Finance

How Do I Find My Customer File Number IRS?

Modified: February 21, 2024

Looking to locate your Customer File Number with the IRS? Find out the details with our helpful finance guide and get the information you need.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- What is a Customer File Number?

- Why do I need a Customer File Number?

- Methods to find your Customer File Number

- Contacting the IRS

- Using the IRS Online Services

- Checking your Tax Returns or Documents

- Finding your Customer File Number on Notices or Letters

- Visiting an IRS Taxpayer Assistance Center

- Recovering your Customer File Number through the Mail

Introduction

When it comes to taxes, dealing with the Internal Revenue Service (IRS) can sometimes be an overwhelming experience. The IRS has various identification numbers and codes that individuals and businesses need to navigate the tax system effectively. One of these numbers is the Customer File Number (CFN).

A Customer File Number is a unique identifier assigned by the IRS to each taxpayer. It helps the IRS organize and track individual tax accounts and business entities. It is typically used for tax-related correspondence, such as returns, payments, and notices.

As a taxpayer, it is important to keep track of your Customer File Number, especially when communicating with the IRS. Whether you are an individual taxpayer or a business owner, having your CFN readily available can help streamline the tax-related processes and ensure accurate and efficient communication with the IRS.

In this article, we will explore various methods to find your Customer File Number with the IRS. It is important to note that the specific process may vary depending on your personal circumstances, so it is best to consult with a tax professional or contact the IRS for personalized guidance.

What is a Customer File Number?

A Customer File Number (CFN) is a unique identifier assigned by the IRS to taxpayers. It is essentially a tracking number that helps the IRS organize and manage individual tax accounts and business entities. The CFN is used for various tax-related purposes, including filing returns, making payments, and receiving notices and correspondence from the IRS.

Your Customer File Number is different from your Social Security Number (SSN) or Employer Identification Number (EIN). While the SSN and EIN are widely known and used for identification purposes, the CFN is specifically assigned by the IRS to track your tax-related activities.

It is important to note that not all taxpayers have a Customer File Number. Individuals who are not required to file tax returns or who have not previously interacted with the IRS may not have a CFN assigned. However, if you have filed tax returns in the past or have engaged with the IRS for any reason, you are likely to have a Customer File Number.

The Customer File Number is a 10-digit numerical code assigned to individual taxpayers by the IRS. It is unique to each taxpayer and should be kept confidential to ensure the security of your tax-related information.

Having a Customer File Number can provide numerous benefits when dealing with the IRS. It allows for more efficient communication by ensuring that the IRS can associate your tax information with the correct taxpayer. It helps in verifying your identity and facilitating the processing of your tax returns, payments, and any other tax-related transactions you may have with the IRS.

Being aware of your Customer File Number and understanding its purpose can help you stay organized and better navigate the tax system. In the following sections, we will explore different methods to find your CFN and ensure you have it readily available whenever you need to interact with the IRS.

Why do I need a Customer File Number?

Having a Customer File Number (CFN) is essential when dealing with the IRS. Here are a few reasons why you need a CFN:

1. Efficient Communication: When you need to communicate with the IRS regarding your tax matters, having your CFN readily available ensures that your inquiries, documents, and payments are properly associated with your taxpayer account. This helps in expediting the processing and resolution of any tax-related issues you may have.

2. Identity Verification: The IRS uses the CFN to verify your identity and ensure that all tax-related transactions are accurately linked to your taxpayer account. Using your unique CFN adds an extra layer of security and prevents any potential mix-ups or errors in processing your tax returns or payments.

3. Streamlined Tax Processing: When you fill out your tax forms, including your CFN helps the IRS process your return more efficiently. It ensures that your tax information is associated with the correct taxpayer account and reduces the chances of errors or delays in processing your tax return.

4. Retrieval of Past Documents: Your CFN allows you to access your tax documents and records from previous years. This can be crucial when you need to review your past tax filings or provide documentation for audits, financial planning, or other purposes.

5. Correspondence with the IRS: Whenever the IRS sends you notices, letters, or communications related to your taxes, they will typically reference your CFN. Having your CFN on hand allows you to easily identify and understand the purpose of the IRS correspondence, enabling you to take appropriate actions or seek professional assistance if needed.

6. Business Transactions: If you are a business owner, having a CFN is particularly important. It helps facilitate tax-related activities such as filing business tax returns, making payments, and engaging in other business transactions with the IRS.

Overall, having a Customer File Number is crucial for effective communication and smooth interactions with the IRS. It ensures that your tax-related matters are handled accurately and efficiently, allowing you to navigate the tax system with confidence. In the following sections, we will explore various methods to find your CFN if you are uncertain or unaware of your existing number.

Methods to find your Customer File Number

If you are unsure about your Customer File Number (CFN) or need to find it for the first time, there are several methods you can use to locate it. Here are some options to consider:

- Contacting the IRS: The IRS is the primary authority for determining and providing your CFN. You can contact the IRS directly through their toll-free customer service line and speak with a representative who can assist you in retrieving your CFN. They will likely ask you some verification questions to confirm your identity before providing you with the CFN.

- Using the IRS Online Services: The IRS offers various online services, such as the “Get Transcript” tool, where you can view and download past tax returns and transcripts. By logging in to your IRS online account, you may be able to locate your CFN in the account settings or profile section.

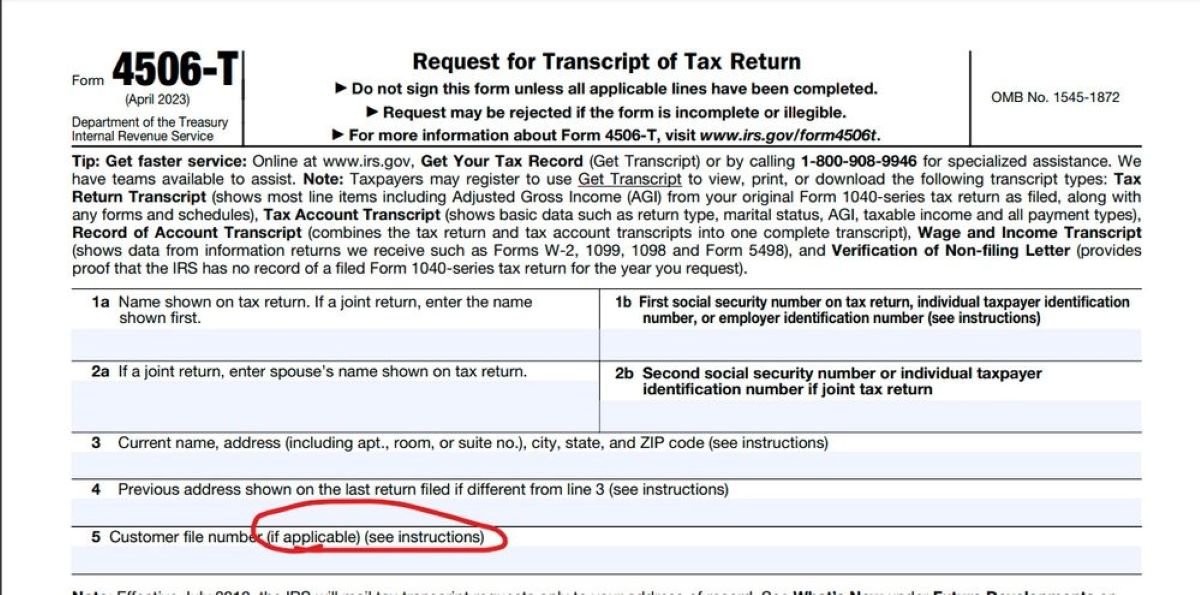

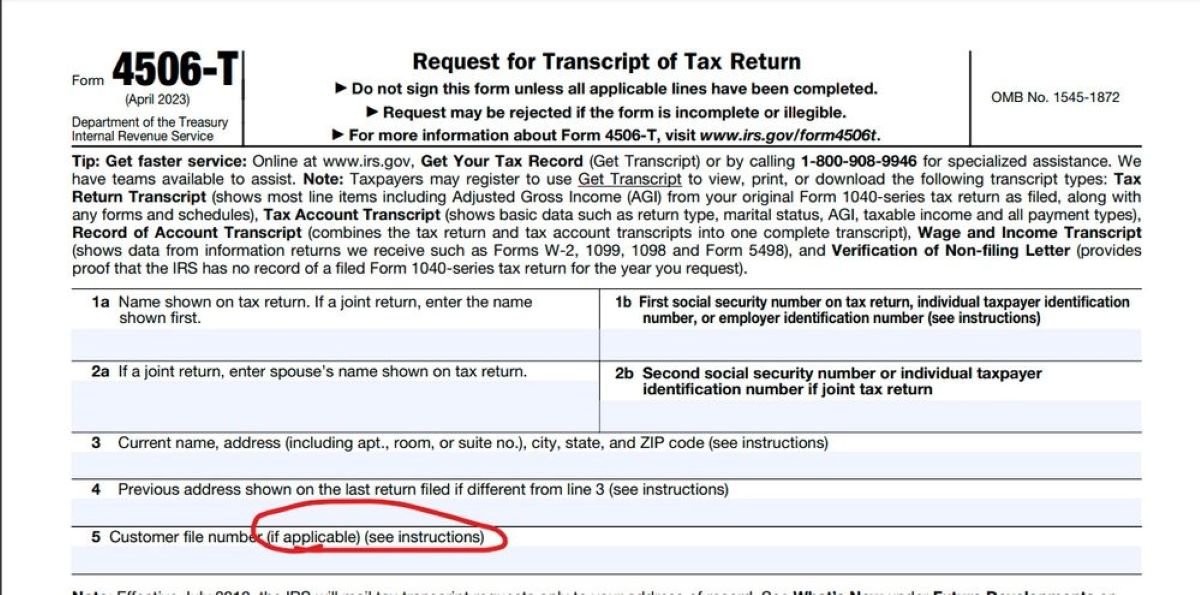

- Checking your Tax Returns or Documents: If you have physical copies or digital files of your past tax returns or documents, your CFN may be listed on these forms. Look for any official tax-related documents, such as Form 1040, and check for the presence of the CFN.

- Finding your CFN on Notices or Letters: The IRS often includes your CFN on various tax-related notices or letters that they send. If you have received any correspondence from the IRS, check the letterhead or body of the communication to see if your CFN is mentioned.

- Visiting an IRS Taxpayer Assistance Center: If you prefer an in-person interaction, you can visit your nearest IRS Taxpayer Assistance Center. IRS representatives at these centers can assist you in locating your CFN and provide personalized guidance for your specific situation.

- Recovering your CFN through the Mail: If you are unable to locate your CFN through other methods, you can submit a written request to the IRS via mail. Include your full name, address, Social Security Number, and a brief explanation of your request for the CFN retrieval. The IRS will process your request and mail you a response with your CFN information.

It is important to note that the specific method to find your CFN may depend on your individual circumstances. Not all taxpayers will have a CFN, and the availability of certain methods may vary. It is always recommended to consult with a tax professional or contact the IRS directly for personalized guidance in locating your CFN.

Once you have successfully retrieved your CFN, make sure to keep it in a safe place for future reference. Having your CFN readily available will help streamline your interactions with the IRS and ensure accurate communication regarding your tax matters.

Contacting the IRS

If you are unable to locate your Customer File Number (CFN) through other methods, one of the most direct ways to obtain it is by contacting the IRS directly. The IRS has dedicated representatives who can assist you in retrieving your CFN and provide personalized guidance for your specific situation.

There are several ways you can reach out to the IRS for assistance:

- Toll-Free Phone Number: The IRS has a toll-free customer service line that is available for taxpayer inquiries. You can call the IRS at 1-800-829-1040 and speak with a representative who can assist you in retrieving your CFN. Keep in mind that there may be wait times, especially during peak tax seasons, so it is advisable to be patient when calling.

- Online Contact Form: Another option is to use the IRS website and submit an online contact form with your request for the CFN. Visit the IRS website and navigate to the “Contact Us” page. From there, you can fill out the online contact form with your personal details and request for assistance in locating your CFN. Provide as much information as possible to ensure a smooth and efficient response from the IRS.

- Letter or Written Request: If you prefer a more traditional approach, you can submit a written request to the IRS via mail. Include your full name, address, Social Security Number, and a brief explanation of your request for the CFN retrieval. Send the letter to the appropriate IRS address, which can be found on the IRS website or by contacting their customer service line.

When contacting the IRS, be prepared to provide verification information to prove your identity and establish your ownership of the tax account. They may ask for details such as your Social Security Number, date of birth, and other personal identification information.

It is important to keep in mind that contacting the IRS may involve wait times and a few administrative steps to ensure proper verification. However, their representatives are trained to handle these inquiries and assist taxpayers in retrieving their CFN and resolving any related issues.

Remember to be patient and provide accurate information when contacting the IRS. They are there to help you navigate the tax system and ensure that you have the necessary information to successfully manage your tax affairs.

Using the IRS Online Services

The IRS offers a range of online services that can be convenient and efficient for retrieving your Customer File Number (CFN). These online services are designed to provide taxpayers with quick access to their tax-related information and facilitate communication with the IRS. Here are some ways you can use IRS online services to find your CFN:

- Create an IRS Online Account: The first step to accessing IRS online services is to create an online account. Visit the IRS website and look for the “Secure Access: How to Register for Certain Online Self-Help Tools” page. Follow the instructions to create your account, which will require providing personal identification information and verifying your identity.

- Get Transcript: Once you have set up your online account, you can use the “Get Transcript” tool to access your tax records and transcripts. This service allows you to view and download copies of past tax returns, including your CFN. Log in to your online account and navigate to the “Get Transcript” section to retrieve your CFN if it is available.

- Online Account Services: Within your IRS online account, there are various services and tools that you can explore. Look for any sections or options related to your profile or taxpayer account information. Your CFN may be listed in your account settings or profile details.

- Help and Frequently Asked Questions (FAQs): The IRS website provides comprehensive help resources and FAQs that can assist you in navigating through their online services. Look for relevant FAQs or search for specific information related to CFN retrieval. The FAQs may provide step-by-step instructions or further guidance on how to find your CFN using their online services.

- Contacting Online Help Support: If you encounter any difficulties or need further assistance while using the IRS online services, you can reach out to their online help support team. Look for the contact information provided on the IRS website and reach out to them for guidance on locating your CFN through their online platform.

Using IRS online services can save you time and provide convenient access to your tax information. However, it is important to ensure the security of your online account by using strong passwords and keeping your login credentials confidential.

Not all taxpayers may have access to certain online services, and the availability of CFN retrieval options may vary. If you encounter any issues or have questions about using the IRS online services, it is recommended to contact the IRS directly for personalized assistance.

Exploring the IRS online services can be a valuable resource in finding your CFN and managing your tax-related information effectively. Take advantage of these tools to streamline your interactions with the IRS and access the necessary information you need.

Checking your Tax Returns or Documents

If you are looking for your Customer File Number (CFN), one of the simplest ways to locate it is by checking your past tax returns or related documents. Your CFN may be listed on official tax forms or documents that you have received from the IRS. Here’s how you can check your tax returns or documents:

- Physical Copies: If you have physical copies of your tax returns or related documents, such as W-2 forms or 1099 forms, take a close look at these forms. Typically, your CFN will be located in the header or footer of these documents. Look for a 10-digit numerical code that is labeled as the Customer File Number or CFN.

- Digital Copies: If you have digital copies of your tax returns or documents, open the files using appropriate software, such as a PDF viewer. Use the search feature in the software to look for keywords like “Customer File Number” or “CFN” within the document. This should help you locate the relevant section where your CFN is mentioned.

- Tax Preparation Software: If you used tax preparation software to file your taxes, such as TurboTax or H&R Block, you may be able to access your past returns within the software. Open the software and navigate to the section that displays your previously filed returns. Look for a specific section or field that references the CFN.

It is important to note that not all tax documents may display your CFN. Some tax forms, such as Form 1040 or Schedule C, may not include the CFN directly. In such cases, it is recommended to refer to other methods mentioned in this article, such as contacting the IRS directly or using their online services.

Having your tax returns and documents organized and easily accessible can help streamline the process of finding your CFN. If you cannot find your CFN on your tax returns or documents, consider alternative methods such as contacting the IRS or using their online services for assistance.

Retaining copies of your past tax returns and related documents is also crucial for record-keeping purposes. These documents serve as proof of income, deductions, and other tax-related information, and may be required for future reference or in the event of an audit or review by the IRS.

Remember, if you have difficulty locating your CFN through this method, consult with a tax professional or reach out to the IRS for personalized guidance in finding your CFN.

Finding your Customer File Number on Notices or Letters

If you have received any notices or letters from the IRS, these documents can be a valuable source for finding your Customer File Number (CFN). The IRS often includes your CFN on tax-related correspondence to help identify and track your tax account. Here’s how you can find your CFN on notices or letters:

- Read the Letterhead: Start by carefully examining the letterhead of the IRS notice or letter. Look for any identification numbers or codes that appear in the header section. The CFN is typically listed somewhere near your name and address. It is commonly labeled as “Customer File Number” or “CFN.”

- Check the Body of the Letter: Read through the contents of the letter or notice. The IRS may explicitly reference your CFN within the body of the communication. Look for any sections where your CFN is mentioned or where the IRS asks you to provide it for further correspondence.

- Scan for Data Tables: Some IRS notices or letters include data tables or grids that outline specific account information. Check these tables for columns or fields that mention your CFN. It may be listed as a separate identifier alongside other details like your name, address, and Social Security Number.

- Review the Footer: In some cases, your CFN may be located in the footer section of the IRS notice or letter. Scan the bottom of the document, as the CFN may appear alongside other reference numbers or codes related to your tax account.

- Highlight or Make Note: Once you locate your CFN on the notice or letter, it is advisable to highlight or make note of it for future reference. Keeping a record of your CFN will help you easily retrieve it when needed for future interactions with the IRS.

It is important to carefully review any notices or letters received from the IRS, as they often contain critical information related to your tax obligations or account status. By locating your CFN on these documents, you can ensure accurate and efficient communication with the IRS.

If you are unable to find your CFN on your notices or letters, consider utilizing other methods mentioned in this article, such as contacting the IRS directly or using their online services for assistance in retrieving your CFN.

Remember, if you have any questions or concerns about the notices or letters you receive from the IRS, it is advisable to consult with a tax professional or reach out to the IRS directly for guidance.

Visiting an IRS Taxpayer Assistance Center

If you prefer face-to-face assistance, visiting an IRS Taxpayer Assistance Center can be an effective way to retrieve your Customer File Number (CFN) and receive personalized help with your tax-related inquiries. IRS Taxpayer Assistance Centers are local offices where you can speak directly with IRS representatives. Here’s what you need to know about visiting an IRS Taxpayer Assistance Center:

- Locate the Nearest Center: Use the IRS website or contact their toll-free customer service line to find the nearest IRS Taxpayer Assistance Center to your location. Make note of the address, office hours, and any specific appointment requirements, if applicable.

- Prepare Identification Documents: Before visiting the Taxpayer Assistance Center, gather the necessary identification documents to prove your identity and establish your ownership of the tax account. These documents may include a valid government-issued ID (such as a driver’s license or passport), Social Security Number, and any other relevant tax-related documents.

- Schedule an Appointment: While some IRS Taxpayer Assistance Centers allow walk-ins, it is advisable to schedule an appointment in advance, if possible. This ensures that an IRS representative will be available to assist you with your specific needs, including retrieving your CFN.

- Speak with an IRS Representative: When you visit the Taxpayer Assistance Center, explain that you need assistance in finding your CFN. The IRS representative will guide you through the necessary steps and help locate your CFN in their system. Be prepared to answer any verification questions to confirm your identity before they can provide you with the CFN information.

- Ask Additional Questions: In addition to retrieving your CFN, take advantage of the opportunity to ask any other tax-related questions you may have. IRS representatives at the Taxpayer Assistance Center are there to assist you and provide guidance on a wide range of tax issues.

Keep in mind that the availability of IRS Taxpayer Assistance Centers may vary depending on your location and the time of the year. It is recommended to check the IRS website or contact their customer service line for up-to-date information before visiting.

Visiting an IRS Taxpayer Assistance Center allows for in-person, personalized assistance in finding your CFN. The representatives can provide guidance based on your specific tax situation and help address any concerns you may have. Remember to bring all necessary identification documents and be prepared to wait, as the centers can sometimes be busy.

If you are unable to visit an IRS Taxpayer Assistance Center or need immediate assistance, consider utilizing other methods mentioned in this article, such as contacting the IRS directly or using their online services to retrieve your CFN.

Return to [Methods to find your Customer File Number](#methods-to-find-your-customer-file-number)

Recovering your Customer File Number through the Mail

If you are unable to find your Customer File Number (CFN) through other methods, you can request the recovery of your CFN by contacting the IRS through mail. This method allows you to submit a written request and receive a response with your CFN delivered to your mailing address. Here’s how you can recover your CFN through the mail:

- Prepare a Written Request: Begin by drafting a letter addressed to the IRS requesting the recovery of your CFN. Include your full name, current mailing address, Social Security Number, and a brief explanation of your request for the CFN retrieval. Be clear and concise in expressing your need for the CFN and provide any relevant details that may assist the IRS in locating your tax record.

- Send the Request: Once you have prepared the written request, send it to the appropriate IRS address. Ensure that you use certified mail or another traceable mailing service to track the delivery of your request. Retain a copy of the letter and any proof of mailing for your records.

- Wait for a Response: After the IRS receives your written request, they will process it and send a response to your mailing address. The response will include your CFN information along with any additional instructions or clarifications if needed.

- Keep the CFN Secure: Once you receive the response from the IRS with your CFN, keep this information safe and secure. Treat it confidentially, as your CFN is a unique identifier tied to your tax account.

Keep in mind that the process of recovering your CFN through the mail may take some time. The IRS needs to review and verify your request before sending a response. It is advisable to be patient and allow sufficient time for the IRS to process your request and send the information to you.

If you have not received a response within a reasonable timeframe, or if you have any questions or concerns, consider reaching out to the IRS directly to inquire about the status of your CFN recovery request.

This method of CFN recovery through the mail provides a paper trail and allows for a physical copy of your CFN. However, if you require quicker assistance or prefer other retrieval methods, such as contacting the IRS by phone or using their online services, consider exploring those options as well.

Having your CFN on hand is essential for efficient communication and accurate processing of your tax-related matters. By following the steps outlined above, you can successfully recover your CFN through the mail and have it available for future interactions with the IRS.