Home>Finance>Credit Review: Definition, Purposes, How To Read Them

Finance

Credit Review: Definition, Purposes, How To Read Them

Published: November 5, 2023

Learn the essentials of credit reviews in finance - including the definition, purposes, and expert tips on how to read them accurately.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Understanding Credit Reviews: Unveiling the Secrets of Credit Reports

When it comes to your financial well-being, one of the most crucial elements is your creditworthiness. Building and maintaining good credit is essential for various aspects of your financial life, from getting approved for a loan to securing lower interest rates. But how can you assess your creditworthiness? This is where credit reviews come into play. In this article, we will delve into the world of credit reviews, exploring their definition, purposes, and providing you with valuable insights on how to read them.

Key Takeaways:

- Credit reviews are an evaluation of an individual’s creditworthiness, based on their credit history and financial behavior.

- They serve several purposes, primarily allowing lenders, landlords, and employers to assess the risk associated with extending credit or offering opportunities.

So, what exactly is a credit review? Put simply, it’s an evaluation of an individual’s creditworthiness based on their credit history and financial behavior. Credit reviews are conducted by credit bureaus, also known as credit reporting agencies, which collect and maintain records of individual credit activities.

Now, you might be wondering why credit reviews are important. There are several purposes behind conducting credit reviews, and understanding them can empower you to take control of your financial future. Here, we’ll outline a few key reasons why credit reviews are essential:

- Creditworthiness Assessment: Lenders, such as banks or credit card companies, rely on credit reviews to assess the risk associated with lending money. A good credit review can increase your chances of securing a loan or credit card with favorable terms, such as lower interest rates or higher credit limits.

- Employment Opportunities: Some employers review credit reports as part of their hiring process, particularly for positions that involve financial responsibilities. A positive credit review can enhance your chances of landing a job, as it demonstrates fiscal responsibility and trustworthiness.

- Landlord Consideration: When looking for a rental property, landlords often review credit reports to evaluate the financial trustworthiness of prospective tenants. A positive credit review can strengthen your rental application, potentially giving you an edge over other applicants.

Now that we understand the importance of credit reviews, let’s dive into the nitty-gritty of reading them. Credit reviews typically include various components that offer insights into your credit history and behavior. Here are some key elements you should pay attention to when reading your credit review:

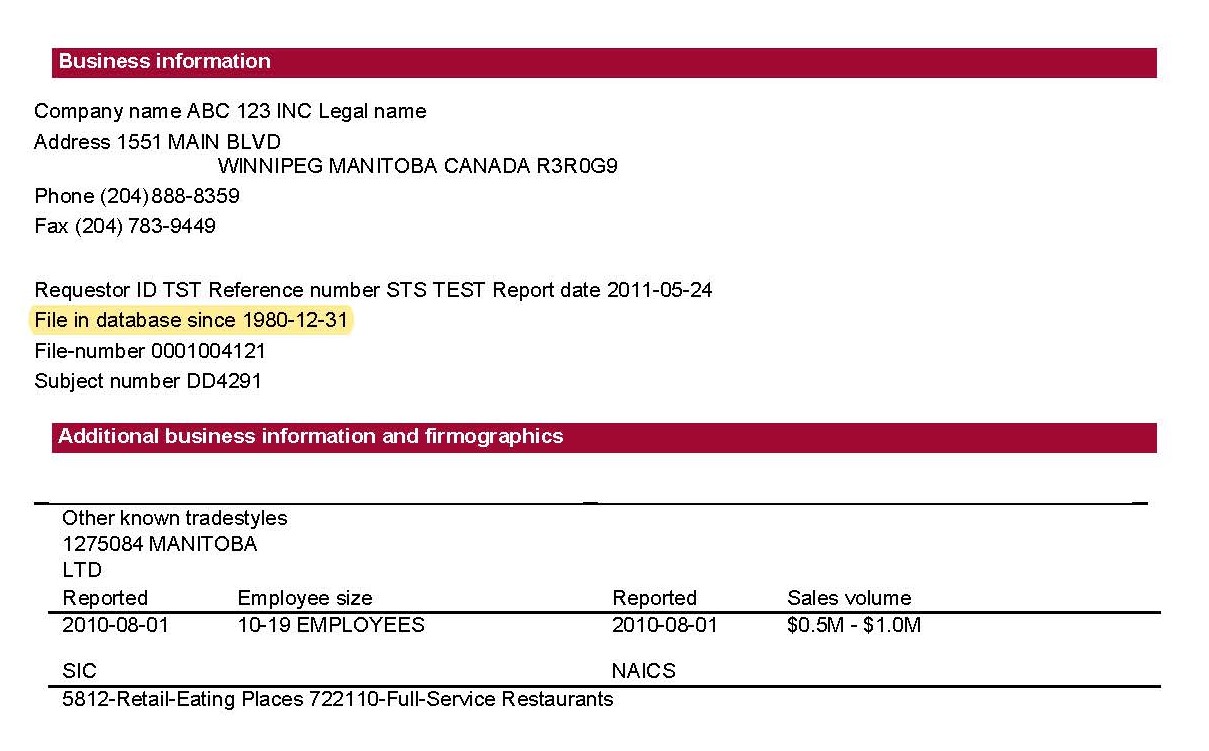

- Personal Information: Check for any errors or inaccuracies in your name, address, and other personal details. These errors can sometimes lead to mix-ups or confusion in credit evaluations.

- Account Details: Review the list of your accounts, including credit cards, loans, and mortgages. Ensure that all the information is accurate and up to date.

- Payment History: This section provides a snapshot of your payment behavior. Look for any late payments, defaults, or collections, as these can significantly impact your credit score.

- Outstanding Balances: Check the balances on your accounts and make sure they align with your own records. High outstanding balances can indicate potential financial strain.

- Credit Utilization: This refers to the proportion of your available credit that you are currently utilizing. Aim to keep this ratio below 30% to maintain a healthy credit rating.

By understanding the various components of a credit review, you can identify areas for improvement and take steps to enhance your creditworthiness. Should you come across any errors or discrepancies, contact the credit bureau immediately to rectify them.

In conclusion, credit reviews play a vital role in assessing an individual’s creditworthiness and can impact various aspects of their financial life. By familiarizing yourself with the details of your credit review and taking proactive measures to maintain good credit, you can pave the way for a more secure financial future.