Finance

Why Cant I Get A Debt Consolidation Loan

Modified: February 21, 2024

Looking for a debt consolidation loan? Learn why you're having trouble getting one and find solutions to improve your financial situation. Get help with finance today!

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Debt Consolidation Loans

- Factors That Can Affect Loan Approval

- Poor Credit Score and Impact on Loan Eligibility

- High Debt-to-Income Ratio and Its Effect on Loan Approval

- Insufficient Collateral for Secured Loans

- Multiple Existing Loans and Their Impact on Consolidation Loan Approval

- Inconsistent or Unstable Income and Its Role in Loan Eligibility

- Unresolved Tax Liens or Bankruptcy and Their Influence on Loan Approval

- Lack of Proper Documentation and Its Effect on Loan Application

- Conclusion

Introduction

Are you drowning in debt and searching for a way to consolidate your financial obligations? If so, you may have come across the option of a debt consolidation loan. This type of loan can be a lifeline for individuals burdened with multiple debts, as it enables them to combine their existing loans into a single, more manageable monthly payment.

However, getting approved for a debt consolidation loan is not always a straightforward process. Many individuals find themselves asking, “Why can’t I get a debt consolidation loan?”

In this article, we will explore the various factors that can affect your eligibility for a debt consolidation loan. By understanding these factors, you can better assess your own financial situation and take steps to improve your chances of obtaining a consolidation loan.

It’s important to note that each lender has its own criteria for loan approval, and the specific requirements may vary. However, there are common factors that most lenders consider when evaluating loan applications.

So, why can’t you get a debt consolidation loan? Let’s dive in and explore the potential reasons.

Understanding Debt Consolidation Loans

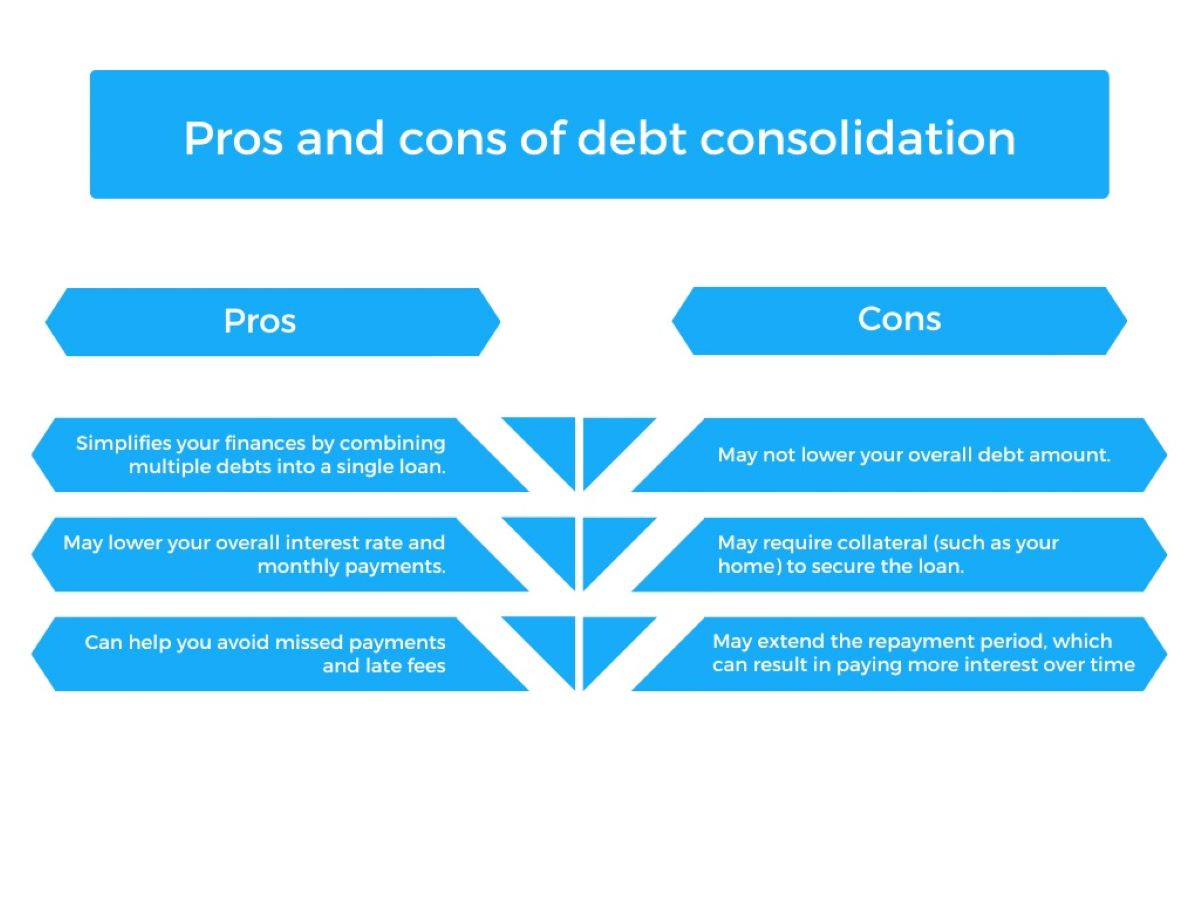

Before we delve into the reasons why you may be unable to secure a debt consolidation loan, let’s first understand what these loans entail. A debt consolidation loan is a financial product that allows you to merge your existing debts into one loan, typically with a lower interest rate and a longer repayment period. The purpose of this loan is to simplify your debt repayment and potentially reduce the overall cost of borrowing.

The mechanics of a debt consolidation loan are quite simple. You apply for a loan amount that covers the balances of your existing debts, such as credit cards, personal loans, or medical bills. Once approved, the funds are used to pay off these debts in full. From that point forward, you only have to make one monthly payment towards the consolidation loan.

This type of loan is particularly beneficial for those who struggle with managing multiple debts with varying interest rates and due dates. By consolidating your debts, you can streamline your finances and gain more control over your repayment strategy. Additionally, a debt consolidation loan may offer more favorable terms, such as a lower interest rate or a longer repayment period, which can potentially reduce your monthly payment.

Now that we have a clear understanding of what a debt consolidation loan is and how it works, let’s move on to explore the various factors that could be hindering your ability to obtain such a loan.

Factors That Can Affect Loan Approval

When applying for a debt consolidation loan, there are several factors that lenders take into consideration when assessing your eligibility. Understanding these factors can help you identify potential roadblocks standing in your way. Here are some common factors that can affect loan approval:

- Credit Score: Your credit score is a reflection of your creditworthiness and plays a significant role in getting approved for a debt consolidation loan. Lenders prefer borrowers with a good credit score, as it indicates a track record of responsible borrowing and a lower risk of default. If your credit score is low, you may struggle to get approved for a consolidation loan.

- Debt-to-Income Ratio: Lenders also consider your debt-to-income ratio (DTI), which is the percentage of your monthly income that goes towards debt payments. A high DTI indicates a heavy debt burden and can be a red flag for lenders. If your DTI is too high, lenders may see you as a risky borrower and may be reluctant to approve your loan.

- Collateral: Some debt consolidation loans, such as home equity loans, require collateral to secure the loan. If you don’t have sufficient collateral or valuable assets to pledge, it can hinder your chances of getting approved for a consolidation loan.

- Existing Loans: Multiple existing loans can complicate your application for a debt consolidation loan. Lenders may be concerned about your ability to handle additional debt. If you already have a significant amount of outstanding loans, it can raise red flags and reduce your chances of loan approval.

- Income Stability: Lenders want assurance that you have a stable and consistent income to repay the debt consolidation loan. If your income is inconsistent or unstable, it could raise doubts about your ability to make timely loan payments. This can make lenders hesitant to approve your loan application.

- Financial History: Negative financial events like unresolved tax liens or bankruptcy can significantly impact your loan application. These events indicate a higher level of financial risk, and lenders may view your application unfavorably.

- Documentation: Insufficient documentation or incomplete paperwork can lead to loan rejection. Lenders require specific documentation to verify your financial stability and identity. If you fail to provide the necessary documentation, it can hinder the loan approval process.

These are just some of the factors that lenders consider when evaluating your loan application. It’s essential to be aware of these factors and address any issues that may negatively impact your loan eligibility. In the next sections, we will dive deeper into each factor to help you understand its significance and explore possible solutions.

Poor Credit Score and Impact on Loan Eligibility

Your credit score plays a crucial role in determining your eligibility for a debt consolidation loan. A poor credit score can significantly impact your chances of approval or result in higher interest rates and less favorable loan terms. Here’s how a low credit score can affect your loan eligibility:

1. Higher Interest Rates: Lenders use your credit score as an indicator of risk. If your credit score is low, lenders may view you as a high-risk borrower and charge you a higher interest rate to compensate for the increased risk. This can increase the overall cost of borrowing, making the loan less attractive and more difficult to manage.

2. Limited Lender Options: Some lenders have strict credit score requirements when approving loan applications. If your credit score falls below their threshold, you may be limited to lenders who specialize in working with borrowers with poor credit. These lenders may offer loans with less favorable terms or higher fees, further limiting your options.

3. Loan Denial: In some cases, a poor credit score may lead to outright loan denial. Lenders may be unwilling to extend credit to individuals with a history of defaults, late payments, or other negative marks on their credit report. This can be particularly challenging if you’re relying on a debt consolidation loan to alleviate your financial burden.

Improving your credit score can significantly increase your chances of getting approved for a debt consolidation loan. Here are some steps you can take to improve your credit score:

1. Check Your Credit Report: Start by requesting a copy of your credit report from the major credit bureaus (Experian, Equifax, TransUnion). Review the report for any errors or discrepancies that might be negatively affecting your score. If you find any errors, dispute them and request corrections.

2. Pay Bills on Time: Late or missed payments can have a detrimental impact on your credit score. Make it a priority to pay your bills on time, including credit card payments, loans, and other financial obligations.

3. Reduce Credit Utilization: High credit card balances can lower your credit score. Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total credit limit) below 30%. Pay down your credit card debt and avoid maxing out your credit cards.

4. Avoid New Credit Applications: Applying for multiple credit accounts within a short period can raise red flags for lenders. Limit new credit applications and only apply when necessary.

5. Use Different Types of Credit: Demonstrating responsible use of different types of credit, such as credit cards, installment loans, and mortgages, can help improve your credit mix and boost your credit score over time.

Remember, improving your credit score takes time and effort. Be patient and consistent in your financial habits, and you’ll gradually see your credit score improve. In the meantime, explore alternative options, such as working with credit counseling agencies or seeking assistance from nonprofit organizations, to manage your debt while you work on rebuilding your credit.

High Debt-to-Income Ratio and Its Effect on Loan Approval

Another important factor that lenders consider when evaluating your eligibility for a debt consolidation loan is your debt-to-income ratio (DTI). Your DTI is a measure of the percentage of your monthly income that goes towards debt payments. A high DTI can impact your loan approval in the following ways:

1. Increased Risk Perception: A high DTI indicates that a significant portion of your income is already committed to repaying existing debt. Lenders may perceive this as a higher risk, as it may leave less room in your budget to comfortably afford additional loan payments. Consequently, lenders may be hesitant to approve your loan application.

2. Reduced Borrowing Capacity: Lenders typically have guidelines for the maximum DTI ratio they are willing to accept. If your DTI exceeds their limit, it may significantly decrease the amount of money you can borrow or result in loan denial. This can make it challenging to consolidate your debts into one loan.

Managing a high DTI requires careful financial planning. Here are some strategies to improve your DTI and increase your chances of loan approval:

1. Increase Income: Look for opportunities to increase your income, such as taking on a side job or freelance work. An increased income will help lower your DTI ratio and demonstrate to lenders that you have the ability to manage additional debt responsibly.

2. Pay Down Existing Debt: Reducing your existing debt balances can have a significant impact on your DTI ratio. Prioritize paying off high-interest debt first, such as credit card balances. Consider implementing a debt repayment strategy, such as the debt avalanche or debt snowball method, to systematically eliminate your debts.

3. Avoid New Debt: While you’re working on reducing your existing debt, it’s important to avoid taking on new debt. Any additional debt will further increase your DTI ratio and make it more difficult to qualify for a debt consolidation loan.

4. Consider Increasing Loan Term: If your DTI is preventing you from securing a debt consolidation loan, you may explore extending the loan term. By stretching out the repayment period, you can lower the monthly payment and potentially improve your DTI ratio. However, keep in mind that a longer loan term may result in paying more interest over time.

Improving your DTI ratio requires discipline and a commitment to reducing your debt. Creating a budget, trimming unnecessary expenses, and making consistent debt payments will gradually improve your financial health and increase your chances of getting approved for a debt consolidation loan.

Insufficient Collateral for Secured Loans

When it comes to debt consolidation loans, there are two main types: secured and unsecured. Secured loans require collateral, such as a home or a car, to secure the loan, while unsecured loans do not require any collateral. If you’re unable to provide sufficient collateral for a secured loan, it can impact your loan approval. Here’s why:

1. Risk Mitigation: Lenders require collateral as a way to mitigate their risk. Collateral provides them with a form of security in case you default on the loan. If you don’t have enough valuable assets or if the value of your assets is insufficient compared to the loan amount, lenders may be reluctant to approve your loan application.

2. Loan Amount Limitation: The amount you can borrow with a secured debt consolidation loan is typically tied to the value of the collateral. If your collateral’s value is not high enough, it may limit the loan amount that lenders are willing to offer you. This can make it challenging to consolidate all your debts into a single loan.

However, having insufficient collateral doesn’t necessarily mean you won’t be able to consolidate your debts. Here are some alternatives you can consider:

1. Unsecured Loans: If you’re unable to provide collateral, you may explore unsecured debt consolidation loans. These loans do not require collateral, relying solely on your creditworthiness and income to qualify. Keep in mind that unsecured loans often come with higher interest rates and may have stricter eligibility criteria.

2. Other Assets: If you don’t have sufficient collateral with significant value, consider other assets that you can use as collateral. For example, valuable jewelry, electronics, or investments that can secure a loan. Be cautious when pledging personal possessions as collateral, as defaulting on the loan could result in losing those assets.

3. Co-Signer or Joint Application: If you have a trusted family member or friend with good credit and sufficient collateral, you may consider applying for the loan together as co-signers. A co-signer can help strengthen your loan application and improve your chances of approval.

4. Seek Professional Advice: If you’re struggling to find suitable collateral or explore alternative options, it may be beneficial to seek advice from a financial advisor or credit counselor. They can provide guidance on which options are best for your specific situation and help you navigate through the loan application process.

Remember that the availability of alternatives may vary depending on your financial circumstances and the lenders you approach. It’s important to carefully consider your options and choose the one that aligns with your financial goals and ability to repay the loan.

Multiple Existing Loans and Their Impact on Consolidation Loan Approval

If you have multiple existing loans, such as credit card balances, personal loans, or student loans, it can have an impact on your eligibility for a debt consolidation loan. Lenders take into account these existing debts when evaluating your loan application. Here’s how multiple existing loans can affect consolidation loan approval:

1. Debt Burden: Lenders assess your debt-to-income ratio (DTI) to evaluate your ability to handle additional debt. If you already have a significant amount of outstanding loans, it can result in a high DTI. A high DTI indicates a heavier debt burden and may make lenders wary of approving your consolidation loan.

2. Repayment History: Lenders also consider your repayment history on your existing loans. If you have a history of missed payments or defaults, it can raise concerns about your ability to manage additional debt. A strong repayment history, on the other hand, can make you a more attractive candidate for a consolidation loan.

3. Credit Utilization: High credit card balances and maxed-out credit cards can negatively impact your credit utilization ratio. Lenders look at this ratio to assess your creditworthiness. If you have high balances on your credit cards, it could suggest that you are relying heavily on credit and may have difficulty managing additional debt.

While having multiple existing loans can pose challenges, it’s not necessarily a roadblock to securing a consolidation loan. Here are some steps you can take to improve your chances:

1. Assess Loan Terms: Review the terms of your existing loans to determine if they have any prepayment penalties or if there are any limitations to early repayment. Understanding these terms can help you plan your debt consolidation strategy effectively.

2. Pay Off High-Interest Debt: Prioritize paying off high-interest debt, such as credit card balances, while making minimum payments on other loans. This can help reduce your overall debt burden and improve your credit utilization ratio.

3. Consider Consolidation Options: Explore different consolidation loan options, such as a personal loan or a balance transfer credit card. Compare the interest rates and terms to determine which option will help you consolidate your debt most effectively.

4. Work with a Credit Counseling Agency: If managing multiple loans becomes overwhelming, consider seeking assistance from a reputable credit counseling agency. They can help negotiate lower interest rates or create a debt management plan that fits your financial situation.

Remember, managing multiple loans requires careful budgeting and discipline. By taking proactive steps to reduce your debt burden and improve your creditworthiness, you can increase your chances of getting approved for a consolidation loan.

Inconsistent or Unstable Income and Its Role in Loan Eligibility

When applying for a debt consolidation loan, lenders assess your ability to repay the loan. One crucial factor they consider is your income stability. If you have inconsistent or unstable income, it can impact your eligibility for a loan. Here’s how it can affect loan approval:

1. Risk Assessment: Lenders prefer borrowers with a stable and reliable source of income. Inconsistent or unstable income can make lenders wary because it raises doubts about your ability to consistently make loan payments. Lenders want assurance that you have sufficient income to handle the loan repayment.

2. Loan Repayment Ability: Lenders need to ensure that you have a steady income that is enough to cover your monthly expenses, including the new consolidation loan payment. If your income varies significantly from month to month or if there are frequent gaps in income, it can raise concerns about your ability to meet your financial obligations.

3. Financial Verification: During the loan application process, lenders typically request various financial documents, including pay stubs, tax returns, and bank statements. These documents help verify your income and stability. If your income is inconsistent or unpredictable, it may be more challenging to provide the necessary documentation to support your loan application.

Having inconsistent or unstable income doesn’t automatically disqualify you from getting a debt consolidation loan. Here are a few strategies to improve your loan eligibility:

1. Show Consistent Income: If you have inconsistent income due to freelancing, commission-based work, or self-employment, consider providing a longer history of income, such as bank statements or tax returns for multiple years. This can help demonstrate an overall consistent income pattern, even if it fluctuates month to month.

2. Provide Additional Verification: If you have irregular income, it may be beneficial to provide additional documentation that demonstrates your financial stability, such as contracts, client agreements, or invoices. These documents help lenders understand the source and reliability of your income.

3. Plan Budget with Variability in Mind: If your income fluctuates, it’s important to create a budget that accounts for these variations. Identify your average monthly income and plan your expenses accordingly. This will help reassure lenders that you can manage your finances even during periods of lower income.

4. Strengthen Credit and Savings: Having a strong credit score and a robust savings account can help offset any concerns about inconsistent income. Lenders may view you as a less risky borrower if you have demonstrated financial responsibility and have a safety net to rely on during leaner months.

It’s crucial to communicate openly with potential lenders about your income situation. They may have alternative loan options or specific programs designed for borrowers with inconsistent income. Working with a financial advisor or credit counselor can also provide guidance on how to best present your financial situation to lenders.

Remember, while inconsistent or unstable income can present challenges, it doesn’t automatically disqualify you from obtaining a debt consolidation loan. By taking proactive steps to demonstrate your ability to manage your finances and repay the loan, you can improve your chances of loan approval.

Unresolved Tax Liens or Bankruptcy and Their Influence on Loan Approval

When applying for a debt consolidation loan, lenders consider your financial history, including any unresolved tax liens or bankruptcy filings. These factors can have a significant impact on your loan approval. Here’s how tax liens and bankruptcy can influence loan eligibility:

1. Increased Risk Perception: Lenders see unresolved tax liens and bankruptcy as red flags that indicate financial instability and potential repayment challenges. These negative marks on your credit history may raise concerns about your ability to repay a new loan.

2. Limited Lender Options: Some lenders have strict policies regarding borrowers with unresolved tax liens or a history of bankruptcy. They may be unwilling to extend credit to individuals with these issues, making it more challenging to find a lender willing to approve your consolidation loan.

3. Higher Interest Rates or Fees: If you’re able to obtain a consolidation loan with unresolved tax liens or bankruptcy, lenders may mitigate their risk by charging higher interest rates or fees. This compensates for the perceived higher likelihood of default. As a result, your loan repayment may be more expensive compared to borrowers with a stronger financial history.

While unresolved tax liens and bankruptcy can pose challenges, there are steps you can take to improve your loan eligibility:

1. Resolve Tax Liens: If you have outstanding tax liens, it’s important to work with the tax authorities to resolve them. Set up a payment plan or negotiate a settlement to clear the liens from your credit report. This shows lenders that you are taking proactive steps to address your financial obligations.

2. Rebuild Credit: Focus on improving your credit score by making timely payments on your existing debts. Consider opening a secured credit card or becoming an authorized user on someone else’s credit card account to rebuild your credit history. Over time, positive credit behavior can help offset the impact of bankruptcy or tax liens.

3. Establish a Stable Financial History: Demonstrating financial stability through responsible budgeting, steady employment, and consistent payment history can help offset the negative impact of bankruptcy or tax liens. Lenders may be more inclined to approve your loan if they see a track record of positive financial behavior.

4. Research Lenders: Not all lenders have the same criteria when it comes to unresolved tax liens or bankruptcy. Some lenders specialize in working with borrowers who have experienced financial difficulties. Research and identify lenders who are more open to lending to individuals with these challenges, as they may be more likely to consider your loan application.

Remember, it’s important to be transparent about your financial history when applying for a consolidation loan. Lenders may ask for additional documentation or explanations regarding your bankruptcy or tax liens. Providing these details can help present a complete picture of your financial circumstances and increase your chances of loan approval.

Lack of Proper Documentation and Its Effect on Loan Application

When applying for a debt consolidation loan, providing the necessary documentation is crucial. Lenders rely on this documentation to verify your financial information and assess your eligibility for the loan. If you have a lack of proper documentation, it can have a significant effect on your loan application. Here’s why:

1. Incomplete Application: Lenders require specific documents to complete your loan application. If you fail to provide the required documentation, the lender may consider your application incomplete. This can lead to delays in the loan approval process or even result in outright loan denial.

2. Verification of Income and Assets: Lenders need to verify your income and assets to determine your ability to repay the debt consolidation loan. Without the proper documentation, such as pay stubs, bank statements, or tax returns, lenders are unable to verify your financial stability. This lack of verification can raise doubts about your ability to manage the loan payment.

3. Assessment of Creditworthiness: Documentation such as credit reports, credit scores, and proof of payment history are essential for lenders to assess your creditworthiness. Without these documents, lenders are unable to evaluate your creditworthiness accurately. This can make them hesitant to approve your loan application or result in less favorable loan terms.

.

4. Compliance with Regulations: Lenders need to abide by various regulations and lending standards, which often require specific documentation from borrowers. Failing to provide the necessary documentation can prevent lenders from complying with the legal requirements, making it challenging for them to proceed with your loan application.

To ensure a smooth loan application process, it’s important to have the proper documentation in order. Here are some tips to help you gather the necessary documents:

1. Review Loan Requirements: Understand the specific documentation required by the lender. Review the loan application checklist provided by the lender and ensure you have all the documents ready before applying. This can help prevent delays and ensure that your application is complete.

2. Double-Check Accuracy: Ensure that the documentation you provide is accurate and up-to-date. Mistakes or discrepancies can raise concerns and lead to additional document requests from the lender, delaying the loan approval process.

3. Maintain Organized Records: Keep all relevant financial documents organized and easily accessible. This includes pay stubs, bank statements, tax returns, and anything else that may be requested by the lender. Having organized records can expedite the loan application process.

4. Seek Professional Assistance: If you’re unsure of the specific documentation requirements or need help gathering the necessary documents, consider reaching out to a financial advisor or credit counselor. They can guide you through the process and ensure that you have all the required documentation in order.

Remember, providing the proper documentation is essential for a successful loan application. Take the time to gather the necessary paperwork and present it to the lender in an organized and timely manner. This will increase your chances of getting approved for a debt consolidation loan.

Conclusion

Obtaining a debt consolidation loan can be a viable solution for individuals looking to simplify their finances and manage their debt more effectively. However, various factors can impact your eligibility for a consolidation loan. Understanding these factors allows you to identify potential obstacles and take steps to improve your chances of loan approval.

Factors such as poor credit score, high debt-to-income ratio, lack of collateral, multiple existing loans, inconsistent income, unresolved tax liens or bankruptcy, and insufficient documentation can all present challenges in obtaining a debt consolidation loan. However, by addressing these factors, you can improve your eligibility and increase your chances of securing a loan.

Improving your credit score, reducing debt, increasing income stability, resolving tax liens or bankruptcy, exploring alternative collateral options, and providing the necessary documentation are just some of the steps you can take to enhance your loan application. It’s crucial to be transparent about your financial situation, communicate openly with potential lenders, and seek guidance from professionals when needed.

Remember that the loan approval process may vary from lender to lender, and there are alternative options available, such as unsecured loans or working with credit counseling agencies, even if you face challenges due to specific factors.

Overall, the journey to obtaining a debt consolidation loan may require patience, discipline, and financial planning. By understanding the factors that can impact your loan approval and taking proactive steps to address them, you can increase your chances of consolidating your debt and working towards a healthier financial future.