Finance

How To Check Credit Score On TD App

Modified: February 21, 2024

Learn how to check your credit score on the TD App and stay on top of your finances. Monitor your credit health with ease and make informed financial decisions.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Welcome to the world of personal finance and credit scores! Your credit score plays a crucial role in your financial journey, affecting your ability to secure loans, obtain favorable interest rates, and even rent an apartment. Keeping track of your credit score is essential for maintaining healthy financial habits and ensuring you are on the right track.

When it comes to checking your credit score, convenience and accessibility are key. Fortunately, TD Bank provides a user-friendly mobile banking app that makes it easy for you to access your credit score anytime, anywhere. With just a few simple steps, you can stay informed about your credit health and take control of your financial future.

In this article, we will guide you on how to check your credit score using the TD App. Whether you’re an existing TD Bank customer or considering opening an account, this step-by-step tutorial will help you navigate through the process effortlessly.

Before we dive into the details, it’s essential to understand what a credit score is and why it matters. Your credit score is a three-digit number that represents your creditworthiness. It is based on various factors such as your payment history, credit utilization, length of credit history, types of credit, and new credit applications.

A high credit score indicates financial stability and responsible credit management, making it easier for you to qualify for loans, credit cards, and favorable interest rates. On the other hand, a lower credit score may lead to difficulties in accessing credit or getting approved for certain financial products.

Now that you understand the importance of your credit score, let’s explore how to access your credit score using the TD App. Don’t worry if you’re new to the app or not tech-savvy – we’ll guide you every step of the way. So, grab your smartphone, follow along, and take control of your financial future!

Step 1: Download and Install TD App

The first step in checking your credit score on the TD App is to download and install the app on your smartphone. The TD App is available for both Android and iOS devices and can be found on their respective app stores.

- If you have an Android device, open the Google Play Store.

- If you have an iOS device, open the App Store.

Once you have opened the app store, search for “TD Bank” and look for the official TD Bank app. It should have the TD Bank logo and the app name. Tap on the app to view more details.

Make sure that the app is developed by TD Bank and has positive reviews. This ensures that you are downloading the legitimate and official app from the bank.

Tap on the “Install” or “Get” button to begin the download and installation process. The app will start downloading and installing in the background. The time it takes to download and install the app will depend on your internet speed.

Once the installation is complete, you will see the TD App icon on your home screen or in your app drawer. Tap on the icon to launch the TD App.

To ensure a seamless experience, make sure you have a stable internet connection while downloading and installing the TD App. Additionally, ensure that your device has enough storage space available for the app.

Congratulations! You have successfully downloaded and installed the TD App on your smartphone. Now, it’s time to move on to the next step – logging in to your TD account.

Step 2: Login to Your TD Account

Now that you have the TD App installed on your smartphone, it’s time to log in to your TD Bank account to access your credit score. Follow these simple steps to log in:

- Open the TD App by tapping on the app icon.

- On the login screen, enter your TD Bank online banking username and password. If you haven’t registered for online banking yet, you can do so by selecting the “Sign Up” or “Register” option on the login screen.

- After entering your username and password, tap the “Log In” button to proceed.

- For added security, you may be prompted to verify your identity using multifactor authentication, such as providing a One-Time Password (OTP) sent to your registered mobile number or email address.

- If you prefer, you can enable biometric authentication, such as fingerprint or Face ID, for quicker and more secure login in the future.

Once you have successfully logged in to your TD Bank account through the TD App, you will have access to a variety of banking features and services, including your credit score.

If you encounter any issues while logging in, ensure that you have entered the correct username and password. Remember that passwords are case-sensitive, so check for any uppercase or lowercase letters if you’re having trouble logging in.

If you continue to experience difficulties logging in, you can reach out to TD Bank’s customer support for assistance. They will be able to guide you in resolving any login-related issues.

With your TD Bank account successfully logged in on the TD App, you’re ready to move on to the next step – navigating to the credit score section to view your credit score.

Step 3: Navigate to Credit Score Section

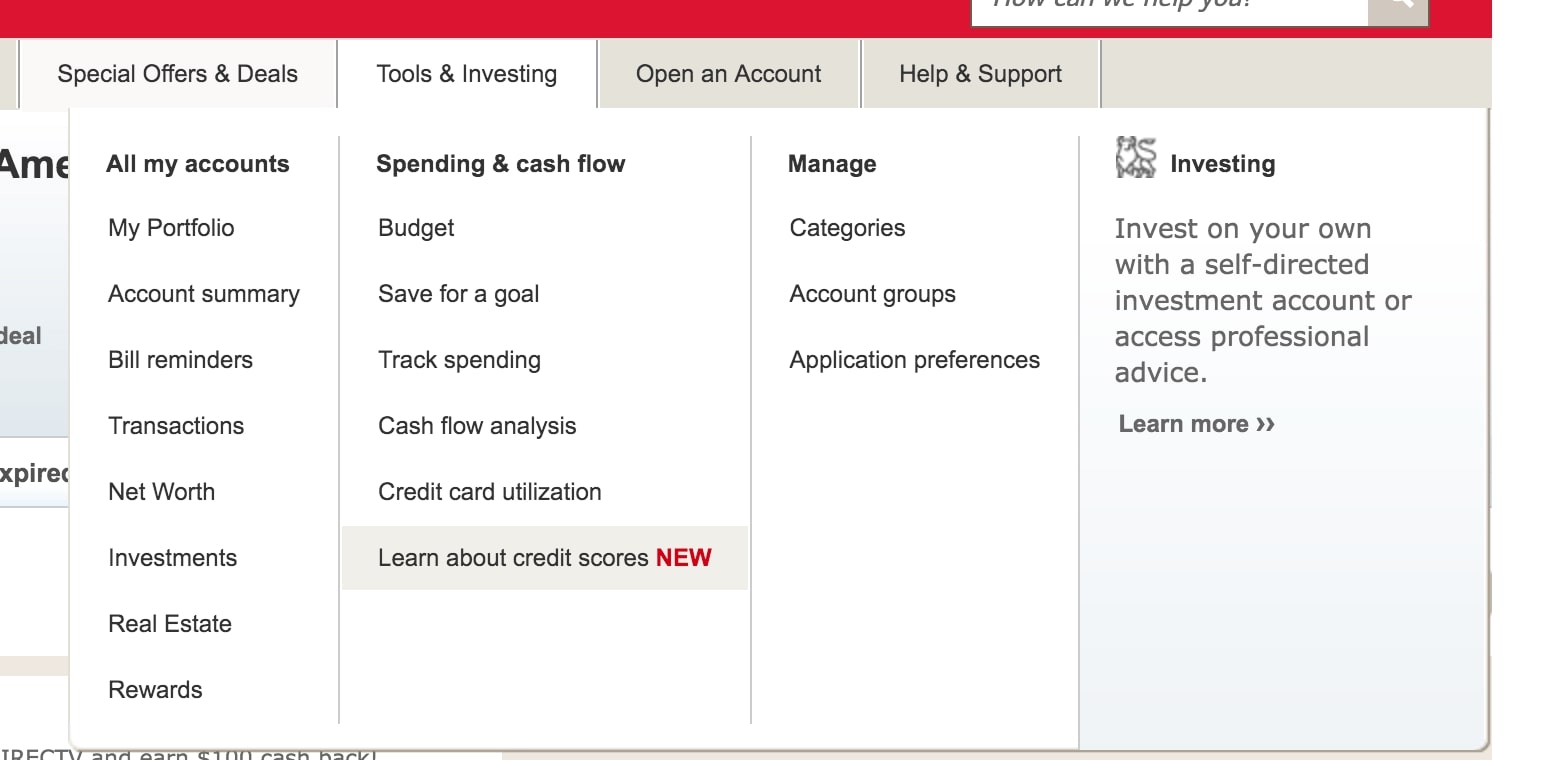

Now that you have logged in to your TD Bank account through the TD App, it’s time to navigate to the credit score section. Follow these steps to find the credit score feature:

- On the home screen or main dashboard of the TD App, look for a menu icon. It is typically represented by three horizontal lines or three dots stacked on top of each other.

- Tap on the menu icon to expand the navigation menu.

- Scroll through the menu options and look for a section related to “Credit Score” or “Credit Health.” The exact wording may vary slightly, but it should be something along those lines.

- Tap on the “Credit Score” or “Credit Health” section to access it.

Depending on the layout of the TD App, the credit score feature may be directly displayed on the home screen or in a secondary menu. If you are having trouble locating the credit score section, you can refer to the app’s user guide or contact TD Bank’s customer support for guidance.

Once you have successfully navigated to the credit score section, you’re one step closer to viewing your credit score. Stay tuned for the next step, where we will explore how to access and understand the details of your credit score.

Step 4: View Your Credit Score Details

After navigating to the credit score section in the TD App, you are ready to view your credit score details. Follow these steps to access and explore your credit score:

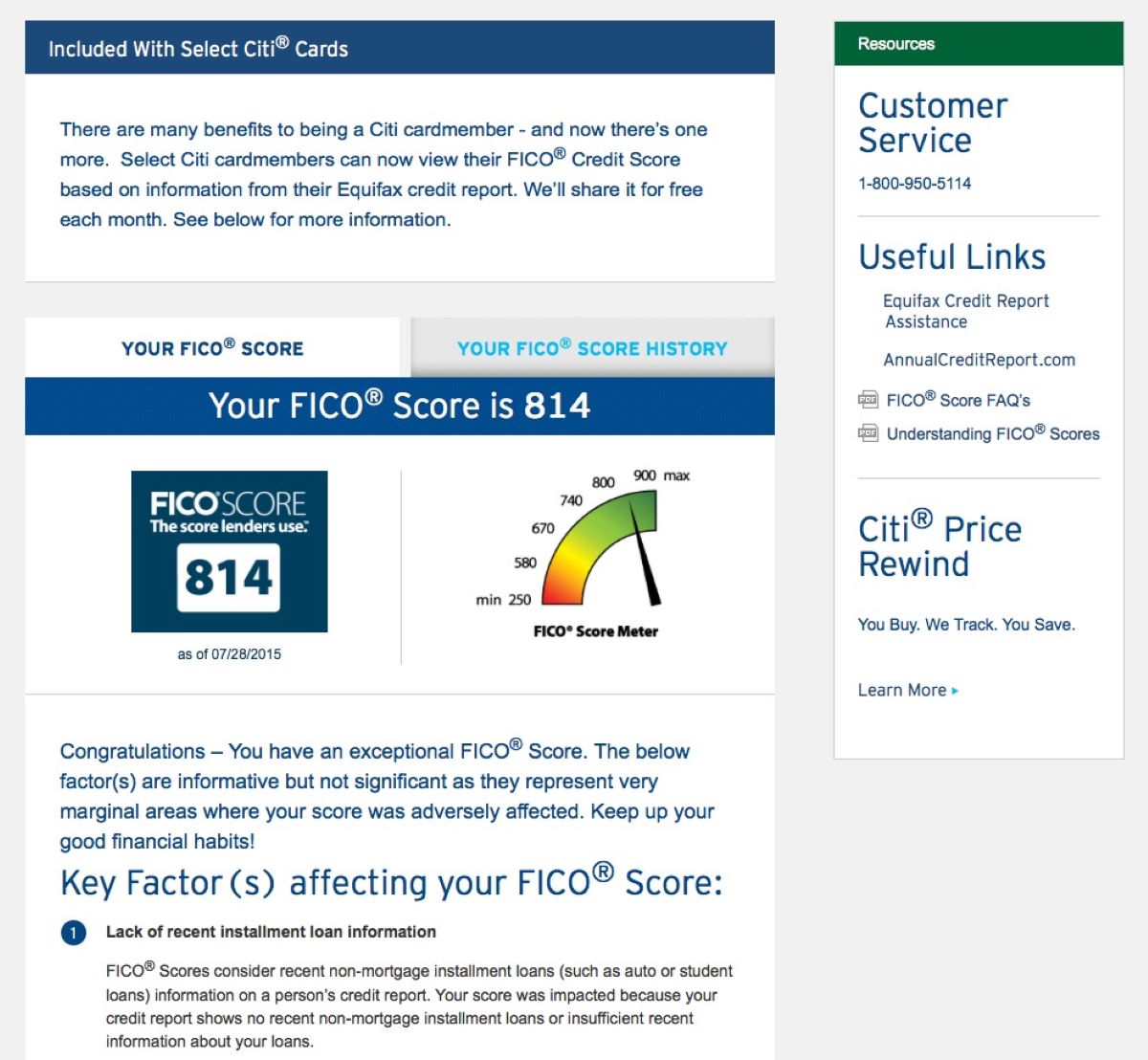

- Once you are in the credit score section, you will likely see an overview of your credit score displayed prominently on the screen.

- Take a moment to review the three-digit number, which represents your credit score. This score is typically based on a range from 300 to 850, with higher numbers indicating better creditworthiness.

- Below your credit score, you may find additional information such as the credit bureau used to generate your score (e.g., Equifax, TransUnion), the date of the score update, and any score changes since the last update.

- Explore the different tabs or sections within the credit score feature to access more detailed information about your credit history and factors influencing your score.

- Common sections found in credit score features may include:

- Credit Summary: Provides a summary of your accounts, including the number of open and closed accounts, total credit available, and total debt.

- Payment History: Shows your track record of on-time payments, any missed or late payments, and any collection accounts or public records.

- Credit Utilization: Displays the percentage of your available credit that you are currently using. Lower utilization is generally better for your credit score.

- Length of Credit: Provides information on the average age of your credit accounts and the oldest and newest accounts on your credit history.

- Credit Inquiries: Shows recent credit inquiries and applications, which may impact your credit score.

- Factors Affecting Your Score: Highlights the key factors influencing your credit score, such as payment history, credit utilization, and length of credit history.

By exploring these different sections and tabs, you can gain a deeper understanding of your credit score and the factors that contribute to it. This knowledge can help you identify areas for improvement or actions to maintain your healthy credit habits.

Keep in mind that the specific layout and information provided in the credit score section may vary between banking apps and institutions. If you have any questions or need assistance interpreting your credit score details, reach out to TD Bank’s customer support for guidance.

Congratulations! You have successfully accessed and explored your credit score details using the TD App. Now, let’s move on to the next step – understanding the factors that influence your credit score.

Step 5: Understand Your Credit Score Factors

Now that you have viewed your credit score details using the TD App, it’s important to understand the factors that influence your credit score. These factors play a significant role in determining your creditworthiness. Here’s how you can gain insights into the factors affecting your credit score:

- Within the credit score feature of the TD App, locate the section or tab that provides information about the factors influencing your credit score.

- Review the factors listed, which may include:

- Payment History: Your track record in making payments on time.

- Credit Utilization: The percentage of your available credit that you are currently using.

- Length of Credit History: The age of your oldest and newest credit accounts.

- Credit Mix: The types of credit accounts you have, such as credit cards, loans, and mortgages.

- New Credit: Recent credit inquiries and applications for new credit.

- Pay close attention to any factors that are highlighted as having a significant impact on your credit score. These are areas where you may need to focus or make adjustments to improve your creditworthiness.

- Take note of any negative factors that are affecting your credit score. Addressing these factors can help you improve your credit score over time.

- Use the information provided in the TD App to develop a strategy for managing and improving your credit. This may involve making timely payments, reducing credit card balances, and diversifying your credit mix.

Remember that improving your credit score is a gradual process. It takes time and effort to build a strong credit profile. By understanding the factors affecting your credit score, you can take proactive steps to improve your financial standing and achieve better credit opportunities in the future.

If you have any questions or need further clarification on the credit score factors, don’t hesitate to reach out to TD Bank’s customer support. They can provide guidance and advice specific to your credit situation.

Well done! You have successfully gained insights into the factors influencing your credit score using the TD App. Now, let’s move on to the final step – tracking your credit score over time.

Step 6: Track Your Credit Score Over Time

Once you have accessed your credit score and understood the factors influencing it using the TD App, it’s important to track your credit score over time. Regularly monitoring your credit score can help you stay informed about any changes or fluctuations and identify potential issues early on. Here’s how you can track your credit score using the TD App:

- Within the credit score feature of the TD App, look for an option or section that allows you to track your credit score history or view past scores.

- Tap on this option to access your credit score history. Depending on the TD App’s features, you may be able to view your credit score from previous months or even years.

- Take note of any significant changes in your credit score over time. This can help you identify patterns or trends and take appropriate actions to maintain or improve your creditworthiness.

- Consider setting up notifications or alerts within the TD App. These alerts can notify you whenever there is a significant change or update to your credit score.

- Regularly review your credit score and track its progress to celebrate achievements or detect any potential issues that need attention.

Tracking your credit score over time not only helps you stay on top of your financial well-being but also allows you to proactively address any changes or discrepancies that may arise.

In addition to using the TD App, you can also leverage other credit monitoring services or sign up for credit score updates from credit bureaus. This can provide you with a comprehensive view of your credit health from multiple sources.

Remember, maintaining a good credit score requires responsible financial habits, including making timely payments, keeping credit card balances low, and monitoring your overall credit utilization. By tracking your credit score regularly, you can stay in control of your financial goals and make informed decisions about your credit.

Congratulations! You have successfully learned how to track your credit score over time using the TD App. By following these steps and staying proactive, you can navigate the world of credit with confidence and achieve your financial aspirations.

Conclusion

Checking your credit score is a crucial component of maintaining a healthy financial life. With the convenience and accessibility of the TD App, you can easily access and track your credit score on the go. By following the steps outlined in this guide, you have learned how to navigate the TD App, login to your TD account, view your credit score details, understand the factors influencing your score, and track your credit score over time.

Remember, your credit score is a reflection of your financial habits and history. By regularly monitoring your credit score, you can make informed decisions about your financial well-being and take steps to improve your creditworthiness. Whether you’re looking to qualify for a loan, apply for a credit card, or simply maintain a healthy credit profile, TD App’s credit score feature empowers you with the information you need.

Additionally, understanding the factors that impact your credit score allows you to address any areas of concern and develop a plan for improvement. By making timely payments, managing your credit utilization, maintaining a good credit history, and being aware of credit inquiries, you can work towards building a stronger credit profile.

It’s important to remember that improving your credit score is a gradual process. It requires consistency, discipline, and responsible financial habits. By using the TD App to monitor your credit score regularly, you can track your progress, celebrate achievements, and make necessary adjustments along the way.

As you embark on your financial journey, make use of the resources available to you, including the TD App and the expert guidance from TD Bank’s customer support team. They can provide personalized advice and assistance to help you navigate the complex world of credit and achieve your financial goals.

So, take control of your credit health and start using the TD App to unlock valuable insights about your credit score. Armed with this knowledge, you can make informed financial decisions, improve your creditworthiness, and pave the way for a brighter financial future.