Finance

How To Change Your Name On A Credit Card

Published: October 26, 2023

Looking to update your name on your credit card? Read our step-by-step guide on how to change your name on a credit card, and take control of your finances today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

Changing your name on a credit card may seem like a complex undertaking, but it is actually a relatively straightforward process. Whether you recently got married, went through a divorce, or simply decided to legally change your name, updating your name on your credit card is important for many reasons.

In this article, we will guide you through the step-by-step process of changing your name on a credit card. We will outline the necessary documents and information you’ll need, provide instructions on how to contact your credit card issuer, and explain the steps required to update your identification documents. Additionally, we will discuss how changing your name on a credit card may impact your credit history and offer some tips to mitigate any potential negative consequences.

Changing your name on a credit card is not only a matter of personal preference, but it is also essential for ensuring that your financial records accurately reflect your new legal identity. By updating your name on your credit card, you can avoid any confusion or complications when using your card for online transactions, making payments, or applying for loans or other credit-related services.

While the process may differ slightly depending on the credit card issuer, the general steps remain the same. By following our guidelines and being prepared with the necessary documentation, you can successfully navigate the name change process with minimal hassle or confusion.

So, if you’re ready to take the necessary steps to change your name on a credit card, let’s dive into the details and get started!

Why Would You Want to Change Your Name on a Credit Card?

There are several reasons why you might want to change your name on a credit card. Let’s explore some of the common scenarios:

- Marriage: If you recently got married and took your spouse’s last name, you might want to update your credit card to reflect your new name. This can help maintain consistency across all your financial accounts and avoid any confusion when making transactions.

- Divorce: In the event of a divorce, you may choose to revert to your maiden name or a previous name. Changing your name on your credit card ensures that your financial records accurately reflect your new legal identity.

- Legal Name Change: People may opt to legally change their name for a variety of personal reasons, such as cultural or gender identity. If you have legally changed your name, updating it on your credit card is crucial for ensuring that all your financial records remain up to date.

- Identity Security: If you suspect that your identity has been compromised or stolen, changing your name on your credit card can help protect you from fraudulent activity. By updating your name, potential thieves will have a harder time accessing your credit card information and making unauthorized transactions.

Regardless of the reason for changing your name on a credit card, it is important to take the necessary steps to ensure that all your financial records align with your new legal identity. This includes updating your credit card, identification documents, and any other accounts or services tied to your name.

Now that you understand why changing your name on a credit card is important, let’s proceed to the next section, where we will discuss the documents and information you’ll need to initiate the name change process.

Required Documents and Information

Before you begin the process of changing your name on a credit card, it is essential to gather the necessary documents and information. Here are the key items you will need:

- Legal Name Change Document: Depending on the reason for your name change, you will need the appropriate legal documentation. This may include a marriage certificate, divorce decree, court order, or any other legal document that verifies your new name.

- Identification Documents: You will need to provide identification documents that prove your identity. These typically include a valid government-issued photo ID, such as a driver’s license, passport, or national ID card.

- Credit Card Information: Have your credit card handy, as you will need to provide the necessary details, such as the card number, expiration date, and security code. This information will help the credit card issuer locate your account and make the necessary changes.

- Address and Contact Information: The credit card issuer will likely ask for your current address and contact information to update their records. Be prepared to provide your current residential address, phone number, and email address.

It’s important to note that the specific documents and information required may vary slightly depending on your credit card issuer and the nature of your name change. Some credit card issuers may have additional requirements or request specific forms to be filled out.

Once you have gathered the necessary documents and information, you’re ready to contact your credit card issuer and initiate the name change process. In the next section, we will discuss the different methods you can use to reach out to your credit card issuer and request a name change.

Contacting Your Credit Card Issuer

Once you have gathered all the required documents and information, the next step is to contact your credit card issuer to request a name change. There are several ways you can reach out to them:

- Call Customer Service: The most direct and efficient method is to call the customer service number provided on the back of your credit card. This way, you can speak directly with a representative who can guide you through the name change process.

- Visit the Bank/Branch: If your credit card is linked to a specific bank or financial institution, you can also visit their branch in person. This allows you to speak with a representative face-to-face and provide the necessary documents for the name change.

- Online Chat: Some credit card issuers offer online chat support on their website. This can be a convenient option if you prefer a written record of your conversation or if you have specific questions about the name change process.

- Secure Message: Many credit card issuers have a secure messaging system on their website or mobile app. You can use this feature to send a message requesting the name change and attach any required documents securely.

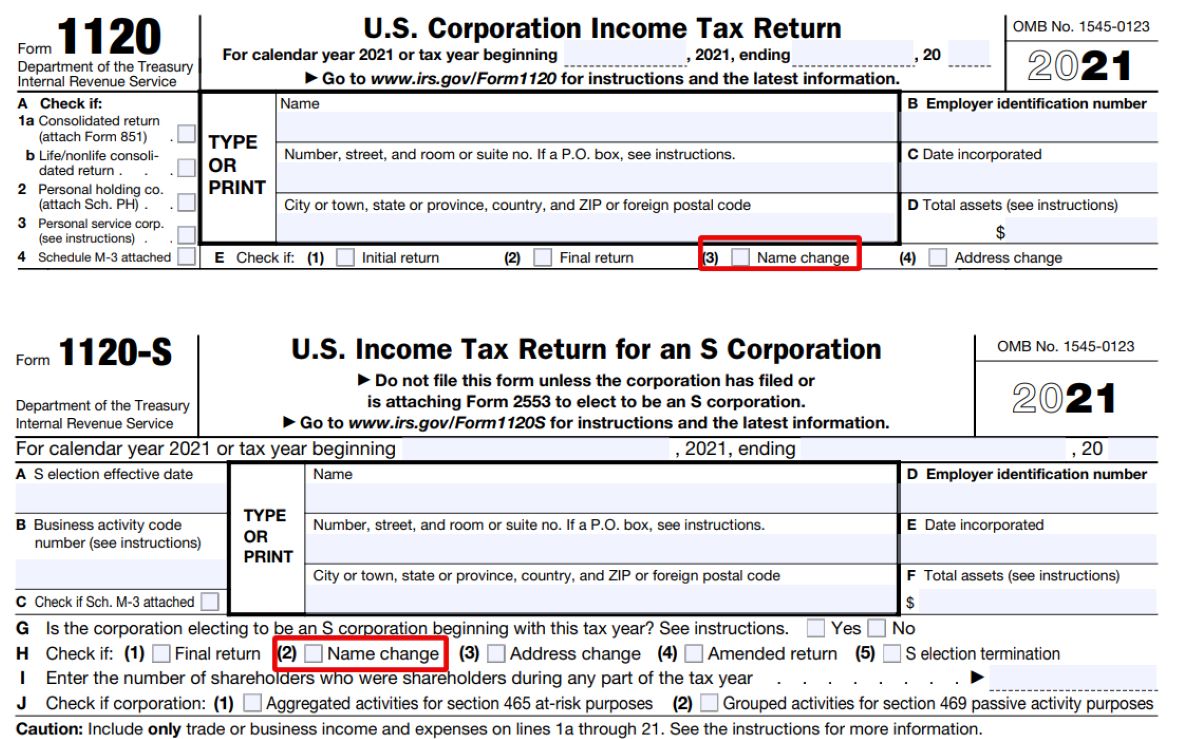

When contacting your credit card issuer, be prepared to provide the necessary documents and information we discussed earlier. Explain your request clearly and follow any instructions provided by the representative. They may ask you to submit the documents via email, fax, or regular mail for verification purposes.

It’s important to note that some credit card issuers may have specific instructions or procedures for name changes. They may have specific forms to fill out or additional steps to follow. Therefore, it is advisable to check their website or contact customer service in advance to understand the exact requirements and process.

Once you have successfully contacted your credit card issuer and informed them of your name change, they will guide you through the next steps to update your official credit card records. In the next section, we will discuss the process of updating your identification documents to align with your new name on the credit card.

Requesting a Name Change

After contacting your credit card issuer, you will need to formally request a name change on your credit card. Here are the general steps to follow:

- Explain Your Request: Clearly communicate your intention to change your name on the credit card to the representative. Provide any relevant details about the reason for the name change, such as marriage, divorce, or a legal name change.

- Submit Required Documents: Depending on your credit card issuer’s specific requirements, you may need to submit copies of the legal documentation that supports your name change. This could include a marriage certificate, divorce decree, court order, or any other relevant legal document.

- Update Personal Information: If your name change affects other personal information on file, such as your address or contact details, make sure to update those as well. This will ensure that all your information is accurate and up to date.

- Follow Additional Instructions: Your credit card issuer may provide specific instructions or forms to complete as part of the name change process. Follow these instructions carefully and provide any additional documents or information they request.

- Verify Your Identity: To protect against fraud, your credit card issuer may ask you to verify your identity before processing the name change. This could involve providing additional identification documents or answering security questions.

It’s important to note that the time it takes to process a name change request can vary. Some credit card issuers may update the name on your credit card immediately, while others may take a few days or weeks to complete the process.

During this time, it is advisable to continue using your credit card with your old name until you receive confirmation that the name change has been processed. This will help avoid any issues or confusion during transactions.

Now that you have successfully requested a name change, let’s move on to the next step – updating your identification documents to align with your new name on the credit card.

Updating Your Identification Documents

Once your credit card issuer has processed your name change request and updated your credit card, it’s important to update your identification documents to reflect your new name. This will help ensure consistency and avoid any complications when using your identification for various purposes. Here are the steps to update your identification documents:

- Driver’s License or ID Card: Visit your local Department of Motor Vehicles (DMV) or licensing agency to update your driver’s license or identification card. Bring the required documents, such as your new credit card with the updated name, legal name change documentation, and any other supporting documents as per your state’s requirements. Fill out the necessary forms and pay any applicable fees to obtain a new identification card with your updated name.

- Passport: If you have a passport, you will need to apply for a passport name change. Visit the official website of your country’s passport agency to find the necessary forms and instructions for updating your passport. Provide the required documentation, such as your new credit card, legal name change documents, and passport application form. Follow the instructions for submitting your application and pay any applicable fees.

- Social Security Card: Contact your local Social Security Administration office or visit their website to request a name change on your Social Security card. Fill out the necessary application form and provide supporting documents, including your new credit card and legal name change documents. Submit the application and wait for your new Social Security card with your updated name to arrive by mail.

- Other Identification Documents: Depending on your circumstances, there may be other identification documents that need to be updated, such as your voter registration card, health insurance card, or employment records. Contact the relevant authorities or organizations to inquire about their process for changing your name and provide the required documentation.

It is important to note that the process and requirements for updating identification documents may vary between countries, states, and institutions. Be sure to check the specific instructions and guidelines provided by the respective authorities to ensure a smooth and accurate name change process.

Once you have updated your identification documents, it’s time to move on to the final step – updating your other accounts and services to ensure consistency with your new name. We’ll discuss this in the next section.

Updating Your Other Accounts and Services

Now that you have successfully changed your name on your credit card and updated your identification documents, it’s important to ensure consistency across all your accounts and services. Here are some key areas to consider:

- Bank Accounts: Contact your bank to update your personal information, including your name, on all your bank accounts. This may include checking accounts, savings accounts, and any other accounts you have with the bank.

- Utility Companies: Reach out to your utility providers, such as electricity, water, gas, and internet service providers, to update your name on your utility accounts. Provide them with the necessary documents to facilitate the name change.

- Insurance Providers: Contact your insurance companies, including car insurance, health insurance, and any other insurance policies you hold. Request a name change on your policy and provide the required documentation to update your records.

- Employer and Payroll: Inform your employer about your name change and provide any necessary documentation. Update your name in their records, including on your paychecks, tax forms, and employee benefits documents.

- Mailing Address: If your name change also requires updating your mailing address, be sure to inform the post office and any other relevant entities, such as subscription services or online retailers, to ensure your mail is delivered correctly.

- Financial Services: If you have additional financial accounts, such as investment accounts, retirement funds, or loans, contact the respective institutions to update your name on these accounts as well.

Remember to keep thorough records of all the accounts and services you have updated with your new name. This will help you ensure that all the necessary changes have been made and avoid any confusion or complications in the future.

Lastly, consider reviewing your credit reports and monitoring your credit activity to ensure that your new name is accurately reflected in your credit history. Any discrepancies or inaccuracies should be reported and corrected promptly to maintain the integrity of your credit profile.

By taking the time to update your other accounts and services, you’ll minimize any potential issues that may arise from using your new name officially. This will help ensure a smooth transition and avoid any complications in the future.

With all the necessary updates made, you have successfully completed the name change process across your accounts and services. In the final section, we will discuss the potential impact of changing your name on a credit card on your credit history.

Potential Impact on Your Credit History

Changing your name on a credit card can potentially have an impact on your credit history. Here are some factors to consider:

1. Credit History Continuity: When you change your name on a credit card, it is important to maintain continuity in your credit history. This means ensuring that your old credit history is linked to your new name. Contact the credit bureaus — Equifax, Experian, and TransUnion — to update your personal information and ensure that your credit history is correctly associated with your new name.

2. Credit Score: Your credit score may be temporarily affected when you change your name on a credit card. This is because the credit bureaus need time to update their records and reflect the name change. However, as long as your credit history remains intact and you continue to make timely payments, your credit score should not be significantly impacted in the long run.

3. Accuracy of Credit Reports: Changing your name on a credit card is part of ensuring the accuracy of your credit reports. It is important to regularly check your credit reports to ensure that all your accounts, including your credit card, reflect your correct name. Any discrepancies or errors should be promptly addressed and corrected with the credit bureaus.

4. Lenders and Credit Checks: When you apply for new credit or loans, lenders may perform credit checks using your updated name. It is important to ensure that all your identification documents, including your updated credit card and identification documents, reflect your new name. This will help lenders accurately match your identity during the credit application process.

5. Existing Credit Accounts: Your name change on a credit card should not affect the terms and conditions of your existing credit accounts, such as interest rates, credit limits, or account history. However, it’s always a good idea to review your account statements and contact your credit card issuer if you notice any discrepancies or changes that were not initiated by you.

It’s important to note that the impact of changing your name on a credit card will vary depending on individual circumstances and how diligently you update your information across all relevant institutions. By monitoring your credit reports and promptly addressing any issues, you can ensure that your credit history remains accurate and up to date.

Now that you understand the potential impact on your credit history, let’s conclude our discussion in the next section.

Conclusion

Changing your name on a credit card is an important step in maintaining consistency and accuracy across your financial records. Whether it’s due to marriage, divorce, or a legal name change, updating your name on your credit card ensures that your credit history reflects your new legal identity.

Throughout this article, we have discussed the step-by-step process of changing your name on a credit card. We covered the necessary documents and information you’ll need, how to contact your credit card issuer, and the steps involved in requesting a name change. We also highlighted the importance of updating your identification documents and other accounts and services to reflect your new name.

While changing your name on a credit card may have an impact on your credit history, it is crucial to maintain continuity and accuracy by updating your information with the credit bureaus and monitoring your credit reports. By doing so, you can ensure that your credit score remains intact and that your credit history is correctly associated with your new name.

Remember, the exact process and requirements for changing your name on a credit card may vary depending on your credit card issuer and your specific circumstances. It’s essential to follow the instructions provided by your credit card issuer and other relevant institutions and maintain thorough records throughout the name change process.

Changing your name on a credit card may seem like a daunting task, but with the right preparation and follow-through, you can successfully navigate the process. By updating your name on your credit card and other relevant accounts, you’ll maintain consistency and accuracy in your financial records.

So, if you’ve recently had a name change, take the necessary steps to update your credit card and ensure that all your identification documents and accounts reflect your new name. By doing so, you’ll have peace of mind knowing that your financial records are aligned with your legal identity.