Finance

How To Get A Small Business Loan In Ohio

Modified: February 21, 2024

Looking for finance options to get a small business loan in Ohio? Discover the best strategies and lenders to help you secure the funding you need.

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

- Introduction

- Understanding Small Business Loans in Ohio

- Determining Your Small Business Loan Needs

- Researching Small Business Loan Options in Ohio

- Preparing Your Small Business Loan Application

- Applying for a Small Business Loan in Ohio

- Understanding the Small Business Loan Approval Process

- Managing and Repaying Your Small Business Loan in Ohio

- Conclusion

Introduction

Welcome to the world of small business loans in Ohio! If you are an entrepreneur or a small business owner looking to expand your operations, purchase new equipment, or fund your next big project, then you have come to the right place. Ohio is a bustling hub of economic activity, with numerous opportunities for entrepreneurs to thrive.

However, obtaining financing for your small business can be a daunting task. With various loan options available, it’s important to understand the process and make informed decisions to secure the funding you need. Whether you’re a startup or an established business, this guide will provide you with valuable insights on how to get a small business loan in Ohio.

In this article, we will explore the different types of small business loans available in Ohio, the steps involved in securing a loan, and tips to ensure a successful loan application. We will also discuss the approval process, managing the funds, and the importance of timely repayments. By following these guidelines, you can increase your chances of obtaining the financing necessary to fuel your business growth and achieve your goals.

Before we dive into the nitty-gritty of acquiring a small business loan in Ohio, it’s important to emphasize the significance of thorough research, careful planning, and an understanding of your unique business needs. Taking the time to evaluate your financial requirements and exploring the available loan options will enable you to make informed decisions.

So, whether it’s launching a new product, expanding your workforce, or improving your infrastructure, let’s delve into the world of small business loans in Ohio and equip you with the knowledge and tools needed to secure the funding that will propel your business forward.

Understanding Small Business Loans in Ohio

In order to navigate the world of small business loans in Ohio, it is important to have a solid understanding of the different loan options available and how they can benefit your business. Ohio offers a variety of options tailored to the unique needs of small businesses, each with its own set of terms, interest rates, and eligibility requirements.

One common type of small business loan in Ohio is the traditional bank loan. These loans are typically offered by banks and credit unions and require a detailed business plan, financial statements, and a good credit history. While bank loans may have stricter requirements and longer approval times, they often come with lower interest rates and longer repayment terms.

Another popular option for small business owners in Ohio is the Small Business Administration (SBA) loan program. The SBA works with participating lenders to provide government-backed loans to small businesses. These loans offer favorable terms, such as lower interest rates and longer repayment periods. SBA loans can be used for various purposes, including working capital, purchasing real estate or equipment, and refinancing existing debt.

In addition to traditional and SBA loans, Ohio also offers microloans, which are small loans typically ranging from a few hundred to a few thousand dollars. These loans are ideal for startups or businesses in need of a small infusion of capital. Microloans are often provided by nonprofit organizations or community development financial institutions (CDFIs) and may come with more flexible eligibility criteria.

Furthermore, Ohio’s Development Services Agency (DSA) provides various loan programs specifically designed to promote economic development within the state. These programs aim to stimulate job creation, support small businesses in disadvantaged areas, and encourage growth in industries such as agriculture, manufacturing, and technology.

Understanding the specific types of loans available in Ohio will help you identify the most suitable option for your business. It is important to carefully evaluate your financial needs, repayment capacity, and eligibility requirements before choosing a loan type. Additionally, consider other factors such as interest rates, loan terms, and any associated fees when making your decision.

Now that you have a basic understanding of the small business loan landscape in Ohio, it’s time to determine your specific loan needs and explore the loan options available to you.

Determining Your Small Business Loan Needs

Before embarking on the process of applying for a small business loan in Ohio, it is essential to accurately assess your business’s financial requirements. Determining your loan needs will help you identify the appropriate loan amount, repayment terms, and loan type that aligns with your business goals.

Here are some steps to help you determine your small business loan needs:

- Evaluate your business goals: Start by identifying the specific goals or objectives you want to achieve with the loan. Are you looking to expand your physical space, purchase new equipment, hire additional staff, or invest in marketing and advertising? Understanding your business objectives will help you estimate the amount of funding required.

- Conduct a thorough financial analysis: Review your company’s financial statements, including income statements, balance sheets, and cash flow statements. Analyze your revenue, expenses, and profit margins to gain insights into your business’s financial health. This analysis will assist you in assessing your repayment capacity and determining how much you can afford to borrow.

- Factor in additional costs: Consider any additional expenses associated with your loan, such as origination fees, closing costs, and interest payments. These costs can impact the overall affordability of the loan and should be factored into your loan amount calculations.

- Anticipate future cash flow: Evaluate your business’s projected cash flow to understand how the loan repayment will impact your ability to cover your expenses and obligations. It’s important to ensure that your business can generate enough revenue to comfortably repay the loan while continuing to operate and grow.

- Consider the loan term: Depending on your business needs, you may require a short-term loan or a long-term loan. Short-term loans are typically repaid within a year, while long-term loans have extended repayment periods, sometimes up to 10 years or more. Assess your business’s ability to meet the repayment schedule based on the loan term you choose.

- Explore funding alternatives: While a traditional loan might be suitable for some businesses, others might benefit from alternative funding options, such as crowdfunding, angel investors, or grants. Consider these alternatives alongside traditional loans to determine which avenue best aligns with your business’s needs and objectives.

By carefully evaluating your business’s financial needs and considering future projections, you can determine the loan amount, repayment terms, and loan type that will best support your business’s growth and success. Armed with this information, you are now ready to research the small business loan options available in Ohio that meet your specific requirements.

Researching Small Business Loan Options in Ohio

Once you have determined your small business loan needs, it’s time to explore the various loan options available in Ohio. Conducting thorough research will empower you to make informed decisions and choose the best loan option for your business. Here are some steps to help you research small business loan options in Ohio:

- Seek out local banks and credit unions: Start your research by reaching out to local banks and credit unions in your area. These financial institutions often have specific loan programs designed to support small businesses. Check their websites or make inquiries to understand the types of loans they offer, eligibility criteria, interest rates, repayment terms, and any additional fees or requirements.

- Explore the Small Business Administration (SBA) loan program: The SBA partners with lenders to offer government-backed loans to small businesses. Visit the SBA website or contact your local SBA office to learn about the different loan programs available and their eligibility requirements. SBA loans often have more favorable terms, including lower interest rates and longer repayment periods.

- Consider microloans and nonprofit organizations: If you need a smaller loan amount or have difficulty meeting the requirements of traditional loans, explore microloan programs offered by nonprofit organizations or community development financial institutions (CDFIs). These loans are specifically tailored for small businesses and startups and may have more flexible eligibility criteria.

- Research Ohio’s Development Services Agency (DSA) loan programs: Ohio’s DSA provides various loan programs aimed at supporting economic development within the state. These programs offer financing options for different industries, including agriculture, manufacturing, technology, and more. Visit the DSA website or contact their office to understand the loan programs available and their specific requirements.

- Compare interest rates, terms, and fees: As you research different loan options, pay close attention to the interest rates, repayment terms, and any associated fees. Compare these factors across different lenders and loan types to identify the most cost-effective option for your business. Remember to consider both short-term and long-term implications to ensure your business can comfortably meet the repayment schedule.

- Read reviews and seek recommendations: Take the time to read reviews and seek recommendations from other business owners who have obtained loans in Ohio. Their experiences can provide valuable insights into the loan application process, customer service, and overall satisfaction with different lenders. Additionally, consider joining small business networks or associations to leverage their resources and access to recommended lenders.

By conducting comprehensive research on the loan options available in Ohio, you can compare and evaluate the different programs to find the one that best fits your business’s needs. Remember to take into account the loan amounts, interest rates, terms, eligibility criteria, and any specific requirements that may be applicable to your industry or business type.

With your research completed, you are now ready to prepare the necessary documentation and application for your small business loan in Ohio. We will cover these crucial steps in the next section.

Preparing Your Small Business Loan Application

Once you have thoroughly researched the different small business loan options in Ohio, it’s time to prepare your loan application. This step is crucial, as a well-prepared and comprehensive application increases your chances of obtaining the financing you need. Here are some key steps to help you in preparing your small business loan application:

- Gather all necessary documentation: Start by collecting all the required documentation for your loan application. The specific documents may vary depending on the lender and loan type, but generally, you will need financial statements (profit and loss statement, balance sheet, cash flow statement), tax returns, bank statements, business licenses, articles of incorporation, and any other relevant legal documents.

- Organize your financial information: Ensure that your financial documents are accurate, up-to-date, and well-organized. Review them carefully to identify any discrepancies or inconsistencies that might raise concerns for the lender. Your financial information should highlight the stability and profitability of your business, as this will play a crucial role in the loan approval process.

- Create a comprehensive business plan: Your business plan is a crucial component of your loan application, especially for startup businesses. It should provide an overview of your business, including your mission, target market, competition analysis, marketing strategies, financial projections, and repayment plans. A detailed and well-crafted business plan demonstrates your preparedness and increases your credibility as a borrower.

- Prepare a loan proposal: In addition to your business plan, consider including a loan proposal that outlines how you will use the funds, the expected impact on your business, and how you plan to repay the loan. This proposal should demonstrate your understanding of the loan’s purpose and showcase how it will contribute to the growth and success of your business.

- Check and improve your credit score: Lenders consider your personal and business credit score when evaluating your loan application. Review both your personal and business credit reports, and address any errors or discrepancies. Take steps to improve your credit score if necessary by making timely payments, reducing outstanding debts, and maintaining a low credit utilization ratio.

- Prepare a repayment plan: Outline a clear and realistic repayment plan that shows how you will repay the loan. Include details such as estimated monthly payments, the source of funds for repayment, and contingency plans in case of unexpected circumstances. A well-thought-out repayment plan assures lenders of your commitment and ability to repay the loan.

- Review and proofread: Before submitting your loan application, thoroughly review and proofread all the documents and materials. Check for any missing or incomplete information, grammatical errors, or formatting issues. A well-presented and error-free application demonstrates professionalism and attention to detail.

Preparing a strong loan application requires careful attention to detail, organization, and a deep understanding of your business’s financial position and goals. By gathering all the necessary documentation, creating a comprehensive business plan, and presenting a clear repayment plan, you are positioning yourself as a confident and reliable borrower.

Once your loan application is meticulously prepared, it’s time to move on to the next crucial step: submitting your application and initiating the process of applying for a small business loan in Ohio. We will explore this process in detail in the upcoming section.

Applying for a Small Business Loan in Ohio

Now that you have gathered all the necessary documentation and prepared your loan application, it’s time to submit your application and begin the process of applying for a small business loan in Ohio. Follow these steps to ensure a smooth and successful application process:

- Select the right lender: Choose the lender that best suits your business’s needs and loan requirements. Review the eligibility criteria, loan terms, interest rates, and reputation of the lender. Consider factors such as their experience working with small businesses, their customer service reputation, and any additional services they may offer.

- Contact the lender and express your interest: Reach out to the lender to express your interest in applying for a small business loan. This initial contact allows you to ask any questions you may have, confirm the required documentation, and understand the next steps in the application process.

- Complete the loan application form: Fill out the loan application form accurately and thoroughly. Double-check all the information to ensure it is correct and up-to-date. Incomplete or inaccurate applications can delay the approval process or result in rejection.

- Submit all required documentation: Assemble all the necessary documents and submit them along with your loan application. Ensure that you include all the financial statements, tax returns, business licenses, and any other supporting documents requested by the lender.

- Include a cover letter: Consider including a cover letter along with your loan application. In this letter, briefly explain your business, its goals, and why you believe you are a strong candidate for the loan. This personal touch can help create a positive impression and add context to your application.

- Follow up with the lender: After submitting your application, follow up with the lender to confirm that they have received your documents and application. This demonstrates your commitment and eagerness to move the process forward.

- Be prepared for additional requests or interviews: Depending on the lender and the complexity of your loan application, they may request additional documentation or interviews to gain a deeper understanding of your business. Be prepared to provide any additional information in a timely manner.

- Keep track of the application status: Maintain open lines of communication with the lender to stay informed about the progress of your application. This allows you to address any concerns or provide any necessary clarifications promptly.

- Review the loan offer and terms: If your application is approved, carefully review the loan offer and terms. Pay attention to the interest rate, repayment schedule, any limitations or restrictions, and any associated fees. Take the time to understand the loan agreement before accepting it.

Applying for a small business loan in Ohio requires attention to detail, timely submission of documentation, and excellent communication with the lender. By following these steps, you increase your chances of securing the funding you need to support your business’s growth and success.

Once you have successfully gone through the application process and received approval for your small business loan in Ohio, it is important to understand the loan approval process and how it will impact your business. We will delve into this topic in the next section.

Understanding the Small Business Loan Approval Process

Once you have submitted your small business loan application in Ohio, it’s important to understand the loan approval process and what happens next. While the specific process may vary depending on the lender and loan type, here are the general steps involved in the loan approval process:

- Application review: The lender will review your application and supporting documents to evaluate your business’s financial health, creditworthiness, and ability to repay the loan. They will assess factors such as your credit score, business revenue, cash flow, and debt-to-income ratio.

- Underwriting: During the underwriting stage, the lender will analyze your application in more detail and may request additional information or clarification. They will assess the risks associated with providing you with a loan and determine the terms, interest rate, and loan amount they are willing to offer.

- Credit check: The lender will conduct a thorough credit check, reviewing both your personal and business credit history. They will assess factors such as your payment history, outstanding debts, and any bankruptcies or defaults. A positive credit history increases your chances of loan approval.

- Collateral evaluation (if applicable): If you are offering collateral to secure the loan, such as real estate, equipment, or inventory, the lender will evaluate the value and condition of the collateral. This provides added security for the lender in case of default.

- Decision and loan offer: Based on the application review, underwriting process, credit check, and collateral evaluation, the lender will make a decision regarding your loan application. If approved, they will present you with a loan offer detailing the terms, interest rate, repayment schedule, and any associated fees.

- Acceptance and funding: If you are satisfied with the loan offer, carefully review the terms and sign the loan agreement. The lender will then proceed to fund the loan, depositing the approved funds into your business bank account or disbursing them as agreed upon.

It’s important to note that the approval process can take time, and additional documentation or interviews may be requested. It’s crucial to promptly provide any requested information to avoid delays in the approval and funding process.

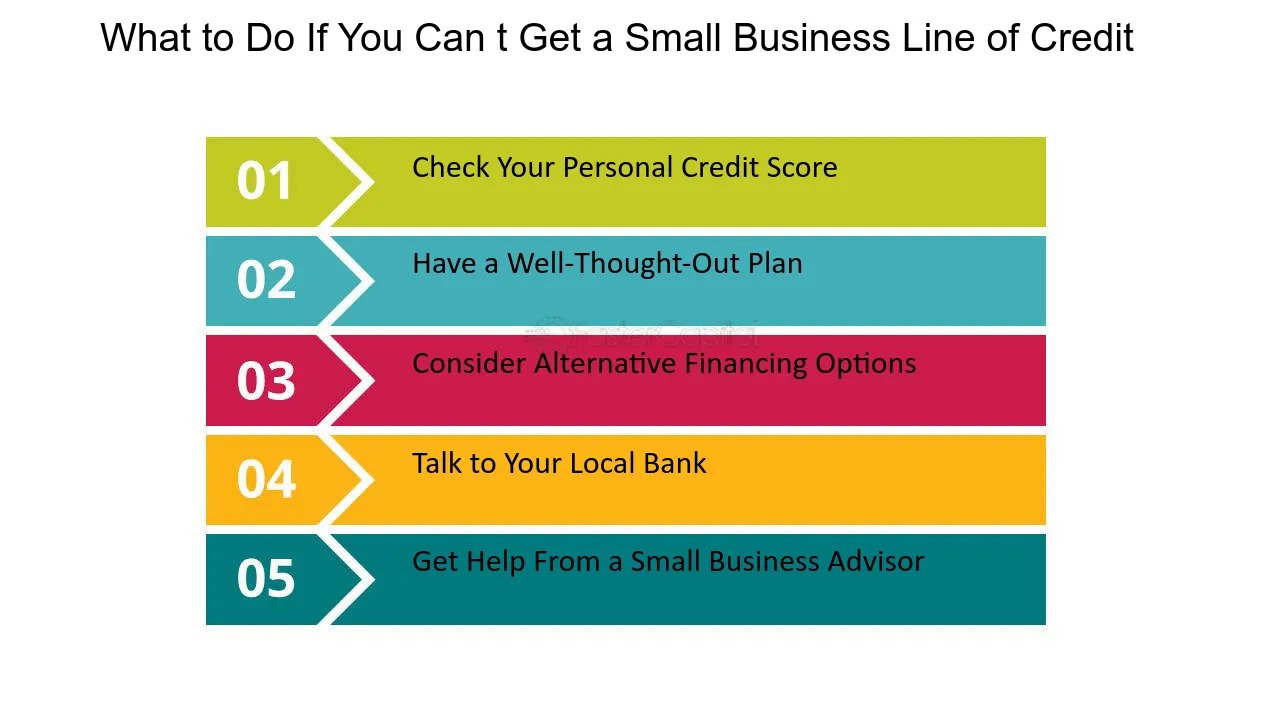

It’s also important to keep in mind that loan approval is not guaranteed, and factors such as your credit history, business financials, and the specific lender’s criteria will play a significant role in the decision. If your loan application is not approved, take the time to understand the reasons for the denial and work to improve any areas of concern before reapplying.

Understanding the small business loan approval process in Ohio enables you to navigate the process with confidence and clarity. By being prepared, responsive, and actively engaged with the lender throughout the process, you increase your chances of a successful loan approval.

Once your loan is approved and funds are disbursed, it’s crucial to effectively manage and repay the loan. We will explore strategies for loan management and repayment in the next section.

Managing and Repaying Your Small Business Loan in Ohio

After securing a small business loan in Ohio, effectively managing and repaying the loan is crucial to maintaining healthy finances and avoiding any potential issues. Here are some strategies to help you manage and repay your small business loan:

- Create a repayment plan: Develop a well-structured repayment plan that outlines how you will make regular payments towards the loan. Consider factors such as your cash flow, business expenses, and other financial obligations to ensure that you can comfortably meet the repayment schedule.

- Keep track of repayment deadlines: Stay vigilant and keep track of the repayment deadlines. Mark the due dates on your calendar or set up reminders to ensure timely payment. Late payments can result in additional fees and negatively impact your credit score.

- Budget efficiently: To ensure that you have sufficient funds for loan repayment, create a realistic budget for your business operations. Monitor your income and expenses closely and make any necessary adjustments to ensure that you have enough cash flow to meet your loan obligations.

- Manage cash flow effectively: Cash flow management is critical for successfully repaying your small business loan. Implement strategies to improve your cash flow, such as negotiating favorable payment terms with suppliers, incentivizing prompt customer payments, and closely monitoring inventory levels to avoid overstocking.

- Communicate with your lender: If you encounter financial difficulties or anticipate challenges in meeting your loan repayments, promptly communicate with your lender. Many lenders are willing to work with borrowers to find alternative solutions, such as modifying repayment terms or deferring payments. Open and honest communication is key to maintaining a positive relationship with your lender.

- Maintain accurate financial records: Keep detailed and accurate financial records, including income statements, profit and loss statements, and cash flow statements. Regularly review your financial performance and compare it to your repayment plan to ensure you are on track.

- Avoid unnecessary debt: While running a business, it’s crucial to avoid taking on unnecessary debt. Be mindful of your financial obligations and avoid taking on additional loans or credit unless it is absolutely necessary for the growth and success of your business.

- Consider early repayment: If your finances allow, consider making early or extra loan repayments whenever possible. By paying off your loan earlier than the agreed-upon term, you can reduce the total interest paid and potentially improve your creditworthiness.

By effectively managing your small business loan and making timely repayments, you not only fulfill your financial obligations but also demonstrate financial responsibility and build a positive credit history. This can open up opportunities for future financing and contribute to the long-term success of your business.

In case of any financial challenges or concerns, don’t hesitate to seek the advice of financial professionals or small business support organizations in Ohio. They can provide guidance and assistance tailored to your specific situation.

With proper planning, budgeting, and proactive management, you can successfully navigate the process of repaying your small business loan in Ohio and set your business on a path of sustainable growth and success.

As we conclude this guide, we hope that the information provided has equipped you with valuable insights on how to obtain, manage, and repay a small business loan in Ohio. Remember, thorough research, careful planning, and responsible financial management are key to achieving your business goals through the support of a small business loan.

Conclusion

Congratulations! You have now reached the end of our comprehensive guide on how to get a small business loan in Ohio. Throughout this article, we have explored various aspects of obtaining, managing, and repaying a small business loan to support your entrepreneurial journey in the Buckeye State.

We began by highlighting the importance of understanding small business loans in Ohio and how they can benefit your business. By familiarizing yourself with the loan options available and evaluating your specific needs, you can make informed decisions to secure the financing necessary for growth and success.

We then delved into the process of determining your loan needs, emphasizing the significance of evaluating your goals, conducting a financial analysis, and considering future cash flow projections. Armed with this information, you were well-prepared to embark on the journey of acquiring a small business loan in Ohio.

Next, we discussed the importance of researching small business loan options in Ohio. By exploring local banks, credit unions, the Small Business Administration (SBA) loan program, microloans, and Ohio’s Development Services Agency (DSA) loan programs, you were able to identify the loan type and lender that best fit your business’s unique requirements.

We then guided you through the process of preparing your loan application, emphasizing the gathering of necessary documentation, the creation of a comprehensive business plan, and the importance of presenting a clear and realistic repayment plan. With a well-prepared application, you were ready to embark on the application process.

Furthermore, we provided insights into the small business loan approval process, highlighting the steps involved, such as application review, underwriting, credit checks, collateral evaluation (if applicable), and the ultimate decision and loan offer. Understanding this process empowered you to navigate the application process with confidence.

To ensure your success as a borrower, we discussed strategies for effectively managing and repaying your small business loan in Ohio. From creating a repayment plan and budgeting efficiently to maintaining accurate financial records and open communication with your lender, these strategies are key to maintaining financial stability and successfully repaying your loan.

As you move forward on your small business loan journey in Ohio, remember that responsible financial management, proactive communication, and a clear understanding of your business’s financial needs will contribute to your success. Consider seeking guidance from financial professionals or small business support organizations in Ohio when needed.

Good luck on your quest to secure a small business loan in Ohio! With the right knowledge, preparation, and perseverance, you can secure the financing you need to take your business to new heights and achieve your entrepreneurial dreams.