusting your calculations when necessary, you can ensure the property continues to generate positive cash flow or take corrective measures if needed.

Remember, cash flow is just one aspect to consider when evaluating an investment property. Other factors like location, appreciation potential, tenant demand, and property management should also be taken into account to make a well-rounded investment decision.

Ultimately, calculating cash flow allows you to assess the financial performance and profitability of a rental property. It helps you determine if the property aligns with your investment goals and if it can generate a steady income stream. By conducting thorough cash flow analysis, you can make informed decisions and embark on a successful journey in real estate investing.