Finance

What Is The Most Accurate Credit Score App

Published: October 22, 2023

Discover the most accurate credit score app for managing your finances. Track your credit score and stay in control of your financial health with this powerful tool.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Credit Scores

- Importance of Credit Scores

- Different Credit Score Models

- Factors That Affect Credit Scores

- Types of Credit Score Apps

- Features to Look for in a Credit Score App

- Comparison of Popular Credit Score Apps

- Pros and Cons of Using Credit Score Apps

- Tips for Using Credit Score Apps Effectively

- Conclusion

Introduction

Welcome to the world of credit scores, where a three-digit number can hold tremendous power over your financial life. Whether you’re looking to buy a new car, purchase a home, or even apply for a credit card, your credit score plays a critical role in determining your eligibility and the terms you’ll be offered.

But with so many credit score apps available in the market, how do you know which one is the most accurate and reliable? In this article, we will explore the world of credit scores and dive into the different credit score models, factors that affect credit scores, types of credit score apps, and tips for using them effectively.

Before we delve into the specifics, it’s important to have a clear understanding of what a credit score is. Essentially, a credit score is a numerical representation of your creditworthiness, indicating how likely you are to repay your debts in a timely manner. It is based on various factors such as your payment history, credit utilization, length of credit history, types of credit, and recent credit inquiries.

Having a good credit score is crucial because it determines whether lenders will approve your loan applications and at what interest rate. A higher credit score opens doors to better financial opportunities, lower interest rates, and more favorable terms. On the other hand, a poor credit score can limit your options and make it difficult to secure loans or credit cards.

Now, let’s explore the different credit score models that exist. The most popular credit score models are FICO and VantageScore. FICO scores range from 300 to 850, with a higher score indicating better creditworthiness. VantageScore, on the other hand, uses a range from 300 to 850 as well, but may weigh certain factors differently than the FICO model.

Keep in mind that each lender may have its own credit scoring system or may use a specific version of the FICO or VantageScore model. Therefore, it’s important to have a general understanding of your creditworthiness by regularly checking your credit scores through reliable sources.

In the next sections, we will take a closer look at the different types of credit score apps available, the key features to consider when choosing one, and a comparison of popular credit score apps in the market. Let’s dive in!

Understanding Credit Scores

Before we explore the intricacies of credit score apps, it’s important to have a solid understanding of what credit scores are and how they are calculated. Your credit score is a numerical representation of your creditworthiness, indicating how trustworthy you are as a borrower.

Credit scores are typically calculated by credit bureaus or credit reporting agencies, such as Experian, Equifax, and TransUnion, based on the information in your credit report. The most commonly used credit scoring models are FICO and VantageScore.

The FICO score is widely used and ranges from 300 to 850. The higher your FICO score, the better your creditworthiness. The factors that contribute to your FICO score include:

- Payment history: This accounts for the largest percentage of your credit score and reflects your track record of making payments on time.

- Credit utilization: This refers to the percentage of your available credit that you are currently using. It’s best to keep your credit utilization ratio below 30% to maintain a good score.

- Length of credit history: The longer your credit history, the more information lenders have to assess your creditworthiness. This includes the age of your oldest and newest accounts, as well as the average age of all your accounts.

- Credit mix: Having a diverse mix of credit accounts, such as credit cards, mortgages, and auto loans, can positively impact your credit score.

- New credit: Opening multiple new credit accounts within a short period of time may lower your credit score, as it could indicate financial instability.

VantageScore, on the other hand, has a score range of 300 to 850 as well, but may weigh certain factors differently than the FICO model. The factors considered by VantageScore include:

- Payment history

- Credit utilization

- Credit balances

- Depth of credit

- Recent credit behavior

Both FICO and VantageScore aim to provide lenders with an accurate assessment of your creditworthiness. However, it’s important to note that these scoring models can differ slightly in their calculations, leading to variations in your credit scores.

Understanding how credit scores are calculated is essential for managing your credit responsibly and improving your creditworthiness over time. By maintaining a good payment history, keeping your credit utilization low, and diversifying your credit mix, you can positively impact your credit scores.

In the next sections, we will explore the importance of credit scores, the different credit score models, factors that can affect your credit scores, and the types of credit score apps available to help you monitor and improve your creditworthiness.

Importance of Credit Scores

Your credit score holds significant importance when it comes to your financial well-being. It not only impacts your ability to secure loans and credit cards but also affects the interest rates and terms you’ll be offered by lenders. Let’s delve into the key reasons why credit scores are important:

- Lending Decisions: A good credit score is essential for obtaining loans from banks, credit unions, and other financial institutions. Lenders use credit scores to assess the level of risk involved in lending money to you. A higher credit score indicates that you are more likely to repay your debts on time, making you a desirable borrower. This can lead to better loan offers, lower interest rates, and more favorable terms.

- Access to Credit Cards: Credit card companies also rely on credit scores to determine your eligibility for their cards. A higher credit score expands your options and increases the likelihood of being approved for credit card applications. Additionally, it can open doors to credit cards with higher credit limits, better rewards programs, and lower fees.

- Housing Opportunities: Renting or purchasing a home often requires a credit check. Landlords and mortgage lenders use credit scores to evaluate the risk associated with renting or lending property to you. A good credit score can increase your chances of getting approved for a lease or mortgage and may even result in better rental terms or lower interest rates on your mortgage.

- Insurance Premiums: Some insurance companies factor credit scores into their premium calculations. They believe that creditworthiness is an indicator of how likely you are to file claims. Therefore, a good credit score can help you secure lower insurance premiums and potentially save you money in the long run.

- Employment Opportunities: In certain industries, employers may check an applicant’s credit score as part of the hiring process. Although a credit score alone does not determine your qualification for a job, it can be a factor in decision-making. A high credit score may demonstrate your financial responsibility and reliability, which can work in your favor during the hiring process.

It’s worth noting that while credit scores are important, they are not the sole determinant of your financial health. Other factors such as your income, employment history, and current debt obligations also play a role in financial decision-making processes.

Now that we understand the significance of credit scores, let’s delve into the different credit score models and the factors that can impact your credit scores.

Different Credit Score Models

When it comes to credit scores, there are several different models that lenders and credit bureaus use to assess an individual’s creditworthiness. The two most commonly used credit score models are FICO and VantageScore. Let’s take a closer look at each of them:

FICO: FICO, which stands for Fair Isaac Corporation, is the most widely recognized and used credit scoring model. Developed in the 1950s, FICO scores are calculated based on various factors found in your credit report. The FICO scoring model ranges from 300 to 850, with a higher score indicating better creditworthiness. The factors considered by FICO include payment history, credit utilization, length of credit history, credit mix, and new credit inquiries. Lenders and financial institutions often rely on FICO scores when making lending decisions.

VantageScore: VantageScore is a credit scoring model introduced by the three major credit reporting agencies – Experian, Equifax, and TransUnion – as an alternative to the FICO model. VantageScore uses a similar scoring range of 300 to 850 and considers factors such as payment history, credit utilization, credit balances, depth of credit, and recent credit behavior. While the specific calculations may differ from the FICO model, VantageScore aims to provide lenders with an accurate assessment of an individual’s creditworthiness.

It’s important to note that different lenders and financial institutions may use different credit scoring models or versions of the FICO or VantageScore models. Each model may weigh the factors differently, which can result in slight variations in your credit scores. Therefore, it’s a good practice to monitor your credit scores from all three credit bureaus regularly to get a comprehensive view of your creditworthiness.

In addition to FICO and VantageScore, there are other credit scoring models in use, such as the CE Score, NextGen Score, and Experian Credit Score. These models may have different scoring ranges and utilize unique algorithms, but the underlying objective remains the same – to assess an individual’s creditworthiness based on their credit history and financial behavior.

It’s important to keep in mind that while credit scores are an essential component of the lending process, they are not the sole factor taken into consideration. Lenders may also consider other factors such as income, employment history, and debt-to-income ratio when making lending decisions.

Now that we have explored the different credit score models, let’s delve into the factors that can impact your credit scores and how credit score apps can help you monitor and improve your creditworthiness.

Factors That Affect Credit Scores

Understanding the factors that impact your credit scores is essential for maintaining a healthy credit profile. Your credit scores are influenced by several key factors, each carrying a different level of importance. Let’s explore these factors:

- Payment History: Your payment history plays a significant role in determining your credit scores. Lenders want to see a track record of on-time payments. Late payments, delinquencies, and accounts in collections can have a negative impact on your credit scores.

- Credit Utilization: Credit utilization refers to the percentage of your available credit that you are currently using. It is calculated by dividing your total credit card balances by your total credit limits. A lower credit utilization ratio indicates responsible credit usage and can positively impact your credit scores.

- Length of Credit History: The length of your credit history is also taken into consideration. Lenders prefer to see a longer credit history as it provides more data on your credit management habits. This factor considers the age of your oldest account, the age of your newest account, and the average age of all your accounts.

- Credit Mix: Having a diverse mix of credit accounts can have a positive impact on your credit scores. This includes a combination of credit cards, mortgages, auto loans, and other types of loans. However, it’s important to manage these accounts responsibly and not take on more credit than you can handle.

- New Credit Inquiries: When you apply for new credit, such as a credit card or loan, a hard inquiry is placed on your credit report. Too many hard inquiries within a short period can lower your credit scores. It’s best to limit new credit applications unless necessary.

It’s important to note that certain factors may have a stronger impact on credit scores than others. For example, payment history and credit utilization tend to carry more weight in credit scoring models like FICO and VantageScore.

Additionally, other influential factors that are not directly included in credit scores may still affect lenders’ decisions. These factors include your income, employment history, debt-to-income ratio, and the overall economic climate. However, credit scores remain a crucial factor in evaluating your creditworthiness.

Now that we understand the factors that can affect your credit scores, let’s explore the different types of credit score apps available to help you monitor and manage your credit.

Types of Credit Score Apps

Credit score apps have become increasingly popular as individuals seek to monitor and manage their credit profiles more effectively. These apps provide convenient access to your credit scores and reports, along with various features to help you track your credit health. Here are the different types of credit score apps available:

- Free Credit Score Apps: As the name suggests, these apps allow you to access your credit scores and reports for free. They provide you with a snapshot of your credit health and may offer basic credit monitoring features. While these apps are a great starting point, they may not provide comprehensive credit monitoring or advanced features.

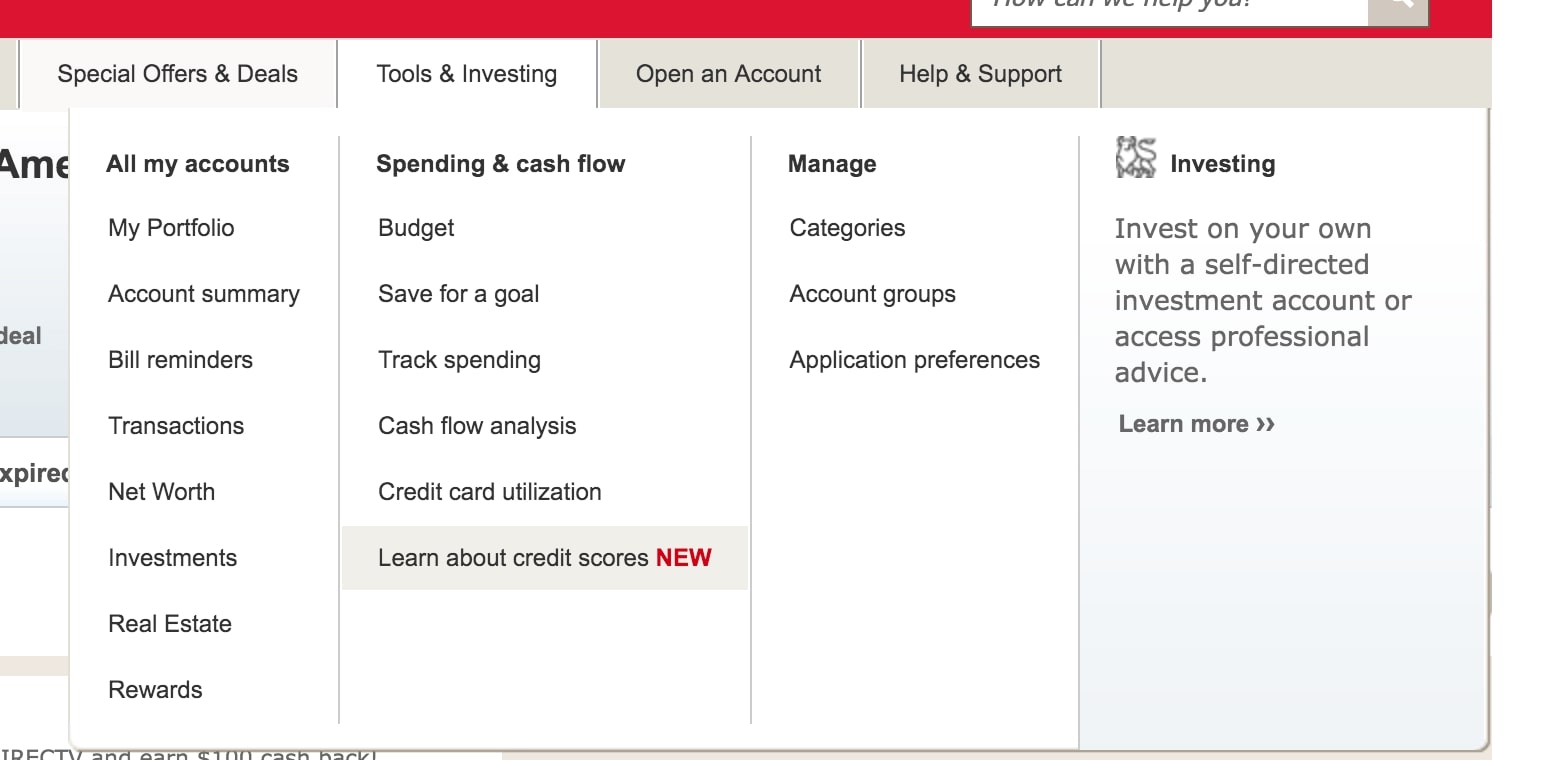

- Subscription-Based Credit Score Apps: Subscription-based credit score apps usually offer more robust features and monitoring tools. They often provide access to credit scores and reports from multiple credit bureaus, along with additional features such as credit score simulators, identity theft protection, and personalized credit improvement recommendations. These apps come with a monthly or annual fee.

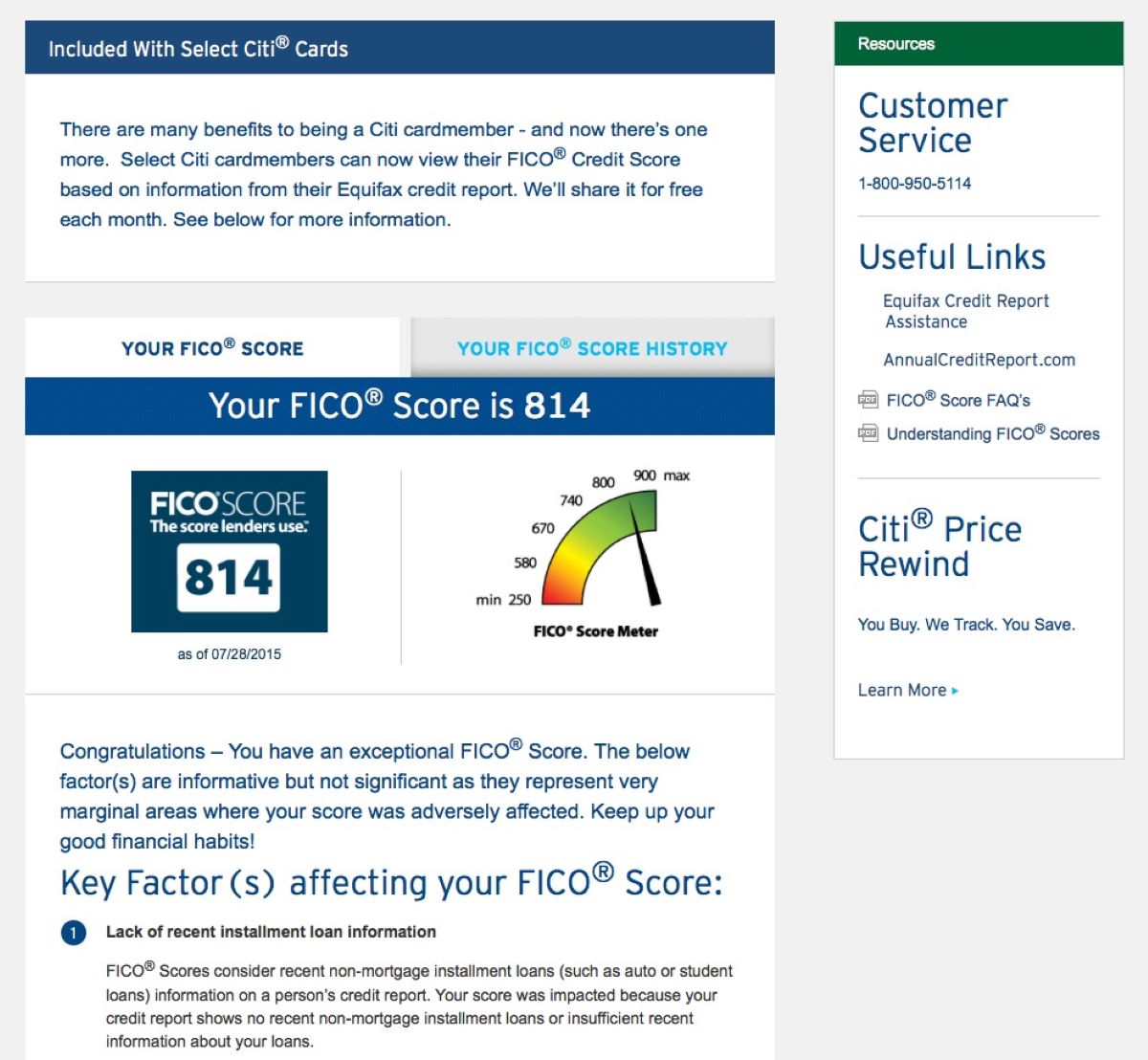

- Lender-Specific Credit Score Apps: Some lenders offer their own credit score apps or credit monitoring services for their customers. These apps are tailored to the specific lender’s credit scoring model and provide access to the credit scores that the lender uses in their lending decisions. These apps can be beneficial if you want to monitor the credit score that a particular lender sees when evaluating your creditworthiness.

- Third-Party Credit Score Apps: There are also third-party credit score apps that partner with credit bureaus to provide access to credit scores and reports. These apps often provide additional features like credit monitoring, identity theft alerts, financial goal setting, and credit education resources. They may offer both free and premium subscription plans.

When choosing a credit score app, consider your specific needs and priorities. Some individuals may prefer a free app that provides basic credit monitoring, while others may be willing to pay for a comprehensive app with advanced features and personalized recommendations.

It’s important to note that credit score apps are not the only way to monitor your credit health. You can also obtain free credit reports directly from the major credit bureaus once a year. However, credit score apps offer convenient and real-time access to your credit scores, allowing you to stay updated on any changes that may impact your creditworthiness.

Now that we have explored the different types of credit score apps, let’s discuss the features to look for when choosing the right app for your needs.

Features to Look for in a Credit Score App

When choosing a credit score app, it’s important to consider the features it offers to ensure it meets your needs for credit monitoring and management. Here are some key features to look for when evaluating different credit score apps:

- Access to Credit Scores and Reports: The app should provide you with access to your credit scores and reports from one or more credit bureaus. It should display your scores clearly and provide detailed information about the factors influencing your scores.

- Credit Monitoring and Alerts: Look for an app that offers credit monitoring features, such as real-time alerts for changes in your credit reports. These alerts can help you detect potential identity theft, fraudulent activities, or errors on your credit reports.

- Credit Score Simulator: A credit score simulator is a valuable tool that allows you to understand how certain actions or financial decisions can impact your credit scores. It can help you strategize and make informed decisions when managing your credit.

- Identity Theft Protection: Identity theft is a significant concern in today’s digital world. A credit score app with identity theft protection features can help safeguard your personal and financial information, providing you with peace of mind.

- Personalized Recommendations: Look for an app that provides personalized recommendations and tips for improving your credit scores. These recommendations can include steps to reduce credit card balances or establish a stronger payment history, helping you take proactive measures to improve your credit health.

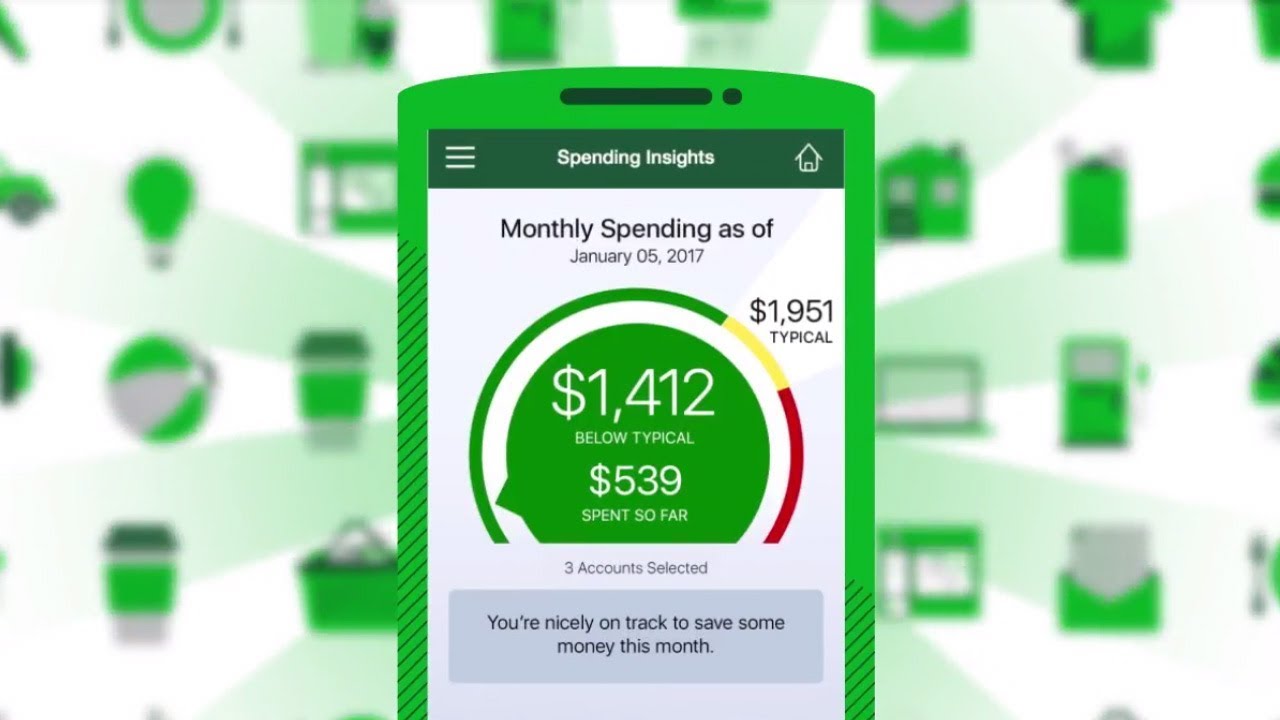

- Financial Goal Setting: Some credit score apps offer features that allow you to set financial goals, such as improving your credit scores, paying off debts, or saving for a specific financial milestone. These goal-setting tools can help you stay motivated and track your progress.

- Credit Education Resources: Consider an app that provides educational resources to help you understand credit scores, credit reports, and credit management concepts. These resources can empower you to make more informed financial decisions and improve your credit knowledge.

- User-Friendly Interface: A credit score app should have a user-friendly interface that is easy to navigate and understand. It should provide clear visuals and explanations of your credit scores and reports, making it simple for you to track and monitor your credit health.

Keep in mind that not all credit score apps offer the same features, and some may require a subscription or additional fees to access certain functionalities. Consider your specific needs and priorities, and choose an app that provides the features that align with your credit monitoring and management goals.

Now that we know what features to look for in a credit score app, let’s compare some popular credit score apps available in the market to help you make an informed decision.

Comparison of Popular Credit Score Apps

There are numerous credit score apps available in the market, each offering different features and benefits. To help you make an informed decision, let’s compare some popular credit score apps:

- Credit Karma: Credit Karma is a well-known credit score app that provides users with free access to their credit scores and reports from TransUnion and Equifax. It offers credit monitoring and sends alerts for changes in your credit reports. Credit Karma also provides personalized recommendations for improving your credit scores and offers educational resources to help you understand credit management better.

- Experian: The Experian app allows users to access their credit scores and reports from Experian. It provides real-time credit monitoring, sends immediate notifications for changes in your credit reports, and offers identity theft protection. The app also offers credit score simulators and provides personalized recommendations for improving your credit scores. Experian offers both free and premium subscription plans with additional features.

- myFICO: myFICO is an app tailored specifically to the FICO scoring model. It provides users with access to their FICO scores and reports from all three major credit bureaus. The app offers credit monitoring, sends alerts for changes in your credit reports, and provides a credit score simulator to help you understand the impact of different actions on your credit scores. myFICO offers a subscription model with different pricing options.

- Credit Sesame: Credit Sesame is a free credit score app that gives users access to their credit scores, reports, and personalized recommendations. It offers credit monitoring and sends alerts for changes in your credit reports. The app also provides identity theft protection and offers additional services such as credit score analysis, financial goal setting, and credit education resources.

- WalletHub: WalletHub is a comprehensive financial management app that includes credit score monitoring as one of its features. It provides free access to credit scores and reports from TransUnion and VantageScore. The app offers credit monitoring, personalized recommendations for improving your credit scores, and a credit score simulator. WalletHub also provides additional financial tools such as account aggregation, spending analysis, and personalized money-saving offers.

It’s important to note that each credit score app may have variations in terms of the credit scoring model used, the credit bureaus they pull data from, the features offered, and the pricing structure. Consider your specific needs, such as the credit score model you prefer, the level of monitoring you require, and any additional features you find valuable.

Take the time to research and compare different credit score apps, read user reviews, and determine which app aligns best with your credit monitoring and management goals. Remember that regular monitoring of your credit scores and reports is vital to staying on top of your credit health.

Now that we have compared some popular credit score apps, let’s explore the advantages and disadvantages of using credit score apps.

Pros and Cons of Using Credit Score Apps

Credit score apps have become valuable tools for individuals looking to monitor and manage their credit health. However, it’s essential to consider both the pros and cons before fully relying on these apps. Here are some advantages and disadvantages of using credit score apps:

Pros:

- Easy Access to Credit Information: Credit score apps provide convenient access to your credit scores and reports, allowing you to stay updated on your credit health at any time.

- Real-Time Monitoring: These apps often provide real-time credit monitoring, sending alerts for changes in your credit reports and potential fraudulent activities, allowing you to take immediate action if necessary.

- Personalized Recommendations: Credit score apps may offer personalized recommendations to help you improve your credit scores. These recommendations can guide you in taking specific actions to positively impact your credit health.

- Credit Education Resources: Many credit score apps provide educational resources to help you understand credit management concepts better. These resources can empower you to make informed financial decisions and improve your credit knowledge.

- Identity Theft Protection: Some credit score apps offer identity theft protection features, such as monitoring your personal information and providing alerts for potential breaches or fraudulent activities.

Cons:

- Reliance on Credit Score Models: Credit score apps are based on specific credit scoring models, such as FICO or VantageScore. If lenders use different models, your scores may vary from what the app shows.

- Accuracy of Information: While credit score apps strive to provide accurate information, errors or delays in credit reporting can occur. It’s important to regularly review your credit reports directly from the credit bureaus to ensure accuracy.

- Additional Costs: Some credit score apps offer premium features or require a subscription for full access, which can add to your overall costs.

- Data Security: Sharing personal and financial information via credit score apps raises concerns about data security and privacy. Ensure that the app you choose has robust security measures in place to protect your sensitive information.

- Not a Solution for Financial Issues: While useful for monitoring credit health, credit score apps are not a solution for financial problems. They provide insights into your credit status but can’t address deep-rooted financial issues or guarantee specific outcomes.

Ultimately, credit score apps can be valuable tools for monitoring and managing your credit health. However, it’s important to use them in conjunction with other financial practices, such as regularly reviewing your credit reports, practicing responsible financial behavior, and seeking professional advice when needed.

Now that we have evaluated the pros and cons of credit score apps, let’s explore some tips for effectively using these apps to improve your credit health.

Tips for Using Credit Score Apps Effectively

Using credit score apps can be a powerful tool in managing and improving your credit health. To make the most out of these apps, consider the following tips:

- Monitor Your Credit Regularly: Make it a habit to check your credit scores and reports regularly using the credit score app. This helps you stay informed of any changes or potential issues affecting your credit health.

- Understand Your Credit Factors: Pay attention to the factors that impact your credit scores, as provided by the credit score app. Focus on improving the areas where you may be lagging, such as paying bills on time or reducing credit card balances.

- Set Financial Goals: Utilize any goal-setting features offered by the credit score app to set specific financial goals. Whether it’s improving your credit scores, paying off debts, or saving for a major purchase, having goals helps you stay motivated and focused on achieving them.

- Actively Monitor Credit Alerts: Take advantage of the credit monitoring and alert features provided by the app. Promptly address any alerts related to potential fraud or suspicious activities to minimize the impact on your credit health.

- Follow Personalized Recommendations: Implement the personalized recommendations offered by the credit score app. These recommendations are designed to help you improve your credit scores, so it’s important to take them into account and make the necessary adjustments in your financial habits.

- Stay Informed: Take advantage of the credit education resources available in the app. Educate yourself about credit management and financial best practices to make informed decisions and maintain a healthy credit profile.

- Maintain Good Financial Habits: Ultimately, credit scores are influenced by your financial behavior. Use the insights from the credit score app to cultivate good financial habits, such as paying bills on time, keeping credit card balances low, and avoiding unnecessary debt.

- Review Your Credit Reports Directly: While credit score apps provide you with an overview of your credit health, it’s important to periodically review your credit reports directly from the credit bureaus. This will help you ensure the accuracy of the information and identify any potential discrepancies.

Remember that credit score apps are just one part of the equation in managing your credit health. It’s important to use them in conjunction with other financial practices, such as responsible spending, budgeting, and maintaining healthy financial habits.

By actively using credit score apps and incorporating these tips into your financial routine, you can effectively monitor and improve your credit health over time.

Now that we have covered tips for using credit score apps effectively, let’s conclude our discussion.

Conclusion

Credit score apps have become valuable tools for individuals looking to monitor and manage their credit health. They provide easy access to credit scores, real-time monitoring, personalized recommendations, and educational resources to help you understand and improve your credit. However, it’s important to remember that credit score apps are just one piece of the puzzle when it comes to maintaining a healthy credit profile.

Throughout this article, we explored the importance of credit scores, different credit score models such as FICO and VantageScore, factors that affect credit scores, and the various types of credit score apps available in the market. We also discussed the pros and cons of using credit score apps and provided tips for using them effectively.

Using credit score apps can empower you to take control of your credit health, spot potential issues, and make informed financial decisions. Regularly monitoring your credit, understanding the factors that influence your credit scores, and taking proactive steps to improve your credit are all crucial for maintaining a healthy credit profile.

Remember to utilize the features offered by credit score apps, such as credit monitoring, personalized recommendations, and goal-setting tools, to actively manage your credit health. However, it’s essential to supplement the information provided by these apps with other financial practices, such as responsible spending, budgeting, and reviewing your credit reports directly from the credit bureaus.

By adopting these practices and using credit score apps effectively, you can work towards improving your credit scores, gaining better financial opportunities, and ultimately achieving your long-term financial goals.