Finance

What Is The Credit Limit On Amex Platinum

Published: January 8, 2024

Discover the credit limit on Amex Platinum and take control of your finances with this comprehensive guide. Learn how to maximize your spending power

(Many of the links in this article redirect to a specific reviewed product. Your purchase of these products through affiliate links helps to generate commission for LiveWell, at no extra cost. Learn more)

Table of Contents

Introduction

When it comes to premium credit cards, the Amex Platinum is undoubtedly one of the most prestigious options on the market. With its array of exclusive benefits and exceptional rewards program, it’s no wonder why this card is highly sought after by avid travelers and luxury enthusiasts. But before diving into all the perks, it’s important to understand the credit limit on your Amex Platinum card.

Simply put, the credit limit is the maximum amount of money that the credit card issuer, in this case, American Express, allows you to borrow for purchases. This limit is determined based on a variety of factors such as your creditworthiness, income, and the issuer’s internal policies. The credit limit serves as both a safeguard for the issuer and a boundary for the cardholder, ensuring responsible credit usage.

The Amex Platinum credit limit may vary for each cardholder based on their unique financial profile and credit history. It’s important to note that the credit limit assigned to an Amex Platinum card can be significantly higher than what you may find with other credit cards due to the card’s elite status and emphasis on high-spending customers.

Understanding the credit limit on your Amex Platinum card is crucial for managing your finances and making the most of the card’s benefits. Knowing your credit limit allows you to plan your spending, use the card strategically, and avoid any potential issues or fees associated with exceeding the limit.

In the following sections, we will delve deeper into the factors that determine your Amex Platinum credit limit, explore ways to increase it if needed, and provide tips for effectively managing your credit limit to maximize your Amex Platinum experience.

Understanding Amex Platinum Credit Limit

The Amex Platinum credit limit is determined by a combination of factors, including your creditworthiness, income, and the issuer’s internal policies. American Express assesses these factors to evaluate your ability to repay any credit borrowed on the card. Let’s take a closer look at these factors:

- Creditworthiness: Your credit score and credit history play a significant role in determining your Amex Platinum credit limit. A higher credit score indicates a lower risk of default and may result in a higher credit limit. American Express looks at your credit history to assess your repayment patterns, delinquencies, and other factors that affect your creditworthiness.

- Income: Your income level is taken into consideration when determining your Amex Platinum credit limit. A higher income demonstrates a greater ability to repay debts, which may result in a higher credit limit. It’s important to provide accurate information about your income during the application process.

- Internal Policies: Each credit card issuer, including American Express, has its own internal policies and guidelines for determining credit limits. These policies consider various market factors, industry standards, and risk management practices. American Express aims to provide a credit limit that aligns with the cardholder’s financial profile and spending habits.

It’s important to note that the Amex Platinum credit limit is not static and can be adjusted by the card issuer over time. American Express regularly reviews credit limits for its cardholders based on their credit performance, changes in income, and other relevant factors. This means that your credit limit can be increased or decreased depending on your financial activity and creditworthiness.

As an Amex Platinum cardholder, it’s essential to understand and monitor your credit limit to ensure responsible credit usage. Exceeding your credit limit can result in penalties, fees, and even a negative impact on your credit score. Being aware of your credit limit allows you to plan your expenditures effectively and make the most of your card’s benefits within the set boundaries.

Factors that Determine Amex Platinum Credit Limit

The credit limit assigned to your Amex Platinum card is influenced by several key factors. Understanding these factors can help you gain insight into the credit evaluation process and potentially guide you in managing your credit wisely. Here are the primary factors that influence your Amex Platinum credit limit:

- Credit Score: Your credit score is a numerical representation of your creditworthiness based on your credit history. A higher credit score indicates a lower credit risk and may result in a higher credit limit. American Express considers your credit score when evaluating your creditworthiness and determining your Amex Platinum credit limit.

- Income: Your income level plays a crucial role in determining your Amex Platinum credit limit. A higher income demonstrates a greater ability to repay debts, which may result in a higher credit limit. American Express assesses your income information to evaluate your financial stability and determine the credit limit that aligns with your income.

- Payment History: Your past payment behavior, including any delinquencies or late payments, can impact your credit limit. Consistently making timely payments and demonstrating a positive payment history can work in your favor, potentially leading to a higher credit limit. Conversely, a history of missed payments or defaults may result in a lower credit limit.

- Debt-to-Income Ratio: Your debt-to-income ratio is the percentage of your monthly income that goes towards debt repayment. A lower debt-to-income ratio indicates a healthier financial situation and may positively affect your credit limit. American Express considers this ratio to assess your ability to handle additional credit and may adjust your credit limit accordingly.

- Length of Credit History: The length of your credit history is taken into account when determining your creditworthiness. A longer credit history can provide more data for assessing your creditworthiness, potentially resulting in a higher credit limit. If you have a limited credit history, American Express may assign a lower credit limit until more information becomes available.

- Relationship with American Express: If you have an existing relationship with American Express, such as being a long-standing cardholder with a good payment history, it can positively influence your credit limit. American Express values customer loyalty and may reward it with a higher credit limit.

It’s important to note that the weight given to each factor may vary, and American Express uses a combination of these factors to determine your Amex Platinum credit limit. By maintaining a good credit score, managing your debts responsibly, and demonstrating a positive payment history, you can potentially improve your chances of receiving a higher credit limit on your Amex Platinum card.

How to Increase Your Amex Platinum Credit Limit

If you want to increase your Amex Platinum credit limit, there are several steps you can take to improve your chances. While the ultimate decision lies with American Express, following these strategies can help boost your credit limit:

- Monitor and Improve Your Credit Score: Your credit score plays a significant role in determining your creditworthiness. Regularly monitor your credit score and take steps to improve it, such as paying bills on time, reducing credit card balances, and disputing any errors on your credit report. A higher credit score can increase your chances of receiving a higher credit limit.

- Provide Updated Income Information: If your income has increased since you last applied for your Amex Platinum card, consider updating your income information with American Express. This can demonstrate your improved financial position and potentially lead to a higher credit limit.

- Make Timely Payments: Consistently making on-time payments not only helps maintain a positive payment history but also showcases your responsible credit behavior. This can give American Express confidence in your ability to handle a higher credit limit.

- Pay Off Existing Debt: Lowering your overall debt can positively impact your creditworthiness. Pay off existing balances on your credit cards and reduce your debt-to-income ratio. By showcasing that you can manage your debts effectively, you may increase your chances of securing a higher credit limit.

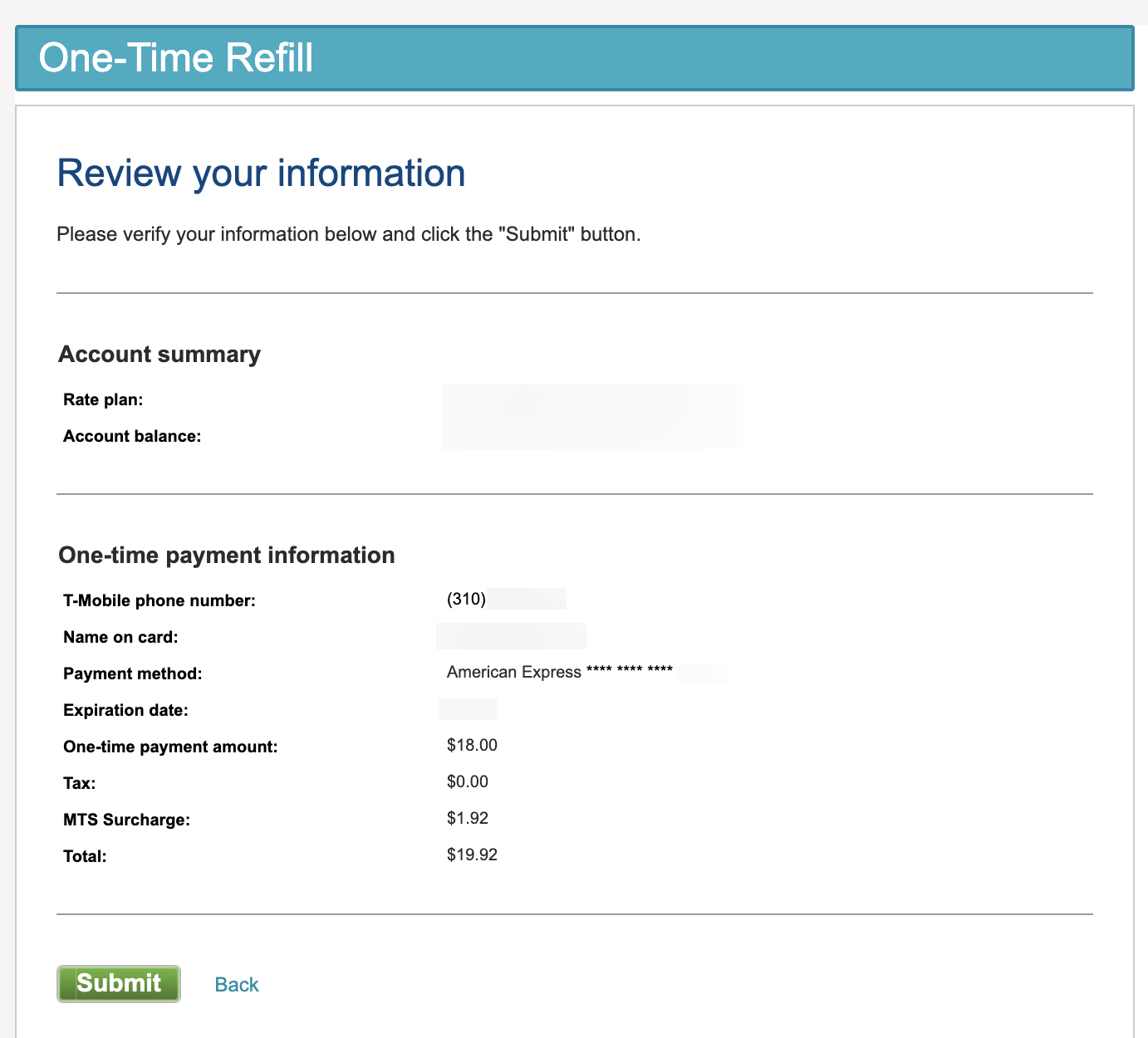

- Request a Credit Limit Increase: If you’ve demonstrated responsible credit behavior and have a good payment history, you can request a credit limit increase from American Express. Contact their customer service or visit their online portal to submit a request. Be prepared to provide updated income details and any other relevant information to support your request.

- Use Your Card Responsibly: Utilize your Amex Platinum card regularly and responsibly. Avoid maxing out your credit limit or carrying high balances. Showing consistent responsible credit usage can lead to a favorable impression from American Express and potentially result in a credit limit increase.

It’s important to note that while these strategies can increase your chances of a credit limit increase, American Express has its own internal policies and discretion when evaluating credit limit requests. Therefore, there is no guarantee that your request will be approved or result in a significant increase. Patience and responsible credit usage are key when working towards a higher credit limit on your Amex Platinum card.

Tips for Managing Your Amex Platinum Credit Limit

Effectively managing your Amex Platinum credit limit is essential for maintaining financial stability and maximizing the benefits of your prestigious card. Here are some tips to help you manage your credit limit wisely:

- Track Your Spending: Keep a close eye on your spending to ensure you stay within your credit limit. Regularly review your statements and track your purchases to avoid any surprises or accidental overspending.

- Create a Budget: Establish a budget to allocate your funds effectively. By planning your expenses in advance, you can prioritize your spending and prevent unnecessary financial strain.

- Pay on Time: Make your payments on time to maintain a positive payment history and avoid any late fees or penalty rates. Consider setting up automatic payments or reminders to ensure you never miss a payment.

- Pay More Than the Minimum: Whenever possible, strive to pay more than the minimum payment due. By paying off your balance in full or making larger payments, you can reduce your credit utilization ratio and potentially increase your credit limit over time.

- Communicate with Customer Service: If you anticipate needing a higher credit limit for a specific purchase or trip, consider contacting American Express customer service in advance. They may be able to temporarily increase your credit limit to accommodate your needs.

- Keep a Low Credit Utilization Ratio: Aim to keep your credit utilization ratio, which is the percentage of your credit limit that you are utilizing, as low as possible. This can help improve your credit profile and may increase your chances of securing a higher credit limit in the future.

- Avoid Exceeding Your Credit Limit: Exceeding your credit limit can result in penalties, fees, and potential damage to your credit score. It’s crucial to always stay within your credit limit to maintain a healthy credit profile.

- Frequently Review Your Credit Limit: Periodically review your credit limit to ensure it aligns with your financial needs and spending habits. If you believe you are eligible for a higher credit limit, consider requesting a credit limit increase from American Express.

- Monitor Your Credit Health: Regularly check your credit reports to identify any errors or discrepancies that might impact your credit limit. Act promptly to dispute and rectify any inaccuracies you find.

- Utilize Additional Cards Strategically: If you have authorized users or additional cards linked to your Amex Platinum account, monitor their spending and set limits if necessary. Being aware of all card activity helps you maintain control and manage your credit limit effectively.

By implementing these tips and exercising responsible credit usage, you can successfully manage your credit limit on your Amex Platinum card, maintain a healthy credit profile, and fully enjoy the exclusive benefits and rewards that come with being an Amex Platinum cardholder.

Conclusion

Understanding and managing your Amex Platinum credit limit is crucial for maximizing your financial well-being and making the most of your prestigious card. By comprehending the factors that determine your credit limit, you can work towards improving your creditworthiness and potentially securing a higher limit. Monitoring your credit score, maintaining a good payment history, and responsibly managing your finances are all key components to increasing your credit limit over time.

Additionally, it’s important to implement strategies to effectively manage your credit limit. By tracking your spending, creating a budget, and paying on time, you can stay within your credit limit and avoid any penalties or fees. Regularly reviewing your credit limit, communicating with customer service, and keeping a low credit utilization ratio are also vital for maintaining a healthy credit profile. These practices can enhance your chances of securing a higher limit in the future and enjoying the exclusive benefits that come with being an Amex Platinum cardholder.

Remember to use your Amex Platinum card responsibly and strategically to make the most of its rewards and perks. By managing your credit limit wisely, you can navigate the world of luxury and travel with confidence, knowing that you are achieving the utmost value from your card.

As always, it’s essential to consult with American Express directly for specific information about your Amex Platinum credit limit, as their policies and guidelines may vary. Take control of your credit limit, make informed financial decisions, and enjoy the exclusive privileges that come with owning an Amex Platinum card.