Finance

How Do I Find My AGI IRS?

Published: October 31, 2023

Looking for your AGI IRS? Learn how to find your Adjusted Gross Income for tax purposes and manage your finances efficiently.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to filing taxes, there are a few key pieces of information that are vital to have on hand. One such piece of information is your Adjusted Gross Income (AGI). But what exactly is AGI? And why is it important to find your AGI when filing your taxes?

AGI, or Adjusted Gross Income, is a crucial figure when it comes to calculating your tax liability. It represents your total income from all sources, minus specific deductions that you are eligible to take. AGI serves as the starting point for determining your taxable income and ultimately, the amount of tax you owe to the IRS.

So, why do you need to find your AGI? Well, your AGI is required to file your federal income tax return. It is used to determine your eligibility for various tax credits, deductions, and exemptions. Additionally, your AGI may also be needed for other personal financial activities, such as applying for a loan or mortgage, obtaining financial aid for college, or even qualifying for certain benefits or assistance programs.

The process of finding your AGI may sound complex, but fear not. There are several methods you can use to locate this essential figure. In this article, we will discuss four common methods to help you find your AGI with ease.

What is AGI?

Before diving into the methods of finding your AGI, let’s take a closer look at what AGI actually represents and how it is calculated.

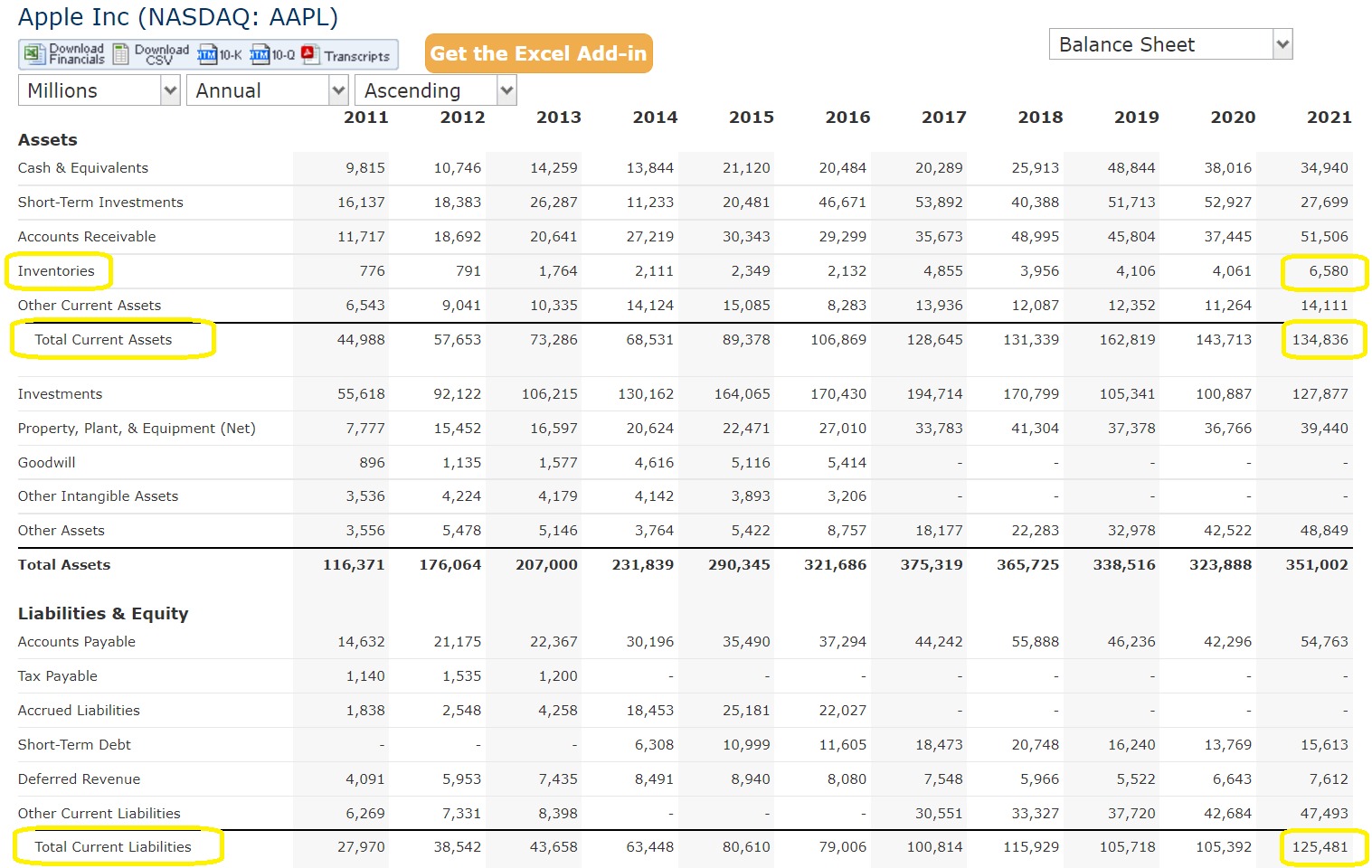

AGI, or Adjusted Gross Income, is a key component of your income tax return. It is the total income you receive from various sources, such as wages, self-employment income, rental income, and investment earnings, minus specific deductions that you are eligible to claim.

Calculating your AGI requires you to start with your gross income. Gross income includes your salary, wages, tips, and any other income you receive throughout the year. It also incorporates income from business activities, rental properties, investments, and other sources.

Once you have calculated your gross income, you can subtract specific deductions, known as “above-the-line” deductions, to arrive at your AGI. These deductions include expenses such as student loan interest, alimony payments, contributions to retirement accounts, and self-employed health insurance premiums, among others.

Your AGI is important because it serves as the basis for determining your taxable income. Your taxable income is calculated by subtracting additional deductions, known as “below-the-line” deductions or itemized deductions, from your AGI. These deductions may include expenses such as mortgage interest, state and local taxes, medical expenses, and charitable contributions.

By starting with your AGI and subtracting itemized deductions or taking the standard deduction, you can calculate your taxable income. This taxable income amount is then used to determine the amount of income tax you owe to the IRS.

Understanding your AGI is crucial because it affects various aspects of your tax return. It determines your eligibility for certain deductions, credits, and exemptions. It also determines the tax bracket you fall into, which directly impacts the amount of tax you owe.

Now that we have a better understanding of what AGI is and how it is calculated, let’s explore the methods you can use to find your AGI when filing your taxes.

Why do you need to find your AGI?

When it comes to filing your taxes, finding your Adjusted Gross Income (AGI) is an essential step. Your AGI is used to determine various aspects of your tax return, making it crucial to have this figure on hand. Let’s explore why it’s important to locate your AGI.

1. Filing your tax return: Your AGI is required to file your federal income tax return. It serves as the starting point for calculating your taxable income and determining the amount of tax you owe to the IRS.

2. Eligibility for tax credits and deductions: Many tax credits and deductions have income limits or phase-out ranges. Your AGI helps determine your eligibility for these benefits. By knowing your AGI, you can identify which credits and deductions you may qualify for, potentially reducing your tax liability.

3. Financial transactions: Your AGI may be requested for various financial activities. For example, when applying for a loan or mortgage, lenders often ask for your AGI as part of the application process. Providing your AGI helps lenders assess your financial standing and determine your loan eligibility.

4. College financial aid: If you or your dependents are applying for financial aid for college, the AGI plays a crucial role. It helps determine your Expected Family Contribution (EFC), which is used to calculate the amount of financial assistance you may receive. Having your AGI readily available can simplify the financial aid application process.

5. Benefits and assistance programs: Some government assistance programs, such as Medicaid, subsidized housing, or food stamps, may consider your AGI when determining eligibility. Providing your AGI is often a requirement to determine your eligibility and the level of assistance you may receive.

6. Tax planning and financial decisions: Knowing your AGI can help you with tax planning strategies and making informed financial decisions. By understanding your AGI, you can evaluate the impact of certain actions, such as contributing to retirement accounts or making charitable donations, on your tax liability.

Overall, finding your AGI is important for accurate tax filing, determining eligibility for tax benefits, financial transactions, college financial aid, government assistance programs, and making informed financial decisions. Now, let’s explore the methods you can use to locate your AGI.

Methods to find your AGI

There are several methods you can use to find your Adjusted Gross Income (AGI) when filing your taxes. Let’s explore four common methods that can help you locate this essential figure.

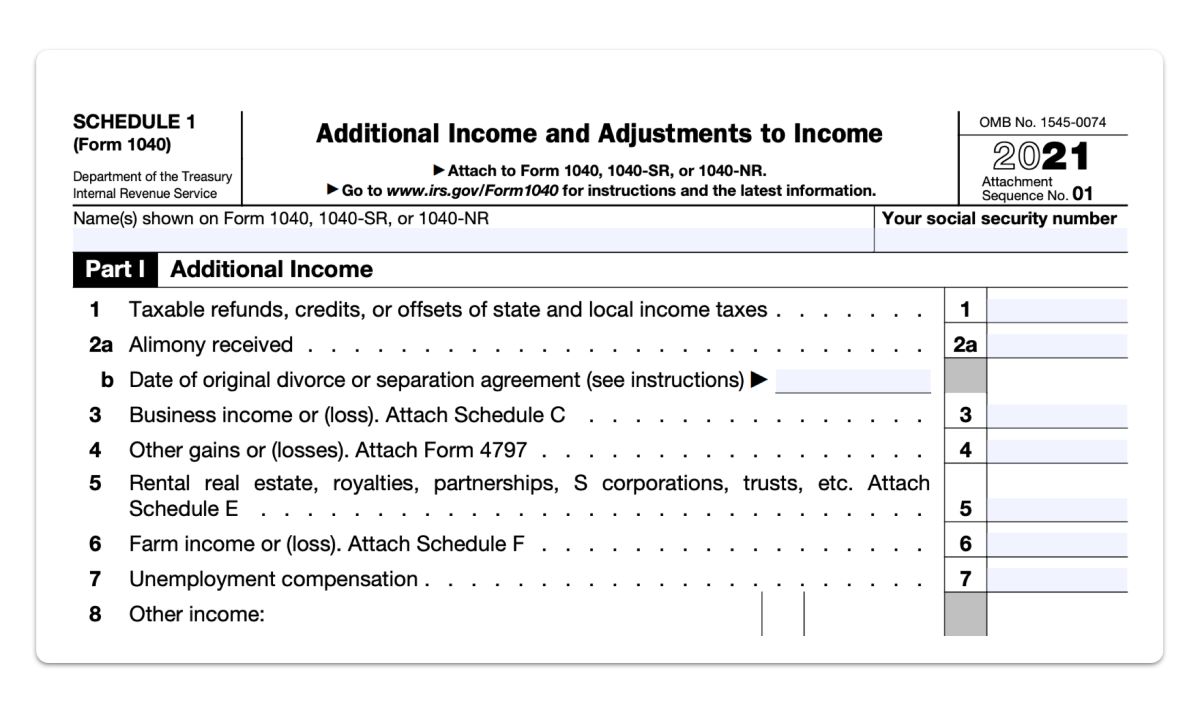

Option 1: Previous year’s tax return: One of the simplest and most reliable ways to find your AGI is by referring to your previous year’s tax return. Your AGI is prominently displayed on your tax form, making it easy to locate. If you have a physical copy of your tax return, you can find your AGI on line 11 of Form 1040, line 7 of Form 1040A, or line 1 of Form 1040EZ. If you used tax preparation software or an online platform to file your taxes, you can access your previous return and find your AGI there.

Option 2: Transcript from the IRS: Another method to find your AGI is by requesting a transcript from the Internal Revenue Service (IRS). The IRS provides several types of transcripts, including the Tax Return Transcript and the Wage and Income Transcript. You can request these transcripts online through the IRS website, by mail, or by calling the IRS. The transcript will include your AGI from past tax years.

Option 3: Tax preparation software or online platform: If you used tax preparation software or an online platform to file your taxes, you can often access your previous returns through the same platform. These tools usually store your tax information, including your AGI, from previous years. Simply log in to your account and navigate to the appropriate section to retrieve your AGI.

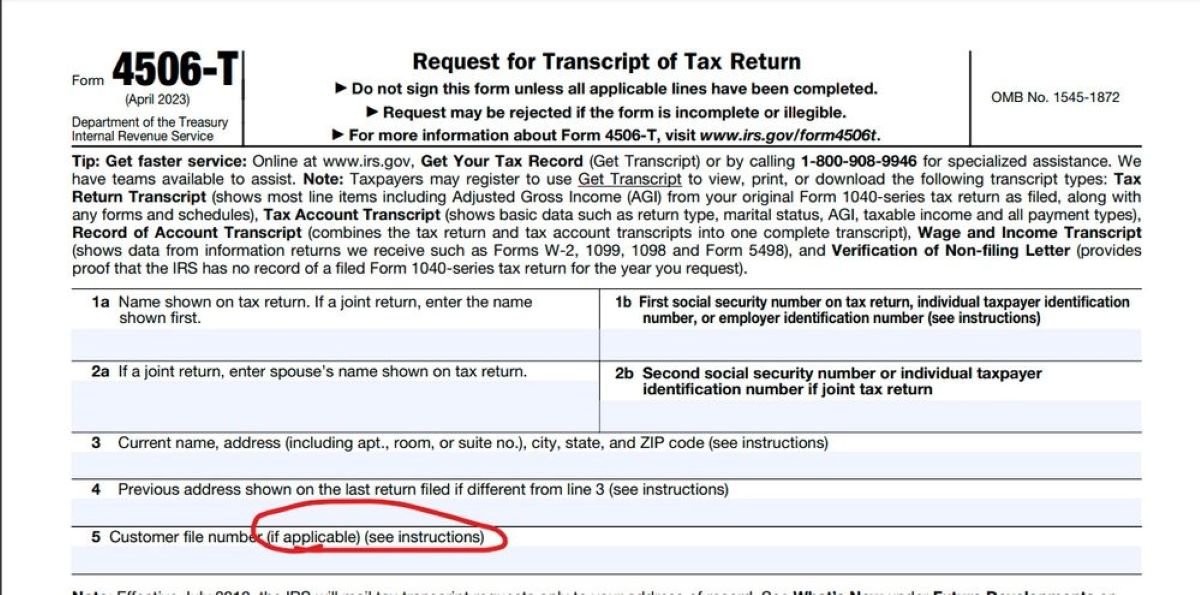

Option 4: Requesting a copy from the IRS: If you are unable to locate your previous year’s tax return or access it through tax preparation software, you can request a copy of your tax return directly from the IRS. You can do this by submitting Form 4506-T, Request for Transcript of Tax Return. This form allows you to request a copy of your tax return, including your AGI, for a specific tax year.

By utilizing these methods, you can easily find your AGI and ensure accurate tax filing. Remember to keep your AGI in a secure place and make a note of it for future reference. Now that you know how to locate your AGI, you can confidently proceed with filing your taxes and completing any other financial activities that require this important figure.

Option 1: Previous year’s tax return

A straightforward and reliable method to find your Adjusted Gross Income (AGI) is by referring to your previous year’s tax return. Your AGI is prominently displayed on your tax form, making it easy to locate and use for your current tax filing.

If you have a physical copy of your tax return, you can find your AGI in a specific location depending on the form you used to file. For example:

- On Form 1040: Your AGI can be found on line 11.

- On Form 1040A: Your AGI is located on line 7.

- On Form 1040EZ: Your AGI can be found on line 1.

If you used tax preparation software or an online platform to file your taxes, locating your previous year’s AGI becomes even easier. Simply log in to your account and navigate to the appropriate section or summary page, which typically displays important figures from your tax return, including your AGI.

By using your previous year’s tax return or accessing it through tax preparation software, you can save time and effort searching for your AGI. Additionally, using this method ensures accuracy, as the AGI reported on your previous tax return has already been verified and submitted to the IRS.

Remember to keep your previous year’s tax return in a safe place, as it contains important information that may be needed for future reference and financial activities. It’s always a good practice to make a digital or physical copy of your tax return and store it in a secure location for easy access when needed.

Utilizing your previous year’s tax return to find your AGI streamlines the tax filing process and enables you to quickly and accurately complete your current tax return. Be sure to double-check the accuracy of the AGI you use for your current filing to avoid any discrepancies or errors in your tax calculations.

Now that you know how to locate your AGI using your previous year’s tax return, you can confidently move forward with filing your taxes and ensure a smooth tax preparation experience.

Option 2: Transcript from the IRS

If you don’t have access to your previous year’s tax return or need to find your Adjusted Gross Income (AGI) for multiple years, you can request a transcript from the Internal Revenue Service (IRS). The IRS offers different types of transcripts that include your AGI information, providing a reliable and official source to obtain the required figures.

To request a transcript, you have several options:

- Online: The IRS provides an online tool called “Get Transcript” that allows you to view and print various tax transcripts, including the Tax Return Transcript and the Wage and Income Transcript. You can access this tool by visiting the IRS website and following the prompts to request your transcript online. Please note that you will need to provide personal information and answer security questions to verify your identity.

- Mail: You can submit Form 4506-T, Request for Transcript of Tax Return, to request a transcript by mail. Fill out the form with the required information, including the specific type of transcript you need, and mail it to the address provided on the form. It typically takes around five to ten business days to receive the transcript through mail.

- Phone: Alternatively, you can request a transcript by calling the IRS at their toll-free number. Be prepared to provide your personal information and answer security questions to verify your identity over the phone. Once your identity is confirmed, the IRS agent will assist you in obtaining the transcript you need.

When you receive your transcript, it will include your AGI from the requested tax year(s). The transcript serves as an official document issued by the IRS and can be used for various purposes, including tax filing, loan applications, and financial verification.

It’s important to keep your transcripts in a safe and secure place, just like your tax returns. Transcripts contain sensitive information related to your tax history, so ensure that you store them appropriately to protect your personal data.

Utilizing the transcript option from the IRS is a reliable way to obtain your AGI when you don’t have access to your previous tax returns. By using an official transcript, you can be confident in the accuracy of the AGI information you retrieve. Remember to plan ahead and allow sufficient time for the processing and delivery of the transcript when using this method.

Now that you know about requesting a transcript from the IRS, you have an additional option to find your AGI and complete your tax filing accurately. Choose the method that suits your needs and circumstances best, and enjoy a hassle-free tax preparation experience.

Option 3: Tax preparation software or online platform

If you have used tax preparation software or an online platform to file your taxes in the past, accessing your Adjusted Gross Income (AGI) becomes remarkably convenient. These tools often store your previous tax information, making it easy to retrieve your AGI for the current year.

To find your AGI using tax preparation software or an online platform, follow these steps:

- Log in to your account: Visit the website or open the application for the tax preparation software or online platform you used previously.

- Access your previous returns: Navigate to the section or summary page that displays your previous tax returns. This is usually labeled as “Prior Years,” “Previous Returns,” or something similar.

- Select the desired tax year: Choose the tax year for which you need to locate your AGI.

- Retrieve your AGI: Once you access your previous tax return, locate the section that displays your AGI. It might be labeled as “Adjusted Gross Income,” “AGI,” or something similar.

- Note and record your AGI: Make sure to note down the exact figure and keep it in a secure place for future reference.

Using tax preparation software or an online platform to find your AGI offers convenience and accuracy since the software automatically calculates your AGI based on the information you provided for your previous returns. This method is particularly helpful if you consistently use the same software or platform to file your taxes each year.

Furthermore, using tax preparation software or an online platform helps streamline the overall tax filing process. These tools often guide you through the required steps and offer insights into potential deductions or credits you may qualify for, making your tax preparation experience more efficient and comprehensive.

Remember to keep your login credentials for the tax preparation software or online platform in a safe place. Also, make sure to update your software or platform to the latest version to ensure accuracy and access to previous return information.

If you haven’t used tax preparation software or an online platform in the past, consider exploring reputable options available in the market. Research different platforms to find one that aligns with your needs and preferences, offering both user-friendly interfaces and comprehensive tax services.

By utilizing tax preparation software or an online platform, you can easily access your AGI and complete your tax filing with confidence and efficiency. Take advantage of technology to simplify your tax preparation process and ensure accurate reporting of your financial information.

Option 4: Requesting a copy from the IRS

If you are unable to locate your previous year’s tax return or access it through tax preparation software, you can request a copy of your tax return directly from the Internal Revenue Service (IRS). By submitting Form 4506-T, Request for Transcript of Tax Return, you can obtain a copy of your tax return, including your Adjusted Gross Income (AGI), for the specific tax year you need.

To request a copy from the IRS, follow these steps:

- Download Form 4506-T: Visit the IRS website or search online for “Form 4506-T” to download the form.

- Fill out the form: Complete Form 4506-T with the required information. Provide your personal details, including your name, Social Security number, and address, as well as the tax year for which you need the copy of your tax return.

- Specify the type of transcript: On the form, indicate that you are requesting a “Tax Return Transcript” and not an “Account Transcript” or any other type.

- Submit the form: Once you have filled out the form, sign and date it. You can submit the form electronically through the IRS website, by mail, or by fax. The contact details for submission are provided on the form itself.

- Receive your transcript: The IRS typically processes transcript requests within 5 to 10 business days. Once processed, you will receive a copy of your tax return, including your AGI, for the specified tax year.

Upon receiving your transcript, review it to locate and note down your AGI accurately. It is essential to keep your transcript in a secure location, just like your tax return, as it contains sensitive personal information.

Note: Requesting a copy of your tax return from the IRS may incur a fee. However, you can typically request a Tax Return Transcript, which is a free service provided by the IRS, to obtain your AGI.

By requesting a copy of your tax return directly from the IRS, you can access your AGI with confidence, knowing that it is an official document issued by the IRS itself. This method is particularly useful if you didn’t retain a copy of your tax return or if you need your AGI for multiple years.

Make sure to plan ahead and allow sufficient time for the processing and delivery of the transcript when using this method. Keep in mind that IRS processing times may vary, particularly during busy tax seasons.

Now that you know how to request a copy of your tax return from the IRS, you can proceed with the request and obtain the necessary information, including your AGI, for your tax filing and other financial activities as needed.

Conclusion

Locating your Adjusted Gross Income (AGI) is a crucial step when filing your taxes or engaging in various financial activities. Your AGI serves as the starting point for calculating your taxable income and determining your tax liability. It is also used to determine eligibility for tax credits, deductions, financial aid, loans, and assistance programs.

In this article, we discussed four common methods to find your AGI:

- Referencing your previous year’s tax return, where your AGI is prominently displayed.

- Requesting a transcript from the Internal Revenue Service (IRS), which includes your AGI for specific tax years.

- Utilizing tax preparation software or online platforms that store your previous tax returns and make your AGI easily accessible.

- Requesting a copy of your tax return directly from the IRS using Form 4506-T.

Choose the method that suits your situation best, based on the availability of your previous tax returns or access to tax preparation software. Each of these methods provides a reliable way to obtain your AGI.

Remember to keep your AGI, tax returns, and transcripts in a safe and secure place. These documents contain sensitive information and may be required for future reference or financial activities.

By finding your AGI and accurately reporting it, you can ensure a smooth tax filing process, claim eligible tax benefits, apply for financial aid or loans, and meet requirements for various assistance programs. Keep in mind that it’s always beneficial to consult with a tax professional or utilize IRS resources for any specific questions or concerns regarding your tax obligations.

Now that you have a comprehensive understanding of the importance of AGI and the methods to find it, you can confidently navigate the tax filing process and other financial activities with ease.