Finance

How To Use A Capital One Platinum Credit Card

Modified: March 5, 2024

Learn how to effectively manage your finances with the Capital One Platinum Credit Card. Take advantage of its benefits and start maximizing your financial stability today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Capital One Platinum Credit Card?

- How to Apply for a Capital One Platinum Credit Card

- Activating and Setting up Your Capital One Platinum Credit Card

- Understanding the Benefits and Features of a Capital One Platinum Credit Card

- How to Make Payments with Your Capital One Platinum Credit Card

- Tips for Managing Your Capital One Platinum Credit Card Wisely

- Using Your Capital One Platinum Credit Card for Online Purchases

- Redeeming Rewards and Benefits with Your Capital One Platinum Credit Card

- Managing Your Capital One Platinum Credit Card Account Online

- Keeping Your Capital One Platinum Credit Card Secure

- Common Questions and Troubleshooting Guide for Capital One Platinum Credit Card Users

- Conclusion

Introduction

Welcome to the world of credit cards, where financial flexibility and convenience become a reality. If you’re in the market for a credit card, you’ve come to the right place. In this article, we’ll explore the Capital One Platinum Credit Card and how it can help you manage your finances effectively.

A credit card is a powerful tool that allows you to make purchases and pay off the balance over time. Unlike debit cards, which draw from your existing funds, credit cards provide a line of credit that you can borrow against. This can be particularly useful for emergencies, big-ticket purchases, or simply for building your credit history.

The Capital One Platinum Credit Card is a popular choice among consumers for its valuable features, competitive interest rates, and stellar customer service. Whether you’re a first-time credit card user or looking for a new card to add to your wallet, the Capital One Platinum Credit Card is worth considering.

In this article, we’ll guide you through the process of applying for and using a Capital One Platinum Credit Card. We’ll cover the benefits and features, payment methods, online account management, security measures, and more. By the end of this article, you’ll have a solid understanding of how to take advantage of the Capital One Platinum Credit Card to its fullest potential.

It’s important to note that while credit cards offer convenience and financial flexibility, they also come with responsibilities. It’s crucial to use your credit card wisely, make payments on time, and maintain a good credit score. With that in mind, let’s dive into the world of the Capital One Platinum Credit Card and learn how to make the most of this financial tool!

What is a Capital One Platinum Credit Card?

A Capital One Platinum Credit Card is a type of credit card offered by Capital One, one of the leading financial institutions in the United States. It is designed to provide individuals with a versatile and reliable tool for managing their finances.

As a Platinum credit card, it offers a range of benefits and features that can help users build or rebuild their credit, access credit for necessary purchases, and enjoy added perks and rewards. Although it is labeled as a Platinum card, it is accessible to a wide range of consumers, including those with average or limited credit histories.

One of the key advantages of the Capital One Platinum Credit Card is that it does not require a security deposit, making it an excellent choice for individuals who may not have the funds to open a secured credit card. Moreover, the credit limit is determined by Capital One based on your creditworthiness, financial stability, and income level.

With this card, you’ll have access to a credit line that you can use to make purchases, whether online or in-store. You can also use the card for cash advances, balance transfers, and other transactions, depending on the terms and conditions provided by Capital One.

One notable feature of the Capital One Platinum Credit Card is its lack of an annual fee. This means that you won’t be charged an additional fee each year for carrying this card, making it a cost-effective option for credit card users.

In addition to its basic features, the Capital One Platinum Credit Card offers tools and resources to help users manage their finances effectively. This includes access to Capital One’s online account management platform, which allows you to track your spending, set up payment reminders, and monitor your credit score.

Furthermore, the Capital One Platinum Credit Card offers the potential for credit line increases over time. By using your card responsibly and making regular payments, you can demonstrate your creditworthiness to Capital One, which may result in a higher credit limit.

Overall, the Capital One Platinum Credit Card is a versatile financial tool that provides individuals with the opportunity to build credit, access credit when needed, and enjoy additional cardholder benefits. In the next section, we’ll explore the application process and how you can obtain a Capital One Platinum Credit Card.

How to Apply for a Capital One Platinum Credit Card

To apply for a Capital One Platinum Credit Card, follow these simple steps:

- Start by visiting the Capital One website or using their mobile app. Look for the section that allows you to apply for a credit card.

- Provide the necessary personal information, including your full name, date of birth, social security number, and contact information. Make sure the information you enter is accurate and up to date.

- Enter your financial information, including your annual income and employment status. Capital One will use this information to assess your creditworthiness and determine your credit limit.

- Review the terms and conditions of the Capital One Platinum Credit Card. Make sure you understand the interest rates, fees, and any other important details before proceeding.

- Submit your application. Capital One will review your application and perform a credit check. This process typically takes a few minutes, and you may receive an instant decision or be notified of any additional steps required.

- If approved, you will receive your Capital One Platinum Credit Card in the mail within 7-10 business days. Activate your card by following the instructions provided in the welcome package.

- Once your card is activated, you can start using it for purchases, cash advances, or balance transfers, depending on the terms and conditions set by Capital One.

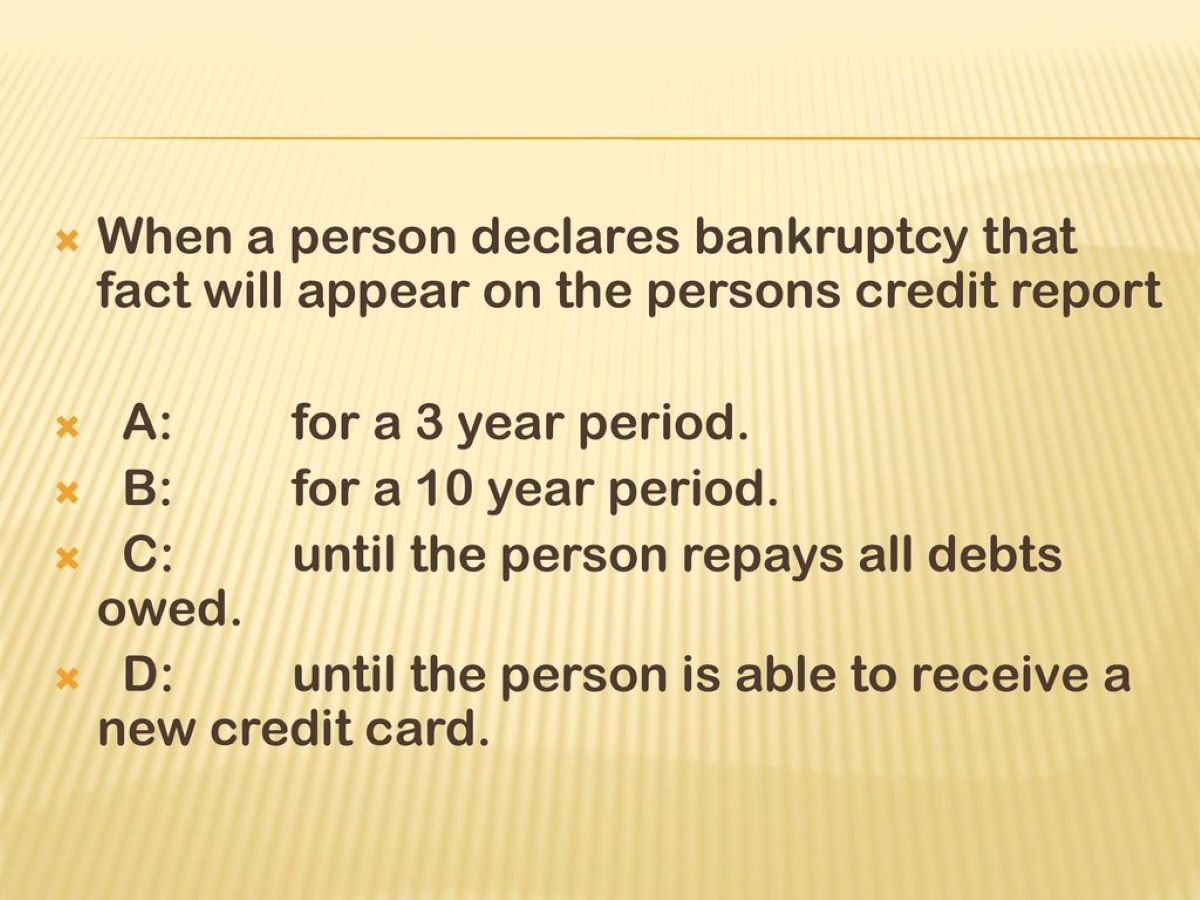

It’s important to note that the approval process for a credit card is based on various factors, including your credit history, income, and debt-to-income ratio. While the Capital One Platinum Credit Card is accessible to individuals with limited or average credit, it’s still recommended to have a good credit score to increase your chances of approval and potentially receive a higher credit limit.

If you are not approved for a Capital One Platinum Credit Card initially, don’t be discouraged. Capital One offers a secured credit card, the Capital One Secured Mastercard, which can be an alternative option for building credit or improving your creditworthiness. With responsible use, you may be able to upgrade to the Capital One Platinum Credit Card in the future.

Now that you know how to apply for a Capital One Platinum Credit Card, let’s move on to the next section, where we’ll explore how to activate and set up your new card for use.

Activating and Setting up Your Capital One Platinum Credit Card

Once you receive your Capital One Platinum Credit Card in the mail, the next step is to activate and set it up for use. Follow these steps to get started:

- Locate the activation sticker on your new card. It will have a phone number or a website URL to initiate the activation process.

- Call the phone number or visit the website provided on the sticker to activate your card. You will typically need to provide your card details, such as the card number and security code, as well as personal identification information for verification.

- Once your card is activated, decide how you want to set up your online account. Visit the Capital One website or use their mobile app to create an account if you don’t have one already.

- Provide the required information to set up your online account, including your name, email address, and a password. You may also need to set up security questions or additional verification measures.

- Link your Capital One Platinum Credit Card to your online account. This allows you to easily view your account balance, make payments, track transactions, and access various account management tools.

- Set up any additional features or services offered by Capital One. This may include setting up alerts, automatic payments, or customizing your account preferences.

- Explore the online account dashboard to familiarize yourself with its features. Take advantage of tools such as transaction history, balance tracking, and credit score monitoring to stay on top of your finances.

By activating and setting up your Capital One Platinum Credit Card, you gain access to convenient online account management tools that make tracking and managing your spending easier. It’s important to regularly monitor your account for any unauthorized charges or suspicious activity to maintain the security of your card.

In addition to online account management, Capital One also offers mobile apps for iOS and Android devices. These apps provide a seamless and user-friendly experience, allowing you to manage your card and finances on the go, access account alerts, and make payments from your smartphone.

Now that your Capital One Platinum Credit Card is activated and set up, you are ready to start using it for purchases, payments, and more. In the next section, we’ll delve into the benefits and features of the Capital One Platinum Credit Card, helping you make the most of your cardholder experience.

Understanding the Benefits and Features of a Capital One Platinum Credit Card

The Capital One Platinum Credit Card offers a range of benefits and features designed to enhance your financial journey. Let’s take a closer look at what makes this card stand out:

1. No annual fee: Unlike many credit cards, the Capital One Platinum Credit Card does not come with an annual fee. This means you can enjoy the benefits and features of the card without incurring any additional costs.

2. Credit-building opportunity: The Capital One Platinum Credit Card is an excellent option for individuals looking to build or rebuild their credit. By using the card responsibly and making regular on-time payments, you can establish a positive credit history.

3. Credit limit increases: With responsible use, Capital One may consider increasing your credit limit over time. This allows you to have more purchasing power and flexibility in managing your finances.

4. Fraud protection: Capital One takes the security of your card seriously. You are protected against unauthorized charges with their $0 fraud liability policy, which means you won’t be held responsible for fraudulent transactions.

5. Access to credit education resources: Capital One provides valuable resources and tools to help you understand and improve your credit. From credit education articles to credit monitoring services, you can access resources to enhance your financial knowledge and make informed decisions.

6. Access to Capital One Perks: As a cardholder, you may have access to Capital One Perks, which offers various discounts, benefits, and experiences with partner merchants and retailers. These perks can help you save money and enhance your overall cardholder experience.

7. 24/7 customer service: Capital One is known for its exceptional customer service. Whether you have questions about your card, need assistance with a transaction, or want to report a lost or stolen card, their customer service team is available 24/7 to assist you.

These are just some of the benefits and features that come with the Capital One Platinum Credit Card. It’s important to review the terms and conditions provided by Capital One to fully understand the offerings of this credit card.

Now that you have a good understanding of the benefits and features, let’s move on to the next section, where we’ll discuss how to make payments with your Capital One Platinum Credit Card.

How to Make Payments with Your Capital One Platinum Credit Card

When it comes to managing your Capital One Platinum Credit Card, making payments on time is crucial. Here’s a step-by-step guide on how to make payments with your card:

- Review your monthly statement: Capital One will provide you with a monthly statement that outlines your transactions, balance, minimum payment due, and payment due date. It’s important to carefully review this statement to ensure accuracy and identify any fraudulent charges.

- Choose a payment method: Capital One offers various payment methods to conveniently meet your needs. You can make a payment online through their website or mobile app, set up automatic payments, pay by phone, or mail in your payment.

- Online Payments: To make an online payment, log in to your Capital One online account. Navigate to the payments section and follow the instructions to enter your bank account information or use a debit card to initiate the payment. Ensure that you enter the correct payment amount and review the payment due date to avoid late fees.

- Automatic Payments: If you prefer a hassle-free option, set up automatic payments through your online account. This feature ensures that your payment is automatically deducted from your bank account on the specified due date, so you never miss a payment.

- By Phone: If you prefer to make a payment by phone, you can call the Capital One customer service number provided on the back of your card. Follow the prompts to make a payment using your bank account or debit card details.

- Mail-In Payment: If you prefer to send a payment by mail, locate the payment address on your monthly statement or on the Capital One website. Include your account number and ensure that you send it well before the due date to avoid any delays.

- Monitor payment confirmation: After making a payment, monitor your online account to ensure that it has been successfully applied. Keep track of your payment due dates to avoid late fees or penalties.

It’s important to note that making your payments on time is not only essential for maintaining a good credit standing but also for avoiding late fees and potential interest charges. Setting up payment reminders or automatic payments can help you stay organized and ensure timely payments.

Now that you know how to make payments with your Capital One Platinum Credit Card, let’s move on to the next section, where we’ll provide tips for managing your card wisely.

Tips for Managing Your Capital One Platinum Credit Card Wisely

Managing your Capital One Platinum Credit Card responsibly is key to making the most out of your credit card experience and maintaining a healthy financial profile. Here are some tips to help you manage your card wisely:

- Create a budget: Set a budget for your monthly expenses and stick to it. This will help you avoid overspending and ensure that you can comfortably make your credit card payments without accumulating excessive debt.

- Pay on time: Always make your credit card payments on time to avoid late fees and negative impacts on your credit score. Consider setting up automatic payments to ensure you never miss a payment due date.

- Pay more than the minimum payment: While the minimum payment is the minimum required to avoid late fees, paying only the minimum will result in accumulating interest charges. Whenever possible, pay more than the minimum to reduce your outstanding balance and save on interest.

- Monitor your credit utilization: Your credit utilization ratio is the percentage of available credit you are currently using. Keep this ratio low (preferably below 30%) to demonstrate responsible credit usage and maintain a good credit score.

- Avoid maxing out your credit limit: Instead of utilizing your full credit limit, aim to keep your credit card balances well below the credit limit. Maxing out your card can negatively impact your credit score and make it harder to manage your debt.

- Regularly review your statements: Take the time to review your monthly statements for any errors or unauthorized charges. Report any discrepancies immediately to the Capital One customer service team for resolution.

- Track your spending: Use the online account management tools provided by Capital One to track your spending habits. This will help you identify areas where you may need to cut back and make adjustments to your budget.

- Avoid unnecessary fees: Be aware of the fees associated with your credit card, such as cash advance fees or balance transfer fees. Minimize these fees by understanding the terms and conditions and avoiding unnecessary transactions.

- Regularly check your credit score: Capital One provides tools to monitor your credit score. Regularly check your credit score to ensure accuracy and track your progress in building a positive credit history.

- Keep your contact information updated: Notify Capital One promptly if there are any changes to your contact information, including your address, phone number, or email address. This will ensure that you receive important communication regarding your card and account.

By following these tips, you can effectively manage your Capital One Platinum Credit Card, build a positive credit history, and stay on top of your finances. Remember, responsible credit card usage can set you up for a more secure financial future.

In the next section, we’ll explore how to use your Capital One Platinum Credit Card for online purchases, offering convenience and security.

Using Your Capital One Platinum Credit Card for Online Purchases

The Capital One Platinum Credit Card offers a convenient and secure way to make online purchases. Here are some key tips for using your card effectively for online transactions:

- Ensure the website is secure: Before making a purchase online, confirm that the website is secure. Look for the padlock icon in the address bar, which indicates that the site is encrypted and your personal information will be protected.

- Keep your card information private: Only enter your Capital One Platinum Credit Card information on trusted and secure websites. Avoid sharing your card details through email or unsecured platforms to protect yourself from fraud.

- Set up transaction alerts: Capital One offers transaction alerts that notify you when your card is used for online purchases. Enable these alerts to quickly identify any unauthorized activity and report it to Capital One immediately.

- Use virtual card numbers: Capital One provides the option to generate virtual card numbers for added security. These temporary card numbers can be used for online purchases and provide an extra layer of protection by keeping your actual card details hidden.

- Save your receipts: Keep a record of your online purchase receipts, either by saving digital copies or printing them out. This will assist you in tracking your expenses, ease returns or exchanges, and provide proof of purchase if needed.

- Review your statements regularly: As with any credit card usage, it’s crucial to review your monthly statements for any unauthorized charges. Ensure that the transactions listed match your online purchases and report any discrepancies to Capital One.

- Take advantage of online shopping protections: Certain credit cards, including the Capital One Platinum Credit Card, may offer additional buyer protections for online purchases. These can include extended warranties, purchase protection, and price protection. Familiarize yourself with these benefits to maximize your online shopping experience.

- Be cautious with public Wi-Fi: When making online purchases, avoid using public Wi-Fi networks, especially for sensitive transactions. Public networks can be vulnerable to hacking and may compromise your personal and financial information.

- Keep your contact information updated: Ensure that your contact information is accurate and up to date with Capital One. This way, you can receive important notifications related to your card and any potential issues regarding online transactions.

By following these tips, you can confidently and safely use your Capital One Platinum Credit Card for online purchases. Capital One prioritizes the security of their cardholders, so you can shop online with peace of mind.

In the next section, we’ll explore how you can redeem rewards and benefits with your Capital One Platinum Credit Card.

Redeeming Rewards and Benefits with Your Capital One Platinum Credit Card

The Capital One Platinum Credit Card offers a variety of rewards and benefits that you can take advantage of. Here’s how you can maximize your card’s perks:

Rewards: The Capital One Platinum Credit Card may offer rewards in the form of cash back, travel miles, or other points-based systems. To redeem your rewards, log in to your online account, navigate to the rewards section, and explore the available redemption options. You may be able to redeem rewards for statement credits, travel bookings, gift cards, or merchandise. Review the redemption rules and options provided by Capital One to make the most of your earned rewards.

Sign-up Bonus: Some Capital One Platinum Credit Card offers include a sign-up bonus, where you can earn additional rewards or cash back after meeting specific spending requirements within a certain time frame. Pay attention to any sign-up bonus details and ensure that you fulfill the requirements to claim the bonus.

Bonus Categories: Some Capital One Platinum Credit Cards offer bonus rewards in certain spending categories, such as dining, groceries, or gas stations. Take advantage of these bonus categories to earn extra rewards on your everyday purchases. Monitor promotional offers and activate any available bonus rewards categories through your online account.

Travel Benefits: Depending on the specific Capital One Platinum Credit Card you have, you may have access to travel benefits such as travel insurance, rental car insurance, and access to airport lounges. Familiarize yourself with these benefits and understand how to utilize them to enhance your travel experience.

Extended Warranty and Purchase Protection: Capital One Platinum Credit Cards may offer extended warranty protection, which extends the manufacturer’s warranty on eligible items. Additionally, purchase protection may cover you against damage or theft for a certain period after making a purchase with your card. Review the terms and conditions to understand the coverage provided and how to take advantage of these benefits.

Price Protection: Some Capital One Platinum Credit Cards may offer price protection, allowing you to receive a refund if the price of a purchased item drops within a specified time frame. Check the details of this benefit and file a claim if you find a lower price on an item you recently purchased.

Customer Support Services: Capital One Platinum Credit Cardholders have access to 24/7 customer support. If you have any questions regarding your rewards, benefits, or need assistance with any aspect of your card, don’t hesitate to reach out to the dedicated customer support team for assistance.

Take the time to understand the rewards and benefits offered by your specific Capital One Platinum Credit Card. Regularly review your available rewards and stay updated on any new promotions or offers that may provide additional value.

In the next section, we’ll explore how to manage your Capital One Platinum Credit Card account online for a seamless and convenient experience.

Managing Your Capital One Platinum Credit Card Account Online

Capital One provides a user-friendly online account management platform that allows you to efficiently manage your Capital One Platinum Credit Card. Here’s how you can make the most of managing your account online:

- Create an online account: If you haven’t already done so, visit the Capital One website or use their mobile app to create an online account. Follow the prompts to provide the necessary information and set up your account credentials.

- Access your account dashboard: Once your online account is set up, log in to access your account dashboard. Here, you can view your current balance, recent transactions, and payment due dates at a glance.

- Pay your bill online: The online account management platform allows you to make payments conveniently and securely. Simply navigate to the payments section and follow the instructions to make a payment using your bank account or debit card.

- Set up automatic payments: To ensure timely payments, set up automatic payments through your online account. This feature deducts the payment amount from your chosen bank account on the due date, saving you time and effort.

- View and download statements: Access your monthly statements online and download them for your records. This allows you to track your spending, review past transactions, and reconcile your expenses.

- Monitor your credit score: Capital One provides tools to help you monitor your credit score through your online account. Take advantage of these features to stay informed about your credit standing and track your progress over time.

- Set up alerts and notifications: Customize your account preferences by setting up alerts and notifications for various activities, such as payment due reminders, suspicious activity alerts, or account balance updates. This helps you stay on top of your card account.

- Manage additional features: Explore additional features provided by Capital One, such as balance transfers, credit limit increase requests, or adding authorized users to your account. These options can be conveniently managed online.

- Update your contact information: Ensure that your contact information, including your address, phone number, and email address, is up to date. This allows Capital One to communicate important account-related information and provides a means for verification.

- Stay vigilant against fraud: Regularly monitor your online account for any unauthorized or suspicious activity. Report any concerns to Capital One immediately to ensure the security of your card and account.

The online account management platform offered by Capital One provides comprehensive tools and features to help you effectively manage your Capital One Platinum Credit Card. Take advantage of this convenience and make use of the available resources to stay in control of your finances.

In the next section, we’ll discuss important measures for keeping your Capital One Platinum Credit Card secure and protected.

Keeping Your Capital One Platinum Credit Card Secure

Maintaining the security of your Capital One Platinum Credit Card is of utmost importance to protect your personal and financial information. Here are some essential measures to keep your card secure:

- Keep your card safe: Ensure that your physical card is stored in a secure location, such as a wallet or a locked drawer, when not in use. Avoid leaving your card unattended or in easily accessible places.

- Memorize your PIN: If your Capital One Platinum Credit Card has a PIN, memorize it and do not share it with anyone. Avoid writing it down or storing it electronically, as this can make it easier for unauthorized individuals to gain access to your card.

- Protect your information online: Be cautious when sharing your card information online. Only enter your details on secure and reputable websites. Look for the padlock symbol in the address bar, indicating that the site is encrypted.

- Monitor your transactions: Regularly review your online account or monthly statements for any unauthorized or suspicious transactions. If you notice any discrepancies, report them to Capital One immediately.

- Enable transaction alerts: Take advantage of the transaction alerts provided by Capital One. These alerts notify you of any transactions made with your card, allowing you to quickly identify and report any unauthorized activity.

- Use strong passwords: When creating an online account for managing your Capital One Platinum Credit Card, use a strong and unique password. Avoid using personal information or easily guessable passwords. Consider using a password manager for added security.

- Be cautious with your card details: Avoid sharing your card details, such as the card number, expiration date, or CVV code, through unsecured platforms or via email. Be wary of unsolicited requests for this information.

- Secure your online account: Enable any available security features provided by Capital One, such as two-factor authentication or biometric login options. These additional layers of security help protect your account from unauthorized access.

- Keep your contact information updated: Notify Capital One promptly about any changes to your contact information. This ensures that you receive important notifications and helps prevent potential fraud by allowing Capital One to verify your identity.

- Report lost or stolen cards immediately: If your Capital One Platinum Credit Card is lost, stolen, or compromised in any way, contact Capital One’s customer service immediately to report it. They will assist in blocking your card and issuing a new one.

By following these security measures, you can significantly reduce the risk of unauthorized access or fraudulent activity on your Capital One Platinum Credit Card. It is essential to remain vigilant and take proactive steps to protect your card and your personal information.

In the next section, we’ll address common questions and provide troubleshooting guidance for Capital One Platinum Credit Card users.

Common Questions and Troubleshooting Guide for Capital One Platinum Credit Card Users

As a Capital One Platinum Credit Card user, you may have certain questions or encounter common issues. Here is a guide to help address some frequently asked questions and offer troubleshooting solutions:

1. What do I do if my Capital One Platinum Credit Card is lost or stolen?

If your card is lost or stolen, contact Capital One immediately at their customer service number provided on their website or on the back of your card. They will assist in blocking your card and issuing you a new one.

2. How can I dispute a charge on my Capital One Platinum Credit Card statement?

If you notice an unauthorized or incorrect charge, contact Capital One’s customer service right away to dispute the charge. They will guide you through the dispute process and investigate the matter on your behalf.

3. What should I do if I forget my online account password?

If you forget your online account password, visit the Capital One website or use their mobile app to initiate the password reset process. Follow the instructions provided to reset your password and regain access to your account.

4. Can I request a credit limit increase on my Capital One Platinum Credit Card?

Yes, you can request a credit limit increase by contacting Capital One’s customer service or by logging into your online account. Capital One will review your request and determine if you qualify for a credit limit increase based on your credit history and financial stability.

5. How can I keep track of my credit score with my Capital One Platinum Credit Card?

Capital One provides tools and resources to monitor your credit score through your online account. Log in to your account to access your credit score and track its progress over time.

6. Can I add an authorized user to my Capital One Platinum Credit Card?

Yes, you can add an authorized user to your Capital One Platinum Credit Card. Contact Capital One’s customer service or log into your online account to initiate the process. You will need to provide the necessary information for the authorized user.

7. What should I do if I spot fraudulent activity on my Capital One Platinum Credit Card?

If you suspect any fraudulent activity on your card, contact Capital One immediately to report the issue. They will guide you through the necessary steps to resolve any potential fraudulent charges and secure your card.

8. How can I access my Capital One Platinum Credit Card statements online?

Log in to your online account and navigate to the statements section. Capital One provides digital statements that can be viewed and downloaded for your convenience. You can access past and current statements through your online account.

9. Is there a fee for balance transfers with my Capital One Platinum Credit Card?

Check the terms and conditions of your specific Capital One Platinum Credit Card to determine if there are any fees associated with balance transfers. Some cards may have a balance transfer fee, while others may offer promotional periods with no fees.

10. What should I do if I need help or have other questions related to my Capital One Platinum Credit Card?

If you need assistance or have other questions about your Capital One Platinum Credit Card, contact Capital One’s customer service. They are available 24/7 to provide support and address any concerns you may have.

If you encounter any other issues or have specific questions related to your Capital One Platinum Credit Card, reach out to their customer service for personalized assistance. They are there to help you navigate any challenges you may face.

Now that we’ve covered common questions and troubleshooting tips, let’s wrap up this guide.

Conclusion

The Capital One Platinum Credit Card offers a range of benefits, features, and conveniences that can enhance your financial journey. From building or rebuilding your credit to earning rewards and accessing valuable cardholder benefits, this credit card provides a versatile tool for managing your finances.

In this guide, we explored how to apply for a Capital One Platinum Credit Card, activate and set it up for use, and make payments effectively. We also discussed tips for managing your card wisely, using it for online purchases, redeeming rewards, and benefits, and managing your account online.

By following the recommended strategies, such as paying your bills on time, keeping your card secure, and taking advantage of online account management tools, you can optimize your experience with the Capital One Platinum Credit Card.

If you have any questions, concerns, or encounter any issues with your card, always reach out to Capital One’s customer service for assistance. They are dedicated to providing exceptional support and ensuring that you have a positive cardholder experience.

Remember, responsible credit card usage is key. Make mindful financial decisions, track your expenses, and stay within your budget to maintain a healthy credit profile. By doing so, you can make the most of your Capital One Platinum Credit Card and pave the way for a secure financial future.

Now that you have a comprehensive understanding of the Capital One Platinum Credit Card, its features, benefits, and how to manage it effectively, you’re well-equipped to embark on your credit card journey. Use this knowledge to make informed decisions, take advantage of the perks offered by your card, and leverage its potential to enhance your overall financial well-being.